Tickmill verification documents, tickmill verification documents.

Tickmill verification documents

The promotion is suited for both novice and professional traders, to tryout the trading conditions of tickmill’s pro account type.

No deposit forex bonuses

If you wish to continue trading with the pro account with your own fund, go to the account opening page from below.

Tickmill $30 welcome account

30 USD for free to all new traders of tickmill!

Free 30 USD to start trading with the licensed MT4 broker!

Promotions

Top pages

- How to withdraw tickmill $30 no deposit bonus on MT4? What's the requirement/conditions?

- FBS $140 level up bonus

- What happens if I withdraw funds from XM $30 bonus account?

- Verified my account but I can't get XM $30 bonus. Why is that?

- Completed the verification but I didn't get XM's $30 bonus. Why is that?

- Octafx $1,000 instagram contest

- Fxgiants $70 no deposit bonus

- XM 100% deposit bonus

- Instaforex $1000 no deposit bonus

- Trade stocks & metals with "$50 no deposit bonus" by xtrade

Tickmill’s “$30 welcome account” welcomes new traders of tickmill with 30 USD no deposit bonus.

The promotion allows participants to start trading forex and cfds without making a deposit at all, thus providing them the opportunity to invest in forex and CFD markets with risk-free.

The promotion involves no fees or hidden commissions.

Tickmill $30 welcome account

This tickmill’s $30 no deposit bonus promotion is the ultimate risk-free promotion.

The promotion is suited for both novice and professional traders, to tryout the trading conditions of tickmill’s pro account type.

Here are the main information of the promotion “tickmill $30 welcome account”.

| Promotion type | no deposit bonus |

|---|---|

| bonus amount | 30 USD |

| requirement | account opening and verification |

| promotion period | 90 days from the account opening |

| withdrawal of bonus | not available |

| withdrawal of profit | available (from 30 to 100 USD) |

You can even withdraw profits made in the “$30 welcome account” by meeting some conditions.

Visit tickmill official website and go to “promotions” and “$30 welcome account” as below.

How to get tickmill’s $30 no deposit bonus?

The promotion is available for all new traders of tickmill ltd.

Follow the steps below to open tickmill’s $30 welcome account today.

- Go to the promotion page in tickmill official website

only new traders can open the “$30 welcome account”. - Fill in the registration form

in the promotion page, complete your online registration. - Login to MT4 with the provided login credentials

you will receive MT4 login credentials to your email address. Install MT4 trading platforms of tickmill and login, then you will find 30 USD already credited in the account. - Start trading for 90 days

each $30 welcome account is available for trading for 90 days from the date of account opening.

Why you should open tickmill’s $30 welcome account?

This tickmill’s promotion isn’t ordinary like others, but has a lot of advantages for online traders.

Here are the 3 main benefits of the promotion “$30 welcome account”.

- Free – no need to deposit funds

the promotion requires zero deposits from you. You don’t need money to start trading forex with tickmill. - No risk – no risk of losing your money

your money stays in your bank account at all times. While trading in tickmill’s $30 welcome account, the risk is limited to the 30 USD which is given from tickmill for free. - Profitable – profits earned can be withdrawn

profits made in the $30 welcome account can be withdrawn by meeting certain requirements.

You don’t lose anything or risks involved by participating in this promotion.

$30 welcome account is pro account type

Tickmill’s $30 welcome account has the same trading conditions as the pro account type.

Tickmill’s pro account type has the following conditions.

| Minimum spread | 0.0 pips |

|---|---|

| trading commission | $2 per side per 100,000 traded |

| maximum leverage | 1:500 |

| trading volume | from 0.01 lot |

| execution model | NDD |

| execution type | market execution |

| average execution speed | 0.15 seconds |

| stop out % | 30% |

If you wish to continue trading with the pro account with your own fund, go to the account opening page from below.

90 days promotion period

Tickmill’s $30 welcome account promotion runs for the unlimited time period, but the trading period is limited to 90 days from the date of account opening.

When you opened the $30 welcome account, you can trade in the account for 90 days.

If your profit amount after 90 days is above 30 USD, then you have an opportunity to withdraw it by meeting certain requirements.

If you fail to make profit of at least $30, then you won’t be able to withdraw the profit later.

Profit withdrawal from $30 welcome account

From tickmill’s $30 welcome account, you can withdraw the profit only one time.

The available withdrawal amount is from 30 USD to 100 USD .

To be able to withdraw any profits from the account, you must meet the following conditions:

- Signup and register for tickmill again.

- Verify your account information with documents in the client portal.

- Open a live trading account and deposit at least $100, or equivalent amount in other currencies.

Once you have met the above conditions, send an email to tickmill support team to request profit withdrawal from $30 welcome account.

Available only with tickmill ltd (FSA SC regulated)

Tickmill is a multi-regulated online forex and CFD broker, and due to regulatory reasons, the promotion may not be available for traders residing certain countries.

Tickmill also specifies the traders of the following countries cannot participate in the promotion: algeria, armenia, australia, azerbaijan, belarus, bulgaria, colombia, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan, kenya and european union.

Use of eas (expert advisers) is prohibited

Throughout the promotion, you cannot use eas (expert advisers) or any algorithm trading robot in tickmill’s $30 welcome account.

Tickmill’s $30 welcome account is provided, so new traders of tickmill can experience the trading conditions of MT4 pro account without making a deposit.

The promotion is especially suited for novice traders of forex market for this purpose.

Posted by FXBONUS.Info

For more information, please inquire to tickmill official website official website directly. In order to participate to the promotion, you must have a tickmill account. If you haven't opened an account yet, please open one from here for free.

Tickmill official website is here.

Please click "introduction of tickmill", if you want to know the details and the company information of tickmill.

Tickmill minimum deposit

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

Tickmill minimum deposit amount

The minimum deposit at tickmill is $100.

Check the following comparison table to see how tickmill stacks up against similar brokers when it comes to minimum deposits:

| tickmill | axi | FXCM | |

|---|---|---|---|

| minimum deposit | $100 | $0 | $300 |

The minimum deposit means that you will first need to transfer this amount to your brokerage account from your bank account in order to start trading. It is sometimes called an initial deposit or funding.

Beyond the required minimum deposit, there are a couple of other factors to consider when you are about to open an account at tickmill. Here are the main pros and cons when it comes to depositing at tickmill:

| Pros | cons |

|---|---|

| • credit/debit card deposit | none |

| • no deposit fee | |

| • depositing is user-friendly |

Open account

73% of retail CFD accounts lose money

Why does tickmill require a minimum deposit?

Online brokers sometimes require a minimum deposit in order to cover their initial costs associated with creating a new account and to ensure their profitability. The higher the amount you deposited, the higher the chance for you to trade more and generate bigger profits for the broker.

In some cases, the very high minimum deposit (like the £1 million amount at the VIP account of saxo bank) is there to differentiate the level of services they offer you.

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill minimum deposit

tickmill deposit fees and deposit methods

Tickmill does not charge a deposit fee. This is great because the broker won't deduct anything from your deposits and you only have to calculate with the costs charged by the bank / third-party you send the money with. If you want to know more about tickmill fees, check out the fee chapter of our tickmill review.

While there is no deposit fee at tickmill, the available deposit methods are also important for you. See how tickmill deposit methods compare with similar online brokers:

| tickmill | axi | FXCM | |

|---|---|---|---|

| bank transfer | yes | yes | yes |

| credit/debit card | yes | yes | yes |

| electronic wallets | yes | yes | yes |

The average transfer times for the different methods are:

- Wire transfer: 2-3 days

- Credit / debit card and online wallets: instant or a few hours

A minor issue with depositing money to tickmill is that based on our experience it's not user-friendly compared to similar brokers. This means either that the interface is not user-friendly or that figuring out where and how you have to make the transfer is a bit complicated.

Find out more about depositing to tickmill on their official website:

Open account

73% of retail CFD accounts lose money

Tickmill minimum deposit

deposit currencies

Each trading account has a base currency, which means that the broker will hold your deposited money in that currency. At some brokers, you can also have more trading accounts with different base currencies. For example, at IG, it is possible to have both EUR and USD-based accounts.

Why does this matter? A currency conversion fee will be charged if you deposit in a different currency than the base currency of the target trading account. It's likely not a big deal but something you should be aware of.

Some online brokers offer trading accounts only in the major currencies (i.E. USD, GBP, EUR and sometimes JPY) and some support a lot more than that.

| tickmill | axi | FXCM | |

|---|---|---|---|

| number of base currencies | 4 | 11 | 4 |

Tickmill supports the major currencies like USD, GBP and EUR, but does not support minor currencies. If you would deposit in a major currency anyway, then the online broker won't have to convert it. However, if you use a minor currency that is not supported, tickmill will convert your deposits and you will be charged a currency conversion fee.

A convenient way to save on the currency conversion fee if you wish to fund your brokerage account from a less common currency (or just a currency different from your existing bank account) can be to open a multi-currency digital bank account. At revolut or transferwise the account opening only takes a few minutes after which you can upload your existing currency into your new account, exchange it in-app at great rates, then deposit it into your brokerage account for free or cheap.

Want to stay in the loop?

Sign up to get notifications about new brokerchooser articles right into your mailbox.

Tickmill minimum deposit

steps of sending the minimum deposit

The specific process of sending your minimum deposit to tickmill might vary slightly from the following, but generally the process involves the following steps:

Step 1: open your broker account

At most brokers, you can open your trading account online. To open an account, you have to provide your personal details, like your date of birth or employment status, and there is also usually a test about your financial knowledge. The last step of the account opening is the verification of your identity and residency. For this verification you usually have to upload a copy of your ID card and a document that validates your proof of residence, for example, a bank statement.

If you don't know which broker is suitable for you, use our broker selector tool.

Step 2: make the deposit

First you have to sign in to your already opened trading account and find the depositing interface. After this, you select one of the deposit methods the broker supports, enter the deposit amount and make the deposit.

The deposit methods can be one or more of the following:

- Bank transfer (sometimes called wire transfer): you have to add your bank account number in the deposit interface. The bank account has to be in your name. After this, you need to start a bank transfer from your bank. The broker will give you a reference number that you'll have to enter as a comment in your transaction. This will allow them to identify your deposit.

- Credit or debit cards: just as with a normal online purchase, you are required to enter the regular card details. However, unlike any other online purchase, it's required to use a card that's in your name. In some cases, like with IC markets, you'll also need to verify your card by scanning it and sending it to the broker. This is yet another anti-money laundering measure on their end. Card payment is usually the preferred and most convenient way of depositing. On the other hand, some brokers define a cap for card deposits, so for a larger amount you might have to use the bank transfer.

- Online wallets like paypal, skrill, neteller, etc.: it works just like any other online purchase. The interface of the wallet will pop up where you'll have to enter your credentials (username and password) and carry out your transaction.

Step 3: review your transaction

Depending on the method you chose, it might take a couple of days for your deposit to show up on your brokerage account. When it happens, the brokers usually send you an email to confirm the receipt of the deposit.

Open account

73% of retail CFD accounts lose money

Tickmill review

Regulated by: FCA, cysec, seyschelles FSA

Headquarters: united kingdom

Ranking: 7

Spread: 0.1 pips (EURUSD)

Leverage: 500:1

Minimum deposit: $100

Tickmill review & author's comment

Is tickmill reliable?

One of the best CFD and forex brokerage firm, tickmill was launched back in 2011 to provide traders with a great trading experience. With its headquarters located in both UK and seychelles, the company offers its clients a wide range of account choices with respect to the status of tax and location.

The UK headquarters is located in london and the accounts registered to this office are controlled by the financial conduct authority or FCA. The best thing about the UK accounts is that they come with protection up to an amount of £50,000 deposit. Seychelles financial services authority or FSA regulates the seychelles accounts of tickmill.

The best thing about tickmill is that it offers you to trade in a large variety of instruments listed under cfds including four different german government bonds. Apart from the government bonds, you will also be able to trade on more than 62 currency pairs, commodities like gold, silver, crude oil, 15 different equity indices and also bitcoin when with US dollar. As a matter of fact, all the trading instruments are equally available for both UK as well as seychelles accounts. The only difference lies in the requirement of minimum deposit. Furthermore, the maximum leverage that is available for UK accounts is 30 to 1 as per regulations of ESMA. On the contrary, the maximum allowable leverage in seychelles is up to 500.

Tickmill account types

One of the most helpful things that the brokerage firm does is to offer new clients with a demo account which is free of any risk. Apart from the complete access to the MT4 platform, the demo account also provides you with all the assets that can be traded. Apart from that, the demo account also shows the real-life volatility as well as prices to help you to get acquainted with the market.

With tickmill, you will also be able to choose from at least 5 different real money account types.

Out of all the accounts that tickmill offers, the classic account is undoubtedly the most accessible. The classic account is obviously an entry level account which allows you to enter the trade without having to spend much money on deposit or commissions. The minimum amount that you need to deposit is 100 of whatever the base currency you choose. The maximum leverage that you can obtain from this account type is 1:500 with the spread starting from 1.6 pips. Furthermore, the trade execution on this account type is of NDD variety.

The pro account type, on the other hand, provides you with a much-improved spread. While you need to pay a commission of 2 per side on every lot, the spread starts from 0 pips with a maximum leverage of 1:500.

If you can manage to maintain a minimum balance of 50,000 base currency then you are qualified enough to open a VIP account. While the commission for this account is just 1 for every side and every lot, the spread starts from 0 pips and the maximum leverage is 1:500 too.

Tickmill also allows traders to become professional clients if they can log high trading volumes. However, there are a few conditions that you must fulfil to become a professional client.

First of all, you need to have a very impressive portfolio which needs to exceed the amount of EUR 500,000. Secondly, you need to have a trading volume of 10 trades in every quarter over the past four quarters. Lastly, you need to have a working experience of at least a year in the financial sector to become a professional client of tickmill.

Tickmill also allows you to open an islamic account which is fully compliant to the sharia law. To have an islamic account, you will have to open any of the aforementioned accounts and request the brokerage to convert it into an islamic account. The trading conditions for the islamic accounts are same as the previously mentioned account types.

Tickmill customer support

Tickmill is especially popular for its extraordinary customer support. It offers you with robust customer support in 14 different languages through phone calls, live chat, social media, email and call back request.

The support team takes only 5 minutes to respond to live chat. On the other hand, it usually takes an hour to get responded on the social media posts. Furthermore, the callback requests are obviously attended within the same business day. So, you will not have to worry about getting helped by the support team.

Tickmill trading platforms

Similar to several other forex brokers, tickmill also provides you with highly advanced as well as user-friendly MT4 trading platform which is also available in mac as well as windows OS, android, ios and web-based versions.

MT4 has undoubtedly remained the most popular trading platform since 2005. This trading platform offers you a completely user-friendly interface along with all the tools that you require including technical indicators, charting packages, expert advisors and a highly advanced backtesting environment.

Moreover, tickmill has also collaborated with myfxbook to provide you with advanced trading options through the autotrade platform. The brokerage also offers their clients with VPS service so that they can install their preferred eas and run them on any device. You will be able to acquire the VPS package at an expense of £20 per month.

Tickmill deposit and withdrawal methods

If you have an account in tickmill then you will be able to deposit and withdraw money through different channels.

The very first option that you will be able to use is the debit or credit cards. The thing that you need to note here is that only the cards issued by visa and mastercard are allowed. And it usually takes about one business day to process the payment.

You will also be able to deposit money through wire transfers. Moreover, the vietnamese and thai clients of tickmill’s seychelles branch are provided with the option of instant online bank transfers.

You will also be able to deposit money through skrill, neteller, paysafecard, fasapay, china unionpay, dotpay, qiwi wallet, nganluong and globepay. Out of these e-wallet options, dotpay, skrill and neteller are available on a global scale. Other options are specific to the clients of seychelles.

The best thing about tickmill is that it does not charge anything on withdrawals and deposits. Moreover, the lowest amount that can be withdrawn is $10.

Tickmill bonus and promotions

- $30 welcome bonus – $30 bonus shall be credited to your trading account when you open a real account. You do not have to deposit any more to get this bonus and the profits are withdrawable.

- Trader of the month – tickmill chooses the best among existing clients and award the best performing trader with a $1,000 prize every month.

- Tickmill NFP contest – during every NFP week, tickmill chooses one instrument during every US non-farm payroll week and challenges traders to guess its price in MT4 platform at 16:00 which is 30 minutes after the NFP release. An exact hit shall be rewarded with a $500 bonus. In case of no exact hit, the trader with the closest prediction will get a $200 prize.

Tickmill final word

The brokerage understands that trading conditions are not similar across the globe. Thus, they have modified the offerings as per the location and economic conditions of their clients. Tickmill allows the traders to trade with tickmill seychelles if they need high leverage. And those who can comply with the regulations of ESMA can obviously join the UK or europe branch of the brokerage. In other words, you will be able to achieve complete flexibility as a trader with tickmill.

Tickmill – step by step live account opening guide

In this section, I will guide you through the account opening process in order to be able to make the deposit and start trading at tickmill. There are two major steps which are very easy and should not take more than several minutes

Step 1 – fill the registration form

First of all, you have to choose the regulator that your live account is going to be registered to. The clients living outside european union should select FSA of seychelles whereas european clients should proceed with FCA of the united kingdom regulator.

Registration form requires you to submit your basic personal information such as country, name, last name, phone number, e-mail and date of birth. All the information must be correct so that you will need to verify this information later.

Tickmill reviews – guide

This is how tickmill allows you to start a demo account, i.E. A demo account that you can use to learn or check the platform. The demo account also requires verification by e-mail, so you should provide such an e-mail to which we have access because the acceptance of your account is possible by receiving a special link that should be clicked on to verify your account in tickmill.

Starting a real account – investing real money

Creating an account at tickmill, step 1/2

In order to set up an account in tickmill, you must complete all required boxes on the registration page. You must provide all the correct data if you want to connect a real account to this account, because this account associated with the email address will receive all very important information connected with the account. Also the password reminder or changing data will require receiving emails that will be combined with the account.

Payment and withdrawal methods

At tickmill, there are various deposit and withdrawal options. After opening the account you will be able to check which option is the most advantageous for you. Depositing money is done by selecting a payment method, selecting a deposit and depositing funds. If we want to withdraw our money, we do the same. We select the method of payment, order the appropriate amount available on the platform and accept the transfer.

Registration step 2/2

In step two, you have to complete almost all boxes. In this step you should also answer all the questions that are to verify your knowledge. It is worth changing the language of the platform at the top of the page so that the questions are in your native language. The important thing is understanding these questions and honest answers.

Completing the registration

After completing the filling out the boxes, accept the regulations and information about the risk and correctness of the entered data. After this step, we will receive an email with a link to the verified your account. After clicking on it your account will be active and you will be able to log in with the entered data.

Verifying the account on the tickmill website.

After logging into your tickmill account, you have to verify your account by submitting the two required documents. Your account will not be active without verifying these two required documents. In order to do this, please attach a scan of the document with a photo in the first window, and a document confirming your home address in the second. Complete guidelines concerning documents are available after logging into the platform. It is important that the document is legible and the picture clearly visible. After adding the photo we send it through the platform and we wait for someone to activate our account. Account activation takes from several hours to several days. After accepting the documents we will receive a message about the correctness or rejection of the application. If the documents are correct, our account will be activated, if not- our application is rejected. If it is rejected, check what was wrong, what document was incorrect, correct it and send back again.

No deposit bonus, withdraw profits – tickmill

Make your perfect risk-free start with $30 forex no-deposit welcome bonus presented by tickmill. Feel the superior execution quality and the perfect trading environment with no-deposit bonus where no investment involves trading live forex. Besides, withdraw all profit earned traded by non-deposit welcome bonus, with a single condition given below. Each client can open only one account for this welcome no-deposit promotion.

€£$ TICKMILL 30 forex no-deposit welcome bonus

Joining link: get-bonus

Ending date: december 31, 2021

Offer is applicable: new traders with a live account

How to apply:

- Register a client account

- Make a live account under client profile

- Bonus is added after complete the registration.`

Cash out: only profits can be withdrawn as below

- Verify the profile by uploading the required documents.

- Trade 5 lots to withdraw all profits.

- At least a 100 deposit must be made to another live trading account.

Terms – tickmill NO deposit bonus

The bonus is not available for the client of algeria, armenia, australia, azerbaijan, belarus, bulgaria, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

Bonus need to claim within 14 business days from the date of registration.

This forex bonus is available to one per client.

Tickmill’s deep review

By comparethemfx team

Introduction

Tickmill is one of the most credible and reliable forex brokers in the market. Founded in 2014 with its headquarters in london – UK, this company has been providing quality brokerage services to users across the world from the past six years. Users of this broker get to access various financial markets like forex, soft/hard commodities, indices, bonds, etc.

Compared to other brokers with the level of tickmill’s market experience, this broker proved to be heavily regulated with some of the top tier financial regulators. Tickmill offers four types of well curated accounts and users get to pick the ones that is most appropriate to them. Demo trading facility is also available for users which could help novice traders to get the hang of the platform they are going to use.

This broker offers their services on the MT4 trading platform which is highly accepted by traders across the world. Using this platform, users get to trade on both desktops (windows/mac), and smartphones (android/ios). Apart from these, there are various other services this broker provides for their users like trading bot services called autochartist, VPS and many more.

The unique selling proposition of this broker is the lowest fees they offer. When compared to other regulated brokers, tickmill charges very less commissions and trading fees. Options to deposit and withdrawal are also many and are typically not charged. On the flip side, users get to access limited number of asset classes when compared to other brokers of this range.

Regulated

- Min deposit: $ 100

- Max leverage: 500:1

- Welcome account: yes

Regulatory bodies

Tickmill has its presence in various geographical areas and all of its entities are regulated by the respective regulatory bodies in that jurisdiction. For instance, in the UK, this broker is regulated by the FCA (financial conduct authority) which is a tire-1 regulator. In europe, tickmill has its licenses under the regulation of cysec which is also one of the very well-known regulators in the world. Apart from these two, this broker also is being regulated by another tier-2 regulator FSA (seychelles financial services authority).

Available asset classes

Users of this broker gets to access financial instruments from some of the most liquid markets in the world like forex, commodities, bonds and indices. If there is any one setback for this broker with respect to competition, it would be in this space. Because, very limited assets are offered but all of them are highly traded in their corresponding markets. So the available instruments should be good enough for all the typical traders who are willing to trade high volatile assets classes.

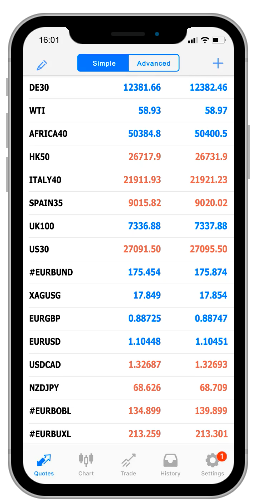

Currently, 85 assets can be accessed by tickmill users. The breakdown is as follows – 62 forex currency pairs, 17 stock indices and oil, 2 metals and 4 bonds.

Some of the most traded asset classes with this broker can be found in the table below.

| Forex currency pairs | stock indices & oil | metals | bonds |

| EUR/USD | AUS200 | XAG/USD | EURSCHA |

| EUR/GBP | FRANCE40 | XAU/USD | EURBUXL |

| EUR/CZK | UK100 | EURBUND | |

| AUD/JPY | USTEC | EURBOBL | |

| AUD/USD | BRENT | ||

| USD/CAD | XTIUSD | ||

| NZD/USD | WTI |

Types of accounts

This broker has curated three different types of accounts to cater to a large group of traders. As shown in the snapshot below, the three types are classic, pro and VIP accounts. The minimum deposit required to open a classic and pro accounts are 100 dollars, euros or pounds. But to open a VIP account, a minimum balance of 50,000 dollars, euros or pounds is mandatory. Maximum leverage allowed in all three account types is 500X. There is also islamic swap free account and demo account facility for interested users.

Account opening procedure

Opening an account with tickmill broker is a pretty seamless procedure. It would take a maximum of five minutes to complete the entire process. Below is the step by step procedure for the same.

Step 1: visit the tickmill official website and click on ‘create account’ button on the top right corner.

Step 2: depending on the geography you are located on, you must pick the regulator. If you are a resident of UK, please consider choosing FCA and FSA for rest of the world.

Step 3: you must then enter your personal information like name, DOB, contact info, etc. Once done, click on ‘proceed to step 2.’

Step 4: as shown below, you must enter all the information in the corresponding sections. Make sure to enter the address and other details as per the documents you hold. They will eventually be cross checked during the verification procedure. Once all of that is done, click on open account. (you must check the second box as it is mandatory to agree with the client service agreement and risk disclosure statement).

You should then be seeing the below alert.

Step 5: please check your mail box and verify by clicking on the ‘validate email.’

Step 6: once done, you will be able to see the below screen. Please login using your credentials.

Step 7: to access any of the services offered by tickmill, your account must be verified. Completing the verification just takes a couple of minutes as all you have to do is to submit two ID’s, one for identity verification and the other is for proof of address.

Once your documents are submitted, it will take about 48 hours for your account to be verified as shown in the snapshot below.

Liquid account verification & identification changes

Liquid is embarking on becoming a licensed crypto exchange operator in singapore. We are committed to improving operational excellence, and are therefore enhancing our account verification processes. These changes apply to both new and existing customers.

Contents

What is happening with account verification?

Many of our long time liquid users have recently been contacted by our support team to provide additional information such as government issued ID, a valid proof of address (utility, bill, bank statement, etc.) or a selfie.

Why is liquid asking for more information?

Liquid is in the process of applying for a license under singapore's payment services act (PSA) for the provision of digital payment token (DPT) services. The monetary of singapore requires all licensees to comply with strict anti-money laundering (AML) and know-your-customer (KYC) practices. This additional information is used to better protect the interests of our global user community.

- Proof of address (please submit one of the following): A utility bill (such as an electric bill, gas bill, sewage bill, etc), bank statement, tax document, a national ID card that contains your address (document must be less than 3 month s old) .

- Identity document (please submit of the following): national ID, valid passport, driver’s license, government-issued ID.

- Selfie: clear, straight-on head shot, color photo.

My account was already "approved"; why is more information needed?

During our operating history, there were periods when liquid accounts were approved based on different sets of documents. As liquid is applying for a license under the payment service act, we are enhancing our KYC process in order to continue servicing our global community. If you have been contacted, it means at least one of the required documents or information is missing from your records. The email we sent to impacted users has specifics about exactly which document was/is missing.

Where can I submit the required documents?

Information can be provided via various secure channels:

You are now able to upload your documents directly via the liquid GUI web site or by using the latest version of our liquid pro mobile app

Sign-in to your liquid account and chat with your customer champions who can guide you through the secure document upload process

Is someone going to take my crypto?

No. Our goal is to serve the crypto community in a compliant manner. You will be able to withdraw your crypto assets or leave it at liquid during the account verification process. If someone is asking you to send any crypto to an unknown address, this is not liquid. Liquid will never reach out via telegram or social media unless via the official account.

When do we need to complete account verification?

To ensure continuity of trading services we encourage customers to complete account verification by 27th july 2020. Detailed timelines are provided in the email correspondence you will have received via your registered email address. Liquid customer champions are available 24x7 to help complete account verification over the next 3 months.

Services for unverified users will be impacted as set out as follows:

15th july 2020 : unverified users will no longer be able to deposit funds. Users are required to update the liquid pro app (version 1.5.0 and 1.5.0.1 are required to continue using liquid).

21st july 2020: previously approved users with missing or invalid documents will be set to “declined” status.

28th july 2020: unverified users will no longer be able to trade on the liquid exchange or withdraw fiat.

8th october 2020: unverified users will lose access to remaining services, including crypto withdrawals.

There are so many scammers out there, how do I know the email is real?

All genuine email from liquid are sent from domain `@liquid.Com` or `@quoine.Com`. Users may recall our branding changed in september 2018 with the launch of liquid.Com.

Please do not request for support on telegram and social media as this opens the door to impersonators.

From the liquid team to our users

From its humble beginnings working in a 1 bedroom apartment in saigon, liquid has always been an ambitious project. In 2014 we were one of the first global exchanges to offer a fiat-crypto exchange venue. Liquid has been early to apply for licensing and work with regulators around the world to develop crypto ecosystems in a compliant manner. In japan when we were licensee #2 of virtual currency exchange (VCE) licenses issued by the japan financial services authority (JFSA) in september of 2017.

We are now in the first wave of applicants under the singapore's payment services act license for the provision of digital payment token services.

Regulators, exchanges and technologists around the world are wrestling with how to develop blockchain utilization while still adhering to important principles such as anti money laundering (AML) & counter financing of terrorism (CFT).

Being one of the first global exchanges that is trying to find the delicate balance between facilitating mass adoption of blockchain & working with regulations that were not developed with this technology in mind has not been easy.

Blockchain was designed from the onset to be a decentralized peer-to-peer payment system with built-in anonymity. It’s a long journey but we at liquid are committed to serving our users & the regulatory ecosystem to find that balance.

We appreciate your continued faith in liquid and look forward to serving our users with a focus on innovation, compliance, and security.

More information

Read our terms of use for more detailed information on liquid services.

Follow us on twitter and look for more updates on the liquid blog posts.

All guest authors’ opinions are their own. Liquid does not endorse or adopt any such opinions, and we cannot guarantee any claims made in content written by guest authors.

This content is not financial advice and it is not a recommendation to buy or sell any cryptocurrency or engage in any trading or other activities. You must not rely on this content for any financial decisions. Acquiring, trading, and otherwise transacting with cryptocurrency involves significant risks. We strongly advise our readers to conduct their own independent research before engaging in any such activities.

Liquid does not guarantee or imply that any cryptocurrency or activity described in this content is available or legal in any specific reader’s location. It is the reader’s responsibility to know the applicable laws in his or her own country.

Providing liquidity for the crypto economy.

Tickmill – forex broker rating and review 2021

| https://www.Tickmill.Co.Uk/ | |

| status | |

| regulation | FCA UK, cysec, FSA seychelles |

| trading software | metatrader4 |

| headquartered | 1 fore street, EC2Y 9DT, london, united kingdom |

Tickmill is an award-winning global ECN broker, authorised and regulated in the UK by the financial conduct authority (FCA) and the FSA of seychelles.

Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data centre.

Tickmill mission

Tickmill is a new way of trading with extremely low market spreads, no requotes, true STP and DMA, absolute transparency and innovative trading technology. Our mission is to provide you with the best possible trading environment so you can focus on trading and become a successful trader.

Tickmill has been built by traders for traders. Our team members have trading experience that goes back to 1994 and have successfully traded on all major financial markets from asia to north america.

Tickmill trading information

Tickmill — latest reviews and comments 2021

Tickmill is scam broker they don't give your money back. Be careful & don't waste your time.

K. Sudesh ranga 16 april, 2020 reply

I chose tickmill through a referal from a forex education centre and it totally disappointed me. The online team is not 24 hours and they can barely do anything when you talk to them. Even after they arrange for a call back, it does not happen on many occasions. On top of them, they do not exercise margin calls like most brokers. My positions got wiped out just like that. And even after they liquidated some of my positions, my margin continues to be negative though my positions are in positive. Till date, this had not been resolved as they are always slow in replies. Recommend all to avoid this broker at all cost!

Vincent lim 15 april, 2020 reply

I chose tickmill accidentally, when I didn't understand anything in forex, but I was lucky that I didn't run into a rogue, but got into a good company, although all the chances were against me. First I opened there a demo account, then a real one, and soon decided to withdraw some money - on trial, would they not deceive you. Brought out. Then I began to quietly trade, and since then two more times I have withdrawn relatively small amounts - two times $ 300 each. There were no obstacles, only at the very first withdrawal it was a little long, scans of documents were required, but the next time they were no longer required.

Malcolm 25 july, 2019 reply

Want to start trading with 50% more funds? When you open and fund a vantage FX live trading account with $200 or more, we will give you an extra 50% to trade with. Start trading with a leading CFD broker now!

I usually do not write reviews, but here the situation is different, tickmill is a relatively young broker. I've been trading here for a month, and managed to withdraw, and I could bargain with the manager, I can confirm that I had a good deal of trying to make my debut. For a couple of weeks you will not make an objective conclusion about the company, but judging by what has already happened, and if there is something that will force me to stop working with the company, then it’s logical that I will not be silent, like everyone here, but as long as the stones do not fly towards the broker, then there are few newcomers here, they usually choose monopolists in the market, and this is a young broker, only those who are looking for it will find it, and the reason why there is not enough negative for you broker to maintain the level of service, after all, they are interesting for now.

Antony 18 july, 2019 reply

I work with three forex brokers companies simultaneously, including tickmill. I use different trading strategies with different brokers, so I can't guarantee 100% comparison accuracy, but it feels more comfortable with tickmill. First of all, I speak about situations when the price is going up and down and does not catch your stop, although the candle crossed it. But it can be a matter of strategy and selected tools, I can't vouch for it. But in principle I can advise with a clear conscience, a good broker, only maybe not for beginners.

I do not like to praise people or companies for nothing. But I am going over the facts on the experience of working with tickmill. This is quite a powerful STP broker from experienced major companies. The interbank market access is an highly important moment for me since there is no conflict of interest with the broker. This is seen immediately both in execution and real spreads that you observe in the terminal. As to spread without additional commissions, it is very adequate for them, the broker does not pull three skins from the client. With this, the spreads in their specifications correspond to those in real trading. They are not moving apart too much, even with extra volatility, as a pound has been observed recently. Just recently, the week on dollar/yena started with a gap and I was standing up for sale. The price opened at 40 points with a gap and immediately closed the deal. I planned to take 50 pips off the taka and took more than 90 off. Fact! I appreciate them for their honesty towards their clients.

Not bad broker, but kridex offers better spread, lower commissions, higher leverage nad faster execution

I love tickimil and they the best broker, but I am not sure why the withdrawals comes in half half. This is a good broker ever

Very good. Problem is leverage. Too small!

I have a serious problem with the bonus you provide us with.You're saying that "we can withdraw any profit we make"but why is it difficult to withdraw our profit.Even the log in details doesn't go through. What's wrong.I need help

Sharl 31 january, 2019 reply

Are serious about what you saying cos I was also asked to do the same but I haven't. Not sure if I should go ahead or just drop everything.

David 28 august, 2019

Tickmill trading bonus is a scum. Made 700usd and after they told mi to fund account so that I can withdraw then I did so nd since that day I'm still waiting to receive my profit so be careful guys

Thabo 12 november, 2018 reply

Tickmill rating

Tickmill reviews rating

Top 10 forex brokers 2021

Latest forex reviews

In an effort to cement our current position as leading international broker of choice, we're proud to announce that we have.

Tickmill is pleased to announce that our educational seminar "forex trading and strategies in depth" was a huge success seminar. A great number of attendees.

As part of our mission to give our global client base access to top-level trading education, we have formed an exclusive partnership with the renowned.

Tickmill exhibited as a silver sponsor at the world of trading expo, germany's leading trading expo which took place on 15-16 november 2019.

In recognition of some of our most loyal clients in asia, tickmill hosted a VIP gala dinner in malaysia's capital city, kuala lumpur. As a broker who always.

Tickmill group once again surpasses previous financial records, posting growth in key financial metrics. The unaudited consolidated net profit for the first.

Join the expert as he as he guides you through the world's largest financial market and get hands-on knowledge on the basics of trading, technical analysis.

As a company, tickmill is always aiming to enhance the experience of our traders through tailoring our services and product portfolio. This time.

Tickmill review and tutorial 2021

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Trade on majors, minors and exotics with up to 1:500 leverage.

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customisation and suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Popular alternatives to tickmill

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

Tickmill offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

Tickmill offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

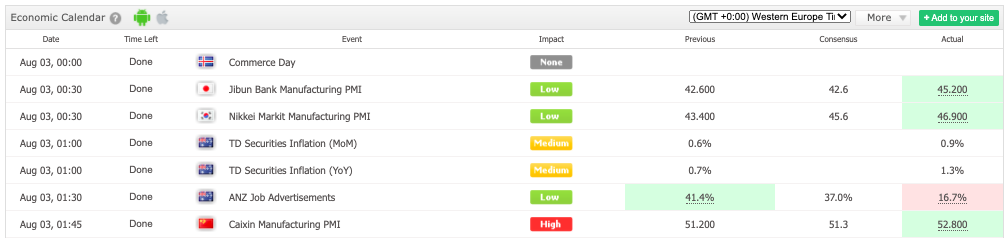

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email – support@tickmill.Com

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Tickmill’s internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use tickmill from united states, canada, japan, bangladesh, nigeria, pakistan, kenya.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

So, let's see, what we have: free 30 USD to start trading with the licensed MT4 broker! At tickmill verification documents

Contents of the article

- No deposit forex bonuses

- Tickmill $30 welcome account

- 30 USD for free to all new traders of tickmill!

- Tickmill $30 welcome account

- How to get tickmill’s $30 no deposit bonus?

- Why you should open tickmill’s $30 welcome...

- $30 welcome account is pro account type

- 90 days promotion period

- Profit withdrawal from $30 welcome account

- Available only with tickmill ltd (FSA SC...

- Use of eas (expert advisers) is prohibited

- Posted by FXBONUS.Info

- Tickmill minimum deposit

- Tickmill minimum deposit amount

- Tickmill minimum deposit tickmill deposit...

- Tickmill minimum deposit deposit currencies

- Tickmill minimum deposit steps of sending...

- Tickmill review

- Regulated by: FCA, cysec,...

- Headquarters: united kingdom

- Ranking: 7

- Spread: 0.1 pips (EURUSD)

- Leverage: 500:1

- Minimum deposit: $100

- Tickmill review & author's comment

- Is tickmill reliable?

- Tickmill account types

- Tickmill customer support

- Tickmill trading platforms

- Tickmill deposit and withdrawal methods

- Tickmill bonus and promotions

- Tickmill final word

- Tickmill – step by step live account opening guide

- Step 1 – fill the registration form

- Tickmill reviews – guide

- Starting a real account – investing real money

- Creating an account at tickmill, step 1/2

- Payment and withdrawal methods

- Registration step 2/2

- Completing the registration

- Verifying the account on the tickmill website.

- No deposit bonus, withdraw profits – tickmill

- €£$ TICKMILL 30 forex no-deposit welcome bonus

- Tickmill’s deep review

- Introduction

- Regulatory bodies

- Available asset classes

- Types of accounts

- Liquid account verification & identification...

- Contents

- What is happening with account...

- Why is liquid asking for more...

- My account was already "approved"; why is more...

- Where can I submit the required documents?

- Is someone going to take my...

- When do we need to complete account verification?

- There are so many scammers out there, how...

- From the liquid team to our users

- More information

- Tickmill – forex broker rating and review 2021

- Tickmill trading information

- Tickmill — latest reviews and comments 2021

- Tickmill rating

- Tickmill reviews rating

- Top 10 forex brokers 2021

- Latest forex reviews

- Tickmill review and tutorial 2021

- Tickmill company summary

- Trading platforms

- Popular alternatives to tickmill

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

Comments

Post a Comment