XTrade Review 2021, xtrade review.

Xtrade review

Besides major currency pairs like EUR/USD, GBP/USD, USD/JPY, etc., xtrade also offers a range of minor and exotic currencies to its customers.

No deposit forex bonuses

All fees are charged as spreads, which happens to be fixed and ranges between 2-5 pips. We accessed its website during a weekend, the spread on EUR/USD was showing 5 pips, which would be pretty high compared to its close competitors. Although, we are sure that it comes down to 2 pips during regular trading hours, which is sunday 9 p.M. To friday at 9 p.M.

Xtrade review 2021

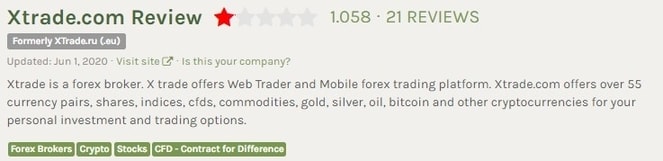

Xtrade rating

Pros / cons

- Bad reputation

- Not metatrader platform

- High spreads

- Min. Deposit of $250

What is xtrade?

Founded in 2003 and based in melbourne (australia), xtrade is owned by the xtrade.Au pty ltd. Although xtradde is primarily registered as an australian company and has authorization from the australian securities and investments commission (ASIC – ACN: 140899476 licence no: 343628) throughout the world and has multiple offices located in its major geographical markets.

As an innovative company, this financial firm was one of the first brokers to offer forex trading via contracts for differences (cfds). Xtrade is one of the largest providers of CFD trading and has clients from around the world.

The football star cristiano ronaldo was their ambassador from 2016-2017.

Regulation & trust

Is xtrade a good and regulated broker?

Yes, its australian clients are protected by one of the most strict government regulatory authorities, the australian securities and investments commission (ASIC – ACN: 140899476 licence no: 343628).

Xtrade has a very poor history of fraudulent behaviour ( withdrawal issues, unfair conditions in its platform, …).

Trading platforms & tools

As xtrade is a CFD broker, it does not have to pass customer orders to the real market, because all books are maintained internally. Hence, they do not offer traditional trading software like other forex brokers.

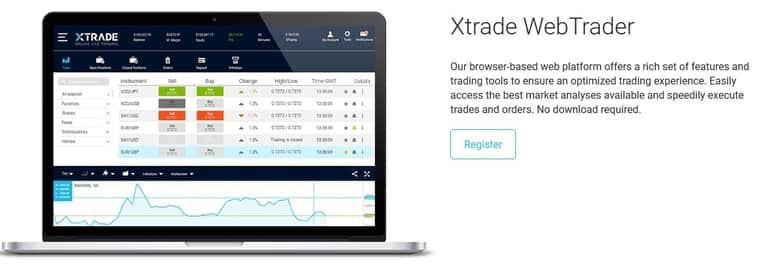

Instead, this broker has developed its own proprietary trading platform, which customers can access from any regular modern browser and from their smartphone.

Currently, they offer mobile trading applications for android, ios devices, and windows phones.

Does xtrade use metatrader?

Not, they don’t support metatrader platforms.

Instruments

How many assets can be traded at xtrade?

They provide trading shares of major companies and indices. N addition to the equities, they also allow its customers to trade major commodities like gold and silver. However, the largest collection of trading instruments offered by them is the forex currency pairs.

Besides major currency pairs like EUR/USD, GBP/USD, USD/JPY, etc., xtrade also offers a range of minor and exotic currencies to its customers.

During our research for this review, we found that their customers can also trade virtual cryptocurrencies like the bitcoin on its platform.

Trading conditions

What are the xtrade spreads?

All fees are charged as spreads, which happens to be fixed and ranges between 2-5 pips. We accessed its website during a weekend, the spread on EUR/USD was showing 5 pips, which would be pretty high compared to its close competitors. Although, we are sure that it comes down to 2 pips during regular trading hours, which is sunday 9 p.M. To friday at 9 p.M.

What are their fees and commissions?

Xtrade.Com don’t charge commissions on their accounts, but they have a $50 inactive account fee per month if you don’t trade for a period of 3 months.

What is their max leverage with icmarkets?

They offer up to 400:1 leverage on all of its instruments.

Research & education

They offer basic online educational tools including video tutorials, forex courses and an economic calendar.

Type of accounts

You can choose among 4 accounts depending on your minimum deposit:

- Standard: $250 min. Deposit. Basic features, with high spreads.

- Premium: $1,000 deposit is required. A dedicated account manager is provided by xtrade.

- Platinum: you must deposit $5,000. You get a VIP trading support, and lowest spreads.

- VIP: $20,000 minimum deposit is required. This account includes a priority account, individual trading strategy, and lowest spreads.

Xtrade demo account

All of these 4 accounts come to include a free demo version.

What is the minimum deposit on xtrade?

Customers can open a standard account with a $250 initial deposit.

Client support

They offer several popular channels of communication to its customers, including, live chat, email, or telephone. However, we found that xtrade hour support team is available from sunday at 22:00 GMT to friday at 22:00 GMT only.

Customers are encouraged to send an email to [email protected] prior to calling. However, xtrade does offer strong phone support.

In addition to phone and email support, xtrade also has a live chat option on their website where customers can reach customer support during business hours, which excludes the weekends.

Conclusion

Although that xtrade is an australian regulated broker and this broker was a pioneer in CFD trading and its extensive global reach made it one of the handfuls of top brokers around the world, last years they’ve gained a very bad reputation in the industry due to many client complaints about withdrawal issues, manipulation of prices, and huge spreads.

Xtrade review

Overview

Table of contents

Website

Company

Address

Phone

Regulation

Warning

Rating

Xtrade details

Xtrade is an online trading broker owned by xtrade international ltd and located at cork street, no 5 belize city belize.

They can be contacted by phone number at +442038074001 or by email at [email protected].

Their website can be found at : xtrade.Com

Traders opinion

To avoid being scammed by a con artist’s scheme, it is recommended to first take a look at what other people are saying about the company you want to invest in.

After doing some research on social medias (facebook, twitter, instagram…) and trading forums, we found out that some users are unhappy about their experience with xtrade and wrote mixed reviews about it.

It seems like xtrade is not a reliable broker and you should take that into consideration before investing.

If you don’t want to be the next victim of a fraudulent broker operating with a fake company, always do your own research first.

Is xtrade legit or a scam?

This is the most important thing you need to know about a broker before using it. Is xtrade regulated ? Is it an offshore company ?

Most brokers are unregulated or regulated by an offshore regulation authority which won’t help you in case of problem. Keep in mind that if a broker steal your funds, you won’t be able to complain about it unless they are licensed by a serious regulator such as:

- The cyprus securities and exchange commission (cysec)

- The financial conduct authority (FCA)

- The australian securities and investments commission (ASIC)

An unregulated broker is clearly not authorized to operate in any regulated country and you should definitely not put any money into it.

You should definitely avoid any unregulated or offshore trading compagnies!

How online trading scams work

The common used strategy by fraudsters is to first display some winning trades on your account to give you the impression that you are quickly and effortlessly making money. This allow them to gain some trust and confidence from you.

Their next step is usually asking you to invest more money or get some friends and family to invest in order to get the maximum funds they can from you.

When they feel that you are not able to invest any more money into the scam, they will simply suspend your account and you probably won’t hear from them any longer.

Many scam firms fraudulently claim to be based in a regulated juridiction using fake addresses and regulation licences in order to look truthfull in the eyes of future clients.

XTRADE review (2020): scam update

Is xtrade a scam? A real xtrade review

Is xtrade legit? Are they regulated? This xtrade review will answer these questions and more while clarifying if xtrade is a forex scam.

Is xtrade a regulated forex broker?

Xtrade is regulated by the cyprus securities and exchange commission. They are also registered as a cyprus investment firm and are therefor covered under the investor compensation fund (I.C.F). This means that if the forex company goes bankrupt, clients are guaranteed their invested funds up until €20,000.

Xtrade is regulated by the cyprus securities and exchange commission (cysec) under the name xtrade europe ltd. This means that they are authorized to provide services throughout the EU.

However xtrade.Com is not covered under this regulation. The only approved xtrade owned domains that are regulated by cysec are offerfx.Com and offersfx.Eu. This means that if you’re trading on an xtrade website, they are not regulated.

Xtrade europe has previously used the names XFR financial ltd. And O.C.M. Online capital markets ltd.

It’s important to note that despite any claims otherwise, xtrade is not and never was regulated by the FCA . Xtrade australia has been flagged by the australian securities and investments commission (ASIC) as well as the british columbia securities commission (BCSC).

Is xtrade regulated in australia?

Xtrade is regulated in australia by the australian securities and investments commission. This means that australians citizens are offered a certain level of protection when trading with them.

If you’ve been scammed by xtrade, you can get your money back. Contact us here.

If you’re a client of xtrade and you are certain that you have been treated in a way that is highly questionable, you are likely being scammed.

Be wary of recovery scams targeting xtrade clients. There are methods of getting money back from xtrade. We can advise you on what’s possible and what’s just another scam. Contact us.

Is xtrade legit?

Xtrade is known to deny their clients withdrawals. For this reason alone xtrade is a scam.

There are additional red flags that indicate that xtrade should not be trusted which we’ll cover below.

What is xtrade?

Xtrade is an offshore forex broker that offers forex and CFD trading services. They were established in 2003 and are registered in belize at no.5 cork street, belize city, belize. C.A. Where they also claim to be located. They have additional offices in cyprus, israel and australia.

If one chose to visit them to try and get their money back, it’s likely that a trip to their registered location would be in vein, as most belize based forex brokers are actually scams and don’t have a physical operation anywhere in the country.

You might be more likely to find their offices here.

If they are located in belize should I trust them?

It would make sense to conclude that the reason that xtrade is located in belize is because they are a scam. Many forex scams choose belize as their location to register. We’ve covered this topic in other articles but to put it simply, belize is a haven for individuals who look to open up companies without having to identify who they are or be held accountable for their business practices.

The fact that they are registered and claim to be located in a country that is fraught with corruption and well known for being a money laundering hotbed, is enough to label them a scam. But why stop there when there’s more?

Before we do so, and for the sake of covering all things xtrade, let’s have a quick look at their platform and offerings.

What services do they offer?

In terms of services, xtrade offers 1:400 leverage on over 150 CFD’s, 51 currency pairs in addition to bitcoin, 74 stocks, 12 indices to choose from and 13 commodities. They have the lowest minimum deposit in town at $100 USD (or $1 USD according to some clients) and they do not charge commissions or hidden fees.

The trading platform – xtrade website and app review

The xtrade website is designed with state of the art graphics and is optimized to suit their global client base and convince even the most suspecting individual of their legitimacy. They use their own proprietary trading platform which is available as a web application and a mobile app for both android and apple devices.

Account management and types

The xtrade website doesn’t officially state that they offered managed accounts, however many reports have told us that there is account management taking place.

As far as actual types of accounts, unlike most of their competitors, xtrade does not offer different account options. This is unusual to find with a scam broker. The sales processes used in the forex fraud industry is heavily bolstered by a method of funneling individuals through different accounts. You can read more about how that works here.

Is xtrade a market maker?

Yes, xtrade is a market maker and all executions take place in house. This means that clients are betting against the house. What’s even more concerning is their usage of a proprietary platform. Combine this with their lack of regulation makes for a “do whatever you want” environment.

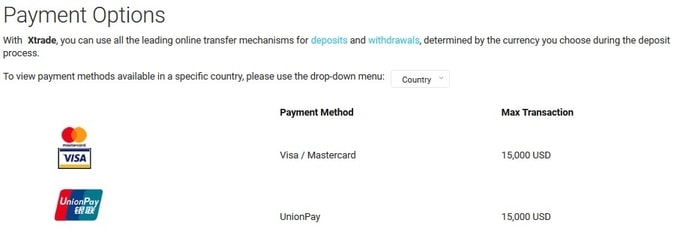

Payment options

Xtrade is exceptional when it comes to funding your account. They offer a wide variety of payment options on their website, these include visa/mastercard, and over 60 other methods of payment. They make it very easy to find what methods of deposit are available with their country drop down menu. Many of the options of deposit are geared towards their south american clientele.

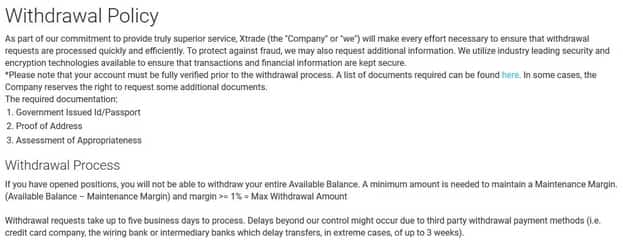

Withdrawal policies

When it comes to withdrawals, this company has a bit of a lengthy process. According to their policies, three conditions are required to process a withdrawal.

- A government issued ID or passport

- Proof of address

- Assessment of appropriateness

In addition to the above, the website states that withdrawal requests can take up to five business days, or in extreme cases, up to 3 weeks! That kind of policy could be considered a scam even if xtrade wasn’t a proven scam broker. This is also something you won’t find on your average xtrade review.

Most financial service providers allow you to simply press a button. Xtrade provides that button as well, however be prepared for a lengthy withdrawal process that eventually leads to not receiving any funds and the clear conclusion that xtrade is a scam.

The rule of thumb with forex scam companies is; withdrawals are granted as a tool that the broker uses only in order to earn the clients trust so that they will deposit more money. This is certainly the case with xtrade. If one does manage to make a withdrawal, they can get ready for the broker to ask for a lot more money on the next call.

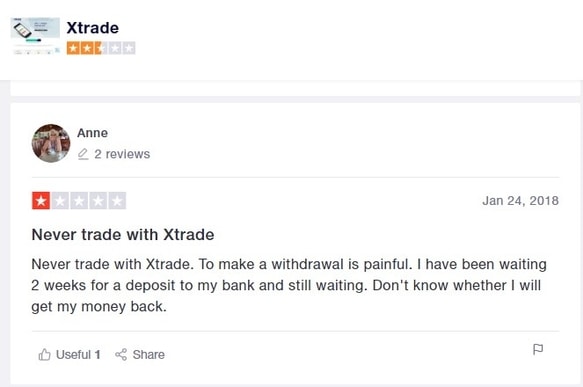

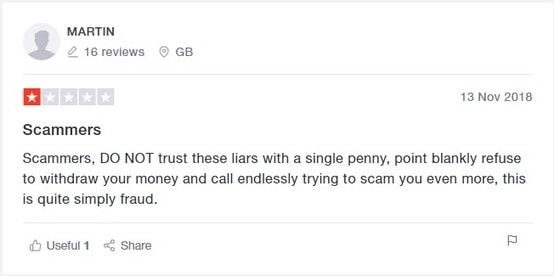

Xtrade online reviews – what the customers are saying.

Online reviews are not always what they seem to be, especially in the forex industry. However there is often enough material available to sort the wheat from the chaff. In this case, it’s not too difficult.

One thing we know regarding sites like trustpilot. A company has the right to dispute a negative review. If the reviewer can’t provide proof of their experience, then the negative review is removed. Here’s an example of an online review from january of 2018 that has not been removed, it relates to the withdrawal policies that we mentioned above.

Unfortunately, we have to assume that anne never got her money back.

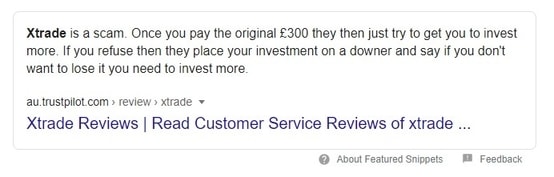

It even seems like google agrees that xtrade is a scam.

Forex peace army (FPA) review of xtrade

These website used to be a very reputable one but has recently experienced on onslaught of fake reviews. We’ve still seen efforts by FPA to maintain integrity. Recent choices of sponsored ads on their site have lead us to second guess what’s really going on. The overall rating of a company is something that can be used as a general reference to a company’s standing.

Here’s how they grade the subject of our review.

How about their customer service?

Thinking that customer service actually exists at a company like this one is a mistake in it of itself. The fact that an online review website awarded them the 2017 best forex customer service award just tells us a little bit about the standards of that website.

Customer service is something earned and in the case of xtrade here’s how the clients feel.

It would seem that martin from the UK who lost his money to this company puts it into the most eloquent way possible as he says in his review, “DO NOT trust these liars with a single penny.

Proof of the scam

In essence, xtrade has not done anything that we haven’t seen over and over again in terms of being a scam broker. Their history with regulators is only one of the many damning factors. This is a company that while it still did have regulation was directly partnered with xforex, another infamous unregulated forex scam. However in addition to all of the above factors, the very complaints that clients have made to us regarding xtrade and the consistent nature of these reports is enough to know that this company is up to no good.

Conclusion

While xtrade made efforts early on to attain regulation and paint itself as a worthy broker. The reports are out and it’s clear from their lack of regulation and insistence on not returning their clients funds that xtrade is a scam.

If you’ve been burnt by xtrade and you want to get your money back, report your case to us here. We’ll tell you how you can get your money back.

We’ll also contact you if a criminal investigation takes place and if a class action lawsuit is pursued.

Getting your money back.

There are two possible ways to get your money back from a company like xtrade and they don’t apply to all situations. We can tell you where you stand in terms of possible recovery of your funds and what to lookout for.

Xtrade scam

Is xtrade australia a scam?

Xtrade australia review – can this broker be trusted?

Is xtrade scam or legit?

Introduction

Looking for a way to earn money? There are hundreds of thousands of people in the world who are looking for opportunities to make money. Sure, you can earn from a 9-to-5 job, but with the rising expenses for maintaining a certain lifestyle, it can become difficult to make ends meet. Even if you are able to fulfill your needs, there is just not enough left over to save for the future. So, what should you do? Wouldn’t it be great if there was a way that you could make money quickly and with a small investment? The good news is that such an option does exist and it is referred to as online trading.

The trading markets have been around for years; you have probably heard of the stock market and the forex market where people are known to make millions. But, most people don’t give it much thought because it involved a lot of logistics that not everyone could handle. However, in the last few decades, things have been changing gradually in every industry. Technology has resulted in a number of changes in almost every space, as has the internet. This is also applicable to the world of financial trading, which has become a lot more accessible than it ever used to be.

Gone are the days when you actually had to go out to trade in the financial markets, or when you needed experience and knowledge to even think about trading. Likewise, there is no longer any need for you to have massive amounts of capital to invest in one go either. Today, thanks to online trading, you can trade from anywhere, trade even if you have never done so before and start with a very small amount, until you are ready to invest more. Hence, there has been an influx of people in the trading markets in the last decade or so.

More people have taken interest because these markets are filled to the brim with opportunities and it is up to you to take advantage of them. But, how do you do that? Where do you have to go in order to do so? This is where you start looking for an online broker, as they are the ones providing you with the trading platform that connects you to the financial markets. They are responsible for giving you access to the tools and resources needed for your trading journey.

With the popularity of online trading, the number of companies offering trading services in the financial markets has increased substantially. There are a multitude of brokerages that you can find, but it is crucial to remember that every company is different. No two companies will offer you the same level of services or features, so it is up to you to make the decision. In addition, it is vital to remember that scams and frauds are also rampant in the online markets, so you need to ensure that the company you are considering can be trusted.

You have to be extremely diligent because the broker you choose will have a direct impact on how your trading experience turns out and also whether you succeed or not. Xtrade australia is one of the options that you will find when you start searching for a good broker. A quick look at their website indicates that they are quite competent and offer all the required services, but it is easy for anyone to make claims these days. You should make the effort of verifying the information in order to confirm if the company can be trusted or not. This means assessing various aspects of their services, which you can do below.

An introduction to xtrade

| broker | xtrade |

| website | https://www.Xtrade.Com.Au/ |

| trading accounts | 4 account types; standard, premium, platinum and VIP |

| minimum deposit | $250 |

| assets coverage | shares, forex, commodities, indices and cfds (contract for difference) |

| trading tools | live charts, economic calendar, risk management tools, price alerts, technical analysis, financial news and daily analysis videos |

| education and training | yes; , glossary, e-books, online video courses, webinars, tutorials and expert sessions |

| customer support | 24/6 through live chat, email and phone number |

| security policy | KYC (know your customer) and AML (anti-money laundering) |

| parent company | xtrade europe ltd |

| regulation | cyprus securities and exchange commission (cysec) |

First and foremost, you should know that xtrade australia is a forex and CFD (contract for difference) broker, which means that you don’t need to purchase assets physically and only trade based on contracts of the underlying asset. They have been offering their services in the market for more than a decade, which means they have plenty of experience and understand how the financial markets work. The fact that they have been able to survive that long indicates that they know what they are doing and can be trusted. Their offices are located in limassol, cyprus and they were founded by xtrade europe ltd.

You will discover that xtrade australia is a registered and licensed broker and falls in the jurisdiction of the cyprus securities and exchange commission (cysec). It is one of the most renowned regulators in the world and companies that fall under its umbrella can be trusted and relied upon because all their activities are monitored. According to the rules of cysec, xtrade australia has to be transparent in its services and dealings and its policies are also in accordance with rules of consumer protection. It doesn’t exploit any customers and is honest with them.

Moreover, cysec regulation means that customers of xtrade australia also qualify for the investor compensation fund. Thus, if the company goes bankrupt or has to shut down for any other reason, all traders will be compensated and will not lose their entire investment. This is not a security that you can get with many companies, so it gives you peace of mind and tells you that the broker can be trusted. But, there are a number of other things that you need to check. What are they? Read on to find out:

Xtrade australia’s trading products

The trading products of any brokerage are their most important feature because they determine what kind of returns you can get. Some people enter the trading markets with the intention of trading some specific assets, while others may just want to diversify their investment portfolio. No matter what category you fall into, it is necessary to know what you will be able to trade. Most companies you come across will make big claims about offering you lots of variety and the best trading products, but when you take a closer look, it becomes apparent that most of these are just big claims.

How does xtrade australia fare in this regard? You will come to know that they have been quite honest about their offerings and do provide the substantial variety they claim to have. The trading products that you can find on their platform include:

Commodities: one of the best option for traders with a low risk appetite is the category of commodities, which include soft ones, along with hard ones. The former refers to agricultural commodities, such as coffee, corn, wheat, cocoa and sugar, while the latter refers to precious metals like gold, silver, copper and aluminum, and even energies like natural gas and crude oil.

Forex: the biggest market in the world, the foreign exchange market involves trading of currency pairs and has a daily trading volume of more than $5 trillion. You can trade major currency pairs, minor ones and even some exotic and rare choices are available. Some of the currency pairs that can be explored include GBP/USD, EUR/USD, USD/JPY, AUD/USD, NZD/USD and USD/CHF.

Stocks: the stock market provides traders with the opportunity of buying and selling shares of some of the leading companies in the world. You can invest in prominent ones like google, apple, spotify, pfizer, amazon.Com, aurora, BMW, microsoft, coca cola, netflix, VISA and paypal.

Indices: while the stock market deals with investments in individual companies, the combined stocks are dealt with in the indices market. These are very lucrative and can offer solid returns to traders. You can opt for some of the top indices in the market, such as the FTSE 100, NASDAQ, dow jones, nikkei, CAC 40, DAX and S&P 500.

With xtrade australia, you will have the freedom to trade in any category or all of them, if you want. This gives you plenty of room to diversify your portfolio, which is helpful in reducing your risks and giving you maximum returns.

Xtrade australia trading solutions

Before deciding to trust a broker, it is a good idea to take a look at their trading solutions. After all, it is this particular feature that you will be using the most because it involves executing your trades in the markets. The trading platform will determine how quickly your transactions are executed, how easily you are able to make them and the trading tools you can use for making your decisions. In most cases, every brokerage offers their own trading solutions to their clients, which means there is no guarantee of what you will get.

If you take a look at some of the negative reviews that companies have received, you will notice that traders focus on the trading platform the most because it is used for making the trades. If it doesn’t perform well and has loopholes or lacks in any way, you will not be able to have a profitable experience. Hence, you need to see what kind of trading solutions are available at xtrade australia. One of the good things about this company is that it fully recognizes and understands the needs of modern traders.

Since it has been operating in the market for a long time, it knows how the trading markets have changed and the kind of trading solutions that can fulfill every trader’s needs. First and foremost, you will come across a web trading platform at xtrade australia, which provides flexibility and functionality to its users, all rolled into one. As it doesn’t require any kind of downloading or installation and is accessible through the web browser, traders can use it on any device they have handy. This gives them flexibility to trade without being restricted to a single device.

In addition to this feature, xtrade australia has ensured that traders can take advantage of instant trade execution and real-time results of their trades. They can use one-click trading and use the leading trading tools, including trading indicators, live and interactive charts, price alerts, daily market news and trends and an economic calendar to keep you updated. Furthermore, keeping the technological advancements in mind, mobile trading solutions have also been added. You can find apps that can be used on ios and android smartphones, as well as tablets.

These apps are intuitive and user-friendly, so everyone can use them without any problems. Also, they offer multi-asset trading functionality, allowing you to trade the asset of your choice. However, the biggest perk is that you can trade from anywhere and at any time, keeping track of your trading account and taking account of all movements. Xtrade australia has also equipped the apps with the best trading tools to help traders in making the most of their experience.

Xtrade australia’s account options

It is a given that when you want to avail any online service, you are expected to create an account with the company you are getting it from. This is something you will also come across when you want to sign up with a broker in the online trading market. Traders have to open an account because this is where all their personal information, trading history, record of transactions and other details are kept. You have to register with the company first and then you are offered several account options to choose from. These options are developed for facilitating different traders because not everyone has the same style, risk tolerance and goals.

When it comes to registration, xtrade australia has kept their process simple and quick, so traders can directly move onto the trading process without much hassle. You need to fill out a form on their website with basic details like your name, location, phone number, email address and a password. The last two are used as your login details for your trading account. You should check their terms & conditions, privacy policy, risk disclosures and other essential documents before completing the registration process. Once this is done, you can take a look at the account options available.

You will discover that a total of four accounts are provided at xtrade australia, each of which are developed for a different type of trader. The first account is referred to as standard, which carries a minimum deposit requirement of $250 and is primarily developed for beginners and newbies who don’t want to invest big right away. The second account is known as premium, which has a minimum deposit of $1,000. It is a better fit for intermediate traders, who have some knowledge and experience under their belt. The third account option that has been created is referred to as platinum, which needs a minimum deposit of $5,000, making it a good fit for advanced traders.

The last account option that you will come across on xtrade australia is named VIP and this one is for professional and VIP traders who can afford to meet the minimum deposit requirements of $25,000. The trading conditions of each account vary, with the lowest and most competitive ones offered to professional traders. Apart from that, there are also other features that can vary from account to account, but some remain consistent. You can get personalized trading, online chat support, daily news, webinars, online courses, e-books and more. Plus, they also provide you signals and daily trends and news.

While these account options are appealing, what makes people realize that xtrade australia is worth trusting is the fact that they have also added a demo account. This is a practice account that gives people virtual currencies they can use for trading. Sure, it is a perk for newcomers who get a chance to get acquainted with how the trading markets work, but can also help experienced traders in testing new strategies without actually risking their investment. Most importantly, it gives everyone a chance to test the company’s trading platforms and their conditions to see exactly what they will find when they create a real account with them. Only trusted and professional platforms will ever let you check this.

Xtrade australia’s educational resources

Thanks to online trading, anyone can enter the financial markets to start trading, but if you are interested in making profits in the long run, then you cannot simply rely on luck. It is possible that you will be able to rake in some returns initially by making lucky trades, but eventually it will run out and your capital can be wiped out easily with a single mistake. So, how do you avoid that? You can do so by polishing your understanding of the markets and acquiring detailed knowledge of how they work. But, where do you learn all of this? Finding the proper resources is easier said than done.

While the internet is a huge fountain of information, not everything you come across is authentic and accurate. This is where xtrade australia proves to be extremely valuable, as they have put together in-depth and extensive educational and learning resources for their clients. These cover a wide range of topics related to the trading world and can be helpful for not just newbies, but also experienced traders. These resources are provided in different formats for your convenience, which include e-books, online financial courses, videos and tutorials and there are also webinars that are held by market experts.

Xtrade australia’s security features

A broker’s commitment to security can show you whether it is a good idea to trust them or not. The online world comes with a lot of security risks. Every other day, you come across news of some kind of hack or breach happening and people losing their money or information. To combat this issue, you need to have solid security in place because online trading involves investing your money and also divulging your personal and sensitive information. At xtrade australia, you will come to know that the company has not made any compromises where security is concerned, particularly because it is a regulated broker.

As per the rules, they are required to take necessary security measures to ensure that traders are not exposed in any way. Their website is secured with 256-bit SSL (secure socket layer) encryption, which keeps all transaction and data safe from third parties and unauthorized individuals. They also follow rules of customer account segregation, which means that your funds are deposited in separate accounts and not mixed with the company’s own. Apart from that, xtrade australia’s security team is constantly monitoring the website and checking for any problems to fix them in order to prevent people from breaking into their system.

Moreover, xtrade australia has also implemented verification procedures for the purpose of preventing money laundering, terrorist financing and identity fraud. They require clients to provide a scanned copy of their passport, showing their name and date of birth, in order to confirm their identity. The next step is to provide proof of residence, which is given by submitting a utility bill, such as phone, electricity or gas, or a bank statement that shows your name and address. You should ensure that these documents are not more than six months old. It is a way of preventing suspicious actors from creating an account on their trading platform.

Final verdict

You will also find that xtrade australia is forthcoming about their trading conditions and have not tried to mislead their clients. They have also added convenient and diverse payment solutions to make banking secure for their clients. Lastly, they have not stinted where customer support is concerned and have added several secure channels that can be used for getting in touch with their team, all of which indicating that xtrade australia is a broker that can be trusted.

Xtrade review – get access to the best platform and tools for trading

Xtrade has been serving traders for more than a decade and it has remained committed to providing them with access to different financial markets.

Xtrade review

Do you want to trade in the forex market? It could be that you are interested in CFD trading. There is no doubt that trading has become a popular activity, especially amongst people who are looking for a way to earn some passive income. The fact that it is profitable and easy to begin also works in its favor. The problem is that many people are not able to move forward because they get stuck at the first step i.E. The choice of a broker. You need a broker because they are your bridge to the market, but the issue is that there are too many brokers offering their services.

These options can be confusing and many people end up choosing unreliable brokers that turn out to be scams. You need a legitimate and trustworthy broker if you have any hopes of succeeding in the trading world and this is where xtrade comes in. It is regarded as a leading global CFD and forex broker as well as financial institution. The company has been operating in the market for more than a decade and has helped traders in different parts of the world. Xtrade provides its clients with direct access to a wide array of financial markets, which include forex, crypto, commodities, stocks, etfs, options and cfds.

During its time in the market, xtrade has offered its services to some of the most renowned traders all over the globe and has facilitated them by providing a secure and safe trading environment. Let’s check out this broker and its services in detail:

Background

As stated earlier, xtrade has been serving traders for more than a decade and it has remained committed to providing them with access to different financial markets. The reason it is regarded as a unique trading platform is because of the services it is offering to its client base. If you check out most of the leading brokerages, you will discover that they are available for maximum 6 days of the week, but this is not the case with xtrade. This broker provides traders with access every single day of the week. They also have a round the clock customer support department for helping out traders whenever they come across problems with their accounts.

Thus, xtrade has become a favorite of traders because of its availability and the great services they offer. Even though it is not available in some jurisdictions, it allows traders from most of the countries in the world to access hundreds of financial instruments from their platform. In the past decade, the broker has handled transactions worth billions of dollars.

Scam or legitimate?

When you are trading in the market, you should first know the regulatory status of a broker before you sign up with them. When you trade with legitimate brokerage firms, you will enjoy peace of mind because you will know that your funds are secure and your personal data is safe. It is a legitimate brokerage firm that has been associated with some of the big names in the world. Since xtrade has years of experience under its belt, the company knows exactly how to simplify the trading process to make it easy for their clients to trade different financial assets.

When it comes to xtrade, you can rest assured that it is a regulated company because this firm is regulated and authorized by the international financial services commission (IFSC). Since it is a regulated company, xtrade is required the follow the international policies that are followed in financial markets, which include the know your customer (KYC) and AML (anti-money laundering) regulations. These policies are followed by xtrade in order to maintain 100% transparency and to play its role in curbing crimes in the financial world. They have also made significant effort to ensure that all data and funds kept on their platform are kept safely.

With the AML and KYC policies in place, it is easier to eliminate some common problems faced by traders, such as identity theft, terrorism funding, money laundering and more. It is also helpful in keeping user funds safe as well as the personal information they share with the brokerage. Xtrade has a team of highly efficient and professional individuals who are constantly working to grant users a regulated and safe trading environment. When it comes to making transactions like deposits and withdrawals, even these procedures come with top notch security measures.

Moreover, you will find an easy-to-understand and comprehensive terms and conditions page on xtrade. The company has mentioned everything pertaining to its business in a straightforward manner, which means you can find out everything you need to know before you sign up with the broker. They also have a great regard for the privacy of their clients, which means they don’t share your data with any third-party. All information that’s shared with xtrade will remain private and confidential, in accordance with their privacy policies.

Regulation and safety of funds on xtrade

As stated earlier, xtrade is a fully regulated brokerage firm, which has implemented the KYC and AML policies. Under these policies, traders who sign up with this broker are required to verify their identity and residence before they can access certain features. When it comes to security of funds that are deposited by clients, a robust security system has been implemented, which allows xtrade to protect them from hackers and other shady elements. Segregated client accounts are maintained by the broker for ensuring that client assets and company assets are kept separate.

This allows traders free access to their money whenever they want. Furthermore, xtrade use international financial institutions for their banking needs, which means that reputable EU credit institutions safeguard client funds. As far as data security is concerned, even here the highest encryption standards have been implemented and strong firewalls are also in place for keeping out hackers and other cyber-criminals that may try to gain access to the system.

Account options available on xtrade

One of the best things about xtrade is that the broker lets you enjoy a complete trading experience. The trading account options provided by the broker cover customers from different classes and reliable services are offered under every account type for the convenience of the traders. Nonetheless, there are some differences that do exist between the account types. Let’s see what they have to offer:

- Standard

The first account option that you will find on xtrade is the standard account option, which requires a minimum deposit of $250. Mobile and desktop trading are supported under this account option. If you choose this account option, you will have the facility of accessing a demo account, an economic calendar that keeps you updated on the latest events in the market and 24/7 customer support that can reached through several channels. You will also be able to take advantage of daily video market reviews that can make it easier for traders to understand what is happening in the market and to use that information for making informed decisions. In addition, users of standard account also get a 1-on-1 platform lesson, where they can learn more about trading.

- Premium

The minimum deposit amount for this account is higher as you have to pay $1,000 for it. If you choose to open this account with xtrade, you will be able to enjoy a variety of features. Desktop and mobile trading options are available here as well as are daily market reviews, demo accounts and economic calendar. All features of the standard account can be used in the premium account, but this is not where the offerings stop. When you go with this account, you will also receive a welcome bonus, which can be cash or credit, depending on what you prefer. Other than that, you also get the autochartist market reports, alerts and forecasts.

These can provide you with further insights into the market and how you can take advantage of the movements that take place. When you open the premium account on xtrade, you also get another major benefit; you can get access to the metatrader 4 platform, which comes with a wide array of trading tools and other resources. Every user is provided with a dedicated account manager for helping them make trading decisions and they can also gain access to educational e-books and video tutorials.

- Platinum

Moving on with the account options, you can go with the platinum account, which asks for a deposit of $5,000. There are a plethora of features that are offered to traders through this account type, which include all of those available in standard and premium accounts. But, the offerings don’t end there. Other than the exclusive welcome bonus, a VIP bonus is also provided, again with the option of cash or credit. However, the most prominent feature of this account type is that the spreads on trades are reduced significantly. A VIP dedicated senior account or trading support manager is assigned to every trader with this account who can be very helpful.

- VIP

The last account option that you will find on xtrade is referred to as the VIP account, which requires a minimum deposit of $20,000. One of the biggest advantages of this account type is that VIP account holders are given priority when it comes to payment processing. Apart from that, they can also get access to individual trading strategies and customer support. It should also be noted that VIP traders are given corporate gifts that are exclusive to them only.

No matter which account type you go with on xtrade, you will be able to enjoy some essential services, such as fast order execution, 24/7 customer support, a streamlined payment system and more. It is also worth saying that the account opening procedure is extremely simple and easy. It doesn’t take up a lot of time and you don’t have to deal with a lot of paperwork to register yourself.

Trading conditions on xtrade

You need to know the trading conditions of a broker before you choose to use their services. If you don’t like them, there is no point in going through the hassle of opening an account. The highest leverage that xtrade has to offer is 1:400 and it is not possible to change the default leverage ratio. As far as the minimum trading lot is concerned, you can lower it by getting in touch with customer service. No transaction fee is charged for making deposits or withdrawals on xtrade, which is undoubtedly a benefit because it reduces your cost of trading. However, a processing fee may be charged by the financial institution you plan to use for these deposits and withdrawal.

Xtrade does charge some other fees that you need to know. There is a premium fee, a spread fee and there is also an inactivity fee, which becomes applicable if your account is left dormant for three months. Depending on what account you open with xtrade, the broker supports both variable and fixed spreads. The spreads reduce as you move up the account ladder due to which a lot of traders prefer to opt for the platinum or VIP accounts because it gives them lower spreads as compared to those opening the other account types. Thus, you need to give some thought to your spread preference when you are choosing an account type.

Deposits and withdrawal options on xtrade

Xtrade has simplified the payment process to make it easy for traders to deposit funds or to withdraw them when needed. If you want to add funds to your account on xtrade, there are a few simple steps you need to follow. First, you have to go to their website and log into your account. You need to access the dashboard and click on the ‘deposit’ option provided. The next step is to select the payment method you prefer to use. Next, you need to enter the amount you wish to deposit and then submit the application. It will take a few minutes for the funds to appear in your account. If you choose bank wire transfers, you should know that it could take a day for the funds to be reflected in your account.

If you want to know what payment methods are supported on xtrade, you will be pleased to know that a variety of payment options are available. Some of them include:

- E-wallets

You can use electronic wallets, such as skrill and neteller, for making payments on xtrade. As mentioned earlier, the broker will not take any transaction charges, but these services may deduct their own charges from you. Usually, this method provides you with funds instantly, whether you are depositing or withdrawing.

- Credit/debit cards

Xtrade also accepts credit and debit cards because it is the most common payment method that’s used by traders all over the world. The transactions made via this method are approved almost immediately. Again, no charges are deducted by the broker, but the card itself may have a fee associated with it.

- Bank wire transfers

If you are trading from a region where debit or credit cards cannot be used, bank wire transfers are an excellent option. This method is highly secure; the only downside is that it takes at least 2 to 5 business days for the transactions to be reflected in your account.

When you want to withdraw funds from your xtrade account, there are similar steps that you need to follow. Instead of clicking on the deposit button this time, you have to click on the ‘withdraw’ button. Fill out the form that will be provided to you. You have to wait for the withdrawal request to be approved and then your account will be credited with the amount.

All of this sounds very straightforward, but there is one important thing you need to know; your account needs to be verified for you to be able to withdraw funds from xtrade. This verification is essential on xtrade, as it is required by the KYC and AML regulations. The purpose is to verify that you are really the owner of the account and to safeguard your data and funds. How do you get verified? There are some documents that have to be submitted.

- Proof of identification

The documents that you can submit for proving your identity include national ID card, international passport or a driver’s license. You should ensure that the documents you are submitting are valid and the information on them matches with what you have provided on your xtrade account.

- Proof of address

For verifying your address, the documents that you can submit on xtrade include bank account statement or a utility bill, which include be gas, electricity, water, oil, phone or internet. All documents that you submit have to be recent and not older than three months. They should contain all your necessary details and should be clear.

You should bear in mind that if you don’t verify your account, you will not be able to conduct some transactions, such as funds withdrawal. Moreover, this verification process is perfectly normal amongst all leading regulated brokers in the industry.

Trading platform on xtrade

When it comes to the trading platform that this broker has to offer, you will be pleased to know that it provides support for web trader as well as the meta trader 4 platform. The former is the most popular one on xtrade because you don’t have to perform any downloads or installations for using it. Furthermore, it is compatible with almost every browser, which includes mobile devices. Also, there are several important features that webtrader has to offer to traders like market news and analysis, demo accounts, economic calendar, price charts and more.

Nevertheless, the most popular trading platform in the industry is the metatrader 4, which is renowned because of the various features it offers. It is a highly secure platform and boasts a number of tools, such as financial calendar, market news, market analysis, live price chart, expert advisors, educational resources and dedicated account managers. But, the MT4 is only offered to traders who sign up for a higher account type on xtrade.

The mobile app offered by xtrade is available for both ios and android users. It is extremely convenient because it allows traders to access their accounts easily and carry out their transactions on the go. You will find that all platforms offered by xtrade have a smooth interface, which makes it very easy for every user to navigate.

Educational resources on xtrade

Different educational materials have been made available to traders on xtrade. If you want to stay ahead in the crypto space or any other financial market, you need to be aware of the latest trends. To make this happen, xtrade provides a ton of tutorials to its user-base. Amongst the educational resources the broker is offering, you will find video tutorials, e-books, blogs and a glossary. The content is available for both new and experienced traders and it can help them in learning new trading techniques.

In terms of other resources, xtrade has also added a plethora of trading tools to its platform. No matter which trading platform you are using with the broker, you can use the economic calendar, daily market news, price charts, live currency rates, market analysis and some others. All of these can help you in making better trading decisions.

Customer service on xtrade

One of the prominent things about xtrade is that they have one of the best customer support teams in the entire industry. They are available 24/6 and willing to attend to customers’ needs throughout the day. They can be reached easily through the live chat feature, phone call or email. Their agents are friendly and highly professional and they try their level best to resolve your challenge as quickly as possible.

Conclusion

Xtrade is offering some of the best features in the market with a good set of trading instruments at your disposal. It is well-regulated and one of the most reliable brokerages to use for making your mark.

Xtrade review

Xtrade

Leverage: 1:30

Regulation: cysec, IFSC

Min. Deposit: 250 US$

HQ: cyprus

Platforms: MT4, xtrade webtrader

Found in: 2003

Xtrade licenses

- Xtrade europe ltd - authorized by cysec (cyprus) registration no. 108/10

- Xtrade international limited (ex. Financial arena ltd) - authorized by IFSC (belize) registration no. IFSC/60/383/TS/18

Top 3 forex brokers

FXTM review

GO markets review

FP markets review

- Is xtrade safe or a scam?

- Awards

- Is xtrade safe or a scam?

- Leverage

- Accounts

- Trading instruments

- Fees

- Deposits and withdrawals

- Trading platform

- Customer support

- Education

- Conclusion

What is xtrade?

The broker xtrade firstly known as XFR financial ltd was established back in 2003, while recently headquarters in cyprus and offering traditional trading through cfds on shares, commodities, forex and indices.

The company also continuously increases their ranges and add instant access to the most popular cryptocurrencies that are available 24/7 directly through the trading platform: bitcoin, bitcoin cash, litecoin, dash, ethereum, ripple and other digital coins.

The international proposal through performed through stablished entity in belize that allows international traders to open account and also get high leverage or other conditions. Yet, be sure you learn differences about regulations and conditions well.

| Pros | cons |

|---|---|

| worldwide coverage through entities in the cyprus and belize | support not available 24/7 |

| forex and CFD instruments | international trading done through belize entity |

| good quality trading technology | |

| choice between MT4 and proprietary platform | |

| low costs based on spread | |

| fast account opening | |

| quality customer support |

10 points summary

| �� headquarters | cyprus |

| ��️ regulation and license | cysec, IFSC |

| �� platforms | MT4, xtrade webtrader |

| �� instruments | cfds on shares, commodities, forex and indices, cryptocurrencies |

| �� costs | 0.6 pips |

| �� demo account | offered |

| �� minimum deposit | 250$ |

| �� base currencies | three currencies available |

| �� education | free education with courses and daily analysis |

| ☎ customer support | 24/5 |

Awards

In fact, xtrade through the long operation spread around globally while serving clients from a vast number of countries. As a recognized company in online trading with years of experience and worldwide presence, the firm confirmed its status by many awards and industry achievements.

Xtrade & cristiano ronaldo – the broker supports various social activities which increase their presence in world picture. Cristiano ronaldo was xtrade official ambassador of 2016-2017, which signifies an opportunity to support the world’s greatest footballer while promoting marketing-leading CFD trading products.

Is xtrade safe or a scam?

| Pros | |

|---|---|

| regulated international broker | not listed on stock exchange |

| cysec authorized | runs offshore entity in belize |

| cross border licenses and global coverage | |

| negative balance protection applied |

Is xtrade legit?

The xtrade group and the company fully comply with the cysec regulation, as per their headquarters in cyprus and its obtained license, along with numerous registration and authorization across the EEA zone. The international brand that serves worldwide clients xtrade international operates in various jurisdictions through its license obtained by the international financial service commission in belize (IFSC).

Even in fact this license if offshore one, which regarded as not safe enough on its own, yet the additional regulation by the european entities confirms that the broker strictly complies with the international protective measures.

How are you protected?

The client’s funds are always segregated as we see through our xtrade review, means an account in which the trader’s assets are kept is separated from the broker’s assets that enable security and money protection, while also every client account is opened under the investor compensation fund.

Furthermore, xtrade continuously monitors its operations as per regulatory requirement and provide comprehensive security for all online transaction or manipulations provided.

In addition, according to the regulation sets the trader cannot lose more than the initial deposit, since the broker applied negative balance protection, which all in all makes xtrade considered to be a safe forex broker.

Leverage

Leverage is a quite unique opportunity to magnify trading potential using the tool of leverage. However, every trader should remember that leverage can work both for you as well as against you, so you should be cautious when using it and learn more how to use tool smartly.

In terms of xtrade leverage offering, as there are two main regulatory obligations the clients of different jurisdictions will fall under specific levels of leverage.

- European clients or those traders that are operated under the cysec regulation, as per current updates are allowed to use maximum leverage of 1:30.

- The international clients operated through xtrade international may enjoy leverage till 1:400.

Accounts

Through one xtrade single account, you are able to trade across multiple devices that make no difference between the traders. At the beginning, the trader can always try out the risk-free environment through demo-account opening.

| Pros | cons |

|---|---|

| fast account opening | none |

| five account types offered depending on account size | |

| selection between three base currencies | |

| demo account | |

| analysis and exclusive education for VIP clients |

Account types

You can either grow your account so once the account reach or holds a balance of a certain amount it will turn either to premium account with 1,000$ balance, platinum account with 5,000$ and VIP account 25,000$ accordingly.

The trading conditions won’t be different and features the same support, education, news and available numerous signals. Yet, there is a spread reduction and additional education videos available for platinum and VIP account holders.

Trading instruments

The xtrade trading instruments or trading products are offered through a popular cfds or contract for difference model, which allows vast flexible opportunities on price speculation without particular ownership of an asset.

– xtrade equity cfds allow trading cfds worldwide on the most actively traded shares– apple, google, nike, JP morgan, IBM, etc. With a 5% initial margin.

– forex trading includes the most popular international currency pairs – EUR/USD, USD/JPY, etc, as well as the highly demanded cryptocurrencies. Xtrade trading system provided over 50 leveraged forex pairs with leverage up to 1:400.

– index cfds – S&P 500, dow jones, etc. The contract value of one index CFD equals the price quoted in the currency of the index. The broker offers the market fixed spreads between the buy and sell prices and no commissions.

– commodity cfds – gold, silver, oil, natural gas, etc. The contract value of one commodity CFD equals the price quoted in the currency of the commodity. For example, if gold cfds are trading at $1,200.50, then the value of one ounce gold CFD is $1,200.50.

The xtrade offers various technical solutions and tools for better trading conditions, along with reduced costs by no commissions’ policy with only fixed spreads (e.G. Spreads between the buy and sell prices for EUR/USD 2-5 pips).

| Pros | cons |

|---|---|

| fast digital deposits, including credit card, debit card, electronic wallet, paypal | conditions may vary according to trading entity |

| no deposit fee | |

| withdrawals free of charge |

Forex fees

Xtrade trading fees are based on a xtrade spreads only strategy, with a fixed amount, means that traders’ costs included into a spread, which is the difference between the bid and the ask price of a financial instrument. To see the spread value for each product please refer to the table below that gives you a reference on a price model, however, check the most accurate data on the official xtrade website or platform.

However, the trader will have a better price offering from the xtrade broker as long as account size or type increases. Thus, the spread of the common EUR/USD pair is fixed to 5 pips in standard account, 3 pips in premium and platinum, 2 pips in VIP account.

Overall xtrade spreads considered to be a low spread offering among the market, for instance, check out and compare xtrade to etoro fees.

Trading fees of xtrade vs similar brokers

| asset/ pair | xtradefees | bdswiss fees | avatrade fees |

|---|---|---|---|

| EUR USD | 0.6 pips | 1.5 pips | 1.3 pips |

| crude oil WTI | 1.5 | 6 | 3 |

| gold | 10 | 25 | 40 |

| BTC/USD | 95 | 2000 | 0.75% |

| inactivity fee | yes | yes | yes |

| fee ranking | low | high | average |

Swap fee

Keeping a position open after a specific hour (approximately 22:00GMT), subject trader to an xtrade funding premium fee or overnight fee that is subtracted from the trading account. This premium covers the cost of the associated funding and varies from the asset for another, e.G. Eur/usd fee for sell or buy is around 1.8.

Deposits and withdrawals

To deposit or withdraw the funds, the client has many options to choose from, yet, depending on the client’s location, which you can easily check through the official xtrade website.

| Pros | cons |

|---|---|

| fast digital deposits, including credit card, debit card, electronic wallet, paypal | conditions may vary according to trading entity |

| no deposit fee | |

| withdrawals free of charge |

Deposit options

The available methods include the following ones, so you can choose the most convenient one for you.

- Credit/debit cards,

- Bank transfers,

- American express,

- Paypal,

- Skrill and many more common options.

There are no deposit or withdrawal fees charged to the client from the company,

What is the minimum deposit for xtrade?

The xtrade minimum deposit is 200$, yet you should calculate and cover necessary expenses since the variety of trading instruments offers different margins and spreads. E.G. To open a new position at equity, the account must exceed the trade’s initial margin level requirement. Also, xtrade occasionally runs promotions offering lower deposit threshold minimums.

Withdrawal

Another pleasant addition, that xtrade withdrawal fee or deposit charge is 0$, means the broker covers transaction expenses, however, unless your own bank or payment method requires some performance charges.

Always note, that withdrawal shall be processed via the same method that the deposit was made. If you deposit via credit card, any withdrawal amounts will be returned to that credit card. Likewise, if a deposit is made via bank transfer, the withdrawals will be transferred back to your bank account.

Trading platforms

The xtrader platform range offers mainly an online-based proprietary software, as well as to stay trading with an industry leader metatrader4. However, the proprietary platform gained numerous rewards, from both industry professionals and the traders, thus you may try and then never leave xtrade platform.

| Pros | cons |

|---|---|

| proprietary web trading platform | none |

| user friendly design and login | |

| price alerts | |

| MT4 offered as well | |

| supporting many languages |

Web platform

The platform does not require installation and offers a rich set of trading tools for optimal trading, as well enriched with market analysis and fast execution of orders.

Mobile trading

In order to never miss an opportunity, xtrade developed a powerful mobile platform that is available on ios, android and windows. The mobile platform is a customer-friendly and supported by alerts and professional charting tools.

Desktop platform

Overall, as a trader you will get access to real-time charting and almost all possible manipulations in the web platform or its applications, which is fully intuitive and easy to understand or perform even to the newbies, not considering professionals that will find the full capacity of very powerful features.

Customer support

Xtrade provides also multiple support that increases the trading experience and makes it a smooth process. You can reach out customer team through live chat, email or phone lines, also due to international coverage, there is multilingual support and centers that run 24/5.

Education

You are able to develop trading skills and strategies with professional trading tools, along with educational resources and daily market reviews, which makes it possible for beginners to join as well.

In addition, there is an economic calendar, analysis tools and news feed inbuilt into the platform, daily analysis video and other education support essential for everyday trading.

| Pros | cons |

|---|---|

| education courses for different levels seminars | none |

| exclusive education videos for premium and VIP clients | |

| research and analysis tools | |

| free demo account |

Conclusion

After the xtrade review, the overall impression is that the broker brings stable and reliable conditions to trade. Their main offering mainstays on a fixed spread with no hidden fees, powerful online-based platform and comprehensive trading instruments variety.

As a regulated broker, the company does follow the strict rules of the client’s protection along with the funds’ security and safe trading environment. What is pleasing also, is that xtrade supports their traders by various means, from excellent support to 0$ fees on money transactions, as well as widely supported methods.

All in all, the xtrade is a choice to engage into trading with, while understanding what to expect and run to the potential outcomes from the trading available to traders of different size and level.

Nevertheless, we would be happy to hear your personal opinion which you may share in the comment area below.

So, let's see, what we have: is xtrade a trusted market maker broker? Let’s review in-depth including assets. Trading platforms, accounts, demo, spreads, regulation and minimum deposit. At xtrade review

Contents of the article

- No deposit forex bonuses

- Xtrade review 2021

- Xtrade rating

- Pros / cons

- What is xtrade?

- Regulation & trust

- Trading platforms & tools

- Instruments

- Trading conditions

- What are the xtrade spreads?

- What are their fees and commissions?

- What is their max leverage with icmarkets?

- Research & education

- Type of accounts

- Client support

- Conclusion

- Xtrade review

- Overview

- Xtrade details

- Traders opinion

- Is xtrade legit or a scam?

- How online trading scams work

- XTRADE review (2020): scam update

- Is xtrade a scam? A real xtrade review

- Is xtrade a regulated forex broker?

- Is xtrade legit?

- What is xtrade?

- What services do they offer?

- Is xtrade a market maker?

- Payment options

- Withdrawal policies

- Xtrade online reviews – what the customers are...

- How about their customer service?

- Proof of the scam

- Conclusion

- Xtrade scam

- Xtrade australia review – can this broker be...

- Is xtrade scam or legit?

- Xtrade review – get access to the best platform...

- Xtrade has been serving traders for more than a...

- Xtrade review

- Xtrade review

- Top 3 forex brokers

- What is xtrade?

- Awards

- Is xtrade safe or a scam?

- Leverage

- Accounts

- Trading instruments

- Deposits and withdrawals

- Trading platforms

- Customer support

- Education

- Conclusion

Comments

Post a Comment