MT4 Web Trader Platform, tickmill trading platform.

Tickmill trading platform

In combination with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform directly in your browser, accompanied by spreads from 0 pips and 1.5s execution.

No deposit forex bonuses

Complete your registration, login to your client area and upload the required documents.

MT4 web trader

platform

An online platform that gives quick and easy access to the market. No need for additional software, downloads or installations.

Why trade with tickmill’s

MT4 web trader?

Trading is more accessible than ever with our metatrader 4 web trader platform. It’s the same MT4 platform that you’re used to, but is now available directly in your browser.

In just one click, your metatrader 4 web trader platform will open up in a new window giving you instant access to trading – anywhere, anytime!

With all of the same functionality as the native application, tickmill’s web trader gives you a reliable and intuitive interface, enhanced by securely encrypting any transmitted data. Our traders have access to one-click functionality to open & close trades, employ effective risk management and access exceptional charting capabilities.

In combination with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform directly in your browser, accompanied by spreads from 0 pips and 1.5s execution.

Key features of MT4 webtrader

real-time quotes in the market watch. Customizable price charts. 9 different time frames. Direct access through all modern browser. 30+ indicators. Complete trading history. Securely encrypted data transmission.

Launch web trader now

Tickmill’s MT4

web trader benefits

FULL MT4 FUNCTIONALITY

NO DOWNLOAD NECESSARY

ENHANCED TWO-WAY SYNCHRONISATION

HTML-BASED APPLICATION

INSTANTANEOUS SYNCHRONISATION

FULL ACCOUNT HISTORY ACCESS

START TRADING with MT4

webtrader platform

Register

Complete your registration, login to your client area and upload the required documents.

Create an account

Once your documents are approved, create a live trading account.

Make a deposit

Select a payment method and fund your trading account.

TRADE

Open the MT4 webtrader through your browser, login and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

FOREX

Access the world’s largest market and trade more than 60 currency pairs.

What is forex?

Foreign exchange, or forex for short, is quite simply a market where you’re able to exchange one currency for another. When you ‘sell’ a currency, there is a buyer for that currency somewhere else. Now, the exchange rate between those two currencies is what’s important when trading forex. The exchange rate is constantly fluctuating, and it’s these fluctuations that allow market speculators to earn from trading.

With a daily trade volume of $6.5 trillion dollars, the forex market itself is huge! It eclipses the likes of the new york stock exchange (NYSE) which, by comparison, has a trading volume of only $22.4 billion per day.

The forex market’s sheer size attracts a wide range of different participants, including central banks, investment managers, hedge funds, corporations, brokers and retail traders – with 90% of those market participants being currency speculators!

Why TRADE FOREX

with tickmill?

Our aim is to help our traders succeed by providing an exceptional trading experience.

Spreads from 0.0 pips. Access to 60+ currency pairs.0.20s average execution speed. All trading strategies enabled. Leverage up to 1:500.

CURRENCIES

| instrument | minimum spread | typical spread | long position | short position |

| AUDUSD | 0 | 0.1 | -1.9 | -1.6 |

| EURGBP | 0 | 0.4 | -3.87 | -0.77 |

| EURJPY | 0 | 0.5 | -3.9 | -1.1 |

| EURUSD | 0 | 0.1 | -4.8 | -0.11 |

| GBPAUD | 0 | 2.5 | -3.3 | -3.8 |

| GBPJPY | 0 | 1 | -1.9 | -3.7 |

| GBPUSD | 0 | 0.3 | -3 | -2.5 |

| USDCAD | 0 | 0.2 | -2.6 | -3 |

| USDCHF | 0 | 0.4 | 0.5 | -4.2 |

| USDJPY | 0 | 0.1 | -1.3 | -3 |

HOW-TO

trade forex

The value of each currency depends on the supply and demand for it, thus determining the ‘exchange rate’ between the two currencies, which is continually fluctuating. The exchange rate itself is basically the difference between the value of one currency against another.

It's this exchange rate that determines how much of one currency you get in exchange for another, e.G. How many pounds you get for your euros.

Now, when you’re trading forex, you’ll be trading currency pairs. So, two different currencies will be involved, and you’ll be speculating about their value in relation to each other.

Learn to trade forex

FOREX

trading hours

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Exclusive: tickmill launches futures trading on CQG platform

According to tickmill co-founder, illimar mattus, the product has been in the works for over 18 months.

London-based brokerage firm, tickmill is expanding its product portfolio with the launch of futures trading to capitalize on the growing popularity for such instruments outside their traditional users.

“after partnering with CME, the world’s leading derivatives marketplace, we’re giving to our clients access to globally regulated futures exchanges, including NYMEX, COMEX, CBOT and EUREX. This will provide you with direct market access, giving you fast and reliable execution on our new CQG platform,” the UK broker told finance magnates.

According to duncan anderson, CEO of tickmill UK ltd, the product has been in the works for over 18 months and the company “intends to bring strong competition into futures and options space with competitive pricing, access to a wide range of markets and excellent customer service.”

As part of its plans, tickmill has partnered with top-tier regulated exchanges in order to lower trading costs and let them tap into their range of futures aimed at smaller investors.

The broker broadens its product line as clients’ desire to garner exposure to regulated markets has been increasing. The moves are a sign that more retail traders are looking to diversify their trading options and further marks how such regulated products are starting to appeal beyond a relatively small group of institutional investors.

Suggested articles

FP markets launches intuitive and feature-packed mobile trading appgo to article >>

Although heavily regulated with a limited ability to juice up their bets, exchange-traded derivatives offer certain advantages over traditional OTC products. The list includes standardization, liquidity, and elimination of default risk. Etds can be also used to hedge exposure or speculate on a wide range of financial assets like commodities, equities, FX and even interest rates.

Tickmill is a group of companies with UK FCA, cypriot cysec, SC FSA, south african FSCA and malaysian LFSA licenses.

Tickmill has recently reported strong financial results for the fiscal year 2019, having bested its equivalents from the year before. Additionally, the net revenue stood at $68.6 million, marking a 52.1% increase from 2018’s result of $45.1 million. Moreover, net profit came in at $37.7 million, an increase of 91.4% compared to 2018’s figure of $19.7 million.

On the trading volumes front, tickmill disclosed that in 2020 its platforms process over 9 million trading transactions per month and in march 2020 its turnover hit the all-time record of $170 billion in notional value.

Tickmill review and tutorial 2021

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Trade on majors, minors and exotics with up to 1:500 leverage.

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customisation and suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Popular alternatives to tickmill

Assets

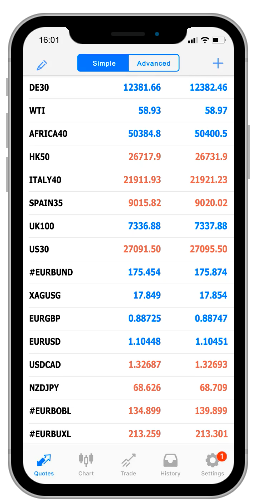

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

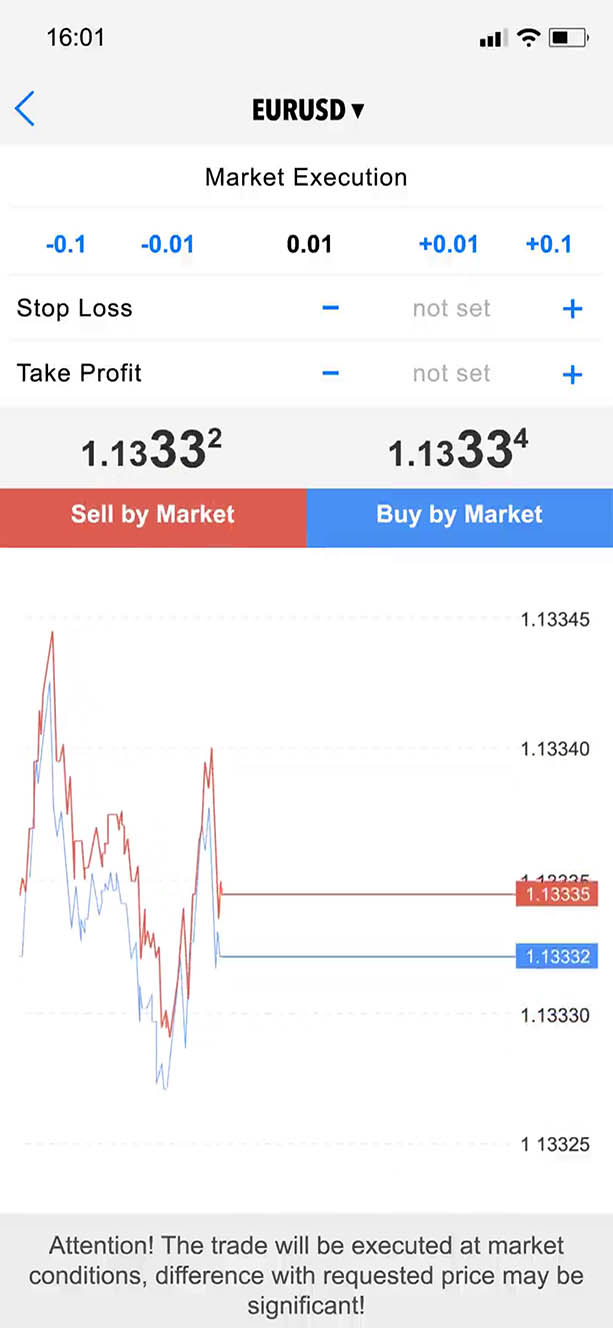

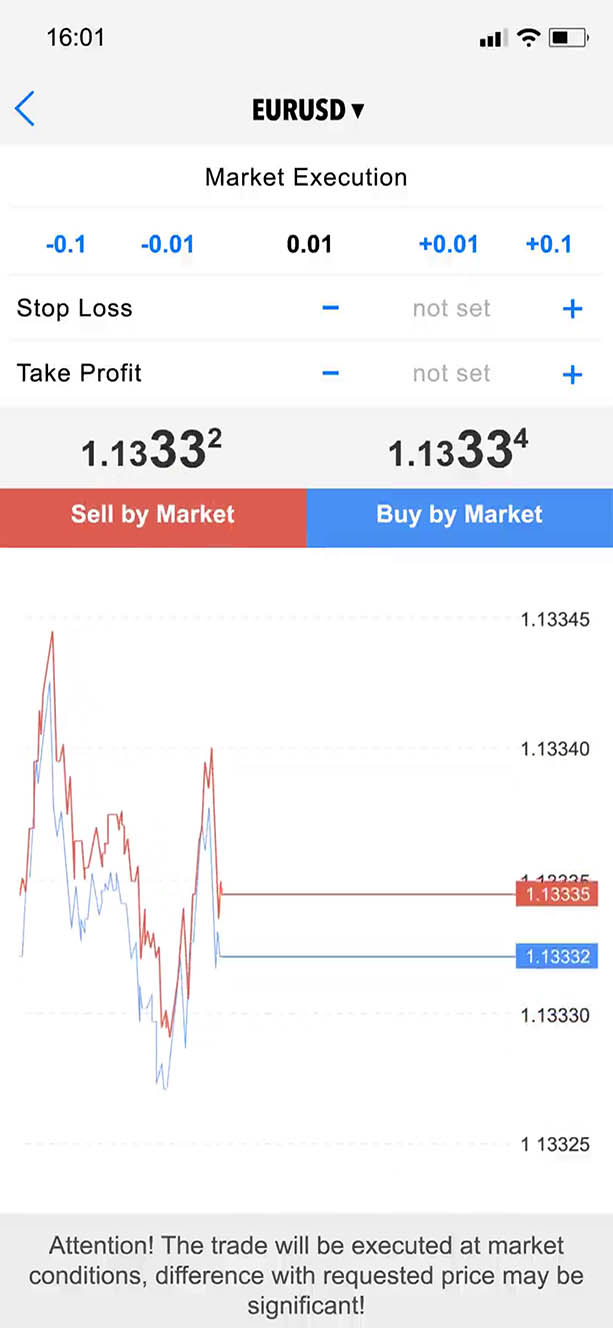

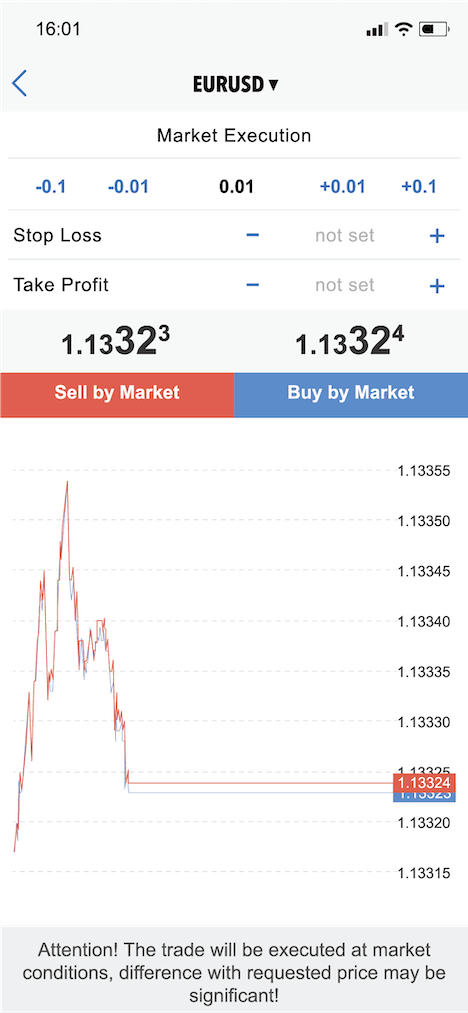

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

Tickmill offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

Tickmill offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

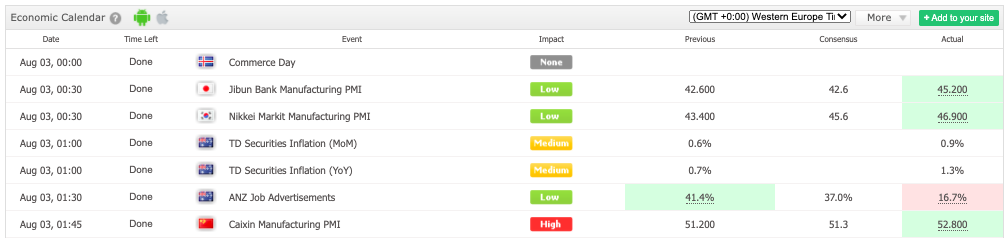

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email – support@tickmill.Com

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Tickmill’s internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use tickmill from united states, canada, japan, bangladesh, nigeria, pakistan, kenya.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

FOREX

Access the world’s largest market and trade more than 60 currency pairs.

What is forex?

Foreign exchange, or forex for short, is quite simply a market where you’re able to exchange one currency for another. When you ‘sell’ a currency, there is a buyer for that currency somewhere else. Now, the exchange rate between those two currencies is what’s important when trading forex. The exchange rate is constantly fluctuating, and it’s these fluctuations that allow market speculators to earn from trading.

With a daily trade volume of $6.5 trillion dollars, the forex market itself is huge! It eclipses the likes of the new york stock exchange (NYSE) which, by comparison, has a trading volume of only $22.4 billion per day.

The forex market’s sheer size attracts a wide range of different participants, including central banks, investment managers, hedge funds, corporations, brokers and retail traders – with 90% of those market participants being currency speculators!

Why TRADE FOREX

with tickmill?

Our aim is to help our traders succeed by providing an exceptional trading experience.

Spreads from 0.0 pips. Access to 60+ currency pairs.0.20s average execution speed. All trading strategies enabled. Leverage up to 1:500.

CURRENCIES

| instrument | minimum spread | typical spread | long position | short position |

| AUDUSD | 0 | 0.1 | -1.9 | -1.6 |

| EURGBP | 0 | 0.4 | -3.87 | -0.77 |

| EURJPY | 0 | 0.5 | -3.9 | -1.1 |

| EURUSD | 0 | 0.1 | -4.8 | -0.11 |

| GBPAUD | 0 | 2.5 | -3.3 | -3.8 |

| GBPJPY | 0 | 1 | -1.9 | -3.7 |

| GBPUSD | 0 | 0.3 | -3 | -2.5 |

| USDCAD | 0 | 0.2 | -2.6 | -3 |

| USDCHF | 0 | 0.4 | 0.5 | -4.2 |

| USDJPY | 0 | 0.1 | -1.3 | -3 |

HOW-TO

trade forex

The value of each currency depends on the supply and demand for it, thus determining the ‘exchange rate’ between the two currencies, which is continually fluctuating. The exchange rate itself is basically the difference between the value of one currency against another.

It's this exchange rate that determines how much of one currency you get in exchange for another, e.G. How many pounds you get for your euros.

Now, when you’re trading forex, you’ll be trading currency pairs. So, two different currencies will be involved, and you’ll be speculating about their value in relation to each other.

Learn to trade forex

FOREX

trading hours

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Metatrader 4

(MT4) platform

Tickmill’s MT4 platform is fully customisable and designed to give you that trading edge.

Why trade with tickmill’s

metatrader 4?

Designed specifically for traders, our metatrader 4 platform provides a user-friendly and highly customisable interface, accompanied by sophisticated order management tools help you control your positions quickly and efficiently.

MT4 is widely recognised as the world’s favorite forex trading platform. It offers an easy-to-use user interface, enhanced charting functionality, indicators and supports MQL language. So, you can easily program indicators and expert advisors (eas) to trade the forex market 24/5 with no intervention needed from your side.

Combined with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform accompanied by spreads from 0 pips and 0.20s execution.

Key features of MT4

cfds on forex, stock indices, commodities and bonds. Execute your order with no partial fills, as a result of our huge depth of liquidity. EA trading facilities by using our VPS services. Advanced technical analysis, 50+ indicators and customisable charting… in 39 languages. Trading signals with an advanced notification system.

User manuals

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADE

Launch the platform, enter tickmill’s server name to log in and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least £25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

Compare captrader vs tickmill

Online brokers compared for fees, trading platforms, safety and more. See how captrader stacks up against tickmill!

- Low stock and ETF fees

- Wide range of products

- Many great research tools

- Low forex fees

- Fast and easy account opening

- Free deposit and withdrawal

- Complicated account opening

- Complex desktop trading platform

- High forex fees

- Only forex and cfds

- Trading platforms with outdated design

- Basic news feeds

- Credit/debit card not available

- Electronic wallets not accepted

- Only 5 account base currencies

- Clear fee report

- Good customizability (for charts, workspace)

- Order confirmation

- Clear fee report

- Good customizability (for charts, workspace)

- Good variety of order types

- Clear fee report

- Good customizability (for charts, workspace)

- Price alerts

- Stock

- ETF

- Forex

- Fund

- Bond

- Options

- Futures

- CFD

- Crypto

- Warrants

- Structured products

- Autochartist integrated

- Great analysis written by tickmill experts

- Superb economic calendar

- Majority of clients belong to a top-tier financial authority

- High level of investor protection

- Negative balance protection

- Does not hold a banking license

- Not listed on stock exchange

- Financial information is not publicly available

- Majority of clients belong to a top-tier financial authority

- Negative balance protection

Save this comparison!

Sign up and we'll send you this comparison in email so you can dig deeper later.

About

Discover

Follow us

Disclaimer:

by trading with securities and derivatives you are taking a high degree of risk. You can lose all of your deposited money. You should start trading only if you are aware of this risk.

Brokerchooser.Com does not provide any investment advice, we only help you to find the best broker for your needs.

Advertiser disclosure:

brokerchooser is free for everyone, but earns a commission from some of the brokers. We get a commission, with no additional cost to you. Our recommendations and rankings are based on our methodology, independent from partnerships we have. Please use our link to open your account so that we can continue to provide broker reviews for free.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

So, let's see, what we have: with MT4's webtrader online trading platform, trade forex, futures & more from any browser and operating system - open a metatrader 4 demo account today at tickmill trading platform

Contents of the article

- No deposit forex bonuses

- MT4 web trader platform

- Why trade with tickmill’s MT4 web...

- Key features of MT4 webtrader

- Tickmill’s MT4 web trader...

- FULL MT4 FUNCTIONALITY

- NO DOWNLOAD NECESSARY

- ENHANCED TWO-WAY SYNCHRONISATION

- HTML-BASED APPLICATION

- INSTANTANEOUS SYNCHRONISATION

- FULL ACCOUNT HISTORY ACCESS

- START TRADING with MT4

- Register

- Create an account

- Make a deposit

- TRADE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- FOREX

- What is forex?

- Why TRADE FOREX with...

- CURRENCIES

- HOW-TO trade forex

- Learn to trade forex

- FOREX trading hours

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Exclusive: tickmill launches futures trading on...

- According to tickmill co-founder, illimar mattus,...

- Suggested articles

- Tickmill review and tutorial 2021

- Tickmill company summary

- Trading platforms

- Popular alternatives to tickmill

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

- FOREX

- What is forex?

- Why TRADE FOREX with...

- CURRENCIES

- HOW-TO trade forex

- Learn to trade forex

- FOREX trading hours

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Metatrader 4 (MT4) platform

- Why trade with tickmill’s ...

- Key features of MT4

- User manuals

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

- Compare captrader vs tickmill

- Online brokers compared for fees, trading...

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

Comments

Post a Comment