Honest Tickmill Forex Broker Review; Scam or not, is tickmill regulated.

Is tickmill regulated

- The best choice for automatic programs

- Low latency

- Cheap fees (22$ per month)

No deposit forex bonuses

Honest tickmill forex broker review – scam or not?

| Review: | regulation: | min. Deposit: | forex pairs: | spreads: |

|---|---|---|---|---|

| (5 / 5) | FCA (UK), cysec (EU), FSA (SE) | 100$ | 50+ | 0.0 pips + 1$ commission per 1 lot |

Are you looking for real experiences and a critical test to the tickmill broker? – then you are exactly right on this page. As traders with more than 7 years of experience in the financial markets, we have tested the provider in detail for you with real money. Learn more about the conditions and seriousness of the broker. Is it really worth it to invest in forex broker tickmill money or not? – inform yourself in detail now.

Official website of tickmill

What is tickmill? – the company presented

Tickmill is an international broker for trading derivatives financial forex and cfds. The main headquarters are located in london: 1 fore street, london EC2Y 9DT, united kingdom. For many years, the company has proven itself to offer traders professional trading on the best terms. Also, there are branches in cyprus and seychelles.

According to the website, tickmill should provide an excellent trading experience with the cheapest spreads and commissions, which we will take a closer look at in the following test. Furthermore, the broker shines with many different awards in the industry and allows his traders to pursue any trading strategies.

Facts about tickmill:

- Forex broker from great britain (london)

- Made by traders for traders

- Specialized in forex trading with special conditions and lowest spreads

- Worldwide branches in different countries

- 114 billion average trading volume per month

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Is tickmill a regulated forex broker?

Regulations and licenses are important for traders and brokers so that a trusting relationship can be created. When a broker applies for a license, certain criteria and requirements must be met. A violation of the policy means in most cases a direct loss of the license.

Tickmill is even regulated several times. The broker has licenses from the FCA (UK), cysec (cyprus) and FSA (seychelles). It gives us a positive direct impression. European traders have to trade with the english license (FCA) or cysec license, which brings further benefits. On the other side, international traders have to choose the FSA license.

The safety of customer funds

The security of client funds should be given to a trusted broker. In online investments, trust in a broker is very important. Many smaller brokers with no license and experience sometimes handle money incorrectly. In order to avoid such a fraud, one should pay attention to certain criteria in broker selection.

Tickmill insures client funds separately from corporate funds to manage. For this purpose, the barclays bank is used, which operates internationally and is always liquid. In addition, client funds will be protected in the unlikely event of a bankruptcy or financial dilemma of tickmill with the financial services compensation scheme (FSCS) of up to £ 75,000. This is a very high value compared to other brokers, which usually have no deposit guarantee or a smaller one.

Regulation and safety:

- Regulated by FCA, cysec, and FSA

- Customer funds are managed by barclays bank

- High deposit guarantee of 75,000 GBP (FCA license)

- Safe website communication

Review of the tickmill conditions for traders

Tickmill is a true NDD broker (non-dealing desk) with well-known liquidity providers. It is traded herewith excluded conflict of interest between broker and customer. This is a big advantage as it is not a market maker.

There are more than 84 instruments available on the market. The broker is constantly trying to expand its offer and, for example, integrate new assets such as bitcoin. The offer is quite manageable and the tickmill tries to specialize with its offer on currencies (forex). Cfds (contracts for difference) are also available for commodities, government bonds or stock indices. Individual shares cannot be traded on this broker, so here’s a small smear in the rating that must be made.

Tickmill is characterized by its extremely tight spreads and low commission. We have compared many providers in recent years and tickmill is and remains the cheapest. The typical spread in the EUR/USD is only 0.00 – 0.01 pips small and the commission is a maximum of $ 2 per traded $ 100,000 (1 lot) in the pro account. Traders with higher deposits can even benefit from even smaller commissions ($ 1).

In addition, there are no requotes, as it is a true forex broker. This means you will always be able to open and close a position for the next best price in the market. The liquidity is always given by the various liquidity providers and the slippage is also very low on business news.

The best conditions:

- Very low spreads starting at 0.0 pips

- The extreme low commission in pro and VIP account is a huge advantage

- Pay only 2$ (pro) or 1$ (VIP) commission per 1 lot traded

- Fast execution and high liquidity

- More than 50 forex pairs

- Max. Leverage of 1:500

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

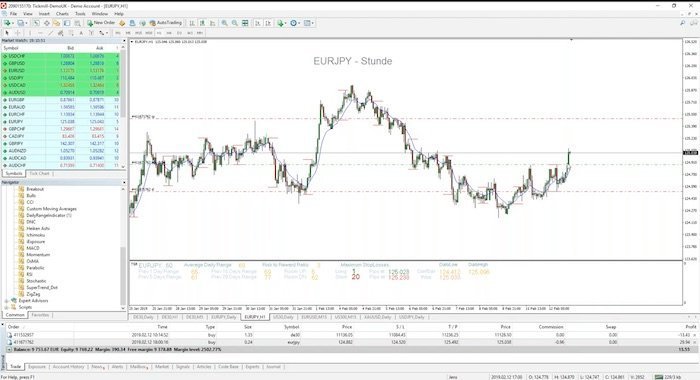

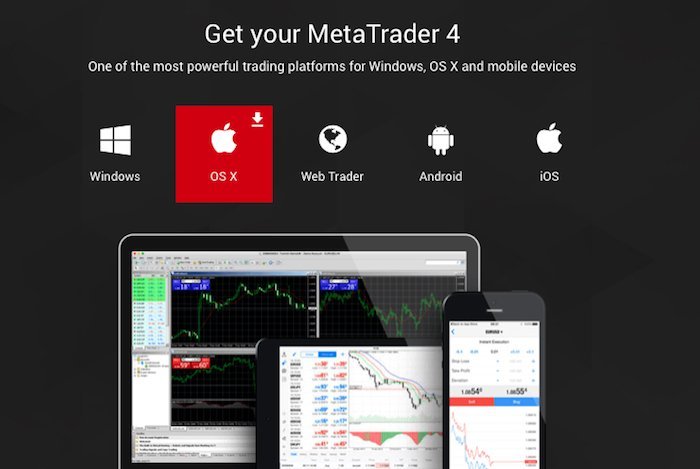

Tickmill trading platform test

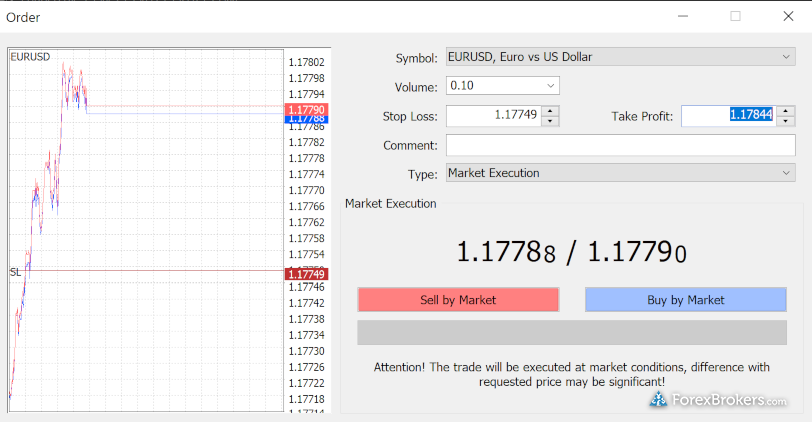

As a trading platform, the metatrader 4 is offered to you. This is a proven and worldwide trading platform for private and professional traders. The platform is available for the browser (web), desktop (download), android (app) and ios (app). With the metatrader, you can easily and flexibly access the markets of tickmill from anywhere in the world.

The metatrader is perfect for any trader who wants to earn sustainable money in the markets. Even with small capital can be traded, because there are micro lots available. In addition, there is always a guaranteed execution at tickmill and no partial execution.

Professional charting and analysis

A trading platform should be user-friendly and flexible. This can offer the metatrader. Several chart settings for the technical analysis are adjustable. Use the well-known candlesticks for an even better analysis of the markets. Tickmill also provides educational tutorials for beginners.

In addition, use free indicators, which are adjustable for your personal strategy. The metatrader comes with a lot of tools after installation. If you do not have enough, you can add additional tools to metatrader 4. Use self-programmed indicators for every chart.

Facts about the platform:

- Flexible and user-friendly trading platform

- Available for every device

- Free indicators

- Very many different analysis tools

- Automated trading possible

Available for any device

In addition, tickmill offers education material and webinars for its clients.

Trading tutorial: how do forex and CFD trading work?

Forex is the largest market worldwide. Daily several trillions of dollars are being transacted in this market. That is why it is also highly liquid and interesting for beginners and experienced traders. Tickmill offers over 60 different currency pairs. Including many currencies from emerging markets. This is a huge advantage for those who are looking for an exotic currency pair for trading. For currencies, you can bet on falling or rising prices. Buy one currency and sell the other currency from the currency pair. The difference in the price is well written as profit.

Cfds are also offered. They are leveraged derivatives that can be traded on a variety of values. For the opening of a CFD trade, you do not buy directly the underlying asset, but only the contract to that value. This has several advantages because you can act with a high level of leverage and very easily place short trades. The broker rounds off the offering with cfds on stock indices, commodities, precious metals, and bonds.

Invest in falling or rising prices and secure the position with a stop loss and take profit. These are limits that automatically close your position. Since the calculation is sometimes confusing, tickmill offers a forex calculator. With this calculator, you can determine your risk and the position size in just a few seconds.

Tickmill offers fast order execution and high liquidity

Tickmill has several data and data centers around the world. In metatrader 4 you can choose the best access (server) for you. The broker is also characterized by its low latency. With the connection to the live server in london I have a latency of under 30 ms. If that is still too slow, you can rent a VPS server.

Personally, we had no problems with the order execution. The website also emphasizes that there are no requotes. Even with large position sizes 30 lot + can be traded easily. You always get a direct and immediate execution at the best prices.

Tickmill is a non-dealing desk broker, which has a similarity to an ECN broker. The difference between NDD and ECN is that the broker still sits between the market and clients. An obligation to pay additional funds can be excluded.

Use a VPS-server for the best connection

The provider allows any strategies and automatic programs. Expert advisors (eas) can run 24 hours a day automatically through a VPS server at tickmill. The latency is very low and the price from $ 22 a month too.

- The best choice for automatic programs

- Low latency

- Cheap fees (22$ per month)

Tickmill automated trading is possible

Tickmill allows every strategy and also automated programs. As mentioned above you can rent a VPS server very cheap. In connection with the metatrader 4 it works without problems and the setup is very simple. Program automatic programs for your trading or use provided trading systems. Today, more than 50% of the order executions are made automatically in the forex market.

Here you can see again that tickmill is a serious NDD broker. Dubious brokers forbid strategies or automatic programs. In addition, tickmill has no limit for stop-loss and take-profit brands. So it can be traded very small movements. Due to the low fees, it is worthwhile to scalping and day trading.

VPS-server allows you trading 24/7 on tickmill.

How to open your free tickmill account:

Another plus point for tickmill is the simple depot opening. According to the website, you need a maximum of 3 minutes for this and we can confirm this personally. Fill in the form with your personal data. Then you get direct access to the customer portal of tickmill. In addition, your email must be confirmed.

After that, the account has to be verified. Thanks to the strong regulations, brokers are not allowed to pay out to unverified customers. Even after the first deposit, the account must be verified urgently. Since our account is a bit older, we can not tell you whether a deposit without verification is possible.

For verification, it is sufficient to upload your ID and proof of address. The broker confirms the documents within 24 hours (weekdays). For even faster verification, contact support and say that your documents have been uploaded. Then you have access to the full functions of the trading account.

Unlimited demo account for beginners at tickmill

The free demo account of tickmill is perfect for beginners or experienced traders. It is unlimited and without expiration time. Traders can trade the markets with virtual assets and simulate real trading. Experienced traders learn new strategies or test new markets. For the demo account, no deposit or verification is necessary.

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

3 different account types – which one you should choose?

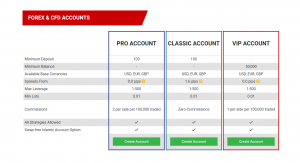

Tickmill offers 3 types of accounts for traders. Interesting for us is only the pro and VIP account. From our experience, it is not worth the classic account to open, because the fees are accordingly higher than in the pro account. In the following text, we will inform you about the terms of each account.

As described above, the fees are sensationally low. Read the table below for more details. The pro accounts commission is only $2. So you pay only a fee of $4 per completed trade. When you open a VIP account, you save another 50%, because you only pay $2 for each completed trade. Even with our code (under the registration button) can save another 5%.

Tickmill gives you the exact interbank spreads from 0.0 pips. Trading is smooth and fast processing is provided by european servers. Upon request, an islamic account without swaps (interest) can be created.

| Classic | pro | VIP | |

|---|---|---|---|

| min. Deposit: | 100$ | 100$ | 50.000$ |

| spreads: | 1.6 pips | 0.0 pips | 0.0 pips |

| leverage: | max. 1:500 | max. 1:500 | max. 1:500 |

| commission: | 0$ | 2$ per 1 lot traded | 1$ per 1 lot traded |

Info: tickmill also offers its european customers to sign up as a professional trader and keep the high leverage of 1: 500.

The VIP account is the best choice for high volume forex traders

High-volume traders or companies can open a VIP account. From a deposit of 50,000$, you have even cheaper fees. You then only pay $ 1 per traded lot. This makes $ 2 per completed trader. These low costs can generate an increased profit. In addition, stop orders and limit orders are allowed close to market prices. This is a very good offer in comparison.

In summary, tickmill account types offer a great opportunity for every trader. The terms are very good and much better than other forex brokers. No matter if you want to trade the markets with small or big capital, tickmill is the right decision for beginners or advanced traders.

Compare the terms between tickmill and other brokers yourself. Tickmill is always the cheapest and has, therefore, made the first place in my forex broker comparison. With no other broker, you get so cheap trading fees without conflict of interest.

Review of the deposit and withdrawal of tickmill

At tickmill you can deposit and withdraw using the same methods. Bank transfer, credit card, skrill and neteller are available. On the payment and deposit, there are no fees.

My tests and experiences have shown that the payouts are very fast and the money is sent on the journey within 24 hours. You will receive a confirmation email after payment when the payout has been made.

How high is the minimum deposit? – trading with a small amount of money

The minimum deposit is regularly 100$/€. You can trade in the trading platform as low as 0.01 lot. This is a very small position size and the risk is in most cases only a few cents high. The provider is thus broadly positioned because even larger investors can trade without problems at this broker.

Tickmill deposit and withdrawal methods

Questions and tips for your transactions:

- Open your free account at tickmill. Complete your data and verify the account. After verification, all functions of the broker are available to you.

- How much money should you deposit? – this is entirely up to the goals and ideals of the trader. Some trading strategies, for example, are not feasible with a small sum of € 100. Be sure to test the demo account before making your first deposit.

- Are my transactions with tickmill safe? – yes, tickmill works only with the best banks and verified payment providers. You can check all transactions in the customer portal.

- Also, open several trading accounts in the customer portal. Thus it is possible to use different accounts for different strategies. An internal transfer takes only a few minutes.

New: now use sofortüberweisung (klarna) or paysafecard to capitalize your account even faster.

Is there negative balance protection?

The negative balance of an account is very feared by many traders. And this is also very justified. For some brokers, traders in the past have been able to build up debt or negative balance through extreme market conditions, which had to be balanced.

At tickmill there is no additional funding and you are thus protected against a negative balance.

With tickmill you cannot lose more money than your deposit.

Tickmill service and support for traders

One of the last important points in this review is trader support and service. Tickmill offers support in more than 10 different languages (also africa, asia, india, thai clients). From our experience, the broker employs international employees who exclusively look after every customer.

Support is available to customers 24 hours a week, 7 days a week. The support is provided by chat, phone or email. A trader should not lack anything here. My tests showed that the support is always fast and reliable!

Tickmill presented itself in different countries, for example at the world of trading in frankfurt. The broker had his own stand there and sought direct contact with his clients. Service is one of the most important things for traders and tickmill shows confidence and seriousness.

To further improve its service, well-known and professional traders are invited to hold webinars or other information sessions. Well-known names are giovanni cicivelli or mike seidel. The saying “by traders for traders” also applies here. Tickmill tries to give its customers the best performance combined with good service.

In summary, the support from tickmill is very good and professional. Our personal concerns were always resolved very quickly and we can make a clear recommendation here. Overall, the overall package is rounded off with a great service.

| Support: | available: | phone number: | special: |

|---|---|---|---|

| phone, chat, email | 24/5 | +44 (0)20 3608 6100 | webinars, 1 to 1 support, events |

Conclusion of my review: tickmill is one of the best forex brokers

My experience and tests show on this page that tickmill is a very good broker. He gets from us a 5-star rating. We recommend this forex broker with a clear conscience. Tickmill offers an offer for every type of trading.

With the world’s cheapest fees, the broker is currently topping any competitor. The trading experience is unique with this broker and you save a lot of money on the order execution. For every trader who trades forex, this is the right provider.

If you have further questions, contact support by phone or chat. International employees are ready to help you.

Advantages:

- UK regulation and high customer safety

- The cheapest forex broker of the world

- No requotes and high liquidity

- The best execution

- Good service and support

- The best conditions for forex traders

- Very low trading fees

Disadvantages:

- No stocks for trading

Tickmill is the best forex broker in the world because of the cheap trading fees and good execution. (5 / 5)

Read our other articles about tickmill:

Tickmill review

Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.

Top takeaways for 2021

Here are our top findings on tickmill:

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Special offer:

Overall summary

| feature | tickmill |

|---|---|

| overall | 4 stars |

| trust score | 81 |

| offering of investments | 3 stars |

| commissions & fees | 5 stars |

| platforms & tools | 3 stars |

| research | 4 stars |

| mobile trading | 3 stars |

| education | 4 stars |

Is tickmill safe?

Tickmill is considered average-risk, with an overall trust score of 81 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | tickmill |

|---|---|

| year founded | 2014 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 1 |

| tier-2 licenses | 2 |

| tier-3 licenses | 0 |

| trust score | 81 |

Offering of investments

Tickmill offers a total of 85 tradeable symbols encompassing mostly currency pairs, with barely a dozen cfds on indices, metals, and bonds. The following table summarizes the different investment products available to tickmill clients.

| Feature | tickmill |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 62 |

| cfds - total offered | 13 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Tickmill offers three accounts. Bottom line, tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry.

Classic accounts: the classic account is commission-free, where traders only pay the bid/ask spread. However, the average spreads are higher relative to the other two account types, making the classic account unattractive.

Spreads: using typical spread data listed by tickmill for its pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips. It is worth noting that tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: pro and VIP accounts both have a per-trade commission added to lower prevailing spreads and standout as competitive. With a low commission rate, the pro account will be ideal for most traders compared to the classic account, as spreads are inherently less expensive, and 75 instruments, including 62 currency pairs, can be accessed.

VIP versus pro accounts: while the VIP account requires a minimum balance of $50,000 for traders to access low commissions of $1 per standard lot (100k units) or $2 per round-turn (RT), the pro account has similar pricing with an RT commission of just $4 per round-turn standard lot. The pro account is available with as little as a $100 deposit.

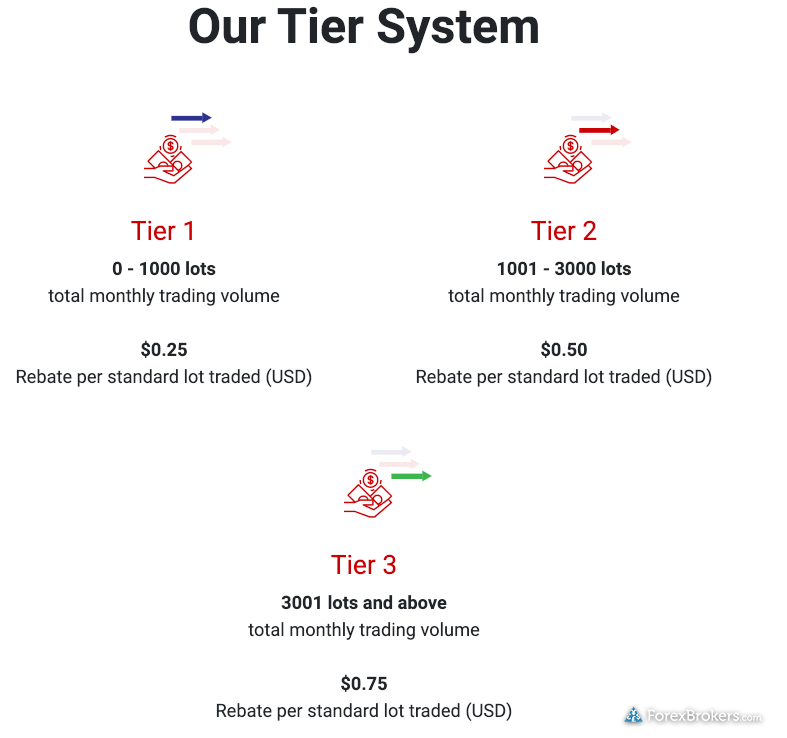

Active trader discounts: tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard for up to 1000 standard lots per month, to as much as $0.75 at tier-3 for those who trade more than 3001 standard lots monthly.

Gallery

| Feature | tickmill |

|---|---|

| minimum initial deposit | $100.00 |

| average spread EUR/USD - standard | 0.53 (august 2020) |

| all-in cost EUR/USD - active | 0.32 (august 2020) |

| active trader or VIP discounts | yes |

Platforms and tools

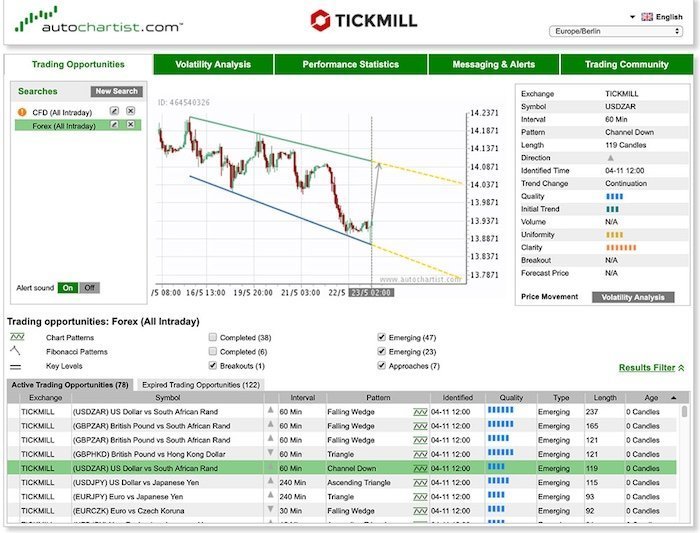

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Gallery

| Feature | tickmill |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | no |

| ctrader | no |

| duplitrade | no |

| zulutrade | yes |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

Tickmill is competitive in its offering of market research and continues to improve its research year over year. That said, tickmill still lags industry leaders IG and saxo bank in depth, personalization, and overall quality.

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Copy trading: in addition to the native MQL5 signals market available in MT4, tickmill also offers the autotrade feature of myfxbook for social copy-trading (note: this service is not available from the firm's UK branch).

Market insights: tickmill has a team of analysts that produce daily technical and fundamental analysis on the company's blog. I found that the broker does a good job covering the markets with a wide variety of research content for traders. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its youtube page.

Gallery

| Feature | tickmill |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | no |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

Tickmill's education offering is better than the industry average but not quite good enough to make the cut as best in class (top 7).

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Drawbacks: tickmill continues to expand its scope of education material across written and video formats; however, educational content is mixed with market research, which makes it difficult to navigate and filter through. A dedicated educational portal would be a notable boost to tickmill’s educational offering.

Gallery

| Feature | tickmill |

|---|---|

| has education - forex | yes |

| has education - cfds | yes |

| client webinars | yes |

| client webinars (archived) | yes |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | no |

Mobile trading

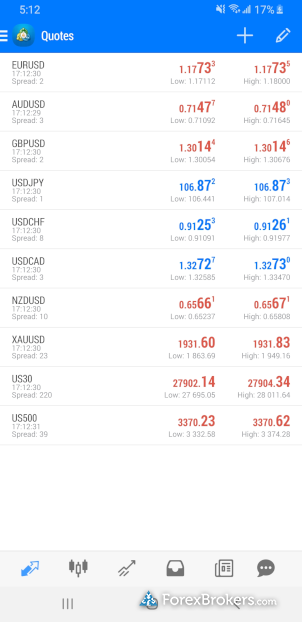

Since tickmill is a metatrader-only broker, ios and android versions of the MT4 app come standard and are both available for download from the apple itunes store and android play store, respectively.

Gallery

| Feature | tickmill |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

Tickmill caters best to high volume, high balance traders who trade only the most popular forex and CFD instruments. With a lack of platforms and a small range of markets, there is no question that there are better forex brokers for traders to consider in 2021 unless you can afford the VIP account at tickmill, which has highly-competitive pricing.

About tickmill

Tickmill was established in 2014 after armada markets moved its retail clients to tickmill's entity in seychelles, where it is regulated by the financial services authority (FSA). Today the tickmill brand holds regulatory status in UK, cyprus, and malaysia. According to its website, tickmill group has over 200 staff and more than 50,000 customers.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Built by traders, for traders, tickmill offers low spreads and commission on both ECN and traditional accounts. All accounts feature ultra-fast STP execution (0.15s on average and no requotes) and support for the MT4 platform with all strategies allowed.

Regulated by the FCA in the UK, cysec in europe, and the seychelles FSA internationally вђ“ and a regular winner of trade execution and trading conditions awards вђ“ tickmill also offers 80+ instruments to trade alongside dedicated multi-lingual support and negative balance protection.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Tickmill ltd is regulated by the seychelles FSA (license: SD 008) and has been regulated by the FCA (license: 717270) since 2016. Cysec has regulated the european entity, tickmill europe ltd (license: 278/15) since 2015.

Tickmillвђ™s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex CFD provider 2019 (online personal wealth awards), best forex execution broker 2018 (UK forex awards)В andв best forex trading conditions 2017В (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker 2017 (global brands magazine) for a continual focus on keeping pricing competitive and maintaining a fair trading environment.

Trading conditions

All accounts at tickmill offer STP market executed trades in 0.1 seconds on 62 currency pairs in addition to cfds on stock indices, metals, and bonds, without any dealing desk interference. Tickmill does not offer cryptocurrency cfds.

The margin call and stop-out percentage differ for the retail and professional versions of the accounts where the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30%.

Clients can choose between four wallet currencies вђ“ USD, EUR, GBP, and PLN.

Account types

Tickmill offers three different live accounts in addition to the demo account. While trading conditions improve with the account type, the main differentiating factor is the initial deposit required.

Demo account вђ“ A demo account is available for new traders and will remain open until there is no login for seven consecutive days.

Classic account вђ“ this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. The spreads start at 1.6 pips and maximum leverage is 1:500 вђ“ note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account вђ“ this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for professional traders. Tighter spreads are available in exchange for a commission of 2 USD per side per 100,000 (a standard lot) traded. This commission pricing and structure is an industry-standard and is in line with what other STP brokers offer clients for the same services.

VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit. The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Spreads and commissions

The minimum spread on the classic account is 1.6 pips with zero commission. The minimum spread on the pro and VIP accounts is 0.0 pips with a commission of 2 USD per side per standard lot trade and 1 USD per side per standard lot traded, respectively.

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited. Should the trading account become inactive, tickmill reserves the right to start reimbursing transfer fees.

Tickmill for beginners

Tickmill does not have a traditional introductory course, but they do publish webinars and seminars to help new traders get their footing. They have also made available a detailed ebook which many new traders will find useful. Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer new perspectives on currency markets.

Educational material

For new traders, tickmillвђ™s main resource is its downloadable ebook, but the webinars and seminars are also of great assistance.

The 46-page ebook, titled the majors вђ“ insights & strategies, is well illustrated and a suitable replacement for an online course for beginners. The ebook covers forex trading basics and how forex trading works, an introduction to the major currency pairs, trading strategies and the major types of forex analysis. The ebook ends with a section of top tips which will give traders more confidence in their decisions.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like news trading strategies to technical analysis and chart theories like standard elliot wave models.

Tickmill has a schedule of free seminars around the world, which introduce traders to new areas of learning and also allows clients to meet brokers in person and create relationships.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unique among brokers, who typically shy away from one-to-one contact with traders when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

Trading platforms

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders.

There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading tools

Tickmill also provides a number of useful trading tools.

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and adds little complication to the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available on tickmill is myfxbook autotrade, which is a cross-broker social trading platform that allows for copy trading without the need for additional software.

The one-click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Tickmill VPS has partnered with beeksfx to provide discounted VPS services to clients. While many brokers will include VPS as a free service for active traders, VPS has chosen to partner with a leading 3rd party provider and asks clients to take on the additional cost.

Mobile trading apps

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with tickmill ltd.

Overview

Tickmill is an award-winning and trustworthy STP broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, additional premium tools offered to traders for no extra cost, and good trading conditions, tickmill should be a top choice in forex brokerage.

So, let's see, what we have: is tickmill a scam or a trusted broker? | honest forex broker review 2021 | withdrawal | trading tutorial ➜ read more about it now at is tickmill regulated

Contents of the article

- No deposit forex bonuses

- Honest tickmill forex broker review – scam or not?

- What is tickmill? – the company presented

- Is tickmill a regulated forex broker?

- The safety of customer funds

- Review of the tickmill conditions for traders

- Tickmill trading platform test

- Professional charting and analysis

- Trading tutorial: how do forex and CFD trading...

- Tickmill offers fast order execution and high...

- Use a VPS-server for the best connection

- Tickmill automated trading is possible

- How to open your free tickmill account:

- Unlimited demo account for beginners at tickmill

- 3 different account types – which one you should...

- The VIP account is the best choice for high...

- Review of the deposit and withdrawal of tickmill

- How high is the minimum deposit? – trading with a...

- Is there negative balance protection?

- Tickmill service and support for traders

- Conclusion of my review: tickmill is one of the...

- Tickmill review

- Top takeaways for 2021

- Overall summary

- Is tickmill safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About tickmill

- 2021 review methodology

- Forex risk disclaimer

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for tickmill

- Is tickmill safe?

- Trading conditions

- Tickmill for beginners

- Trading platforms

- Evaluation method

- Overview

Comments

Post a Comment