Contact Us, jp markets email address.

Jp markets email address

Financial professionals can call our advisor service center to speak to a J.P.

No deposit forex bonuses

Morgan representative:

1-800-338-4345 J.P. Morgan asset management is the brand name for the asset management business of jpmorgan chase & co. And its affiliates worldwide.

Jp markets email address

Speak directly with a service representative monday - friday, 8 a.M. To 6 p.M. EST, or for your convenience, use our touchtone system, available 24 hours a day, 7 days a week.

Financial professionals can call our advisor service center to speak to a J.P. Morgan representative:

1-800-338-4345

Direct shareholders and all other inquiries should call shareholder services to speak to a representative:

1-800-480-4111

GENERAL INQUIRIES

If you have difficulty using any function on our site, please email us at funds.Website.Support@jpmorganfunds.Com. The more information you can provide, the better technical support we will be able to provide to you.

Wire transfer information

To send a wire transfer to J.P. Morgan funds, please reference the following information:

(for etfs: please contact your broker or financial advisor for specific information.)

DST asset manager solutions, inc.

2000 crown colony drive

quincy, MA 02169

ATTN: jpmorgan funds services

ABA 021 000 021

DDA 323125832

FBO insert fund name

fund #/account #

registration. [account owner(s)]

order # [confirmation #. If applicable]

Regular mail

J.P. Morgan funds

PO box 219143

kansas city, MO 64121-9143

Overnight mail

J.P. Morgan funds

430 W 7th street suite 219143

kansas city, MO 64105-1407

J.P. Morgan is committed to making our products and services accessible to meet the financial services needs of all our clients.

Please direct any accessibility issues to the advisor service center at 1-800-338-4345.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan asset management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

INFORMATION REGARDING MUTUAL FUNDS/ETF:

Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing. The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read carefully before investing. To obtain a prospectus for mutual funds: contact jpmorgan distribution services, inc. At 1-800-480-4111 or download it from this site. Exchange traded funds: call 1-844-4JPM-ETF or download it from this site.

J.P. Morgan funds and J.P. Morgan etfs are distributed by jpmorgan distribution services, inc., which is an affiliate of jpmorgan chase & co. Affiliates of jpmorgan chase & co. Receive fees for providing various services to the funds. Jpmorgan distribution services, inc. Is a member of FINRA FINRA's brokercheck

INFORMATION REGARDING COMMINGLED FUNDS:

For additional information regarding the commingled pension trust funds of jpmorgan chase bank, N.A., please contact your J.P. Morgan asset management representative.

The commingled pension trust funds of jpmorgan chase bank N.A. Are collective trust funds established and maintained by jpmorgan chase bank, N.A. Under a declaration of trust. The funds are not required to file a prospectus or registration statement with the SEC, and accordingly, neither is available. The funds are available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the funds are not bank deposits and are not insured or guaranteed by any bank, government entity, the FDIC or any other type of deposit insurance. You should carefully consider the investment objectives, risk, charges, and expenses of the fund before investing.

INFORMATION FOR ALL SITE USERS:

J.P. Morgan asset management is the brand name for the asset management business of jpmorgan chase & co. And its affiliates worldwide.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan asset management in accordance with our privacy policies at https://www.Jpmorgan.Com/privacy.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright © 2021 jpmorgan chase & co., all rights reserved

Global contacts

For general inquiries regarding jpmorgan chase & co. Or other lines of business, please call

+1 212 270 6000

For chase customer service, please call +1 800 935 9935.

For individual and family offices, please contact private banking.

For corporations and institutions with revenues between $20 million and $2 billion, contact commercial banking.

Media contacts

- Europe, middle east and north africa

- Asia pacific

Global

- Chief communications officer

darin oduyoye - Global head of media relations for asset management

kristen chambers

Americas

- Head of asset management americas media relations

kristen chambers - Brazil

darin oduyoye - Please direct private bank inquiries to:

kaitlin finnerty

Asia pacific

- Head of APAC media relations

charlotte powell - Hong kong

kathleen wang - Japan

keiko kobayashi - Singapore

mandy chew - Korea

kathleen wang - Taiwan

eileen chiang - Head of private bank asia media relations

celia wan - Australia

charlotte powell

Europe

- Head of asset management EMEA media relations

anoushaa massouleh - Benelux

noor driessen

imma vives - Germany

annabelle duechting

pia bradtmoeller - Nordic region

lennart vaara - Switzerland

geneva/lugano:

imma vives - Zurich

vanja brunner - United kingdom

anoushaa massouleh - France

amayes aouli - Italy

laura barberis - Spain & portugal

víctor acero - United kingdom investment trusts

anoushaa massouleh - Please direct private bank inquiries to:

head of europe, middle east and africa private bank media relations

jason lobo

For press or media inquiries regarding chase or jpmorgan chase, please visit corporate global media relations

Мы работаем круглосуточно.

Есть вопросы или нужна помощь?

Наша служба поддержки готова прийти вам на помощь в любой момент.

Международный поставщик услуг CFD IC markets имеет подразделения в различных странах и регионах мира.

International capital markets pty ltd

Бесплатные телефоны

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018.

Contact us

Contact details for J.P. Morgan asset management’s offices.

For information on our fund range, or to speak to a member of our sales team:

J.P. Morgan asset management

client administration centre

PO box 12272

chelmsford

CM99 2EL

Life companies & platforms

Camilla mckane, client advisor

camilla.S.Mckane@jpmorgan.Com

tel: +44 207 7425645

James yates, client advisor

james.A.Yates@jpmorgan.Com

tel: +44 207 7425061

James wring, client advisor

james.Wring@jpmorgan.Com

tel: +44 797 5561049

Jordan mildwater, business development client advisor

jordan.Mildwater@jpmorgan.Com

tel: +44 207 7425108

Rob maltby, client advisor

rob.Maltby@jpmorgan.Com

tel: +44 755 2211786

Jordan mildwater, business development client advisor

jordan.Mildwater@jpmorgan.Com

tel: +44 207 7425108

Scotland and northern ireland

Michael dinwoodie, client advisor

michael.Dinwoodie@jpmorgan.Com

tel: +44 797 0822453

Charlotte daughtrey, business development client advisor

charlotte.L.Daughtrey@jpmorgan.Com

tel: +44 207 7423972

Victoria williams-gray, client advisor

victoria.Williams-gray@jpmorgan.Com

tel: +44 7817 826 674

Charlotte daughtrey, business development client advisor

charlotte.L.Daughtrey@jpmorgan.Com

tel: +44 207 7423972

Charlotte maloney, client advisor

charlotte.Maloney@jpmorgan.Com

tel: +44 207 7423242

Rob sedgley, client advisor

robert.Sedgley@jpmorgan.Com

tel: +44 207 7429310

Harry boys, business development client advisor

harry.Boys@jpmorgan.Com

tel: +44 207 7429776

London national discretionary fund managers

Personal or confidential information

If contacting us via email please do not send any personal or confidential information as this is not guaranteed to be a secure communication method.

Ask us a question

If you have not been able to find the information you need on our site - or if you need clarification on something - please email your query to us and we will look into it for you.

Please do not include any account details or additional personal information. We cannot act on any instructions or respond to any enquiry directly relating to an account you may hold with us.

J.P. Morgan in united kingdom

Local expertise. Global resources. Our commitment to the united kingdom.

Important information

We are aware of a number of scams and attempted frauds through phone calls and emails claiming to be from a representative of J.P. Morgan offering an investment opportunity.

London is the regional headquarters for our europe, the middle east and africa (EMEA) business. We are recognized as one of the premier financial institutions in the united kingdom, and provide our clients with a range of integrated services from across our franchises under both the J.P. Morgan and J.P. Morgan cazenove brands.

J.P. Morgan has operated in europe for nearly 200 years and has a sophisticated local market presence across europe, the middle east and africa (EMEA). Within the region, J.P. Morgan has an unparalleled client base and leadership across the spectrum of financial services products. The regional head office in london is complemented by a strong regional footprint, with offices in all major financial centers.

Globally, through the jpmorgan chase foundation, we make philanthropic investments in cities where we have major operations, assisting those at a disadvantage by helping them build better lives for themselves, their families and their communities. Across EMEA, the firm focuses its investment and attention on three pillars: economic development, financial empowerment and workforce readiness.

J.P. Morgan is a global leader in financial services, offering solutions to the world's most important corporations, governments and institutions in more than 100 countries. As announced in early 2018, jpmorgan chase will deploy $1.75 billion in philanthropic capital around the world by 2023. We also lead volunteer service activities for employees in local communities by utilizing our many resources, including those that stem from access to capital, economies of scale, global reach and expertise.

Our local history

With a legacy dating back to 1799, we have a history of demonstrating leadership during times of both economic growth and financial instability.

J.P. Morgan’s leadership in the united kingdom extends back to the middle of the nineteenth century. J. Pierpont morgan’s father, junius, was in the merchant banking business in london from 1854 until his death in 1890. In 1873, the scottish american investment trust, a predecessor firm (robert fleming & co. Was sold to chase manhattan in 2000) was formed. In 1887, jarvis-conklin mortgage trust company opened in london and through a series of mergers and reorganizations, this firm became part of the chase manhattan bank.

Today, the firm has offices in london, bournemouth, glasgow and edinburgh — with london serving as the headquarters of the EMEA region. The bournemouth campus is the largest private sector employer in dorset, offering technology and operational processing. The european technology center, based in glasgow, is one of the largest technology employers in scotland, with edinburgh as the center for the investor services business.

Jp markets email address

JP markets does not have a strict minimum deposit – our clients are welcome to invest whatever they are comfortable with. We do however recommend starting with around R3 000, particularly if you require training.

How much does JP markets charge for training?

Our clients enjoy complimentary access to some of the best forex training and mentorship at no charge, provided they have live, funded accounts with JP markets – there are different levels of access available depending on the value of your investment. We offer classes at selected offices across south africa, or online and video courses should you prefer to learn at your own pace.

Have a look at our training calendar on our website or email learn@jpmarkets.Co.Za to book, or to enquire about our self-study options.

What documents are required to open an account?

As a licensed financial services provider, we are obligated to comply with the financial intelligence centre act (also known as FICA). This act is the government’s response to the global fight against money laundering and fraud. To comply with the act, we must identify, verify and update clients’ information, which includes their proof of residence or proof of address. In short – these efforts ensure a safer financial system for all of us. As most of our business is conducted online and we do not transact with our clients face-to-face, we are subject to stricter laws than other entities. We therefore require the following in order to validate your account:

- A certified copy of your ID.

- Confirmation of residential address. Examples include the following:

- A utility bill reflecting the name and residential address of the person;

- A recent lease or rental agreement reflecting the name and residential address of the person;

- Municipal rates and taxes invoice reflecting the name and residential address of the person;

- Mortgage statement from another institution reflecting the name and residential address of the person;

- Fixed -line telephone account reflecting the name and residential address of the person;

- Valid television licence reflecting the name and residential address of the person;

- A statement of account issued by a retail store that reflects the residential address of the person.

- We will also require confirmation of your bank details in order to process any withdrawals.

I don’t receive any mail in my name – what can I submit as proof of address?

You can request a cohabitation form from us, and ask the homeowner to complete and submit along with their supporting documentation. Alternatively you could approach your ward councilor or local police station for an affidavit confirming your residential address.

I just tried to login and it says invalid login/password/no connection.

Open your MT4 client terminal.

Click on open an account.

Click on scan and let the whole scanning of the servers finish.

Once scanning finishes, click on jpmarkets-live (for live) or jpmarkets-practice (for demo).

Input login and password and you should be able to connect.

Should this fail please contact us via support@jpmarkets.Co.Za, the live chat feature on our website, or telephonically at (+27) 021 276 0230.

How do I fund my trading account?

JP markets differs from its competitors because we are authorized and licensed to accept local deposits from clients. We have bank accounts with absa, FNB, standard bank and nedbank, as well as multiple payment gateways. It’s as easy as doing an EFT or cash deposit, or a simple card transaction on our website with your preferred intermediary. Please click here for more details: jpmarkets.Co.Za/bank-details.

Can I fund my account using bitcoins?

Yes you can, but only via skrill – fund your skrill wallet using bitcoin and use this intermediary to fund your JP markets trading account.

What reference must I use when I make a deposit?

Please use your MT4 account number as reference number when making a deposit. Should your MT4 number not be active, please use your full name and surname. You can also forward your proof of payment to finance@jpmarkets.Co.Za with your MT4 number in the subject line.

What is the turnaround time for my deposit to be allocated and reflect in my account?

Deposits are allocated almost instantaneously but because this is done manually, we try to adhere to a maximum TAT of 1 hour during business hours. Please be aware that this window may be slightly longer around news events etc.

My deposit has not reflected on my account – what is the problem?

Please ensure that you have used the correct reference, and that your proof of payment contains the following:

- Sending bank, and recipient bank, details.

- Date of transaction.

- Amount.

- Beneficiary reference.

Kindly note that due to high incidences of fraud, we cannot allocate bigger amounts until they have reflected in our bank account. It is for this reason also that all cheques deposits are subject to a 10-day clearance period.

I just downloaded MT4, why can’t I place any trades?

Sometimes upon downloading, not all symbols are displayed automatically. To enable this, you need to do the following:

– right click on your ‘market watch’ list. – select ‘show all’

Please make sure that you trade the instruments that has a dash (-) next to it.

I forgot my password for the client portal.

To reset your password, go to JP markets home.

– enter your email address and select ‘reset’

You will receive email instructions to reset your password.

Should this fail please contact us via support@jpmarkets.Co.Za, the live chat feature on our website, or telephonically at (+27) 021 276 0230.

I forgot my password for my trading platform.

Log into your client portal via our website and click ‘my accounts’ then click on the account number (in blue) to access your trading account.

Click on ‘change password’

Enter the new password in both blocks and submit – you should now be able to access your trading account with your new password.

How do I request a withdrawal?

Withdrawing funds from your JP markets account is easy and quick. Withdrawal are processed monday to friday from 9am to 5pm, GMT +2 (south african standard time), with all others being acted on within 24 hours.

For security reasons, we will call you to verify the request- if you are expecting a withdrawal, please answer any 087 / 010 / 021 calls to avoid further delays.

Please log in to your member area at secure.Jpmarkets.Co.Za and do an internal transfer from your trading account to your landing account.

Click on ‘transfers’ on the top grey bar and select ‘internal transfers’ from the bar on the right hand side.

The ‘from’ account is your trading account and the ‘to’ account is your landing account.

Enter the amount (in your trading currency) that you would like to withdraw. We will process the conversion on our side and click on submit, and it will go to our finance department for verification.

Ensure all documentation is in order before submitting your request, or it will be declined. We require clear, scanned copies of the following in order to process a withdrawal – ID, proof of address and bank statement confirming your INDIVIDUAL bank details – we are not allowed to process third party payments as per FSB regulations.

More information relating to withdrawals is available on our website.

What is the turnaround time for a withdrawal?

Withdrawals are processed immediately and paid within 4 hours provided that all documentation is in order and you have spoken with our withdrawals department to verify your banking details.

How long does it take for a withdrawal to reflect?

Withdrawals are paid from our bank accounts to yours within 4hrs after approval, usually from the same bank. The notable exception is capitec as they do not offer business bank accounts. These withdrawals are therefore regrettably delayed by the banking system which is unfortunately outside of our control.

Can I withdraw a bonus?

Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

How much is a spread?

Spreads are variable based on market conditions. However, JP markets offers some of the most competitive spreads in the market. On average you can get EUR/USD for about 2 pips, under normal market conditions.

Does JP markets have control over the spread/platform?

No, JP markets has no control over the platform, spreads or clients’ accounts. Unlike some other brokers, our liquidity comes directly from the biggest banks in the world such as JP morgan. UBS and morgan stanley to mention just a few. As a result, the spread is determined by the market conditions. The platform is a 3rd party company – we basically connect our best pricing into MT4. As a result, clients receive market pricing and the most stable and fair pricing.

How much is a swap?

Swaps are dependent on the pairs but can be checked by right clicking in your market watch, and selecting ‘symbols and properties’.

Pending order expiration

When setting a pending order(buy/sell limit OR buy/sell stop), you specify price and can also specify expiry.

In the MT4 platform you can either uncheck or check the expiry box. When unchecked, the pending order will be GTC (good till cancelled), thus the pending order will not expire unless you close it manually. If the expiry box is checked, you will be prompted for a time, take note that the default time is to expire at the close of the next hour.

In the mobile MT4 platform, you will also be asked for expiration either GTC or an expiry time/date. The default is also to expire at the close of the next hour.

Even if you specify a stop loss, the price specified as stop loss is not guaranteed as you may get a worst price due to market conditions as stop orders are always executed as market orders.

Also, it is imperative to clarify that orders may get closed before it reaches the TP or SL levels due to account reaching a stop out level.

Does JP markets give signals to clients?

JP markets does not give signals to clients. However, we do provide world class information and education around specific pairs and symbols and what is happening in the markets. These are sometimes received up to 3 times a day via SMS and email to ensure you get the best available information to make the most informed trading decision. Remember, your success is our success.

Does JP markets buy mandela coins?

JP markets does not accept mandela coins as a preferred method of payment as it is not authorized by the FSB. Clients can cash this in at their bank and then fund their account via the usual channels.

How do I become an introducing broker (IB)?

You can sign up directly on our website under our partners tab. You can also call on at our head office on 021 276 0230 or email support@jpmarkets.Co.Za.

We pay the best commissions in the industry and you can withdraw your rebates at any time. You can also track your rebates on your MT4 account which you can trade with or withdraw at any time. We also have a dedicated team of IB professionals that help you with your business from building a website, hosting seminars, online marketing, designing banners to mention a few. These individuals are focused to take all these tasks away from you to ensure you can focus on sales.

Our goal for all our partners is to help them grow so that one day they too can open their own brokerage, if that is their aim. Our sister company, JP technology, can assist with all the requirements to start your own brokerage.

We can also tailor make a structure to suit your individual requirements. Your success is our success!

What different account types does JP markets offer?

We understand that traders are different, and therefore their requirements are different, based on their trading style. As a result, we offer different types of accounts structured to suit you as a trader. We have ZAR, USD and GBP based accounts, as well as accounts which charge you commission or an account which charge you spread as a cost. All these accounts have direct market access and your order flows directly into the market, thereby ensuring you receive the best possible market price from the forex market with no manipulation of prices, slippages or lagging of any sort. We do not differentiate between micro or mini accounts – you are free to trade all available pairs without restriction.

What is the difference between ECN and standard accounts?

An ECN account stands for electronic communication network. It means that your orders are executed directly in the market. The difference between the two is that on an ECN account, you will see a commission charged per transaction whereas on a standard account you will be charged on spread. Both accounts work out to similar in cost so it is all dependent on what you as a trader prefer.

How much is the commission on an ECN account?

The commission charged is $ 10 per lot. We do offer a lower commission on our VIP accounts.

Why was my stop loss / take profit not hit?

System brief the way pending orders work in financial markets is as follows:

If a client has placed a buy limit or a buy stop order, the orders will get executed if the ask price reaches the specified level.

If a client has placed a sell limit or a sell stop order, the orders will get executed if the bid price reaches the specified level.

If a client has placed a buy order, both SL (stop loss) and TP (take profit) levels will be executed if the bid price reaches the specified levels.

If a client has placed a sell order, both SL (stop loss) and TP (take profit) levels will be executed if the ask price reaches the specified levels.

- By default, MT4 platform only displays bid price line. Enable the ask price line on the charts.

- All the highs and lows of all symbols are made from the bid prices.

Clients make their trading decisions based only on the bid price line which is what they see ontheir charts and then think that their stop loss and take profit levels were wrongly executed.

Clients place trades only using the pricing information on the charts which is not the right way asthe charts are made not from the tradable prices but from pricing library.

Clients should place trades using the prices displayed on the market watch as those are theprices JP markets is willing to buy and sell.

How a chart looks with only bid price line

How chart looks with both bid and ask price lines

How does JP markets make money if you are offering free courses and your clients are “profitable”?

JP markets makes revenue when clients trade. Therefore the more that clients trade, the more revenue that is made. It is for this reason we ensure that our clients receive all the knowledge and tools available to be able to make their own educated trading decisions.

Who regulates JP markets?

JP markets is an authorized FSP 46855. We are regulated by the financial services board and the responsible acts such as FIC act, SARB and FICA act.

How much money can I make if I deposit X amount?

Your profits all depend on the type of trader you are. There are no limitations or restrictions on what you can make in the forex market. Some people have managed to make 10 000 % in one day but what is important is to manage your risk.

I want to start trading but I don’t know how?

We can teach you through our online courses, PDF forex book or any of our free classes we host. Contact us at learn@jpmarkets.Co.Za to find out more.

Do I have to pay JP markets for their services other than my investment?

No, there are no fees you have to pay.

Can JP markets trade on my behalf?

No, we do not trade clients’ funds on their behalf, and we do not recommend that you give your login credentials to anyone to trade on your behalf. We can however teach you how to trade the markets on your own. Alternatively you could link your account to that of a master trader – check out our social trading facility here copytrader.Jpmarkets.Co.Za. You can compare the trading history of the available traders and pick the one whose trading strategy is most closely aligned with your investment goals.

Does JP markets make any deductions for taxes on the money I make/withdraw?

No, we do not make any deductions – your tax considerations are completely between you and SARS. However, it should be noted that any profit that you make from trading forex will be classed as contributing to your gross income in the income tax act, and thus would be taxed as income, based on the income tax tables for an individual. Consequently, any expense that you incur in the production of the income can be deducted. Please speak to your tax consultant to be completely clear about the tax implications.

Is my money safe?

Your funds are completely safe. Funds are kept in client to client segregated accounts which gets monitored and audited daily by a third party registered auditor every single day. Therefore, your funds are separate and completely safe and secured. In addition, we also have fidelity and professional indemnity insurance to give our clients that extra piece of mind.

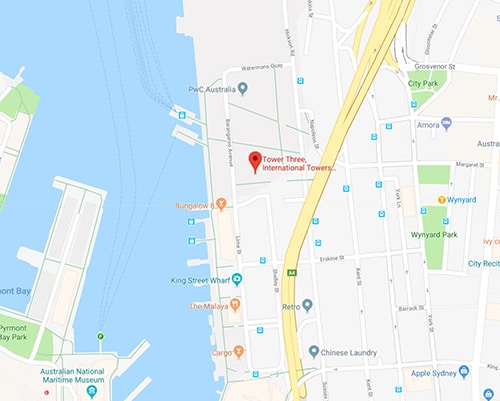

Contact us

If you would like to get in touch, please contact us using the details below.В

1300 303 888 +61 (0) 2 8221 2100

CMC markets asia pacific pty ltd

level 20, tower 3, international towers, 300 barangaroo avenue

sydney

NSW 2000

australia

International offices

- CMC markets austria CMC markets germany gmbh niederlassung wien

- Millennium tower wehlistrasse 66/5

- 1200

- Wien

- Гѓвђ“sterreich

- CMC markets canada inc

- 100 adelaide st. West, suite 2915

- M5H 1S3

- Toronto, ontario

- Canada

- CMC markets germany gmbh

- Garden tower neue mainzer str. 46-50

- 60311

- Francfort-sur-le-mai

- Allemagne

- CMC MARKETS GERMANY GMBH

- Garden tower neue mainzer str. 46-50

- 60311

- Frankfurt

- Deutschland

- CMC markets germany gmbh

- Garden tower neue mainzer str. 46-50

- 60311

- Frankfurt

- Germany

- CMC markets germany gmbh

- Garden tower, neue mainzer str. 46-50

- Francoforte

- 60311

- Germania

- CMC markets NZ ltd

- Level 25, 151 queen street

- Auckland

- New zealand

- CMC markets

- Fridtjor nansens plass 6

- 0160

- Oslo

- Norge

- CMC markets germany gmbh spгіе‚ka z ograniczonд… odpowiedzialnoе›ciд… oddziaе‚ w polsce

- Ul. Emilii plater 53

- 00-113

- Warszawa

- Polska

- CMC singapore

- 50 raffles place #30-02/03 republic

- 048623

- Singapore

- Singapore

- CMC markets (spain)

- C/ serrano 21, 4ВЄ planta

- Madrid

- 28001

- Spain

- CMC markets

- Neue mainzer str. 46-50

- 60311

- Frankfurt am main

- Germany

- CMC markets UK plc

- 133 houndsditch

- London

- EC3A 7BX

- United kingdom

Trade cfds on one of the world's most popular platforms

Next generation platform

Access our full range of products, CFD trading tools and features on our award-winning platform

Investing in CMC markets derivative products carries significant risks and is not suitable for all investors. You could lose more than your deposits. You do not own, or have any interest in, the underlying assets. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Spreads may widen dependent on liquidity and market volatility.

The information on this website is prepared without considering your objectives, financial situation or needs.

J.P. Morgan in united kingdom

Local expertise. Global resources. Our commitment to the united kingdom.

Important information

We are aware of a number of scams and attempted frauds through phone calls and emails claiming to be from a representative of J.P. Morgan offering an investment opportunity.

London is the regional headquarters for our europe, the middle east and africa (EMEA) business. We are recognized as one of the premier financial institutions in the united kingdom, and provide our clients with a range of integrated services from across our franchises under both the J.P. Morgan and J.P. Morgan cazenove brands.

J.P. Morgan has operated in europe for nearly 200 years and has a sophisticated local market presence across europe, the middle east and africa (EMEA). Within the region, J.P. Morgan has an unparalleled client base and leadership across the spectrum of financial services products. The regional head office in london is complemented by a strong regional footprint, with offices in all major financial centers.

Globally, through the jpmorgan chase foundation, we make philanthropic investments in cities where we have major operations, assisting those at a disadvantage by helping them build better lives for themselves, their families and their communities. Across EMEA, the firm focuses its investment and attention on three pillars: economic development, financial empowerment and workforce readiness.

J.P. Morgan is a global leader in financial services, offering solutions to the world's most important corporations, governments and institutions in more than 100 countries. As announced in early 2018, jpmorgan chase will deploy $1.75 billion in philanthropic capital around the world by 2023. We also lead volunteer service activities for employees in local communities by utilizing our many resources, including those that stem from access to capital, economies of scale, global reach and expertise.

Our local history

With a legacy dating back to 1799, we have a history of demonstrating leadership during times of both economic growth and financial instability.

J.P. Morgan’s leadership in the united kingdom extends back to the middle of the nineteenth century. J. Pierpont morgan’s father, junius, was in the merchant banking business in london from 1854 until his death in 1890. In 1873, the scottish american investment trust, a predecessor firm (robert fleming & co. Was sold to chase manhattan in 2000) was formed. In 1887, jarvis-conklin mortgage trust company opened in london and through a series of mergers and reorganizations, this firm became part of the chase manhattan bank.

Today, the firm has offices in london, bournemouth, glasgow and edinburgh — with london serving as the headquarters of the EMEA region. The bournemouth campus is the largest private sector employer in dorset, offering technology and operational processing. The european technology center, based in glasgow, is one of the largest technology employers in scotland, with edinburgh as the center for the investor services business.

Global office contact details

Czech republic - servicing countries from central and eastern europe

Czech republic - servicing countries from central and eastern europe

Saxo bank A/S, organizační složka

na poříčí 3a

praha 1, 110 00

czech republic

Denmark

Saxo bank A/S (headquarters)

philip heymans alle 15

2900 hellerup, denmark

France

Saxo banque (france)

10, rue de la paix

75 002 paris, france

Italy - customer service in italian language

Italy - customer service in italian language

Saxo bank A/S

philip heymans alle 15

2900 hellerup, denmark

Netherlands

Saxo bank A/S the netherlands

barbara strozzilaan 310,

1083 HN amsterdam,

netherlands

Switzerland

Saxo bank (suisse) SA

representative office geneva

place de la fusterie 5 bis

CH-1204 geneva, switzerland

Switzerland

Saxo bank (schweiz) AG

beethovenstrasse 33

CH-8002 zürich, switzerland

United kingdom

Saxo markets

40 bank street, 26th floor

E14 5DA london, united kingdom

Australia

Saxo capital markets (australia) limited

suite 1, level 14, 9 castlereagh st

sydney NSW 2000

sydney, australia

Shanghai, china

Saxo asgard computer technology (shanghai) co., ltd.

Hong kong S.A.R

Saxo capital markets HK limited

19th floor

shanghai commercial bank tower

12 queen’s road central

hong kong

India

SAXO group india private limited

5th floor, MLCP tower

candor techspace, sector 21, gurugram

122016 haryana, india

Japan

Saxo bank securities ltd.

Toranomon kotohira tower 22F

1-2-8 toranomon minato-ku tokyo 105- 0001

〒105-0001 東京都港区虎ノ門1-2-8

虎ノ門琴平タワー 22F

japan

Singapore

Saxo markets

3 church street, #30-00

samsung hub

singapore 049483

Dubai

Saxo bank A/S - representative office

due to coronavirus controls, with many of our staff working from home, we are not able to meet with clients in our reception at present, unless by appointment in exceptional circumstances. We remain at your service on the phone and email details below. Thank you for your understanding.

Dubai, UAE

Other inquiries

Support centre

Find answers to questions about our platforms, products and services.

Complaints

Should you wish to file a complaint, click the button below.

Careers

View our current career opportunities and vacancies.

Press contacts

Find key information in our media centre.

Democratising trading

and investment for

more than 25 years.

Saxo bank A/S (headquarters)

philip heymans alle 15

2900

hellerup

denmark

Products & pricing

- Forex

- Cfds

- Futures

- Commodities

- Forex options

- Listed options

- Stocks

- Bonds

- Etfs

- Mutual funds

- Investment portfolios

- Trading strategies

- General charges

Platforms

Accounts & service

General

Other

Across

Trade responsibly

all trading carries risk. Read more. To help you understand the risks involved we have put together a series of key information documents (kids) highlighting the risks and rewards related to each product. Read more

This website can be accessed worldwide however the information on the website is related to saxo bank A/S and is not specific to any entity of saxo bank group. All clients will directly engage with saxo bank A/S and all client agreements will be entered into with saxo bank A/S and thus governed by danish law.

Apple and the apple logo are trademarks of apple inc, registered in the US and other countries and regions. App store is a service mark of apple inc. Google play and the google play logo are trademarks of google LLC.

So, let's see, what we have: feel free to contact us if you would like further information about J.P. Morgan funds, using the information provided and we will respond as soon as possible. At jp markets email address

Contents of the article

- No deposit forex bonuses

- Jp markets email address

- GENERAL INQUIRIES

- Global contacts

- +1 212 270 6000

- Мы работаем круглосуточно.

- Бесплатные телефоны

- Торговля на форекс

- Характеристики

- О компании IC markets

- Торговля на форекс

- Характеристики

- О компании IC markets

- Contact us

- Personal or confidential information

- Ask us a question

- J.P. Morgan in united kingdom

- Our local history

- Jp markets email address

- How much does JP markets charge for training?

- What documents are required to open an account?

- I don’t receive any mail in my name – what can I...

- I just tried to login and it says invalid...

- How do I fund my trading account?

- Can I fund my account using bitcoins?

- What reference must I use when I make a deposit?

- What is the turnaround time for my deposit to be...

- My deposit has not reflected on my account – what...

- I just downloaded MT4, why can’t I place any...

- I forgot my password for the client portal.

- I forgot my password for my trading platform.

- How do I request a withdrawal?

- What is the turnaround time for a withdrawal?

- How long does it take for a withdrawal to reflect?

- Can I withdraw a bonus?

- How much is a spread?

- Does JP markets have control over the...

- How much is a swap?

- Pending order expiration

- Does JP markets give signals to clients?

- Does JP markets buy mandela coins?

- How do I become an introducing broker (IB)?

- What different account types does JP markets...

- What is the difference between ECN and standard...

- How much is the commission on an ECN account?

- Why was my stop loss / take profit not hit?

- How does JP markets make money if you are...

- Who regulates JP markets?

- How much money can I make if I deposit X amount?

- I want to start trading but I don’t know how?

- Do I have to pay JP markets for their services...

- Can JP markets trade on my behalf?

- Does JP markets make any deductions for taxes on...

- Is my money safe?

- Contact us

- International offices

- J.P. Morgan in united kingdom

- Our local history

- Global office contact details

- Czech republic - servicing countries from central...

- Denmark

- France

- Italy - customer service in italian language

- Netherlands

- Switzerland

- Switzerland

- United kingdom

- Australia

- Shanghai, china

- Hong kong S.A.R

- India

- Japan

- Singapore

- Dubai

- Other inquiries

Comments

Post a Comment