Tickmill Review, tickmill mpesa.

Tickmill mpesa

First and main problem is fake and imaginary WTI CFD price they offer in the moment.

No deposit forex bonuses

Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review. Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

Tickmill review

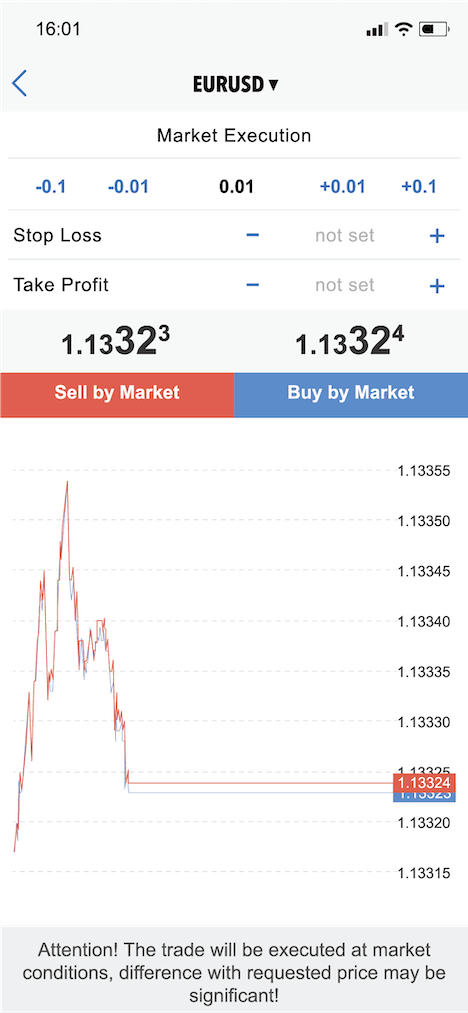

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Metatrader 4

(MT4) platform

Tickmill’s MT4 platform is fully customisable and designed to give you that trading edge.

Why trade with tickmill’s

metatrader 4?

Designed specifically for traders, our metatrader 4 platform provides a user-friendly and highly customisable interface, accompanied by sophisticated order management tools help you control your positions quickly and efficiently.

MT4 is widely recognised as the world’s favorite forex trading platform. It offers an easy-to-use user interface, enhanced charting functionality, indicators and supports MQL language. So, you can easily program indicators and expert advisors (eas) to trade the forex market 24/5 with no intervention needed from your side.

Combined with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform accompanied by spreads from 0 pips and 0.20s execution.

Key features of MT4

cfds on forex, stock indices, commodities and bonds. Execute your order with no partial fills, as a result of our huge depth of liquidity. EA trading facilities by using our VPS services. Advanced technical analysis, 50+ indicators and customisable charting… in 39 languages. Trading signals with an advanced notification system.

User manuals

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADE

Launch the platform, enter tickmill’s server name to log in and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

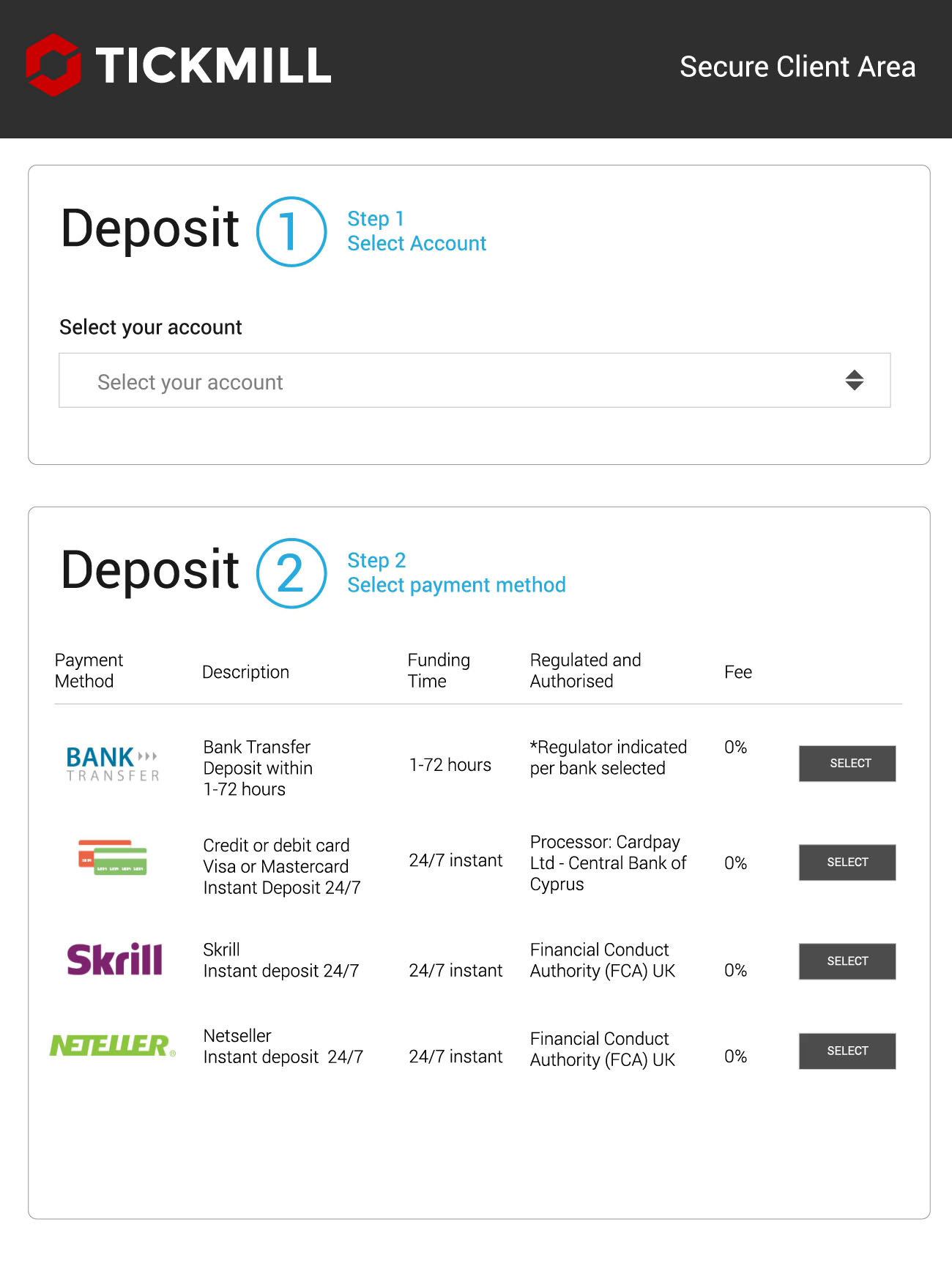

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 EUR, USD, GBP |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , IDR |

|---|---|

| min. Deposit | $100 or 1,500,000 rp |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | CNY |

|---|---|

| min. Deposit | 700 ¥ or € / $ / £ 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | 1-2 hours |

| on withdrawal | within 1 working day |

| currencies | VND |

|---|---|

| min. Deposit | 2,000,000 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , RUB , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to funding@tickmill.Com.

Internal transfers from an IB account to an MT4 account are processed automatically.

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Nisaidieni jinsi ya kuweka pesa TICKMILL

Sirmweli

JF-expert member

Kibuje

JF-expert member

Bora pesa yako uvute bangi

Nrangoo

JF-expert member

Kwa wale trader ambao wangependa kumtumia broker templerfx.

Broker huyu anakuwezesha kuweka PESA na kutoa kwa njia ya M-PESA.

Kujisajili ni rahisi sana kwa kutumia kitambulisho chako cha kupigia kura,kitambulisho cha taifa, leseni ya udereva au kitambulisho chochote kinachotambulika na mamlaka husika, namba yako ya simu utakayotumia kuweka na kutoa pesa kwa broker pamoja na E-mail.

Ni broker pekee ambae anayekuwezesha kuweka kiasi kidogo kuanzia dollar ($) 1 kwenye akaunti yako ,pia vilevile ana huduma ya haraka sana wakati wa kutoa pesa yako, dakika 15-30 tiyari pesa inakuwa imeshatumwa kwenye account yako.

Ndani ya saa 72 au chini ya hapo unakuwa na akaunti yako tiyari na kuanza kuitumia.

JISAJILI SASA

wasiliana na mimi PM kwa msaada zaidi BURE.

Sent from my iphone using tapatalk

Jeroy

Member

Heb fungua real acc. Kwa hyo templer weka pesa kdgo kwa mpesa uone moto wake

Jeroy

Member

Ukiikuza acc. Kwa hiko kias zen feel hyo confidence

Jeroy

Member

Usisahau kutupa mrejesho

Member

Usisahau kutupa mrejesho

Nipe mda nikushangaze.Ntaleta mrejesho hapa

Jeroy

Member

Nipe mda nikushangaze.Ntaleta mrejesho hapa

Jeroy

Member

Fanya hiv..Fungua skrill acc. Deposit hela yko kwa templer kutumia mpesa zen ihamishie skrill alaf itupie kwa tickmill.

Warning usi trade kwa templer mi hata simuamin kaniliza huyu jamaa

Member

Fanya hiv..Fungua skrill acc. Deposit hela yko kwa templer kutumia mpesa zen ihamishie skrill alaf itupie kwa tickmill.

Warning usi trade kwa templer mi hata simuamin kaniliza huyu jamaa

Asante mkuu,ngoja nijaribu hii njia yako ya kudeposit.Templer tunampiga kibishi hivyohivyo.Alikufanyaje mkuu?

Jeroy

Member

Asante mkuu,ngoja nijaribu hii njia yako ya kudeposit.Templer tunampiga kibishi hivyohivyo.Alikufanyaje mkuu?

Kuna mda ni kama soko ana li control yeye hasa kama ukiingia lot size kubwa utajuta hta kama kwa mistake hta mda wa ku cancel order huna kwn anahakikisha acc.Ime blow. Yaan jamaa kama anaku zoom

Old story

JF-expert member

Nasubiri mwisho wa forex ntakuja kuchangia

Member

Nasubiri mwisho wa forex ntakuja kuchangia

Endelea kusubiri dreamliner stand ya mkoa

Skorondinga

Member

Fanya hiv..Fungua skrill acc. Deposit hela yko kwa templer kutumia mpesa zen ihamishie skrill alaf itupie kwa tickmill.

Warning usi trade kwa templer mi hata simuamin kaniliza huyu jamaa

Unafunguaje skrill mkuu nimejaribu hiyo lkn nmeshindwa kuhamisha kwa templer kwenda skrill au lzm niweka bank account?

GODLOVEME

JF-expert member

This telegram group nimeona lina msaada

Matella3

Member

Asante mkuu,ngoja nijaribu hii njia yako ya kudeposit.Templer tunampiga kibishi hivyohivyo.Alikufanyaje mkuu?

Chillah

JF-expert member

Chillah

JF-expert member

Matella3

Member

Tickmill

inbox

C

christophoros panagiotou | tickmill

to me

jul 26, 2018

details

hi

It was a pleasure talking to you earlier.

To make a mobile payment deposit – mpesa – for example please follow below steps:

- Send email to funding@tickmill.Com stating the following:

- Your trading account number with tickmill

- The amount you want to deposit in your local currency – tanzanian shilling

- The mobile phone number you will use to deposit ( must match the number you provided upon registration with tickmill )

- Then we will reply with a link. You click on that link and follow few steps to complete a deposit .

Kind regards,

christoforos panayiotou

africa regional manager | tickmill ltd

We want traders to succeed

FCA UK & FSA SC regulated | spreads from 0.0 pips | execution speed 0.1 sec. (average) | leverage 1:500 | all strategies allowed | fast withdrawals & support | 80 trading instruments

united kingdom

1 fore street, london EC2Y 9DT

united kingdom

tel.: +44 203 608 2100

email:support@tickmill.Co.Uk

seychelles

3, F28-F29 eden plaza, eden island, mahe, seychelles

tel.: +248 434 7072

email:support@tickmill.Com

Tickmill is a trading name of tmill UK limited (a company registered in england and wales under number 09592225). Principal and registered office: 1 fore street, london EC2Y 9DT. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270. Tickmill is also the trading name of tickmill ltd seychelles, regulated as a securities dealer by the financial services authority of seychelles with license number (SD 008) and the principal office at: trop-X securities exchange building, 3 F28-F29 eden plaza, eden island, mahe, republic of seychelles.

Disclaimer: the information contained in this email and any attachments (the 'email') is intended for one or more specific individuals or entities, and may be confidential, proprietary, or otherwise protected by law. If you are not the intended recipient, please notify the sender immediately, delete this email and do not disclose, distribute, or copy it to any third party or otherwise use this email. Emails are not secure or error free and can contain viruses or may be delayed, and the sender is not liable for any of these occurrences. The sender reserves the right to monitor, record transmission and retain emails.

Risk warning: trading foreign exchange on margin carries a high level of risk and may not be suitable for everybody. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your trading objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss in excess of your initial deposit and therefore you should not deposit money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent adviser if you have any doubts. Please refer to tickmill's full "risk disclosure"

Forex brokers that accept mobile money and mpesa (2021)

If you want mobile money’s convenience and instancy, then here are the forex brokers that accept mobile money.

Trading is stressful and risky enough; when you make the profits, you want a convenient way of withdrawing your forex trading profits.

The solution, mobile money: a convenient service by telecoms and finetechs driving financial inclusion in remote places beyond the reach of mainstream banking.

In this article are forex brokers that accept all the major mobile money services like MTN mobile money, airtel money, mpesa forex brokers, and ecocash forex brokers.

What is mobile money?

Mobile money is an electronic financial service using mobile devices to send and receive money.

It is widely popular in many african and asian countries with a low penetration of VISA and other online payment services.

Thanks to telecom companies, you can deposit to and withdraw money with forex brokers that accept mobile money and forex brokers using mpesa.

Mobile money providers for funding A forex trading account

Forex brokers that accept MTN mobile money

MTN’s mobile money is arguably the most used mobile money service in africa.

So if you want to forex brokers that accept MTN MOMO in uganda, nigeria, ghana, guinea bissau, benin, ivory coast, cameroon, rwanda, and south africa, try exness, XM, and forextime (FXTM).

Forex brokers that accept airtel money.

Airtel provides a tremendous mobile money service for forex traders.

Exness, XM, and forextime (FXTM) are the forex brokers that accept airtel money from traders who live in any of these countries: uganda, kenya, burkina faso, democratic republic of congo (DRC), congo brazzaville, gabon, ghana, nigeria, malawi, chad, niger, rwanda, seychelles, sierra leone, tanzania, zambia, madagascar, bangladesh, india, and sri lanka.

Forex brokers using mpesa

The attraction of mpesa forex brokers is it enables locals use M-pesa – a popular mobile money payment service in kenya and tanzania.

Exness, XM, tickmill, and forextime (FXTM) are the best forex brokers that accept mpesa by safaricom in kenya and vodacom in tanzania

Forex brokers that accept ecocash

If you are a trader in zimbabwe, you are not left out; exness and XM are some of the forex brokers that accept ecocash.

Quick review of forex brokers that accept mobile money and mpesa

Exness

Exness is the best forex broker that accepts mobile money and mpesa. Withdrawals are instant 24/7.

Exness’ mobile money deposit and withdraw limit is $500

When you withdraw from XM, expect the money to land on your mobile wallet within 30 minutes to 2 hours. Once in awhile, withdrawals may take 24 hours.

XM’s mobile money deposit and withdraw limit is $500

FXTM – forextime

Forextime – FXTM accepts funding a forex trading account with mobile money wallets.

FXTM’s mobile money withdraw and deposit limit is $1,500

Advantages of trading with a broker that accepts mobile money.

- Withdrawals and deposits are fast.

- Mobile money is available 24 hours a day

- A forex broker like exness provides instant withdrawals 24/7

Over to you – what is the best forex broker that accepts mobile money in your country?

Let me know which of these brokers provides the best mobile money experience? Is there a forex broker that accepts mobile money or a mobile money service we need to include on the list?

You may also enjoy these articles

Exness review 2021

The best forex trading app UK (forex trading platforms) in 2021

Documents you need to verify a forex trading account.

From the blog

- All

- Brokers in africa

- Brokers in asia

- Brokers in europe

- Brokers in middle east

- Brokers in south america

- Candlestick patterns

- Discipline

- Emotion

- Forex broker reviews

- Forex brokers

- Forex trading

- Infographics

- Trading articles

- Trading journal

- Trading platforms

- Trading psychology

- Trading tools

- Verification

Learn more

Disclaimer

Forex and CFD trading are highly leveraged products. You may make a lot of money but, you risk losing your investment. Consider your investment options and choices wisely. Do not trade with money you are not comfortable to lose.

Tickmill reviews and comments 2021

Tickmill is scam broker they don't give your money back. Be careful & don't waste your time.

K. Sudesh ranga 16 april, 2020 reply

I chose tickmill through a referal from a forex education centre and it totally disappointed me. The online team is not 24 hours and they can barely do anything when you talk to them. Even after they arrange for a call back, it does not happen on many occasions. On top of them, they do not exercise margin calls like most brokers. My positions got wiped out just like that. And even after they liquidated some of my positions, my margin continues to be negative though my positions are in positive. Till date, this had not been resolved as they are always slow in replies. Recommend all to avoid this broker at all cost!

Vincent lim 15 april, 2020 reply

I chose tickmill accidentally, when I didn't understand anything in forex, but I was lucky that I didn't run into a rogue, but got into a good company, although all the chances were against me. First I opened there a demo account, then a real one, and soon decided to withdraw some money - on trial, would they not deceive you. Brought out. Then I began to quietly trade, and since then two more times I have withdrawn relatively small amounts - two times $ 300 each. There were no obstacles, only at the very first withdrawal it was a little long, scans of documents were required, but the next time they were no longer required.

Malcolm 25 july, 2019 reply

I usually do not write reviews, but here the situation is different, tickmill is a relatively young broker. I've been trading here for a month, and managed to withdraw, and I could bargain with the manager, I can confirm that I had a good deal of trying to make my debut. For a couple of weeks you will not make an objective conclusion about the company, but judging by what has already happened, and if there is something that will force me to stop working with the company, then it’s logical that I will not be silent, like everyone here, but as long as the stones do not fly towards the broker, then there are few newcomers here, they usually choose monopolists in the market, and this is a young broker, only those who are looking for it will find it, and the reason why there is not enough negative for you broker to maintain the level of service, after all, they are interesting for now.

Antony 18 july, 2019 reply

I work with three forex brokers companies simultaneously, including tickmill. I use different trading strategies with different brokers, so I can't guarantee 100% comparison accuracy, but it feels more comfortable with tickmill. First of all, I speak about situations when the price is going up and down and does not catch your stop, although the candle crossed it. But it can be a matter of strategy and selected tools, I can't vouch for it. But in principle I can advise with a clear conscience, a good broker, only maybe not for beginners.

I do not like to praise people or companies for nothing. But I am going over the facts on the experience of working with tickmill. This is quite a powerful STP broker from experienced major companies. The interbank market access is an highly important moment for me since there is no conflict of interest with the broker. This is seen immediately both in execution and real spreads that you observe in the terminal. As to spread without additional commissions, it is very adequate for them, the broker does not pull three skins from the client. With this, the spreads in their specifications correspond to those in real trading. They are not moving apart too much, even with extra volatility, as a pound has been observed recently. Just recently, the week on dollar/yena started with a gap and I was standing up for sale. The price opened at 40 points with a gap and immediately closed the deal. I planned to take 50 pips off the taka and took more than 90 off. Fact! I appreciate them for their honesty towards their clients.

Not bad broker, but kridex offers better spread, lower commissions, higher leverage nad faster execution

I love tickimil and they the best broker, but I am not sure why the withdrawals comes in half half. This is a good broker ever

Very good. Problem is leverage. Too small!

I have a serious problem with the bonus you provide us with.You're saying that "we can withdraw any profit we make"but why is it difficult to withdraw our profit.Even the log in details doesn't go through. What's wrong.I need help

Sharl 31 january, 2019 reply

Are serious about what you saying cos I was also asked to do the same but I haven't. Not sure if I should go ahead or just drop everything.

David 28 august, 2019

Tickmill trading bonus is a scum. Made 700usd and after they told mi to fund account so that I can withdraw then I did so nd since that day I'm still waiting to receive my profit so be careful guys

Thabo 12 november, 2018 reply

I've been trading for a couple of years now and have tried out many brokers, but tickmill has really made a difference for me. Really reliable broker, with great execution. Plus, I've never had any issues with withdrawals.

Fraud company. One of their representative name - sumit lakeshri in india took 12,000 INR from me to deposit funds in tickmill & now since last 20 days his number is switch off. Fraud company & fraud executive. Don't attend call from tickmill.

Have you tried any methods to recover your investment? I hired a refund solution professonial to retrieve my funds.

Christie 2 august, 2017

Compared platform trading conditions with other brokers, it's just better.

Jozefntou1 14 march, 2017 reply

**wanted to add 5 stars!! But website put 1 star?

Jozefntou1 14 march, 2017

For sure this broker can be recommended. Trading is profitable here. The orders are executed instantly. I prefer forex trading with advantage on its ECN pro account with minimum deposit $ 25. ECN spreads are fluctuating but great widening is not observed. I like to trade chinese yuan against USA dollar. The environment allows the yuan to trade freely and forecast the movements of it taking advantage of the exchange rate fluctuation. The broker even credits positive slippage to my account… sometimes there is a negative one during news release – get used to it trading with other brokers. Do not think it is possible to avoid it completely.

Ingmar 21 june, 2016 reply

Excellent broker. One of the best. Good prices. Competitive.

Timay10 13 august, 2016

Don’t like it at all. Though, I heard many good things about tickmill. But I lost my money several times here because of slippage. In reviews they say that there is no slippage (I’ve read). “you got me all misty-eyed,” - as my favorite character says. The price moves up and down regardless of what is requested. The connection with the platform is often interrupted. I faced the problems with closing of positions and execution of the orders. Moreover, usually fast withdrawals suddenly just stopped. I could not get my money immediately already twice waiting for withdrawals during a week. Wouldn’t recommend this broker. I’m leaving.

I have been trading with tickmill nearly around 7 months with their clas sic account. I have gone through some profits and losess in my trading account. I can say they are really have good spreads start from 1.2pips for EURUSD in their clas sic account. I think their trading platform for offshore broker are really awesome, and I noticed in 7months I trade with tickmill, I never has disconnecting problem, or freezing chart problem. Customer services are polite. Wide range payment methods, including famous e-payment methods in my country. I hope in near future they will have more regulations and offer swap free account.

Arsen 2 february, 2016 reply

Opened an ECN account with them and deposit small amount , $100 to test their executions. My plan was do news trade with this broker,because they claimed as ECN. To be honest, my news trade was executed perfectly. Their spreads when news were litlle bit high , around 1.2-2 pips when news, but no problem,. As long as my trade executed fairly. Made some profits and some losses, got 40% profits, and decide to withdraw my profits, and recieved it fast in my skrill account. Good broker with good services. They are fair and not mess with your account with you made some profits.

Mahesaroni 26 january, 2016 reply

I have a ECN account with them. The execution is fast and the spread is very good, never had an issue with trading , like delayed trades, freezing chart , or any other problems that usually happen with another brokers, if you are a news trader, you need to adjust your stoploss with their widening spreads. Depositing money in any brokers are always smooth ,however tickmill withdrawing process is fast. A good forex broker with good attitude so far.

Ardian 15 january, 2016 reply

I've trading with tickmill for 4 months and what i can say, they are honest broker. Trade with their no commisions account and satisfied with their spreads, 1.2 pips for EURUSD is perfect spreads for trading either scalping or intraday. However it is variable spreads, so sometimes i got 2.0 pips. But it is normal if we trade with variable spreads broker. Their customer service is good, professional and polite when answering my questions. But i will love them more if they are add more trading platform like ctrader. Overall as a happy clients , so far, they are doing a great job and i hope they can maintain and stick with their quality in future. Sorry if i have error in grammar since english is not my mother language

Verry2114 8 january, 2016 reply

Move to tickmill from my old broker. And i am satisfied with tickmill trading conditions. My old broker compare with tickmill ?My old brokers charge 5 pips spread and $50 commisions, so i am very satisfied with tickmill

and different with my old broker, their platform never freeze in high impact news. Fast withdrawal. What i can expect more?

Daftar2ijak 21 november, 2015 reply

As a white label partner, you can offer your clients the same award-winning technology and broad product range enjoyed by thousands clients worldwide, under your own brand.

Malenchelon 24 december, 2015

My trading style is to put all of my balance in one trading. That is why i only deposit as low as possible and take profit as much as possible. And market only need move 50.0-100.0 pips against my open trade before i got stop out

other broker ban my trading style. I do not know why. And some of other let me do my style and delete my profit after that. Which is unfair. In my tickmill ECN account, i can trading using my style without any problem. They accept my style.And have no problem withdrawing my profit

Daftar2ijak 27 october, 2015 reply

One of best broker for arbitgeur trader, open an ECN account to test my arbitrage EA with small deposit and i am notice my arbitrage EA working smooth here smooth execution for my EA transaction cost is not expensive i will see how my portofolio grow here.

Riza 18 august, 2015 reply

Is it problem to trade with tickmill and use the bank which is their liquidity providers ( barclays? Or it can affect some how?

Gabriel 16 march, 2019

I click close the newly appear lossing trade but this time it update immediately as a loss. Their explanation was you have a cache problem!!

Ben dunn 10 august, 2015 reply

Tickmill is an award-winning global ECN broker, authorised and regulated in the UK by the financial conduct authority (FCA) and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and.

Regulation: FCA UK, cysec, FSA seychelles

M-pesa forex brokers: what you need to know

When it comes to forex trading, at the end of the day, it is all about being able to transfer money to the account easily and safely. Without money on your trading account, you cannot start trading at all. Makes sense, right? Therefore, the rise of the forex market led to the emergence of more and more payment systems that offer their services to brokers everywhere around the globe, and unsurprisingly so. This has provided a great benefit for all sides of trading – brokers, traders, and the service providers themselves.

We have already discussed several main payment systems that have already taken their niche in the global trading market. But today we will focus on the very specific one – M-pesa. It is specific because it is mostly accepted in african countries like uganda, ghana, and kenya. Thus, the majority of forex brokers using M-pesa can be found there. In fact, we have witnessed a significant rise in forex trading in kenya using M-pesa. As the forex market is still not fully developed there, neither is the payment system that operated there. However, it is slowly but surely getting more streamlined and commonly accepted.

Trade with exceptional trading conditions on every type of live account!

Forex brokers that accept M-pesa

A number of well-regarded international forex brokerages have started accepting M-pesa payments. The ease of use of M-pesa system and the accessibility it provides for its users promises a great opportunity for these companies to expand their operations in the african markets.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

M-pesa payment system general overview

M-pesa is an africa-based payment system that was launched by vodafone in 2007. Currently, that is the largest mobile transfer network in kenya and tanzania. However, as it is continually expanding and growing, it is now available in south africa, afghanistan, india, romania, and albania, with the exponentially growing number of F orex brokers that accept M-pesa.

Among the services provided by the company you may find:

- Deposit and withdrawal of funds

- Transfer of funds to other users

- Payment of bills

- Purchase of airtime

- Save of funds in a virtual account called mshwari

- Transfer of funds between the M-pesa account and a bank account

The platform itself is similar to the safaricom of kenya and vodacom of tanzania as it was created as a subsidiary of those. However, there are still some minor differences to it.

The system is basically using your mobile device as an e-wallet. Just by tying your SIM card and mobile account to the banking one, you can easily pay for services, products, utilities, as well as charge your forex trading account with money. With M-pesa sending money from one account to another is actually as easy as sending text messages, making M-pesa trade extremely accessible.

One thing to note would be, that the funds kept on M-pesa accounts are not actually controlled by the company itself, it is stored in safaricom headquarters. Which are, in turn, managed by the kenyan government that keeps this money in a vault. And it doesn’t just store this money, no. Those funds are going for the development of the economy as they are spread among different commercial banks and sectors. That is exactly what we mean when we say that the establishment of M-pesa benefits the whole economy. Therefore, if you are using its services, you become part of the process as well.

Moreover, everything about M-pesa operations is fully transparent. Meaning that the kenyan government closely manages the actions of the safaricom company in order not to allow it to affect the distribution of the funds raised by the M-pesa payment system in any way.

Transaction limitations and fees charged

The main factor that dictates for much the users of the M-pesa forex trading account will be charged depends on whether the user is registered or not. For instance, traders within kenya will be charged with the 66 kshs fee for transfer to any of unregistered traders in case if the amount of the transfer is between 101-500 kshs. But if the transfer is going to the registered user, then the fee will be 27 kshs for the same transfer amount. Meanwhile, the maximum amount of the transfer can be 35,000 kshs with a fee of 275 kshs for unregistered users. Through a number of corporate agreements, however, transaction to a number of platforms was made extremely easy, such as transaction from S krill to M-pesa that can be done in microseconds.

Different locations of M-pesa forex brokers

As noticed previously, the forex trading brokers working with M-pesa are usually located in african countries. But let’s take a look at where exactly those brokers are based.

Kenya

The sizable portion of brokerage companies from the list of best M-pesa forex brokers are located in kenya. Notably, the payment system came to kenya in 2007 when the local company, safaricom, decided to establish its own money transfer network. Once the government saw the growth of the company’s share, the kenyan finance minister decided to check up on the company in order to find some fraudulent actions. However, it failed to do so and the company continued to attract even more loyal customers. Thus, the overall amount of estimated cash flow of all transfers managed reached KES. 2.1 trillion in 2014, which, in turn, showed a 28% growth since 2013. Also, hotforex is among the latest forex brokers that accept mpesa deposits in kenya.

Afghanistan

Yet another country with dozens of licensed FX brokers allowing M-pesa payments is afghanistan. The company was brought here in 2008 by the local mobile service provider, roshan. Interestingly, the company is responsible not only for controlling the forex brokers‘ transactions but also for salary payment to policemen, control over merchant payments, peer-to-peer transfers, loan disbursements, and other types of payments.

Tanzania

The service was launched here in 2007 by vodacom. The service was showing impressive growth ever since it was launched. Thus, by 2013, M-pesa already had five million subscribers to its platform, and a certain portion of those are traders who are signed with the forex trading brokers working with M-pesa.

India

Another country that witnessed a rise in the number of forex brokers using M-pesa is india. The company was launched in india a bit later, in 2011, as a direct partner of ICICI bank.

South africa

The service was launched here in 2010 as there were millions of potential forex traders and simple users that did not have a bank account where they could store their funds. Therefore, in the next three years, approximately 10 million users were successfully registered. However, the growth stopped at some point because of several arguments with governmental policies. So now there are only 1 million subscribers that are transferring funds from an account to account with M-pesa. Thus, we may logically come to the conclusion that there are not many CFD brokers with M-pesa payment method available there, yet there is still hope that the number of F orex brokers accepting M-pesa will likely increase over time.

Regulations of brokerages from the M-pesa brokers list

As M-pesa seeks to reach a high level of transparency and reliability in operations for its users, it was regulated by a couple of regulators. Those are the UK’s financial conduct authority (FCA) and the payment card industry (PCI). The company also follows the KYC (know your customer) principle and, thus, requires all of its users to provide them with data that will be kept confidential but will help them to make sure that you are a real person who does not have any bad intentions for forex trading.

The first steps

Notably, one of the first-ever forex trading brokers with M-pesa withdrawal option was EGM securities. The brokerage was the pioneer of the african market that took a risk of using a young payment system and was not disappointed. That actually was a huge step for the whole forex market in african countries. As it gave those direct access to the rest of the global trading market. It advanced the depth of the financial market and improved economic growth, and acted as an incentive for the rising number of F orex broker with M-pesa deposit options.

Why is the number of forex brokers accepting M-pesa growing?

That phenomenon in countries like kenya might be explained by the fact that forex brokerage accepting M-pesa receives a number of benefits provided by the local payment system rather than paying larger fees for using foreign ones.

Meanwhile, M-pesa is truly a convenient tool for low-cost, fast and safe payment, transfer, and storage of money. Moreover, as everyone knows how tough and depressing is the economic situation in african countries, especially in countrysides. Thus, there is a common thing that relatives living in urban centers are often sending money to other family members who live in villages. And as it might be simply complicated and time-consuming to send money via post or in any other way, the M-pesa transfers of money comes in handy. Also if you are using M-pesa for forex trading purposes only, it still is a great option. As the transaction and administration fees are not as high as with other global payment systems.

Yet another bright side is that there is no minimum transfer amount. That means that everyone can use the service. All in all, M-pesa provides not only benefits for the ones who are into forex trading, but to all citizens. Cause the creation of such a financial platform leads to the development of the whole financial market as a result.

Even bill gates once said: „ kenya’s M-pesa proves that when people are empowered, they will use digital tech to innovate on their own behalf.“

Moreover, we would like to notice how the establishment of M-pesa leads to a decrease in corruption levels in such countries as south africa and afghanistan. As all transactions become transparent and traceable, that is easier for governmental institutions to control money laundering and find the scams easily.

Best forex brokers that accept mpesa in kenya

We've ranked the forex brokers accepting mpesa after comparing their trading fees, regulations, ease of withdrawals & 5 other factors.

Last updated: december 30, 2020

Trading forex in kenya is legal & regulated. But there are only a few brokers that offer local deposit & withdrawal methods. Traders in kenya must select only from among the very few highly regulated forex brokers that offer mpesa.

Only a handful of reputed forex brokers in kenya accept mpesa payments. The majority of brokers offering mpesa option are either unsafe or unregulated.

We reviewed 18 brokers that accepted mpesa, and have chosen only those forex brokers that are highly regulated – having minimum 2 tier-1 & tier-2 regulations. All these are also having an established track record and reputation.

We have also made a comparison for their diverse plus points including trading fees, platforms, and others.

Comparison table of best forex brokers in kenya that accept mpesa

6 best forex brokers that accept mpesa

These reputed forex brokers accept mpesa from traders in kenya:

Let’s compare all the pros & cons of each broker that accepts mpesa.

#1 fxpesa – best forex broker that accepts mpesa in kenya

Regulations: CMA kenya

Minimum deposit: ksh. 500 or $5

Trading fees: from 1.5 pips for EUR/USD with standard account

EGM securities is the parent company of fxpesa. They are among the only 4 forex brokers in kenya regulated by CMA – capital markets authority. So, they are regulated and considered safe for traders in kenya.

In comparison with other brokers, fxpesa charges a higher spread on standard currency pairs. For a major currency pair like EUR/USD, the typical spread is 1.6 pips per standard lot. They offer trading on MT4, web trader, and mobile platforms.

Fxpesa offers only a single account type to traders. It is a no-commission – spread only account. The minimum deposit required is $5 and maximum leverage is 1:400. Deposits and withdrawals with fxpesa do not have fees.

66 pairs of currency are offered to trade on fxpesa’s platform. Their other instruments are limited – include 12 global indices, a wide variety of share cfds, and cfds on 8 commodities including platinum, silver, gold, and oil.

Customer support offered by fxpesa is good. During our test, the live chat response was a bit slow though with some holding at times. The E-mail response to our queries was in under 1 hour. Fxpesa does offer support & sales through a phone number in kenya.

- Fxpesa’s parent company EGN securities is CMA regulated. So, considered safe.

- The fee structure is very simple.

- Their support is very good. They also offer local phone number for support to traders in kenya.

- Higher spreads of 1.6 pips and above.

- Limited CFD instruments other than forex.

#2 XM forex – zero commission mpesa accepting broker

Regulations: ASIC, cysec of cyprus

Minimum deposit: $5

Trading fees: as low as 0.8 pips for EUR/USD with ultra low account

XM forex is also a highly regulated forex broker that is regulated with top-tier global financial authorities. These include the ASIC & CYSEC. XM broker is one of the largest forex brokers in the world & is well reputed. It is thus regarded as quite secure for traders.

XM charges fees with their account only through the spread. They do not charge any additional commission per lot. The fees for XM ultra-low account are among the lowest among leading forex brokers.

The ultra-low account as per our benchmark with the EUR/USD has average spread of as low as 0.8 pips.

The minimum deposit required for opening an XM account is $5. The leverage offered to traders is 1:888. Traders get to trade in 57 currency pairs and 1, 183 stock cfds. The other asset classes are 9 equity indices cfds, 5 cfds on energies, 10 commodity cfds, and 4 precious metals cfds. XM however does not offer crypto cfds.

XM offers customer support 24X7 via E-mail and live chat. We did not experience a hold time of more than 2 minutes when we tested their support with live chat at 3 different occasions. They offered us fast & accurate responses to all your queries on their fees, regulations, funding & withdrawals.

A local phone number support in kenya is not offered by XM. You can however request a call back through E-mail or live chat.

- Regulated by ASIC, and CYSEC

- Ultra-low account offers very low standard spread for EUR/USD with 0.8 pips.

- Quick execution of orders and nil re-quotes.

- Negative balance protection offered.

- Withdrawals and deposit fees are not charged.

- Well-informed and quick support via live chat.

- Phone number support in kenya not available.

- Limited cfds other than forex.

- XM does not offer CFD trading on cryptos.

#3 exness – low spread forex trading using mpesa

Regulations: FCA (UK), cysec of cyprus

Minimum deposit: $1

Trading fees: as low as 0.1 pips for EUR/USD

Exness has been operating from 2008 and is regulated by multiple tier-1 and tier-2 regulators. These include the FCA (UK) and CYSEC – cyprus securities and exchange commission.

Spread with exness is variable based on account type but generally they have tight spreads. The spreads for standard cent account begin from 0.3 pips. There is no commission on the trading volume, other than spread. For standard account – the costs are based on tight spreads starting from 0.1 pips. The spreads overall are very low with exness.

You can open an account with exness with as less a $1. The professional account however requires a $ 200 deposit. Professional ECN account has raw spread with a commission for each trade.

A metatrader only broker, exness offers you to trade on both MT5 and MT4 platforms. Trade executions are almost instant. Like hotforex, there are no fees for withdrawals and deposits.

Exness offers multiple instrument classes, including trading forex on 107 pairs of currencies. It also includes 7 cryptocurrencies, metals, energies, and cfds on indices and stocks.

Customer support at exness is available 24X5. This is via live chat and E-mail. Live chat support in the english language is offered 24X7. They offer quite good support to the traders as per our tests. However, they too do not offer support through a local phone in kenya.

- Exness is regulated with multiple regulators.

- Several types of accounts and methods of execution, suitable for both professionals and beginners.

- Higher options of currency pairs available for trading forex.

- MT4 & MT5 platforms, with advanced range of tools and analysis for research.

- Limited account base currency options.

- Limited cfds other than forex.

- No local phone support in kenya.

#4 scope markets kenya – local forex broker that accepts mpesa

Regulations: CMA

Minimum deposit: $20

Commission/trading fees (benchmark): lowest, 1.1 pips for EUR/USD

#5 hotforex – low cost forex broker that accepts mpesa

Regulations: FCA (UK), FSCA, FSA

Minimum deposit: $5

Commission/trading fees (benchmark): on average, 1.2 pips for EUR/USD trade with premium account

Hotforex is a legit forex broker successfully operating in the industry for 10 plus years. They are extremely well regulated – including with 1 tier-1 & multiple tier-2 regulators. Their regulations include the FCA – financial conduct authority and FSCA – financial security conduct authority (FSP no.46632). Thus hotforex is considered safe for traders in kenya.

Hotforex has competitive fees with the premium account. You are not charged for withdrawals or deposits through mpesa. The average USD/EUR spread with the premium account is 1.2 pips. This account needs a minimum deposit of $ 100. However, the micro account needs just a $ 5 deposit for activation.

Premium is free of commission – spread only trading account. The zero account meanwhile has a low spread + $6 per 100,000 units (1 standard lot). Trading on the latest MT4 and MT5 platforms for all devices are offered by HF.

There are 50 currency pairs available for trading at hotforex platform – that includes majors, minors, and exotic. Its trading assets also include 4 cryptocurrencies, cfds on 56 shares, 8 commodities, leading 11 indices globally, 3 top global bonds, energies such as brent oil, crude oil, US natural gas, and spot metals – gold and silver.

Hotforex has excellent customer support as per our tests. Live chat is available 24 hours on weekdays. We did not experience a hold time of more than 60 seconds during our tests when connecting.

E-mail response to your queries is quite fair. We received a reply usually within 2 hours on weekdays. But hotforex does not have local phone support for traders in kenya. Nevertheless, overall customer support services are good.

- Hotforex is regulated with multiple regulators in different countries. So considered safe.

- STP (straight through processor) forex broker, so there is no conflict of interest.

- No fees are charged for your withdrawals or deposits, including no fees for mpesa.

- Offers some of the most generous bonuses to new traders, especially 100% credit bonus.

- Quick execution of trades.

- Spreads are tight.

- Excellent and very helpful customer support.

- Not regulated with CMA in kenya.

- Does not offer local phone support in kenya.

#6 FXTM – CMA regulated forex broker accepting mpesa

Regulations: CMA, FCA, FSCA, cysec

Minimum deposit: $10

Trading fees: from 2.1 pips for EUR/USD with cent account

Forextime is regulated in diverse jurisdictions globally. Their top-tier financial regulations are with CMA, FCA, CYSEC, and FSCA (FSP no. 46614).

But a higher average spread is charged with FXTM’s standard accounts as per our benchmark test for EUR/USD. The standard account has an average of higher than 2.1 pips spread. The FXTM cent account has even higher spread.

FXTM charges commission for its ECN account. This is $2 for each side which adds to $ 4 per trade for 1 standard lot. All deposits are free of charge at FXTM, including for mpesa. However, there are fees for withdrawals depending on the method.

The minimum deposit to open an FXTM cent account is $10. The standard account requires $100.

You can trade with FXTM through the metatrader 4 and 5 platforms. Their financial instruments include forex currency pairs, cryptocurrencies, stocks, cfds, commodities, and precious metals.

FXTM offers fair customer support. Live chat offers a quick response and we did not find any hold times of over a minute during our test. We got a response to our queries within 3 hours through E-mail on a weekday. They do not have a local phone number in kenya.

- Well regulated with multiple regulators.

- Account opening process is fast.

- Good educational section on their website.

- High trading fees on forex & cfds. Also, fees for withdrawal and inactivity.

- No local phone number dedicated for kenya.

How we selected the best mpesa accepting forex brokers?

Here are the major factors that we have considered while reviewing the forex brokers accepting mpesa:

1. Top-tier regulation(s): the most crucial factor is the number of tier-1 regulators that regulate the forex broker. FCA, ASIC, NFA are considered as tier-1 by the forex industry. FSCA and CYSEC are tier-2 regulators. If the forex broker is listed publicly in a major stock exchange, then it is an extra trust factor.

Also, if the broker is regulated in kenya then it is to be considered safe. There are just 3 brokers regulated with kenya’s CMA if you are looking to trade with only a local broker. One of them is fxpesa.

2. Overall fees: the factors considered here are spread, commissions, and charges on withdrawals and deposits.

Majority of the brokers charge fees for dormant/inactive accounts too. Some of them also levy extra fees on a few CFD instruments. So, it is vital to research the overall fees of the asset that you are seeking to trade.

3. Solid trading platform on mobile & desktop: the broker must offer a well-equipped and user-friendly trading platform.

Also, there must be multi-device support, quick execution, no freezing, and multiple order types. These can significantly enhance your trading comfort.

4. Easy & quick account opening: the account opening must be easy and fast. The approval of the account upon submission of documents (ID & address proof) must not take more than 48 hours.

5. Overall trading conditions: the execution of orders must be fast without slippage or re-quotes. The best option is to choose a broker offering direct market access than market maker brokers.

You must also be offered negative balance protection so that the loss does not exceed the account balance. Availability of guaranteed stop-loss protection is also an advantage.

The broker must also offer funds segregation for the security of funds. The number of available product classes/trading instruments is also a factor. You must also check if the instrument that you are looking to trade is offered for the lowest fees or not.

6. How is the customer support: customer support must be accessible 24X5 through live chat, E-mail, and phone. The chat support must be helpful with minimal hold time. The E-mail revert to your queries must be quick and preferably within 1 or 2 hours max.

The local phone number support in kenya will be another plus point. The knowledge base must provide instant solutions.

Frequently asked questions: forex brokers that accept mpesa

Which reputed forex brokers accept mpesa?

As per our research, hotforex & exness offer the best trading conditions for traders, and both of them accept mpesa with zero fees on funding & withdrawals.

If you are looking for a local broker that has office in kenya, then we recommend fxpesa, which is the brand of EGM securities – a CMA regulated broker.

What is the minimum deposit required for forex trading using mpesa?

Here is a brief overview for traders in kenya:

- Hotforex – $5 deposit with micro account. $100 for lower spread premium account.

- Exness – as low as $1 with standard account

- XM forex – $5 minimum deposit for opening micro account. $50 for ultra low account

- Fxpesa – $5 deposit required for standard account

How can you start trading forex in kenya using mpesa?

You should start by learning forex trading. If you are a beginner then start by reading our forex trading for beginners guide.

Once you have understanding of the concepts like technical analysis, risk management & fundamentals, then you can take then next step & open demo account with the broker of your choice.

Only when you are profitable on demo, you should open live account with a regulated broker that accepts mpesa & has low minimum deposit requirements. After trading, analyze all your trades & only scale if you have good understanding of all the risks & trading strategy.

So, let's see, what we have: is tickmill a good forex broker? Read real reviews, by traders, for traders? Add your rating to the largest forex review database by forex peace army? At tickmill mpesa

Contents of the article

- No deposit forex bonuses

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Metatrader 4 (MT4) platform

- Why trade with tickmill’s ...

- Key features of MT4

- User manuals

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Nisaidieni jinsi ya kuweka pesa TICKMILL

- Sirmweli

- Kibuje

- Nrangoo

- Jeroy

- Jeroy

- Jeroy

- Jeroy

- Jeroy

- Jeroy

- Old story

- Skorondinga

- GODLOVEME

- Matella3

- Chillah

- Chillah

- Matella3

- Sirmweli

- Forex brokers that accept mobile money and mpesa...

- What is mobile money?

- Mobile money providers for funding A...

- Forex brokers that accept MTN mobile...

- Forex brokers that accept airtel...

- Forex brokers using mpesa

- Forex brokers that accept ecocash

- Quick review of forex brokers that accept...

- Advantages of trading with a broker that...

- Over to you – what is the best forex...

- You may also enjoy these articles

- Exness review 2021

- The best forex trading app UK (forex trading...

- Documents you need to verify a forex trading...

- From the blog

- Learn more

- Disclaimer

- Tickmill reviews and comments 2021

- M-pesa forex brokers: what you need to know

- Forex brokers that accept M-pesa

- M-pesa payment system general overview