MetaTrader 5 (MT5), xm traders.

Xm traders

No, you can’t. You need to have an XM MT5 trading account. To open an XM MT5 account click here.

No deposit forex bonuses

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Metatrader 5 (MT5)

Why XM MT5 is better?

The XM MT5 offers all the pioneering features that the XM MT4 has to offer, with the addition of 1000 CFDS on stocks (shares), which makes it the ideal multi-asset platform. Trade forex and cfds on stocks, gold, oil and equity indices from 1 platform with no rejections, no re-quotes and leverage from 1:1 to 30:1.

XM MT5 features

- Over 1000 instruments, including stock cfds, stock indices cfds, forex, cfds on precious metals and cfds on energies.

- 1 single login to 7 platforms

- Spreads as low as 0 pips

- Full EA functionality

- One click trading

- All order types supported

- Over 80 technical analysis objects

- Market depth of latest price quotes

- Hedging allowed

XM MT5 - 1 platform, 6 asset classes

Gain access to the world’s financial markets.

- Download the terminal by clicking here (.Exe file)

- Run the XM.Exe file after it has downloaded.

- When launching the program for the first time, you will see the login window.

- Enter your real or demo account login data.

- Multi-asset platform for over 1000 instruments

- Ability to display 100 charts simultaneously

- Supports all order types, including market, pending, stop orders, and trailing stop

- Over 80 technical indicators and over 40 analytical objects

- Superior built-in MQL5 development environment

- Mobile trading for android & IOS

- Web trading for windows, mac, linux operating systems

- Internal mailing system

- Operating system: microsoft windows 7 or higher, the 64-bit version of windows 10 strongly recommended

- Processor: with SSE2 support suitable for all modern cpus (pentium 4/athlon 64 or higher)

- Other hardware requirements depend on the specific platform use (e.G. Load from running MQL5 applications, number of active instruments and charts)

- STEP 1: click start → all programs → XM MT5 → uninstall

- STEP 2: follow the on-screen instructions until the uninstall process finishes

- STEP 3: click my computer → click drive C or the root drive, where your operating system is installed → click program files → locate the folder XM MT5 and delete it

- STEP 4: restart your computer

How can I gain access to the MT5 platform?

To start trading on the MT5 platform you need to have an XM MT5 trading account. It is not possible to trade on the MT5 platform with your existing XM MT4 account. To open an XM MT5 account click here.

Can I use my MT4 account ID to access MT5?

No, you can’t. You need to have an XM MT5 trading account. To open an XM MT5 account click here.

How do I get my MT5 account validated?

If you are already an XM client with an MT4 account, you can open an additional MT5 account from the members area without having to re-submit your validation documents. However, if you are a new client you will need to provide us with all the necessary validation documents (i.E. Proof of identity and proof of residency).

Can I trade stock cfds with my existing MT4 trading account?

No, you can't. You need to have an XM MT5 trading account to trade stock cfds. To open an XM MT5 account click here.

What instruments can I trade on MT5?

On the MT5 platform you can trade all the instruments available at XM including stock cfds, stock indices cfds, forex, cfds on precious metals and cfds on energies.

The online trading platform metatrader 5, or commonly known as MT5, is the successor of the well-known metatrader 4 (MT4). It was developed by metaquotes software corp., and initially released in 2010 as a beta version. Over the years, metaquotes had invested in continuous development, testing and improvements, which made MT5 today as the next generation of trading platforms with extended possibilities.

The biggest advantage that MT5 possesses over its predecessor is its flexibility to offer an extended number of instruments from various asset classes with different settings, all tradable from the same interface and the same trading account.

Metatrader 5 (MT5) takes the famous charting package and the automated trading possibilities to a whole new level. All the features that made metatrader 4 (MT4) the platform of choice have been kept and have been upgraded to a more sophisticated back end infrastructure that can support trading on multiple instruments from various asset classes.

Multi-asset trading on MT5

MT5 gives online investors the option to trade on multiple asset classes ranging from forex (currency trading), contracts for difference (cfds) for individual stocks (shares), stock indices, precious metals, energies and commodities.

Whether for beginner, more advanced or professional online traders, MT5 has opened up new perspectives to not just trade but also gain better visibility across different markets and different asset classes.

Moreover, in the 21st century, the ability for online investors to trade various financial assets from one account offers the benefit of strategic asset allocation (or asset management), with the primary aim to allocate the invested capital in several different assets and manage risk according to market volatility, as well as according to how those assets perform in the short or in the long run.

Advantages of MT5 in online trading

The multi-functionality of the MT5 platform includes powerful features, which were all developed with state-of-the-art technology and by keeping several major criteria in mind, the most important ones being the same second to none charting package, the possibilities and flexibility of automated trading (algorithmic trading) and now a diversity of markets supported.

For both beginner and professional traders MT5 ensures platform features and functionalities that are in line with the highest expectations of any online investor today. These include the variety of pending order types (buy limit, buy stop, sell limit, sell stop, buy stop limit, sell stop limit); a database that holds an unlimited number of trade positions that can be placed and the cutting-edge programming language MQL5 that allows traders to program their own trading robots and indicators customized to their individual trading preferences and choice of financial assets to trade on.

Mobile trading on MT5

The MT5 suite comes with apps for both ios and android devices that offer full access to your account while on the go, with features including the unrivalled mobile chart plus technical analysis options with over 30 built-in indicators and 24 analytical objects.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited, registration number HE251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

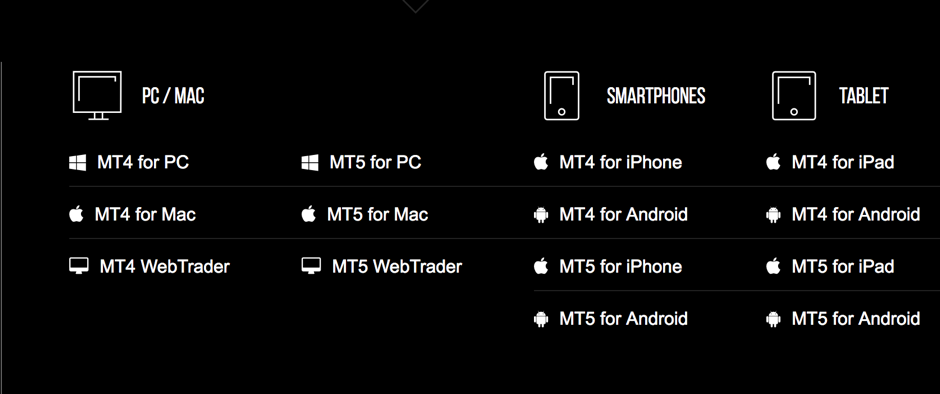

Platforms

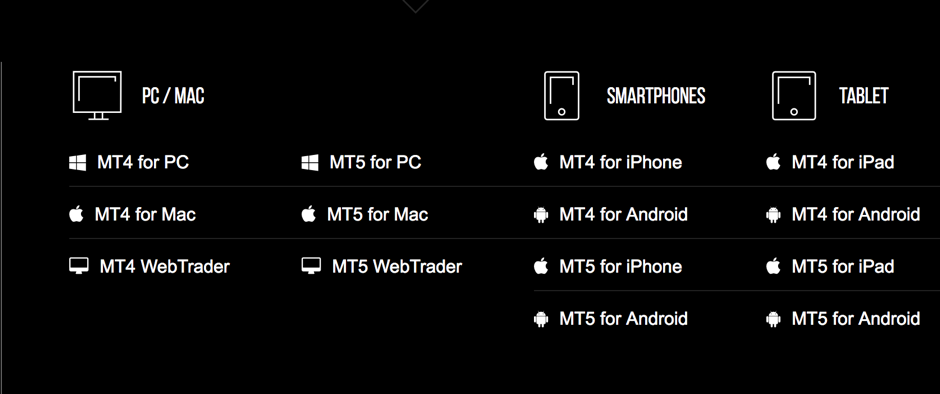

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

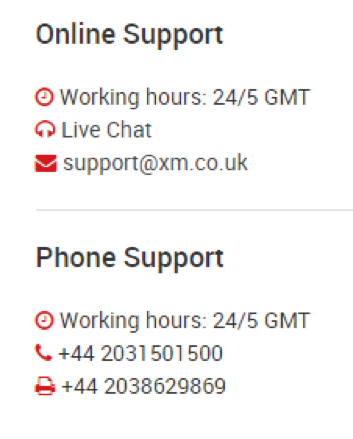

Customer support

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM review

Trading point of financial instruments

XM group is a group of online brokers. XM group offers the MT4, MT5 and webtrader currency trading platforms. XM.Com offers over 55 currency pairs and cfds on stocks, metals, commodities, equity indices, and energies for your personal investment and trading options.

Former websites of this broker include trading-point.Com.

Other websites related to this company include xmtrading.Com, pipaffiliates.Com, xmarabia.Net, XM.Co.Uk, xmsina.Com.

Broker details

Live discussion

Join live discussion of XM.Com on our forum

XM.Com profile provided by chris zacharia, mar 28, 2017

XM is a forex broker. XM offers the metatrader 5, metatrader 4 and mobile global forex trading top platforms. XM.Com offers over 55+ forex pairs, stocks,cfds, equities, indices, metals, and energies for your personal investment and trading options.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Super legit platform

I have started trading with real money on december 7,2020 and at the end of the month thursday 31 my account was up approximately 53 % .

Everything is working more than expected. And if there is more than five starts for evaluation I will give them all the starts in the sky. What a wonderful company .

They are very honest and sincere and think of clients more than themselves. Any question I ask I get a prompt reply from professional works that really appreciate to help you make money as they earn money too. It is a win win game.

In short, there is no company as good as xm.Com it is really the business itself.

Deposit easy, but its difficult to withdraw

I ve been trading for 2 months use XM broker, yesterday as i want to withdraw quite large above 3000usd suddenly they ask for scan of my bank account with my name on it, i understand that this is for security.

So I sent them as they request, but then they reply I need to sent from my registered email. Now the registered email using gmail that has dots, they receive my email without dots( so they assume its not registered how come since they sent all the daily confirmation to my same email address)

So i ve already change the email with dots and until now there is no reply from them

I just got info that XM has been awarded with best global forex 2020, and I hope they act like one

Length of use: over 1 year

Length of use: over 1 year

I am utterly disappointed with XM, yesterday they recorded a lower price compared to other platforms and brokers. Due to this irregular behavior and price move, my positions were stopped out and thus disrupting my day, throwing me off balance completely.

Can anyone let me know if such behavior is possible? Customer support always gives you generic response, the feeling of helplessness when you discover your broker does not have your best interest at heart is devastating.

I am now convinced that perhaps I should look for another broker.

I am new to FPA, but I have been looking at the site for a long time, I saw the alerts about xm, but as I had support in portuguese I decided to take a chance, I figured that the problems described might not occur to me!

It was a big mistake on my part, i made some deposits, and i went through unsuccessful operations i lost a good amount of money at xm, so far so good, they are not to blame for that. When I finally make a new deposit and I have a "good" day, I deposited 100 and made 105.71 of total profit 105.71, I thought I will make a withdrawal and continue using the broker, that's when my headache started, I asked for the withdrawal via neteller, in which I had already deposited an amount, my withdrawal was denied and I was asked to withdraw via an astropaycard which had been the method of my last deposit, I went to the chat to complain, because I know about the money laundering law, I should be able to withdraw a part by neteller, after much discussion I was informed that I should withdraw by astropaycard, I accepted and withdrew, but in just 2 minutes after leaving the chat the following email arrived:

Important news

dear client,

We are contacting you regarding account (s) number 40025313 ("your account (s)") maintained at our company.

The trading patterns in your account (s) raise serious concerns regarding the trading bonuses credited to your account (s), as these were used in “cash-back arbitration” activities.

In accordance with the terms and conditions applicable to our credit bonuses, the following activities qualify as "cash-back arbitration":

any form of commercial arbitration

bonuses claimed by multiple accounts that have been registered using the same IP address

various bonus handling practices

violation of any points that are included in our bonus terms and conditions

any fraudulent activities, disputes or situations that our company considers to be fraudulent.

Given the fact that your account (s) trading patterns do not comply with the terms and conditions of the respective trading bonus program, we regret to inform you that any bonuses previously assigned to your account (s) will be deducted, with immediate effect and your account (s) is / are not eligible to participate in any future trading bonus programs.

Please note that our decision on this matter must be considered as definitive and binding on all participants and that, in addition to the notification set forth hereinafter, no further correspondence will be made on the matter in question.

I know that there are people who abuse the bonus programs, but it is not my case, I would be very happy if XM pointed out a concrete proof to the FPA, because accusing customers of having broken the rules at random is very easy for them to steal customers ! And all this happens only when you ask for a withdrawal! While I was losing money with them everything was great, everything was beautiful, it was me having a small profit that started this antics!

It is not a large amount, but note that in the current situation it is complicated to keep losing small amounts! The worst is the feeling of helplessness that we have when dealing with these scams!

I have further investigated the issue raised in your review and I can confirm that it was correctly decided that you will no longer be eligible to participate in any trading bonus programs, due to the nature of your trading activity.

Particularly and for your better understanding, please note that the trading patterns and trading behavior in your trading account(s) held with our company indicated that you were exploiting arbitrage opportunities. As you were accurately informed by the relevant department of our company via email, any actions taken in relation to your trading account(s) were fully in line with our company’s controls and procedures. At this point, I would like to stress the fact that no adjustments were performed to your trading account(s).

In view of the above, kindly note that the same trading conditions will apply to any new trading account(s) registered with our company. In this respect, I regret to inform you that your request to remove these trading conditions from your trading accounts is rejected.

I hope that the above information explains what has occurred, and I would like to assure you that it is not our wish to trouble our clients and further confirm that we always abide by the client - company agreement which governs our business relationship.

Length of use: over 1 year

Please note that I have investigated the issue raised in your review and I can confirm that your withdrawal request under question was correctly and successfully executed by our back office department as per our internal withdrawal procedures.

Notwithstanding the above, you have contacted our company claiming that you did not receive the relevant funds as such, our personnel correctly informed you that in order for us to be in position to escalate the case we need some supporting documents. More specifically, you were requested to provide us with a bank statement starting from the date of the withdrawal (i.E., 25/11/2020) as proof of non receipt of the funds so as to investigate further with the bank.

Due to the fact that we were not provided with the requested document, the relevant department of our company was not in position to escalate the case and as such, I would like to inform you that once we are provided with the requested proof, all the necessary actions will be taken.

I have further investigated the issue raised and I can confirm that the reason as to why your withdrawal requests are being rejected is due to the fact that the bank details submitted are invalid.

Particularly and as you were accurately informed via email by our back office department, we were unable to proceed with your withdrawal requests, as the bank account information you have provided us with was incorrect. At this point, I would like to stress the fact that you submitted several withdrawal requests using different bank accounts; however all of them were bouncing back as invalid.

In addition to the above, I can further confirm that you were requested to provide additional documentation in order to prove that all bank details you input were correct, but we never received any documentation from you and as such, we could not raise the case to our payment service provider.

I would like to assure you that it is not our wish to trouble our clients and further confirm that upon receipt of the requested documentation, the relevant steps will be taken.

Low lavrage

Length of use: 6-12 months

Length of use: over 1 year

->->->->->->->"is hedging allowed on XM MT4/MT5 trading accounts?

Answer:

Yes, you can hedge your positions as much as you can with XM.

The margin requirements will be balanced out and there is no required margin for hedging with XM.

However, for hedging CFD instruments, margin is only required once.

*even when hedging positions, the required margin can be increased due to market conditions.

Please note that XM does not allow ‘arbitrage’ trading on their trading platforms.

There are certain rules to protect other traders and the broker’s benefit. For more information, please refer to XM’s terms and conditions or contact the support team.

Date: mo., 9. Dez. 2019 um 01:01 uhr

subject: important notice - account no. 19123879, 19125255, 19122186, 19125256, 19117576, 18059051, 21188365, 19124598, 19124597, 21188390

to:

cc: christos gogas

Dear sir/madame,

we are writing in connection with your account no. 19125255 19125256(hereinafter “your account”) with our company.

In that regard, our anti-fraud department has brought to our attention that the trading patterns in your account(s) raise serious concerns that your account was being used for ‘arbitrage’ activities.

Pursuant to the terms and conditions such activities are being qualified as fraudulent.

Accordingly, we regret to inform you that, in accordance with the terms and conditions, we have decided, with immediate effect to:

- close all of your trading account(s);

As a result, you are kindly requested to submit a withdrawal request for your remaining balance through the withdrawals section of our members area and this shall be processed accordingly. If no withdrawal request is received within the next 48 hours, your funds will be sent back to the source.In view of the above, please note that you will be strictly prohibited from opening any new trading account(s) and trade with our company. Nonetheless, in cases where you may successfully open an account and trade with our company due to any technical and/or human error, we reserve every right to immediately close your account upon identification, nullify any profit/loss generated and refund the original amount of deposit, excluding any deposit and withdrawal charges, back to the same source of deposit.

Please note that, in accordance with the terms and conditions, our decisions are final and binding on all participants and that, other than the notification set forth herein, no further correspondence will be entered into.

Kind regards

--

XM team

Hello,

I don't use "arbitrage". I only use hedging with 2 accounts. I've been your customer since 3 years and you wanna close all my accounts yet?You will lose a lot of customer because I did free marketing for you. I told all my own customer about you. In these 3 years I never did a mistake and now you will close all my accounts?Then I will switch to another broker and tell all my customer what you do. I like XM and I show my loyality to XM. But you close negative trades and I lose one whole day. How you will make it good?

Best regards

anthony ******

That's now 1 year ago. I write them a new message some days ago to clarify:

Hello,

it‘s now 1 year ago you close all my accounts because you say I did arbitrage. I said to you, I don‘t did arbitrage. I hedged my trades but you don‘t give me a chance to show that. You didn‘t show me any proof. Now I work with a lot of big other brokers. I‘m ready to apologize your mistake because I want to be a customer of xm. Because I know xm has good conditions. Is it possible to clarify? For me it‘s not important. I can be a customer from the other brokers too. That’s your decision. I am not dependent on you. So you can choose now, if you maybe has a very loyal customer, who recommends you to other people or you haven‘t.

Best regards

anthony ******

---------- forwarded message ---------

von: christos gogas

date: mo., 19. Okt. 2020 um 10:54 uhr

subject: my account 19117576

to:

Dear sir/madam,

thank you for contacting us.

Regarding your concern I would like to ask you to refer to the email you received about the status of your account.

Kind regards,

I think they don't read the message, they are all to lazy to clarify that. XM has good conditions but the support isn't existing.

Dec 26, 2019 - 2 stars hello,

XM has good conditions for their customers.

I prefer the deposit bonus and the margin stop out level. The spreads are very stable.

But the support ist terrible. I have been your customer for more then 3 years.

I never did a mistake.

For more then 2 weeks ago I opened two low spread accounts. With one account I bought EURUSD and with the other I sold EURUSD. At the midnight I got a message that I'm a scammer because I used "arbitrage". That's not f***ing arbitrage. That's hedging. So they close all my accounts. After that I wrote a message to my account manager and to the support. I replied the message of them. But they only wrote back "we can't do anything".

What the hell. I was a very loyal customer, I told other people that xm is the best broker. Some of my customers are customers of xm because I told them about them.

You can make one mistake and they give a f on you. That's not a support. They should get 0 stars for that. But I see the positive sides too.

I'm very angry about that. They destroyed my ranking on MQL5 and had stolen more than 4 hours of my life. But thanks to god. I got a meesage from another broker which want to work with me. I would have deposit a very big amount in xm. But now it's to late. I don't want to work with a broker who gives a f on their customer. Bye.

Reply by chris zacharia submitted jan 8, 2020 dear at0nu5,

In order for us to properly investigate this and be able to provide you a comprehensive reply we would need the account number of one of the accounts which you used.

Reply by chris zacharia submitted oct 30, 2020 dear at0nu5,

Following investigation of your trading accounts and trading activity, I can confirm that our business relationship was correctly terminated due to the fact that you were placing opposite orders within your trading accounts. Kindly note that the latter is also confirmed by you in your review above.

This cannot be deemed as an acceptable strategy as you create an environment which does not follow the fair rules of trading and makes the strategy in a way risk free and therefore not permitted. It should be also noted that the latter constitutes a violation of our terms and conditions of business. In addition to the previously-mentioned, I can confirm that the remaining balance in your trading account has been withdrawn.

In view of the above, I regret to inform you that unfortunately, due to the above violation, we are not in position to accept you as a client again.

Kindly note that our company allows its clients to use the hedging strategy; however, by placing opposite orders in-between your trading accounts, you create an environment which does not follow the fair rules of trading and makes the strategy in a way risk free(i.E., exploiting arbitrage opportunities) and therefore not permitted.

Due to our “no negative balance” policy, the trading strategy described above would have limited the potential loss to the entire balance of the account having the loss-making position and the account having the profit-making positions to have unlimited upside potential which would duly cover the losses suffered in the loss-making account.

In this respect, kindly bear in mind that the above cannot be deemed as an acceptable strategy and it is considered as a violation of the company’s terms and conditions of business.

Frequently asked questions

Is XM a good broker?

The best way to answer if XM is a good broker is to read the unbiased traders reviews on forex peace army. Https://www.Forexpeacearmy.Com/forex-reviews/7214/xm-forex-brokers.

Please come back often as broker services are very dynamic and can improve or deteriorate rapidly.

Additionally, we recommend to check recent XM broker community discussions: https://www.Forexpeacearmy.Com/community/tags/xmcom/

What is the minimum deposit for XM broker?

XM brokers offers several account types. Micro and standard accounts have a minimum deposit of $5. Other account types vary in their minimum deposit requirements by region.

How do I deposit money in to my XM broker?

XM's broker deposit procedure is fairly straightforward. Once the account is registered and approved, follow these simple steps:

- Login to XM broker members area.

- Select the deposit method (credit and debit cards, neteller, bank wire transfer or other).

- Select the XM account and specify the deposit amount.

- Enter the appropriate payment details.

Funds availability depend on the funding method, with card deposit being "instant". If you have any questions or problems contact XM broker live chat.

How long does it take to withdraw from XM?

XM broker says they process nearly all withdrawal requests within 24 business hours.

Then it may take another 2-5 business days for the bank to process wire or for card transaction to be reflected in your account.

For faster XM withdrawal you may opt for the XM card or e-wallet, these payments are received the same business day.

Can I withdraw XM bonus?

Profits made by trading XM bonuses are withdrawable. However, you can not withdraw XM bonus itself.

Check the terms and conditions of any bonus program before accepting a bonus.

How much can I withdraw from XM?

XM's minimum withdrawal amount is $5 for credit/debit cards and e-wallets and is $200 for the bank wire.

The maximum withdrawal amount from XM is determined by the payment method with bank wire limits being the highest.

Please be aware of the XM withdrawal priorities, if you deposited money with the credit card or e-wallet, then withdrawal is processed via the same method up to amount deposited before you are able to select other withdrawal methods.

Does XM allow scalping?

XM allows scalping as well as trading during time of increased volatility.

It is always a good idea to check fresh reviews on forex peace army to see if traders recently encountered any serious problems with scalping using XM trading platforms.

Https://www.Forexpeacearmy.Com/forex-reviews/7214/xm-forex-brokers.

What is XM zero account?

XM zero accounts feature near-zero spreads (EURUSD average spread is as low as 0.1 pips) and a no requotes execution policy with all trading styles welcome.

The trade off is a broker commission of $7 per lot round turn charged when opening the trade.

Some regions may have different account options.

Is XM a regulated broker?

XM broker is regulated by several government regulators:

- Australian securities and investments commission (ASIC), registration #443670;

- Belize international financial services commission (IFSC), registration #IFSC/60/354/TS/18;

- Cyprus securities and exchange commission (cysec), registration #120/10.

Does XM charge commission?

XM broker offers several account types:

- Micro account and standard account are commission free

- XM zero account features ultra-thin spreads but charges commission of $7 per round lot traded payable at the order opening time

- Some regions may have other account types

What is XM leverage?

XM offers flexible leverage from 1:1 to as high as 888:1 that can be instantly changed in your account members area.

Higher leverage allows to trade the borrowed capital which increases both the profit potential and the risk of loss.

Some trading strategies like automated scalping may require high leverage while many professional traders do not use much leverage.

Please trade responsibly selecting the leverage based on your risk appetite and loss tolerance level. Some regions may only offer lower leverage.

XM review and tutorial 2021

XM.Com offer a range of account types and a low minimum deposit to appeal to all levels of trader. With 1000+ markets and low spreads they offer a great service.

XM.Com deliver ultra low spreads across a huge range of forex markets. Flexible lot sizes, and micro and XM zero accounts accommodate every level of trader.

XM review; touted as the next generation broker for online forex and commodity trading, XM global webtrade is suitable for beginner and seasoned traders alike. Traders can get started with the trading software real account, or test the waters with a demo account platform with $100,000USD of virtual currency.

Highlights of this particular broker service include auto trading, no hidden fees or commissions and fast order executions, with 99.35% taking place in under 1 second.

Company details

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

The platform boasts over 1.5 million clients with traders in 196 countries. The XM ethos is all about being big, fair and human. The company prides itself on things like excellent customer service and a personalised approach for every client, no matter their investment goals.

XM trading platform

XM offers 2 trading platforms which are accessible from both real and demo accounts. The multi-award winning metatrader 4 is predominantly a forex trading platform that supports stop, limit, market and trailing orders.

The metatrader 5 platform is a multi-asset trading platform which also offers access to stocks, stock indices and precious metals. Both platforms are available on apple and android devices, which makes for a smooth and easy-to-use mobile trading experience.

The trading area offers additional, optional tools, such as economic calendar or trade volume stats.

Assets / markets

This broker has more than 1000 financial instruments which can be traded on the MT4/MT5 platforms and this includes forex trading, stocks cfds, commodities cfds, equity indices cfds, precious metals cfds and energies cfds.

Forex trading is available on over 55 pairs, including the major USD, GBP, EUR and JPY pairs.

XM does not offer binary options or futures.

Spreads & commission

Spreads vary depending on the kind of account opened. It’s possible to open a micro account, standard account and XM zero account. The minimum spread across all accounts is 0.1 pips, and the average spread for a major pair such as EUR/USD is 0.1 pips.

XM operates a strict “no hidden fees or commission” policy. As such, commission is only given for XM zero accounts. XM covers all transfer fees and same-day withdrawals are guaranteed.

Leverage

Depending on the instrument, the leverage can range from 2:1 to 30:1. This is completely flexible and XM offers its clients the chance to manage their own leverage risk. Margin requirements remain constant throughout the week and never widen at weekends or at night.

This leverage applies to clients registered under the EU regulated entity of the group.

XM mobile apps

XM is available on a number of android and apple devices, including apple iphone, apple ipad and android tablets and android phones. Login is super-easy and can be done via fingerprint. You can download their apps from the apple app store or the google play store.

They are both fully functional and allow for monitoring and trading on-the-go. The desktop platforms for PC and mac both support one-click trading.

XM global trading platforms

Payment methods

In line with conventional KYC regulations, users need to provide a colour copy of an official identification document such as a passport or a driver’s license. They also need to provide a recent utility bill dated within the last three months as proof of address.

Once registered, the minimum deposit amount is $5 for micro and standard accounts, while zero accounts require a minimum deposit of $100.

Deposits can be made using most major credit cards, electronic payment methods, wire transfer, local bank transfer and more.

Deposits can be made in any currency and it will be automatically converted into the currency you select as your base currency when opening the account.

All withdrawals are processed in 24 hours and there are no fees to take your money out of your ewallet.

Demo account

XM excels in its demo account offering. Users can set up a demo account with just a few details and then get trading with a virtual balance of $100,000USD. The XM demo account is unique in that it offers exactly the same trading conditions as the real thing.

There are no time limits on how long you can use your demo account.

Bonus deals and promotions

XM also offers a free VPS (virtual private server) service to help increase the speed of trades. This VPS is accessible from anywhere and available 24/7. They claim to eliminate downtime and are available across the globe.

XM are also offering commission and fee free withdrawals and deposits.

As an EU regulated brand, XM comply with the ESMA ban on bonuses, and the $30 deposit bonus is no longer available to EU traders.

Regulation and licensing

As noted above, XM group has a range of brands covered by different regulators.

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

Additional features

One of the biggest perks available on the XM platform is the wealth of training and educational materials available. The platform hosts regular webinars aimed at newcomers and seasoned professionals alike.

The platform is inherently social, encouraging users to learn from their team of instructors. The company also published research and technical analysis.

XM MT4 and MT5 forex trading

XM account types

There are four levels of trading account, micro, standard and zero. All accounts allow up to 200 open/pending positions per client.

- Micro accounts: micro accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and can get started with a minimum deposit of $5USD. 1 micro lot is 1,000 units of the base currency.

- Ultra low accounts: XM ultra low accounts, can use EUR, USD, GBP, AUD, ZAR, SGD as the base currency and traders will require a minimum deposit of $50 USD. 1 standard ultra lot is 100,000 units of the chosen base currency, whereas, 1 micro ultra lot is 1,000 units of the base currency. XM ultra low accounts are not applicable to all entities of the group.

- Standard: standard accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and traders can get started with just $5USD. 1 standard lot is 100,000 units of the chosen base currency.

- Zero accounts: zero accounts can use USD, JPY and EUR as the base currency and traders will require a minimum deposit of $10USD. Like the standard account, 1 standard lot is 100,000 units of the chosen base currency.

Benefits

XM offers a full-service education package on forex, ideal for those making their first steps into trading.

However, this isn’t at the expense of the more seasoned professional, who also have access to expert analysis and unparalleled tracking tools. As a company that prides itself on solid customer service, their users are well-served with support available in many different languages.

Drawbacks

While the support may be strong, some users dislike that customer support is only available monday to friday. Another disadvantage is the lack of diversity between the different account types makes for a less personalised feel.

Other brokers offer more a distinct offering in their accounts, but the micro, standard and zero accounts are almost identical. And finally, paypal deposits are not currently supported, which can be problematic for some.

Traders from certain regions are also forbidden to open an account due to licensing laws, these include canada and the united states.

Trading hours

In line with worldwide forex market hours, XM is available 24 hours a day. For phone trading, the XM trading hours are sunday 22:05 GMT through to friday at 21:50 GMT.

Contact details / customer support

The easiest way to contact XM is through their live chat feature found on the contact page of their website.

You can also email support on: support@xm.Com

Safety and security

There are no obvious security concerns with the website. Users are required to confirm their email address in order to open a demo account but signing up for email updates is not a requirement. In order to open a trading account, identification documents are required.

According to the company privacy policy, XM has organisational procedures in place to ensure that personal data is kept secure.

Overall verdict

XM offers a comprehensive broker service to traders of all levels. Whether you are just starting out and learning the ropes, or if you’re a seasoned trader looking for a reliable and efficient platform, XM is a solid choice.

Despite the shortcomings with the different account options, the platform is easy to use and simple to navigate.

Accepted countries

XM accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use XM from united states, canada, israel, iran, portugal, spain.

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

Platforms

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

Customer support

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM trading review 2020

Michael graw PRO INVESTOR

XM is a well-established broker for forex and CFD trading in the UK. This broker offers nearly 60 currency pairs and more than 1,000 cfds, plus commission-free account options. What especially stands out about XM is that it gives traders access to the full metatrader software suite, which enables you to use automated trading, forex signals, and more.

So, is XM trading the best UK broker for you? In our XM trading review, we’ll take a closer look at this broker to highlight what you can trade, how the trading platform works, and whether XM can match up against competitors like etoro.

What is XM trading UK?

XM is a global forex and CFD broker founded in 2009. The broker is owned by trading point holding, which also owns trading.Com. XM trading is fully available in the UK, and the broker boasts more than 2.5 million clients in 196 countries around the world.

XM trading offers a comprehensive platform with a huge variety of assets to trade. In addition to offering dozens of currency pairs for forex trading, XM has over 1,000 stock, commodity, cryptocurrency, and index cfds. The broker is also dedicated to offering exceptional service, which has helped it build a loyal following among UK traders over the past decade.

XM trading assets

XM offers UK traders access to an incredibly wide range of assets. Let’s take a closer look at all the markets you can do with this broker.

Forex

XM has built its brokerage first and foremost around forex trading and it has earned a reputation as one of the top UK forex brokers. The trading platform currently offers 57 currency pairs with leverage up to 30:1. XM also has several different account types, which we’ll discuss in more detail below, that vary the size of a forex lot and your fees for forex trading.

Stocks and indices

Although XM was founded for forex trading, it’s made huge headway as a stock broker as well. You can trade any of 1,240 stock cfds (contracts for difference) at leverage up to 20:1. The diversity of stocks is very large, as XM allows trading for companies from the US, UK, europe, canada, brazil, and russia. Notably there are no stock cfds to trade from japan, hong kong, or china.

If you want exposure to markets in these countries, though, you can trade 28 different stock index cfds. XM doesn’t offer ETF trading at this time.

Commodities

XM doesn’t have the widest selection of cfds for commodity trading, although all of the most popular commodities are available. For instance, the broker’s 15 cfds allow oil trading for brent and WTI crude, gold trading, and futures trading for a variety of soft commodities like cocoa and wheat.

Cryptocurrency

One thing that UK traders will want to be aware of is that XM does not offer any cryptocurrency trading. This is a major disadvantage for trading with XM in the UK, since nearly all of its major competitors offer cfds for the most popular digital coins.

XM trading account types

XM has three different account types for forex trading: micro, standard, and zero. Which trading account you choose will affect the lot size for forex trades, your fees for forex trading, and what currency you can use for your account.

The micro account is a commission-free account that treats one lot as 1,000 forex future contracts. It’s ideal for beginner and intermediate forex traders who would rather pay spreads than fixed commissions and how want to trade relatively small amounts of money.

The standard account is almost identical to the micro account, except that one lot is equivalent to 100,000 forex contracts. So, it is best if you want to trade larger volumes. Both the micro and standard accounts support 11 different base currencies and have a minimum deposit requirement of just £5.

The zero account reduces spreads for forex trading to as low as zero pips, but introduces fixed trade commissions of $3.50 per lot. The zero account only supports USD, EUR, and JPY as base currencies and requires a $100 minimum deposit. So, expect to pay some additional currency conversion fees when using this account type.

XM trading spreads

Spreads for forex trading and CFD trading at XM are incredibly low, which is one of the biggest reasons that this brokerage is so popular in the UK. XM charges just 1.7 pips for trading the EUR/USD forex pair during peak market hours, which is well below the industry average. At its lowest, the spread can drop to 1.0 pips.

Note that if you have a zero account, the spread can be even lower. During peak market hours, some major forex pairs can have no spread at all.

CFD trading is commission-free, but spreads can vary widely depending on what assets you are trading. Generally, the spreads are much lower than the industry average. For example, XM charges a spread of 0.7 pips for the popular S&P 500 index CFD, compared to an average of over 1 pip at many other UK brokers.

XM trading fees

All XM trading in the UK is 100% commission-free, with the exception of forex trading if you sign up for a zero account. In that specific case, you will pay reduced spreads but a fixed commission of $3.50 per lot with a zero account.

Importantly, XM is relatively light on account fees. You won’t pay a deposit or withdrawal fee at this brokerage, and there is no monthly fee simply for having an account. XM does charge a withdrawal fee, but it’s just £15 after one year of inactivity and £5 per month for every additional month of inactivity.

It also helps that XM supports 11 different base currencies, including GBP. This reduces the amount that you’re likely to spend on currency conversion fees.

XM trading minimum deposit

Micro and standard accounted require a minimum deposit of just $5, while zero accounts have a $100 minimum.

XM trading platform

XM doesn’t offer its own proprietary trading platform. Instead, it gives traders access to the widely used and hugely popular metatrader 4 and metatrader 5 software packages.

The two versions of metatrader are similar in many ways, except that metatrader 4 only supports forex trading. Metatrader 5 supports forex and CFD trading for stocks, indices, commodities, and cryptocurrencies. Both metatrader 4 and 5 are available on your computer as well as through mobile trading apps for ios and android.

The metatrader software comes with a steep learning curve, especially for first-time traders. The layout of the software is somewhat confusing, and it can be difficult to search for specific assets. The main way to find assets is to navigate through a drop-down folder structure, which isn’t all that efficient.

Once you get a handle on the platform, however, it becomes clear why XM relies on metatrader. Metatrader 5 comes with more than 80 built-in technical studies and dozens of drawing tools to help you analyze price movements. In addition, you can easily build your own custom indicators using the software’s purpose-built coding language.

The platform’s charts are exceptionally flexible, too. You can easily switch between candlestick and other types of charts, such as heikin-ashi charts. Metatrader 4 also supports tick-level price data as well, so you can see what the market is doing in real time.

Importantly, metatrader 4 and 5 each support forex signals and forex robots. You can create these using any of metatrader’s built-in indicators or by creating your own custom technical indicators. The software also provides all the tools you need to backtest a strategy to make sure that your signals will work as expected. You can access up to 10 years’ worth of historical price data for any currency pair that XM supports and see how your forex signal or robot would have triggered under past conditions.

XM trading MT4

Why use metatrader 4 for XM trading in the UK as opposed to metatrader 5? Metatrader 5 isn’t simply a newer version of metatrader 4 – there are some important differences between them.

The most relevant to UK traders is that metatrader 4 primarily supports forex trading and only has charts and data for a limited range of cfds. Metatrader 5 has much more support for CFD trading, so it’s the better choice if you plan to trade stocks or commodities with XM.

Another thing worth noting is that metatrader 4 allows you to manage trades individually rather than in aggregate for an asset. This means, for example, that if you have three long positions for the EUR/USD forex pair, you can modify or close each specific position – they are not aggregated into one large position as they would be in metatrader 5. This can be important for more complex trading strategies.

Keep in mind that if you want to use both metatrader 4 and metatrader 5 with XM, you can. XM allows you to open multiple accounts, and you get to decide which trading platform you want to use for each.

XM trading tools

While XM doesn’t offer its own trading platform, it does have a huge variety of tools to help you make trading decisions. To start, the broker offers all the feeds you would expect from a top-tier broker. There’s a news feed that covers global forex, stock, and commodity headlines along with an economic calendar. Both can be filtered by the market that headlines or events are expected to impact.

XM also gives you access to technical research from its in-house analysts. These are typically focused on major and minor forex pairs, and take a closer look at the day’s price charts to identify potential trends or support and resistance levels. XM typically releases several technical analysis posts daily, which can be quite helpful for forex traders looking for a leg up on the market.

Even better, the brokerage offers daily trade ideas that cover the forex, stock, and commodity markets. Most of these are sourced using autochartist, an automated technical analysis software that identifies price patterns. One thing that’s especially nice about these trade ideas is that they come with quality scores and well-defined price targets.

One other critical tool that’s worth highlighting is XM’s technical indicators for metatrader 4 and 5. There are more than 20 custom-built indicators that aren’t standard for these software packages. Better yet, these indicators can easily be incorporated into your trading strategy as forex signals.

Is XM trading legit?

XM trading has been around for more than a decade and is under the authority of some of the most highly respected financial authorities in the world. In the UK, XM is governed by the australian securities and exchange commission. All UK trading accounts are protected by the UK’s financial services compensation scheme in the event that the broker runs into financial trouble.

Another benefit to XM trading is that the broker provides negative balance protection. So, even when you’re trading with leverage, you cannot lose more money than you deposit into your account.

How to use XM trading

Ready to get started with XM trading in the UK? We’ll walk you through how to set up an account and place your first trade with this broker.

Step 1: create an XM trading account

To create an XM trading account, head to the broker’s website and click ‘open an account’ from the menu. You will need to enter personal information like your name, email, and phone number. Then choose what type of trading account you want to open and whether you want access to the metatrader 4 or metatrader 5 platform.

XM requires that you verify your identity in order to comply with government regulations. To complete your registration, upload a copy of your driver’s license or passport.

Step 2: fund your XM trading account

Log into your new XM trading account, navigate to the member’s area, and select ‘deposits/withdrawals.’ you can choose to deposit funds to XM by credit or debit card, e-wallet, bank transfer, or wire transfer. Keep in mind that the minimum deposit for micro and standard accounts is £5, while the minimum deposit for zero accounts is £100.

Step 3: place your first trade

Now you’re ready to place your first trade with XM. You’ll need to do this through the metatrader trading software rather than through your online XM account.

In metatrader, use the ‘symbols’ menu to find a forex pair or CFD to trade. You can browse by asset type or search for an asset by name. Click on the asset to open a chart, then click ‘new order’ to open a new order form.

In the order form, you can select the parameters for your trade like when it should be executed and how much money you want to trade. You can also set a stop loss or take profit level in accordance with your trading strategy. When you’re ready, click ‘buy’ or ‘sell’ to open your first trade with XM.

XM trading pros & cons

wide variety of forex pairs and stock cfds multiple account types for forex trading very low spreads, especially for cfds includes metatrader 4 and metatrader 5 platforms supports custom indicators and forex signals very few account fees

no ETF or cryptocurrency trading doesn’t support social trading metatrader has a steep learning curve for beginners

XM trading vs etoro

Our XM trading review found that this broker offers low spreads, a wide variety of assets, and a capable trading platform. But how does XM stack up against one of the best forex and CFD brokers in the UK – etoro?

Etoro trading edges out XM when it comes to what assets you can trade. While etoro doesn’t have as many exotic forex pairs, the broker offers more than 450 etfs and CFD trading for more than a dozen top cryptocurrencies. It’s also worth noting that you can buy etoro’s more than 800 global shares outright or through cfds depending on your trading goals.

We also found that etoro has slightly lower fees for many assets compared to XM. Etoro’s spreads for major forex pairs like the EUR/USD is just 0.7 pips with a standard account, compared to 1.6 pips at XM. Etoro also keeps its spreads for stock cfds well below the industry average, and all trades – including outright stock and ETF trades – are 100% commission-free.

XM’s trading platform is somewhat more technical than etoro’s, which can be helpful for more advanced traders. For instance, etoro’s charting software doesn’t support backtesting or custom indicators. However, etoro’s trading platform is easier to use, especially for beginners, and the broker has a massive social trading network. This is a major advantage because it enables you to interact with other traders and quickly gauge traders’ sentiments about any asset.

Overall, we think etoro is a better choice than XM for most UK traders. It boasts more tradable assets, lower fees, and a highly versatile trading platform with a built-in social network.

£15 inactivity fee after 12 months

£10 inactivity fee after 12 months

Conclusion

Our XM trader review found that this broker offers powerful trading tools that help it stand out for UK traders. The metatrader 4 and 5 software platforms can be hard to get started with, but they allow you to create custom indicators, backtest a new strategy, or apply forex signals to improve your trading. Even better, XM has its own library of forex signals that you can copy or modify to jumpstart your account.

We liked that XM generally offers low fees, particularly for stock and index cfds. The selection of forex pairs and stock cfds is also very nice, although it’s noteworthy that XM doesn’t offer any ETF trading or cryptocurrency trading. This can be a major blow for UK traders who want to trade a wider variety of asset classes.

On the whole, we would recommend etoro over XM for the majority of UK traders. Etoro beats XM when it comes to the variety of assets you can trade and the spreads for CFD trading. Plus, etoro’s capable trading platform comes with a massive social trading network to help you get an edge on the market.

Ready to get started with etoro? Click the link below to sign up for an account today!

Etoro – best UK trading platform with 0% commission

Can I open a demo account at XM?

Yes, XM allows you to open a demo account for free. Demo accounts never expire, but the account activity will reset after 90 days of inactivity.

Does XM support islamic trading accounts?

Yes, XM allows you to open an islamic or halal account with its micro or standard account types.

Does XM allow me to open more than one trading account?

You can open up to eight trading accounts with XM. They can each be a different type so you can take advantage of different lot sizes and fee structures. You don’t need to verify your identity again when creating an additional account.

Is there a sign-up bonus when I make my first deposit at XM?

XM does not offer a cash bonus when you make your first deposit. However, you can get a free virtual private server (VPS) with your account to increase the speed of your trade execution.

Does XM support forex options trading?

XM does not allow options trading of any kind, including forex options or binary options.

So, let's see, what we have: metatrader 5 (MT5) is based on the metaquotes software and customized to feature no requotes, one click trading and live news streaming for individual stocks, stock indices, forex, precious metals and energies. At xm traders

Contents of the article

- No deposit forex bonuses

- Metatrader 5 (MT5)

- Why XM MT5 is better?

- XM MT5 - 1 platform, 6 asset classes