Start trading forex with $100, start trading forex with $100.

Start trading forex with $100

Rule 3: avoid the news spikes the first method is to trade with money management as the number 1 focus.

No deposit forex bonuses

This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

How to start trading forex with only $100

If you’re going to become a forex trader, one thing’s for sure: you’re going to have to make an investment. You can’t trade without any funds in your trading account, obviously, and many brokerages don’t even offer accounts for less than $500. While many beginners dream of opening a trading account, the thought of investing such a large amount of money into something that may not be profitable is scary. After all, you can do a lot more with that money. Others simply don’t have that much in disposable funds, so trading seems impossible. The good news is that it is possible to open a trading account and to be successful with a small starting deposit of about $100. Some brokers will even let you get started with around $5 or even $1, but it is best to make a slightly larger investment if you can.

Before you make the decision to start, you’ll want to have realistic expectations. It is highly unlikely that your $100 investment will turn into thousands of dollars quickly. You aren’t going to make the same profits as someone that has invested $20,000 into their account. Beginners need to ease into the market. If you lose your entire investment, it doesn’t mean you should quit. Instead, you need to look more into education and base your trades on more evidence.

Indicators, economic calendars, charts, graphs, and so on can give you more information from a technical and fundamental standpoint. The good thing is that if you lose your $100 investment, it won’t break you, and you can start again. Losing a larger amount of money could scare someone away from trading for good. If you find that you’re well-prepared and you start making money, you could always invest more later.

Here are a few quick tips for opening a trading account and getting started with around $100:

-try to find a broker that offers some type of bonus. Some even offer $30 welcome bonuses or simple deposit bonuses that would add to what you’re investing. Just make sure that your deposit is large enough to qualify.

-make sure you sign up with a broker that offers good conditions. You should have access to average spreads and fees with a $100 deposit. Don’t open an account with insane fees just because it is the only option with a certain broker. Look for better options and compare what you can get for what you have.

-don’t use too high of a leverage! This is important because overleveraging your trades can cause you to lose a lot. Many beginners use too high of a leverage to increase their investment power, but this usually backfires. Start smaller and work your way up over time.

-never risk much on any one trade. Many professionals recommend risking 1% or less of your total account balance on a single trade. This might lead to slower profits, but it is safer. If you go risking 10% on one trade, 20% on another, and so on, you could quickly blow your account.

Once you get started, you should focus more on trading and less on how much you’re making. Opening a trading account with a small amount of money isn’t going to make you rich overnight. It’s going to take a lot of hard work and dedication before you get there. You can plant the flower by opening a trading account, but you need to water it by doing research, getting an education, taking risk-management precautions, and keeping a trading journal to log your progress. You’ll also need to treat your small account the same way you would a large one. You might not feel as worried about losing $1 compared to how you’d feel if $100 was on the line, but it still matters. Understand that it is normal to lose some money, but every dollar lost adds up.

In conclusion, you should be aware that opening a trading account with as little as $100 (or less) is possible and it can be profitable. If you have realistic expectations, you can be successful with an account that has a low initial investment. Remember some of our tips about finding a good broker that offers bonuses and using risk-management precautions so that you can make the most out of your account. Don’t get discouraged if you’re only making a small amount at first. Every trader must start somewhere, and seeing profits is much better than seeing losses! If you manage to increase your account balance by even a few dollars, then you’re doing better than many others that have tried. As you work your way up, you’ll likely gain access to better accounts and have more money to invest, which will help to grow your account more quickly in the future.

How to start forex trading with $100 and turn it into $10,000

The thing I like most about forex trading is that you can start trading forex with as little as $100 and turn it into $10,000 or even more. In fact, you can open a free demo account and start trading with no money at all. So, how do traders increase their wealth by investing $100?

No forex trading experience: what should I do?

If you are new in the forex industry and you want to become a successful trader, but you unsure how, then you have come to the right place.

Luckily, if you have no previous trading experience, some platforms offer free demo accounts, and you should consider opening one before you begin trading. Moreover, most demo accounts require a $1 deposit or no deposit at all.

Can I gain trading experience without losing money?

By opening a demo account and placing orders there, you will gain trading experience without putting money into an account straight away and risking them. The easiest way for new forex traders to lose their money is,

The most significant advantage of demo accounts is that you still get access to the same markets and trading tools. This way, you will learn how to analyze the market correctly. Also, you will have more time to see how the market works, and there is no risk of losing your money.

Once you have more knowledge, you are more confident, and you understand how to place trades and how to manage risk, then you are ready to open a live trading account.

How do I choose a brokerage for my live trading account?

When it comes to finding the best brokerages, it is essential to do in-depth research. You have to see what each brokerage has to offer, what trading tools the brokerage has to offer, and, most of all, whether a significant oversight body regulates the brokerage.

Your goal is to find the most trusty brokerage before you open an online account.

Can I start trading with $100?

Yes, you can. Opening an online account with $100 is a good start if you want to see your money grow to $10,000. But to ensure your trading success, make sure you follow these steps before you place an order:

- Learn as much as you can about trading

- Understand the basics of FX terminology

- Research, study and analyze the market

- Learn more about the economy of the country

- Learn how to calculate profits properly

- Learn more about the major forex pairs, their nicknames

- Learn how to read forex currency pair quotes

- Create a trading strategy and follow it!

If you do follow the mentioned above steps, you will be one step closer to achieving your goal of turning $100 into $10,000. It won’t happen overnight, so you have to be patient.

Why starting with $100 is A smart choice?

The answer is easy: risk management reasons. Before you place an order, it would be smart to stick to risk management rules. Experienced traders don’t risk more than 1% of their accounts. And that’s how they don’t lose a lot of money.

So, if you begin with $100, then your risk should be $1. Some people might say that $1 won’t help you make money, but you always have to keep your interest!

Imagine what will happen if your risk is $100, and your investment choice was terrible. How will you be able to make $10,000 if you have $0 in your account?

Bottom line

Be patient, invest smart, and over time, your account will grow, and you will reach your goal of making $10,000 with $100.

If you invest more than $100, but you still use everything I shared with you in this article, your chances of achieving your goal sooner, will be higher. When it comes to trading forex, money makes money in this industry.

To learn more about each of the steps I mentioned above, or which are the three best brokerages in 2019, you should read this insightful article.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

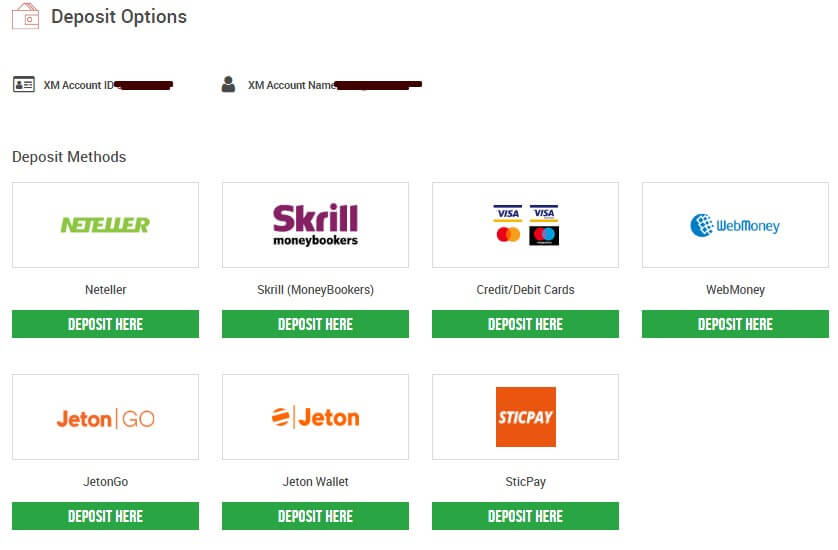

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

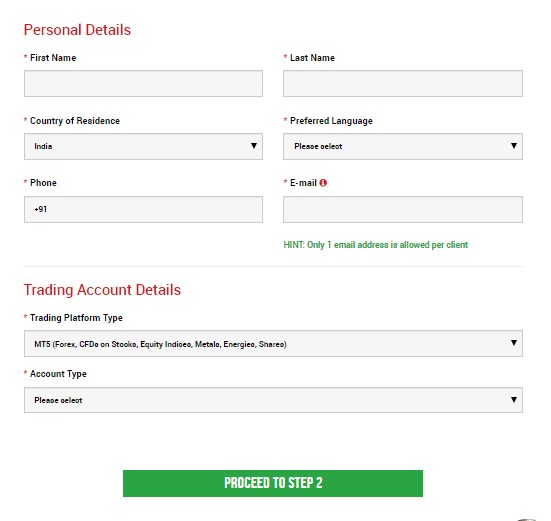

Step 2: filling the personal details

Fill all the box with accurate details

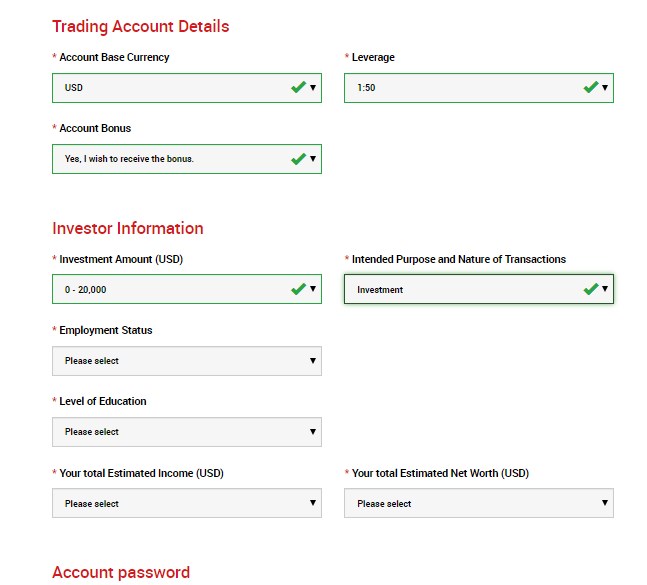

Step 3: investor information & trading account details

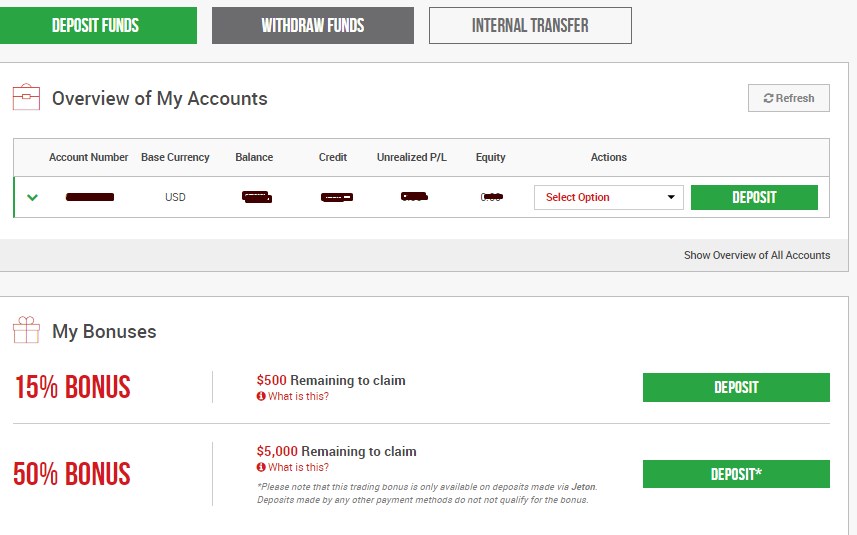

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

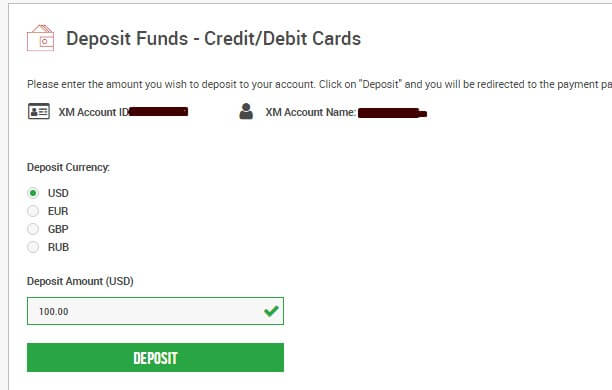

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

How to trade forex with $100

→ click here to start trading forex with $100 .

How to trade forex with just $100 as a starting point?

How to start trading with small initial capital?

How much money do I need to start trading forex?

How long do I have to wait before I start making a decent amount of money from initially trading forex with $100?

Perhaps these are just some of the questions strolling through your mind if you’re to consider trading forex as a newbie. Especially if you want to trade forex with $100!

Can you trade forex with $100?

While there is nothing certain in the world of forex trading, there are many trading possibilities to help you become a pro. One of them is to start trading forex with $100.

Trading forex with a small amount of capital is great if you’re not familiar with the forex market. The truth is that you should trade forex with $100 only when this $100 is not the only money you have to put food on the table. Because to trade forex, you have to be prepared to lose before you win!

That said, there are many other factors to consider before you start trading forex with $100. After all, there’s so much more to forex than earning money!

Invest in forex trading education , practice trading to build up some confidence and develop a consistent forex trading strategy, and always explore your emotions while trading forex.

Should you trade forex with $100?

Too many people believe that trading in the foreign exchange market requires you to start with a considerable initial amount of money at your disposal or to be already pretty wealthy.

Well, to trade forex, you should be financially stable and able to lose. Experts claim that any money you invest in forex trading should be disposable ; in other words, financial losses shouldn’t affect your daily life.

If you are new to the forex market, in particular, you can expect at least a dozen sources to bombard you with recommendations and suggestions on how to get rich trading forex and build considerable forex wealth at a rapid pace and with a low amount of money.

One of the most popular and controversial theories in the field of forex trading suggests that you can initially invest just $100 in entering the forex market, which can quickly grow to as much as $10,000 or even a million in a short period of time. Whether or not forex beginners can stand a chance of a great return is a subject of an endless list of factors. But it’s unlikely.

How to trade forex with $100

Although many people believe that a large amount of money at your disposal is much needed for starting trading forex, there are also many forex beginners coming into the forex market with relatively small trading accounts of just $100, £100 or similar amounts.

Here we should note that there are different forex trading accounts you can consider. Forex brokers often offer four types: standard, mini, micro, and nano accounts. While standard accounts require initial capital, mini accounts allow people to trade forex using mini lots.

However, one of the main fundamentals in the foreign exchange market is that the size of your account is not the most important thing in this initial stage.

Learning is what matters the most in order to benefit from the potential chance to earn money by trading forex. Hands down, you will soon find out that it is easier said than done as it takes a lot of patience and discipline to be able to witness the progress of your account.

If you’re looking for some great options for a forex trading education, make sure you check out trading education’s free forex trading course . With the right educational background and a lot of practice, you will be able to learn the art of forex trading.

On top of that, to trade forex, one should be consistent . Never trade forex out of greed or revenge! Discipline, patience, and emotional control, along with other characteristics and skills valued in the forex realm, are just a few of the fundaments that you should master.

How do you trade forex with $100 and potentially make a profit?

Let’s continue on. As mentioned above, the point of the size of your forex trading account is not that important. Even if you decide to trade forex with $100, you can definitely do so!

The size of your account just provides you with different possibilities, which makes it a function to achieving success… but also experiencing failure. Both success and failure can happen to accounts worth millions of pounds or dollars too.

But let’s assume that we all live in a perfect world and all the flashy forex trading advertisements are without a doubt going to change your life. You want to start your “home business”, you want to trade forex with $100 at first and make a decent monthly profit, you want to be this regular person succeeding on the road to the riches fast and easily.

Speaking hypothetically, all this can eventually happen with the help of forex trading. Thanks to the high leverage in the forex market , you can truly pursue paths that are not available with other sorts of investment endeavours . A quick return is something that in reality does and has happened to some people in forex trading. It is also a truth that some people tend to be treated kindly by the market and have managed to learn from their failures to make more successful forex trades.

How do you really trade forex with $100?

However, this is not the mentality you should enter the forex market with. Simply because all these hypothetical cases are just hypothetical - not something that happens on a day-to-day basis to the regular trader.

At the same time, there is no doubt that compared to other investment opportunities, forex won’t break the bank in order for you to enter the market. You can start trading forex with just $100 . Here are some tips to help you make money with $100.

1. Learn more about forex trading and its complexities

Forex is considered the biggest and most liquid financial market in the world, and some of the advantages of forex trading include:

- You can trade from home and you don’t need to rent an office.

- All you need is a computer and internet connection.

- You don’t need any employees or special inventory.

- You don’t need marketing and advertising.

- Forex operates 24 hours a day, so you can trade forex as a side job.

- You don’t need a university degree. However, a good education is highly recommended. Here’s the link to the free forex course in case you missed it.

It sounds like forex trading offers some really good opportunities, right? Well, you can explore the advantages of forex trading even if you decide to trade forex with $100.

2. Understand leverage in forex

Here we should mention that one of the main factors which attracts traders to forex trading is high leverage. That said, the primary reason why so many people fail and leave the forex market is high leverage, too.

Normally, a minimum of 50:1 leverage ratio is what the majority of all the reliable brokers out there offer . Though leverage in forex can be limited and controlled by government regulations, in some countries forex brokers may offer you a leverage ratio of 500:1 or even 1000:1!

Though all this sounds like a good way to make some quick money, be aware that the higher the leverage, the higher the possibility of losing money. So you may want to keep the risk and the leverage low.

3. Focus on the trading process, not on the money

Do not focus solely on making money. Forex trading is not a get-rich-quick scheme. To trade forex you need to invest a lot of time, resources, and patience.

Of course, we all know that the main motivation in forex trading is making a living. Making money can be a pretty powerful moving force, indeed.

But such motivation can pressure you into making rushed decisions. That’s why do not enter the forex market with the one and only goal of making quick money. Better think of forex trading as constant progress and growth instead of an easy way to monetise everything you do and plan to do.

There is a lot of truth in the saying that making money in forex is simply a result of trading it successfully. When you develop a consistent trading strategy and style , you will soon understand the wise meaning behind these words.

4. Balance life, realistic expectations & forex trading

When it comes to making money, one of the main problems that many newbies face is the way they treat forex trading. Some beginners who want to trade forex with $100 may quit their day jobs in hopes of making forex the main source of income in their lives. Some hope to become millionaires before the age of 40.

When you focus all your mental energy on monetising every step you take, though, you lose your focus of more important things, such as creating a risk management technique , mastering an effective strategy, being consistent, and having a healthy lifestyle.

5. Treat your small account the same you would treat a big one

Even if you trade forex with $100, you need to treat your account as if it is a big one . You better focus on how to be a good trader first.

From then on, it is all a step-by-step learning process, which will help you to trade with a larger account. Once you learn how to trade forex successfully, your money is more likely to follow.

6. Learn to control your emotions when trading forex with $100

No matter if you trade forex with $100 or a large amount, emotional self-control is one of the main keys to success in forex trading. A slow, calculated approach, as well as a lot of patience and discipline, is something that many good forex traders mention when asked about their success.

Interestingly enough, forex traders with smaller accounts tend to be more emotional when trading forex because they want to make their accounts grow fast. Don’t allow this urgent “need” of growing your account to lead you to over-trading, over-leveraging, over-risking, and most probably losing money consistently.

Additionally, do not forget that large accounts are not built overnight; it takes a lot of consistency and a long-term approach rather than taking big risks. Even the “big fish” in forex trading have a trading win rate of between 55% and 70% which is, as you can see, definitely not a perfect and smooth day-to-day trading experience.

In fact, when it comes to forex trading, the path to success is definitely not paved with taking a lot of high risks. Only risk 1% of your trading account . You wouldn’t risk the shirt on your back, right?

7. Build a consistent track record to improve your forex trading performance

Last but not least, having a very small forex trading account means that you need to focus on keeping a consistent track record.

In fact, good track records will help you boost your confidence as a forex trader slowly and surely - even when you trade forex with $100. Once you start making progress - and your track record progresses too - you can then consider proceeding with further developing your forex account and trading larger sums.

This step-by-step approach in forex trading is a very important one. You may have already built your own forex trading strategy and an efficient trading routine . So stick to them and don’t fall into the rabbit hole of over-analysing every piece of data and every headline you have access to.

It is also highly recommended to have a forex trading journal as it will help you stay more disciplined and organised while also providing you with valuable self-reflection insights.

How to manage a small forex trading account?

The basic principles of managing a small and a large forex account are all the same.

However, when you manage a small account you will be obviously trading smaller position sizes per trade, which can lead to dissatisfaction and impatience. In this case, keep greed and emotions out of the equation and avoid over-leveraging and trading too large. This is a common mistake many forex trading beginners tend to make, which can destroy your account faster than you can spell your name.

Focus on trading only the most obvious and confluent price action setups, adopt a more relaxed forex trading style, don’t be aggressive. This will help you manage your money and increase your chances of making a profit.

Also, every time you enter a trade, make sure that you are prepared to lose as you could potentially lose any forex trade. After all, there is a theoretical pattern of loss and gain in life, and forex trading is no exception.

Trading forex with $100: conclusion

With nano and micro forex trading accounts gaining more and more popularity these days, opening an account with $100 is definitely possible. In fact, many brokers work with an initial deposit as low as $10. Some even accept the extreme $5 or $1!

But there is a significant difference between whether you can start to trade forex with $100 and whether you should do it. Just because it is allowed and possible, does not mean that you should start with this amount. Then again, just because someone tells you $100 is too low does not mean that you should not try at all.

The leitmotif in all cases, however, is that you have to be realistic in your expectations and focus on working on a consistent and efficient forex trading strategy . Do not take high risks, do not get emotional, and do not enter obsessed with the idea of earning money overnight; simply try to define the meaning of forex trading “success” beforehand.

Key points

- As there are different forex accounts that traders can consider, trading forex with $100 is possible and potentially profitable.

- The size of your account is not the most important factor in forex trading, so treat your small account the same way you would treat a larger one.

- Education, emotional self-control, consistency, and patience are crucial to success.

- Whether you trade forex with $100,000 or $100, you should be realistic, persistent and ready to lose before you win.

Trade with the largest forex broker

Now you know how to trade forex with just $100

Whether you’re just getting started or ready to take your trading to the next level, forex.Com can help. As the global market leader, forex.Com offers tight spreads on over 90 pairs and access to 300+ markets. Learn more about what it’s like to trade with the largest forex broker and open an account with $100.

Best forex trading platform in the USA

Sign up for forex.Com and start trading forex with $100. There are no management fees or other hidden costs involved.

Forex.Com have proven themselves trustworthy within the industry over many years – we recommend you try them out.

Remember: forex trading involves significant risk of loss and is not suitable for all investors

How to trade forex with $100

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Many people realize that $100 doesn’t buy much these days, but if you want to trade the forex market, $100 can get you started and could even generate a new source of income you can earn at home. If you manage to develop and implement a successful trading plan, then your first $100 forex account could ultimately change your life for the better.

On the other hand, if you plan to just get into the currency market to make a few practice trades or to gamble a bit, then a loss of $100 usually won’t break the bank for most people.

The key to success as a forex trader consists of having a viable trading plan that you can easily stick to, no matter whether you’re trading with $100 or $1,000,000 in your margin account. Read to learn how to get started trading forex with $100.

Step 1: research the market.

Knowledge is power. These words take on a special meaning when applied to trading in the forex market that holds the top position for trading volume among the world’s financial markets. Knowing more about markets and trading in general increases your chances of succeeding when you trade forex.

Of course, if you just want to take a quick gamble with your $100, then you wouldn’t need to learn much more than how to enter orders in your brokerage account using an online trading platform.

To achieve any level of consistent long-term success, however, you will need to acquire a certain amount of knowledge about currencies and the fundamental factors that influence their relative valuation. Most online brokers provide ample educational resources for new traders that can include articles, ebooks, webinars and tutorial videos. All of these can help you learn more about the forex market before you begin risking money.

You will probably also need to learn how to analyze a market’s behavior to have a better chance of predicting its future direction. The 2 principal analytical market research methods for traders consist of fundamental and technical analysis.

Fundamental analysis

This method analyzes the impact of economic releases and news on the market. Each currency’s relative value generally reflects the state of that particular nation’s economy and its geopolitical situation compared with the currency it is quoted relative to.

Below are the most important news events and indicators watched by fundamental forex analysts:

- Geopolitical shifts and other major news events

- Central bank monetary policy and benchmark interest rate levels

- Gross domestic product (GDP)

- Employment statistics (non-farm payrolls, unemployment rate, weekly initial jobless claims, etc.)

Fundamental analysis gives you an important edge when you trade. Not only can it help predict longer term exchange rate trends, but it can also help explain and predict sharp short-term movements, such as those that coincide with significant economic releases.

Most online forex brokers include a news feed with their trading platform to help you perform fundamental analysis. Another important resource for fundamental trading is the economic calendar that lists all the important upcoming economic releases for various major economies.

Technical analysis

You can study the forex market using technical analysis such as charts and computed technical indicators — a common method to determine the levels of supply and demand in the market that can influence and predict an exchange rate’s future movement.

By looking at exchange rate charts you can identify common patterns with predictive value. You could also use a variety of popular indicators based on market observables to help predict short- and long-term trends in the market.

These indicators can include moving averages, momentum oscillators, overbought or oversold indicators and volume figures. Some important indicators include the moving average convergence divergence indicator (MACD), the relative strength index (RSI) and the 200-day moving average, to name just a few.

Trading volume is another important market observable to give an indication of how much activity accompanies a particular market move. Also, support and resistance levels suggest the degree of supply and demand existing at different exchange rate levels.

The charts themselves can also give important information to use and act upon. For example, a fascinating system of interpreting and trading candlestick charts was originally developed by japanese rice merchants. These informative charts indicate the opening and closing exchange rates, the range of the currency pair and whether the exchange rate increased or decreased for each period displayed on the chart.

Overall, technical analysis provides a relatively objective way to analyze the forex market that can work well for predicting short-term market moves. Many scalpers and day traders use technical analysis to inform their trading activities.

Step 2: open a demo account.

Most online forex brokers provide clients with a fully functional demo account, which reflects market conditions but does not require you to make a deposit.

The forex platforms provided by these brokers generally have comprehensive technical analysis tools such as charting and indicators that incorporate into the chart. If the broker supports the popular metatrader 4 platform developed by metaquotes, then you can automate your trading with expert advisor (EA) software you can buy or develop yourself.

The reason opening a demo account makes sense is so that you can get a feel for the market and learn how to use a broker’s trading platform without committing any funds. You can also use a demo account to begin working out your own trading strategy and putting it into a trade plan.

By learning how to take risk as a forex trader and seeing how disciplined you are when dealing with taking profits and losses, you can also determine if you have the necessary mindset to become successful as a forex trader.

Once you’ve opened your demo account and have begun trading with virtual money, you can start developing a trading plan. If you plan on success, remember that the more you know, the easier developing a trading strategy becomes. Take the time to review as many of the online educational resources on trading that you can, so that your trading plan has a solid foundation in best practices.

Step 3: fund an account and start trading.

Once you’ve traded in your demo account and worked out a trading plan you feel confident with, you can fund a live account and make your first real trade. Although trading in a live account may seem identical to trading in a demo account, you’ll have to deal with the emotional swings that come with winning and losing money, even if you’re only risking $100.

Fortunately, any viable trading plan can be traded with a $100 account since most brokers will let you trade in micro units or 0.01 lots. After you’ve refined your trading plan and have increased your working capital with profitable trading, you can then increase the size of your trading units. Avoid taking larger than expected losses by incorporating a sound money management component into your trading plan.

If you’re a beginning trader, you may want to restrict your trading activities to one particular currency pair before taking positions in multiple pairs in your account. Each currency pair differs in the way it trades because of the underlying fundamentals of the component currencies.

How to start trading forex with $100

No wonder why inexperienced investors’ first question is usually this: can I start trading forex with just $100? Moreover, often, they wonder if it is possible to earn a living by trading forex? Well, the answer to both questions will be explained in this article. Also, we will share with you five examples. So, keep on reading.

Can I start trading forex with $100?

Yes, you can. Typically, margin trading allows traders to open trades with small amounts of money. However, the live trading is different than trading on a demo account. You may lose through the first or even the second $100 in less time than it took to deposit it. Generally, when it comes to trading forex, you should not fear any loss. Each loss can help you learn from your mistakes.

So, if you have lost $100 a couple of times, and you haven’t quit, then you are ready to experiment with other strategies. Moreover, the more you practice your skills in live trading sessions, the sooner you will start earning money. First, you will double the account balance. Then you will increase it again. When it comes to trading forex, time and experience are crucial factors. Also, the key is to learn why you failed. By acknowledging your weakness, you can adjust accordingly.

Further, many experienced investors advise beginners to keep notes on their trades. This way, you can keep track of your weaknesses and strengths over time. For example, have your emotions affected your decision making? What was the feeling you felt when you had trades open? Also, when you write everything down, you will notice if you need to learn how to control your emotions.

Is it possible to earn a living by trading forex?

Well, the answer here is the same. Yes, you can. However, it will take years before you can reach this level. Moreover, when you are not afraid to lose money in order to practice, and you are not a quitter, then you can indeed master your trading skills and eventually start earning a living.

By grasping all the little details, there will come a time when you will double your account balance. Also, it is a good indicator if you manage to double your account twice. Once you achieve this, you might be ready to start working towards earning your living by trading forex.

However, don’t expect to achieve excellent results in a month or two. It might take up to 2 years or even longer to actually see positive results. So, be patient as it takes time. Otherwise, you might experience a spectacular failure.

When should I start trading forex?

Many investors make the same mistake of not practicing enough on a demo account. Before you risk your own money, it’s wiser to master your trading skills. In other words, you should first open a demo account. By doing so, you can try out your strategies with virtual money. Also, you can try the strategy of other experienced traders.

However, the first thing you need to do is to learn the basics of forex trading. Understand how the market works. Practice on a demo account because it allows you to become familiar with trading. Also, it will help you decide on whether you want to put in actual money into your traders or you prefer using virtual funds.

Further, you should invest real money if you have done your homework first. Meaning you:

- Have learned all terms and you understand how they are co-related

- Know how the market works

- Have learned the basics of forex trading

- Know the bid-ask spread you are facing

- Have practiced on a demo account for a while now

- Study the charts

- Have understood the volatility and risk involved

Bottom line

The main reason why people start trading forex is due to the high possibility of being able to make profits. Not only this, but it is possible to earn profits with only a small capital outlay. However, many essential aspects need to be covered first. Otherwise, you will lose everything you have invested in your account balance.

How to start forex trading with only $100-$150?

Forex brokers have proposed something called micro-accounts. For beginners, the advantage is that you can open an account and start buying and selling for $ 100 or less.

Some brokers even think that micro is not enough so that they start to provide “nano” accounts.

For people with limited price volatility, a flexible role size, and a small minimum deposit may also be suitable answers.

Forex dealers are not your friends. If they do n’t want your phone to open an account, they wo n’t ask because they really do n’t care.

Their first priority is for you to determine the price range. This is the reason for micro and nano debt. It allows foreign exchange brokers to access customers who are unable to inject funds into fashionable accounts due to financial constraints.

In other words, these unconventional account types are designed to acquire dealers, not you.

I am not a sour merchant for those brokers now. Nor am I saying that your broker does not have or does not provide an incredible carrier.

The simplest factor I have here is that you have to do your due diligence and must not be compared with money, otherwise you will lose enough money.

It is also important to take this into account because just because they provide you with a way to start with one hundred dollars does not mean that you should do so.

In this submission, I will address the following questions: can you and must start foreign exchange transactions for one hundred dollars. We will discuss numerous account types and feature sizes. In addition, I will also make some suggestions on how to determine the correct account size.

Forex account type and lot

I no longer spend a lot of time on this issue because it is not a recognized primary issue.

However, it is a good idea to familiarize yourself with these terms, especially if you plan to use micro or nano accounts for trading.

For the purpose of this article, there are four common foreign exchange debts. I’m pretty sure there are others, but these are the largest foreign exchange brokers can provide.

- General;

- Miniature;

- Micro; and,

- Nano

These three names represent various devices that you can change. This gives us the name of the various qualities or gadgets you want to buy or sell.

As you can see, the nano batch is one-thousandth of the preferred batch. Therefore, if one point circulated on the EURUSD with a regular lot is equal to 10 USD, then the lot in nanometers may equal 0.01 USD.

If you open a popular account, then you can choose to replace micro or micro quality. Now, if you want to change the trendy use of large amounts of mini or micro debt, equality is not always practiced; the purpose of these regulations is to prevent large transactions in mini, micro, and nano debit transactions.

Having said that, I found that some agents absolutely ignore these restrictions, which surprised me why they have no restrictions at all.

But this is a general concept. As you can see, the potential for replacing small hands is so small that 1 point is equal to $ zero.01, so the first thing that works is one hundred dollars.

Feasible, but unlikely now

With the emergence of micro and nano banknotes in many foreign exchange agents, in fact, you only need a minimum of one hundred dollars. Heck, I found that some people only offer a minimum deposit of $ 1.

Many brokers also provide at least one: 1,000 leverage. Combining it with a minimum deposit of $ 1, they created a ticking time bomb for undoubted traders.

Fortunately, the reality that you are analyzing here means that you will not be attracted to this kind of plan.

Just because you might do something does not always mean you should do it. So if the forex broker offers a way to start with one hundred dollars, have you accepted it?

It depends on many factors, but if there are as many as me, the solution may not usually be.

We will go into details later, but for now, just know that it depends on the opportunity. What percentage do you or others turn your one-hundred-dollar account into one hundred thousand dollars?

Quite slim.

It is difficult to display a $ 5,000 or $ 10,000 account as six certain amounts, but it is almost impossible to do it with only one hundred dollars.

As a foreign exchange trader, your task is to accumulate odds according to your choice. You may have already done this when comparing other settings, but it is equally important (if it is not so important now), you can determine the starting length of your account.

Money and emotion

Money is a powerful aspect. Too much loss in the transaction process, you will be postponed entirely out of the belief that you risk taking cash in the financial market.

However, there is another aspect of cash and emotion that haunts our buyers, which may be a sense of accomplishment and pride.

Welcome bonus forex $100

Get our welcome bonus forex 100 and start your forex trading career. Try our award-winning platform for free on any device and develop your trading skills.

FREE $100 BONUS TO TRADE - AM broker gives you free money to start your forex journey and trade real

BOOST YOUR SKILLS - besides $100 you get a full set of educational materials and trading strategies

DOUBLE YOUR BONUS - refer 3 live clients and get no deposit bonus of $100

How to get the welcome bonus forex 100?

Step 1: sign up

Just enter your details into the fields of our online form and click ‘submit’. Once email is confirmed you will be able to access the trader's room.

Step 2: open real account

Click on create an account, select real account, leverage 1:500 and USD as currency. You will receive an email with the credentials: login and password.

Step 3: upload documents

Fill out your personal profile and upload the required documents: ID copy, bank book and proof of residence.

Step 4: activate your account

Deposit a minimum of $30 to activate a real trading account and be eligible for the welcome bonus.

Step 5: claim your bonus

Click on "promo codes" and type in "WELCOME100" to be eligible for the welcome forex bonus 100. Click on "claim your bonus" to activate the campaign and the 100$ forex welcome bonus will be visible in your live trading account.

Step 6: start trading

Access the trading account from any device with metatrader 5 for desktop, web and mobile and start trading. The maximum profit you can withdraw is 200$. Good luck and happy trading!

Welcome bonus forex 100 faqs

This promotion gives new client a chance to test our trading conditions (execution, spreads, work of the trading platform) on the real account (on the real trade server). If the client likes trading conditions, he/she can fund account and continue trading with us.

As an international company, AM broker respects the anti-money laundering (AML), meaning that clients can not receive funds without depositing funds previously. Allowing profit withdrawals from free money offerings may put ourself and our clients at risk. Clients have to make an extra $30 deposit to be able to get the welcome bonus and withdraw funds according to the AML policy.

You can easily add more funds to your real accounts by logging in to AM broker trader’s room. Once you log in to trader’s room, click the deposit button and select one of the multiple options available with AM broker.

The welcome bonus forex 100 can be used by the client in trading operations without any restrictions. You can use automated trading or scalping techniques, any trading method is allowed with AM broker

You can receive a welcome bonus forex 100 only once. It is an welcome bonus. However, you can get a new type of bonus for any of your new deposits with AM broker.

You can get up to 25% bonus at deposit and 12% fixed annual interest for your next deposits at your wish. Just choose the suitable campaing, make a deposit and claim your new bonus.

If you forgot your username, please contact us for assistance. If you forgot your password, please go to trader’s room to reset your password.

- Trading

- Trading

- Accounts

- Demo trading

- Margin requirments

- Trading platform

- Web trading

- Android trading app

- Ios trading app

- Markets

- Markets

- Forex

- Indices

- Shares

- Funds

- Commodities

- Resources

- Resources

- Economic calendar

- Robo advisor

- Trading signals

- Webinars

- Courses

- Other

- Other

- Become a partner

- Marketing affiliate HUB

- Fixed annual bonus

- Bonus at deposit

- About us

- Contact

- Support center

Cfds are complex financial instruments traded on margin. Trading cfds carries a high level of risk and may not be suitable for all investors. Please ensure that you understand the risks involved as you may lose all your invested capital. Past performance of cfds is not a reliable indicator of future performance. Most cfds have no set maturity date and a CFD position matures on the date an open position is closed. Please read our ‘risk disclosure notice’. When trading cfds with AM globe services LTD, you are merely trading on the outcome of a financial instrument and therefore do not take delivery of any underlying instrument, nor are you entitled to any dividends payable or any other benefits related to the same.

AM globe services ltd. Is the holding company of AM broker.

AM globe services ltd, the financial services center, stoney ground, kingstown, st. Vincent and the grenadines is incorporated under registered number 24863 IBC 2018 by the registrar of international business companies, registered by the financial services authority of saint vincent and the grenadines.

AM glober services ltd reserves the right to amend and upgrade its policies, terms and conditions. Most updated and valid company policies are published on AM broker website. Using any services of AM broker, clients and partners agree with the current terms and conditions provided in the company's agreements and legal documents. Clients and partners are considered aware of all risks concerning financial services and charges applied by AM globe services ltd.

Please be advised, the services and products described on this website are not offered to citizens of E.U. Member states, the united states, canada, japan, turkey and australia. AM globe services ltd and its products and services offered on the site www.Ambroker.Com are NOT registered or regulated by any U.S. Or canadian regulator and not regulated by FINRA, SEC, NFA or CFTC.

© AM globe services ltd. All rights reserved.

So, let's see, what we have: fxdailyreport.Com unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little at start trading forex with $100

Contents of the article

- No deposit forex bonuses

- Fxdailyreport.Com

- How to start forex trading with $100

- How to start trading forex with only $100

- How to start forex trading with $100 and turn it...

- No forex trading experience: what should I...

- Can I gain trading experience without losing...

- How do I choose a brokerage for my live...

- Can I start trading with $100?

- Why starting with $100 is A smart choice?

- Bottom line

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- How to trade forex with $100

- Can you trade forex with $100?

- Should you trade forex with $100?

- How to trade forex with $100

- How do you trade forex with $100 and...

- How do you really trade forex with...

- 1. Learn more about forex trading and its...

- 2. Understand leverage in forex

- 3. Focus on the trading process, not on...

- 4. Balance life, realistic expectations &...

- 5. Treat your small account the same you...

- 6. Learn to control your emotions when...

- 7. Build a consistent track record to...

- How to manage a small forex trading...

- Trading forex with $100:...

- Key points

- How to trade forex with $100

- Step 1: research the market.

- Step 2: open a demo account.

- Step 3: fund an account and start trading.

- How to start trading forex with $100

- Can I start trading forex with $100?

- Is it possible to earn a living by trading...

- When should I start trading forex?

- Bottom line

- How to start forex trading with only $100-$150?

- Welcome bonus forex $100

- How to get the welcome bonus forex 100?

- Step 1: sign up

- Step 2: open real account

- Step 3: upload documents

- Step 4: activate your account

- Step 5: claim your bonus

- Step 6: start trading

- Welcome bonus forex 100 faqs

Comments

Post a Comment