Nasdaq on fbs, nasdaq on fbs.

Nasdaq on fbs

FBS offers a wide range of trading instruments including forex major and exotic currency pairs, metals, cfds, and stocks.

No deposit forex bonuses

You can choose any type according to your needs and strategies. Perform your first deals on the market. See how different instruments behave and improve your strategies.

Nasdaq

12921

Related instruments

Progress on the market with the best trading instruments

FBS offers a wide range of trading instruments including forex major and exotic currency pairs, metals, cfds, and stocks. You can choose any type according to your needs and strategies.

Register in the personal area and create an account type to your liking.

On the contract specifications page, choose a suitable instrument. All of them are grouped within a drop-down list.

Perform your first deals on the market. See how different instruments behave and improve your strategies.

Share with friends

Open account

Frequently asked questions

How to open an FBS account?

Click the ‘open account’ button on our website and proceed to the personal area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the withdrawal page on the website or the finances section of the FBS personal area and access withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account . You may want to test the environment with virtual money with a demo account. Once you are ready, enter the real market and trade to succeed.

How to activate level up bonus?

Open level up bonus account in web or mobile version of FBS personal area and get up to $140 free to your account.

FBS at social media

Contact us

- Zopim

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Nasdaq on fbs

Don’t waste your time – keep track of how NFP affects the US dollar!

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Follow us on facebook

Beginner forex book

Beginner forex book will guide you through the world of trading.

Thank you!

We've emailed a special link to your e-mail.

Click the link to confirm your address and get beginner forex book for free.

FBS mobile personal area

Warning! Old version of the browser!

Press one of the icons below to proceed to the official website of the developer and download the latest version of your browser.

The NASDAQ is an index of the 100 largest non-financial companies listed on the nasdaq stock market. It focuses on the top performing industries such as technology (54%), consumer services (25%), and healthcare (21%).

This index the index tracks the performance of the world’s most innovative companies, including apple, google, intel, and tesla. The NASDAQ is a benchmark primarily for the US tech stocks.

Imagine a basket of companies, which issue shares. The NASDAQ index follows up changes in their share prices. It’s well-know for its day-to-day volatility. That’s why it’s so attractive for traders around the world.

How is it calculated?

The NASDAQ-100 index is a modified market capitalization-weighted index. The value of the index equals the aggregate value of the share weights, also known as the index shares, of each of the index securities multiplied by each such security's last sale price, and divided by the divisor of the index.

This weighting allows limiting the influence of the largest companies and balancing the index with all members. No company on the nasdaq-100 can have more than a 24% weighting.

How to trade NASDAQ with FBS?

You can trade contracts for difference (cfds) on the NASDAQ. Cfds reflect the NASDAQ movement. It allows you to trade in both directions. In other words, you can gain as from the price going down as well as from it going down.

Also, you can use leverage. This means that with only a small amount of money you can control much bigger financial positions. Always remember that leverage gives you an opportunity to multiply your account. On the downside, you may lose a considerable part of it if the market if the market goes against your trades.

What drives the NASDAQ price?

As mostly the technology sector index, the NASDAQ is driven by earnings reports, key appointments and new product launches. Moreover, the US economic factors such as interest rates, monetary policy and economic indicators in general can hugely influence the index as they impact company investment rates and consumer appetite for products.

NASDAQ

The NASDAQ is an index of the 100 largest non-financial companies listed on the nasdaq stock market. It focuses on the top performing industries such as technology (54%), consumer services (25%), and healthcare (21%).

This index the index tracks the performance of the world’s most innovative companies, including apple, google, intel, and tesla. The NASDAQ is a benchmark primarily for the US tech stocks.

Imagine a basket of companies, which issue shares. The NASDAQ index follows up changes in their share prices. It’s well-know for its day-to-day volatility. That’s why it’s so attractive for traders around the world.

How is it calculated?

The NASDAQ-100 index is a modified market capitalization-weighted index. The value of the index equals the aggregate value of the share weights, also known as the index shares, of each of the index securities multiplied by each such security's last sale price, and divided by the divisor of the index.

This weighting allows limiting the influence of the largest companies and balancing the index with all members. No company on the nasdaq-100 can have more than a 24% weighting.

How to trade NASDAQ with FBS?

You can trade contracts for difference (cfds) on the NASDAQ. Cfds reflect the NASDAQ movement. It allows you to trade in both directions. In other words, you can gain as from the price going down as well as from it going down. Check contract specifications.

Also, you can use leverage. This means that with only a small amount of money you can control much bigger financial positions. Always remember that leverage gives you an opportunity to multiply your account. On the downside, you may lose a considerable part of it if the market if the market goes against your trades.

What drives the NASDAQ price?

As mostly the technology sector index, the NASDAQ is driven by earnings reports, key appointments and new product launches. Moreover, the US economic factors such as interest rates, monetary policy and economic indicators in general can hugely influence the index as they impact company investment rates and consumer appetite for products.

S&P500, nasdaq sell-off on january 28

Information is not investment advice

The indices continue going down after yesterday's plunge. The fed had little effect on the markets, while the USD swings increase the volatility of majors.

Similar

What is moving the markets today?

The federal reserve will release its statement at 21:00 MT time (GMT+2). Jerome powell's press conference will follow at 21:30 MT time. How will this event influence the USD, forex majors, and gold?

The USD is strengthening, while S&P 500 and NASDAQ paused their advance. Traders and investors worry that the US fiscal stimulus won't arrive soon. The video contains our trade ideas, what are yours?

Popular

What is moving the markets today?

The indices continue going down after yesterday's plunge.

The federal reserve will release its statement at 21:00 MT time (GMT+2). Jerome powell's press conference will follow at 21:30 MT time. How will this event influence the USD, forex majors, and gold?

Share with friends:

Account opening

Choose your payment system

Risk warning: 74% of retail accounts lose money when trading ᏟᖴᎠs with this provider. ᏟᖴᎠ's are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how ᏟᖴᎠ's work and whether you can afford to take the high risk of losing your money. Please refer to our risk acknowledgement and disclosure

The website is owned and operated by tradestone limited (address: 89, vasileos georgiou street, 1st floor, office 101, potamos germasogeias, 4048 limassol, cyprus), registration number HE 353534, authorized by cyprus securities and exchange commission, license number 331/17.

NASDAQ

The NASDAQ is an index of the 100 largest non-financial companies listed on the nasdaq stock market. It focuses on the top performing industries such as technology (54%), consumer services (25%), and healthcare (21%).

This index the index tracks the performance of the world’s most innovative companies, including apple, google, intel, and tesla. The NASDAQ is a benchmark primarily for the US tech stocks.

Imagine a basket of companies, which issue shares. The NASDAQ index follows up changes in their share prices. It’s well-know for its day-to-day volatility. That’s why it’s so attractive for traders around the world.

How is it calculated?

The NASDAQ-100 index is a modified market capitalization-weighted index. The value of the index equals the aggregate value of the share weights, also known as the index shares, of each of the index securities multiplied by each such security's last sale price, and divided by the divisor of the index.

This weighting allows limiting the influence of the largest companies and balancing the index with all members. No company on the nasdaq-100 can have more than a 24% weighting.

How to trade NASDAQ with FBS?

You can trade contracts for difference (cfds) on the NASDAQ. Cfds reflect the NASDAQ movement. It allows you to trade in both directions. In other words, you can gain as from the price going down as well as from it going down. Check contract specifications.

Also, you can use leverage. This means that with only a small amount of money you can control much bigger financial positions. Always remember that leverage gives you an opportunity to multiply your account. On the downside, you may lose a considerable part of it if the market if the market goes against your trades.

What drives the NASDAQ price?

As mostly the technology sector index, the NASDAQ is driven by earnings reports, key appointments and new product launches. Moreover, the US economic factors such as interest rates, monetary policy and economic indicators in general can hugely influence the index as they impact company investment rates and consumer appetite for products.

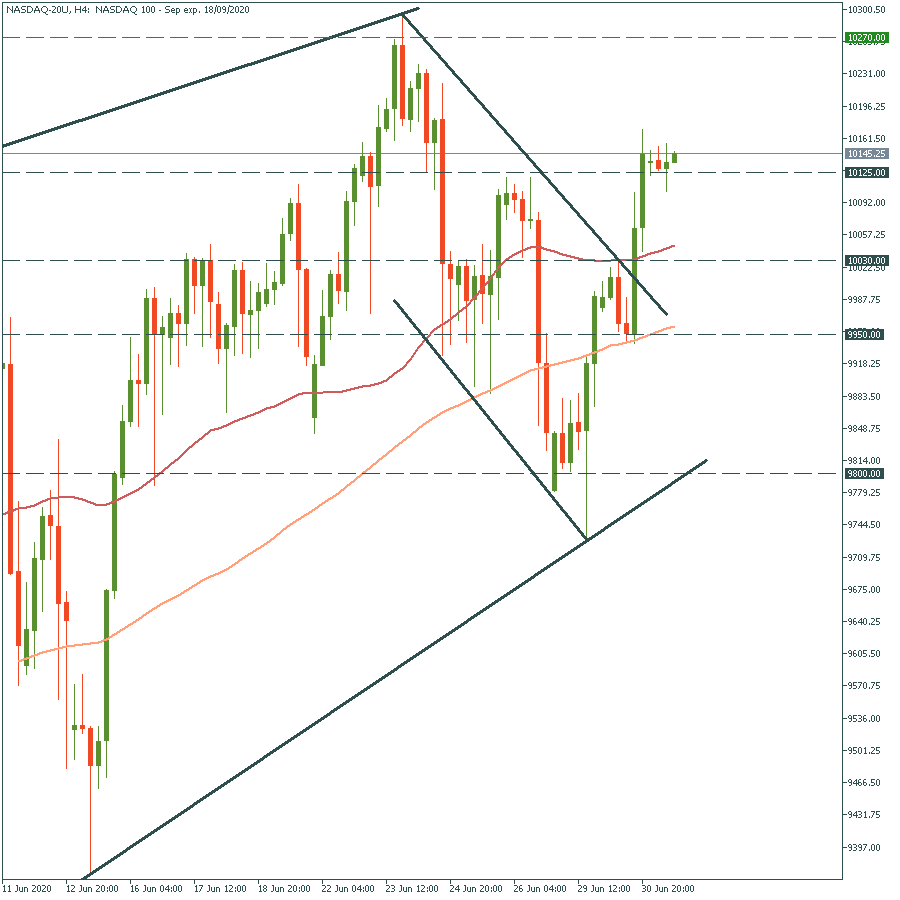

Nasdaq: momentum is strongly upwards

Nasdaq may reach new highs soon. Get ready with us!

Fundamental outlook

The coronavirus pandemic was devastating for service, tourism and hospitality industries. In opposite, it turned out beneficial for tech companies. The lockdown restrictions forced people to stay at home and binge-watch netflix, order online home deliveries through amazon and even work remotely and use cloud services and microsoft’s teams video-conferencing service. No wonder that tech nasdaq gained amid the virus outbreak. The stock index hugely surpassed pre-crisis levels and set a strong upward trend.

Technical tips

The nasdaq is headed towards the resistance at the all-time high at 10 270. Hopefully, the risk-on market sentiment will contribute to it. The price has been stuck between two major trend lines. So, we can assume that the stock will continue its zig-zag movement and move up further. Support levels are at the recent low at 10 125 and the 200-day moving average at 10 030. Follow further news, especially the ADP report today at 15:15 MT time. If it comes better than the forecast, the market sentiment will improve and push stocks up.

Nasdaq is traded as CFD futures contract in MT4 and MT5. You need to choose NASDAQ-20U in order to open a position.

This post is written and submitted by FBS markets for informational purposes only. In no way shall it be interpreted or construed to create any warranties of any kind, including an offer to buy or sell any currencies or other instruments. The views and ideas shared in this post are deemed reliable and based on the most up-to-date and trustworthy sources. However, the company does not take any responsibility for accuracy and completeness of the information, and the views expressed in the post may be subject to change without prior notice.

Fxstreet trading signals now available!

Latest analysis

Latest forex analysis

Editors’ picks

GBP/USD approaches yearly high as equities attempt recovery

The financial world is all about equities’ behavior these days. Wall street pulling off daily lows adds pressure on the greenback, which in turn results in higher highs for GBP/USD. Mixed vaccines-related news taking their toll.

Gamestop stock news: GME rises as SEC comments on recent activity

Shares in gamestop (GME) resumed their recent surge on friday, bouncing back from heavy losses seen on thursday. GME shares were up 60% at $314 at the time of writing.

Brokers’ restrictions on GME and AMC set a dangerous precedent – fxstreet editorial

“reduce-only mode” is a message that shocked robinhood traders who attempted to trade in gamestop inc (NYSE: GME) and other companies such as AMC entertainment holdings inc (NYSE: AMC) on thursday.

Robinhood suspends cryptocurrency trading following doge’s 1,000% rally

Robinhood has just restricted cryptocurrency trading as dogecoin price exploded by 1,000%. The trading app has been under a lot of criticism lately after limiting buy orders for gamestop. A famous reddit group named wallstreetbets boosted gamestop stock to fight shorts.

US dollar index: upside capped by the resistance line near 90.80

DXY extends the rejection from weekly highs below the 91.00 mark, shedding ground for the second session in a row on friday.

Forex majors

Cryptocurrencies

Signatures

Note: all information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

FBS minimum deposit guide (2021)

If you have read our FBS review then it is already very likely that you know a great deal about what this major forex broker has to offer.

Here though we take the opportunity to hone in on some specifics.

These specifics are the various funding methods made available at FBS and particularly the FBS minimum deposit and how this can change depending on the choices you make.

Table of contents

74-89% of retail CFD accounts lose money

FBS account base currency

The FBS base currencies are limited. If you are trading from within europe, you can only access euro as your base currency and deposit in euro only. You also cannot convert other currencies into euro through FBS.

If you are trading from another location within the international market then you will have access to two base currencies in the form of euro and USD. In this case, if you find the account with another currency, it is possible you will incur a conversion fee.

FBS funding and deposit methods

As a major forex broker, FBS makes a wide number of options available for you to choose from when funding your account. We have detailed these below and the FBS fees which are associated with each method.

Wire transfer

FBS deposit by wire transfer funding is available around the world and comes with no fees attached at all. With this said, you will want to double-check your bank’s policy of wire transfers since it is possible to incur a fee from their side, but never from the broker side in the case of FBS.

This deposit method takes 3-4 business days in order to be processed and available for trading.

Credit/debit cards

FBS credit and debit card deposits are of course also available. In this situation, visa and mastercard are both accepted although mastercard is only available within europe, while visa deposits are available around the world.

Deposits made through this method are instant and immediately available to trade within your FBS account. There are also no fees associated with this form of deposit.

Ewallets

FBS ewallet deposits are an increasingly popular way to fund your trading account. For that reason, the broker makes both neteller, and skrill available worldwide for funding.

Perfectmoney is another ewallet service which is available for FBS traders outside of europe only. Bitcoin deposits are also not permitted within the EU.

The ewallet deposits will not encounter any type of FBS fee and are also instantly available to trade with.

Deposits from indonesia

With FBS there are special exceptions made when it comes to deposits from indonesia. Indonesian traders can benefit from a fixed-rate currency exchange of 10,000 IDR for 1 USD. This means that you will not be impacted at all by currency fluctuation when making your FBS deposit.

Additional methods of deposit which are available to indonesian traders include local bank deposits from BCA, BNI, BRI, and more local banks in the country. This should make it very easy and fast to deposit.

Every deposit method offered in this case is fee-free with the exception of stic pay which charges a minimal commission. Both fasapay and perfectmoney are available without any fees.

The only point to note is that bank deposits will also still incur a commission based on your bank and their policy. All the methods noted, allow for an instant deposit to your account. The exception again here is banks which can take up to 24-hours.

Other methods

There are other FBS deposit methods available aside from what we have mentioned. This is particularly the case outside of the EU in areas such as the middle east and asia. Bitwallet is one such method available only in japan.

When it comes to other methods, the minimum deposit for FBS may vary along with some fees.

FBS minimum deposits

Having looked at the various funding methods available, let’s look closer at the FBS account types, of which there are many, and the minimum deposit FBS applies in each case.

Cent account

The FBS cent account is one that offers great value particularly to new traders, trading in cents.

This account type is available worldwide and has a very reasonable minimum deposit of 10 EUR within the EU or just $1 USD when trading outside of europe. This account has been also featured in our forex brokers with low minimum deposit guide.

FBS islamic accounts are also available.

Standard account

The FBS standard account is again one that the broker makes available to traders around the world.

Islamic accounts are always available should you require one, and the minimum deposit here stands at 100 EUR within the EU or $100 if you are trading under international regulation.

Micro account

The FBS micro account is only available to those trading from outside europe and it trades with micro lots. The account type offers excellent value again with a minimum deposit of just $5 to trade, and FBS islamic accounts available on request.

Zero account

Another account that is available only outside europe is the FBS zero account. This account makes zero spread trading available although there are commissions in place.

The FBS minimum deposit on these accounts will set you back $500 with the option of an islamic account again available if needed.

ECN account

Continuing the trend of only being available outside europe, the FBS ECN account provides for fast, effective ECN execution of your trades at the best prices and with the lowest spreads. Commissions are charged though, and only forex trading is available.

The ECN account features a minimum deposit of $1,000.

Copytrading account

The final FBS account type to take a look at is the copytrading account. This is again only available to those trading from outside europe and you can choose to be a signal provider or an investor.

If you choose to be a signal provider, you should be aware that you will only be allowed to open standard or micro account types and so you will be subject to those conditions and minimum deposits associated with those accounts.

As an investor, also known as a copytrader, you can open any account type and start to copy trade once your account is verified and you have a balance of more than $100. So, in the end, the FBS copy trade minimum deposit is 100$.

Related guides:

FBS deposit bonus

Lastly, after all the FBS broker minimum deposit variables, we will take a look at the FBS bonus conditions and criteria. This will help ensure that you do not miss out on an FBS bonus if one is available to you.

No deposit bonus

An FBS no deposit bonus of $100 is available to you as a trader under certain conditions. Among these conditions are that you cannot withdraw the money immediately. So, as such, you cannot withdraw this base FBS bonus. What you can do though is withdraw the profits you make on the bonus in the event that you successfully trade at least 5 lots within a 30-day timeframe.

$123 no deposit bonus

The FBS 123 bonus is one that used to be available. It is no longer available however and has since been replaced with the no deposit bonus which we mentioned above. This still represents a positive FBS bonus deal for the majority of traders.

100% deposit

An FBS deposit bonus is also available on request and under certain conditions. This means that you can effectively double your FBS deposit depending on the circumstances up to a limit.

FBS pro challenge

The final FBS bonus we will take a look at is the FBS pro challenge. In fact, this is not a direct type of deposit bonus, but it is a special type of contest event which is periodically opened to FBS traders to participate in.

With this type of challenge, you typically get to trade with a $10,000 FBS demo account on 100:1 leverage. If you are successful in making the most profit among your fellow competitors on this demo account over a 2-week period, then you will receive an FBS bonus amount of $450.

74-89% of retail CFD accounts lose money

FBS trader

Trading schedule changes soon!

On january 18, it is martin luther king jr. Day in the US.

Due to the holiday, there will be certain changes.

❎ closed for the whole day ❎

US stocks

⌛ early close at 20:00 (UTC+2) ⌛

metals: XAUUSD, XAGUSD, platinum, palladium

CFD & futures: S&P500, YM, NASDAQ, WTI, BRN

FBS trader

Time to see what the future will bring us! NFP and other important trading events of the next week.

�� february 2, 05:30 UTC+2 – australian interest rate (AUD)

since march 2020, the interest rate in australia has been held steady at 0.1%. The RBA was committed to making the financial environment as favorable as possible. The board’s plan is to keep the rate at 0.1% until the inflation reaches 2-3%. The latter would indicate that the australian economy is warmed enough to raise the rates. When is that expected to happen? That we will hear on tuesday.

�� february 4, 14:00 UTC+2 – UK interest rate (GBP)

the UK is passing through one of its worst economic periods in decades. The downturn caused by the virus doesn’t get alleviated by the finally-done brexit. Observers report that many companies are leaving london in search of a more comfortable business environment in the EU. This makes the UK economy more vulnerable from the international side while it’s struggling to keep going domestically. How grave is the situation for the GBP? We will see that on thursday during the BOE’s monetary policy report.

�� february 5, 15:30 UTC+2 – US non-farm payrolls (USD)

the last non-farm payrolls release was bad. The american labor market saw a 140K decline in the number of jobs against an expected 71K rise. The hit was aggravated by the very fact that it’s the first decline in the job dynamic since the beginning of the recovery that started roughly nine months ago. On the other hand, that cooled down the market expectations. The forecasters are now seeing the negative 200K as the most probable report this friday – that would definitely make the USD even softer. Will that be the case?

So, let's see, what we have: get updates on the nasdaq exchange rates, as well as the latest economic news, market analytics, and statistics. At nasdaq on fbs

Contents of the article

- No deposit forex bonuses

- Nasdaq

- 12921

- Related instruments

- Progress on the market with the best trading...

- Open account

- Frequently asked questions

- How to open an FBS account?

- How to withdraw the money you earned with FBS?

- How to start trading?

- How to activate level up bonus?

- FBS at social media

- Contact us

- Data collection notice

- Nasdaq on fbs

- Data collection notice

- Follow us on facebook

- Beginner forex book

- Thank you!

- How is it calculated?

- How to trade NASDAQ with FBS?

- What drives the NASDAQ price?

- NASDAQ

- How is it calculated?

- How to trade NASDAQ with FBS?

- What drives the NASDAQ price?

- S&P500, nasdaq sell-off on january 28

- Account opening

- Choose your payment system

- NASDAQ

- How is it calculated?

- How to trade NASDAQ with FBS?

- What drives the NASDAQ price?

- Nasdaq: momentum is strongly upwards

- Fundamental outlook

- Technical tips

- Fxstreet trading signals now available!

- Latest analysis

- Latest forex analysis

- Editors’ picks

- GBP/USD approaches yearly high as equities...

- Gamestop stock news: GME rises as SEC comments on...

- Brokers’ restrictions on GME and AMC set a...

- Robinhood suspends cryptocurrency trading...

- US dollar index: upside capped by the resistance...

- Forex majors

- Cryptocurrencies

- Signatures

- FBS review and tutorial 2021

- History & headlines

- Trading platforms

- Markets

- Trading fees

- FBS leverage

- Mobile apps

- Payments

- Demo account review

- Trading bonuses

- Licensing

- Additional features

- Trading accounts

- Pros and cons

- Trading hours

- Customer support

- Trader safety

- FBS verdict

- Accepted countries

- Where is FBS regulated?

- Is FBS a good broker?

- Does FBS offer any bonuses?

- What is the minimum deposit at FBS?

- What platforms does FBS offer?

- Does the FBS broker have trading on nas100?

- FBS minimum deposit guide (2021)

- FBS account base currency

- FBS funding and deposit methods

- FBS minimum deposits

- FBS deposit bonus

- Facebook

Comments

Post a Comment