How to Start Forex Trading with $100 and Turn it Into $10,000, how to start forex trading with $100.

How to start forex trading with $100

The most significant advantage of demo accounts is that you still get access to the same markets and trading tools.

No deposit forex bonuses

This way, you will learn how to analyze the market correctly. Also, you will have more time to see how the market works, and there is no risk of losing your money. So, if you begin with $100, then your risk should be $1. Some people might say that $1 won’t help you make money, but you always have to keep your interest!

How to start forex trading with $100 and turn it into $10,000

The thing I like most about forex trading is that you can start trading forex with as little as $100 and turn it into $10,000 or even more. In fact, you can open a free demo account and start trading with no money at all. So, how do traders increase their wealth by investing $100?

No forex trading experience: what should I do?

If you are new in the forex industry and you want to become a successful trader, but you unsure how, then you have come to the right place.

Luckily, if you have no previous trading experience, some platforms offer free demo accounts, and you should consider opening one before you begin trading. Moreover, most demo accounts require a $1 deposit or no deposit at all.

Can I gain trading experience without losing money?

By opening a demo account and placing orders there, you will gain trading experience without putting money into an account straight away and risking them. The easiest way for new forex traders to lose their money is,

The most significant advantage of demo accounts is that you still get access to the same markets and trading tools. This way, you will learn how to analyze the market correctly. Also, you will have more time to see how the market works, and there is no risk of losing your money.

Once you have more knowledge, you are more confident, and you understand how to place trades and how to manage risk, then you are ready to open a live trading account.

How do I choose a brokerage for my live trading account?

When it comes to finding the best brokerages, it is essential to do in-depth research. You have to see what each brokerage has to offer, what trading tools the brokerage has to offer, and, most of all, whether a significant oversight body regulates the brokerage.

Your goal is to find the most trusty brokerage before you open an online account.

Can I start trading with $100?

Yes, you can. Opening an online account with $100 is a good start if you want to see your money grow to $10,000. But to ensure your trading success, make sure you follow these steps before you place an order:

- Learn as much as you can about trading

- Understand the basics of FX terminology

- Research, study and analyze the market

- Learn more about the economy of the country

- Learn how to calculate profits properly

- Learn more about the major forex pairs, their nicknames

- Learn how to read forex currency pair quotes

- Create a trading strategy and follow it!

If you do follow the mentioned above steps, you will be one step closer to achieving your goal of turning $100 into $10,000. It won’t happen overnight, so you have to be patient.

Why starting with $100 is A smart choice?

The answer is easy: risk management reasons. Before you place an order, it would be smart to stick to risk management rules. Experienced traders don’t risk more than 1% of their accounts. And that’s how they don’t lose a lot of money.

So, if you begin with $100, then your risk should be $1. Some people might say that $1 won’t help you make money, but you always have to keep your interest!

Imagine what will happen if your risk is $100, and your investment choice was terrible. How will you be able to make $10,000 if you have $0 in your account?

Bottom line

Be patient, invest smart, and over time, your account will grow, and you will reach your goal of making $10,000 with $100.

If you invest more than $100, but you still use everything I shared with you in this article, your chances of achieving your goal sooner, will be higher. When it comes to trading forex, money makes money in this industry.

To learn more about each of the steps I mentioned above, or which are the three best brokerages in 2019, you should read this insightful article.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

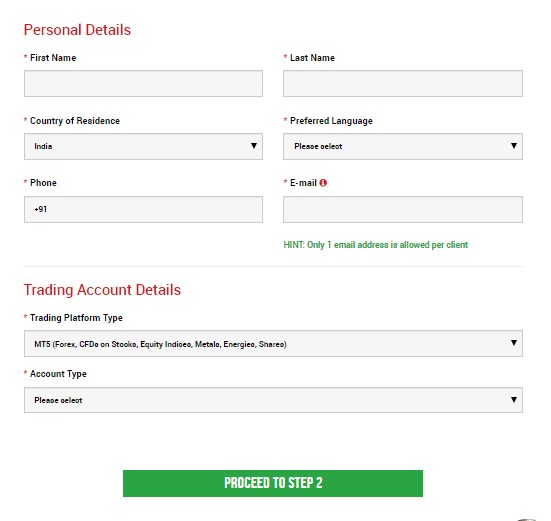

Step 2: filling the personal details

Fill all the box with accurate details

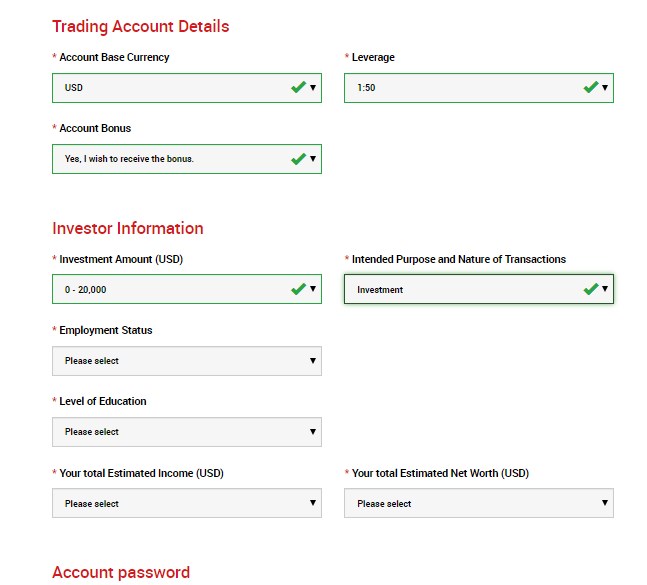

Step 3: investor information & trading account details

Step 4: depositing $100 to trade

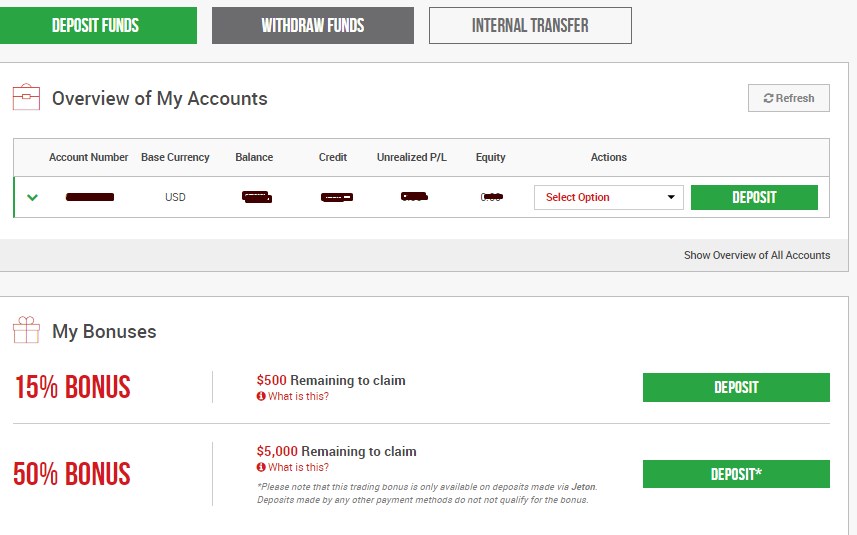

After opening your account you must confirm your email address and then login to XM account with your account username and password.

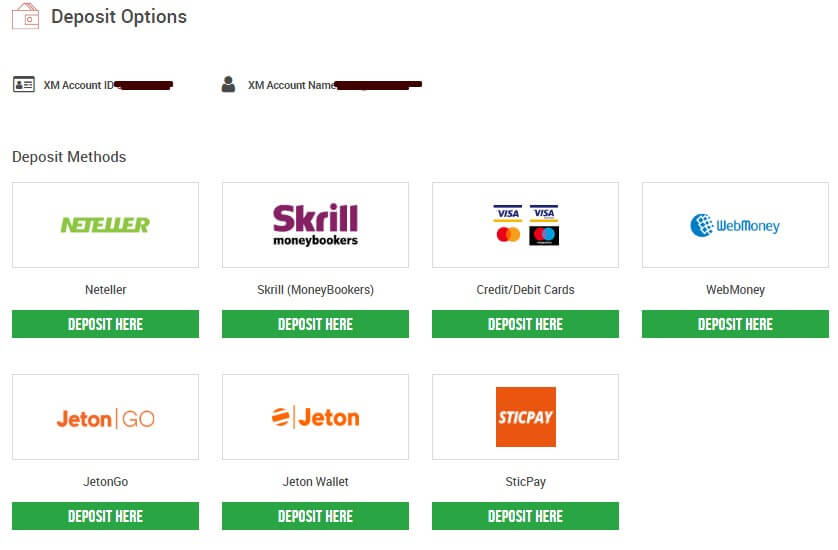

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

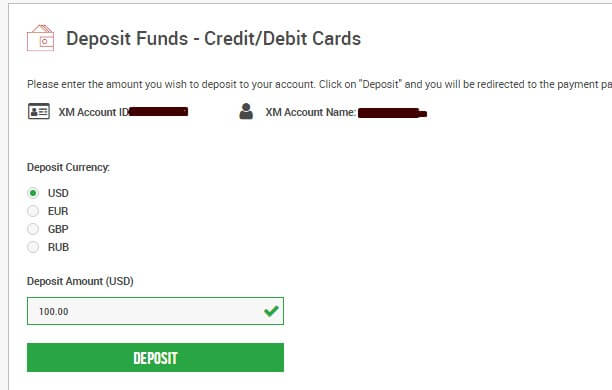

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

How to start trading forex with only $100

If you’re going to become a forex trader, one thing’s for sure: you’re going to have to make an investment. You can’t trade without any funds in your trading account, obviously, and many brokerages don’t even offer accounts for less than $500. While many beginners dream of opening a trading account, the thought of investing such a large amount of money into something that may not be profitable is scary. After all, you can do a lot more with that money. Others simply don’t have that much in disposable funds, so trading seems impossible. The good news is that it is possible to open a trading account and to be successful with a small starting deposit of about $100. Some brokers will even let you get started with around $5 or even $1, but it is best to make a slightly larger investment if you can.

Before you make the decision to start, you’ll want to have realistic expectations. It is highly unlikely that your $100 investment will turn into thousands of dollars quickly. You aren’t going to make the same profits as someone that has invested $20,000 into their account. Beginners need to ease into the market. If you lose your entire investment, it doesn’t mean you should quit. Instead, you need to look more into education and base your trades on more evidence.

Indicators, economic calendars, charts, graphs, and so on can give you more information from a technical and fundamental standpoint. The good thing is that if you lose your $100 investment, it won’t break you, and you can start again. Losing a larger amount of money could scare someone away from trading for good. If you find that you’re well-prepared and you start making money, you could always invest more later.

Here are a few quick tips for opening a trading account and getting started with around $100:

-try to find a broker that offers some type of bonus. Some even offer $30 welcome bonuses or simple deposit bonuses that would add to what you’re investing. Just make sure that your deposit is large enough to qualify.

-make sure you sign up with a broker that offers good conditions. You should have access to average spreads and fees with a $100 deposit. Don’t open an account with insane fees just because it is the only option with a certain broker. Look for better options and compare what you can get for what you have.

-don’t use too high of a leverage! This is important because overleveraging your trades can cause you to lose a lot. Many beginners use too high of a leverage to increase their investment power, but this usually backfires. Start smaller and work your way up over time.

-never risk much on any one trade. Many professionals recommend risking 1% or less of your total account balance on a single trade. This might lead to slower profits, but it is safer. If you go risking 10% on one trade, 20% on another, and so on, you could quickly blow your account.

Once you get started, you should focus more on trading and less on how much you’re making. Opening a trading account with a small amount of money isn’t going to make you rich overnight. It’s going to take a lot of hard work and dedication before you get there. You can plant the flower by opening a trading account, but you need to water it by doing research, getting an education, taking risk-management precautions, and keeping a trading journal to log your progress. You’ll also need to treat your small account the same way you would a large one. You might not feel as worried about losing $1 compared to how you’d feel if $100 was on the line, but it still matters. Understand that it is normal to lose some money, but every dollar lost adds up.

In conclusion, you should be aware that opening a trading account with as little as $100 (or less) is possible and it can be profitable. If you have realistic expectations, you can be successful with an account that has a low initial investment. Remember some of our tips about finding a good broker that offers bonuses and using risk-management precautions so that you can make the most out of your account. Don’t get discouraged if you’re only making a small amount at first. Every trader must start somewhere, and seeing profits is much better than seeing losses! If you manage to increase your account balance by even a few dollars, then you’re doing better than many others that have tried. As you work your way up, you’ll likely gain access to better accounts and have more money to invest, which will help to grow your account more quickly in the future.

How to start forex trading with only $100-$150?

Forex brokers have proposed something called micro-accounts. For beginners, the advantage is that you can open an account and start buying and selling for $ 100 or less.

Some brokers even think that micro is not enough so that they start to provide “nano” accounts.

For people with limited price volatility, a flexible role size, and a small minimum deposit may also be suitable answers.

Forex dealers are not your friends. If they do n’t want your phone to open an account, they wo n’t ask because they really do n’t care.

Their first priority is for you to determine the price range. This is the reason for micro and nano debt. It allows foreign exchange brokers to access customers who are unable to inject funds into fashionable accounts due to financial constraints.

In other words, these unconventional account types are designed to acquire dealers, not you.

I am not a sour merchant for those brokers now. Nor am I saying that your broker does not have or does not provide an incredible carrier.

The simplest factor I have here is that you have to do your due diligence and must not be compared with money, otherwise you will lose enough money.

It is also important to take this into account because just because they provide you with a way to start with one hundred dollars does not mean that you should do so.

In this submission, I will address the following questions: can you and must start foreign exchange transactions for one hundred dollars. We will discuss numerous account types and feature sizes. In addition, I will also make some suggestions on how to determine the correct account size.

Forex account type and lot

I no longer spend a lot of time on this issue because it is not a recognized primary issue.

However, it is a good idea to familiarize yourself with these terms, especially if you plan to use micro or nano accounts for trading.

For the purpose of this article, there are four common foreign exchange debts. I’m pretty sure there are others, but these are the largest foreign exchange brokers can provide.

- General;

- Miniature;

- Micro; and,

- Nano

These three names represent various devices that you can change. This gives us the name of the various qualities or gadgets you want to buy or sell.

As you can see, the nano batch is one-thousandth of the preferred batch. Therefore, if one point circulated on the EURUSD with a regular lot is equal to 10 USD, then the lot in nanometers may equal 0.01 USD.

If you open a popular account, then you can choose to replace micro or micro quality. Now, if you want to change the trendy use of large amounts of mini or micro debt, equality is not always practiced; the purpose of these regulations is to prevent large transactions in mini, micro, and nano debit transactions.

Having said that, I found that some agents absolutely ignore these restrictions, which surprised me why they have no restrictions at all.

But this is a general concept. As you can see, the potential for replacing small hands is so small that 1 point is equal to $ zero.01, so the first thing that works is one hundred dollars.

Feasible, but unlikely now

With the emergence of micro and nano banknotes in many foreign exchange agents, in fact, you only need a minimum of one hundred dollars. Heck, I found that some people only offer a minimum deposit of $ 1.

Many brokers also provide at least one: 1,000 leverage. Combining it with a minimum deposit of $ 1, they created a ticking time bomb for undoubted traders.

Fortunately, the reality that you are analyzing here means that you will not be attracted to this kind of plan.

Just because you might do something does not always mean you should do it. So if the forex broker offers a way to start with one hundred dollars, have you accepted it?

It depends on many factors, but if there are as many as me, the solution may not usually be.

We will go into details later, but for now, just know that it depends on the opportunity. What percentage do you or others turn your one-hundred-dollar account into one hundred thousand dollars?

Quite slim.

It is difficult to display a $ 5,000 or $ 10,000 account as six certain amounts, but it is almost impossible to do it with only one hundred dollars.

As a foreign exchange trader, your task is to accumulate odds according to your choice. You may have already done this when comparing other settings, but it is equally important (if it is not so important now), you can determine the starting length of your account.

Money and emotion

Money is a powerful aspect. Too much loss in the transaction process, you will be postponed entirely out of the belief that you risk taking cash in the financial market.

However, there is another aspect of cash and emotion that haunts our buyers, which may be a sense of accomplishment and pride.

How to start trading forex with $100

No wonder why inexperienced investors’ first question is usually this: can I start trading forex with just $100? Moreover, often, they wonder if it is possible to earn a living by trading forex? Well, the answer to both questions will be explained in this article. Also, we will share with you five examples. So, keep on reading.

Can I start trading forex with $100?

Yes, you can. Typically, margin trading allows traders to open trades with small amounts of money. However, the live trading is different than trading on a demo account. You may lose through the first or even the second $100 in less time than it took to deposit it. Generally, when it comes to trading forex, you should not fear any loss. Each loss can help you learn from your mistakes.

So, if you have lost $100 a couple of times, and you haven’t quit, then you are ready to experiment with other strategies. Moreover, the more you practice your skills in live trading sessions, the sooner you will start earning money. First, you will double the account balance. Then you will increase it again. When it comes to trading forex, time and experience are crucial factors. Also, the key is to learn why you failed. By acknowledging your weakness, you can adjust accordingly.

Further, many experienced investors advise beginners to keep notes on their trades. This way, you can keep track of your weaknesses and strengths over time. For example, have your emotions affected your decision making? What was the feeling you felt when you had trades open? Also, when you write everything down, you will notice if you need to learn how to control your emotions.

Is it possible to earn a living by trading forex?

Well, the answer here is the same. Yes, you can. However, it will take years before you can reach this level. Moreover, when you are not afraid to lose money in order to practice, and you are not a quitter, then you can indeed master your trading skills and eventually start earning a living.

By grasping all the little details, there will come a time when you will double your account balance. Also, it is a good indicator if you manage to double your account twice. Once you achieve this, you might be ready to start working towards earning your living by trading forex.

However, don’t expect to achieve excellent results in a month or two. It might take up to 2 years or even longer to actually see positive results. So, be patient as it takes time. Otherwise, you might experience a spectacular failure.

When should I start trading forex?

Many investors make the same mistake of not practicing enough on a demo account. Before you risk your own money, it’s wiser to master your trading skills. In other words, you should first open a demo account. By doing so, you can try out your strategies with virtual money. Also, you can try the strategy of other experienced traders.

However, the first thing you need to do is to learn the basics of forex trading. Understand how the market works. Practice on a demo account because it allows you to become familiar with trading. Also, it will help you decide on whether you want to put in actual money into your traders or you prefer using virtual funds.

Further, you should invest real money if you have done your homework first. Meaning you:

- Have learned all terms and you understand how they are co-related

- Know how the market works

- Have learned the basics of forex trading

- Know the bid-ask spread you are facing

- Have practiced on a demo account for a while now

- Study the charts

- Have understood the volatility and risk involved

Bottom line

The main reason why people start trading forex is due to the high possibility of being able to make profits. Not only this, but it is possible to earn profits with only a small capital outlay. However, many essential aspects need to be covered first. Otherwise, you will lose everything you have invested in your account balance.

How to start forex trading using $100 and turn it into $10,000

The thing I enjoy about forex trading is you may begin trading forex with just as low as $100 and transform it into $10,000 and more. In reality, you’re able to start a free demo account and begin trading without no money in any way. Therefore, just how can traders develop their wealth by investing in $100?

No forex trading experience: what should I do?

If you’re brand new at the forex business and also you wish to be a profitable trader, nevertheless, you unsure just how, then you’ve arrived at the ideal location.

Luckily, when you’ve got no prior trading expertise, then a few platforms supply totally free demo account, also you also need to consider opening one until you start trading. More over, most demonstration accounts demand a 1 deposit or no deposit in any respect.

Can I gain trading experience without losing money?

By establishing a demonstration account and setting orders , you are going to acquire trading experience without even putting money in to an account right off and depriving them. The easiest method for brand new forex traders to reduce excess cash is,

The most critical improvement of demonstration reports is you get access to exactly the equal stores and trading applications. In this manner you are going to discover how to test the marketplace properly. Additionally, you may have additional hours and energy to view the way a marketplace works, and there isn’t any possibility of losing your dollars.

Once you’ve significantly more knowledge, you might be well informed, and you also know just how to set trades and also how to control hazard, then you’re all set to start a live trading accounts.

How do I choose a brokerage for my live trading account?

When it comes to discovering the most useful brokerages, it’s critical todo detailed study. You’ve got to observe what each brokerage offers, what trading applications the brokerage offers, and also, first and foremost, if it’s the considerable supervision human body modulates the brokerage.

Your objective is to locate the absolute most trusty brokerage until you start an internet account.

Can I start trading with $100?

Yes, possible. Launching an internet account with $100 is a fantastic beginning if you would like to realize your money rise to $10,000. However, to ensure that your trading success, be sure you follow these steps until you place an order:

- Learn as much as you can about trading

- Understand the basics of FX terminology

- Research, study and analyze the market

- Learn more about the economy of the country

- Learn how to calculate profits properly

- Learn more about the major forex pairstheir nicknames

- Learn how to read forex currency pair quotes

- Create an trading strategy and follow !

If you follow the cited previously measures, then you may end up one step nearer to achieving your objective of turning $100 to $10,000. It won’t happen overnight, so you have to be patient.

Why starting with $100 is A smart choice?

The answer is easy: risk management reasons. Before you place an order, it would be smart to stick to risk management rules. Experienced traders don’t hazard over 1 percent of their balances. And ‘s the way they overlook ‘t lose a lot of money.

So, if you begin with $100, then your risk should be $1. Some people might say that $1 won’t allow you to earn money, however you will need to maintain your own interest!

Imagine what’s going to happen if your hazard is 100, along with your investment choice has been dreadful. Just how are you going to have the ability to earn $10,000 in the event that you have $0 into your accounts?

Bottom line

Be patient, buy smart, and as time passes, your accounts will probably grow, and you’ll achieve your objective of earning $10,000 with $100.

If you invest a lot more than $100, however you still utilize whatever I distributed to you personally in the following guide, your likelihood of achieving your goal earlier, will probably soon be higher. If it involves trading forex, currency earning money in this business.

To study more about every one of the steps I mentioned previously, or which will be the three most useful brokerages in 2020, you should examine this enlightening article.

How to trade forex with $100

How to trade forex with $100 to earn more than $10000

It seems most of the investors are afraid to go for a huge amount of trades other than a few dollars. Actually, we cannot exactly say that there is no risk of investing more than a hundred dollars. That is why we decided to offer this info on the secrets of how to trade forex with $100.

Forex is one of the most reliable online trading methods. A number of investors are working on this platform to have a remarkable profit at the end of the mission.

However, getting into the system by focusing on profit is a different strategy. So, the beginning level of the system is a somewhat complex task for the newcomers.

But, after a certain period of training, they can get an idea of the real-time, the reliable investing amount, and the future patterns of the trade. Hence, they can easily work on a winning path.

Six steps to start forex with 100 dollars

- Start to invest your money

- The margin calculation takes place

- Calculate the margin that you have already used

- Find the equity

- Explore your free margin

- Finally, obtain the margin level

Trading to have a big profit is not a reliable goal as the word sounds. But, if you use strategies as it, you can achieve your daily target of gaining more than five percent of the profit from the investment amount.

Well, now we are going to invest $100 for the next trade. Keep in mind that we do not go to become a loser again. This is the ideal step to have more than ten thousand dollars within about three months.

1.Start to invest your money

Once you deposit $100 into your current forex account, you can start this journey.

2.The margin calculation takes place

This step is a battle of calculating hacks in between two leading financial units known as euro or USD.

Probably, we invest money using the USD. So, in order to take the final required marginal values, we must explore by going through euros.

You have to work on five micro-lots and the marginal value of one percent. So, the final value may be around sixty dollars.

3.Now, calculate the margin that you have already used

Since this is the one and only trade we are going to place, this value may be the same as the above-obtained one.

4.Find the equity

Check your current position and floating in accordance with it. Now, the equity is equal to the sum of these two values.

5.Explore your free margin

Currently, you have all the data to analyze this. The free marginal value is the amount obtaining through subtracting the used marginal value from the calculated equity.

Now, we have finished almost all the steps in this trading process and there are only two remainings.

6.Finally, obtain the margin level

The level of the margin comes as a percentage and it will decide your future trading outcomes.

So, once you complete all these six steps carefully observe what will happen for your account at the last step. You will notice a profitable change at the end.

The final lines for you..

If you find all these in the correct way by referring further pieces of evidence, you can work on next wining path. So, do not forget that “how to trade forex with $100” is not an unreliable methodology.

But, you have to be strategic to save the invested amount. We hope to meet you with more details. Until that, you can keep engaging with us.

Can I start forex trading with $100?

Can I start forex trading with $100?

Absolutely! With the introduction of micro accounts by forex brokers several years ago you can now open an account with no cash and start trading with as little as $100. But just because you can doesn’t mean you should. In fact, if you do, I think you’ll find your forex trading experience a very short one.

I personally think the regulators need to step in and get some sanity back in the market place because if you start trading forex with $100 it is simply crazy. Let me explain why?

The forex brokers make money from volume turnover by their clients otherwise known as brokerage fees. They’ll take money from anyone in order to make a buck. They know there are millions of traders out there with $100 and they are all potential clients. So, to get the ‘punters’ in they offer 400:1 leverage. That means you can ‘fictitiously’ turn your $100 into $4,000 buying power. Which means you can trade 4 lots (or $400,000) with your $100 capital. Sounds awesome right, especially if you don’t have much money. Wrong!!

Brokerage fees and spreads

Let me explain what’s going to happen to your $100 when you trade 4 lots. As soon as you place a trade, you’ll pay approximately $30/40 in brokerage fees, leaving you with $60-70 as collateral. If the market moves against you by 2 pips, you would lose your account balance and your position would be automatically closed out. The market spread for the major currency pairs is on average 0.3-0.5 pips so in fact, if the market moved 1 pip against you your position would be closed out and your account left empty!

Even if you traded 1 lot with your $100 the most you could afford the market to move against you is 6-7 pips. Don’t forget your brokerage costs took the other $30.

Now before you say ‘hey I could trade micro lots’ and last longer. That’s true, you could, but once again how much money are you going to make trading 0.01 lots? If the market moved 100 pips, you’d be up $10. Now that’s not going to make you rich anytime this millennium.

So, to answer the question “can you start trading forex with $100” the answer is yes, you can, but you sure as hell shouldn’t. You’re basically throwing your money away!

Trading under capitalized leads to high risk and high failure rate

This comes back to the biggest reason why most retail traders are not successful, in my opinion, is because they are undercapitalized. With very little cash in your account you don’t even have a chance to build any significant capital. You pay your brokerage fees and then get whipped out of a position before you have time to blink.

If you did manage to survive the first trade, then it may take you 2 years to double the account to $200 trading micro lots. Now I’m sure that’s not part of the plan. The journey for most new traders is they start with $100 then add another $100 then another $100 then $1,000 and then another $1,000 until they bleed their savings account dry.

The smart decision is to invest in yourself and get some proper training or join a funded trader programme and use that company’s capital to trade. You can find several company’s offering funded programs and they usually start from around $100-150. Just be careful and check the programme structure. The last thing you need is paying monthly subscriptions or hidden fees for additional resources.

So how much money do you need to start trading forex?

In my opinion when you start trading forex the minimum starting balance is $10,000. Anything less than that and you are going to be under pressure from day 1 when you open the account. Now I’m not saying you’re risking the whole $10,000, far from it, in fact you shouldn’t be risking more than 20% of that capital, that’s $2,000, and that’s with an aggressive approach.

Having the $10,000 in the account is to make you relaxed and comfortable and allow you to access some of the leverage available to you.

So, if I’m only risking $2,000 why put in $10,000?

Trading is all about psychology and managing your emotions. If you start with $2,000 and trade the same level of risk as you would with $10,000 in your account you would be thinking every trade, ‘oh no I’m going to lose all my money’. One bad trade and your close to what we call the ‘back door’, an empty account. You won’t be able to relax and straight away you’re trading from a negative space and trading ‘defensively’ is a recipe for disaster. You’ll be trading not to lose instead of trading to win!

Now if you start with $10,000 in your account you’ll be relaxed and calm. You know your maximum drawdown is $2,000 and the chance of you losing all your cash is close to zero. So, you start trading to make money and you’re not worried about a loss. Confidence is a powerful emotion and will often determine your actions. Trading with confidence is an absolute must.

So how much leverage do I need?

There is no need to trade with anything more than 10:1 leverage. The brokerage firms only set up micro leveraged accounts with 500:1 leverage to sucker people in who only have a small amount of money. The banks and hedge funds would even go close to 10:1 leverage. If you have $10,000 in your trading account, you can trade 1 lot and that’s more than enough to make money with.

If you join a funded trader programme with a $100,000 account, you could trade 10 lots and now you really have the chance to make serious money! A move of 30 pips will net you $3,000 USD and that’s a far cry from trading a micro lot and making $3 USD. So, before you open a brokerage account and fund it with your $100 think of your options.

Be realistic with your expectations

It’s imperative you have realistic expectations before you start trading. Don’t believe the hype that you can turn $100 into $100,000, because it just isn’t going to happen. How much money you deposit into your account plays a major role in how much money you’re going to make and that’s why I say investing $10,000 as a minimum is the way to go. You can double your $10,000 in a matter of 2-6 months with proper capital management and trending markets and that will provide the foundations for a long-term trading career. If you don’t have the $10,000 then I’d suggest you invest your cash in a reputable funded trader programme where you can at least leverage up someone else’s money and trade risk free!

How to trade forex with $100

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Many people realize that $100 doesn’t buy much these days, but if you want to trade the forex market, $100 can get you started and could even generate a new source of income you can earn at home. If you manage to develop and implement a successful trading plan, then your first $100 forex account could ultimately change your life for the better.

On the other hand, if you plan to just get into the currency market to make a few practice trades or to gamble a bit, then a loss of $100 usually won’t break the bank for most people.

The key to success as a forex trader consists of having a viable trading plan that you can easily stick to, no matter whether you’re trading with $100 or $1,000,000 in your margin account. Read to learn how to get started trading forex with $100.

Step 1: research the market.

Knowledge is power. These words take on a special meaning when applied to trading in the forex market that holds the top position for trading volume among the world’s financial markets. Knowing more about markets and trading in general increases your chances of succeeding when you trade forex.

Of course, if you just want to take a quick gamble with your $100, then you wouldn’t need to learn much more than how to enter orders in your brokerage account using an online trading platform.

To achieve any level of consistent long-term success, however, you will need to acquire a certain amount of knowledge about currencies and the fundamental factors that influence their relative valuation. Most online brokers provide ample educational resources for new traders that can include articles, ebooks, webinars and tutorial videos. All of these can help you learn more about the forex market before you begin risking money.

You will probably also need to learn how to analyze a market’s behavior to have a better chance of predicting its future direction. The 2 principal analytical market research methods for traders consist of fundamental and technical analysis.

Fundamental analysis

This method analyzes the impact of economic releases and news on the market. Each currency’s relative value generally reflects the state of that particular nation’s economy and its geopolitical situation compared with the currency it is quoted relative to.

Below are the most important news events and indicators watched by fundamental forex analysts:

- Geopolitical shifts and other major news events

- Central bank monetary policy and benchmark interest rate levels

- Gross domestic product (GDP)

- Employment statistics (non-farm payrolls, unemployment rate, weekly initial jobless claims, etc.)

Fundamental analysis gives you an important edge when you trade. Not only can it help predict longer term exchange rate trends, but it can also help explain and predict sharp short-term movements, such as those that coincide with significant economic releases.

Most online forex brokers include a news feed with their trading platform to help you perform fundamental analysis. Another important resource for fundamental trading is the economic calendar that lists all the important upcoming economic releases for various major economies.

Technical analysis

You can study the forex market using technical analysis such as charts and computed technical indicators — a common method to determine the levels of supply and demand in the market that can influence and predict an exchange rate’s future movement.

By looking at exchange rate charts you can identify common patterns with predictive value. You could also use a variety of popular indicators based on market observables to help predict short- and long-term trends in the market.

These indicators can include moving averages, momentum oscillators, overbought or oversold indicators and volume figures. Some important indicators include the moving average convergence divergence indicator (MACD), the relative strength index (RSI) and the 200-day moving average, to name just a few.

Trading volume is another important market observable to give an indication of how much activity accompanies a particular market move. Also, support and resistance levels suggest the degree of supply and demand existing at different exchange rate levels.

The charts themselves can also give important information to use and act upon. For example, a fascinating system of interpreting and trading candlestick charts was originally developed by japanese rice merchants. These informative charts indicate the opening and closing exchange rates, the range of the currency pair and whether the exchange rate increased or decreased for each period displayed on the chart.

Overall, technical analysis provides a relatively objective way to analyze the forex market that can work well for predicting short-term market moves. Many scalpers and day traders use technical analysis to inform their trading activities.

Step 2: open a demo account.

Most online forex brokers provide clients with a fully functional demo account, which reflects market conditions but does not require you to make a deposit.

The forex platforms provided by these brokers generally have comprehensive technical analysis tools such as charting and indicators that incorporate into the chart. If the broker supports the popular metatrader 4 platform developed by metaquotes, then you can automate your trading with expert advisor (EA) software you can buy or develop yourself.

The reason opening a demo account makes sense is so that you can get a feel for the market and learn how to use a broker’s trading platform without committing any funds. You can also use a demo account to begin working out your own trading strategy and putting it into a trade plan.

By learning how to take risk as a forex trader and seeing how disciplined you are when dealing with taking profits and losses, you can also determine if you have the necessary mindset to become successful as a forex trader.

Once you’ve opened your demo account and have begun trading with virtual money, you can start developing a trading plan. If you plan on success, remember that the more you know, the easier developing a trading strategy becomes. Take the time to review as many of the online educational resources on trading that you can, so that your trading plan has a solid foundation in best practices.

Step 3: fund an account and start trading.

Once you’ve traded in your demo account and worked out a trading plan you feel confident with, you can fund a live account and make your first real trade. Although trading in a live account may seem identical to trading in a demo account, you’ll have to deal with the emotional swings that come with winning and losing money, even if you’re only risking $100.

Fortunately, any viable trading plan can be traded with a $100 account since most brokers will let you trade in micro units or 0.01 lots. After you’ve refined your trading plan and have increased your working capital with profitable trading, you can then increase the size of your trading units. Avoid taking larger than expected losses by incorporating a sound money management component into your trading plan.

If you’re a beginning trader, you may want to restrict your trading activities to one particular currency pair before taking positions in multiple pairs in your account. Each currency pair differs in the way it trades because of the underlying fundamentals of the component currencies.

So, let's see, what we have: how to start forex trading with $100 and turn it into $10,000 the thing I like most about forex trading is that you can start trading forex with as little as $100 and turn it into $10,000 or at how to start forex trading with $100

Contents of the article

- No deposit forex bonuses

- How to start forex trading with $100 and turn it...

- No forex trading experience: what should I...

- Can I gain trading experience without losing...

- How do I choose a brokerage for my live...

- Can I start trading with $100?

- Why starting with $100 is A smart choice?

- Bottom line

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- How to start trading forex with only $100

- How to start forex trading with only $100-$150?

- How to start trading forex with $100

- Can I start trading forex with $100?

- Is it possible to earn a living by trading...

- When should I start trading forex?

- Bottom line

- How to start forex trading using $100 and turn it...

- No forex trading experience: what should I do?

- Can I gain trading experience without losing...

- How do I choose a brokerage for my live trading...

- Can I start trading with $100?

- Why starting with $100 is A smart choice?

- Bottom line

- How to trade forex with $100

- How to trade forex with $100 to earn more...

- Six steps to start forex with 100...

- 1.Start to invest your money

- 2.The margin calculation takes...

- 3.Now, calculate the margin that you have...

- 4.Find the equity

- 5.Explore your free margin

- 6.Finally, obtain the margin...

- Can I start forex trading with $100?

- Can I start forex trading with $100?

- Brokerage fees and spreads

- Trading under capitalized leads to high...

- So how much money do you need to start...

- So, if I’m only risking $2,000 why put in...

- So how much leverage do I need?

- Be realistic with your...

- How to trade forex with $100

- Step 1: research the market.

- Step 2: open a demo account.

- Step 3: fund an account and start trading.

Comments

Post a Comment