Review of Tickmill, does tickmill have bonus.

Does tickmill have bonus

- Cfds on indices, forex, commodities, and bonds.

- You can execute orders with no partial fills and have more liquidity depth

- EA trading facilities are available using the VPS service

- Advanced technical analysis is available with 50+ indicators and customizable charts in 39 languages.

No deposit forex bonuses

Just like all reputable brokers, our tickmill review shows the broker has provisions for new traders. When you are new in the market, you will need to acclimate to the latest technology that you use when trading.

Review of tickmill

Tickmill review

In our tickmill review, we cover tickmill bonus, mt4, ttickmill forex, deposit & withdrawal, and tickmill account types. Compare it to other forex brokers before deciding if tickmill has the features you are looking for in a forex broker and give your rating after reading the full reviews. Tickmill broker is a well-known and popular online broker in the currency and CFD markets, which offers competitive differentials in a wide range of assets in global markets. Tickmill was founded in 2007. Tickmill, located in sydney, australia, owns and operates it.

Tickmill bonus offers a cost-effective online trading solution suitable for almost any type of trader when factored with all their great features.

The company's headquarters are located at 6 309 kent street, sydney, NSW 2000. This is mainly because IC markets is trying to close the gap between traders and large institutional investors. Our tickmill review shows they offer investment solutions that were once provided only by investment banks.

They also offer the highest leverage available in australia, low margins and rates, an excellent education center, and much more.

Tickmill MT4

Our tickmill review revealed the following details in terms of platforms you can use. They offer you the globally recognized and accepted MT4 platforms that are available in windows, mac, and webtrader. The features you will get with a platform like this one includes access to:

- Cfds on indices, forex, commodities, and bonds.

- You can execute orders with no partial fills and have more liquidity depth

- EA trading facilities are available using the VPS service

- Advanced technical analysis is available with 50+ indicators and customizable charts in 39 languages.

There is not a lot that is left to be desired when they have the MT4 platform available for you to use. The MT4 mobile app provides as a tickmill bonus feature will give you access to the following things:

- A view of the real-time quotes

- Access to asset classes

- Technical trading indicators

- Trading directly from the chart

You will also have access to autochartist, a plugin for mt4 on windows only that detects key chart patterns and price analysis patterns and other offers.

Tickmill demo

Just like all reputable brokers, our tickmill review shows the broker has provisions for new traders. When you are new in the market, you will need to acclimate to the latest technology that you use when trading.

The demo account tickmill broker providers are what will show you what is available and what you can do with it as a trader. There is a lot to learn, and you will need to know all the details before you get started with live trading.

Ticmill broker

As a broker, our tickmill review shows that they are well-regulated, have no scandals, or other issues, and will serve you well. Any of the payments you make to tickmill accounts are held in a segregated bank account.

To add more security to this as a tickmill bonus feature, they use tier-1 banks. As you may have gathered, the tier-1 banks are on the official measure of a bank’s financial health and strength. This will ensure that the tickmill bonus feature works as a measure to safeguard your money.

Using tickmill forex, you can trade over 60+ currency pairs. At the moment, there are no tickmill bonus offers or promotions because the EU regulations and other regulators forbid them. However, a tickmill bonus you can get is a trader of the month promo, a $30 welcome bonus, and a few other things.

Tickmill account types

Three core accounts are offered, as shown in our tickmill review. They include a pro account, a classic account, and a VIP account. They all have different minimum balances, maximum leverage, and spreads/commissions.

It all depends on which regulator you opened your account. The details are available here: https://www.Tickmill.Com/trading/accounts-overview.

Tickmill customer service

One of the things in which tickmill stands out is at the level of customer service. Because tickmill is an international online broker, we provide our clients with multilingual assistance 24 hours a day, five days a week.

Tickmill is a secure system that protects your data via encryption. Also, they have many years of experience in the online trade industry. They offer competitive services and provide a wide range of sophisticated commercial platforms.

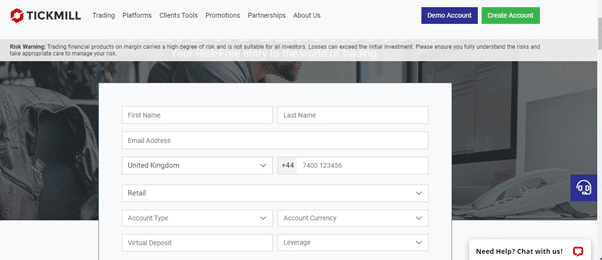

You can open an account at tickmill by completing the application form via the tickmill website, providing personal details, and topping up a minimum of USD 200 mind.

Tickmill details overview

Tickmill rebate promotion review

Tamaño

Plataforma

Vencimiento

Volumen mínimo

When a broker offers an exciting package of trading terms and conditions, as well as has rigid licensing materials featuring on the website, one doesn’t need additional encouragement to jump at the opportunity and start trading with that broker. However, more often than not, such brokers don’t stop there and also offer various bonuses and promotions.

On tickmill, there’s an abundance of said promotions. And you can be dead-sure that the tickmill forex broker is as legit as it can get. On tickmill’s website, you’ll find at least five different promotions that will make your trading a joyful experience: trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion.

Earning bonuses as you trade

This last one, the rebate promotion, is a temporary bonus that has some pretty exciting and impressive offerings, as well as participation conditions. But let’s not get ahead of ourselves and take things one step at a time. First things first, what is this bonus?

Well, the rebate promotion is a temporary bonus that lets you get rebates as you trade onwards. When you open a trade for, say, EUR/USD forex pair or the NASDAQ 100 index CFD, you’ll be able to get a certain amount of money back. The math in this bonus goes like this:

For every lot (100,000 currency units) placed, you’re getting anywhere from $0.25 to $0.75 rebate as a bonus. The exact amount of rebate depends on your tier and there are three different tiers depending on your traded volume:

- Tier 1 – when you’ve traded exactly or less than 1000 lots in a month. In this tier, you’re getting 0.25 US dollars for every lot, which means you can accumulate a total of $250 as a bonus rebate;

- Tier 2 – when you’ve traded from 1001 to 3000 lots in a month. In this tier, you’re getting 0.50 US dollars for every lot. Therefore, you can potentially get $1,500 as a bonus;

- Tier 3 – when you’ve traded more than 3001 lots in a month. In this tier, you’re getting the maximum amount of bonus – 0.75 US dollars for every lot. As a result, you can get at least $2250 as a bonus from the broker.

As you can see, a $0.25-$0.75 bonus may not seem like the biggest reward at a first glance but if you keep in mind that a regular trader has thousands of traded lots per month, you’ll soon realize that this is actually a pretty lucrative bonus.

How to register and how long do you have left?

So, are you interested in the tickmill rebate promo already? Good, because now we’re going to talk about how you can participate in it. But first, let’s see how long you have left to get these rebates. According to the broker, the rebate promo will last from march 29 to june 30, 2020. Therefore, you’ve still got three months at the time of writing this review.

So, how to sign up for the bonus? Well, the first step is to open a live account on tickmill. The registration process is pretty simple and doesn’t require a lot of personal information from you: you’ll need to enter the basic details such as your full name, phone number, email address, etc.

But you’ll also have to fund your account by at least $100. For that, you can use any payment method you want: bank wire, credit cards, neteller, skrill, or fasapay. And when you get the bonus, you can withdraw it with the same platforms as well.

The second step, and a pretty straightforward one, is to actually start trading because as we mentioned earlier, you collect rebates as you trade more and more. And as you move forward and increase the traded volume, your rebates get bigger as well, yielding thousands of dollars of rewards.

Suscríbete para recibir actualizaciones sobre los bonos de FX

Sé el primero en encontrar los bonos disponibles y confiables para trading de forex

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : FCA, FSA, CYSEC

Cryptocurrencies: YES

Minimum deposit: $100

Maximum leverage: 1:500

Spreads: low

My score: 7.9

First thing I can say about tickmill forex broker is that it is one of the fastest growing brokers in the world. Thanks to the company’s aggressive growth policy, tickmill succeeded in reaching thousands of forex traders from a wide range of different countries in a very short period of time. The website has more than a million visitors a month. In this tickmill review, you will find information on tickmill spreads, regulations, account types, deposit and withdrawal methods. Are you wondering is tickmill scam or legit? I would definitely recommend reading this review before opening an account with tickmill.

Tickmill regulation and investor protection

One of the most crucial issues in the forex system is regulation. Because when you have problems with your broker, the regulators help you to solve the problems. Think about; you wanted to withdraw but the broker could not let this. In this situation, the regulator moves in and protects your rights. We can duplicate samples like this. Let’s see what tickmill offers us.

There are two different companies behind the tickmill brand name. One of them is tmill UK limited and the other is tickmill limited. Tmill UK limited regulated by FCA (register number: 717270) in the UK FCA while tickmill limited regulated by FSA in seychelles.

Clients of the UK broker are protected by financial services compensation scheme-FSCS as well as FCA. If the forex broker goes bankrupt, the investors’ money is under the FSCS guarantee. The institution pays investor’s money up to £50,000. This shows your money is in safe if the broker goes bankrupt.

In addition, vipro markets, which operates in cyprus with CYSEC-licenced, joined the tickmill group in 2017. Before joining the tickmill group, this company also had more than 500,000 visitors per month. If a broker wants to have a cysec license, it must keep at least €1,000,000 to prove to clients that they can make a payment. I think it is a reassuring feature for prospective clients who are suspected of not taking their money.

In order to keep your money safe, you must trade with a broker who has a license. Watchdogs allow the brokers to act in accordance with the rules. They periodically inspect the brokers and if the brokers do not obey the rules, they may cancel the licenses.

The tickmill forex broker has grown rapidly in a short period of time and currently serves forex and CFD trading in asia, the middle east and africa.

Tickmill spreads and account types

Tickmill offers customers 4 different account types as follows:

| account type | minimum deposit | maximum leverage | spreads (& commission) | swap free |

|---|---|---|---|---|

| classic | $100 | 1:500 | from 1.6 pips | yes |

| pro | $100 | 1:500 | 0.2 pips + $4 / lot (round turn) | yes |

| VIP | $50.000 | 1:500 | 0.0 pips + $3.2 / lot (round turn) | yes |

In all of these 4 account types, you can trade on 85 trading instruments and use USD, EUR, GBP, PLN as base currency of the account. The maximum leverage in the accounts is 1:500.

Classic account is more suitable for newbie investors. Minimum deposit for classic account is $100. It can be called an average deposit. There is no commission, but spreads start from 1.6 pips on EURUSD. If I compare it with fxpro, I can say that spreads are higher in the classic account in tickmill. However, the pro account that we can see as ECN account is quite advantageous compared to other brokers’ ecns.

In the pro account, the minimum deposit is same with classic account and it is $100. You only pay a commission of $ 2 per lot and $ 4 per round turn. I can easily say that this commision is quite low. If we compare with other brokers, tickmill offers better commission fee. For example FXPRO offers $ 3 per lot and $ 4.5 per round turn.

The most advantageous of all is the VIP account. You only pay a commission of $ 1.6 per lot. However, the minimum deposit for this account is $ 50,000. Tickmill also offers personal multi account manager. With the MAM program, professional money managers are assigned to act on behalf of their clients. In this way, a money manager can perform block trades on all accounts with his master account effectively.

If you are an investor with islamic belief and do not want to earn or pay interest, you can apply for a swap free account for all these account types. Tickmill offers the same terms and conditions as their regular account types to its clients who want to use islamic accounts. The only difference is that there are no swaps. Tickmill may ask you to document your belief. It also has the right to reject your application.

Trading products

Tickmill offers to trade cfds on currency pairs, precious metals, crude oil, stock indices, bonds and cryptocurrencies. The broker includes only BTC on cryptos. This is a disadvantage for tickmill. And also, +60 pairs of forex pairs available.

Trading platforms

You can trade with tickmill on desktop or tablet, browser or on-the-go with your smartphone. Metatrader 4 and web trader are available. MT4 is considered to be the world’s most popular forex trading platform because it is easy to use, offers a variety of graphics and indicators, a variety of expert advisors (eas) and most importantly supports the MQL language.

- Cfds on forex, stock indices, WTI, commodities, bonds and cryptocurrencies

- EA trading facilities

- Micro lots available

- No partial fills

Promotions

Tickmill offers three promotions to its clients. One of them is ‘trader of the month’ : each month, tickmill selects the best and highest performance among its talented clients and rewards it with a $ 1,000 award. They take into account not only good profits, but also money and risk management skills when selecting the winner. I would say that this promotion enables competition among clients. Available to clients of tickmill ltd (FSA SC regulated) only.

The second one is ‘tickmill’s NFP machine’. This promotion is also available to clients of tickmill ltd (FSA SC regulated) only. During every NFP week, they choose one instrument and challenge you to guess its price in their MT4 platform at 16:00, exactly 30 minutes after the NFP release. A perfect hit will bring you $500 to your trading account. If no one breaks the bank by an exact figure, the trader with the closest prediction will cash in a $200 prize.

And the last one is ‘$30 welcome account’. Available to clients of tickmill ltd (FSA SC regulated) only. If you open a new account tickmill gives you $30 welcome bonus.

All promotions have terms and conditions.

Deposit and withdrawal methods.

Tickmill has a wide range of funding and withdrawal methods. These are wire transfer, credit/debit card, skrill, neteller, fasapay and unionpay. I can say that this is enough but unfortunately, there is no BTC. Also, you do not pay any fees thanks to the zero fees policy of the company. Tickmill offers deposit and withdrawal methods as follows:

I did not have any problems with withdrawing and depositing money during my transactions. When depositing money I preferred to deposit with a credit card. When withdrawing money, they deposit the money in the same day.

Final thoughts

Tickmill is a fast-growing broker. A few years ago, nobody knew tickmill. But now all investors on the forex market know tickmill. If this growth continues fast, I can not imagine what will happen in a few years. They have a good designed website and you can find all information about trading.

FCA license and FSCS registration are two of the broker’s strongest features. The broker has cysec license too. There is no doubt that tickmill is a reliable broker. Tickmill offers enough account types to its clients. The classic account has advantages about minimum deposit and spreads. The pro account also offers a highly advantageous and competitive spread. If you are going to use a pro account, I recommend you open an account at tickmill. Finally, tickmill is a reputable broker who has various product portfolio and effective trading conditions.

Free $30 tickmill special welcome bonus

Hello beginners! Want to start trading without deposit your money? The tickmill broker offers a free $30 no deposit welcome bonus to all new clients. The tickmill offers the bonus to kick the bad broker or demo account. Start risk free live trading with earning profit.

How to join:

Get a free $30 and start trading

Valid: unlimited time

Withdrawal: yes profit can be withdrawn

Terms and conditions:

You need to verify your account completely.

Need a unique IP and device to get the bonus.

The welcome account is not available for all countries, check before apply.

You can trade up to 60 days

The trading platform is MT4

General terms and conditions apply.

RELATED ARTICLESMORE FROM AUTHOR

$30 welcome account bonus – tickmill

Welcome bonus 35 USD bonus – fortfs

$1200000 bonus offer for FBS 12 years anniversary

31 COMMENTS

I have liked these website and it us a very good website

I have really liked this site and I my self am having abussiness of selling agricultural out puts and am also looking for support from you, now how can I do that?

I started with them two years ago and the services have been good so far until june last year when their services went bad. Initially, I noticed the charts became unstable. Also, the stop loss was not really effective as it used to be. After I lost 50% of my money, I requested for withdrawal in september but they kept using delay tactics by requesting for unnecessary documents. I was also billed to pay for withdrawal fee. It was in january I noticed my account was no longer accessible and I realised they were trying to play a fast one on me. Immediately, I contacted:

chancynthia086@gmail. Com

I followed as instructed and I’m happy to say I got my money back. I really hope they can improve on their services like it was before.

This is a good one for me, it’s helpful for my business

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least £25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

Tickmill broker review

Reviewer : justin freeman

Published: 23rd december, 2020.

Broker information

- Company name: tickmill ltd

- Founded: 2014

- Country: seychelles

- Phone: +442036086100

Platform info

- Platform: metatrader 4, webtrader

- Dealing desk: no

- Web based: yes

- Mobile trading: yes

Broker services

- Regulators: FCA, cysec, FSA SC

- Bonus: $30 welcome account

- Minimum deposit: $100

- Leverage: 1:500

- US clients: no

- Funding methods: bank transfer, visa, mastercard, skrill, neteller, fasapay, unionpay, dotpay, nganluong.Vn, qiwi wallet, thai online bank transfer, globepay, vietnam instant online bank transfer, paysafe

- Pairs offered: 62+

Open free

demo account

Bonus offer for forexfraud visitors

Expert’s viewpoint

This review of the broker tickmill reaffirms its position as a top-quality platform, built by traders, for traders. This approach results in a trading experience that just has to be tried out – a fact confirmed by the firm’s continued growth and increasing popularity with traders.

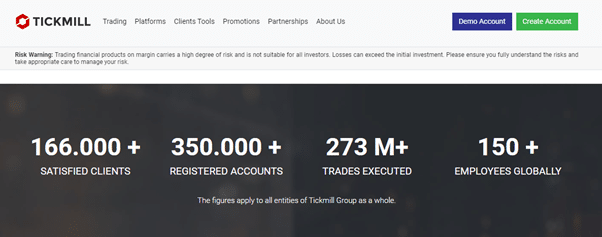

A record number of new clients have taken the decision to sign up to the platform. It now has more than 350,000 registered accounts. It also keeps adding to its impressive collection of industry awards.

The ‘best trading experience’ award from forex brokers in 2020 is just one example of how tickmill continues to get things right.

A quick scan of online feedback from the trading community also gives a glimpse of the strength of tickmill’s fan base. The firm has built a reputation for providing traders with all the tools they need to be successful.

This is backed up by review site trustpilot recording that 82% of reviews mark tickmill as ‘excellent’ or ‘good’.

The forex fraud tickmill review team found the broker to be ‘safe to use’. The tickmill experience is all about great trading, but behind the scenes, the firm has also gained a reputation for being trustworthy. Tickmill complies with regulations to a degree that is well above market average, and it’s a profitable and viable company.

Free demo account

The tickmill trading experience

The tickmill trading platform is set up to provide reliable, low-cost, super-fast trading, in all the popular markets. There are a lot of behind-the-scenes features that go to make tickmill trustworthy, but trying out the actual trading platform using a tickmill demo account (by clicking here) is a hands-on way to find out what a great platform feels like.

The range of extra tickmill support services complements, rather than overwhelms, the trading experience.

Research and learning materials are set at beginner, intermediate and advanced levels. Some are tailored to explaining the basics and preparing clients for trading. When you are ready to enter into the markets, there is a collection of up-to-date research notes that focus on identifying trade entry and exit points.

It takes a few seconds to sign up to a tickmill demo account, and doing so is highly recommended. Whether you’re looking for a new, safe broker or trying trading for the first time, using a tickmill demo offers a risk-free opportunity to see just how good the trading experience can be.

$30 welcome bonus

Broker summary

The tickmill group of companies owns and operates tickmill.Com, a multi-asset, multi-regulated CFD broker. The group’s companies include tickmill UK ltd, tickmill europe ltd, and tickmill ltd. One other subsidiary is the 100%-owned procard global ltd, a UK-registered firm.

Tickmill currently operates in more than 200 countries, and has more than 350,000 registered customers and 150 employees. Reports show that it has executed more than 273m trades and records average monthly trading volume well above $123bn.

There is a focus on quality as well as quantity. With the average trade execution speed at 0.2 seconds, lots of trading tools and a variety of educational materials, the award-winning ECN broker meets most of the requirements of traders, beginners and professionals alike.

Broker introduction

The best way to find out more and explore the reasons for the firm’s popularity is to try out a risk-free tickmill demo account.

Once you have completed the brief registration process, you will be able to use your tickmill sign in at any time. The only requirement is that you supply your email address and phone number, and then you are ready to step into the markets and develop your trading skills.

You can set your balance of virtual funds and leverage terms at a level that suits you. Although you will be ‘paper trading’, you will benefit from all the high-tech mechanisms of the actual tickmill MT4 platform.

Spreads & leverage

Making a consistent profit from the markets isn’t easy. Part of the recipe for success is setting up with a broker that helps you tilt the balance in your favour. One way to improve your trading bottom line is by selecting a platform that offers low-cost access to the markets.

Tickmill fees are low. Bid-offer spreads start from as low as 0.0 pips, and there are also near-zero commissions. Numbers such as these are just hard to beat, and tickmill unsurprising scores highly in this category.

If you’re looking to take advantage of such welcoming T&cs, it’s also possible to apply leverage to your trading. This isn’t for everyone as it comes with additional risks. Tickmill account types score additional bonus points by allowing clients to choose their own leverage terms instead of setting them at a riskier default position.

In line with standard practice, the maximum tickmill leverage terms on offer to clients will be determined by the regulatory body of the country in which you live. UK and EU clients will find leverage capped at 1:30, which is still a considerable level, but some in other domiciles might be able to scale up to 1:500.

Platform & tools

The tickmill MT4 platform gives access to the most popular retail forex platform in the world. It’s been used by millions of traders for many years and is very much the benchmark by which other platforms are measured.

It is available in desktop, web trader and app format for android and ios mobile devices. MT4 is the gold standard in online trading. It is a fully customisable trading environment that provides traders with the tools to create their own technical indicators, custom scripts and expert advisors (eas).

Whichever approach you take, you will have access to analytical tools and trade indicators that are considered to be among the best in the industry. To add a cherry on top of the cake, tickmill clients also gain access to the myfxbook copy trading platform and autochartist.

Hedging and scalping strategies are allowed, which demonstrates that the platform is based on a high-quality IT infrastructure. The operator allows the use of all eas and trading algos – this is the green light for expert users of MT4, who can take full advantage of the power of the best trading platform in the world.

Despite its relative youth, tickmill has already picked up a number of prestigious forex awards. In 2016, it won the ‘most trusted forex broker’ at the best ECN/STP broker awards. That trend continues, and the broker won the ‘best trading award’ at the forex broker awards in 2020.

Commissions & fees

The brokerage offers a free-to-use, risk-free demo account, which gives traders a taste of what’s on offer. The demo account offers full access to MT4, as well as to the full array of tradable assets, not to mention real-life volatility and prices.

There are five varieties of live account. Each is accessed through the same tickmill login portal but offers different T&cs.

- Classic account – this is the most accessible account. It is an entry-level account aimed at those looking to get into the game cheaply, and without having to pay commissions. The tickmill minimum deposit for this account is 100 base currency (EUR, USD, GBP and PLN are all accepted). The maximum available leverage is 1:500 and the spreads start from 1.6 pips. Trade execution is of the NDD variety.

- Pro account – this is quite an improvement in regard to spreads. While it does feature a commission of 2 per side per lot, its spreads start from 0 pips. The maximum available leverage is 1:500 on this account.

- VIP account – the minimum balance for this account is 50,000 base currency, which means that this option is not for everyone. The spreads start from 0 pips on this account and the maximum available leverage is 1:500. Commissions are ultra-low and start from just 1 per side, per lot.

- Professional clients – there are improved T&cs for those putting through high trading volumes. Criteria to qualify include a minimum portfolio size of EUR 500,000; trading volume of at least 10 trades per quarter, over the previous four quarters; and you are required to have worked in the financial sector for at least a year, in a relevant position.

- Islamic account – this is a swap-free option that is fully sharia law-compliant. Those who want to set up such an account have to open a regular account, as described above, after which they have to request the conversion of this account into an islamic one.

Trading conditions offered by the islamic account are the same as those available through the above-mentioned regular accounts.

The required margin for hedging positions on the classic, pro and VIP accounts is 0. Scalping is allowed and there are no time limitations for keeping the positions open.

There are three base currencies to choose from and negative balance protection rules apply. Deposits can be made through an impressive range of accepted methods, such as bank wire, visa, mastercard, neteller, skrill, fasapay, paysafecard, qiwi, unionpay, dotpay and globepay.

There are no commissions charged on most deposits and withdrawals. One exception is bank wire, where charges are applied to small transactions but can be avoided if you make a deposit larger than US$5,000.

Education

Tickmill offers a great range of materials to help traders build up their knowledge and therefore trade safely. There are webinars, tutorials, seminars, ebooks, infographics, glossaries, articles and insights.

There are also dedicated sections to technical and fundamental analysis. All of this ‘how-to’-style material is backed up by other services, such as autochartist, which helps identify actual trading opportunities.

Customer service

Tickmill support is available during business hours, monday to friday. This coverage is not as extensive as it could be, but our review team found the staff to be professional, informed and client-focused.

Final thoughts

Asset prices go up and asset prices go down. No matter how experienced a trader you are, ‘market risk’ is unavoidable.

The important thing is that traders exploit those things that they can control, and broker selection is high up on that list.

Choosing a safe, reliable broker that is well regulated and has been operating for many years is a good first step. Tickmill is firmly in that category, and also offers a lot of other neat and innovative features. It even intermittently offers a $30 bonus scheme to help novice traders try trading with real funds, but in small size, and that are given to them by the broker.

As the regulatory framework that tickmill has put in place is well above average, it’s worth concluding this review with confirmation that the behind-the-scenes infrastructure makes it a safe and reliable broker.

The online broker sector is a competitive one and tickmill stands out for giving traders everything they need, and nothing they don’t.

Broker details

The tickmill group of companies owns and operates tickmill.Com, a multi-asset, multi-regulated CFD broker. The group companies include tickmill UK ltd, regulated by the financial conduct authority (FCA); tickmill europe ltd, regulated by the cyprus securities and exchange commission (cysec); and tickmill ltd, regulated by the seychelles financial services authority (FSA).

Coming under the legislative framework of mifid II, the broker is authorised to provide services across countries in the european economic area (EEA) and beyond. If you are a retail client residing in europe or the UK, you automatically come under the protection of the investor compensation fund (ICF) or the financial services compensation scheme (FSCS).

Open your tickmill account

How can I open a demo account with tickmill?

Demo accounts, in desktop and mobile app format, are free to use and downloadable here.

Is tickmill a regulated broker?

Yes. As tickmill is a global broker, the regulatory protection that applies to clients will depend on where they live. Regulators that tickmill are authorised by include the financial conduct authority (FCA), the cyprus securities and exchange commission (cysec), the seychelles financial services authority (FSA) and the labuan financial services authority (labuan FSA).

What bonus terms does tickmill offer?

These change from time to time, but one offer that regularly pops up is the $30 welcome account, where the broker credits your account with $30 and lets you keep any profits.

How do I withdraw money from tickmill?

To comply with regulations, tickmill requests clients to return funds to the account that made the initial deposit. The good news is that unlike a lot of other brokers, tickmill does not apply charges on these transactions.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

Review of tickmill

Tickmill review

In our tickmill review, we cover tickmill bonus, mt4, ttickmill forex, deposit & withdrawal, and tickmill account types. Compare it to other forex brokers before deciding if tickmill has the features you are looking for in a forex broker and give your rating after reading the full reviews. Tickmill broker is a well-known and popular online broker in the currency and CFD markets, which offers competitive differentials in a wide range of assets in global markets. Tickmill was founded in 2007. Tickmill, located in sydney, australia, owns and operates it.

Tickmill bonus offers a cost-effective online trading solution suitable for almost any type of trader when factored with all their great features.

The company's headquarters are located at 6 309 kent street, sydney, NSW 2000. This is mainly because IC markets is trying to close the gap between traders and large institutional investors. Our tickmill review shows they offer investment solutions that were once provided only by investment banks.

They also offer the highest leverage available in australia, low margins and rates, an excellent education center, and much more.

Tickmill MT4

Our tickmill review revealed the following details in terms of platforms you can use. They offer you the globally recognized and accepted MT4 platforms that are available in windows, mac, and webtrader. The features you will get with a platform like this one includes access to:

- Cfds on indices, forex, commodities, and bonds.

- You can execute orders with no partial fills and have more liquidity depth

- EA trading facilities are available using the VPS service

- Advanced technical analysis is available with 50+ indicators and customizable charts in 39 languages.

There is not a lot that is left to be desired when they have the MT4 platform available for you to use. The MT4 mobile app provides as a tickmill bonus feature will give you access to the following things:

- A view of the real-time quotes

- Access to asset classes

- Technical trading indicators

- Trading directly from the chart

You will also have access to autochartist, a plugin for mt4 on windows only that detects key chart patterns and price analysis patterns and other offers.

Tickmill demo

Just like all reputable brokers, our tickmill review shows the broker has provisions for new traders. When you are new in the market, you will need to acclimate to the latest technology that you use when trading.

The demo account tickmill broker providers are what will show you what is available and what you can do with it as a trader. There is a lot to learn, and you will need to know all the details before you get started with live trading.

Ticmill broker

As a broker, our tickmill review shows that they are well-regulated, have no scandals, or other issues, and will serve you well. Any of the payments you make to tickmill accounts are held in a segregated bank account.

To add more security to this as a tickmill bonus feature, they use tier-1 banks. As you may have gathered, the tier-1 banks are on the official measure of a bank’s financial health and strength. This will ensure that the tickmill bonus feature works as a measure to safeguard your money.

Using tickmill forex, you can trade over 60+ currency pairs. At the moment, there are no tickmill bonus offers or promotions because the EU regulations and other regulators forbid them. However, a tickmill bonus you can get is a trader of the month promo, a $30 welcome bonus, and a few other things.

Tickmill account types

Three core accounts are offered, as shown in our tickmill review. They include a pro account, a classic account, and a VIP account. They all have different minimum balances, maximum leverage, and spreads/commissions.

It all depends on which regulator you opened your account. The details are available here: https://www.Tickmill.Com/trading/accounts-overview.

Tickmill customer service

One of the things in which tickmill stands out is at the level of customer service. Because tickmill is an international online broker, we provide our clients with multilingual assistance 24 hours a day, five days a week.

Tickmill is a secure system that protects your data via encryption. Also, they have many years of experience in the online trade industry. They offer competitive services and provide a wide range of sophisticated commercial platforms.

You can open an account at tickmill by completing the application form via the tickmill website, providing personal details, and topping up a minimum of USD 200 mind.

Tickmill details overview

Tickmill - up to 15% bonus offer

Tickmill is an authorized broker by the FCA of UK and a regulated securities dealer by the FSA of seychelles. The company presents a splendid deposit bonus to its clients who have a live trading account with tickmill.

The clients are allowed to use the bonus in case of drawdown/supports margin, which turns it into a tradable bonus! The minimum deposit for the bonus is 200$, and the bonus will go as high as 1500$ per month depending on the initial deposit in your account as shown in the table below:

Example: 200$ deposit = 20$ bonus

Please note that you can claim the bonus only if you have 50% of the initial deposit in your account. For example, if you make a deposit for a 1000$ and are already down to 70%, meaning you have 300$ left, you do not meet the requirement for this bonus.

In order to withdraw the bonus, you should trade the necessary number of lots, meaning 1 standard lot per each 5$ bonus that you have received in your account. For instance, if you have received 100$ bonus, you should trade 20 lots.

Hereвђ™s how you can get the tickmill up to 15% bonus offer:

register for your personal cabinet at tickmill.Com, deposit the required amount in your live trading account (only external deposits are accepted) and then send the following email to support@tickmill.Com within 14 days of your deposit date:

Вђњi would like to claim my deposit bonus for my deposit of $XXXXX which I made in my trading account number #XXXXX.

I have read and agree with terms and conditions.Вђќ

And upon sending this email, the bonus will be transferred to your account.

Certain conditions:

the email should be sent only by the client himself and not a third party.

The profit can be withdrawn at any time; however, the bonus can be withdrawn after trading the necessary number of lots on a single deposit.

In the event of having several accounts, for each received bonus the required number of lots should be met.

Tickmill

Tickmill overview

Tickmill is a trading name of tickmill ltd, an MT4 broker and offers webtrader trading platform that was established in 2014. Tickmill is regulated by the seychelles financial services authority (FSA) and the financial conduct authority (FCA). Tickmill headquarters at 3, F28-F29 eden plaza, eden island, mahe, seychelles. Tickmill provides 84 trading instruments and low spreads. The minimum trade amount is 0.01 lots and maximum is 100 lots.

Tickmill is a non-dealing desk broker (NDD) and offers $30 USD free welcome bonus. Tickmill supports common deposit options.

Broker overview

| website | visit website |

|---|---|

| broker type | NDD/STP/ECN broker |

| demo link | open demo account |

| founded | 2014 |

| company | tickmill ltd |

| country | united kingdom |

| headquarter | 1 fore street london EC2Y 9DT united kingdom |

| regulation | FCA UK, cysec, FSA SC |

| int offices | united kingdom |

| phone | +44 (0)20 3608 2100 |

| fax | support@tickmill.Co.Uk |

| support@tickmill.Co.Uk | |

| website lang | english, indonesian, chinese, russian, spanish, arabic, polish, german, italian, korean, thai, malay, vietnamese, portuguese |

| accept us clients | no |

| account currencies | USD, EUR, GBP, PLN |

| trading platforms | metatrader 4 |

| promotions | $30 no deposit bonus and forex monthly live trading contest |

| no deposit bonus | $30 forex no deposit bonus |

| welcome bonus | $30 welcome bonus |

| commission | yes |

| withdraw options | bank transfer, credit card, skrill, neteller, fasapay, unionpay, dotpay, nganluong.Vn, qiwi |

| account funding methods | bank transfer, credit card, skrill, neteller, fasapay, unionpay, dotpay, nganluong.Vn, qiwi |

| other trading instruments | yes |

| min deposit | 100 |

| max leverage | 1:500 |

| mobile trading | yes |

| news trading | yes |

| type of spread | fixed and even negative |

| minimum spreads | 0.0 pips |

| lowest spread on eur usd | 0.0 pips |

| precision pricing | 5 digits |

| free demo account | yes |

| mini accounts | yes |

| islamic accounts | yes |

| VIP accounts | yes |

| ecn account | yes |

| swap free accounts | yes |

| segregated accounts | yes |

| managed account | yes |

| interest on margin | yes |

| trading contests | yes |

| hedging | yes |

| expert advisors | yes |

| one click execution | yes |

| oco orders | yes |

| gold silver | yes |

| cfds | yes |

Tickmill trust and regulation

Tickmill is a regulated broker. Tickmill is operated by tickmill ltd and they are regulated from the seychelles, the united kingdom, and europe. They are regulated by the FCA (financial services authority) of seychelles, the license number is SD 008, registered in the UK with 717270 register number and in europe cysec (cyprus securities and exchange commission), the company registration number is 340249 and license number is 278/15. They are also regulated by german bafin, french ACPR, italian CONSOB, spanish CNVM, european mifid II.

Trading instruments

Tickmill provides more than 60 currency pairs including cfds on currency pairs, international stock indices, crude oil, gold and silver precious metals and german government bonds.

See in details:

Currency pairs: tickmill offers more than 60 currency pairs including all major, minor and exotic currency pairs.

Stock indices and WTI: tickmill offers stock indices and crude oil on cfds in MT4 trading platform.

Bonds: tickmill offers the german government 4 bonds for trade euro bobl, euro bund, euro buxl, euro schatz (EURBOBL, EURBUND, EURBUXL, and EURSCHA). Precious metals: tickmill offer 2 metals for trader, gold (XAU/USD) and silver (XAG/USD).

Leverage for trade:

Currency & bond leverage: the minimum leverage is 1:1, the default and maximum leverage is 1:500.

Stock indices and WTI leverage: is 1:20 for major stock indices and 1:10 for non-major indices and WTI leverage is 1:10.

Precious metals leverage: it is depends on your account leverage.

The contract size is 1, friday is triple swap day and GMT+2 and GMT+3 is server time, during DST in the US and europe.

Tickmill account types

Tickmill offers various types of accounts with good trading conditions. Account overview:

Classic account: the classic account that gives trader access to the worldwide market without the strain of commission. These records show market spreads without the markup. If you want to choose the account follow the mentioned points:

Minimum deposit is 100

account base currency is EUS, EUR, GBP, and PLN

zero commissions

0.15 second average execution speed

margin call / stop-out: 100% / 30%

You can trade cfds on 62 currency pairs, WTI, valuable metals, 15 stock indices, and german government bond with variable spreads beginning from 1.6 pips and no commissions.

Pro account: the account especially for maximum advantage of constricted spread and viable commissions’ seeker. Tickmill standard commission for this account is only 2 per side per lot (0.0020% notional).

Execution model, minimum deposit, account currency, execution speed and margin call / stop-out is same of classic account.

Cfds on stock indices, WTI, bonds commission is zero

You can trade same of classic account but fluctuating spreads starting from 0.0 pips.

VIP account: this account for ultra-low commissions’ seeker. You have to minimum balance of 50000 (account currency). Tickmill standard commission is for this account is only 1 per side per lot (0.0010% notional).

You can trade and spreads is same of the pro account.

Islamic account: the account is a swap-free account and followed by the sharia law. The accounts have exact same trading conditions as tickmill regular account. The main difference is that there are no swaps on trading instruments, notwithstanding, dealing with a charge applies for exotic currency pairs medium-term for in excess of three back to back evenings.

Demo account: all demo account from a broker is for beginner to learn forex trading. But tickmill have some policy on the demo account. After opening a demo account, if there are no login attempts within 7 days, the account will expire.

Deposit and withdrawal systems

The minimum deposit is $100 for all types of account and you have to reach a $50,000 minimum balance for a VIP account. Tickmill supports all common standard payment method and doesn’t support fund transfer from any other broker. A trader can deposit their own account in the “client area” section and tickmill doesn’t take any fees for fund deposit.

Withdrawal systems are also same login your “client area” section and withdraw your profit, tickmill has a zero fees policy on deposits and withdrawals.

Tickmill can take up to 24 hours for add (deposit) fund and up to 3-8 working days for withdrawing. Following deposit and withdrawal options are available: bank transfer, credit / visa / mastercard, skrill, neteller, stickpay, fastpay, unionpay, nganluong.Vn, qiwiwallaet, thailand online bank transfer, and vietnam online bank transfer.

Platform and tools

Ticmill is an MT4 broker, and they have own web trader platform. MT4 is a highly customizable, rich and user-friendly trading platform. Tickmill web trader platform also based on MT4. It is very easy and fast accessing for traders. It provides a convenient interface, it allows one-click trading and 100% safety for traders. You can access web trader platform from anywhere

Tickmill customer support

Tickmill has good support system, especially online live support. They provide support on 14 languages.

Live chat: they provide online web live chat support available from monday to friday (07:00-20:00), times is GMT.

Phone support: tickmill provide phone support from two country: UK +44 203 608 6100 and seychelles, +65 3163 0958, +852 5808 2921.

Email: tickmill have two editions they provide support via both ones is tickmill ltd (seychelles) support@tickmill.Com and another one is tickmill UK ltd (united kingdom) support@tickmill.Co.Uk. You can get support on the business day up to 24 hours.

Why you choose tickmill?

62+ currency pairs

spreads are low

zero fees policy on deposits and withdrawals

fast execution

good trading conditions

safe and secure trading platform

raw STP account

the execution model is NDD

good customer service

most trusted broker award (2017) and top CFD broker awarded award and more.

So, let's see, what we have: read our exquisite tickmill review covering tickmill bonus, mt4, ttickmill forex, deposit & withdrawal and tickmill account types. At does tickmill have bonus

Contents of the article

- No deposit forex bonuses

- Review of tickmill

- Tickmill review

- Tickmill rebate promotion review

- Earning bonuses as you trade

- How to register and how long do you have left?

- Forex brokers lab

- Tickmill regulation and investor protection

- Tickmill spreads and account types

- Deposit and withdrawal methods.

- Final thoughts

- Free $30 tickmill special welcome bonus

- RELATED ARTICLESMORE FROM AUTHOR

- $30 welcome account bonus – tickmill

- Welcome bonus 35 USD bonus – fortfs

- $1200000 bonus offer for FBS 12 years anniversary

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

- Tickmill broker review

- Expert’s viewpoint

- The tickmill trading experience

- Broker summary

- Broker introduction

- Spreads & leverage

- Platform & tools

- Commissions & fees

- Education

- Customer service

- Final thoughts

- Broker details

- Review of tickmill

- Tickmill review

- Tickmill - up to 15% bonus offer

- Tickmill

Comments

Post a Comment