JP Markets Demo Account, open jp markets demo account.

Open jp markets demo account

A demo account provides the trader with a practice account that can be used to practice trading in a risk free environment.

No deposit forex bonuses

Demo accounts allow traders to explore the broker’s offer and the trading platforms that they offer and brokers who do not offer this are at a slight disadvantage when compared to the various other brokers who do offer this along with similar trading conditions.

JP markets demo account

JP markets does not offer the option to open a demo account.

Trading can be a very intimidating task for beginners without prior knowledge, skill, or experience in trading and through the provision of demo accounts, brokers provide a comprehensive and risk free environment for beginner traders.

A demo account is often referred to as a practice account due to it providing traders with the ability and freedom to explore the broker’s offering without running the risk of incurring losses through the provision of virtual money with which to practice trading.

Beginner traders can use demo accounts to familiarize themselves with a live trading environment, where they can build up their trading skills by actively participating in trades and develop their own trading strategies.

Demo accounts are not merely intended only for beginners, but it provides more advanced traders the opportunity to explore what JP markets has to offer.

JP markets demo account features

Demo accounts serve the purpose of mimicking a live trading environment without traders risking their actual capital. Trading is conducted by using virtual money while simultaneously having access to all the financial instruments as with a live trading account.

Demo accounts allow traders to explore the broker’s offer and the trading platforms that they offer and brokers who do not offer this are at a slight disadvantage when compared to the various other brokers who do offer this along with similar trading conditions.

Pros and cons

| PROS | CONS |

| 1. Competitive trading conditions offered | 1. Demo account not provided |

What is the difference between a demo and live trading account?

A demo account provides the trader with a practice account that can be used to practice trading in a risk free environment.

Demo accounts are often suited for beginners who need to build up experience with trading as well as advanced traders who would like to test their trading strategies and explore the offering of a broker before registering a live account.

Does JP markets offer a demo account?

Can I convert my demo account to a live trading account with JP markets?

JP markets does not offer the option of opening a demo account, thus traders who choose this broker will only be able to open a live account, either a STP or ECN account which will be tailored to the trader’s needs.

What steps should A beginner take to start trading forex?

If you have asked this question yourself, then congratulations! You have already taken the first right step, unlike the millions of others who just try to jump right in.

Once you know you need to learn more, the next step is to protect yourself from the start. It is true that a lot of new traders blow their first account, and we want to reduce the chances of that happening as much as possible. There are a few key things to make your forex trading career kick off better than those who just jump right in.

Learn the basics

There are a host of websites out there trying to teach people how to trade. I would avoid any that tell you too often that it is easy and you should just go head and drop some money in the market. Figure out what forex trading actually is, where do profits and losses come from and how the basic system works.

There are a lot of “teachers” who will teach you how to trade forex. I have a very pessimistic view on these trainers and academies because I was a trainer for a while myself. And I can tell you, any trainer I came across that advertised a lot did not know how to trade themselves.

The trainers I do know who are legitimate traders would very rarely teach a beginner because it is a waste of your time and money, especially when there are so many resources available to teach you the basics. JP markets have a great forex training course that will probably teach you more than an over priced trainer can, and it will cost you nothing.

Find a broker to work with

The moment you start typing in forex brokers into google, you will be bombarded with results and promises to make you a millionaire. There are no shortage of brokers out there. Many of them are fly by night brokers, but even with those out of the way there are still lots left.

First thing to check is to make sure they are properly regulated, especially in the country they list their head office. A regulated broker needs to comply with a country’s laws on how to manage client’s funds and that sort of thing. It also reduces the risk of the broker being one of those overnight groups just looking for a quick buck.

A good broker should also offer a good training package. I know most of them offer some form of training, but from what I have seen, most of the training offered by these brokers is just one or two aggressive scalping systems. These are designed to get you trading as quickly as possible so they can start earning as quickly as possible. Choose a broker that has a good training course that teaches more than just a few scalping systems.

Deposit bonuses can be a huge positive on a person starting out to trade. Just keep in mind that you can’t instantly withdraw those deposits and a broke will almost always restrict the bonus to only 30 days. This is to stop people from opening accounts and just leaving it dormant. If you use the opportunity properly, and take advantage of a deposit bonus it can really help you get going.

JP markets offers ECN and STP accounts, attractive spreads, complete training, many different account types and more. Everything you need is with one broker

Learn

There is no decent career I can think of where someone can genuinely start doing without some kind of training. Think about what you do for a living. Could someone walk in off the street and immediately pick up your job with no training at all? So why would it be any different when learning how to trade forex?

Before you even start trading, you will need to know what sort of trading strategy suits you the most. This can be based on your personality, your available funds, your available time and a multitude of other factors. So take advantage of as much free information you can, and preferably nothing that promises you can make millions in just a few days! Again. JP markets has an amazing online forex course that is 100% free. No strings attached forex training.

Practice on a demo, but not for too long

Demo accounts can be an amazing way to learn strategies, learn the software, and basically get to grips with how the forex market works. Typically demo accounts are live feeds with the actual exchange rates, and you can use them with the same software you use for a live account. Everything is the same, except for you.

One problem I had, and I have seen many other traders have, is they get too fixed on a demo account and don’t make the transition to live account. Please use demo accounts to learn and get ready, but if you find yourself with demo accounts for months on end, you’re either not putting in enough practice or the demo account has become a security blanket.

Go live!

By this point you have the right broker, you’ve learnt the basics, you’ve learnt some strategies that you think you can do well with and you’ve tested them on a demo account. Now it’s time to go live and open a real trading account. This is where you will start feeling some pressure. And almost every trader who transitions from trading successfully on a demo account will start making some mistakes on a live account that they didn’t before.

This is because you have changed. It’s not the software, it’s not the prices, the markets are pretty much the same markets as before. But the added stress of it being real money will make you leave losing trades too early, very often the moment before they turn to your favour.

This is my forex trading mantra, and repeat after me…

Plan your trade, trade your plan

Keep learning

Yes, I know. You think you’re done, but you’re not! At this stage you should have a working strategy that you are comfortable with. And you can see the money starting to come in. But you will get bored or you will not be happy with the money coming in and want more. This is where you go back to the learning stage and start learning new strategies to try out. There is no reason you can’t have a second demo account to practice new strategies on while you are trading live on another account.

Demo trading account

Trade forex and cfds on shares & indices with a risk-free demo account

Are you new to trading and would like to see what forex is all about or you are just looking to test a new strategy? Sign up for our free demo account today and experience the markets with a risk-free demo account. It only takes a few minutes

Free market data and real-time news

Open a demo trading account via your messenger or telegram app

Trade execution

Our STP technology lets you trade in live market conditions and removes the risk of any conflict of interest on our behalf.

Regulated broker

You can be certain - our reputation and our business practices are aligned with the appropriate regulation.

Live support

Our customer service puts you first. You can reach us by social media anytime, or global phone support from 09:00 to 18.00 EET.

- Open a live trading account and your demo account(s) won`t expire.

Metatrader 4

Forex & CFD trading platform

Iphone app

Metatrader 4 for your iphone

Metatrader 5

The next-gen. Trading platform

MT4 for OS X

Metatrader 4 for your mac

Android app

MT4 for your android device

MT webtrader

About us

Start trading

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

Products

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Digital currencies cfds

- Contract specifications

- Margin requirements

- Volatility protection

- Pro.Cashback

- Invest.MT5

- Admiral markets card

Platforms

Analytics

Education

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Partnership

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Please enable cookies in your browser

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our privacy policy.

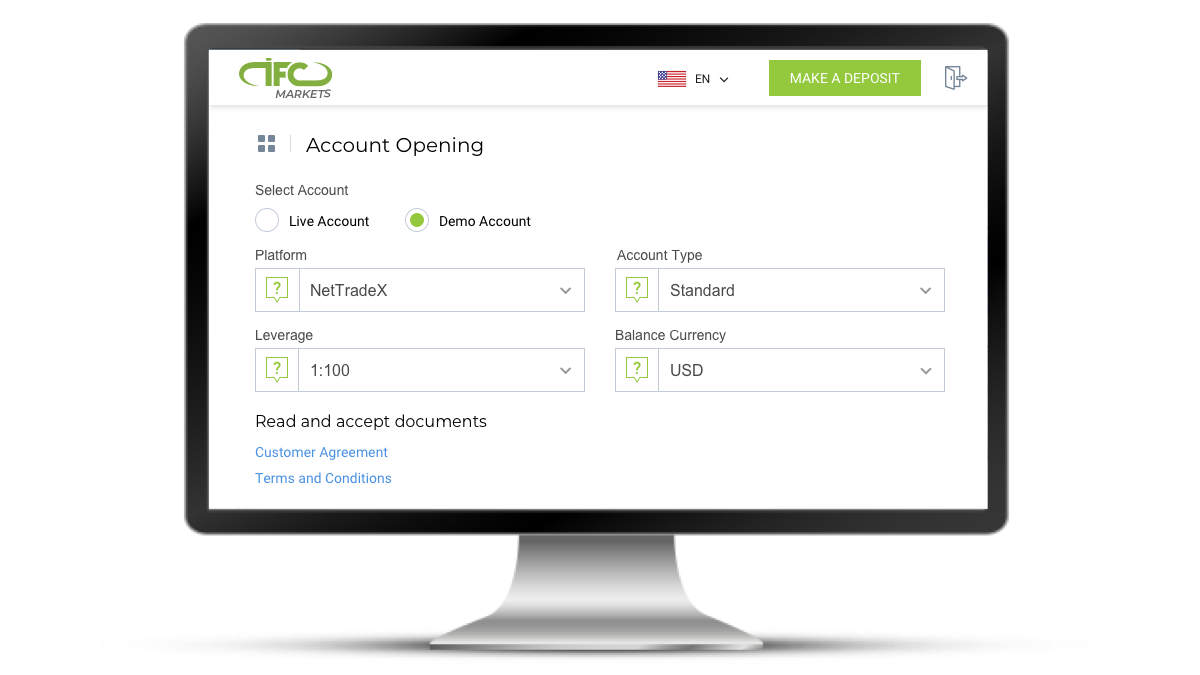

Opening a demo account

We recommend you to open a demo account after registering a profile. The advantage is that you will be able to manage your account and make requests for changing the account leverage and balance in case of need. However, it can be done without registration, directly from the nettradex.

If you have decided to open an account directly from the terminal, make sure you have downloaded nettradex trading terminal and have installed it on your PC successfully.

Opening a demo account from the terminal

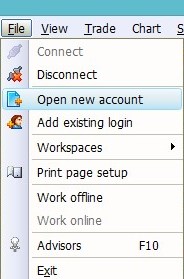

Open the terminal, go to the "file" from the main menu and select "open new account".

"select account type" pop-up window will appear, where you need to choose "open demo account" and press "next" button.

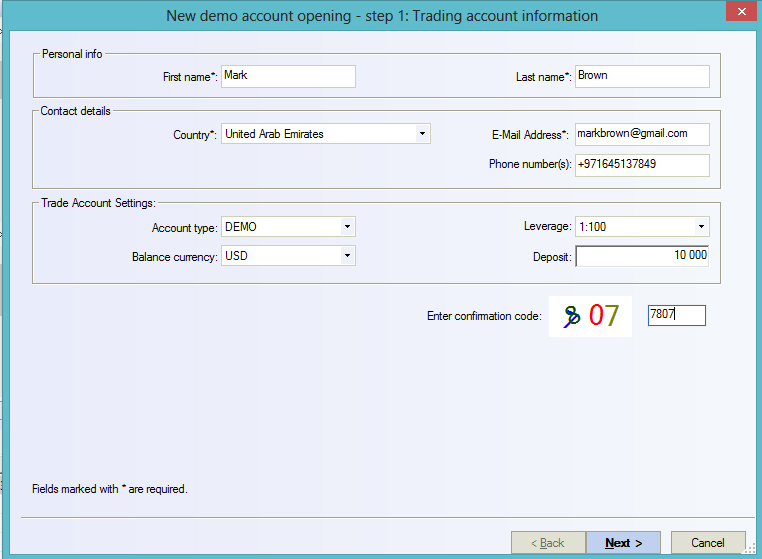

In the opened window, please, fill out the required fields. We strongly recommend you to provide us with valid contact means. After entering the confirmation code, press "next".

In the opened window you will see your workspace. Press "next" in order to see your account parameters.

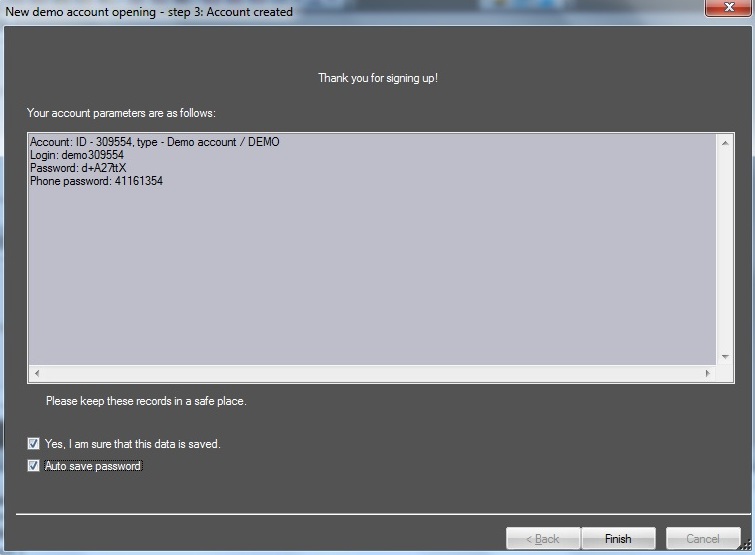

Save the account information, tick check-boxes "yes, I am sure that this data is saved" and "auto save password" and click "finish" to complete the procedure of opening a demo account. You can see your account in the "navigator" window in the drop-down list of logins.

Please select how you would like to be contacted:

IFCMARKETS. CORP. Is incorporated in the british virgin islands under registration number 669838 and is licensed by the british virgin islands financial services commission (BVI FSC) to carry out investment business, certificate no. SIBA/L/14/1073

IFC markets ltd is registered under no. LL16237 in the federal territory of labuan (malaysia) and is licensed by the labuan financial services authority (license number MB / 20/0049).

Risk warning notice: your capital is at risk. Leveraged products may not be suitable for everyone.

CALDOW LIMITED is an authorised payment agent of IFCMARKETS. CORP. Incorporated in the republic of cyprus under registration number HE 335779.

IG consulting s.R.O. Is an authorised payment agent of IFCMARKETS. CORP. Incorporated in the czech republic under registration number 284 07 083.

IFCMARKETS. CORP. Does not provide services for united states, japan and russian residents.

Cookie policy: we use cookies to provide you with a personalised browsing experienceclose

Open jp markets demo account

Veracity markets (pty) ltd is incorporated in south africa with registration number 2018/515174/07 and is a duly appointed juristic representative of nirvesh financial services (pty) ltd with registration number 2014/214417/07, which is an authorised financial services provider under the financial advisory and intermediary services act no 37 of 2002 – FSP4701. The website www.Veracitymarkets.Com is operated by veracity markets (pty) ltd based in south africa.

Clearing services

Veracity markets is an execution-only trading intermediary and makes use of regulated liquidity providers for clearing of its client trades.

High risk investment warning

Online trading consists of complex products that are traded on margin. Trading carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to veracity markets risk disclosure.

Disclaimer

The content of this page is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by veracity markets is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at veracity markets.

Regional restrictions

The information provided by veracity markets is not directed or intended for distribution to or use by residents of certain countries or jurisdictions including, but not limited to, united kingdom, australia, belgium, france, iran, japan, north korea and USA. The company holds the right to alter the above lists of countries at its own discretion.

Responsible trading policy

When it comes to trading on veracity markets platforms and using its features, we encourage responsible behavior among all our users and traders. Our “responsible trading policy” calls on traders to protect themselves from emotional decision making that can result in unnecessary losses. This web page and its products are intended exclusively for legally adult use, given that current legislation anywhere in the world does not permit account onboarding, trading, advising, binding in a legal contract to those under 18 years of age.

Safety of funds

At veracity markets (PTY) LTD, the safety of your funds is paramount to our business activity. With this in mind, all client funds are held in a segregated account separate from the companies funds.

Refund policy

All the funds deposited with veracity markets is for the sole purpose of trading the financial markets on contract for difference. There is no physical delivery of any asset. The clients acknowledge that they incur profit or loss depending on the open and close price of the asset traded. Any funds deposited with veracity markets is the asset of the client and a liability on veracity markets. The client can request for a withdrawal of their unused funds held with veracity markets at anytime. Any funds lost while trading in financial markets with veracity markets is non-refundable and non-withdrawable.

Open jp markets demo account

The online trading market is the biggest and most fluid market around the world, with up to 5.3 trillion dollars exchanged on online trading day by day. Open a demo account today with a perfect online trading intermediary, and practice your trading procedure with $10,000 USD in virtual currency, RISK FREE!

The majority of our demo clients likewise approach an extensive variety of honor winning educational resources, helping them to design their next trading strategy.

Start your trading journey in a safe, virtual, demo environment with all the benefits of a live account including live trading conditions. Familiarise yourself with our MT4 trading platform along with all of its functionalities.

Enjoy our trading tools and practice with a range of instruments and trading strategies in order to improve your trading confidence

| initial deposit | no minimum deposit |

| spreads | floating from 0.6 pips |

| commissions | $0 |

| leverage | 1:500 |

| order volume (lots) | 0.01 - 500 (lot) |

| platforms | MT4 |

| expert advisers | supported |

| maximum open positions | 200 |

| market execution | STP |

Helpdesk

- Tel: +27 (0) 87 012 5545

- Email: help@veracitymarkets.Com

- Registered address: 1 energy lane, century city, 7441, south africa. Suite 305, griffith corporate centre,

P.O. Box 1510, beachmont kingstown,

st. Vincent and the grenadines. -->

Connect now:

Trading

Platforms

Partners

Promotions

Company

Legal and regulation

Veracity markets (pty) ltd is incorporated in south africa with registration number 2018/515174/07 and is a duly appointed juristic representative of nirvesh financial services (pty) ltd with registration number 2014/214417/07, which is an authorised financial services provider under the financial advisory and intermediary services act no 37 of 2002 – FSP4701. The website www.Veracitymarkets.Com is operated by veracity markets (pty) ltd based in south africa.

Clearing services

Veracity markets is an execution-only trading intermediary and makes use of regulated liquidity providers for clearing of its client trades.

High risk investment warning

Online trading consists of complex products that are traded on margin. Trading carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to veracity markets risk disclosure.

Disclaimer

The content of this page is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by veracity markets is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at veracity markets.

Regional restrictions

The information provided by veracity markets is not directed or intended for distribution to or use by residents of certain countries or jurisdictions including, but not limited to, united kingdom, australia, belgium, france, iran, japan, north korea and USA. The company holds the right to alter the above lists of countries at its own discretion.

Responsible trading policy

When it comes to trading on veracity markets platforms and using its features, we encourage responsible behavior among all our users and traders. Our “responsible trading policy” calls on traders to protect themselves from emotional decision making that can result in unnecessary losses. This web page and its products are intended exclusively for legally adult use, given that current legislation anywhere in the world does not permit account onboarding, trading, advising, binding in a legal contract to those under 18 years of age.

Safety of funds

At veracity markets (PTY) LTD, the safety of your funds is paramount to our business activity. With this in mind, all client funds are held in a segregated account separate from the companies funds.

Refund policy

All the funds deposited with veracity markets is for the sole purpose of trading the financial markets on contract for difference. There is no physical delivery of any asset. The clients acknowledge that they incur profit or loss depending on the open and close price of the asset traded. Any funds deposited with veracity markets is the asset of the client and a liability on veracity markets. The client can request for a withdrawal of their unused funds held with veracity markets at anytime. Any funds lost while trading in financial markets with veracity markets is non-refundable and non-withdrawable.

CM trading review – learn forex basics & start trading

CM trading is a south african based forex trading company and its headquarters are in johannesburg. They are registered with south africa FSP (financial services provider) which is very strict and is similar to the regulatory bodies of the UK and EU. They also have a branch which operates out of the seychelles.

Trading accounts

CM trading offer 4 different accounts with a minimum deposit of $250 and their account structure which is a mini account, standard account, executive account and gold account. The mini account is for beginners and the gold for very experienced traders and the investment is above $25,000.

Software overview

There are two software options and they are metatrader 4 (MT4) and sirix system. The mobile and tablet trader application is available on apple istore and on android store.

For the sirix platform, one needs to use the web and log into the sirix site and all the features will be available exactly the same as on your desktop or laptop.

Both systems have built in warnings systems known as the guardian angel to inform you in real time if there are any changes in the market. MT4 allows you to trade multiple commodities at once.

As a beginner, you have the facility of a practice account to help you get the experience and knowledge to train and make sure that you are aware how trading platforms work. Once you have all the training and you feel comfortable understanding the systems then you can go live and start making money.

As a customer, you are also offered the CM trading sirix copykat. This is a system whereby you are allowed to copy an experienced trader. There are two ways a customer can do this by either seeing what the experienced trader is doing and then deciding whether to follow that particular trader or there is also an automatic system. This way your account is linked to the experienced trader’s account and whenever they trade you also trade. This way you make money when the trader makes money with the added advantage that you do not have to be at the computer.

CM trading also trade in other commodities such as cfds, indices, commodities and metals.

Our CM trading forex gallery

Deposits and withdrawals

Cmtrading makes deposits and withdrawals very easy because they accept all major credit and debit cards and also use money brokers cashu and skrill. Payouts are processed within 24 hours, when all the information that is required is provided and in order, especially for foreign owned accounts. To make the payouts even easier for CM trading members can be done when they provide a pre-loaded mastercard that can be used at atms and money points globally.

Customer support

The customer support is on a 24/5 basis during trading hours and the form of communication can be through email, live chat or by telephone. All the assistants are bilingual and there are 16 dedicated international lines to make sure that the customer is able to get professional help.

If you are a new trader in the business, CM trading has an excellent education program and it covers a lot of features which consist of training videos, an ebook and webinars to keep you up with the latest trends. There is also training with the technical aspects of forex trading such as support resistance, the MT4 user manual and the ability to ask questions on a blog site and getting answers from fellow traders.

There is also the daily analyses video that is used to give you incite on what the expert’s predictions are and what they expect so that you are able to make informed decisions.

Safety and regulation

The client’s funds are all kept in segregated accounts and CM trading is regulated by the financial services provider of south africa. The FSP number is 38782, registered as blackstone marketing SA (PTY) ltd. The financial services board is an independent institution to oversee the non-banking financial services in the public interest.

Overall conclusion

CM trading is well set up and is keeping up with the modern trends of the trading platforms. It has excellent training facilities and is known as one of the market leaders in training new users how to trade. They also have some features that other trading companies do not have which makes it a cut above some traders. It has well-developed customer support center and if you are considering to trade online, the CM trading website deserves to be considered.

Other popular forex broker reviews

| # | broker | rating | regulation | reward | review | site |

|---|---|---|---|---|---|---|

| 1 | easy markets | 4/5 | asic, cysec | $2,000 | read review | trade now |

| 2 | XM | 4/5 | asic, cysec, IFSC | up to $5,000 | read review | trade now |

| 3 | markets.Com | 4/5 | cysec, FSB, ASIC | $2,000 | read review | trade now |

*forex trading involves a high level of risk and may not be suitable for all investors as it may result in loss of the invested capital. Please ensure you fully understand the risks involved!

Demo trading account

Trade forex and cfds on shares & indices with a risk-free demo account

Are you new to trading and would like to see what forex is all about or you are just looking to test a new strategy? Sign up for our free demo account today and experience the markets with a risk-free demo account. It only takes a few minutes

Free market data and real-time news

Open a demo trading account via your messenger or telegram app

Trade execution

Our STP technology lets you trade in live market conditions and removes the risk of any conflict of interest on our behalf.

Regulated broker

You can be certain - our reputation and our business practices are aligned with the appropriate regulation.

Live support

Our customer service puts you first. You can reach us by social media anytime, or global phone support from 09:00 to 18.00 EET.

- Open a live trading account and your demo account(s) won`t expire.

Metatrader 4

Forex & CFD trading platform

Iphone app

Metatrader 4 for your iphone

Metatrader 5

The next-gen. Trading platform

MT4 for OS X

Metatrader 4 for your mac

Android app

MT4 for your android device

MT webtrader

About us

Start trading

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

Products

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Digital currencies cfds

- Contract specifications

- Margin requirements

- Volatility protection

- Pro.Cashback

- Invest.MT5

- Admiral markets card

Platforms

Analytics

Education

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Partnership

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Please enable cookies in your browser

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our privacy policy.

Open jp markets demo account

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.03% of retail investor accounts lose money when trading cfds with HF markets (UK) ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please read the risk disclosure.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.03% of retail investor accounts lose money when trading cfds with HF markets (UK) ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please read the risk disclosure.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.03% of retail investor accounts lose money when trading cfds with HF markets (UK) ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please read the risk disclosure.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.03% of retail investor accounts lose money when trading cfds with HF markets (UK) ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please read the risk disclosure.

Contact us 24/5

About

PRODUCTS cfds

TRADING

Platforms

Analysis tools

Legal: HF markets (UK) ltd is authorised and regulated by the financial conduct authority (FCA) under firm reference number 801701.

The website www.Hfmarkets.Co.Uk is operated by HF markets (UK) ltd.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.03% of retail investor accounts lose money when trading cfds with HF markets (UK) ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please read the full risk disclosure.

Regional restrictions: HF markets (UK) ltd offers services to residents of the united kingdom as well as to residents of the european economic area (excluding belgium).

So, let's see, what we have: A no nonsense step by step guide how to open a FREE JP markets demo account for beginners. ✅downloadable ios & android trading app. ✅ super easy trading interface. At open jp markets demo account

Contents of the article

- No deposit forex bonuses

- JP markets demo account

- JP markets demo account features

- Pros and cons

- What is the difference between a demo and live...

- Does JP markets offer a demo account?

- Can I convert my demo account to a live trading...

- What steps should A beginner take to start...

- Learn the basics

- Find a broker to work with

- Learn

- Practice on a demo, but not for too long

- Go live!

- Keep learning

- Demo trading account

- Trade forex and cfds on shares & indices with a...

- Open a demo trading account via your messenger or...

- Trade execution

- Regulated broker

- Live support

- Metatrader 4

- Iphone app

- Metatrader 5

- MT4 for OS X

- Android app

- MT webtrader

- About us

- Start trading

- Products

- Platforms

- Analytics

- Education

- Partnership

- Please enable cookies in your browser

- Opening a demo account

- Opening a demo account from the terminal

- Please select how you would like to be contacted:

- Open jp markets demo account

- Clearing services

- High risk investment warning

- Disclaimer

- Regional restrictions

- Responsible trading policy

- Safety of funds

- Refund policy

- Open jp markets demo account

- Helpdesk

- Connect now:

- Trading

- Platforms

- Partners

- Promotions

- Company

- Legal and regulation

- Clearing services

- High risk investment warning

- Disclaimer

- Regional restrictions

- Responsible trading policy

- Safety of funds

- Refund policy

- CM trading review – learn forex basics & start...

- Trading accounts

- Software overview

- Deposits and withdrawals

- Customer support

- Safety and regulation

- Overall conclusion

- Demo trading account

- Trade forex and cfds on shares & indices with a...

- Open a demo trading account via your messenger or...

- Trade execution

- Regulated broker

- Live support

- Metatrader 4

- Iphone app

- Metatrader 5

- MT4 for OS X

- Android app

- MT webtrader

- About us

- Start trading

- Products

- Platforms

- Analytics

- Education

- Partnership

- Please enable cookies in your browser

- Open jp markets demo account

- Contact us 24/5

- About

- PRODUCTS cfds

- TRADING

- Platforms

- Analysis tools

Comments

Post a Comment