Best Stock Trading Apps for 2021, trading online app.

Trading online app

8. Webull

while webull's mobile app offers more features than robinhood, it struggles to compete with the extensive amount of trading tools provided by the best stock trading apps.

No deposit forex bonuses

Read full review best stock app for professionals - open account

exclusive offer: new clients that open an account today receive a special margin rate.

Best stock trading apps for 2021

The stockbrokers.Com best online brokers 2021 review (11th annual) took three months to complete and produced over 40,000 words of research. Here's how we tested.

Like most things in today's high-tech society, trading has become an everyday activity on mobile devices. Whether you are a beginner or a seasoned active trader, the best stock trading apps offer $0 stock and ETF trades, are easy to use, and overall provide a fully-featured online trading experience.

For our 2021 annual review, we tested and scored 11 different stock trading apps. To assess each stock app, we checked for and tested 40 individual features. Needless to say, scoring high marks was no walk in the park. Testing was conducted using an iphone XS (apple ios) and samsung galaxy S9+ (android).

Best stock trading apps 2021

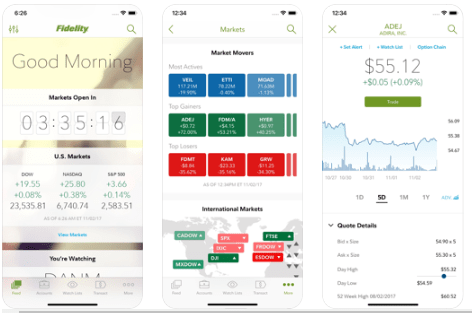

- Fidelity - best stock app for investors

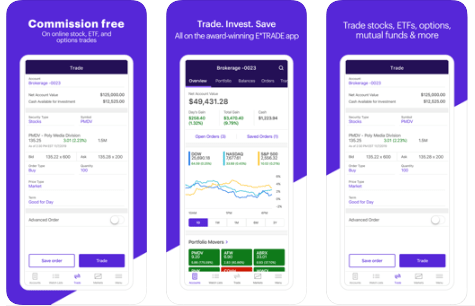

- E*TRADE - best app for options

- TD ameritrade - best stock app for traders

- Interactive brokers - best stock app for professionals

- Merrill edge - great for stock research

Best stock app for investors

Fidelity’s mobile experience is cleanly designed, bug-free, and delivers a phenomenal experience for investors. While active traders may be left wanting more, for the majority, fidelity delivers, winning our award, no. 1 investor app, for 2021. Read full review

Best app for options

In our 2021 review, E*TRADE once again ranked among the best because its apps are easy to use and feature-rich. My recommendation: use E*TRADE mobile for stock trading and power E*TRADE mobile for options trading. Read full review

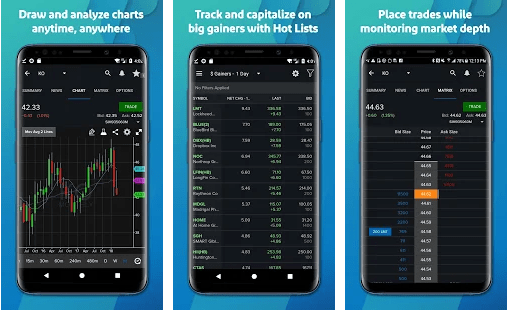

Best stock app for traders

TD ameritrade delivers $0 trades, fantastic trading platforms (including our favorite trading app, thinkorswim), excellent market research, industry-leading education for beginners, and reliable customer service. While not no. 1 for mobile trading, TD ameritrade took first place overall in our 2021 review. Read full review

Best stock app for professionals - open account

exclusive offer: new clients that open an account today receive a special margin rate.

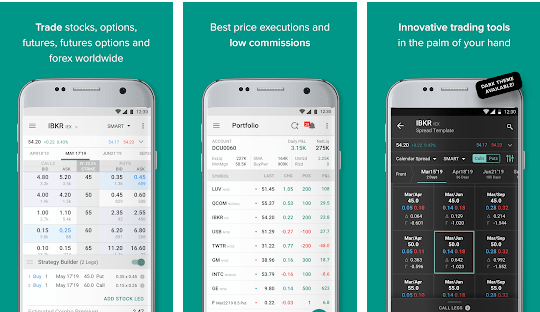

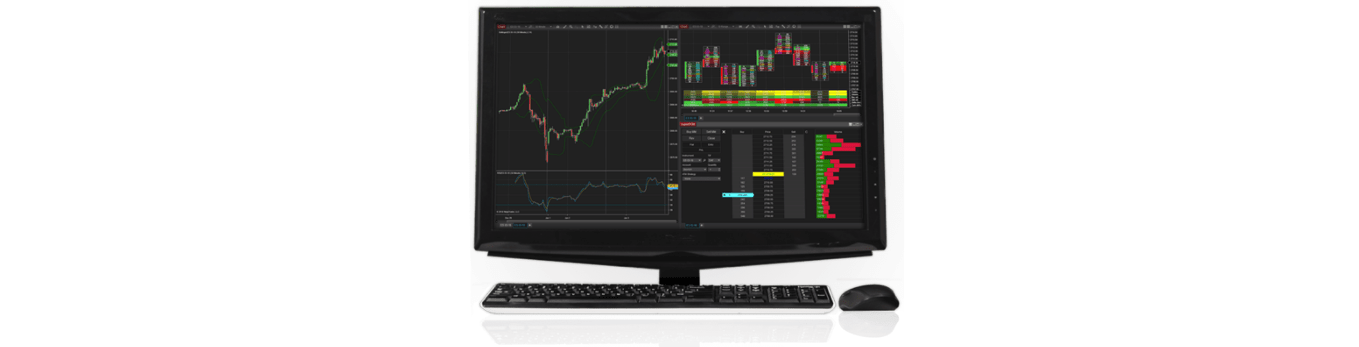

Mobile trading with interactive brokers is well supported across all devices. From lightning-quick streaming data to full-featured order entry and portfolio management, interactive brokers includes everything professionals require to trade on the go. Read full review

Great for stock research

Merrill edge's mobile app is easy to use, great for research (including ESG research), and exceeds the industry standard experience. For existing bank of america customers, the mult-account rewards and universal account functionality makes merrill edge an easy winner. Read full review

Other trading apps

In addition to our top five stock apps for 2021, we reviewed six others: tradestation, charles schwab, webull, robinhood, firstrade, and ally invest. Here's our high-level takeaways for each. To dive deeper, read our reviews.

6. Tradestation

Tradestation's mobile app is meticulously designed and provides the functionality that active and professional traders need to succeed. Thanks to matrix (ladder trading) and complex options trading support, full day trading functionality is incorporated. Read full review

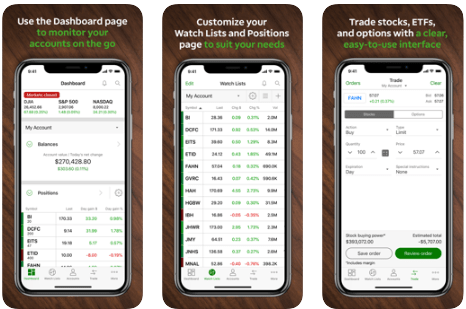

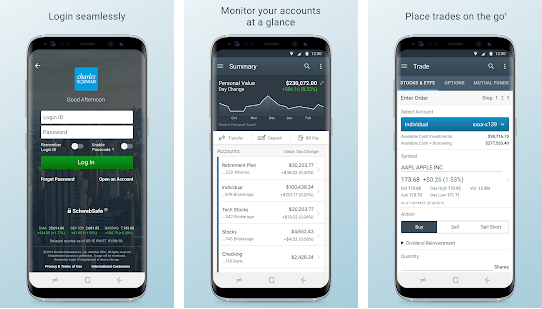

7. Charles schwab

Charles schwab provides a consistent and generally enjoyable experience for mobile trading, regardless of the device. That said, for active traders, schwab's mobile apps lack core functionality in two key areas: alerts and quotes. Read full review

8. Webull

while webull's mobile app offers more features than robinhood, it struggles to compete with the extensive amount of trading tools provided by the best stock trading apps. Read full review

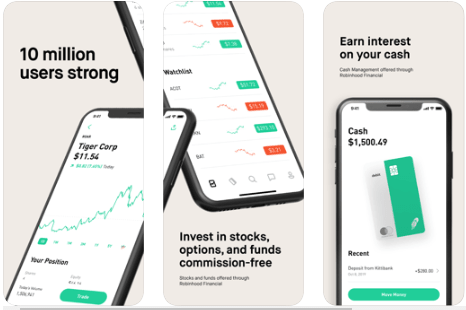

9. Robinhood

robinhood's stock app is very easy to use; however, now that all online brokers offer $0 stock and ETF trades, robinhood's lack of trading tools and research leaves it a step behind the competition. Read full review

10. Firstrade - open account

commission-free trading on 700+ etfs

While firstrade is easy to use and terrific for chinese-speaking investors, its overall offering struggles to stand out against brokers who also offer $0 stock trades. Read full review

11. Ally invest

if you are not already an ally bank customer, ally invest struggles to compete as a standalone broker. Ally invest trails industry leaders in most areas, including trading platforms, tools, investment research, and education. Read full review

Best stock trading apps comparison

Comparing stock apps side by side, while features such as real-time streaming quotes, charting with multiple indicators, and synced watch lists are commonly found, others are not. For example, less than 50% of stock apps support basic stock alerts.

| Feature | E*TRADE | TD ameritrade | fidelity | interactive brokers open account |

| watch list syncing | yes | yes | yes | yes |

| stock alerts | yes | yes | yes | yes |

| charting - after hours | yes | yes | yes | yes |

| charting - drawing | no | yes | no | no |

| charting - study customizations | yes | yes | yes | yes |

| heatmapping | no | no | yes | no |

| stream live TV | yes | yes | yes | yes |

| barcode lookup | yes | yes | no | no |

What is the best stock trading app for beginners?

For beginners in 2021, the best stock trading apps are TD ameritrade and fidelity. Between the two brokers, TD ameritrade has the edge for educational resources and trading tools. Meanwhile, fidelity offers a more comprehensive research experience for casual investors.

What is the best free trading app?

The best free stock trading app is TD ameritrade. Unlike most brokers, TD ameritrade offers two stock apps: TD ameritrade mobile and thinkorswim mobile. TD ameritrade mobile is designed for casual investors. Meanwhile, thinkorswim mobile is designed for the feature-hungry active trader. Both apps are fantastic.

How do I choose the best stock trading app?

Now that all stock apps offer $0 stock trades, we recommend comparing app features to choose the best stock trading app. The most widely used stock app features are watch lists, stock charts, and order tickets, so make sure those are great. To help readers, we include full screenshots of each stock app in our broker reviews.

Fun fact: not all stock trading apps offer real-time streaming quotes. Instead, some apps only refresh stock quotes every few seconds or more. Watch lists aside, apps like TD ameritrade and tradestation do a terrific job with their stock chart tools and stock alerts functionality. Both brokers offer traders access to several hundred technical indicators alongside endless customization options.

Which stock app offers the best technology?

On the innovation front, TD ameritrade was one of the first brokers to offer an alexa skill, and in august 2017, it became the first broker to integrate with facebook messenger, embracing the future of artificial intelligence (AI) with its own chatbot. In 2018, apple business chat was added. Then, in 2019, TD ameritrade for apple carplay and android auto both rolled out. All in all, TD ameritrade is the undisputed leader in mobile and can be found everywhere you are.

Speaking of alexa, for the millions of americans who own an amazon alexa device, TD ameritrade, alongside fidelity, charles schwab, and interactive brokers, all have approved alexa skills. Our testing this year did not incorporate testing specific alexa features; however, based on amazon’s ratings, it appears TD ameritrade has the lead in delivering a diverse quality experience.

Can I start trading with $100?

Yes. Nowadays, most online brokers offer no minimum deposit to open an account, commission-free stock and ETF trades, as well as fractional shares. As a result, new traders can start trading with a small investment such as $100. To compare features and pricing, use our online broker comparison tool.

Summary

To recap, here are the best online brokers for beginners.

Read next

Explore our other online trading guides:

Methodology

For the stockbrokers.Com 11th annual best trading platforms review published in january 2021, a total of 2,816 data points were collected over three months and used to score brokers. This makes stockbrokers.Com home to the largest independent database on the web covering the online broker industry.

Participation is required to be included. Each broker completed an in-depth data profile and offered executive time (live in person or over the web) for an annual update meeting. Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

About the author: blain reinkensmeyer as head of research at stockbrokers.Com, blain reinkensmeyer has 20 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the wall street journal, the new york times, and the chicago tribune, among others.

All pricing data was obtained from a published web site as of 01/19/2021 and is believed to be accurate, but is not guaranteed. For stock trade rates, advertised pricing is for a standard order size of 500 shares of stock priced at $30 per share. For options orders, an options regulatory fee per contract may apply.

TD ameritrade, inc. And stockbrokers.Com are separate, unaffiliated companies and are not responsible for each other’s services and products. View terms.

1 $0.00 commission applies to online U.S. Equity trades, exchange-traded funds (etfs), and options (+ $0.65 per contract fee) in a fidelity retail account only for fidelity brokerage services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an options regulatory fee (from $0.03 to $0.05 per contract), which applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See fidelity.Com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through fidelity clearing & custody solutions® are subject to different commission schedules.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read characteristics and risks of standardized options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Best investment apps

The best brokers and robo-advisors for mobile users

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

With so many different types of online stock brokers and robo-advisors available to investors, it can be tough to choose one that works best for you. That’s why we put these U.S.-based firms through a comprehensive review process that included hands-on research to determine the best in the industry.

Over the last few years, brokers and robo-advisors have increasingly adopted the mantra, “mobile-first.” as more investors and traders use tablets or smartphones as their primary platform, these firms have made efforts to improve their mobile apps, which in turn attract more mobile users. The best online investing apps offer a consistent experience between desktop and mobile platforms, including sharing watch lists and alerts as well as tools such as stock screeners and depositing checks into your account. The best robo-advisor apps keep you in touch with your progress towards your investing goals and make managing your cash simple.

Best investing apps:

- Wealthfront: best automated investing app

- TD ameritrade: best self-directed trading app

- Betterment: best app for beginners

- Interactive brokers: best app for active traders

- Tastyworks: best app for options traders

Wealthfront: best automated investing app

:max_bytes(150000):strip_icc()/wealthfront_productcard-5c74508fc9e77c000136a5cb.jpg)

- Account minimum: $500

- Fees: 0.25% for most accounts, no trading commission or fees for withdrawals, minimums, or transfers. 0.42%–0.46% for 529 plans

Wealthfront won our award for the best robo-advisor of 2020 with a full package of goal-setting, planning, banking, and investing delivered in an elegant, user-friendly platform and mobile app. If you are looking for financial guidance and don’t require it to come from a human, wealthfront offers fully digital investing for a very competitive price. Wealthfront’s goal-setting and planning technology is excellent and should serve as a model for other robo-advisors to emulate. Setting up a wealthfront account gives you access to path, the free financial planning tool that integrates your account data and uses third-party data to better project your financial situation.

The mobile apps, native ios and android, are designed to be extremely simple to use with minimal typing. Data inputs, such as dates and monthly deposits, are displayed on sliders or drop-down menus to avoid making typos. When linking external accounts, however, you still have to enter your user ids and passwords. The workflow for a new account is logical and easy to follow.

Wealthfront has taken huge strides towards its corporate goal of offering what it calls self-driving money with the launch of autopilot, which monitors bank accounts and moves funds above your monthly spending needs into an investment account or wealthfront's high-yield savings account. Wealthfront's cash account is offered in partnership with green dot bank and includes features such as mobile deposit and a network of fee-free atms.

Terrific financial planning that helps you see the big picture.

Goal-setting assistance goes in-depth for large goals, such as home purchases and college savings.

If you have multiple goals, path shows you the trade-offs you’ll face.

Portfolio line of credit and tax-loss harvesting available.

No online chat for customers or prospective customers.

Portfolios under $100,000 are not customizable beyond risk settings.

Larger accounts may contain more expensive mutual funds.

TD ameritrade: best stock trading app

:max_bytes(150000):strip_icc()/td_ameritrade_productcard-5c61ed44c9e77c000159c8f6.png)

- Account minimum: $0

- Fees: free stock, ETF, and per-leg options trading commissions in the U.S., as of october 3rd, 2019. $0.65 per options contract.

TD ameritrade has the distinction of being our pick for the best overall stock trading app in our 2020 online broker review. In fact, TD ameritrade has two of the best apps for stock trading as it allows investors to select between the TD ameritrade mobile app and thinkorswim mobile. Either app is excellent for stock trading, but the TD ameritrade mobile app is geared towards basic investing with an excellent account summary, price alerts, and a wealth of news and research. Buy and hold investors, in particular, will be able to do their trading through the mobile app, freeing them from having to deal with TD ameritrade’s more cluttered desktop interface.

For traders and more active investors, the thinkorswim mobile platform is an acceptable substitute for the full desktop trading platform. Generally, we review the trading functions of mobile apps through the lens of position maintenance while away from the full platform, but thinkorswim and a select few other apps have reached the point where a trader can reasonably plan, assess, and open complex trades on the go. The thinkorswim mobile app workflow for options, stocks, and futures is intuitive and powerful. Traders will find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts. Both apps are very similar to the full platform experiences, so transitioning back and forth is very fluid.

TD ameritrade mobile apps are well-designed and give investors the choice between an investment-focused app and a trading-focused app.

Both apps give customers a simple one-page experience where they can quickly check in on the markets and their account.

Watchlists and customizations sync across all TD ameritrade platforms, including both mobile apps.

All available asset classes can be traded on the mobile apps.

The tools and features available in the apps differ by design, but hybrid investors (swing traders, for example) may find themselves switching between the two to get access to the tools and analysis they need.

Numerous website and platform outages were reported during august 2020.

Interest on uninvested cash earns a very low rate of interest.

Betterment: best app for beginners

:max_bytes(150000):strip_icc()/Betterment-productcard-5c61e44bc9e77c00010a4e52.png)

- Accountminimum: $10

- Fees: 0.25% (annual) for digital plan, 0.40% (annual) for the premium plan

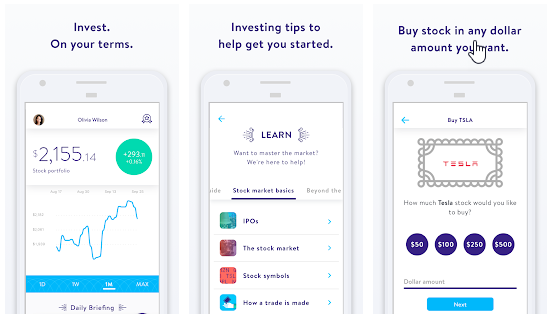

Betterment is our top choice for beginners because its platform is intuitive, user-friendly, and full of educational resources.

Betterment boasts one of the easiest accounts to set up, and the process is optimized for mobile devices. Users enter their age, annual income, and a goal. There are none of the standard risk-related questions. Instead, betterment presents you with an asset allocation suggestion and its associated risk, which you can change by adjusting the percentage of equity versus fixed income held in the portfolio. Betterment offers five portfolio types and clients can switch strategies after a portfolio is funded. The platform will even tell you if there are any tax implications prior to making a change.

The firm launched its cash management offerings, betterment checking and betterment cash reserve, in april 2020. The checking account includes a debit card and reimburses ATM fees and foreign transaction fees. In june 2020, betterment added mobile deposit capability to its checking account offering. With two-way sweep enabled, cash is swept from the checking account into the reserve account, which pays a higher rate of interest.

Quick and easy account setup, even on a phone.

You can sync external accounts to individual goals.

Add a new goal at any time and track your progress with ease.

Easily change portfolio risk or switch to a different type of portfolio.

Checking and cash reserve features offer two-way sweep.

Users of the free planning function are constantly nudged to fund a betterment account.

The standard plan incurs a charge of $199–$299 to talk to a financial planner.

Socially responsible portfolios are invested in exchange-traded funds (etfs) so are less controllable.

There are no borrowing options against your portfolio.

Interactive brokers: best app for active traders

:max_bytes(150000):strip_icc()/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

- Account minimum: $0

- Fees: maximum $0.005 per share for pro platform or 1% of trade value, $0 for IBKR lite

TD ameritrade has the best apps for stock trading overall, but interactive brokers has the edge when it comes to active trading. This shouldn’t come as a surprise as interactive brokers took nearly every important trading category in our 2020 review with the exception of options trading. Whether you are using the powerful traders workstation (TWS) or the mobile app meant to give you the core features on the go, interactive brokers is geared for active traders. The interactive brokers app has nearly all the functionality of the firm’s web-based platform, but it is understandably limited in comparison to the TWS desktop app. That said, you can queue up trades for all asset classes and data streams in real-time.

Interactive brokers’ mobile app is one of the very few that make it possible for traders to assess the market and open new positions on the go as opposed to simply monitoring existing trades. While the mobile app has great research, excellent charts, and a wide selection of indicators, the lack of drawing tools and some other limitations will still result in most active traders preferring the full-featured TWS experience when possible. Compared to other mobile apps for active traders, however, interactive brokers’ app is a step ahead.

Interactive brokers’ mobile app comes close to mimicking the website experience with full order ability and the scanners and alerts active traders expect.

An intuitive trading workflow through the app is combined with the ability to set order presets for faster entry.

Mobile charts come with a suite of useful indicators for quick trading decisions.

Data streams in real-time across only one platform at a time. That said, only traders who have a multi-device approach to their workflow will be affected by this limitation.

There are no drawing tools in the mobile app.

Tastyworks: best app for options traders

:max_bytes(150000):strip_icc()/tastyworks_productcard-5c61ed6b46e0fb00017dd6f7.png)

- Accountminimum: $0

- Fees: $0.00 stock trades, $1.00 to open options trades $0.00 to close

Tastyworks does not suffer from a lack of focus. The brokerage is very focused on options traders, and this focus has allowed tastyworks’ mobile app to unseat interactive brokers in this area. While interactive brokers is still the standard for active traders, traders who are mainly using options strategies will find tastyworks’ app a better fit.

The tastyworks mobile workflow is designed for options order entry, making the process quick and intuitive. Options traders use drag and drop to choose the legs of an options spread, eliminating keyboard entry. Despite this ease of entry, the tastyworks mobile app is better thought of as a short-term substitute for the desktop platform. While you can enter new positions and exit existing ones, the app lacks some of the features available in the desktop platform for researching and analyzing trades. For heavy options trading, it is difficult to match the full feature set and extra visual space that comes with the desktop platforms.

Traders can use a drag and drop selection for options legs in the tastyworks mobile app.

The tastyworks app is streamlined for options trading. There are no unnecessary features and nothing to distract from the core function.

Tastytrade video feed is available through the mobile app.

You can’t open an account through the tastyworks mobile app.

The app won’t replace the desktop for heavy traders, but it can be used to monitor and exit existing positions.

The evolution of investing apps

TD ameritrade and others have now refined their app experience to a point where a majority of investors can take a mobile-only approach to their portfolio. However, traders and more active investors may never reach this point completely, depending on the strategies they are employing and how complex the trades are. These more desktop-dependent investors still benefit from having the ability to monitor their trades on the go and even open up new positions within reason.

It is worth reflecting back on how far the mobile apps of online brokerages have come. The vast majority of mobile apps are stable platforms with streaming data and functional workflows. This wasn’t the case as recently as five years ago when it was difficult to synchronize watchlists between platforms. As brokers and robo-advisors have embraced cloud processing and data storage, it's become the industry standard to offer the same experience on a mobile device as one might have on a desktop platform or website. That is a significant amount of progress for the investing industry overall. We can still pick at layouts and argue about which functions deserve to be included in the mobile version, but the fact remains that investors are closer than ever before to having the market in their hands.

Desktop vs. Mobile experiences

Rather than producing different apps for their customers who trade on the road, brokers now strive for a consistent experience between desktop and mobile platforms, including sharing watch lists and alerts as well as tools such as stock screeners, portfolio analysis, and depositing checks into your account. Streaming data has made its way to mobile apps along with advanced charting and educational offerings. We’ve seen complex options analysis and trading enabled as well. With the availability of computers in our pockets, the way people interact with their trading and investment accounts have forced brokers to offer mobile apps along with their traditional desktop platforms.

Methodology

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Our reviews are the result of months of evaluating all aspects of an online broker’s platform, including the user experience, the quality of trade executions, the products available on its platforms, costs and fees, security, the mobile experience and customer service. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

The best stock trading apps offer a consistent experience between desktop and mobile platforms, including sharing watch lists and alerts as well as tools such as stock screeners and depositing checks into your account. Streaming data, advanced charting, complex options analysis, and trading and educational offerings are key features to have to earn a top rating in this category.

Our team of industry experts, led by theresa W. Carey, conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Click here to read our full methodology.

14 best stock trading apps of 2021 (android & ios)

Try the digital way of stock marketing with stock trading apps. Stock trading has always piqued interest among investors since the time the stock exchange came into existence in the late 16th century.

However, earlier, the way of stock trading was via a middleman called stockbroker. The involvement of the stockbroker incurred hefty charges upon the investors in the form of commission payments to the broker.

With the digitalization of the stock industry, the way of stock trading has been revamped, eliminating the need to depend on the broker to conduct the stock business. The article ahead will talk about the 14 best online trading and investment apps to help you stay on top of global markets.

List of best stock market apps in 2021

Stock investment apps can differ as per the target audience. They can be designed either for beginners as well as for the banking sectors. Below is a curated list of the top stock trading apps to help you analyze market trends and make better investments.

1. Robinhood – investment & trading, commission-free

This is an ideal stock trade app as it is available free of cost to track the stocks independently. The app was launched even before the website came into effect. You don’t need to pay commission to anyone if you use this app.

Key benefits:

- You can look for your stock and then input your trade details and that’s all you need to do to get started with the app.

- You can’t deal with mutual funds or bonds on this app as it only supports stocks and etfs (exchange-traded funds).

- Recently, it started supporting bitcoins too.

- With the premium version of this online trading app – robinhood gold account, you can unlock other trading options like margin trading and extended trading hours.

2. TD ameritrade mobile

This application can be considered among the best stock market app for iphone due to the excellent features with which it provides great user experience to the traders. This iphone app is a product of the most prominent stock trading firm in the US.

Key benefits:

- The TD ameritrade app is the most fundamental app of this firm.

- This app can help you with charts, technical indicators, market trends, and stock analysis.

- You also get to customize your dashboard, screens, etc.

- You can set customized market alerts and even receive personalized advice regarding your investments.

- The snap stock feature helps you acquire knowledge about a company with the help of the product barcode.

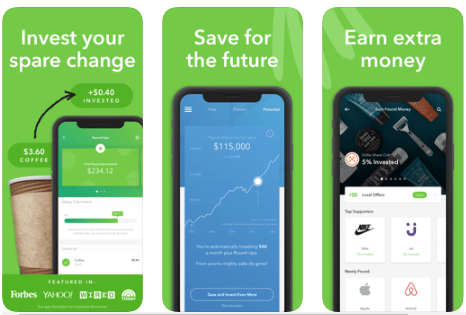

3. Acorns – invest spare change

If you are just stepping into the world of the stock market and have absolutely no idea where to start, then this is the best stock trading app for beginners.

Key benefits:

- With this app, you can invest selectively in etfs.

- You can get started by linking your bank account and then, let the app analyze your expenditure and savings.

- Post this; the app can automatically transfer the remainder of your sum into the acorns account and helpfully build up your stock and bonds portfolio.

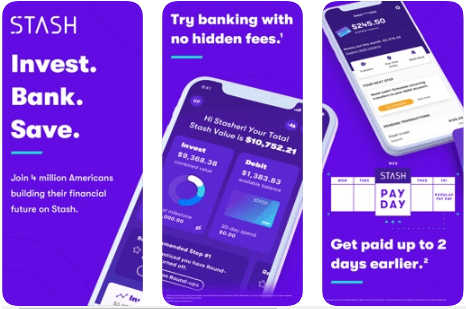

4. Stash: banking & investing app

This is another best place for beginners as it lets you learn about the stock market alongside growing your stock investments with the app.

Key benefits:

- You can get started by investing as little as $5. Investments are majorly into etfs and single stocks.

- There are many articles available to educate you about the stock market.

- The app has an exclusive feature which is the built-in ‘investment coach’ to help you with the investments.

5. E*trade mobile

This is an excellent android stock market app, as they have been in business long enough. They also own the optionshouse, which has its own trade supporting app.

Key benefits:

- Once you have installed the app on your android or ios device, you can then monitor the performance of your investments.

- You can also utilize the app to invest in stocks, etfs, mutual funds, and many more trade options.

6. Schwab mobile

This is exclusively designed for the banking sector as the all-in-one iphone and android app for stock trading. If you indeed hold a schwab account or are involved in investments with this bank, then this is the ultimate app for you.

Key benefits:

- Other than managing your investments, money transfers, and deposits, you can monitor your trade portfolio’s performance.

- Additionally, you can pay bills with this application. Hence, this is the app to fulfill all your banking needs.

- You can also examine the international market data with the help of this app.

7. Fidelity investments

This application for stock marketing can be extremely beneficial for those who have fidelity investments. They have gained several accolades like – best overall online brokers, best for beginners, best for international trading, and many more.

Key benefits:

- The app has extensive features like recognia technical events and trefis stock valuation.

- The trade execution engine helps investors save more on stocks but the minimum investment should be on 500 shares or more.

8. Tradestation

This is a preferred app for active stock trades. This app uses active traders like per share/per contract and unbundled pricing plans.

Key benefits:

- This app offers a flat-fee plan and tsgo plan which don’t require any commissions.

- The app uses sophisticated analytical tools.

9. IBKR mobile

This is the best trade app for stock investments. You get advanced tools and a variety of investment plan options.

Key benefits:

- With this app, investors and traders can undertake international trade easily.

- The app has low commission charges.

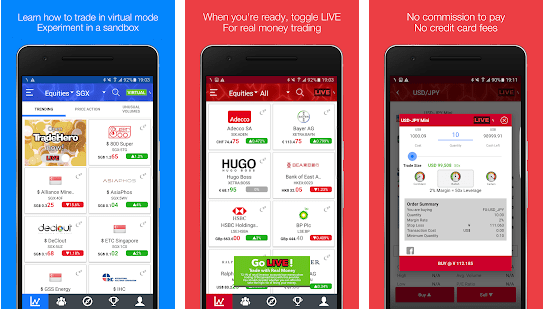

10. Tradehero

This android stock market game app lets you trade a $1,00,000 portfolio at actual stock prices but at the same time, since there is no real-time investment, therefore you bear no financial risk.

Key benefits:

- The app can be used with a promo code.

11. Stockpile

This is the best web-based stock market application for teens. You can not only undertake stock transactions with this app but also gift single shares of stock.

Key benefits:

- You can purchase fractional shares of expensive stocks of larger firms like google, berkshire hathaway, etc.

12. Webull – stock market tracking & free stock trading

The next best mobile trading app on this list that you can use for free U.S. Stock trading is called webull. It also helps you obtain real-time information about global stock markets to make better trading and investment decisions. Let’s have a look at some of its notable features.

Key benefits:

- It’s a free stock trading app, with no additional or hidden charges included.

- Webull provides you with in-depth stock insights of SENSEX, BSE, NIFTY, etc.

- Helps you provide the latest market news with 24*7 updates on major global companies and events.

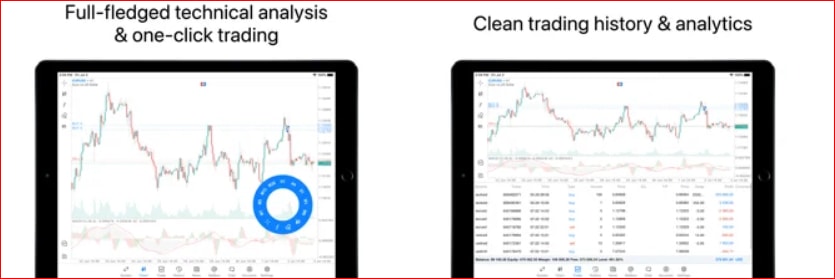

13. Metatrader 5

Metatrader 5 is a decent stock trading app of 2021 that services on both the ios as well as the android platforms. Designed to look after CFD trading and handle stocks well, this one is an app that is not limited to one broker.

- You can access this app with a set of advanced features and multiple technical indicators that take some weight off your shoulder.

- This stock trading app is covered with a powerful trading system and it renders all types of trading operations.

- It offers a chat feature alongside the push notifications, alerts and financial news.

14. Plus 500

Plus 500 rests among the best stock trading apps in 2021 that features noteworthy forex and CFD broker services. This one is neatly structured and super easy to navigate. If you are willing to up the level of your trading, plus 500 one is worth a shot.

- You can easily trade the CFD stocks and shares using this tool on your phone.

- This stock trading app offers real-time trading on major stocks and sends the price alerts.

- It is designed with a clean and intuitive user interface that makes the CFD stock trading less tangled.

To sum up: best stock market apps for trading & investment (2021)

These were some of the best stock trading apps you can use in 2021. Each of the above-listed stock analysis apps can help you significantly conduct your day-to-day investments in the stock market without having to depend on anyone.

From the point of beginners, you can make money by taking small baby steps in the field of trade and commerce. You can buy individual stocks and also opt to invest in low-risk mutual funds. You can also ideally invest in treasury securities. The primary stock trading apps can be of immense help, in the beginning, to understand the stock market correctly.

From the perspective of development, it is essential to focus on the target audience, the app platform, and the features to design the app accordingly.

Migliori app di trading [lista completa con tutte le migliori]

In questo articolo parleremo delle migliori app di trading.

Al giorno d’oggi, gli smartphone accompagnano tutti i momenti della nostra vita. Possiamo utilizzarli per gestire tantissimi aspetti della vita quotidiana e da qualche tempo……anche per fare trading online!

Parliamoci chiaro: la possibilità di investire in maniera rapida, a prescindere da dove ci si trova, è una grandissima rivoluzione! Se sei qui, significa che vuoi saperne di più in merito e scoprire quali sono le migliori app per investire online.

Da diverso tempo abbiamo in mente di scrivere questo articolo. Come già detto, gli smartphone ricoprono un ruolo molto importante nelle nostre vite ed è bene approfondire le opzioni a disposizione di chi vuole fare trading online anche fuori casa, operando dovunque si trovi, con app sicure e gratuite.

In questa guida abbiamo scelto di analizzare le app di alcuni broker legali, famosi in tutto il mondo e adatti anche ai principianti. Un esempio? Il famoso etoro, leader mondiale nel campo degli investimenti con oltre 13 milioni di clienti su tutto il globo.

Come puoi vedere qui sotto, abbiamo preparato anche un indice. Grazie ad esso, potrai scegliere e approfondire gli argomenti che ti interessano di più: buona lettura!

Migliori app di trading [come iniziare]

Specifichiamo subito una cosa: i migliori broker permettono di negoziare indifferentemente da app o da desktop. Tuttavia, lo step iniziale da effettuare è quello della registrazione.

Questo aspetto è regolamentato dalla normativa europea mifid, per la tutela e la protezione di ogni investitore. Occorre quindi compilare dei moduli ed inserire dati personali per poter accedere al conto trading. Sia chiaro, nulla di complicato! Sono passaggi necessari che ci porteranno via pochi minuti.

Tuttavia, per comodità e semplicità, è molto meglio compilare il tutto dal proprio PC. Nel giro di poco tempo riceveremo la conferma dei dati inseriti da parte del broker e sarà quindi possibile ricevere le credenziali per accedere al nostro conto. Nello specifico, il numero per effettuare il login.

Una volta ricevuto questo numero-conto sarà possibile scaricare la app e fare trading comodamente da smartphone. A tal proposito, ecco le migliori opportunità sul mercato.

App di etoro vantaggi e funzionamento

Iniziamo a parlare delle migliori app di trading iniziando da etoro (clicca qui per iniziare a visitare il sito del broker). Disponibile su google play ed apple store, l’app di questo broker è estremamente intuitiva e consente di investire su diversi asset (criptovalute, azioni, materie prime ecc.).

La sua particolarità è però un’altra: gli utenti che la scaricano possono infatti provare il copy trading, una tecnica che rende etoro unico al mondo. In cosa consiste? Nella possibilità di copiare esattamente quanto già fatto da altri trader di successo. Le informazioni sulla loro attività possono essere ricavate tramite bacheche gratuite uguali a quelle dei social network.

Etoro, che è entrato nelle vite di milioni di trader cavalcando una rivoluzione che va ben oltre al mondo degli investimenti, è infatti noto come il social network degli investimenti.

Le bacheche per scegliere i migliori investitori sono a disposizione di tutti, anche da app. Ogni iscritto al broker può infatti condividere informazioni sulle proprie strategie. I migliori, i cosiddetti popular investor, vengono “copiati” da altri utenti. Questi ultimi hanno quindi la possibilità di replicare automaticamente le operazioni effettuate dai popular investor.

Il copy trading, facilissimo da gestire tramite l’app di etoro, permette davvero a tutti di iniziare ad investire anche se si è alle primissime armi. Risulta però chiara l’importanza di scegliere popular investor davvero abili. A tal proposito viene incontro il motore di ricerca interno che permette di selezionare i broker sulla base di numerosi criteri:

- Asset di interesse

- Paese di origine

- Profilo di rischio

- Periodo di attività

- Numero di copiatori

- Performance ottenute

Soprattutto questo ultimo aspetto è un indicatore fondamentale del successo dei singoli popular investor.

Tra le migliori app di trading automatico, etoro permette anche di esercitarsi aprendo un conto demo. Quest’ultimo si contraddistingue per la possibilità di operare con denaro virtuale e senza rischiare il capitale. Non appena ci si sente pronti, si può aprire il conto con denaro reale tramite app: bastano pochi click ed un deposito minimo di 200 euro.

App di forextb per ricevere segnali operativi

Quando si parla delle migliori app di trading, è impossibile non citare l’app di forextb. Si tratta di un altro broker legale, gratuito (non prevede l’applicazione di commissioni), apprezzato in tutto il mondo.

Anche in questo caso, la sua app è scaricabile sia da google play, sia da apple store. Tramite l’app di questa piattaforma di trading online estremamente intuitiva è possibile investire su diversi asset, dalle principali criptovalute, fino alle azioni passando per il forex.

Inoltre, è possibile investire ricorrendo ai CFD (contracts for difference). Questi strumenti derivati, disponibili da 20 anni ma famosi solo da quando il trading online è accessibile a tutti, consentono di speculare sulle variazioni di prezzo dell’asset.

Il loro utilizzo è molto semplice: per trarre profitto basta infatti indovinare l’andamento dell’asset di proprio interesse. Le alternative che l’utente si trova davanti sono le seguenti:

- Apertura della posizione long (acquisto), alternativa da considerare quando si pensa che il valore dell’asset possa aumentare.

- Apertura della posizione short (vendita allo scoperto) in caso contrario.

Aprire una posizione short indica un’operazione puramente speculativa, consistente nella possibilità di -vendere- l’asset pur senza detenerne la proprietà. Infatti, con i CFD è possibile negoziare senza detenere materialmente il bene che andremo a negoziare. Oltre a tutelarci dalla volatilità, questa opzione ci permette di guadagnare sia quando il mercato sale che quando scende: basterà aprire il CFD corrispondente tra long e short.

Nonostante i CFD siano estremamente pratici, risulta comunque importante formarsi prima di cominciare a investire e per questa finalità la app di forextb mette a disposizione ottimi strumenti al proposito. Il primo è senza dubbio l’ebook gratuito, una risorsa di ottimo livello che è possibile scaricare anche tramite app. Semplice e immediata, mette in primo piano i concetti pratici, ossia quelli che servono davvero quando si fa trading online.

La guida in questione, che può essere letta agevolmente anche dallo schermo dello smartphone, ha l’indiscusso vantaggio di essere gratuita. Per questo motivo si differenzia da molti corsi di trading online presenti sul web, che chiedono migliaia di euro senza lasciare alcun contenuto utile.

Molto importante è ricordare che è disponibile anche per chi non è utente del broker. Per leggerla, basta infatti inserire una mail valida.

Considerata una delle migliori app per segnali di trading, con forextb è possibile accedere a un servizio di ottima qualità. Stiamo parlando proprio dei segnali di trading, ovvero consigli sulle posizioni migliori da aprire. A fornirli sono investitori di fama internazionale, i cui suggerimenti sono frutto di analisi sia storiche, sia in tempo reale.

Non c’è che dire: i segnali di trading di forextb sono un servizio unico nel suo genere. Forniti via mail o via SMS, a differenza di quanto accade con altri portali sono gratuiti. Per provarli, è necessario essere utenti di questo broker gratuito, che non richiede il pagamento di alcuna commissione. Fondamentale a tal proposito è attivare il conto con denaro reale con un deposito minimo di 250 euro, che può essere versato facilmente tramite smartphone e con carta di credito in tutta sicurezza.

App di trade.Com per investire con uno specialista

Il panorama delle migliori app di trading è molto vario e senza dubbio comprende infatti anche quella di trade.Com (clicca qui per iscriverti), un altro broker legale e gratuito.

L’app, scaricabile gratuitamente da google play e dall’apple store, è estremamente intuitiva. Permette ovunque ci si trovi di investire su asset come le criptovalute, le materie prime e molti altre asset.

L’app di trade.Com permette di negoziare con i CFD. Un altro suo punto forte importante riguarda la possibilità, per gli utenti titolari di un conto con denaro reale, di ricevere la consulenza telefonica personalizzata di un esperto in trading online.

Abbiamo appena nominato il conto con denaro reale, l’alternativa successiva al conto demo. Quest’ultimo, permette di esercitarsi investendo con denaro virtuale. L’ambiente di lavoro è in tutto e per tutto uguale a quello del conto con denaro reale. L’unica differenza riguarda appunto la presenza di denaro virtuale, che permette di esercitarsi senza rischiare nulla.

Tra le migliori app di trading per iphone, trade.Com è davvero molto completa: permette infatti di accedere a una sezione di video corsi gratuiti, risorse che partono dalle basi del trading per arrivare agli aspetti più complessi.

Tornando ai vantaggi del conto demo, ricordiamo che, non appena ci si sente pronti, è il caso di chiuderlo e di passare al conto con denaro reale. Per cominciare va benissimo il conto base che prevede un deposito di 100 euro.

App di iq option per fare trading partendo da €10

Quando abbiamo pensato a questo articolo sulle migliori app di trading e criptovalute, abbiamo deciso di inserire anche quella di iq option per un motivo principale: il conto con denaro reale può essere aperto con un deposito minimo di 10 euro. Nessun broker consente di iniziare con una cifra così bassa.

L’app di iq option è la chiara dimostrazioni di come, al giorno d’oggi, sia possibile investire senza bisogno di mettere in campo cifre altissime. Questa applicazione è disponibile per dispositivi ios e android ma anche per desktop (sia mac, sia windows), ed è una soluzione di ottima qualità.

Non dimentichiamo infatti che, in pochi anni di regolamentazione, l’app di iq option ha vinto tantissimi premi. Nel 2017, per esempio, è stata annoverata tra le app migliori del mondo per quanto riguarda la categoria finanziaria.

I segreti del suo successo? Sicuramente il funzionamento è estremamente semplice. Anche in questo caso è possibile investire con i CFD, aprendo e chiudendo posizioni in pochi secondi.

Caratterizzata dalla presenza di una chat interna che consente di interagire con gli altri membri della community, quest’app è contraddistinta anche dalla presenza di numerosi video. Questi ultimi, gratuiti ed efficaci, permettono di formarsi partendo dalle basi del trading online, arrivando poi agli aspetti più complessi.

Anche in questo caso è possibile esercitarsi con il conto demo, operando con denaro virtuale su asset come le criptovalute (sono disponibili le principali valute digital, dal bitcoin all’ethereum), le azioni, le materie prime, il forex, gli indici di borsa. Non appena ci si sente sufficientemente pronti, è possibile aprire il conto con denaro reale. Come già detto, è sufficiente un deposito minimo di 10 euro.

Come scegliere le migliori app di trading gratis?

In queste righe, abbiamo approfondito le caratteristiche di alcune tra le migliori app di trading. Si tratta di app famose a livello mondiale, apprezzate sia da principianti, sia da utenti esperti, perfette per imparare il trading online.

A questo punto, ti starai chiedendo come scegliere l’app perfetta per investire. Non ci sono indicazioni specifiche, fatta eccezione per la legalità. Tutte le app che abbiamo descritto sono infatti legali e controllate a livello internazionale e risultano legate a broker in possesso di autorizzazioni e licenze. Nello specifico, si parla della licenza cysec e dell’autorizzazione a operare da parte di un’autorità come la consob.

Se mancano riferimenti in merito, il consiglio migliore da seguire è quello di cambiare strada. Purtroppo non mancano le truffe di trading online, con portali che, anche tramite app mobile, promettono guadagni stratosferici senza far fatica. Parliamo spesso di queste situazioni, approfondendo i pericoli di portali/app come crypto kartal ed herdos, giusto per citare due alternative.

L’elenco potrebbe andare avanti ancora tantissimo. Da quando il trading online è diventato famoso, sono spuntati come funghi numerosi sistemi che sfruttano l’ingenuità degli utenti, spingendoli a investire cifre medie/alte con la speranza di guadagnare cifre altissime senza fatica. Ebbene, questo non è assolutamente possibile. Fare trading per ottenere profitti è di certo possibile, ma non c’è nulla di certo: investire significa infatti esporsi a un livello di rischio ineliminabile.

Le migliori app di trading che abbiamo approfondito specificano chiaramente questo aspetto, avvertendo fin da subito gli utenti. Chi utilizza le app dei broker non può certo dimenticare il rischio ma può affrontarlo. Utilissima a tal proposito è la tecnica del money management, tattica che prevede la divisione del capitale in tantissime piccole parti, ciascuna delle quali va assegnata a una singola operazione non puntando più del 5% ogni volta. In tal modo è infatti possibile diversificare al meglio il rischio.

Da queste righe è chiaro che, quando si tratta di capire come scegliere le migliori app di trading, la legalità è un criterio principe! Per il resto, le opzioni tra le quali scegliere sono soggettive:

- Si vuole investire in automatico? Allora sarà opportuno affidarsi al copy trading di etoro

- Vogliamo approfondire concetti teorici e studiare per bene la teoria? Ecco che l’ebook di forextb fa al caso nostro

- Desideriamo uno specialista del trading a nostra disposizione? Sarà quindi opportuno scegliere la app di trade.Com

- Vogliamo investire con soli €10? Ebbene, iq option ci offre questa opportunità

Ne abbiamo per tutti i gusti e per tutte le esigenze. Ricordiamo ancora una volta che le migliori app per la simulazione di trading offerte da questi broker sono gratuite e testabili senza vincoli. Conviene quindi scaricarne almeno 2 o 3 per scegliere con cura quella più adatta a noi.

App di trading con commissioni

Fino a questo momento abbiamo parlato delle migliori app di trading che non applicano commissioni, particolarmente consigliate a chi inizia con capitali molto piccoli e senza (o con poca) esperienza.

Chi invece dispone di capitali molto sostanziosi e ha già un’esperienza di trading più che solida, potrebbe scegliere anche app che applicano commissioni.

Qui sotto elenchiamo le più importanti tra quelle italiane:

Conclusioni

Speriamo di essere riusciti, con questi consigli, a farti capire meglio quali sono e come funzionano le migliori app di trading. Abbiamo recensito proprio le migliori applicazioni per investire in sicurezza ed al passo con i tempi, grazie al nostro smartphone.

In particolare, in questo articolo abbiamo selezionato esclusivamente app con le seguenti caratteristiche:

- Sicure e affidabili

- Senza costi fissi sull’eseguito

- Facilissime da usare anche per principianti

- Consentono di investire con somme molto basse

- Funzionano ottimamente anche dal punto di vista tecnico

A questo punto, se ti va, ti chiediamo di condividere l’articolo con i tuoi contatti facebook, in modo da aiutare anche altri utenti nella tua situazione a scoprire come fare trading da mobile in maniera sicura!

Si ormai tutti i migliori broker si sono dotati di una versione app per il trading sui mercati. Basterà scaricarla dal play store.

Sicuramente quella di etoro e di forextb, perfette per negoziare anche da mobile.

Si certo, possono essere scaricate gratuitamente e si utilizzano anche con un conto demo.

Verificando la licenza del broker e diffidando da tutte quelle applicazioni che promettono guadagni automatici senza sforzo.

Demo accounts

A free day trading demo account is a fantastic way to gain experience with zero risk. Here, we list the best forex, cfd and spread betting demo accounts. From ‘no registration’ practise accounts, to MT4 simulators that allow you to test strategies, we have reviews for them all. Test out brands and see if day trading could work for you – without risking capital.

Best demo accounts in the united kingdom 2021

What is a demo account?

A demo account is a kind of trading simulator, or practice account, that allows you to practice day trading with a wide range of financial instruments, from stocks, futures, and options to cfds and cryptocurrency.

How do they work?

Demo accounts are funded with simulated money, allowing you to gain trading experience without risking real capital.

This allows you to craft strategies and build confidence while getting familiar with market conditions.

In addition, it’s an effective way to test drive a potential broker and software.

Capabilities

The best demo accounts allow you to simulate real trading with the only difference being that you use pretend money.

This way you get the full experience of the markets and the trading platform, without the pressure of risking your actual funds.

- Exploration – testing different financial markets allows you to get a feel for how they behave while finding the right product for you. Trading penny stocks will be different to commodities, for example.

- Gain experience – before you risk real capital, you can practice opening and closing positions, plus applying stops and limits. In addition, you can view margin requirements, as well as track profit and loss.

- Charting – learn how to interpret and utilise charts, from testing technical indicators to identifying patterns.

- Past performance – you can analyse past performance to correct mistakes and hone your strategy before you put real capital on the line.

- Trading tools – learn how to interpret and utilise information from news feeds and market data.

- Watch-lists – demo accounts also allow you to identify and monitor markets of interest.

Benefits

Whether it’s a forex demo account in the UK and australia or CFD and spread betting in the US, all will offer a number of benefits:

Familiarity

- Risk – because demo accounts are funded with simulated money, mistakes won’t cost you any of your hard-earned capital. In addition, they also allow you to practice day trading while you are still saving for that initial account deposit.

- Price action – the best way to understand price action is to experience it. Stock trading demo accounts, for example, will give you practice reacting to volatile markets and capitalising on price fluctuations.

- Broker & platform – finally, online trading with demo accounts is an effective way to test a potential broker and platform. For example, you can check their software has all the charts and tools you need. In addition, do they offer any useful extras, such as trading contests? So, check the overall quality of the broker’s services before you commit real capital.

Strategy

- Calibration – demo brokerage accounts are the ideal place to fine-tune your strategy. You can make mistakes and adjustments until your plan is consistent, without losing real capital. Because overtrading, cutting profits short and direction bias are all common mistakes that can prove costly if you don’t make them in practice accounts first.

- Forward testing – once you have a market and strategy in mind, you can either backtest or forward test your trading plan. While backtesting can prove useful, it lacks the emotional element. Forward testing enables you to put your plan to trade stocks, for example, into action while battling trading pressures in real-time.

- Drawdowns – regardless of how effective your strategy is, there will be days where the market feels against you. However, investing in a demo account allows you to practice sticking to your plan and perhaps adjusting your position size until things turn around.

Overall, signing up for a demo account in binary or stock options, for example, could give you the ideal risk-free platform to develop an effective strategy.

Drawbacks

Before you start looking at demo accounts for trading, these practice accounts do come with certain limitations:

Physical discrepancies

- Execution – demo accounts often provide better execution than live trading. This is because demo accounts usually fill a market order at the price shown on the screen. However, in a live market, there is slippage. This can result in orders not being filled at the expected price. So, meeting previous profit calculations may prove challenging.

- Increased capital – normally, demo software allows you to choose how much capital you would like to trade with. As a result, many individuals opt for far more than they will have when they live trade. Greater capital allows for smaller losses to be more easily recouped. You may also find yourself unable to afford the expensive instruments you explored when using demo accounts.

- Spreads – online forex brokers, for example, often look to impress potential traders with tight spreads in demo accounts. However, in fast-moving markets, in particular, the spread quoted may be far wider.

- Deposits – although using virtual money, there are some brokers who will require an initial deposit to use their demo accounts. So, this is something to check before you sign up.

- Leverage – many traders enjoy the increased leverage some brokers ofter in demo accounts. Whilst this can result in substantial virtual profits, in live-trading it can also lead to significant losses.

- Deal rejection – in demo accounts, trades almost always go through as requested, regardless of certain factors. However, when live trading, price changes between your trade submission and execution can result in rejection. So, be prepared for re-quotes when you upgrade to live trading.

- Trading tools – free charts and packages you get when your trading gold in your demo account may well come at an additional cost when you live trade.

- Market movements – your demo account server may not take into account interest and dividend adjustments, or out of hours price movements.

Psychological discrepancies

- Emotions – demo accounts will not expose you to the fear, hope and greed that you may experience when you live trade. The fear of losing your capital can result in costly mistakes. Whilst greed can lead to holding onto a winning position for too long. Unfortunately, you cannot practice controlling these emotions with demo accounts.

- Complacency – managing risk properly with a practice account is often overlooked. Traders often take more risks than they would if real funds were on the line. This can result in bad habits when you transition to live trading.

- Overtrading – the excitement of trading can cause many with demo accounts to overtrade. After all, why not take that risk when it isn’t real money on the line? This can develop into a habit of overtrading. However, when you move to live trading, you will then need to learn quantity doesn’t always trump quality.

To conclude, a comparison of a demo account vs a real live-trading offering will highlight a number of potential pitfalls to take into account.

Yet that does not necessarily mean you shouldn’t use demo accounts. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital.

Moving from demo to real money

You open a demo account as your first step towards becoming a trader. You want to be successful and make real money. So why stop at the demo stage?

It is a common feeling. That fear of losing real money and the lack of belief that you might actually be a profitable day trader.

The same fears held us back to, but until you take that leap, you will never know. Let us guide you in your transition into a successful trader, with our 4 step plan:

Demo to real action plan

1. Assign some capital to trading

2. Open A real money account

3. Calculate A trade size

4. Start trading!

You already know how to place trades as you have tried it on the demo account. So let us build on each point with some detail;

Assign some capital

You need to set aside some capital. How much is up to you but £250 to £500 is a reasonable minimum, any less limits the number of trades you can make.

Trading is high risk, so you need to be prepared to lose some or all of this money. If the minimum deposit at a broker is less than you have, you dont need to pay it all in – just set it aside.

Open A real money account

You do not have to use the same firm as your demo account, but this will be the easiest transition. Visit the broker page if you want to try someone new for the real account.

Calculate A trade size

How much will you risk on each trade? 1% to 2% is a good conservative number.

If you make 50 to 100 trades, you will be well placed to know if you have what it takes to be profitable trader.

Any less and you will not know if the results were just good or bad luck. 100 trades starts to separate winners from “unprofitable” traders.

Start trading!

Congratulations, you are a trader! Now, are you a winning one?…

Opening a demo account

Most demo accounts are easy to open, whether it’s for cryptocurrency or binary options of 60 seconds. The majority of the time, you will simply have to head over to the broker’s website and fill in a straightforward form.

You will usually be asked for:

- Email address

- Username

- Password

- Location

Often you require no more details than this. Your account login details will then be emailed to you and instructions on next steps will be given.

You can even find some forex demo accounts that require no registration at all.

Reviews

Whether you are looking for the best demo account for share trading on the stock market, commodity trading, futures, forex or binary options, some of the top options have been collated below.

This will allow you to find the right software and offering to compliment your trading style whilst give you exposure to your preferred markets.

Metatrader 4 demo account

The most popular trading platform is metatrader 4 (MT4). However, you can also get metatrader 5 (MT5) demo accounts. These industry standard platforms are now available at most retailers.

Once you have finished your metatrader download, you will be able to analyse markets using a range of technical indicators, without risking any capital.

This allows you to practice analysing price action, chart figures, support and resistance lines, currency correlations, and more.

In addition, demo accounts on MT4 can be opened in a desktop platform, plus in mobile applications.

Both will also allow you to test automated strategies, calling on historical data to optimise your settings.

Once you have your metatrader account password, you can practice all of the above until your demo account expires. However, you will find plenty of brokers offering MT4 demo accounts that don’t expire.

This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under real market conditions, for as long as you want.

You also benefit from diversity. So, you can choose between MT4 demo accounts in gold trading and FX, just to name a couple.

In fact, because MT4 demo accounts have no time limit, you can try your luck in as many markets as you like, until you find the right product for your trading style. MT4 demo accounts are also available in plenty of countries, from the USA to the UK.

Overall, once you have your MT4 password, you are free to test your strategies for as long as you wish, as most metatrader demo accounts are unlimited.

They provide the ideal risk-free way to identify where your strengths lay and which areas of your trading plan require attention.

IC markets

One of the best forex demo accounts is provided by IC markets. Their forex account is easy to use. It comes with a range of sophisticated charting and trading tools, whilst their website promises a wealth of support and an active user community.

Another major benefit comes in the form of accessibility. You can open a forex demo account from the USA, UK, canada, malaysia, indonesia, and a whole host of other countries.

In terms of technical capabilities, IC markets support a range of platforms.

So, you can select their forex account and get an MT4 download. Alternatively, you can practice on MT5 or ctrader. Also, you can choose between a forex web platform or mobile trading, on both android and ios.

IC markets forex demo account also has no time limit or expiration. So, you don’t have to put real capital on the line until you feel confident.

Overall, if you’re looking for free demo accounts for forex trading, that can be used for an unlimited time, IC markets is a strong contender. They consistently score highly in reviews of forex demo accounts.

Plus500

For demo accounts using cfds only, plus500 is worth considering.

Reviews highlight traders are impressed with the great flexibility, high-quality software, plus competitive spreads when you upgrade to real-time trading.

Another key selling point of plus500 demo accounts is that they do not expire, meaning you can practice indefinitely.

On top of that, you can backtest strategies and get familiar with the nuances of the forex market, all with zero risks.

In addition, head over to the app store and you can get a demo account on your ios or android device. This will allow you to practice on the way to work or at a time convenient for you.

Simply head over to their website and select ‘demo mode’ in the ‘select account mode’ window.

Then follow the on-screen instructions to get set up. Also, you can switch from real money mode to demo by hitting ‘switch to demo mode’. Not to mention, you can reset plus500 demo accounts if you want a fresh start.

So, if you’re looking for a full demo account without needing a deposit, plus500 is a worthwhile choice.

Etoro

If you’re looking for crypto, CFD, or forex demo accounts, etoro is worth exploring.

In fact, once you have registered on their website, a trading account with both real and demo modes is automatically opened.

After you’ve logged in, you simply need to select ‘practice trading login’ on the main screen and enter your etoro login credentials that you registered with.

Etoro is a sensible choice for those looking for a free forex demo account download without a time limit. In addition, demo accounts on etoro can also be reset.

On top of that, you can get their forex demo account in app form, where you can play around with up to €10,000 in virtual funds.

Also, app reviews have been quick to highlight the sleek and easy-to-navigate interface.

A demo account in etoro will also allow you to practice your skills in trading competitions. Furthermore, it’s an ideal choice for those looking for demo accounts without a deposit required.

Summing up

There are plenty of options out there. An MT4 demo account that does not expire could well prepare you for any number of potential markets.

However, remember a forex demo account vs live real-time trading will throw up certain challenges.

So, be wary of those that claim ‘demo account trading is a must in my view’. Instead, consider your needs and look for demo accounts that can replicate real-time trading as accurately as possible, including spreads and trade tools.

NSE demo trading accounts

There are now plenty of options for individuals looking for demo accounts for the NSE (national stock exchange of india). In fact, demo accounts for stock/share trading in india are on the rise.

Both individuals and retailers are swiftly realising demo accounts can prove useful in the often volatile marketplace.

However, it is worth considering whether a minimum deposit is required.

You should also check whether advanced trading tools will come with an additional charge when you upgrade to a live account.

Finally, how long do you have access to their practice offering? Is it unlimited or will you have to look elsewhere after a short while if you’re not ready to upgrade?

It’s also worth noting you can find demo accounts for commodity trading in india. On top of that, there are binary options demo accounts, without needing a deposit.

Furthermore, a number of brokers offer futures demo accounts for an unlimited period. So, it’s worthwhile shopping around before you sign up.

Final word

You do not have to risk your own capital straightaway. You can find plenty of free day trading demo accounts, for binary options and cryptocurrency to forex and stocks.

Location should also not deter you. For example, you can find demo accounts for stock trading in singapore as easily as you can in south africa.

Overall, demo accounts offer a multitude of benefits, from honing a strategy to getting familiar with prospective markets.

However, there are certain limitations, from tackling different emotions to seeing the need for an effective risk management strategy.

But regardless of whether you think using demo accounts is very helpful or not, they remain an effective way to test a potential broker and platform.

So, let's see, what we have: for our 2021 annual review, we tested and scored 11 different stock trading apps. To assess each stock app, we checked for and tested 40 individual features. At trading online app

Contents of the article

- No deposit forex bonuses

- Best stock trading apps for 2021

- Best stock trading apps 2021

- Other trading apps

- Best stock trading apps comparison

- What is the best stock trading app for beginners?

- What is the best free trading app?

- How do I choose the best stock trading app?

- Which stock app offers the best technology?

- Can I start trading with $100?

- Summary

- Read next

- Methodology

- Best investment apps

- The best brokers and robo-advisors for mobile...

- Best investing apps:

- Wealthfront: best automated investing app

- TD ameritrade: best stock trading app

- Betterment: best app for beginners

- Interactive brokers: best app for active traders

- Tastyworks: best app for options traders

- The evolution of investing apps

- Desktop vs. Mobile experiences

- 14 best stock trading apps of 2021 (android & ios)

- List of best stock market apps in 2021

- 1. Robinhood – investment & trading,...

- 2. TD ameritrade mobile

- 3. Acorns – invest spare change

- 4. Stash: banking & investing app

- 5. E*trade mobile

- 6. Schwab mobile

- 7. Fidelity investments

- 8. Tradestation

- 9. IBKR mobile

- 10. Tradehero

- 11. Stockpile

- 12. Webull – stock market tracking & free stock...

- 13. Metatrader 5

- 14. Plus 500

- To sum up: best stock market apps for trading &...

- Migliori app di trading [lista completa con tutte...

- Migliori app di trading [come iniziare]

- App di etoro vantaggi e funzionamento

- App di forextb per ricevere segnali operativi

- App di trade.Com per investire con uno specialista

- App di iq option per fare trading partendo da €10

- Come scegliere le migliori app di trading gratis?

- App di trading con commissioni

- Conclusioni

- Demo accounts

- Best demo accounts in the united kingdom 2021

- What is a demo account?

- Capabilities

- Benefits

- Drawbacks

- Moving from demo to real money

- Demo to real action plan

- Assign some capital

- Open A real money account

- Calculate A trade size

- Start trading!

- Opening a demo account

- Reviews

- NSE demo trading accounts

- Final word

Comments

Post a Comment