Traders way minimum deposit, traders way minimum deposit.

Traders way minimum deposit

Yes, of course. For all accounts our minimum transaction volume is only 1000 units or 0.01 of a lot (1 lot = 100,000).

No deposit forex bonuses

Using a leverage ratio you can start trading with a few dollars, which is why we do not impose limits on the size of the initial deposit for non-ECN accounts. This allows beginners to try out their trading skills without the risk of losing too much money. There are two options available. You can download and install the metatrader 4 trading platform on your computer or you can use the MT4 mobile application on your mobile device. Note, however, that the desktop version has a more robust functionality, providing users with automated trading, expert advisers, and powerful analysis tools.

Traders way minimum deposit

Open a live or demo account online in just a few minutes and start trading on forex and other markets.

Any questions?

Contact us:

Join us in just 1 minute!

Here you can find most frequent questions and answers regarding our products and services:

- Do I need to verify a new account?

- Is it necessary to download the software to my computer?

- What is the cost of using the metatrader 4, ctrader platforms and the iphone application?

- How to run metatrader 4 on mac OS?

- What is the demo account?

- Is the use of trading expert advisors (eas) allowed?

- What is the ECN/STP account? What are the advantages of such an account?

- What is your commission?

- How is the ECN account commission calculated?

- Can a beginner trade with trader's way?

- What is the minimum deposit I need to start trading?

- In what currencies can I deposit?

- What are correspondent bank fees?

- Can I open a corporate account?

Yes, you need to verify your account to be able to make deposits.

To verify your account you need to provide TWO DOCUMENTS:

1) personal ID - a copy of your passport or your national ID card or driver's license (with your photo). Must not be expired.

2) proof of your address - any bill with your name and address: utility bill (gas, water, electricity, fixed phone,etc.) or bank statement. Should be not older than 6 months (THE DATE SHOULD BE CLEARLY VISIBLE).

In addition to the above, corporate clients must also upload the following:

3) articles of incorporation & register of directors for the company.

4) signed copy of the corporate entity agreement provided during the verification process.

Documents' format requirements: 300 dpi resolution, each file - not more than 1mb, file format - *.Gif, *.Jpg, *.Png or *.Pdf.

Documents should be in english or with CERTIFIED english translation.

Please upload these documents in your private office/profile/upload files.

NOTE: please provide documents strictly in line with the requirements mentioned above. In case of any inaccuracy your application will not be accepted.

The compliance department has a right to reject client's verification request without any explanation!

There are two options available. You can download and install the metatrader 4 trading platform on your computer or you can use the MT4 mobile application on your mobile device. Note, however, that the desktop version has a more robust functionality, providing users with automated trading, expert advisers, and powerful analysis tools.

We provide all software free of charge to our clients.

Metatrader 4 was designed for windows OS. Please, read here how to run MT4 on mac OS.

The demo account (demonstration account) is a trading account that works with virtual money. You cannot deposit or withdraw funds from the account. You will find $100,000 worth of virtual funds in your demo account right after opening. Unlike the majority of other companies, we give you a chance to open a demo account that is no different to the groups of our real accounts. You can test-drive any account type and make your final selection with confidence, taking into consideration the results of your work in demo mode.

The trading conditions of demo accounts are almost identical to the trading conditions of real accounts with advisers enabled. Trade, learn, work out a strategy, test your advisers – we allow you to do all of that, absolutely free of charge! But keep in mind that there is a major factor missing while trading in a demonstration environment – the psychological pressure, the fear of losing money. Therefore, we recommend that after some practice, you should transition to the next phase by opening a real account with a small deposit.

Yes, we permit the use of eas and automatic trading.

The ECN (electronic communication network) is an electronic transaction system of purchase and sale created to eliminate intermediaries from the trading process; it connects brokers and traders directly. The ECN system is similar to a stock exchange. However, unlike a stock exchange, the ECN allows traders to make transactions themselves, while at a stock exchange only brokers can make transactions on behalf of the traders. The advantages of such systems are:

- Around-the-clock (24/7) trading; traders can be located in different time zones;

- Traders are fully supplied with all the necessary trading information;

- High-speed performance of transactions due to the latest communication and data processing technologies;

- Empowers traders who in the past had no direct access to trading and could not compete with brokers. Today, orders placed through the ECN by individual traders can influence market dynamics.

STP (straight through processing) is a way of handling or processing trading orders directly, without involving brokers, which increases the speed and quality of order execution. It is similar in nature to an NDD – no dealing desk. As a matter of fact, all these technologies are closely related to each other so they often use the same service names. Trading on such an account has a number of advantages:

- Fast execution of orders;

- As a rule, high liquidity;

- High quality of quotations as a result of eliminating manual order handling and taking brokers out of the trading flow;

- The smallest spreads possible on the market today.

We offer our clients a rare opportunity to take advantage of these trading practices directly by using the metatrader 4 platform.

We do not charge any additional commissions for MT4.VAR accounts. For these types of accounts, all our commissions are already included in the spread. In many ways these accounts have similar conditions and the choice of account is a matter of personal preference. We recommend MT4.VAR. Account because the spreads change according to the market. For ECN accounts the spreads are minimal, but commission will be charged separately. The breakdown of commission rates can be found in the trading conditions section.

Deals on the interbank market are usually charged with a commission per traded volume. Our ECN accounts provide you with a direct access to the interbank market. You get the tightest spreads and pay a small commission for service. If you want to calculate the commission you need to calculate your deal volume in US dollars, divide it by 100,000 and multiply by the commission fee.

For example: deal size - 1 standard lot EURUSD = 100,000 units, EURUSD rate - 1.25, commission fee - 3 USD.

Commission = (100,000 EUR open size + 100,000 EUR close size) * 1.25 EURUSD / 100,000 * 3 USD = 7.5 USD

Yes, of course. For all accounts our minimum transaction volume is only 1000 units or 0.01 of a lot (1 lot = 100,000). Using a leverage ratio you can start trading with a few dollars, which is why we do not impose limits on the size of the initial deposit for non-ECN accounts. This allows beginners to try out their trading skills without the risk of losing too much money.

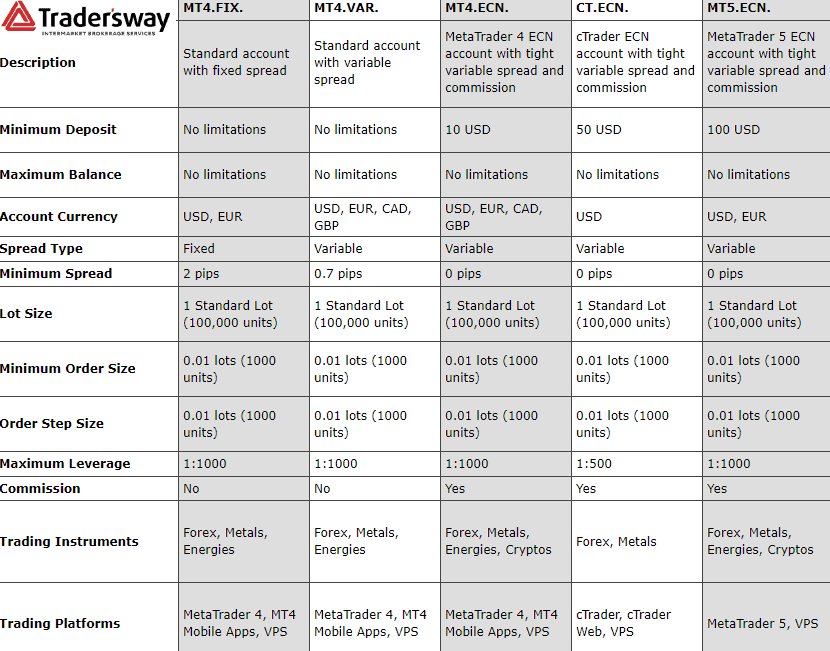

The minimum deposit with which you can start trading is up to you. For ECN accounts the minimum deposit is only $10, check the try best MT4 ECN from $10 ONLY! Promo details.

In what currencies can I deposit?

- For standard accounts with floating spreads and for MT4.ECN. Accounts, there are four options: US dollars, euros, british pounds and canadian dollars. You can decide on your preferred currency when opening an account;

- For standard accounts with fixed spreads and for MT5.ECN. Accounts, there are two options: US dollars and euros.

- For CT.ECN. Accounts you can choose US dollars only.

In the future, we plan to widen the range of deposit currencies.

When an international wire transfer is send out, it may pass through one or more intermediary (correspondent) banks before reaching its destination.

If you wish to make a wire transfer deposit and have a specific amount arrive into your trading account, please check with your bank to see if you have the option of sending the wire using the "OUR" sending method. This method will allow you to pay all correspondent banking fees up front with your own bank.

Please check here additional information for clarification on how correspondent wire fees can be paid during the wire transfer process.

Yes, you can. Please, register here in the name of your company.

Upload the following documents for verification:

- Company incorporation documents, including certificate of incumbency;

- Representative's ID and utility bill;

- A document showing representative's power to manage the company's account.

Traders way – forex broker rating and review 2021

| http://tradersway.Com/ | |

| status | |

| regulation | not regulated |

| trading software | metatrader 4, web trader, mobile trader |

| headquartered | 8 copthall, roseau valley, the commonwealth of dominica 00152 |

Trader’s way, a prime on-line FOREX and CFD broker, was established with the principle mission - to provide traders with the widest opportunities available on financial markets. We’ve collected the best products, technologies and services, so that the needs of every trader are fully satisfied. Under one broker, without losing time, you can find everything to trade the way you like, without boundaries and limits.

We offer you the widest range of possibilities for trading: 3 trading platforms - metatrader 4, webtrader, mobile applications 4 account types - MICRO and ECN, standard accounts with fixed and variable spreads 5 markets - FOREX, stock indices, metals, energies, commodities

High accuracy in prices, no restriction on trades, even on accounts with minimum deposits, and a wide choice of trading opportunities is the pillar of our business activity. It’s the beacon on our way to ensure our mission – to bring you maximum trading with maximum opportunities and freedom!

Traders way trading information

Traders way — latest reviews and comments 2021

Ridiculously high spread, my account was doing fine, they raised their 42 spread up to 4124 under 1 minute, also as a trader i have different brokers running, all the brokers XAUUSD spread are fine and running, but tradersway spread still at 223 and the pair appears as closed market, other brokers like hot forex and hugosway price are at 1878, and tradersway price is still closed at 1876. I have pictures of moves I've never seen before in any other broker, this broker definitely is a scam, we should let all traders know.

MCFX 28 october, 2020 reply

I had 3 trades open on my live account all executed at the same time same lot size 1.00 (BUY) at 6am PST. My profit was definitely $350 at the time and I was waiting for it to increase. But everything stopped suddenly and my profit was -$350. I refreshed my computer and also opened my tradingview account to see if my pairs have stopped, but to my surprise they were still going upward. My only option was to close out my profits because the platform for tradersway was stuck during my live session. This is the second strange things have happened to my account with tradersway. Therefore, do not add your money into this company because I feel as though these people are scammers. The only thing that works with this company is the demo account.

Ralph jones 1 october, 2020 reply

Tradersway is a ripoff, I took a 300 deposit to 17k and withdraw half, I had 3 winning trades opened at 500 profit and 9800 left in my tradersway account. Someone opened up crazy trades with outrageous lot sizes and wiped it down to 900. They say they don't have access to anyone accounts but its a lie. Im fighting to get my money back but im pretty sure it's not gone happen. Procced with caution.

Terrance 21 may, 2020 reply

Give your trading edge a boost and access exclusive technical analysis trading signals across 50+ FX pairs and share cfds from 40+ global exchanges! Start trading with an award-winning forex broker, vantage FX.

They are scammers. I had $33, I grew it to a point where by I maid $700. I made sure that my trades are close when few hours i go back to the market, my account is -$1.34. Please beware of these scammers, guys. Never ever use this broker and please share the bad experience with them!

Saziso shangase 2 april, 2020 reply

Hi guys, I just wanted to share my experience about this broker. Yesterday I took several of winning trades and my balance account was around 5000 $ with my profit secure, so I was satisfy and decided to go to bed and rest. When I woke up this morning I noticed my balance is only around 1300 $ I checked my trading history and I don't know how come but my wining trades from last night are all gone. So I contact the broker by messenger but the agent said they can't access to my trading history and to send an email to the support what I did. I even tried to call them but same answer from the agent over the phone. That just insane I hope it's just a mistake because otherwise it's just crazy. That happened this morning so I am waiting for them to getting back to my email. I will keep you up to date. Cheers

Mouhoub mebrouk 27 march, 2020 reply

Erick 10 april, 2020

They got me for 20K in january 2018.

Made every attempt to try and sign up with these guys, but just ended up wasting time with the horrible deposit options they offer for canadians. Support was pathetic, didn't even try to help. I wouldn't recommend wasting anytime with trader's way, they weren't interested in getting my business.

All was going good with this broker until now, I took a $50 dollar account to $2500 in 2 months with proper risk management and guess what happened? This broker blew up my entire account by making dozens of unauthorized trades not to mention they played with my spreads and would cancel many of my sell and buy orders, tradersway, like many other unregulated brokers hate traders that actually manage to make a decent profit in the market and make no mistake if you start a small account and grow it to quickly you will be shot down like I was, do not use this broker.

Derek 31 january, 2020 reply

Beware this broker if you regularly have open trades over the weekend or holidays. Spreads can go from a few points to 70+ and stop-out your account especially if you're highly leveraged or margined. Also be aware that they will trade for you sometimes and wipe your account out.

Zahed rustami 30 january, 2020 reply

I can attest to this. Was using tradersway when I held a swing trade over the weekend and come 5:00 sunday my entire account balance of $6000 was gone because of the spread manipulation

Pradipta 3 february, 2020

They close my pending orders before they're triggered. Don't take my word for it, see for yourself.

Tradersway review

Tradersway is an unregulated offshore forex broker that will appeal to the trader looking for a large choice of cryptocurrency deposit methods such as bitcoin, dash and litecoin. See our trader’s way review of this ECN broker for trading.

Tradersway – strengths and weaknesses

Tradersway review to assess whether this unregulated broker is legit or not and worth using

Tradersway major strengths

- Choice of trading accounts – variable and ECN spreads

- Most popular trading platforms – metatrader 4 and 5, ctrader

- Low minimum deposits – open an account with $10

- Highest level of leverage – trade with 1:1000

- Large and unique range of funding methods

- Regular promotions – 100% deposit bonus

Tradersway weaknesses

- Poor spreads – wide spreads mean higher costs

- Not a tier-1 regulated broker – questions of trust

- High leverage – risk of big losses in A hurry

- Questionable reputation – online feedback is poor

- Limited choice of cfds – range of markets for trade is small

Our rating

The overall rating is based on review by our experts

Strength 1 – choice of trading accounts – variable and ECN spreads

One of the appeals of trader’s way is they have an account to suit all types of traders. Not too many brokers offer the clients a choice of each of the 2 types of trading spreads. Spread-only variable spreads (commission-free) and variable ECN pricing spreads.

This types of account are commonly called the “standard account” by other brokers. With this account, you get variable spreads with no commissions. In place of commission costs, trader’s way widens the spreads slightly so they can make a small profit on your trades. As this account has no commissions, it is popular with beginner traders who are looking for a more simple cost structure, as your costs are already included in the spread.

This type of account uses variable spreads, which means they are constantly changing depending on the liquidity for each currency pair. Spreads for EURUSD avg 1.4 pip, which is more than double the 0.5 pips MT4.ECN account offers.

When trading with this account, you must be using the metatrader 4 trading platform and you will not be able to trade cryptocurrencies.

MT4.ECN, MT5.ECN, CT.ECN:

The ECN trading account types use ECN/STP/DMA trading (the broker appears to use these terms interchangeably) to give connect you directly with liquidity providers so you can achieve the lowest spreads trader’s way offers. To keep spreads tight, the broker charges a commission fee of USD$3.00 to open your position and $3.00 to close your position. However, at times promotions with reduced commissions are offered (see strength 7). The ECN style low spread account is popular with scalping, high volume and robo-traders who will be looking to save on costs trading of large volumes can add up significantly.

With these accounts, you can choose metatrader 4, metatrader 5 or ctrader platforms and you can trade cryptocurrencies with the metatrader accounts.

Trader’s way trading conditions

Tradersway uses a no dealing desk (NDD) trading model with STP, DMA and ECN trading execution. This model gives traders the opportunity to be linked with various liquidity providers to get the best spreads. As trader’s way is not a market maker, they are not your counterparty and do not own any liquidity.

While straight through provider (STP), electronic communication network (ECN) and direct market access (DMA) are similar but different trading execution concepts, trader’s way appear to be using these terms interchangeably so it is not clear exactly which execution is being used. Nevertheless, each method connects traders with liquidity providers with no human intervention.

Conclusion choice of trading accounts:

With tradersway’s choices of trading accounts, forex traders will have the option to pick the best trading account that suits their trading style.

Strength 2 – most popular platforms – metatrader 4 and 5, ctrader

Trader’s way tradersway offer 3 of the most popular trading platforms found in the marketplace, giving forex traders the option to choose which platform they’d like to trade on.

Metatrader 4 and metatrader 5

Trader’s way offers metatrader 4 (MT4) with the MT4.Fix, MT4.Var, MT4.ECN accounts and metatrader 5 (MT5) with MT5.ECN accounts. If choosing MT4.Fix or MT4.Var, you will not be able to trade cryptocurrencies.

Released in 2005, metatrader 4 is the most popular trading platform worldwide. The trading platform is exceptionally popular with beginner traders (but also advanced traders) and those that only wish to trade forex for the following reasons:

- An easy-to-use platform as it offers all the essential tools needed for successful trading with sufficient advanced tools without going overboard

- Offers a clean and uncluttered trading interface so you can see and execute all the trading information you need without information overload

- It is one of the most trusted platforms due to the fact it is one of the oldest and most developed platforms

- It has the largest community of all platforms, which means you can find the support when you need it

- It has one of the largest marketplaces which allows you to choose from a wealth of real-time signals and advisors

- It uses 32-bit processing so is less resource intensive, which suits retail traders who may not have the resources to take advantage of 64-bit systems

- It is specially designed for decentralised trading such as forex, which has no central exchange

- Availability across several devices (desktop, browser and mobile apps (ios and android))

- Free VPS hosting service with pre-installed MT4 software

Metatrader 5 was released in 2010 and is designed to offer a more comprehensive and powerful platform for trading across multiple assets. Despite being a superior platform than MT4, it is not yet as popular however there are good reasons traders should consider MT5 over MT4 platform.

- Metaquotes have announced support and development of MT4 will be reduced going forward so it makes sense to start learning MT5 now rather than in future

- More brokers will begin to offer MT5 in the future, giving you more options when choosing suitable brokers

- Access to a greater choice of cfds such as shares, which require trading through a central exchange

- MT5 offers all the features MT4 platform offers and more.

- 64-bit processing means faster, more reliable processing. Faster processing helps reduce the risk of slippage.

Regardless if you choose MT4 or MT5, you will be getting access to excellent platforms that offer all the features one needs to trade.

Below is a head-to-head comparison of the features of the platform:

Both platforms offer automated trading through expert advisors. While MT4 uses an order system, MT5 uses a positional system which can make automation with MT5 easier.

Looking at the comparisons, the main difference to note is that MT5 offers everything MT4 does and more:

- MT5 offers more technical indicators which allow you to analyse past movements and anticipate future trends using annual reports and economic data. Indicators are useful as they help you identify future trading opportunities. MT5 offers 38 of these tools, increased from 33 on MT4.

- Analytical tools offer a quantitative analysis, which means decisions can be made on pure data without the influence of emotion. MT5 offer 44 of these tools compared to 33 on MT4.

- Timeframes are very useful tools, as currency pairs are constantly changing due to the sheer liquidity in the market. While basic timeframes such as weekly, daily, 4 hour and hourly will suffice for most traders, MT5 really allows traders to dig deep and isolate trends on micro-scale with greater 21 timeframe choices.

Ctrader

Ctrader is one of the most popular trading platforms among traders. The software offers a variety of charting tools with advanced order types, and most importantly, fast entry and execution of orders. It has a very user-friendly interface where it is connected to a back-end technology, with the software available on multiple devices.

What makes ctrader outperform both MT4/5 is that it has a modern design, advanced ordering plus market depth options (not found on MT4). Additionally, it offers calgo, allowing you to develop your trading software (cbots) or create your own indicators.

Additional software tools

Trader’s way offers social trading tools which can help your trading experience. Social trading is especially popular with beginner traders as they allow you to learn from and copy other successful traders, meaning there is no need to learn to forex trade yourself.

This social and auto trading platform offers a wealth of statistical and financial features in order to provide comprehensive analytical tools so users can get a detailed analysis of the trading systems they are using and statements. By providing a deep analysis of the trader’s statements, trading activities can be improvised.

Myfxbook autotrade

Myfxbook’s autotrade copy trading system allows you to copy from a large choice of systems directly into your metatrader trading account. This makes social copying simple and easy, as you can access all the analytical tools myfxbook offers which can be used to find the system that you plan to copy based on your desired criteria.

A strength of myfxbook’s is that it uses algorithms to eliminate poor-performing signals and prioritise only the best performing signals.

MT4 trading signals

MT4 signals is metatrader’s built-in solution for social trading. As this product is part of the trading platform, all you need to do is choose a signal provider and subscribe to their signals. Once subscribed, you can set up your filters so automatically copy the signals provider.

One of the benefits of choosing the metatrader social trading solution is the large community metatrader offers. This means you can choose from an infinite number of signals to follow, thus increasing the chances of finding someone that trades in a style that suits you.

Rating broker by platforms

We like tradersway platform offering. They offer three of 3 most popular generally available platforms on the market and a few social trading tools to further enhance your trading experience. If you’re looking for even more tools, then pepperstone or IC markets are good options. If you’re looking for a specialist platform with risk management features, then easymarkets may appeal.

Conclusion on most popular trading platforms:

Every forex trader prefers a specified trading platform. Tradersway offers the most popular platforms which facilitate trading and analysis. In forex trading, MT4 is still the most used platform among traders since its release in 2005.

Strength 3 – low minimum deposit – open accounts with $10

Most forex brokers require a minimum deposit of $200 to open a live account. Tradersway allows you to start trading with as little as $10.

While you will definitely benefit by investing larger amounts when trading as this presents more opportunities for greater returns, in some circumstances, traders may wish to open an account with minimal amounts. Reasons could include:

- The trader wishes to practice trading with a minimum amount. While a better option to this would be a demo account, some trader may prefer to use a small amount of their own money.

- You want to trade in nano or mini lots. While it can be hard to get big profits trading with very small amounts, leverage of 1:1000 can help you increase your profits.

- You need to open an account before you can transfer funds to use for trading

Although trader’s way has low minimum deposits, it is worth noting the broker does encourage larger initial deposits through their bonus program. The table below compares the minimum deposits with other notable brokers. If you are a serious trader seeking greater earning potential, then you will end up depositing larger amounts of funds inevitably so there are brokers with reasonably larger minimum deposits such as IC markets should not be discounted. Saxo markets have very high minimum deposits, as they are likely targeting semi-professional traders.

| USD | |

|---|---|

| trader's way | $10 MT4.ECN $100 MT5.ECN |

| IC markets | $200 |

| pepperstone | $200 |

| axitrader | $0 |

| CMC markets | $0 |

| IG group | $300 |

| thinkmarkets | $0 |

| FXCM | $50 |

| FXTM | $10 |

| swissquote | $1,000 |

| saxo markets | $10,000 |

By not requiring a minimum deposit, tradersway is giving the chance for small retail traders and beginners to have the chance to be one of the participants in the financial market.

Strength 4 – highest level of leverage – trade with 1:1000

Tradersway allow leverage of up to 1:1000 for each of its metatrader accounts and 1:500 for its ctrader account. Trader’s way uses tiered leverage with the maximum allowable leverage reduced the more you trade.

| Metatrader balance | metatrader leverage | ctrader balance | ctrader leverage |

|---|---|---|---|

| less than 50,000 | 1:1000 | less than 50,000 | 1:500 |

| 50,00- to 50,000 | 1:500 | 10,00- to 50,000 | 1:200 |

| 50,000 to 60,000 | 1:400 | 50,000 and above | 1:100 |

| 60,000 to 70,000 | 1:300 | ||

| 70,000 to 80,000 | 1:200 | ||

| 80,000 to 100,000 | 1:150 | ||

| 100,000 and above | 1:100 |

What high leverage means for traders

Leverage of 1:1000 gives the trader the ability to borrow $1000 for each $1 deposited (in case the account is in US dollars) when trading the forex market.

Using high leverage can assist traders to greatly increase the amounts of profit they can achieve while committing only a small amount of their own money. Should you trade with high leverage, be aware you can also increase your risks of large losses if the currency pairs moved against you.

With up to 1:1000 leverage available to its customers, tradersway offer far more than a regulated broker will offer. ASIC allows brokers operating in australia to offer up to 1:500, while financial authorities in europe such as the FCA, cysec and bafin allow 1:30 for major currency pairs and 20:1 for minor currency pairs.

Trader’s way policy of reducing maximum leverage the more you trade can be seen as a somewhat sensible policy, as losses with large investments using 1:1000 can lead to crippling financial losses.

Strength 5 – large and unique range of deposits

Tradersway gives its clients a wide range of payment types for deposits and withdrawals, including options not commonly found with most other brokers. Traders looking to fund their account anonymously may appreciate vload, abba, and cryptocurrency options.

Credit cards and debit cards deposits and withdrawals

Trader’s way does not accept credit or debit cards for funding, instead, they provide 3rd party platforms to facilitate payment with visa, mastercard and other bank cards. Tradersway does not charge any fees however the 3rd party provider will have fees as the back end.

- Vload is a voucher system where one can transfer funds and then use a pin to place the vouchers funds into a trader’s way account. Withdrawals fees are 5.5%

- Abba is a mobile platform that will accept funds from credit and debit cards, bankwire and even cryptocurrency from where one can transfer their funds to their trader’s way account. Withdrawal fees with cards range from 4-8%

Cryptocurrency deposits and withdrawals

Funding with cryptocurrency is becoming increasingly popular due to the speed one can make deposits and withdrawals and the anonymity that these funding methods allow. With cryptocurrency, traders don’t need to worry about funding red tape that may be associated with traditional methods.

Trader’s way also accepts a large range of funding via cryptocurrency. Cryptocurrencies accepted include bitcoin, litecoin, ripple, ether, USD coin, tether and trueusd. You will need to purchase the coins via a cryptocurrency exchange such as coinbase and then transfer the coins to your trader’s way account.

While trader’s way does not charge any fees, the cryptocurrency network will have their own charges, which usually apply when you make a withdrawal.

Ewallets / digital wallets

If you prefer to fund your accounts via the web, then you have a range of options. These include skrill, perfect money, fasapay and NETELLER. Use of these services will incur charges from the provider.

Below is a summary of the available options provided by tradersway.

| Methods of payments | comments |

|---|---|

| credit/debit cards via vload | 1. Cash voucher system for online payments 2. Only EUR and USD 3. Min/max withdrawal 100/5000 per transaction 5. 5% fee from vload |

| wire transfer | |

| bank transfer (abra) | 1. Deposits can be made with A. Bank transfer (0-0.25% fee) B. Credit/debit cards (4-8% fee) C. BTC, BCH,LTC (cryptocurrency network fees) |

| cryptocurrency options | |

| bitcoin | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| ether | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| litecoin | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| ripple | 1. No min/max transactions 2. 20 XRP fee for deposits lower than 1000 XRP 3. Rippled network fees to withdrawl |

| USD coin (USDC) | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| tether (USDT) | 1. USDT only accepted on ethereum network (ERC20 protocol) not omni version 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| trueusd (TUSD) | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| digital wallets, ewallets | |

| skrill | 1. Minimum $10 for withdrawals 2. 1.9% fee for deposits 3. 1% fee for withdrawals |

| NETELLER | 1. 1% fee for withdrawals |

| perfect money | 1. 1% fee for withdrawals |

| fasapay | 1. 2.9% fee for deposits 2. No withdrawal fees |

Strength 6 – regular promotions – 100% deposit bonus

Tradersway is generous when it comes to bonuses. This forex broker offers a 100% bonus credit on your initial deposit to use for trading. That means you have double the funds available for trading.

Weakness 1 – poor spreads – wide spreads mean higher costs

Our review of tradersway’s spreads by our analysts shows that they are quite wide when compared to similar brokers. Wider spreads mean higher costs. Scalpers especially will want to trade with a broker with tight spreads due to the high volume of trades they will perform.

Tradersway charges an average spread of 0.5 pips for EUR/USD (ECN accounts) which means each time you open and close a trade you will pay USD$5. With a cost of $10 in total to exit your position, this can be expensive when trading with many lots.

Our table below shows how trader’s way spreads compare with other brokers.

No commission spreads

Trader’s way has an average of 0.5 pips EURUSD for commission spreads. This contrasts with some other brokers like pepperstone and IC markets who average around 0.1 pips. To open and close with trader’s way you will pay $10 on average while to open and close pepperstone and IC markets you could pay as little as 0.20 pips on average, equating to $2.00. This means you will save $8.00 for each standard lot you trade. If you are trading with high leverage, regularly this cost difference can be significant.

Trader’s way decreases the minimum deposit for ECN accounts

Trader’s way, an offshore FOREX and CFD broker, has increased the maximum leverage from 1:100 up to 1:200 and decreased the minimum initial deposit from 100 USD down to 50 USD for CT.ECN. Accounts. The company seeks to offer its clients more opportunities for the most efficient trading on the innovative and user-friendly ctrader platform.

More news about tradersway

- Trader's way goes more social: launches MT4 trading signals jan 15 2014 09:48:07

- Trader's way offers social trading through myfxbook's autotrade jan 03 2014 08:27:25

- The forex customer support challenge: trader's way may 31 2013 07:00:00

- Trader's way bumps MT4 ECN maximum leverage to 1:1000 apr 10 2013 10:25:56

- Trader's way now accepting cashu payments mar 12 2013 14:36:35

FXTM a regulated forex broker (regulated by cysec, FCA and FSC), offering ECN trading on MT4 an MT5 platforms. Traders can start trading with as little as $10 and take advantage of tight fixed and variable spreads, flexible leverage and swap-free accounts.

XM is broker with great bonuses and promotions. Currently we are loving its $30 no deposit bonus and deposit bonus up to $5000. Add to this the fact that it’s EU-regulated and there’s nothing more you can ask for.

FXCM is one of the biggest forex brokers in the world, licensed and regulated on four continents. FXCM wins our admirations with its over 200,000 active live accounts and daily trading volumes of over $10 billion.

Fxpro is a broker we are particularly keen on: it’s regulated in the UK, offers metatrader 4 (MT4) and ctrader – where the spreads start at 0 pips, level II pricing and full market depth. And the best part? With fxpro you get negative balance protection.

FBS is a broker with cool marketing and promotions. It runs an loyalty program, offers a $100 no-deposit bonus for all new clients outside EU willing to try out its services, and an FBS mastercard is also available for faster deposits and withdrawals.

Fxchoice is a IFSC regulated forex broker, serving clients from all over the world. It offers premium trading conditions, including high leverage, low spreads and no hedging, scalping and FIFO restrictions.

Hotforex is a EU regulated broker, offering wide variety of trading accounts, including auto, social and zero spread accounts. The minimum intial deposit for a micro account is only $50 and is combined with 1000:1 leverage - one of the highest in the industry.

| Broker | country | regulation | platform | min deposit | review |

| US | CFTC, NFA | MT4, web, in-house | $100 | review website | |

| US | NFA, CFTC | MT4 | $250 | review website | |

| cyprus, UK, mauritius | cysec, FCA, FSC, FSCA | MT4, MT5, web | $10 | review website | |

| australia, cyprus | ASIC, cysec | MT4, MT5, iress | $100 | review website | |

| cyprus,belize, australia | cysec, IFSC, ASIC | MT4, MT5 | $5 | review website | |

| UK, australia, south africa | FCA, ASIC, FSCA, cysec | MT4, trading station, ninjatrader | $50 | review website | |

| UK, cyprus, UAE, south africa | FCA, cysec, DFSA, FSB | MT4, MT5, fxpro markets, ctrader | $100 | review website | |

| cyprus | cysec | MT4, MT5, web | $1 | review website | |

| belize | IFSC | MT4, MT5 | $100 | review website | |

| cyprus, UK, south africa, UAE | cysec, FCA, FSCA, DFSA | MT4, MT5, web | $5 | review website |

More forex brokers news

Elon “former CEO of dogecoin” musk discusses bitcoin on twitter

Elon musk, the CEO of tesla and co-founder of spacex has caused a stir online when he changed his description on twitter to read “former CEO of dogecoin”, following a conversation he had about moving large sums of money using the bitcoin network with michael saylor – founder of mic. Read more

FBS new year 2021 promo comes with amazing gifts for all active traders

The award winning online forex broker FBS has launched a new year 2021 promotion for all active users of its trading apps, including FBS copytrade, FBS trading broker and FBS trade. Read more

FBS presents free e-mail educational courses on forex trading

FBS launches a series of educational courses created by the company’s financial analysts. Traders of any level can boost their knowledge with the help of the lessons in one of the most convenient formats – email. Read more

FBS copytrade team is holding the ‘FBS copystar’ contest

The FBS copytrade team is ready to introduce the new contest called ‘FBS copystar’. This is the trader-oriented contest for all the new and already existing FBS traders. Read more

Award winning australian broker FP markets adds VIX, XPTUSD, XPDUSD and XNGUSD

The award winning australian broker FP markets has added new products to its long trading list – the US dollar index (USD index), the volatility index (VIX), platinum (XPTUSD), palladium (XPDUSD) and natural gas (XNGUSD). Read more

Hotforex awarded best forex trading conditions global 2020

Hotforex, an established name in the forex trade, wins yet another award. The broker adds the prestigious best forex trading conditions global 2020 to the many recognitions already under its belt. Read more

FBS trader awarded best mobile trading platform in asia

Global banking & finance review awarded FBS trader, a mobile trading platform of FBS, a well-known international broker, best mobile trading platform asia 2020. It is a great step forward and a high honor to meet all the criteria of the judging panel. Read more

Hotforex wins “decade of excellence forex brokerage asia 2020”

“decade of excellence forex brokerage asia 2020” award marks an important milestone in the global expansion of hotforex, the award winning multi-asset broker whose unrivalled reputation has spanned the corners of the world. Read more

‘risk-free investments’ now available in FBS copytrade app

The team of the FBS copytrade app introduces a new ‘risk-free investments feature. This innovation is required to help all new users of the application get the main principles of the social trading world. Read more

FBS offers a demo professional trading account with 1:500 leverage

FBS is ready to present a new option for improving trading. The company is launching a demo professional account. The main advantage of this feature is that it allows traders to see how the real market works by managing virtual funds under the professional category trading conditions. Read more

MT4.VAR.

Forex and CFD trading with floating spreads on metatrader 4 platform. This type of account was designed for traders who prefer trading in real market conditions to take steps to a professional ECN/STP trading but prefer do not pay commissions.

The trader’s way MT4.VAR. Account is a unique account on the metatrader 4 trading platform that combines some of the best features of real-market ECN trading with tight floating spreads and no-commission standard account trading with a small initial deposit.

These accounts are perfect for learning to trade under real interbank market conditions with minimum risk. You can start with a small amount of money and trade without commission while enjoying the benefits of tiny spreads that change according to the prevailing market conditions. The spreads are very small when the market is quiet (though not as small as on ECN accounts) starting from only 0.7 pips.

The trader’s way MT4.VAR. Account offers more trading opportunities while offering all the standard account advantages. You can deposit in several currencies and trade any size from 0.01 standard lot (1,000 units of base currency) while enjoying a maximum leverage ratio of up to 1:1000 without any commission or extra charges. A standard account with variable spreads gives you a great opportunity to experience the same conditions as on the interbank market before you start ECN trading – the highest volatility possible, widening and contracting spreads, and a significant initial deposit.

You can start trading with an MT4.VAR. Demo account to learn about all the peculiarities of trading without any risk. Moreover, you can trade any time and any place, via any mobile device using MT4 mobile applications.The advantages of the most popular MT4 platform – a user-friendly interface, charts, news, updates and much more – are at your service anywhere you go, whatever device you use and whenever you want to trade.

MT4.VAR. Account trading conditions are the following:

Traders way review, rating and comparison | tradersway forex broker

RECOMMENDED FOREX BROKERS

Trading accounts

| Account type/platform | minimum deposit | min. Trade size | maximum leverage | average spreads | execution type | swap-free |

| MT4.FIX | $1 | 0.01 | 1:1000 | fixed, 2 pips on EUR/USD | instant | yes |

| MT4.VAR | $1 | 0.01 | 1:1000 | 1.4 pips on EUR/USD | market | yes |

| MT4.ECN | $100 | 0.01 | 1:1000 | 0.5 pips on EUR/USD + commission $2.5 - $3.0 per lot | market | no |

| CT.ECN | $50 | 0.01 | 1:500 | 0.5 pips on EUR/USD + commission $2.5 - $3.0 per lot | market | no |

Trader’s way offers its clients a selection of account types to make sure traders of all skill level and preferences are well taken care of. There are 2 ECN account types available on two different trading platforms, offering tight spreads with small commission fees.

Besides, there are two MT4 commission-free accounts with no minimum deposit requirement, one of which offers fixed and the other one, variable spreads. Swap-free service is available on both commission-free accounts to clients of islamic belief who are not willing to earn interest for religious reasons.

The company. Security of funds

Founded in 2010, trader’s way is an offshore broker trading in a wide range of currency pairs and cfds on metatrader 4 and ctrader.

Trader’s way is the trading name of a company, registered in the commonwealth of dominica, an island country located in the caribbean sea. The dominica has a wide range of offshore services and with the passing of the international business companies (IBC) act in 1996 it has become an attractive location for offshore company formations. There are certain international banking regulations to which all companies operating out of dominica are bound, however, forex businesses are not regulated at this time.

While it is true that no regulation can protect you from dealing manipulation, misuse of client money, or company bankruptcy and no regulation can guarantee the funds in your pocket or trading account, there are certain states which strive to put some certainty in the decentralized FX market in their jurisdiction. Money rules and minimum capital requirements are set in the US, japan, australia, UK, cyprus, among others. Brokers in these countries are required to report all trades and to comply with various procedures. What is more, in many of them apply compensation schemes which protect client funds in the event of broker insolvency.

To put it simply, if you choose to open an account with an offshore broker, your funds are far from safe. So, if you intend to invest a large amount of money, we would advise you to select among brokers regulated by the respective authorities in the abovementioned states.

We have to point out that despite the above said, trader’s way has more than 6 years of experience on the forex market and has won a reputation of a reliable broker, who strives to provide maximum transparency and security in both its own and clients’ activities.

The broker states on its website that it keeps client funds and company money separate and that it employs strict AML and KYC policies to support international efforts against money laundering and inappropriate usage of funds.

Trading conditions

Minimum initial deposit

there is no minimum initial deposit with trader’s way, which makes this broker quite attractive and accessible for all kinds of traders. Most offshore brokers do not require high initial amounts, which is reasonable, considering the light touch regulation, if any. Liteforex, for instance, a popular broker registered on the marshall islands, requires just $10 from traders as a start.

Average spreads & commissions

this broker offers both variable and fixed spreads. Fixed and floating spreads offered on its commission-free accounts are both average, as fixed ones are 2 pips and the broker quotes as typical variable spreads of 1.4 pips for the EUR/USD pair. In comparison, forexbrokerinc offers variable spreads from 1 pips on its commission-free accounts.

As regards trader’s way ECN accounts (accessible with just $100/$50), the spreads offered are tighter and quite competitive, averaged 0.5 on EUR/USD, and a small commission applies, ranging from $2.5 to $3. This basically means that the average trading costs amount to around 1 pips, commission included.

Maximum leverage

the maximum leverage rates at trader’s way are very high, reaching 1:1000. In comparison, SVG-based octafx and forexbrokerinc both offer leverage up to 1:500. More forex brokers offering leverage equal to or exceeding 1:500 can be viewed here.

Traders, however, should be aware of all the risks associated with trading on margin – higher leverage levels may lead to heavy losses, exceeding initial investments. That is why many jurisdictions set limitations on leverage, which are considerably lower, for instance 1:50 in USA and 1:25 in japan.

Trading platforms

Trader’s way offers its services on two of the most popular platforms among traders - metatrader 4 (MT4) and ctrader and multiple auto trading solutions.

Ctrader is an award-winning multi-asset trading platform designed especially for ECN trading. Fast order entry and execution speeds, direct order entry via charts and level II pricing are just some of the reasons why many traders today choose ctrader as their go-to platform. The trader’s way ctrader suite includes a PC, web and mobile versions, as well as cmirror and calgo. Cmirror is a mirror & social trading application, which works with all ctrader accounts and is broker agnostic, which means a trader can copy any signal provider, regardless of whether they both reside with different brokers within the ctrader ecosystem.

Calgo delivers powerful, fast and reliable automated trading in an easy to use, coding-friendly environment for developing and testing your own robots and custom indicators.

In addition, trader’s way supports the popular trading platform metatrader 4, desktop, web and mobile versions available.

Metatrader 4 is preferred by most experienced traders, because it is equipped with an advanced charting package, a number of technical indicators, expert advisors (EA) and extensive back-testing environment. MT4 also provides a built-in social trading service - trading signals. Using this service, you can copy deals of other traders directly in your terminal. Here is a list of more forex brokers offering MT4 platform.

In addition, trader’s way has partnered with myfxbook and fxstat to provide yet more auto trading options.

Of course, this broker offers high quality VPS hosting service. Access to trader’s way remote server ensures that your robots, expert advisors (eas) and scripts function continuously and without interruption, even if your computer is switched off.

Bonuses & rebates

trader’s way offers various promotions, such as:

- welcome on deposit bonus of 100%, limited by $5,000, which cannot be withdrawn;

- access to the MT4 ECN account with just $10 instead of $100.

Methods of payment

Clients of trader’s way are offered a variety of the following payment modes to choose from: credit cards, bank wire transfers, and the following e-wallets: skrill, neteller, perfect money, webmoney, QIWI, monetaru, easypay, boletto, cashu and others.

Conclusion

Trader’s way is a reputable offshore broker, offering competitive conditions for trading in various currency pairs and cfds on the MT4 and ctrader platforms. Its main disadvantage is lack of regulation. To sum up the above:

| Pros | cons |

| choice of platforms, MT4 available | not regulated |

| no minimum initial deposit for commission-free accounts | |

| access to ECN environment for just $10 | |

| competitive ECN spreads & low commission fees | |

| high leverage levels offered | |

| bonuses available |

Latest news about tradersway

- Trader's way goes more social: launches MT4 trading signals jan 15 2014 09:48:07

- Trader's way offers social trading through myfxbook's autotrade jan 03 2014 08:27:25

- The forex customer support challenge: trader's way may 31 2013 07:00:00

- Trader's way bumps MT4 ECN maximum leverage to 1:1000 apr 10 2013 10:25:56

- Trader's way now accepting cashu payments mar 12 2013 14:36:35

- Trader's way is integrating its fxwire pro newsfeed with MT4 feb 01 2013 13:50:34

- Trader's way adds FXSTAT to its options for trading forex signals dec 10 2012 10:44:39

- Traders' way teams up with tradeo social trading network sep 19 2012 12:58:19

- Trader’s way launches web version of the ctrader platform aug 16 2012 09:08:00

- Trader’s way increases leverage to 1:1000 for accounts below $100 jul 11 2012 08:15:11

all news

- Ctrader got improved interface and algorithmic trading jul 06 2012 10:52:57

- Trader’s way decreases the minimum deposit for ECN accounts jun 18 2012 20:34:53

- Trader’s way introduces ctrader - an ECN forex platform may 02 2012 09:03:11

- Traders way launches iphone and android versions of MT4 may 01 2012 09:17:16

- Trader's way launches quickdeal - a MT4 one-click trading tool apr 04 2012 14:03:12

- Trader’s way upgrades its free forex VPS feb 21 2012 08:47:57

- Trader’s way launches promo MT4 ECN account from $10 feb 09 2012 10:30:40

- Trader’s way now accepts moneybookers (skrill) payments jan 09 2012 11:10:22

- Trader’s way provides its clients with a 24/7 forex VPS nov 21 2011 15:11:21

- Trader's way lowers the minimum deposit for ECN accounts to $100 nov 15 2011 10:43:41

- Trader's way cuts ECN trading commissions to $35 oct 14 2011 17:55:16

- Trader's way announces 55% forex bonus on first deposit sep 16 2011 10:56:22

less news.

FXTM a regulated forex broker (regulated by cysec, FCA and FSC), offering ECN trading on MT4 an MT5 platforms. Traders can start trading with as little as $10 and take advantage of tight fixed and variable spreads, flexible leverage and swap-free accounts.

XM is broker with great bonuses and promotions. Currently we are loving its $30 no deposit bonus and deposit bonus up to $5000. Add to this the fact that it’s EU-regulated and there’s nothing more you can ask for.

FXCM is one of the biggest forex brokers in the world, licensed and regulated on four continents. FXCM wins our admirations with its over 200,000 active live accounts and daily trading volumes of over $10 billion.

Fxpro is a broker we are particularly keen on: it’s regulated in the UK, offers metatrader 4 (MT4) and ctrader – where the spreads start at 0 pips, level II pricing and full market depth. And the best part? With fxpro you get negative balance protection.

FBS is a broker with cool marketing and promotions. It runs an loyalty program, offers a $100 no-deposit bonus for all new clients outside EU willing to try out its services, and an FBS mastercard is also available for faster deposits and withdrawals.

Fxchoice is a IFSC regulated forex broker, serving clients from all over the world. It offers premium trading conditions, including high leverage, low spreads and no hedging, scalping and FIFO restrictions.

Hotforex is a EU regulated broker, offering wide variety of trading accounts, including auto, social and zero spread accounts. The minimum intial deposit for a micro account is only $50 and is combined with 1000:1 leverage - one of the highest in the industry.

Trader’s way review

General overview

Traders way specializes in forex and CFD trading options and attracts many US clients at traders way every day. With 7 years of trading experience in the financial markets, this forex broker is considered by many to be a reliable, good broker that provides limitless trading opportunities.

In order to find out if this review is true, we have thoroughly tested the trader way trading platform and trading conditions. We’ve also shared a review of our experience to help you discover whether this forex broker is your ideal trading partner.

Background

Founded in 2010, trader’s way is an offshore broker and trading company registered in dominica, an island country in the caribbean. Since the passing of the international business companies act (IBC) in 1996, dominica has become an attractive location for any broker to register offshore. This broker aims to increase the freedom of trading and its jurisdiction does not apply to any country’s restrictions.

With this in mind, we recommend all traders review their ability to deal with trader’s way with a legal consultant. Address: 8 copthall, roseau valley, 00152 dominica (1). Phone & fax: +1 846 937 0815 new accounts email address: sales@tradersway.Com customer service email address: helpdesk@tradersway.Com technical support email address: support@tradersway.Com

Tradersway review regulation and security

Trader’s way is registered and working in line with the commonwealth of dominica legislation. Its jurisdiction does not require any special license for forex activity, making trader’s way a non-regulated broker. Despite not being regulated, trader’s way states that its clients’ funds are kept separate from its own funds and exclusively in the hands of reputable banks and financial companies.

Tradersway account types

The four main trading account types available from trader’s way include:

- FIX. – this is a standard account with fixed spreads that enables traders to trade on the metatrader 4 (MT4) platform. There is no minimum deposit or balance amount, no commission and traders are given 1:1000 leverage.

- VAR. – again, this is a standard account for access to the MT4 platform but with variable spreads. It’s ideal for traders wanting to learn to trade without high risk and without commission. There is also no minimum deposit or balance amount and includes leverage of up to 1:1000.

- ECN – this is a metatrader 4 ECN account with tight variable spreads and commission. It comes with a leverage of 1:1000 and requires a minimum deposit of $100.

- ECN – rather than the MT4 platform, this account with tight variable spreads and commission provides traders access to the interbank market through the ctrader platform. It comes with high leverage of up to 1:500, and traders will need to pay a $50 deposit to open.

Before signing up for a live account, traders can assess the quality of services on offer and learn how the different accounts work by opening a demo one and getting a tradersway login for free.

Tradersway commission and fees

There is no charge for inactive accounts.

Tradersway minimum deposit

The minimum deposit is only $10 for ECN accounts.

Payment systems

All tradersway deposits and withdrawals can be done with these payment options:

- Credit card /debit cards via vload

- Wire transfer

- Bank transfer (abra)

- Bitcoin

- Ether

- Litecoin

- Ripple

- USD coin (USDC)

- Tether (USDT)

- Trueusd (TUSD)

- Skrill

- NETELLER

- Perfect money

- Fasapay

These payment options are all subject to local regulations. If a currency conversion needs to be completed for deposit or withdrawal, it is subject to a 1.5% fee from trader’s way.

Tradersway trading platforms

Trader’s way offers two of the most popular trading platforms to monitor trading performance for traders wanting to use its services. Every forex trader has a preference for a particular platform. These are the metatrader 5 (MT5) and metatrader 4 (MT4) and ctrader platforms.

Metatrader 4 is preferred by most experienced traders for its expert advisors (eas), technical indicators, and advanced charting package. The MT4 platform is also well-liked for providing a social trading service where traders can copy other trader’s deals. In addition to offering a web-based MT4 platform, trader’s way offers desktop and mobile versions of the popular platform too.

Then there’s the ctrader platform, which is also a go-to platform for many traders. It’s actually an award-winning platform that comes in web, desktop, and mobile versions and has been designed specifically for ECN trading. This platform is known for its ability to deliver on fast order entry, direct order entry via charts, and great execution speeds, traders can also use cmirror, a mirror, and social trading application that works with all ctrader accounts.

Products

Tradersway allows traders to trade on products including:

- Forex

- Metals (gold and silver)

- Energies (oil and gas)

- Stock

- Indices

- Commodities

All MT4.FIX., MT4.VAR. And MT4.ECN. Accounts can trade all of the instruments listed above, and CT.ECN accounts are only able to trade forex and metals.

Tradersway demo accounts

There are 4 different types of demo accounts available.

- Fixed spread

- Floating spread

- 2 ECN accounts

Review training and education

There is a resources section at trader’s way, however, the training material is very limited. Traders can find an economic calendar, as well as market information and an FAQ area.

They also provide live forex traders webinars with a broker from monday to thursday where traders can review the market and discuss fundamental events, trading techniques, and trade setups in real-time (2). There’s usually a live Q&A session with a broker to review the session at the end of each webinar, and traders can review recorded live sessions on the youtube channel afterward.

Customer service

Traders that have left a review state that they are fairly happy with the level of customer service from this broker.

Tradersway customer service contact details

Frequently asked questions

Does tradersway allow US clients?

Yes tradersway does allow US clients. You have the option of US dollars, euros, british pounds and canadian dollars. You can decide on your preferred currency when opening an account;

Overall impression

Our overall review is that our experience with trader’s way US clients, was good but we have to admit, it could have been better. There is a desperate need for more educational material to capture the interest of newbie traders and enhance user experience. Plus, trader’s way isn’t regulated, meaning clients have no cover at all if and when something happens to the company.

Negatives aside, they do offer some excellent bonuses, such as the 100% deposit bonus limited by $5000 per account. There’s no minimum initial deposit required for commission-free accounts and traders can access the ECN environment for as little as $10. We also like that it supports the most popular trading platforms, MT4, and ctrader.

Trader’s way does appear to be a reliable and fair broker, but the fact that the broker isn’t regulated is a real disadvantage in our eyes. It also means that they might be just too much of a risk for heavy traders and anyone looking to invest excessively may want to stay away.

1 – zoominfo, retrieved from https://www.Zoominfo.Com/c/traders-way/347195065

2 – anna-louise jackson, forbes advisor, retrieved from https://www.Forbes.Com/advisor/investing/what-is-forex-trading

Looking for more information?

If you are looking for more information then take a look at broker choices.

So, let's see, what we have: traders way at traders way minimum deposit

Contents of the article

- No deposit forex bonuses

- Traders way minimum deposit

- Traders way – forex broker rating and review 2021

- Traders way trading information

- Traders way — latest reviews and comments 2021

- Tradersway review

- Tradersway – strengths and weaknesses

- Strength 1 – choice of trading accounts –...

- Strength 2 – most popular platforms – metatrader...

- Metatrader 4 and metatrader 5

- Ctrader

- Additional software tools

- Rating broker by platforms

- Conclusion on most popular trading platforms:

- Strength 3 – low minimum deposit – open accounts...

- Strength 4 – highest level of leverage – trade...

- Strength 5 – large and unique range of deposits

- Credit cards and debit cards deposits and...

- Cryptocurrency deposits and withdrawals

- Ewallets / digital wallets

- Strength 6 – regular promotions – 100% deposit...

- Weakness 1 – poor spreads – wide spreads mean...

- Trader’s way decreases the minimum deposit for...

- More news about tradersway

- More forex brokers news

- Elon “former CEO of dogecoin” musk discusses...

- FBS new year 2021 promo comes with amazing gifts...

- FBS presents free e-mail educational courses on...

- FBS copytrade team is holding the ‘FBS copystar’...

- Award winning australian broker FP markets adds...

- Hotforex awarded best forex trading conditions...

- FBS trader awarded best mobile trading platform...

- Hotforex wins “decade of excellence forex...

- ‘risk-free investments’ now available in FBS...

- FBS offers a demo professional trading account...

- MT4.VAR.

- Traders way review, rating and comparison |...

- RECOMMENDED FOREX BROKERS

- Trading accounts

- The company. Security of funds

- Trading conditions

- Trading platforms

- Methods of payment

- Conclusion

- Latest news about tradersway

- Trader’s way review

- General overview

- Background

- Tradersway review regulation and...

- Tradersway account types

- Tradersway commission and fees

- Tradersway minimum deposit

- Payment systems

- Tradersway trading platforms

- Products

- Tradersway demo accounts

- Review training and education

- Customer service

- Frequently asked questions

- Overall impression

- Looking for more information?

Comments

Post a Comment