TOP 5 BIGGEST FOREX BROKERS 2021 UPDATED, largest forex brokers by volume 2021.

Largest forex brokers by volume 2021

For a broker, safety of security is always a must. And the only way to ensure that is through forex regulations.

No deposit forex bonuses

Forex regulations are like licenses that big and reliable financial organizations grant to brokers after making sure that they can keep traders safe. A reliable broker must always has at least one regulation from the country where they do business. About reliability, you can look for the brokers’ regulations to know if they can be trusted. Here are the regulations of our 5 largest fx brokers:

- Exness: 1 dollar

- XM: 5 dollars

- Hotforex: 5 dollars

TOP 5 BIGGEST FOREX BROKERS 2021 UPDATED. SEE FULL LIST NOW!

BRKV – when you first entered the forex market, the first question always is “ who are the top 5 biggest forex brokers?” or “what are the top reliable or best forex brokers?” of course all traders want to trade with the best forex brokers, but it isn’t easy for beginners to recognize those brokers. It’s even quite difficult for experienced traders like us too!

We have traded forex for a long time. Some of us even worked for some forex companies. And for the last several months, we have been researching and contacting various forex brokers to find you the results below. Thanks to our contacts, you can believe that these results are 100% true and totally unbiased. We also consulted some other lists on the internet but we do believe that they are fake. For example, when we searched “top biggest forex brokers” and we find FBS or FXTM in those lists, we instantly know that they are just for the sake of advertising. We know these brokers. They are new brokers and they only target at some countries in southeast asia and africa, so it’s impossible for them to be among the largest forex brokers. Without further ado, here is our list of the 5 largest forex brokers in the world with their highest trading volume in a month:

- Exness: $785 billion/monthlearn more here

- XM: $320 billion/monthlearn more here

- Hotforex: $300 billion/monthlearn more here

- Saxo bank: $300 billion/month

- Forex.Com: $300 billion/month

Which standards to rank the biggest forex brokers?

Of course to rank the largest forex brokers, we should look at their trading volume first. Some brokers publish their trading volume online so that we can find out how many people choose to trade with them. I really appreciate their transparency. But, of course, I can only trust them when they are audited by the top reliable audit companies. And all the 5 brokers I mentioned above are audited by trusted and large companies. I encourage you to trade at these brokers, because they are very transparent. It’s safer for your fund. And for some other brokers who don’t publish their trading volume, I collect their data from trusted resources such as statistic websites, financial news, or big and famous newspapers.

Some big brokers have very high total trading volume such as: forex.Com and saxo bank but actually, their forex volume is just a part of it. It is because they provide many products like crypto, forex, future, commodities, and stock… therefore, the total volume which are shown to us is high but the actual fx volume is lower.

Forex.Com’s total trading volume is $500 billions, but forex volume is $300 billions.

Saxo bank’s total trading volume is $600 billions, but forex volume is $300 billions.As you can see, the forex trading volume is just about half of their total trading volume. In this article, we are focus on the forex trading only.

Exness

Exness is a real deal in this market. No trader has never heard of this broker. The popularity alone shows you how big this broker is.

Exness always has the highest trading volume in the market. That means the clients of this company are all big traders. They trade thousands of dollars everyday. Exness must be some broker who is really trustworthy and amazing so that big players choose to do business with them.

XM is one of the biggest forex brokers in asia. Have you ever been to one of their conventions? I have been to several in malaysia, philippines, indonesia, and vietnam. And I must tell you, those places are packed. XM is considered the destination for professional asian forex traders.

They are reliable, professional, and big. They offer really low prices as well as amazing customer services.

Hotforex

Hotforex is also a well-known name in the forex market. They are a prestigious forex broker who is trusted by a large community of traders from all over the world.

They have a diverse set of trading accounts that meet all the requirements of every forex trader's level. Moreover, they are well regulated and guranteed by big financial companies.

Learn more about hotforex here.

Other standards

However, choosing a forex broker based only on their trading volume? Everyone will say that you’re stupid. I believe you can find other brokers that have higher trading volume but we would not recommend them. Why? Because they can meet the standards we set for the best forex brokers in the world. Our standards are:

| Trustworthy | trading costs | trading conditions | customer services |

| regulations | spread | accounts | payment system |

| historical activities | commission | quotes | local offices |

| trading volume | slippages | trading platforms | availability |

| rebate/bonus | leverage |

Trustworthy

For a broker, safety of security is always a must. And the only way to ensure that is through forex regulations. Forex regulations are like licenses that big and reliable financial organizations grant to brokers after making sure that they can keep traders safe. A reliable broker must always has at least one regulation from the country where they do business. About reliability, you can look for the brokers’ regulations to know if they can be trusted. Here are the regulations of our 5 largest fx brokers:

| " style="background-color:#ace7ff; border-color:black; border-style:solid; border-width:1px; text-align:center"> exness | " style="background-color:#f1f0ee; border-color:black; border-style:solid; border-width:1px; text-align:center"> cysec, FCA | " style="background-color:#ffffff; border-color:black; border-style:solid; border-width:1px; text-align:center"> learn more here |

| " style="background-color:#ace7ff; border-color:black; border-style:solid; border-width:1px; text-align:center"> XM | " style="background-color:#f1f0ee; border-color:black; border-style:solid; border-width:1px; text-align:center"> cysec , FCA, ASIC | " style="background-color:#ffffff; border-color:black; border-style:solid; border-width:1px; text-align:center"> learn more here |

| " style="background-color:#ace7ff; border-color:black; border-style:solid; border-width:1px; text-align:center"> hotforex | " style="background-color:#f1f0ee; border-color:black; border-style:solid; border-width:1px; text-align:center"> cysec, FCA, FSCA | " style="background-color:#ffffff; border-color:black; border-style:solid; border-width:1px; text-align:center"> learn more here |

| " style="background-color:#ace7ff; border-color:black; border-style:solid; border-width:1px; text-align:center"> saxo bank | " style="background-color:#f1f0ee; border-color:black; border-style:solid; border-width:1px; text-align:center"> FCA, FSA | " style="background-color:#EFF6F8; border-color:white; border-style:solid; border-width:1px; text-align:left"> |

| " style="background-color:#ace7ff; border-color:black; border-style:solid; border-width:1px; text-align:center"> forex.Com | " style="background-color:#f1f0ee; border-color:black; border-style:solid; border-width:1px; text-align:center"> FCM, RFED, CFTC, NFA | " style="background-color:#EFF6F8; border-color:white; border-style:solid; border-width:1px; text-align:left"> |

A household name

Moreover, to know whether a broker is reliable for not, you should check how famous it is. If there are many people know of that broker, it is safer to trade with them. There are a lot of forums online where to can ask traders from all over the world how they feel about certain brokers.

Trading costs

About spread, isn’t it great for the biggest forex brokers to have low spread? As you can see in our article about the lowest spread brokers, spread is a factor that many traders pay attention to when considering a forex broker. Our 5 largest brokerages also come with the very low spread rates:

Minimum deposit

The best large forex brokers are the ones who welcome all types of trader. I know there are some big forex brokers who only allow professional traders or experts, not normal traders like us. They require traders to deposit thousands of dollars just to open an account. Normal traders don't like to deposit that much, not to mention beginners. Therefore, a good big forex broker should have low minimum deposit requirement. Check out the minimum deposit to open an account at our biggest forex brokers:

- Exness: 1 dollar

- XM: 5 dollars

- Hotforex: 5 dollars

Trading conditions

The trading conditions of these 5 forex brokers are also very good. For instance:

- Exness offers traders multiple account types, low commission, less slippages, good quotes and really high execution speed. Their automatic payment system is the fastest in the market, which also allows deposit and withdrawal on weekends (an exclusive feature of exness).

Check exness now - XM has great lot-back and deposit bonuses, the best trading platform in the competition, high minimum withdrawal limitation, and the best cryptocurrency trading conditions.

Check XM now - Hotforex rarely lets slippages happen and if so, they are very low. They require low minimum deposit. Moreover, they hold the best forex conferences and educational programs for forex traders. I’ve been to several and the experiences were really amazing.

Check hotforex now

Diverse trading instruments

A good forex broker must always offer traders with as many choices as possible. There are chances everywhere in the forex market, so traders should have at least the opportunity to have access to those trading instruments.

- Saxo bank offers traders up to 180 currency pairs.

- Exness offers traders up to 120 currency pairs.

- XM offers traders up to 55 currency pairs.

- Forex.Com offers traders 50 currency pairs.

- Hotforex offers traders 45 currency pairs.

Good trading platforms

Trading platform is always an important part of trading forex. Whether it is self designed or a purchased software, a trading platform of a big broker must be able to provide traders with the most useful, common, and advanced trading tools, as well as features and charts. Here, I rank the best trading platforms of my largest forex brokers:

- Exness: MT4 and MT5 platforms

- XM: MT4 and MT5 platforms

- Hotforex: MT4 and MT5 platforms

- Saxo bank: saxotradergo and saxotraderpro

- Forex.Com: MT4 and MT5 platforms

Globalization

The largest forex brokers we are talking about here are the largest in the world. Some brokers only big in there countries. In other to be the largest in the world, a broker must first have local payment system to minimize the transaction fee for traders who want to deposit or withdraw money. Secondly, that broker must be able to form support team who can help customers in their own native languages. Check out the followings for the globally largest forex brokers.

Customer care

The story of customer service never gets old. Every level of forex traders need help from forex brokers. Therefore, this is a very important standard that all brokers have to meet. To help their customers, brokers can open offices in countries that they target at. Moreover, they must have a phone line open 24/7 so that traders can call them any time they need. If telephone is too complicated, at least brokers must have a online message channel on their websites that must be available for customers 24/7. And finally, brokers should not be able to assist clients only in english. Since forex market is a global market, brokers must be able to help us, the traders, in as many languages as possible.

| Languages | work hour | live chat | phone | ||

| exness | 13 | 24/7 | 24/7 | 24/5 | 24/5 |

| hotforex | 9 | 24/5 | 24/7 | 24/5 | 24/5 |

| XM | 8 | 24/5 | 24/7 | 24/5 | 24/5 |

The biggest brokers bring you the best service

Being big brokers mean that they are rich. And when they are rich, they are able to bring you the best service you can get. Only the big brokers can work with local banks so that you can deposit or withdraw quickly and economically. Moreover, large forex brokers can organize better support service that can fix your problems fast and professionally. And finally, bigger brokers can give you the best prices that small brokers can not keep up with. Small brokers can only give you bonuses as a temporary measure. Big brokers can assure the price stay low all the time.

Biggest forex brokers in the UK

You have to know that the biggest forex brokers in asia are nothing like the biggest in the UK. What is the difference? The answer is regulation. You cannot apply the same regulation of asian brokers to european brokers. They operate in different territories, so they can be applied everywhere. In the UK, the forex regulation is that of financial conduct authority, or FCA. Here are the biggest forex brokers that have FCA regulation:

Should we trade with the largest forex brokers?

BRKV – you can see, most brokers in the above list are american and european brokers. So, if you are living in those regions, they may be good for you. But what if you live in asia, africa, or australia? They may not be good for you. They are all reliable forex brokers. But we need to check more things like:

- Whether they are regulated in your countries.

- Can we deposit and withdraw with local bank?

- Do they have local support like offices or seminars or phone numbers?

We can confidently tell you that, if you are living in asia and africa, exness is the best choice for you

Exness targets mainly at asia and africa. Their payment system is remarkable. You can deposit and withdraw instantly and free, while other asian brokers who don’t have local payment system will charge you from 1.7- 4% of your deposit fee. Furthermore, you can deposit and withdraw your fund on weekends. No other brokers allow you to do that. Exness also have offices in most big countries such as: china, indonesia, thailand, singapore, malaysia, cyprus, south africa, india and dubai. For other countries, they support online 24/7. You can get instant responses from their live chat. Or just leave a phone number and they will call you back.

- If you are living in US, forex.Com is the best option. They are reliable and leading in the US market.

- If you are living in europe, saxo bank and exness are the best.

- If you are living in africa, check out the best forex brokers in south africa.

Why should we trade with these biggest forex brokers?

The forex market is a complicated market. There are a lot of scam brokers that will steal your money by dirty hidden acts. For beginners, they don’t know it until they’ve lost all their money. Even for experienced traders, they can also lose a lot until they realized that those brokers are cheating them.

Why can’t we identify a scam broker at the beginning?

As usual, the problems won’t happen at the beginning. They want you win so you will deposit more, and then they can get more later. Even for non-scam brokers, you also tend to win at the beginning. Because you usually follow risk management at the beginning. Yet when you gain higher profit, you tend to be wild and lead to loss.

Trading with largest forex brokers to avoid scam brokers

Because we can’t check scam brokers until we lost our money, we should trade with largest forex brokers only. When they become largest forex brokers, hundreds of thousands of traders are trading there. They will help us check and reviews those brokers. So, if there is any problem, they will talk about it everywhere and you will know.

Nowadays, the world has become flat. We share everything on the internet and social media. So scam brokers can only cheat you once. Only reliable brokers can grow and become the largest forex brokers.

And this is list of 5 biggest forex brokers for you (their average monthly trading volume included as well):

- Exness: $785 billion/month learn more here

- XM: $320 billion/monthlearn more here

- Hotforex: $300 billion/month learn more here

- Saxo bank: $300 billion/month

- Forex.Com: $300 billion/month

So now you know who the biggest forex brokers are. Trading with the largest brokers is an advantage because they can hardly go bankrupt or scam you. The large forex brokers can definitely guarantee your safety and security in the long term.

Fanara filippo

Hey, I’m fanara filippo. I’m the founder of this site. I'm currently living in bangkok, thailand. I have been trading forex for more than 5 years. You can read my articles about the best forex brokers on this page. Let’s review brokers today.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

Largest forex brokers in the world 2020

A lot of traders think that a big broker is better than a smaller one because a larger company has many advantages such as economies of scale, a better liquidity position and is the subject of higher scrutiny from the public and the regulators. While this basic assumption has some merit and to some degree "bigger is better", it is not a total correlation between size and quality of forex brokers. This means that the largest broker is not necessary the best, although all good brokers are sufficiently large in order to be competitive.

If you want to find out which are the biggest forex companies in the world, you should continue reading this article. However, if you want to know which are the best forex brokers in the world when it comes to trading conditions and customer satisfaction, you should check our special forex brokers ranking.

How to measure the biggest forex companies

When it comes to measuring the size of a company, there are several criteria that are generally used. The most common criteria used in ranking companies by size are market capitalization, revenue and profits. Also, when it comes to financial companies such as banks or insurance companies, another way to measure size is by comparing the total assets under management. While these values can be relevant in some situations and industries, they are totally irrelevant when it comes to forex brokers. Here is why:

Market capitalization - the only companies that can be ranked by market capitalization are public companies (those listed on a stock exchange). This would leave most forex brokers out of the ranking. It is also important to note that market capitalization represents the value investors give to a specific company. A small but profitable company can have a higher market value than a large company unable to generate profits.

Revenue - while ranking forex brokers by revenue will render more accurate results, this criteria is still far from being relevant in this particular case. A broker's revenues will come from the commissions it charges and the spreads the traders have to pay. A broker with higher commissions and spreads will generate more revenue than a similar sized broker with lower spreads. There is also the problem of integrated products offered by the companies. A company offering stocks trading, options and futures along with forex trading will generate revenue from more sources as compared to a pure forex broker. If the stocks business generates most of the revenue, the company can be very large but the forex division can still be small compared to others.

Profits - ranking forex brokers by profits is totally irrelevant, as this criteria includes the same problems we identified when discussing about revenues, and many more. Just think about a large company with a bloated business that has huge operating costs. It can be a really big company but generate no profit.

Assets under management (AUM) - in the case of forex brokers, the closest thing to AUM are the client funds. While they are not managed by the brokers, they represent the total value of the client accounts. This measure is much more relevant than the previous ones, but it still lacks the differentiation between the forex business and the other services offered by the company. If you mix stocks trading with forex, it is very likely that the largest part of the client funds will be used in trading stocks, not forex. Another thing that makes clients funds less relevant is the different leverage used by brokers. Lower leverage needs more funds in the broker's custody for the same operations. Also, it is possible to have large forex accounts with very little trading activity.

Considering the above mentioned criteria are irrelevant when judging the size of forex brokers, we must come up with a measure that is more relevant to this specific business. In this case, we think that the most relevant criteria to rank forex brokers is by the average volume of daily transactions.

Average volume of daily transactions (AVDT) - the daily transactions of a forex broker can vary a lot, but the more active clients the broker has, the less volatile the value of daily transactions will be. In order to get a better idea about the real volume of a broker, it is better to calculate the average volume for a larger period of time, as daily and seasonal fluctuations will be less relevant. We think the AVDT becomes relevant when at least the last three months are being taken into consideration when calculating the average. In order for a forex broker to be considered large it must have an AVDT of at least one billion dollars (more than 10,000 standard lots traded daily).

We noticed that all the high quality forex brokers are also large ones and have their AVDT of at least three billion dollars. This is why, in this article we will list only brokers with daily transactions exceeding three billion US dollars.

Largest forex brokers by volume

Below you will see the biggest forex companies in the world by volume of daily transactions. We have separated the companies based on their location, as we have identified four major regions when it comes to forex brokers: united states of america, europe, australia and the rest of the world. The regions we identified have different regulation and the brokers in each region must abide by specific rules. The data presented on this article was compiled from different sources such as company presentations and other information found on the internet. The data is not audited and we cannot guarantee it is accurate. Please take the information about AVDT with a grain of salt as it may contain errors and inaccuracies.

Figure 1: major forex regulators around the world

In order to make it easier for you to identify the best forex brokers from the rest, we have also added our rating next to each broker. The ratings vary from A+ (best) to C- (worst). We have a dedicated page where you can read more information about our forex broker ratings.

Largest forex brokers in the united states

The united states is one of the largest forex markets in the world, but due to very restrictive regulation it has been declining in recent years. It is also the most isolated market since US traders are unable to open account with offshore forex brokers because the FATCA regulations imposed on foreign financial institutions has made it too expensive for anyone to accept US clients.

The strict rules and protection from outside competition had led to consolidation among local brokers, with the most important development being the acquisition of FXCM client base by gain capital (also known as forex.Com). Right now there are only three forex brokers in the united states, and one of them is mostly an institutional broker (interactive brokers), so retail clients have basically only two choices (forex.Com and oanda). Because the CFTC and NFA regulation greatly limits leverage and has the unpopular FIFO rule, the US based brokers have been unable to get traction in foreign markets and the vast majority of their clients are from the US.

Below is the ranking of the biggest US forex brokers by volume:

| AVDT* | rating | broker |

| 15.5 | B- | forex.Com (GAIN capital holdings inc) |

| 10.7 | B+ | oanda (oanda corporation) |

| 3.9 | C- | interactive brokers (interactive brokers LLC) |

* average volume of daily transactions in billion USD

Largest forex brokers in europe

This is where most of the large forex companies are located. Because of europe's cultural and linguistic diversity, local brokers had to adapt early to very different markets and stiff competition, but this has proven to be a great asset when they expanded globally. European brokers are based in different countries and have multiple trading licenses, but the hot spots of forex trading in europe are cyprus (cysec) and the united kingdom (FCA). This is where most brokers are located thanks to the world leading regulation, and even brokers located in other countries such as denmark's saxo bank use a cysec license for their forex trading division. While european regulation varies from country to country, they are all compliant with the MIFID legislation of the european union which adds another layer of protection for traders.

Some of the european brokers have gone global, and their operations are spread on different continents. European brokers are used by many traders in asia, africa, the middle east and latin america, and their total volumes are greatly boosted by their international operations. Some brokers may have the bulk of their activity from non-european clients attracted by the safety of european regulations and the excellent trading conditions offered by some of the world's leading brokers.

Here you can see the largest forex brokers in europe:

| AVDT* | rating | broker |

| 13.4 | A | XM group (trading point of financial instruments ltd, trading point of financial instruments pty ltd and XM global limited) |

| 12.3 | B | saxo bank (saxo bank A/S) |

| 7.8 | B+ | ava trade (ava trade ltd) |

| 6.8 | B- | IG markets (IG group) |

| 6.5 | C | FX pro (fxpro financial services limited) |

| 4.7 | B+ | swissquote (swissquote group holding SA) |

| 4.4 | B- | plus500 (plus500 ltd) |

| 4.3 | C- | etoro (etoro europe ltd) |

| 4.2 | C | markets.Com (safecap investments limited) |

| 3.9 | B- | CMC markets (CMC markets UK plc) |

| 3.8 | B- | FXCM (FXCM group) |

| 3.6 | C+ | forex time (forextime limited) |

| 3.5 | B | dukascopy (dukascopy bank SA) |

| 3.3 | B- | FXDD (fxdirectdealer LLC) |

| 3.2 | C+ | admiral markets (admiral markets group AS) |

* average volume of daily transactions in billion USD

Figure 2: costas cleanthous, XM's CEO at the shanghai forex expo

Biggest forex brokers in australia by volume

We have a separate section for australian brokers because they have their own regulation under the australian securities and investments commission (ASIC). Australian brokers are well represented outside australia's borders as well, because the jurisdiction is very solid and some of the brokers are offering top notch conditions and liquidity. The major forex brokers in australia are also very successful in other english speaking countries as well as in china and southeast asia.

There are three major australian forex brokers that generate very high average daily volumes, and all of them are experiencing good growth rates. Below you can find the largest forex brokers in australia:

| AVDT* | rating | broker |

| 18.9 | A+ | IC markets (international capital markets pty ltd) |

| 6.7 | A- | pepperstone (pepperstone group limited) |

| 5.3 | A- | AXI trader (axitrader limited) |

* average volume of daily transactions in billion USD

Largest forex brokers from other jurisdictions

There are several high volume forex brokers located in other jurisdictions than the ones presented above (australia, europe and united states). Since the remaining big brokers are spread around the world and are not concentrated in a smaller region, we have included them in the "rest of the world" category. The brokers listed here come from very different jurisdictions such as st. Vincent and the grenadines, belize, british virgin islands or cayman islands in the caribbean, seychelles or bermuda.

The brokers in this category abide by different regulation and can vary a lot when it comes to reliability. However, this does not mean that such brokers cannot be good, as you will see that the ratings they received are very different, from very good to very bad.

Here is the list of the largest forex brokers from the rest of the world:

| AVDT* | rating | broker |

| 11.5 | A | hot forex (HF markets ltd) |

| 9.7 | A | vantage FX (vantage international group limited) |

| 9.1 | A- | IFC markets (ifcmarkets corp) |

| 8.4 | A- | exness (exness limited) |

| 5.8 | B | instaforex (instaforex group) |

| 4.3 | B+ | roboforex (roboforex ltd) |

| 4.1 | B | iron FX (notesco limited) |

| 3.8 | B- | X-trade brokers (xtrade international limited) |

| 3.7 | B | eagle FX (eaglefx ltd) |

| 3.5 | B | IQ option (iqoption ltd) |

| 3.3 | B- | FX open (fxopen markets limited) |

| 3.2 | C | easy markets (EF worldwide ltd) |

| 3.1 | B | olymp trade ( inlustris ltd. ) |

| 3.0 | C- | alpari (alpari limited) |

* average volume of daily transactions in billion USD

Which large forex brokers are truly global?

While US traders will have to settle with a US based broker since they are not allowed to open accounts with foreign companies, people from the rest of the world are free to trade using an offshore forex broker account. In most cases, europeans will settle for an european broker and australians will choose a local one as well, but what about people from the rest of the world? What about people in canada, central and south america, the caribbean, africa and asia? They make up more than 85% of the world population, and they must choose a foreign forex broker to trade with. What are their best options?

All forex brokers will accept people from most countries, but only a small number of brokers are truly able to handle a diverse client base. In order to better serve people from various countries and continents, a broker must be able to easily handle deposits and withdrawals with a vast number of internationally used payment methods. The brokers must also allow for accounts denominated in different currencies, have multilingual websites and dedicated customer support for many countries and languages. The brokers targeting a worldwide audience may hold multiple licenses and operate in different jurisdictions in order to provide the best trading conditions for people in different regions. While many of the big forex companies are specialized in serving more than one demographic, we have identified a set of brokers which have a truly global presence and are well suited to handle traders from any corner of the world.

Here are the largest truly global forex brokers:

| AVDT* | rating | broker |

| 18.9 | A+ | IC markets (australia, seychelles) |

| 13.4 | A | XM group (cyprus, australia and belize) |

| 12.3 | B | saxo bank (denmark) |

| 11.5 | A | hot forex (st. Vincent and the grenadines, cyprus, south africa, seychelles, mauritius) |

| 9.1 | A- | IFC markets (british virgin islands) |

| 7.8 | B+ | ava trade (ireland) |

| 6.5 | C | FX pro (united kingdom) |

| 5.8 | B | instaforex (british virgin islands) |

* average volume of daily transactions in billion USD

Disclaimer: the average trading volumes presented on this page are the result of out efforts to gather and compile information from different internet sources. We have no guarantee that the numbers are correct, and considering the volatility of the forex market and the seasonal dynamics, it is possible that such numbers will suffer significant changes from month to month. Please also note that the ratings we give to forex brokers are based on our own research and criteria, but do not represent an endorsement or a critique of any broker. We are not giving investment advice and we think anyone should do his/her personal due diligence before registering with a specific broker. Forex trading is a risky activity and you should never trade with money you cannot afford to lose.

More articles about forex brokers:

Choosing a forex broker can be a very daunting task because the number of available options is overwhelming. With so many brokers advertising themselves as being the best, people go to specialized websites to read reviews and see broker rankings hoping they will find which broker is their best choice. Read more

Since there is a lot of confusion among retail traders about the overall quality of forex brokers, we have decided to create an advanced rating system and evaluate all the major forex brokers in the world according to the same set of criteria. Because we are aware that it is impossible to evaluate all forex brokers. Read more

There are many reasons why people decide to open bank accounts offshore. They can include a better privacy protection, access to better banks where money are safer or simply better services that home based banks don't offer. The same reasons apply when it comes to brokerage accounts. Read more

2021 forex statistics

Key statistics explaining the worlds largest financial market, foreign exchange (forex), are discussed below. Read on to discover key facts about the forex industry as well as its risks, brokers, traders and software.

Forex trading statistics

- Forex markets had a daily turnover of $6.6 trillion dollars in 2019, up from $5.1 trillion in 2016.

- The total value of the forex industry increased from $1.934 quadrillion dollars in 2016 to $2.409 in 2019.

- Forex is the only financial market in the world to operate 24 hours a day.

- The forex market is comprised of 170 different currencies.

- The united states dollar (USD) is on one side of 88% of all forex trades.

- Seven currency pairs make up 68% of the forex markets trading volume.

- Female forex traders tend to outperform male traders by 1.8%.

- 54% of retail traders use metatrader 4 or metatrader 5.

- IC markets is the biggest australian retail forex broker.

- Since 2009, over 6,000 different cryptocurrencies have been released.

How much is the forex market worth in 2021

The worldwide 2021 forex market is worth $2,409,000,000 ($2.409 quadrillion). $6.6 trillion on average every day is traded on foreign exchange markets. This is significantly higher than the previous analysis done by the bank for international settlements (BIS) in 2016 when it was valued at $1.934 quadrillion dollars.

The forex market is the largest financial market in the world in terms of trading volume, liquidity and value. Unlike other markets such as equities, the forex industry is the only financial market with 24/7 availability.

Not surprisingly, spot forex is the most popular asset class with $2 trillion worth of spot transactions traded daily in foreign exchange markets. After spot fx, the instruments with the largest daily turnover are:

- Forwards $1 trillion

- Foreign exchange swaps $3.2 trillion

- Currency swaps $108 billion

- Options and others $294 billion

As the largest financial market in the world, forex market participants are mainly financial institutions such as hedge funds, investment managers, multinational corporations, as well as commercial, investment and central banks. Retail forex trading only accounts for a mere 5.5% of the entire forex market globally.

The majority of forex trading is facilitated in five major financial hubs around the world, with 79% of forex trading occurring in the united kingdom, united states, hong kong, singapore and japan. The UK is by far the largest fx trading centre, contributing to 43.1% of the worlds foreign exchange turnover. With the recent rise in popularity of forex trading in asia, china has increased from the 13th to 8th largest forex trading centre in the world.

| Largest forex trading centres (2019) | country | share of global OTC forex turnover |

|---|---|---|

| 1. | United kingdom | 43.1% |

| 2. | United states | 16.5% |

| 3. | Singapore | 7.6% |

| 4. | Hong kong | 7.6% |

| 5. | Japan | 4.5% |

| 6. | Switzerland | 3.3% |

| 7. | France | 2% |

| 8. | China | 1.6% |

| 9. | Germany | 1.5% |

| 10. | Australia | 1.4% |

The 7 major currency pairs

The global forex market is comprised of over 170 different major, minor and exotic currencies. Although traders’ have a diverse range of currency pair options to choose from, seven major fx pairs make up 68% of global foreign exchange transactions. In 2019, the 7 most frequently traded currency pairs and its share of the OTC forex turnover was the:

- United states dollar vs euro 24%

- United states dollar vs japanese yen 17.8%

- United states dollar vs great british pound 9.3%

- United states dollar vs australian dollar 5.2%

- United states dollar vs canadian dollar 4.3%

- United states dollar vs chinese yuan 3.8%

- United states dollar vs swiss franc 3.6%

The worlds most popular currencies

The united states dollar plays a key role in financial markets and international economics due to pegged currencies, dollarization, as well as most central banks holding their reserves in USD. Although 43.1% of foreign exchange transactions take place in the UK, 88% of global forex transactions include the USD on one side of the transaction, showing the dominance of the USD currency in international forex trading.

The second most likely currency to be included in a forex transaction is the euro. A boost in turnover of the euro during the past 3 years can be linked to increased turnover of EUR/CHF and EUR/JPY currency pairs. While the third most likely currency to be included in forex transactions is the japanese yen, turnover has declined since 2016. Unlike the EUR and JPY, the volume of GBP, AUD, CAD and CHF being traded has remained unchanged over the last 3 years.

The average daily turnover for emerging currencies has increased recently. In 2016, 21% of total forex turnover could be attributed to emerging currencies, compared to 24.5% last year.

Forex risk

As a retail investor, speculating on forex involves a very high risk of losing money due to high leverage and volatile currency markets. When 35 foreign exchange brokers were assessed, compareforexbrokers found that on average 71% of retail fx traders lose money when trading forex.

Although 29% of retail investors achieve capital gains, 99% of fx traders fail to make profits for more than 4 continuous quarters.

| UK broker | jan-20 | feb-20 | mar-20 | apr-20 | may-20 | jun-20 | jul-20 | aug-20 | sep-20 | oct-20 | change |

|---|---|---|---|---|---|---|---|---|---|---|---|

| etoro (UK) ltd | 75% | 62% | 62% | 62% | 75% | 75% | 75% | 75% | 75% | 75% | 0% |

| fxpro UK limited | 70.25% | 70.25% | 70.25% | 70.25% | 79.78% | 75.54% | 75.54% | 78.90% | 78.90% | 78.90% | 0% |

| GKFX | 73% | 73% | 73% | 73% | 81% | 81% | 81% | 73% | 73% | 73% | 0% |

| ICM capital limited | 73.80% | 71.31% | 71.31% | 71.31% | 78.35% | 78.35% | 78.35% | 78.03% | 78.03% | 78.03% | 0% |

| activtrades plc | 71% | 69% | 69% | 69% | 75.70% | 75.70% | 75.70% | 76% | 76% | 76% | 0% |

| thinkmarkets | 72.81% | 73.72% | 73.72% | 73.72% | 78.94% | 78.94% | 78.94% | 78.94% | 78.94% | 78.94% | 0% |

| plus500 UK | 76.40% | 76.40% | 76.40% | 76.40% | 80.50% | 80.50% | 80.50% | 76.40% | 76.40% | 76.40% | 0% |

| axitrader UK | 65.60% | 65.60% | 65.60% | 65.60% | 69.60% | 69.60% | 72.60% | 72.60% | 72.60% | 72.60% | 0% |

| FXCM ltd | 69.66% | 69.66% | 69.66% | 69.66% | 74.74% | 74.74% | 74.74% | 73.38% | 75.38% | 75.38% | 0% |

| FOREX.Com UK | 69% | 69% | 69% | 69% | 72% | 72% | 72% | 73% | 73% | 73% | 0% |

| city index | 72% | 71% | 71% | 71% | 74% | 74% | 74% | 74% | 74% | 74% | 0% |

| XTB limited | 75% | 77% | 77% | 77% | 80% | 80% | 80% | 79% | 79% | 79% | 0% |

| swissquote ltd | 79% | 77% | 77% | 77% | 79% | 79% | 79% | 79% | 79% | 79% | 0% |

| ETX capital | 75.60% | 75.10% | 75.10% | 75.10% | 76% | 76% | 76% | 77.40% | 77.40% | 77.40% | 0% |

| fxopen UK | 60% | 60% | 60% | 60% | 60% | 60% | 60% | 60% | 60% | 60% | 0% |

| interactive brokers (UK) ltd | 60.50% | 60.50% | 60.50% | 66% | 66% | 66% | 64% | 64% | 64% | 64% | 0% |

| hantec markets | 66% | 66% | 67% | 67% | 67% | 65% | 65% | 65% | 68% | 68% | 0% |

| delta financial markets limited | 67% | 64% | 58% | 68% | 68% | 68% | 67% | 67% | 67% | 68% | 1% |

| ADS securities london limited | 70% | 70% | 69% | 69% | 69% | 72% | 72% | 72% | 77% | 77% | 0% |

| one financial markets | 67% | 68% | 68% | 71% | 71% | 71% | 71% | 70% | 70% | 70% | 0% |

| key to markets limited | 71% | 71% | 71% | 71% | 71% | 71% | 71% | 71% | 71% | 71% | 0% |

| avatrade | 71% | 71% | 71% | 71% | 71% | 71% | 71% | 71% | 71% | 71% | 0% |

| fxgiants | 66.22% | 71.03% | 71.03% | 71.03% | 71.03% | 71.60% | 71.60% | 70.39% | 70.39% | 70.39% | 0% |

| tickmill | 72% | 73% | 70% | 73% | 73% | 73% | 73% | 73% | 73% | 73% | 0% |

| IG markets limited | 68% | 68% | 68% | 76% | 76% | 76% | 76% | 76% | 76% | 76% | 0% |

| london capital group (LCG) | 76% | 76% | 76% | 76% | 76% | 76% | 76% | 79% | 79% | 79% | 0% |

| admiral markets UK ltd | 76% | 76% | 76% | 76% | 76% | 79% | 79% | 81% | 81% | 81% | 0% |

| pepperstone limited | 73.60% | 73.60% | 73.60% | 76.50% | 76.50% | 76.50% | 78.60% | 78.60% | 78.60% | 79.30% | 0.70% |

| CMC markets UK plc | 70.50% | 70.50% | 70.50% | 78% | 78% | 78% | 79% | 79% | 79% | 79% | 0% |

| intertrader limited | 78% | 78% | 78% | 78% | 78% | 78% | 73.19% | 73% | 73% | 73% | 0% |

| terafx UK | 78% | 78% | 78% | 79% | 79% | 79% | 76.70% | 76.70% | 76.70% | 78.20% | 2% |

| city credit capital (UK) ltd | 79% | 77% | 77% | 77% | 76.70% | 76.70% | 76.70% | 73.36% | 73.36% | 73.36% | 0% |

| LMAX limited | 70.40% | 70.40% | 70.40% | 70.40% | 69.60% | 69.60% | 75.97% | 75.97% | 75.97% | 75.97% | 0% |

| equiti capital | 66.56% | 75.33% | 75.33% | 75.33% | 73.07% | 73.07% | 73.07% | 73.07% | 73.07% | 73.07% | 0% |

| HYCM ltd | 67% | 67% | 74% | 74% | 71% | 71% | 71% | 71% | 71% | 71% | 0% |

| OANDA europe limited | 73.50% | 73.50% | 76.80% | 76.80% | 73.50% | 73.50% | 73.50% | 73.50% | 76.80% | 76.80% | 0% |

Forex trader demographics

The majority of retail fx investors’ are men, with only 10% of traders being female. Although far fewer women trade forex than men, a study carried out by warwick business school found females outperform men by 1.8% when investing in financial markets, as men are more likely to take risks and break trading rules, while women follow long-term strategies.

In regards to age, 43.5% of traders are aged between 34-45 years, 5% of forex traders are millennials aged between 25-34 while 15% of forex traders are over the age of 45.

The worlds top forex brokers

Australian broker IC markets is the largest australian-based forex broker in the world as mentioned in our forex broker reviews. Retail forex traders gravitate to IC markets as they are regulated by top-tier financial authorities ASIC (australian securities and investments commission), the FSA (the seychelles financial services authority) and cysec (cyprus securities exchange commission). Pepperstone is the second-largest and overseen by ASIC, the FCA (financial conduct authority, UK) and the DFSA (dubai financial services authority).

The largest US forex broker is XM, regulated by a range of financial authorities including cysec in cyprus while the largest forex brokers in europe are XM and saxo bank (often called saxo capital markets).

Largest global forex brokers by daily trading volume

| largest global forex brokers | broker | average trading vol. Per day |

|---|---|---|

| 1. | IC markets | USD 18.9 billion |

| 2. | XM group | USD 13.4 billion |

| 3. | Saxo bank | USD 12.3 billion |

| 4. | Hot forex | USD 11.5 billion |

| 5. | IFC markets | USD 9.1 billion |

| 6. | Avatrade | USD 7.8 billion |

| 7. | FX pro | USD 6.5 billion |

| 8. | Instaforex | USD 5.8 billion |

Forex trading software

Trading platforms

Metatrader 4 is the most popular trading platform currently available to retail investors. In 2018, it was found that 54% of all retail cfds were traded using metaquotes software (metatrader 4 and metatrader 5). Forex traders tend to prefer windows over other computer software, with 85% of traders using windows compatible trading platforms.

A key reason metatrader 4 (MT4) and metatrader (MT5) are so popular is due to the software’s advanced tools designed to assist those executing trading strategies such as day trading or expert advisers. If you want to explore the platforms before you sign up to a live account, most forex brokers offer demo accounts that provide real-time trading conditions.

Mobile trading

As continuous technical and fundamental analysis can increase the chances of successful forex trading by 10%-30%, today’s forex traders want constant access to their forex brokers and trading platforms. When looking for a new broker to trade forex with 35% of traders use their mobile to research account types and trading features. In regards to traders’ software preferences, android is 3% more popular than iphones using ios software, while samsung is more popular than other devices.

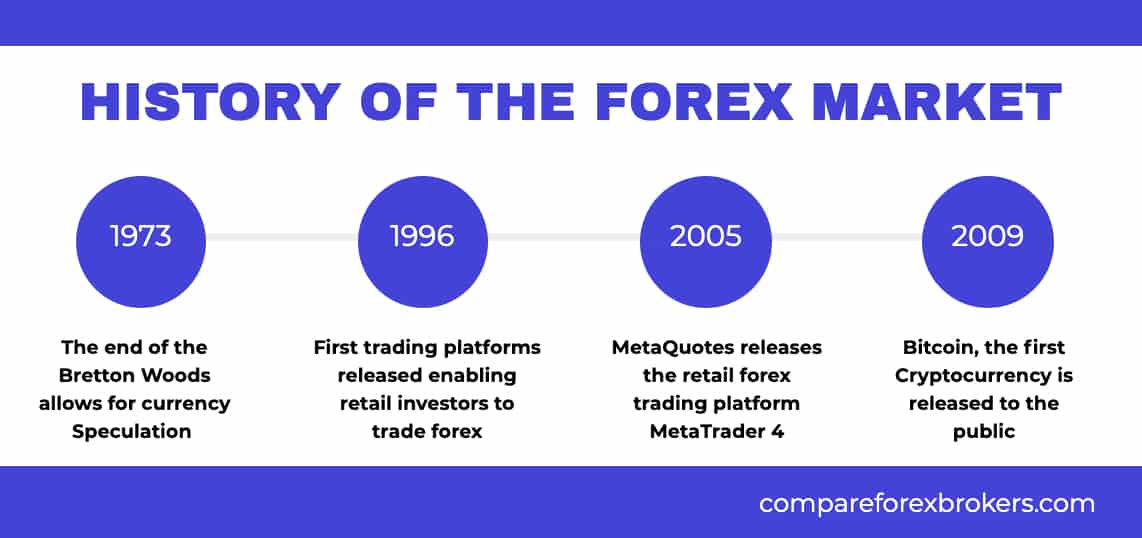

History of forex markets

Prior to the 1970s, forex trading as its known today was prohibited due to the gold standard and bretton woods systems. Exchange rates were controlled, therefore traders could not speculate on foreign currency movements. After the collapse of the bretton woods system in 1973, floating exchange rates opened the door for modern-day forex trading.

Trading platforms

In 1996, the introduction of forex trading platforms allowed retail investors to participate in foreign exchange markets for the first time. Following the introduction of retail traders to forex markets, metaquotes began releasing trading platforms designed for retail traders. In 2005 metatrader 4 (MT4) was launched, which continues to be the gold standard and most popular retail forex trading platform to date. Although metaquotes released metatrader 5 in 2010, MT4 still remains the most popular retail trading platform in the world.

Cryptocurrency

The release of the first decentralised cryptocurrency in 2009 was a pivotal moment in the history of CFD trading and financial markets. Since bitcoins release, over 6,000 other cryptocurrencies have been created that are usually traded against the USD (US dollar), EUR (euro), GBP (great british pound) or AUD (australian dollar). The total value of cryptocurrency markets is now estimated at $201 billion dollars.

Disclaimer: cryptos carry even higher risk than forex and other cfds because of the historically high volatility in crypto markets. Due to this, the UK’s financial authority (the FCA) banned cryptocurrency trading for retail traders in 2020.

Forex faqs

How do I find a forex broker?

When searching for a new forex and CFD broker, it is important to establish the trading platform you want to use, the trading tools you require, along with the CFD products you are looking to trade. To compare top forex brokers offerings, you can find more info here.

How do I choose a forex trading platform?

The trading platform best-suited to you heavily depends on the trading strategies you wish to execute as well as your trading experience. To find out which brokers are the best for beginner traders, click here. Metatrader 4, metatrader 5 and ctrader are ideal for experienced traders looking for advanced trading tools.

How do you start trading forex and cfds?

To get started, you will need to choose a forex broker and trading platform. Once signed up to a trading account, you will be required to choose your account’s base currency and make an initial minimum deposit that varies between brokers. If you want to explore brokers’ features prior to committing to a live account, most brokers offer demo accounts to practise trading in a risk-free environment. To find out more, read our forex trading guide.

Sources

Bank for international settlements (BIS)

The majority of the statistics referenced in this article are sourced from the bank of international settlements (BIS) triennial central bank survey 2019. The survey conducted by BIS is the largest global analysis of financial markets focusing on forex and over the counter (OTC) derivatives.

Justin grossbard has been investing for the past 20 years and writing for the past 10. He co-founded compare forex brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of fintech and digital startups including innovate online and SMS comparison. Justin holds a masters degree and an honours in commerce from monash university. He and his wife paula live in melbourne, australia with his son and siberian cat. In his spare time, he watches australian rules football and invests on global markets.

Statistic categories

The leading forex broker comparison site, compare forex brokers pty ltd is an authorised representative of guildfords funds management pty ltd australian financial services licence no. 471379 (A/R no. 001274082). Copyright 2021 and all rights reserved. Trading forex and cfds with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

Forex statistics

The forex market is a fast-paced, dynamic arena - one that is often maligned. But investing in forex can be a profitable venture - so long as you’re armed with the proper information.

Tim fries

Tim fries is the cofounder of the tokenist. He has a B. Sc. In mechanical engineering from the university of michigan, and an MBA from the university .

Shane neagle

Meet shane. Shane first starting working with the tokenist in september of 2018 — and has happily stuck around ever since. Originally from maine, .

All reviews, research, news and assessments of any kind on the tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.Com. Our company, tokenist media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

The foreign exchange market is the largest and most liquid market on earth. We’ve compiled a list of important, up-to-date, actionable statistics regarding forex trading so that you know what you’re getting into if you choose to trade forex.

These statistics have been sourced from credible, authoritative websites, as well as international surveys, central banks, and other financial institutions. The data we’ve compiled is derived from sources which include:

- The bank for international settlements’ triennial survey released in 2019

- Euromoney magazine’s 2019 FX survey

- The federal reserve bank of new york

- The bank of england

- The australian foreign exchange committee operating under the reserve bank of australia

- The bank of japan

Although the broader market has experienced a variety of unexpected, negative effects due to the COVID-19 pandemic, the forex market has remained relatively unscathed – at least for now. In fact, the volume of trading has increased due to the volatility that the pandemic has brought on.

It is impossible to tell how the pandemic will affect the foreign exchange market from here on out, but up to this point, the increased volatility of the global economy has brought about a huge amount of opportunities for forex traders – particularly in the short term.

History of forex trading

Forex trading as we now know it began in 1973, after the collapse of the bretton woods system, which tightly regulated exchange rates. However, forex trading has existed in one form or another for a very long time – just about as long as humans have used coinage.

There is evidence that forex trading, or an early form of it, occurred in ancient babylon, egypt, and the byzantine empire. In the 15th century, the famed medici family of florence opened banks in foreign lands specifically for the purpose of facilitating trade and currency exchange. The first true forex market was established in the dutch city of amsterdam, some 500 years ago.

The story of modern forex trading begins with the gold standard. Adopted by various countries around the world in the late 19th and early 20th century, the gold standard guaranteed the value of national currencies. Any note could be converted into a certain amount of gold.

The expenses of WW1 meant that countries had to start printing large amounts of money that weren’t backed by gold – this led to inflation, and the eventual abandonment of the gold standard in 1931.

After WW2, a new system was put in place with the bretton woods agreement. The US dollar was pegged to gold, at a fixed rate of $35 per ounce. The dollar became the world’s reserve and reference currency – and other national currencies were fixed to the dollar.

Eventually, the budget and trade deficits of the US, as well as its dwindling gold reserves, led president richard nixon to abandon the bretton woods system in 1971. By 1973, the modern form of forex trading had already taken shape.

But that isn’t quite the end of the story. For the longest time, forex trading was an arena that was solely available to large institutions with a huge amount of capital, such as governments and banks.

However, the 1990s brought with them a perfect storm for forex trading – dozens of economies had begun the transition to capitalism, and technology, particularly the internet and electronic communication networks, revolutionized communication and information exchange.

All of a sudden, the barriers that prevented your average joe from giving forex trading a try were gone. The advent of retail forex brokers allowed individual traders to invest far smaller sums – and it was no longer required to have an army of brokers and traders at your beck and call to participate in this form of investing.

That brings us to the present day. Now, forex trading is popular in a number of jurisdictions. There are a number of regulated forex brokers in the united states, and several other leading countries as well.

But what does the future hold in store? We don’t claim to know for certain, of course – but today’s technological advancements are already beginning to have an effect on the forex market. The rise of cryptocurrencies, in particular, will surely have a large effect on the foreign exchange market by the end of the decade.

Size of the forex market

1. According to BIS’s 2019 triennial survey, trading in FX markets reached an incredible $6.6 trillion per day in april of 2019.

2. The worth of the entire global forex trading market is estimated to approximately $2.4 quadrillion – in other words, around $2409 trillion. 1 BIS, “BIS quarterly review”, accessed june 24, 2020.

3. Global GDP in 2019 amounted to roughly 142 trillion dollars – meaning that the annual turnover of the forex market is almost 17 times larger. 2 BIS, “BIS quarterly review”, accessed june 27, 2020.

4. The forex market dwarfs even the largest stock exchanges in the world – for example, nasdaq has a daily volume that averages around $200 billion.

9. Retail forex trading – that is to say, trading that is done by individuals, accounts for only 5.5% of the entire forex market. Large institutions are still getting the biggest slice of the cake – thankfully, it’s an enormous cake. 6 allfxbrokers, “50 fascinating facts about forex”, accessed june 28, 2020.

10. Five businesses maintain a 40% share of the global forex market, according to euromoney magazine’s 41st annual FX survey released in 2019. 7 euromoney, “euromoney FX survey 2019”, accessed june 28, 2020.

| Rank | counterparty | market share 2019 |

|---|---|---|

| 1 | jpmorgan | 9.81% |

| 2 | deutsche bank | 8.41% |

| 3 | citi | 7.87% |

| 4 | XTX markets | 7.22% |

| 5 | UBS | 6.63% |

Forex trader demographics and statistics

11. Forex traders are perhaps younger than you’d expect – 27% of forex traders fall into the 18-34 age group. 8 forex school online, “forex statistics & trader results from around the world”, accessed june 28, 2020.

12. The 35-44 age group represents 28% of traders, while the 45-54 age group accounts for 21% of traders. Only 24% of traders are older than 55, and only 9% are older than 65. 9 forex school online, “forex statistics & trader results from around the world”, accessed june 28, 2020.

13. Men account for 89.1% of forex traders – meaning that only 10.9% of traders are women. 10 compare forex brokers, “2020 forex statistics”, accessed june 28, 2020.

20. 70% of trades use a live account, while the other 30% are using demo accounts. 17 forex school online, https://www.Forexschoolonline.Com/forex-industry-statistics/, accessed june 28, 2020.

22. There are approximately 10 million forex traders in the world today. 19 brokernotes, “A map of forex traders: where are the 9.6 million online traders?”, accessed june 29, 2020.

Forex broker stats

26. The largest global forex broker is the australian-based IC markets, which has an average daily trading volume of $18.9 billion. 23 wealth&value, “largest forex brokers in the world 2020”, accessed june 29, 2020.

Forex currencies

32. The US dollar is the most popular forex trading currency – with 88.3% of global trades involving the ever-reliable greenback. 29 BIS, “triennial central bank survey”, accessed june 29, 2020.

36. The british pound sterling accounted for 12.8% of all trades in 2019. 33 BIS, https://www.Bis.Org/statistics/rpfx19_fx.Pdf, accessed june 29, 2020.

���� are you a canadian citizen? Review our leading canadian forex platforms.

Forex currency pairs

The most commonly traded currency pairs in the forex market are referred to as the majors. Although there is no strict definition of the term, it is generally used to refer to the 7 most popular currency pairs – all of which involve the US dollar on either the base side or the quote side.

Currency pairs that consist of major currencies and the currencies of developing or emerging economies are referred to as exotic pairs.

Forex market by country

���� are you in singapore? Learn about forex trading in singapore.

67. The forex market is a distributed electronic marketplace, and as such, it doesn’t have a central hub.

68. Forex trading is conducted 24/7 across the world, but a single day’s trading is segmented according to the regional market hours of major marketplaces. The three major segments, also commonly referred to as sessions, represent periods of peak activity. These are, in order: the tokyo session, the london session, and the new york session.

Forex market in the US

US forex market currencies

69. The US dollar is involved in the lion’s share of transactions – 89% of trades in the US market involve the greenback, up from 87% three years ago. 8

70. The euro is the second most traded currency in the US market, accounting for 36% of trades, up from 31% in 2016. 55 federal reserve bank of new york, “the foreign exchange and interest rate derivatives markets”, accessed june 30, 2020.

US forex market currency pairs

Forex market in the UK

UK forex market currencies

75. The UK is the largest hub of the forex market, with a 43% share of the entire global turnover. In 2016, the UK’s share of the global turnover was 37%. 60 bank of england, “BIS triennial survey of foreign exchange”, accessed june 30, 2020.

���� are you a forex trader in the UK? See our top UK forex brokers.

UK forex market currency pairs

85. The USD/GBP pair accounts for 13% of the average daily turnover in the UK market. Percentage-wise, not much has changed from 2016 – in fact, this pair’s share of the market hasn’t changed more than 1% in the last 10 years. 70 bank of england, “BIS triennial survey of foreign exchange”, accessed june 30, 2020.

Forex market in australia

Australian forex market currencies

87. The most traded currency in the australian fx market is the US dollar – which is found at either end of 93% of trades. 72 AFXC, “foreign exchange turnover report”, accessed june 30, 2020.

���� do you want to trade forex in australia? See our top australian forex brokers report.

Australian forex market currency pairs

91. The USD/AUD pair, the aussie, is the most popular currency pair in the australian market. It accounts for 47% of the average daily turnover. This amounts to $66.088 billion each day, on average. 76 AFXC, “foreign exchange turnover report”, accessed june 30, 2020.

92. The second most popular currency pair in australia is USD/EUR – accounting for 11% of turnover, with a daily average turnover of $15.039 billion. 77 AFXC, “foreign exchange turnover report”, accessed june 30, 2020.

93. The USD/JPY pair accounts for 10% of the australian market’s turnover. This amounts to $14.174 billion. 78 AFXC, “foreign exchange turnover report”, accessed june 30, 2020.

94. The USD/NZD pair also accounts for 10% of the market’s turnover – with a slightly lower average trading volume which amounts to $13.546 billion. 79 AFXC, “foreign exchange turnover report”, accessed june 30, 2020.

95. Currency pairs involving the US dollar and minor asian currencies account for 6% of the market’s turnover, amounting to an average daily turnover of $8.985 billion. 80 AFXC, “foreign exchange turnover report”, accessed june 30, 2020.

Forex market in japan

Japanese forex market currencies

97. The japanese yen is the most traded currency on the japanese forex market. It is involved in 38.9% of trades, and the average daily turnover of the yen amounts to $292.3 billion. 82 BOJ, “2019 central bank survey of foreign exchange and derivatives market activity”, accessed july 1, 2020.

Japanese forex market currency pairs

Forex trading vs cryptocurrency

Cryptocurrency is a relatively recent phenomenon. Unless you’ve been living under a rock for the past five years, you’re more than likely aware of these new digital currencies, their potential, and their wild and often unpredictable fluctuations.

Cryptocurrencies have already had an effect on the foreign exchange market, and will continue to have an ever-increasing role as the years go by. We likely won’t see cryptocurrency trading become a part of mainstream investing for another couple of years – at least until the market develops new technologies and becomes much more regulated.

But good investing practices always have one eye pointed to the future. To wrap up our list of forex statistics, let’s take a look at what will undoubtedly be the next big thing in forex.

106. There are currently more than 5,000 cryptocurrencies being traded. Their total market capitalization is estimated to be $201 billion. 91 yahoo finance, “top 10 cryptocurrencies by market capitalisation”, accessed july 1, 2020.

107. The largest and most famous cryptocurrency by far, bitcoin, has a market capitalization of $128 billion. 92 yahoo finance, “top 10 cryptocurrencies by market capitalisation”, accessed july 1, 2020.

108. The second-largest cryptocurrency, ethereum, has a market capitalization of $19.4 billion. 93 yahoo finance, “top 10 cryptocurrencies by market capitalisation”, accessed july 1, 2020.

109. The third-largest cryptocurrency is ripple or XRP, with a market capitalization of $8.22 billion. 94 yahoo finance, “top 10 cryptocurrencies by market capitalisation”, accessed july 1, 2020.

110. There are approximately 43 million crypto traders in the world. 95 chappuis halder, “how many active crypto traders are there across the globe?”, accessed july 1, 2020.

111. There are approximately 15.3 million crypto traders in the united states. 96 chappuis halder, “how many active crypto traders are there across the globe?”, accessed july 1, 2020.

112. There are approximately 11.3 million crypto traders in europe. 97 chappuis halder, “how many active crypto traders are there across the globe?”, accessed july 1, 2020.

113. The trading volume of cryptocurrency spot and futures markets amounted to $8.8 trillion in the first quarter of 2020. 98 bitcoin.Com, “$8.8 trillion traded in cryptocurrency spot and futures markets in Q1”, accessed july 1, 2020.

114. Approximately 99% of cryptocurrency trades occur on centralized exchanges. 99 coincasso, “10 interesting facts about cryptocurrency exchanges!”, accessed july 1, 2020.

115. The world’s largest cryptocurrency exchange, binance, had an average daily trading volume of $2,852,591,354 in 2019, and currently has over 15,000,000 users. 100 binance, “binance 2019: year in review”, accessed july 1, 2020.

116. The most popular cryptocurrency trading pairs that pit cryptocurrencies against fiat currency are BTC/USD, ETH/USD, XRP/USD, and LTC/USD.

117. Cryptocurrency cfds allow you to speculate on the price movements of cryptocurrencies without a crypto wallet.

All reviews, research, news and assessments of any kind on the tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.Com. Our company, tokenist media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Article sources

The tokenist strives to bring you the most up-to-date, accurate, and reliable information from reputable sources. In an effort to maintain such a high standard, we use and share the primary sources which support our work. These can include data compiled by governments, original reporting, interviews with specialists, and more. As part of our editorial policy, we have a established a number of standards to bring you genuine, unbiased, and verifiable information.

1. BIS, "BIS quarterly review", accessed june 24, 2020.

2. BIS, "BIS quarterly review", accessed june 27, 2020.

6. Allfxbrokers, "50 fascinating facts about forex", accessed june 28, 2020.

7. Euromoney, "euromoney FX survey 2019", accessed june 28, 2020.

10. Compare forex brokers, "2020 forex statistics", accessed june 28, 2020.

So, let's see, what we have: ✅✅✅ of course all traders want to trade with the biggest forex brokers, but it isn't easy for beginners to recognize those brokers. Read to learn why. At largest forex brokers by volume 2021

Contents of the article

- No deposit forex bonuses

- TOP 5 BIGGEST FOREX BROKERS 2021 UPDATED. SEE...

- Which standards to rank the biggest forex...

- Exness

- Hotforex

- Other standards

- Trading conditions

- Diverse trading instruments

- Good trading platforms

- Globalization

- Customer care

- The biggest brokers bring you the best...

- Biggest forex brokers in the UK

- Should we trade with the largest forex...

- Why should we trade with these biggest forex...

- Largest forex brokers in the world 2020

- How to measure the biggest forex companies

- Largest forex brokers by volume

- Largest forex brokers in the united states

- Largest forex brokers in europe

- Biggest forex brokers in australia by volume

- Largest forex brokers from other jurisdictions

- Which large forex brokers are truly global?

- 2021 forex statistics

- Forex trading statistics

- How much is the forex market worth in 2021

- The 7 major currency pairs

- Forex risk

- The worlds top forex brokers

- Forex trading software

- History of forex markets

- Trading platforms

- Forex faqs

- How do I find a forex broker?

- How do I choose a forex trading platform?

- How do you start trading forex and cfds?

- Sources

- Bank for international settlements (BIS)

- Statistic categories

- Forex statistics

- History of forex trading

- Size of the forex market

- Forex trader demographics and statistics

- Forex broker stats

- Forex currencies

- Forex currency pairs

- Forex market by country

- Forex market in the US

- US forex market currency pairs

- Forex market in the UK

- UK forex market currency pairs

- Forex market in australia

- Australian forex market currency pairs

- Forex market in japan

- Japanese forex market currency pairs

- Forex market in the US

- Forex trading vs cryptocurrency

Comments

Post a Comment