Xm broker, xm broker.

Xm broker

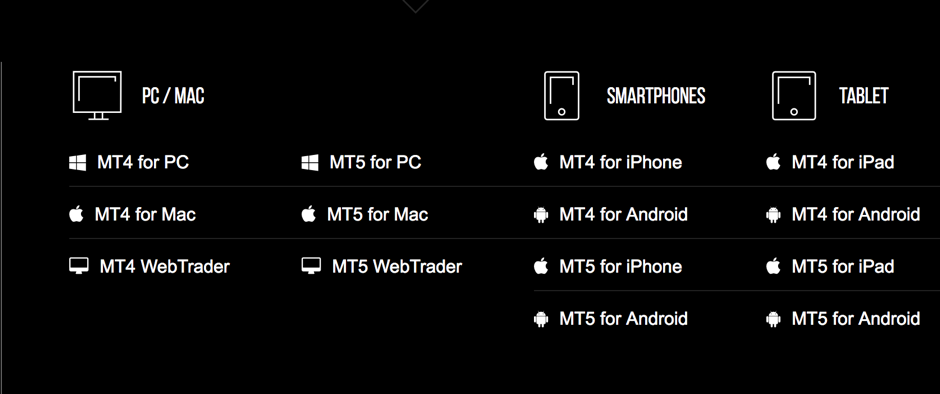

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

No deposit forex bonuses

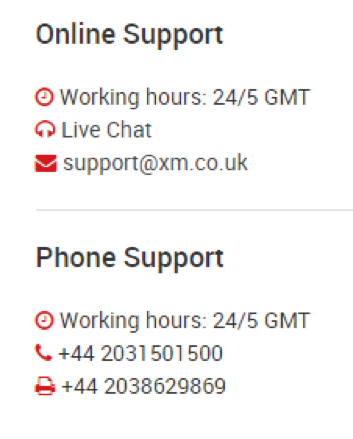

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

Platforms

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

Customer support

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM account login

Broker XM.Com was introduced in the year 2013 and instantly became famous for traders, as the company at that time already had a wealth of experience in financial markets; however, under a different name. The last name of the forex broker, under which he began his thorny journey to win the trust of clients - xemarkets. Both of these brands are owned by a holding corporation registered in cyprus. It is trading point holdings ltd which was established in 2009 by two greek ex-dealers. Having gained a wealth of experience, so to speak, "from the inside", they tried to take into account all the moments that are important for a trader, which provided the company with a reasonably easy start and today the broker XM.Com is already well known on the world stage.

XM broker singapore login: fund protection

Since the most important for each trader when choosing a broker is the issue of security of the invested funds, it is worth paying the most attention to this point. It is necessary to start with the fact that XM broker's head office is located in cyprus, so the parent company's activities are subject to cysec - cyprus securities commission, as well as european legislation with its stringent rules, which are prescribed in special EU directives for the operation of companies providing access to financial markets (mifid).

All customer accounts are kept with barclay, a world-class bank. The scheme of work of the broker completely excludes access to funds from his side.

XM broker login and registration

To pass the registration process on the official website of XM brokerage company, you do not need to spend much time and effort. It is enough to make a few simple steps to achieve this goal, namely:

Go to the page of the official site of XM brokerage company;

In the corner of the start page, find the registration column and click on it;

Fill in the registration form with all the data correctly;

Send personal data to the administration of the XM brokerage website;

Verify and confirm your identity by uploading passport scans.

After that, you will be able to trade and earn money with XM brokerage company without any problems.

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

Trading conditions

The XM.Com broker offers three account types:

Micro for those who want to experiment on forex, but are not ready to invest large sums of money in it yet;

The standard is suitable for more experienced traders who have already seen the reality of making money in forex and want to increase their capital;

It will appeal to severe traders and fund managers, as it provides additional convenience.

The minimum deposit size for micro and standard is only $5. However, for standard - it is frankly not enough and will not allow working comfortably, and for executive will need more than $ 100 thousand. If you wish, you can work with the method of "islamic accounts" on any of the above.

The size of the leverage can be increased up to 1:888, but for executive, it is limited to 1:200. Spread is floating for all accounts - from 1 point.

Clients of XM broker can work with more than 100 assets, among which besides currency pairs, there are precious metals, stock indices, energy resources and so on.

6 asset classes - 16 trading platforms - over 1000 instruments.

Legal: this website is operated by XM global limited with registered address at no. 5 cork street, belize city, belize, CA.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, and trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (cysec) (licence number 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (license number IFSC/60/354/TS/19).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves a significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Restricted regions: XM global limited does not provide services for the residents of certain countries, such as the united states of america, canada, israel and the islamic republic of iran.

Xm broker

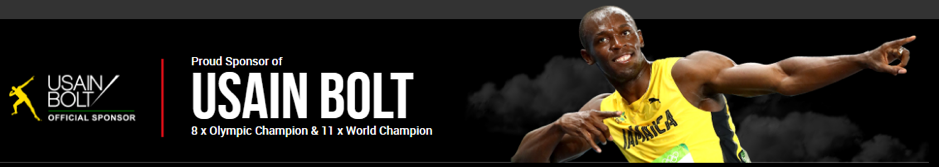

An impressive organisation putting their money into some big brand exposure activity, sponsoring the worlds fastest man, usain bolt. A lot of bonuses and competitions to take part in, making XM one of the highest recommended brokers on our list. Very friendly for new traders with an extensive education / learning section.

Sleek, modern appeal for the “new age” trader

I stumbled across XM forex trading by way of a banner advertising a million dollar forex trading competition. After visiting the website, I was impressed by the very modern feel, they look very much like a forex broker targeting the younger generation.

On their website they also proudly display their sponsorship of usain bolt which couldn’t have been cheap. I always take notice of companies that engage global superstars as brand ambassadors because the truth is, these types of relationships are very much controlled and dictated by the celebrity. A personality like usain bolt has a huge reputation to uphold, countless sponsorship offers and is a mega brand in itself so they would have taken great care in only selecting reputatble businesses to promote. Therefore, XM receives a big boost of credibility in my books.

Opening my account

Very straight forward. Enter details, confirm an e-mail, login and I was requested to upload ID documents through their website. All went smoothly. Within 24 hours, I had a call from my account manager who introduced herself and let me know that I can get in touch with her at any time for assistance. Within another 24 hours, my documents were all verified and I was ready to go.

The million dollar competition

In truth, I signed up so that I could take part in the million dollar trading challenge. Of course I must open an account at many brokers so that I can report here for this website.

The competition details can be found at www.Xm.Com/forex-world-championship/overview but in short, there are 10 rounds of play, each round lasting a calendar month. You start with $10,000 virtual currency and try to make it into the top 5. There are cash prizes for finishing in the top placings each month and the top 5 places gain entry into the semi finals. The winner of the grand final wins a cool $150,000. Not bad for a free game based on skill as well.

Newbie friendly

XM have done everything so well to attract what I would call “new age” traders (people in their 20’s, disposable income, looking for a challenging investment) and ensure that the biggest hurdle for any new trader, education, is covered from top to bottom. The market is tough to grasp so a lot of people need some guidance in understanding all those terms, the charts, the patterns, etc. Sure you can have random fun with a $100,000 demo account but at the end of the day, discplined trading follows a strategy and without anything to learn from, it makes it difficult to want to jump in to real money trading.

Traders of any level should feel extremely comfortable working through the extensive education section at XM.

Key benefits of trading with XM

- Real-time market execution with no re-quotes and no rejection of orders

- 16 MT4- and MT5-based platforms for seamless trading operations

- The same fair trading conditions for every client

- Personal account managers in over 30 languages

- Free trading signals in over 25 languages

- Free live webinars in over 16 languages

- Daily technical analysis and market reviews in multiple languages

- Regular on-site seminars in various countries in the world

All XM bonuses and promotions are subject to terms and conditions, including different bonus amounts and limited availability in some countries. Please check the eligibility rules on the website for more information.

| Deposit | bonus amount | bonus code |

|---|---|---|

| $0 | $30 | none required |

| up to $1000 | up to $500 | none required |

| up to $23,500 | up to $5000 | none required |

$30* no deposit bonus

Open a new account with XM and receive $30 or the equivalent in your chosen currency without making a deposit. The money is automatically credited to your account. The bonus can’t be withdrawn but any profits you make can be withdrawn. An excellent way to get started trading real money without having to put up your own. Highly recommended.

Up to $5,000* in deposit bonuses

You can receive up to $5,000 (or your currency equivalent) in additional bonus funds through a 2 tier deposit bonus system. You will receive a 50% bonus on your deposit up to a maximum of $500, then 20% on any amount over to make up to another $4,500 in bonuses. In other words, if you deposited $5,000 you would receive:

- 50% bonus on your first $1,000 which would give you $500 bonus funds and reach the limit of the first tier

- 20% bonus on your remaining $4,000 which would give you $800 bonus funds

- Your total account balance therefore would be $6,300 (your $5,000 deposit + $500 bonus + $800 bonus)

So this means to receive the maximum $5,000 bonus you would need to deposit $23,500 which is broken down as follows:

- The first $1,000 gives you a 50% bonus which is $500

- The remaining $22,500 gives you a 20% bonus which is $4,500

- Together, the bonus amount is $5,000 on your deposit of $23,500

Our opinion is that this is the best value bonus available right now from the reputable brokers.

Loyalty reward points

You can earn loyalty points through every trade and convert them to bonus funds. Points can be earned from even the smallest micro lot transactions so this is a great way to build up additional credit as you trade.

This ensures that as a client of XM you are consistently rewarded for trading, regardless of whether you are winning or not.

XM regulation & licenses

Where is XM regulated?

XM is authorised and regulated in 3 countries: australia (ASIC), cyprus (cysec) and the united kingdon (FCA).

You can view the licenses: ASIC, FCA, cysec

With australia and the UK both having very strong reputations as stable, first world countries, you can be assured that your dealings with XM are safe and secure.

Furthermore, XM is registered in 10 european countries including germany, spain, italy and france.

Our opinion is that XM is undoubtedly one of the leading forex brokers in the global market.

Minimum & maximum deposits / withdrawals

XM deposits summary table

| deposit method | minimum | maximum | fees |

|---|---|---|---|

| credit card, neteller, skrill | 5 USD | varies by method | XM |

| bank wire | 200 USD | varies by bank | sender pays bank wire fee |

XM minimum deposit

The minimum deposit at XM is 5 USD or the equivalent in any other currency when depositing via credit card or electronic payment (neteller or skrill). All fees are covered by XM. If you are depositing by bank wire, the minimum is 200 USD or the equivalent in any other currency. Fees in this case are only covered on the receiver’s side. You will have to pay whatever your bank charges you for a wire transfer.

XM maximum deposit

The maximum deposit at XM will generally be limited by your deposit source. Bank transfers are the best option if you wish to deposit a large sum of money for your trading account.

Please note that deposits can only be made from account in the same name as your trading account.

Paypal does not appear to be an option for depositing at XM.

XM withdrawals summary table

| withdrawal method | minimum | maximum | fees |

|---|---|---|---|

| credit card, neteller, skrill | 5 USD | varies by method | XM |

| bank wire | 200 USD | varies by bank | XM pays bank wire fee |

XM withdrawals

The minimum withdrawal methods and amounts are exactly the same as deposits. Once again, XM cover fees and do not charge any fees for withdrawals. This is why we believe that XM are one of the best forex brokers.

XM bad reviews

Is XM a scam?

Our verdict is NO. We found that XM representitives were very prompt in replying to all claims made through popular online forex forums. The result of most cases involved customer fraud – people opening multiple accounts, claiming multiple bonuses or not understanding the terms and conditions of trading. We also saw some cases where XM appeared to be at fault, but they were all resolved properly by XM.

We are satisfied that XM handles complaints efficiently. There are no obligations for any forex broker to participate in 3rd party forums but XM make an effort to be available and that’s a very big positive.

What is trust score?

This is a rating out of 100 which we calculate for each broker based on a combination of factors, all of which you will find below on the scorecard.

Every broker starts with a base score of 100 and we subtract points according to what criteria they match in each category.

Whilst trust score provides a good insight into the broker’s reputation, our overall rankings are based off our own thorough reviews plus the user reviews. Therefore, brokers with a high trust score aren’t always guaranteed to be ranked at the top.

XM scorecard – 99 / 100

Major sponsorships: the fastest man on the planet, usain bolt is sponsored by XM. This provides a large credibility boost for this broker as usain bolt would only be associating himself with brands that can further enhance his reputation.

Spreads

Tight spreads as low as 0 pips

Tight spreads as low as 0 pips on all major currency pairs

100+ financial instruments

Trade with NO hidden fees

The lowest possible spreads for all trading account types

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

To keep spreads as narrow as possible, we aim to get optimal prices from all our liquidity providers. Real time prices are aggregated from liquidity providers in order to offer best bid and ask prices to clients. Our electronic pricing engine allows us price updating on every currency pair three times per second, and thanks to this our prices reflect the current global forex market levels.

John papatheodoulou, chief dealer

XM offers tight spreads to all clients, irrespective of their account types and trade sizes. We recognize the fact that tight spreads only make sense for our clients if they can trade with them. This is the reason why we attribute great importance to our execution quality.

Fixed or variable spreads?

XM operates with variable spreads, just like the interbank forex market. Because fixed spreads are usually higher than variable spreads, in case you trade fixed spreads, you will have to pay for an insurance premium.

Many times, forex brokers who offer fixed spreads apply trading restrictions around the time of news announcements – and this results in your insurance becoming worthless. XM imposes no restrictions on trading during news releases.

Fractional pip pricing

XM also offers fractional pip pricing to get the best prices from its various liquidity providers. Instead of 4-digit quoting prices, clients can benefit from even the smallest price movements by adding a 5th digit (fraction).

With fractional pip pricing you can trade with tighter spreads and enjoy most accurate quoting possible.

XM spreads / conditions

- To view XM spreads / conditions for FX instruments ->click here

- To view XM spreads / conditions for commodities instruments ->click here

- To view XM spreads / conditions for equity indices instruments ->click here

- To view XM spreads / conditions for precious metal instruments ->click here

- To view XM spreads / conditions for energies instruments ->click here

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited, registration number HE251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Trading account types

XM CY trading account types

Micro account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 1,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots (MT4)

0.1 lots (MT5)

- Lot restriction per ticket

- 100 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

Standard account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

XM zero accounts

- Base currency options

- USD, EUR, JPY

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 0 pips

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 100$

The figures above should only be regarded as reference. XM is ready to create custom-tailored forex account solutions for every client. If the deposit currency is not USD, the amount indicated should be converted to the deposit currency.

You may be new to forex, so a demo account is the ideal choice to test your trading potential. It allows you to trade with virtual money, without exposing you to any risk, as your gains and losses are simulated. Once you have tested your trading strategies, learned about market moves and how to place orders, you can take the next step to open a trading account with real money.

What is a forex trading account?

A forex account at XM is a trading account that you will hold and that will work similarly to your bank account, but with the difference that it is primarily issued with the purpose of trading on currencies.

Forex accounts at XM can be opened in micro, standard or XM zero formats as shown in the table above.

Please note that forex (or currency) trading is available on all XM platforms.

In summary, your forex trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

Similarly to your bank, once you register a forex trading account with XM for the first time, you will be required to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details.

By opening a forex account, you will be automatically emailed your login details, which will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients’ members area are provided and constantly enriched with more and more functionalities and therefore giving our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your trading account login details will correspond to a login on the trading platform which matches your type of account and is ultimately where you will be performing your trades. Any deposits/withdrawals or other changes to settings you make from the XM members area will reflect on your corresponding trading platform.

What is a multi-asset trading account?

A multi-asset trading account at XM is an account that works similarly to your bank account, but with the difference that it is issued with the purpose of trading currencies, stock indices cfds, stock cfds, as well as cfds on metals and energies.

Multi-asset trading accounts at XM can be opened in micro, standard or XM zero formats as you can view in the table above.

Please note that multi-asset trading is available only on MT5 accounts, which also allows you access to the XM webtrader.

In summary, your multi-asset trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

- 3. Access to the XM webtrader

Similarly to your bank, once you register a multi-asset trading account with XM for the first time, you will be requested to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details. Please note that if you already maintain a different XM account, you will not have to go through the KYC validation process as our system will automatically identify your details.

By opening a trading account, you will be automatically emailed your login details that will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including the depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing the leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients members area are provided and constantly enriched with more and more functionalities, allowing our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your multi-asset trading account login details will correspond to a login on the trading platform which matches your type of account, and it is ultimately where you will be performing your trades. Any deposits and/or withdrawals or other setting changes you make from the XM members area will reflect on your corresponding trading platform.

Who should choose MT4?

MT4 is the predecessor of the MT5 trading platform. At XM, the MT4 platform enables trading on currencies, cfds on stock indices, as well as cfds on gold and oil, but it does not offer trading on stock cfds. Our clients who do not wish to open an MT5 trading account can continue using their MT4 accounts and open an additional MT5 account at any time.

Access to the MT4 platform is available for micro, standard or XM zero as per the table above.

Who should choose MT5?

Clients who choose the MT5 platform have access to a wide range of instruments ranging from currencies, stock indices cfds, gold and oil cfds, as well as stock cfds.

Your login details to the MT5 will also give you access to the XM webtrader in addition to the desktop (downloadable) MT5 and the accompanying apps.

Access to the MT5 platform is available for micro, standard or XM zero as shown in the table above.

What is the main difference between MT4 trading accounts and MT5 trading accounts?

The main difference is that MT4 does not offer trading on stock cfds.

Can I hold multiple trading accounts?

Yes, you can. Any XM client can hold up to 8 trading accounts of their choice.

How to manage your trading accounts?

Deposits, withdrawals or any other functions related to any of your trading accounts can be handled in the XM members area.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited, registration number HE251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Regulation

XM license

Cysec

Cyprus securities and exchange commission

Trading point of financial instruments ltd is licensed by cysec under license number 120/10.

Registrations for outward passporting

Financial conduct authority

Bafin

Federal financial supervisory authority

The national securities market commission

The hungarian national bank

CONSOB

The italian companies and exchange commission

The french prudential supervision and resolution authority

FIN-FSA

The finnish financial supervisory authority

Polish financial supervision authority

Netherlands authority for the financial markets

Financial supervisory authority

Safety of client funds

In the financial industry, the most essential requirement is the safety of our clients’ funds. As a licensed and regulated financial institution we safeguard our business by adopting the below procedures:

- Doing banking with investment grade bank barclays bank plc

- Doing business with paysafe group limited, which is regulated by the financial conduct authority (UK)

- Doing business with przelewy24, which is regulated by financial supervision authority (poland)

- Doing business with klarna bank AB, which is regulated by the swedish financial supervisory authority (sweden)

- Doing business with safecharge limited, which is regulated by central bank of cyprus (cyprus)

- Keeping clients’ funds segregated from our company funds, at tier-one banking institutions, ensuring that these can't be used either by us or by our liquidity providers under any circumstances

- Member of the investor compensation fund

- Use an automated system for monitoring funds transactions and risk management for the sake of no negative balance, and thus protects clients from any losses bigger than their original investments

- Apply multiple transaction methods for funds withdrawals and deposits that guarantee transfer security and clients’ privacy through secure socket layer (SSL) technology

- Embrace the investor protection measures described by the markets in financial instruments directive (mifid)

- Adopt clear procedures to categorize clients and assess their investment suitability for the sake of risk management

- Follow a best execution policy for executing trading orders on terms most favorable to clients

- Ensure trading transparency for its financial instruments by providing detailed information about trading conditions

- Collaborate with multiple liquidity providers to offer the best spreads and liquidity at all times

- Follow a no re-quotes and no extra commissions policy that could negatively affect clients’ investments

Investors in people

XM is recognized by the UK based organization investors in people for its efforts in developing people to realize their full potential and achieve both personal and corporate goals. Investors in people provide a wealth of proven tools and resources designed to complement their unique operational framework in order to boost performance and maximize sustainability. By achieving this standard, XM demonstrates that it is a leading force in the online trading sector and is committed to the provision of quality services and products.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited, registration number HE251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

XM review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex and CFD traders who prefer metatrader platforms and seek great account opening

XM is an online broker whose parent company is trading point holding, a global CFD and FX broker founded in 2009.

XM is available globally and is regulated by three financial authorities: the cyprus securities and exchange commission (cysec), the australian securities and investments commission (ASIC) and the international financial services commission of belize (IFSC).

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

XM pros and cons

XM has low stock CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account.

On the other hand, XM has a limited product portfolio as it offers mainly cfds and forex. Its forex and stock index CFD fees are average, and there is no investor protection for clients onboarded outside the EU.

| Pros | cons |

|---|---|

| • low stock CFD and withdrawal fees | • limited product portfolio |

| • easy and fast account opening | • average forex and stock index CFD fees |

| • great educational tools | • no investor protection for non-EU clients |

| ��️ country of regulation | cyprus, australia, belize, united arab emirates |

| �� trading fees class | low |

| �� inactivity fee charged | yes |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $5 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 11 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD, real stocks for clients under belize (IFSC) |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

XM review

fees

| pros | cons |

|---|---|

| • no withdrawal fee | • inactivity fee |

| • low stock CFD fees | • average FX fees |

| assets | fee level | fee terms |

|---|---|---|

| S&P 500 CFD | low | the fees are built into the spread, 0.7 points is the average spread cost during peak trading hours. |

| Europe 50 CFD | average | the fees are built into the spread, 2.6 points is the average spread cost during peak trading hours. |

| EURUSD | average | with standard, micro, and ultra-low accounts the fees are built into the spread. 1.7 pips is the standard account's average spread cost during peak trading hours. With XM zero accounts, there is a $3.5 commission per lot per trade and a small spread cost. |

| Inactivity fee | low | $15 one-off maintenance fee after one year of inactivity, followed by $5 per month fee if the account remains inactive. |

How we ranked fees

We ranked XM's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

First, let's go over some basic terms related to broker fees. What you need to keep an eye on are trading fees and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

In the sections below, you will find the most relevant fees of XM for each asset class. For example, in the case of forex and stock index trading, spreads, commissions and financing rates are the most important fees.

We also compared XM's fees with those of two similar brokers we selected, XTB and etoro. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of XM alternatives.

To have a clear overview of XM, let's start with the trading fees.

XM trading fees

XM trading fees are average. XM has many account types, which all differ in pricing. The standard, micro, and ultra low accounts charge higher spreads but there is no commission. The XM zero account charges lower spreads, but there is a commission. The following calculations were made using the standard account.

We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products.

We chose popular instruments within each asset class:

- Stock index cfds: SPX and EUSTX50

- Stock cfds: apple and vodafone

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

A typical trade means buying a leveraged position, holding it for one week and then selling. For volume, we chose a $2,000 position for stock index and stock cfds, and $20,000 for forex transactions. The leverage we used was:

- 20:1 for stock index cfds

- 5:1 for stock cfds

- 30:1 for forex

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for XM fees.

CFD fees

XM has low stock CFD, while average stock index CFD fees.

| XM | XTB | etoro | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.6 | $1.4 | $1.5 |

| europe 50 index CFD fee | $2.4 | $1.8 | $2.7 |

| apple CFD fee | $6.4 | $17.3 | $6.7 |

| vodafone CFD fee | $1.2 | $20.8 | - |

Forex fees

XM's forex fees are average compared to its competitors.

| XM | XTB | etoro | |

|---|---|---|---|

| EURUSD benchmark fee | $9.5 | $8.3 | $8.8 |

| GBPUSD benchmark fee | $8.4 | $6.0 | $8.5 |

| AUDUSD benchmark fee | $10.3 | $6.5 | $8.2 |

| EURCHF benchmark fee | $9.7 | $8.9 | $12.6 |

| EURGBP benchmark fee | $10.5 | $8.4 | $12.3 |

Real stock fees

Clients onboarded under IFSC can also trade real stocks using the shares account.

The real stock fees are lower than XTB's, but lag behind etoro's commission-free real stock offers.

| XM | XTB | etoro | |

|---|---|---|---|

| US stock | $1.0 | $10.0 | $0.0 |

| UK stock | $9.0 | $12.0 | $0.0 |

| german stock | $5.0 | $12.0 | $0.0 |

The commissions are volume-tiered with a minimum fee.

| stock market | commission | minimum commission |

|---|---|---|

| USA | $0.04 per share | $1 |

| UK | 0.10% | $9 |

| germany | 0.10% | $5 |

Non-trading fees

XM has average non-trading fees. There is no account fee and XM charges no withdrawal fee in most cases, though bank withdrawals below $200 carry a $15 fee.

There is a $15 one-off maintenance fee after 1 year of inactivity, and this is followed by a $5 monthly fee if the account remains inactive.

So, let's see, what we have: forexbroker is your one stop portal for comparing the best forex brokers, stock brokers and trading platforms in the world! At xm broker

Contents of the article

- No deposit forex bonuses

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- XM account login

- XM broker singapore login: fund protection

- XM broker login and registration

- Trading conditions

- Xm broker

- Sleek, modern appeal for the “new age”...

- Opening my account

- The million dollar competition

- Newbie friendly

- Key benefits of trading with XM

- $30* no deposit bonus

- Up to $5,000* in deposit bonuses

- Loyalty reward points

- XM regulation & licenses

- Where is XM regulated?

- Minimum & maximum deposits / withdrawals

- XM deposits summary table

- XM minimum deposit

- XM maximum deposit

- XM withdrawals summary table

- XM withdrawals

- XM bad reviews

- Is XM a scam?

- What is trust score?

- XM scorecard – 99 / 100

- Spreads

- Tight spreads as low as 0 pips

- Fixed or variable spreads?

- Fractional pip pricing

- XM spreads / conditions

- Trading account types

- XM CY trading account types

- Micro account

- Standard account

- XM zero accounts

- What is a forex trading account?

- What is a multi-asset trading account?

- Who should choose MT4?

- Who should choose MT5?

- What is the main difference between MT4 trading...

- Can I hold multiple trading accounts?

- How to manage your trading accounts?

- This website uses cookies

- This website uses cookies

- Your cookie settings

- Regulation

- XM license

- Registrations for outward passporting

- Financial conduct authority

- Bafin

- Federal financial supervisory authority

- The national securities market commission

- The hungarian national bank

- CONSOB

- FIN-FSA

- The finnish financial supervisory authority

- Polish financial supervision authority

- Netherlands authority for the financial markets

- Financial supervisory authority

- Safety of client funds

- Investors in people

- XM review 2021

- Summary

- XM review fees

Comments

Post a Comment