Forex Trading - Learn to Trade Forex Like the Banks, forex trading - learn to trade forex like the banks coupon.

Forex trading - learn to trade forex like the banks coupon

Update: I’ve gathered a good amount of feedback from students.No deposit forex bonuses

In general most enjoyed the content, but there will be some areas that I will be adding videos to over the coming weeks so STAY TUNED!! Update: I have received some feedback from some students, so i'll be making some updates and enhancements to the course along the way! Stay tuned for more improvements here!!

Forex trading - learn to trade forex like the banks

Чему вы научитесь

Требования

Описание

Update 13/4/2016: added a new introduction video as well as a FAQ video to answer your commonly asked questions

Update: I’ve gathered a good amount of feedback from students. In general most enjoyed the content, but there will be some areas that I will be adding videos to over the coming weeks so STAY TUNED!!

Update: 850 students in the first 3 days!

Update: I have received some feedback from some students, so i'll be making some updates and enhancements to the course along the way! Stay tuned for more improvements here!!

This course will teach you everything you really need to know to start trading the forex market today

I will show you the exact strategies taught to me when I was trading in the banks, and you can use these to make consistent profits easily.

I implement a method that I call the checklist method, which helps traders spot winning trades by filling up a checklist. This helps eliminate most of the uncertainty traders tend to have when entering into trades.

I know your time is precious and so I’ve condensed all the important material into this crash course. It won’t take you long to finish the material and get started on trading.

Nothing will be kept secret as I share all that I have learnt with you. Avoid all the mistakes that new traders make that prevent them from making consistent profits.

- The initial free price will increase shortly, and i'll slowly be increasing the price

- You have unlimited lifetime access at no extra costs, ever

- All future additional lectures, bonuses, etc in this course are always free

- There's an unconditional, never any questions asked full 30 day money-back-in-full guarantee

- My help is always available to you if you get stuck or have a question - my support is legendary in udemy

Introduction to forex- learn to trade forex by yourself

Learn to trade the forex market – get a complete understanding of forex market and a complete introduction to forex

What you’ll learn

- Trading forex on there own

- Creating there own forex strategies

- Understanding how to make a good market analysis

- Be able to find the right information to make good trading decisions

- Understanding how to start in the trading industry

- Learning different ways to

Requirements

Description

The financial markets are not very easy to handle and to trade. The forex market is the biggest of those with more than 2 trillion dollars exchanged on a daily basis. But, there is a way to make profit out of all those transaction with forex trading and this is the goal of this course. Indeed, if you :

– are someone who is interested in forex trading but never actually started

– always wanted to learn how to generate profits on those markets and work from home

– want to learn and understand different styles of trading

– simply want to launch your trading career

Then this course is definitely for you. Indeed, this course will teach you everything you need to know to launch your trading career in no time. From choosing the right broker to opening your first trade this course has all the information that you need to be able to succed in the trading world.

The structure of the course

This course is made to help you enter the trading world step by step. Indeed, each part of the course is here to help you learn new concepts and also to help you achieve your goal of becoming a trader. From choosing the right broker to downloading MT4, talking about different types of analysis and many other things, you are never left alone in your learning. In other words, by the end of this course you will have your broker account set, all the platforms downloaded and everything else ready so you will be able to focus only on the trading and not thinking about anything else.

Also, this course will give you an introduction to different trading strategies since the main goal is to help you create your own trading plan. You will have all the required knowledge in trading money management analyze and any other field that is required to help you become a better trader. Also, there is a lot of practice in this course and this is one of the reasons why it’s definitely a good choice to learn the basics of trading with it.

For who is this course designed

This course is designed for people that have no prior knowledge of trading but who want to learn how to enter the forex trading world. Also, everybody who is simply interested to learn in general about trading, finances and all the basics of those will definitely love this course. Indeed, this course offers a lot of very valuable information about different markets and about different trading styles that it could very useful to know in the trading world but also for personnel purposes.

Why should I take this course

The main reason is that it will give a complete introduction to the biggest financial market. Then, by understanding how this market works you will be able to understand how to generate an income from it. Not only this course will offer you the opportunity to have another stream of income but you will also be able to learn different ways that you can use to be able to limit your risk in this market.

There is no risk involved in taking this course

This course comes with a 100% satisfaction guarantee, this means that if your are not happy with what you have learned, you have 30 days to get a complete refund with no questions asked. Also, if there is any concept that you find complicated or you are just not able to understand, you can directly contact me and it will be my pleasure to support you in your learning.

This means that you can either learn amazing skills that can be very useful in your professional or everyday life or you can simply try the course and if you don’t like it for any reason ask for a refund.

You can’t lose with this type of offer !!

This is why more than 30 000 students have already took the course !! Don’t wait anymore

Day trading forex live – advanced forex bank trading strategies

Sterling suhr's advanced forex bank trading course & live training room

Learn to trade like smart money

Members receive access to the following

1.) forex bank trading course

Our advanced video training course is designed to teach you how to track the banks. Learning how the banks tend to move the forex market is the key to trading successfully. If you know the position they are accumulating; no further information is needed because they control all intra-day trend!

Learning actual techniques used by the banks will give you the confidence to place trades knowing you have smart money behind you. All members receive lifetime access to all updates and continued forex training material.

2.) daily trade signals video

In my opinion, the daily market preview video is the most important part of the service.

In this daily video I break down the directional bias, as well as the exact manipulation points I will be looking to trade from. This real time training is essential to learning to trade forex!

3.) live forex trading room

Every wednesday at 4:00 PM eastern we run a live training room. This weekly live training provides you a chance to ask any questions you might have as you begin to go through the course material.

We also prepare for the day ahead and I show you the exact levels I’ll be looking to trade from.

All live training sessions which allow members to view them at their convenience. Members receive lifetime access to our live forex training room.

4.) live trade setups community forum

Our live forex forum allows for real-time discussion of forex trade setups. Additionally, members can post past setups for feedback. This is a powerful learning tool and allows for the community feedback and assistance. Lifetime access to the forum is included for all members.

5.) lifetime member email support

Members will receive lifetime personal support. We have designed the members forum to cater to the educational process in every way. Email support is yet another way we provide daily assistance to our members, to help them through the learning process as fast as possible. All emails are generally answered within 12 hours or less.

Frequently asked questions

Yes! Regardless of the length of time you’ve been trading you can learn to trade the forex bank trading strategy.

The price of the service is currently $329 USD which includes lifetime access. There are NO other fees or charges.

No! No one can guarantee your success and you should run from any educator telling you otherwise.

Here is the ugly fact…not everyone is cut out to be a trader. Some people will never stop over-trading, revenge trading, system jumping, over-leveraging, etc.

If someone cannot master their emotions then my strategy will not help them, nor will any other. A huge point people miss is that a strategy only works if you follow it.

For those members who do following the strategy, we have countless examples of traders who are now profitable and trading full-time using the forex bank trading strategy.

Since 2010, I’ve taught over 5,000 students the forex bank trading strategy.

Of course! As you go through the course I expect you to have questions. As you do, feel free to send them over!

1.) system jumpers – learning to trade takes time. I highly recommend that people research and believe in the strategy they’re going to learn. Once you decide on a strategy you need to stick with it for at least 3 months.

2.) get rich quickers – trading forex is NOT an easy way to make money! Trading is a business that takes time, money, and a great deal of effort to learn. If your goal is to turn 1K into a million in a few months then this isn’t the service for you.

The best way to learn forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-185920854-56a31baa3df78cf7727bcff9.jpg)

If you've looked into trading forex online and feel it's a potential opportunity to make money, you may be wondering about the best way to get your feet wet and learn how to get started in forex trading.

It's important to have an understanding of the markets and methods for forex trading so that you can more effectively manage your risk, make winning trades, and set yourself up for success in your new venture.

The importance of getting educated

To trade effectively, it's critical to get a forex education. You can find a lot of useful information on forex here at the balance. Spend some time reading up on how forex trading works, making forex trades, active forex trading times, and managing risk, for starters.

As you may learn over time, nothing beats experience, and if you want to learn forex trading, experience is the best teacher. When you first start out, you open a forex demo account and try out some demo trading. It will give you a good technical foundation on the mechanics of making forex trades and getting used to working with a specific trading platform.

A fundamental thing you may learn through experience, that no amount of books or talking to other traders can teach, is the value of closing your trade and getting out of the market when your reason for getting into a trade is invalidated.

It is very easy for traders to think the market will come back around in their favor. You would be surprised how many traders fall prey to this trap and are amazed and heartbroken when the market only presses further against the direction of their original trade.

The famous and painfully true statement from john maynard keynes states, "the market can stay irrational, longer than you can stay solvent." in other words, it does little good to say the market is acting irrationally and that it will come around (meaning in the direction of your trade) because extreme moves define capital markets in the first place.

Use a micro forex account

The downfall of learning forex trading with a demo account alone is that you don't get to experience what it's like to have your hard-earned money on the line. Trading instructors often recommend that you open a micro forex trading account or an account with a variable-trade-size broker that will allow you to make small trades.

Trading small will allow you to put some money on the line, but expose yourself to very small losses if you make mistakes or enter into losing trades. This will teach you far more than anything that you can read on a site, book, or forex trading forum and gives an entirely new angle to anything that you'll learn while trading on a demo account.

Learn about the currencies you trade

To get started, you'll need to understand what you're trading. New traders tend to jump in and start trading anything that looks like it moves. They usually will use high leverage and trade randomly in both directions, usually leading to loss of money.

Understanding the currencies that you buy and sell makes a big difference. for example, a currency may be bouncing upward after a large fall and encourage inexperienced traders to "try to catch the bottom." the currency itself may have been falling due to bad employment reports for multiple months. Would you buy something like that? Probably not, and this is an example of why you need to know and understand what you buy and sell.

Currency trading is great because you can use leverage, and there are so many different currency pairs to trade. it doesn't mean, however, that you need to trade them all. It's better to pick a few that have no relation and focus on those. Having only a few will make it easy to keep up with economic news for the countries involved, and you'll be able to get a sense of the rhythm of the currencies involved.

After you've been trading with a small live account for a while and you have a sense of what you're doing, it's ok to deposit more money and increase your amount of trading capital. Knowing what you're doing boils down to getting rid of your bad habits, understanding the market and trading strategies, and gaining some control over your emotions. If you can do that, you can be successful trading forex.

Managing risk

Managing risk and managing your emotions go hand in hand. When people feel emotional, greedy or fearful, that is when they make mistakes with risk, and it's what causes failure. When you look at a trading chart, approach it with a logical, objective mindset that only sees the presence or lack of potential; it shouldn't be a matter of excitement. If pulling the trigger on a trade feels emotional in any way, you should re-evaluate why you're not able to be objective.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Forex trading – learn to trade forex like the banks

Free download forex trading – learn to trade forex like the banks. This tutorial/course is created by thomas king. See how i remain profitable by trading the simple strategies that banks are using. This tutorial/course has been retrieved from udemy which you can download for absolutely free.

What will I learn?

- You will learn to use the checklist to trade profitably

- How to choose a broker

- How to set up and use metatrader

- You will learn the trading methodology that banks and institutions use

- You will learn how to analyse and interpret news

- You will learn where you can get all the information

- Understand how to choose the right pair to trade

- Learn and understand how to use technical analysis

- You will learn to read the calendar of economic events

- You will master the art of setting targets and stoploss

- You will learn how to size your trades with good risk management

Update 13/4/2016: added a new introduction video as well as a FAQ video to answer your commonly asked questions

Update: I’ve gathered a good amount of feedback from students. In general most enjoyed the content, but there will be some areas that I will be adding videos to over the coming weeks so STAY TUNED!!

Update: 850 students in the first 3 days!

Update: I have received some feedback from some students, so i’ll be making some updates and enhancements to the course along the way! Stay tuned for more improvements here!!

This course will teach you everything you really need to know to start trading the forex market today

I will show you the exact strategies taught to me when I was trading in the banks, and you can use these to make consistent profits easily.

I implement a method that I call the checklist method, which helps traders spot winning trades by filling up a checklist. This helps eliminate most of the uncertainty traders tend to have when entering into trades.

I know your time is precious and so I’ve condensed all the important material into this crash course. It won’t take you long to finish the material and get started on trading.

Nothing will be kept secret as I share all that I have learnt with you. Avoid all the mistakes that new traders make that prevent them from making consistent profits.

- The initial free price will increase shortly, and i’ll slowly be increasing the price

- You have unlimited lifetime access at no extra costs, ever

- All future additional lectures, bonuses, etc in this course are always free

- There’s an unconditional, never any questions asked full 30 day money-back-in-full guarantee

- My help is always available to you if you get stuck or have a question – my support is legendary in udemy

Forex trading – learn to trade forex like the banks

Forex trading – learn to trade forex like the banks udemy free download. See how i remain profitable by trading the simple strategies that banks are using.

This course is written by udemy’s very popular author thomas king. It was last updated on september 18, 2019. The language of this course is english but also have subtitles (captions) in english (US) languages for better understanding. This course is posted under the categories of finance, forex and business on udemy.

There are more than 6048 people who has already enrolled in the forex trading – learn to trade forex like the banks which makes it one of the very popular courses on udemy. You can free download the course from the download links below. It has a rating of 4.7 given by 226 people thus also makes it one of the best rated course in udemy.

The udemy forex trading – learn to trade forex like the banks free download also includes 7 hours on-demand video, 4 articles, 65 downloadable resources, full lifetime access, access on mobile and TV, assignments, certificate of completion and much more.

What am I going to learn?

If you are wondering what you are going to learn or what are the things this course will teach you before free downloading forex trading – learn to trade forex like the banks, then here are some of things:

- You will learn to use the checklist to trade profitably

- How to choose a broker

- How to set up and use metatrader

- You will learn the trading methodology that banks and institutions use

- You will learn how to analyse and interpret news

- You will learn where you can get all the information

- Understand how to choose the right pair to trade

- Learn and understand how to use technical analysis

- You will learn to read the calendar of economic events

- You will master the art of setting targets and stoploss

- You will learn how to size your trades with good risk management

What do I need?

These are the very few things you need first before you can free download forex trading – learn to trade forex like the banks:

Is this course right for me?

If you are still confused whether you should free download forex trading – learn to trade forex like the banks or is it the course you are actually looking for, then you should know that this course is best for:

- This course is suitable for all levels.

- Join if you wish to trade the same way the institutions do

Course description

Update 13/4/2016: added a new introduction video as well as a FAQ video to answer your commonly asked questions

Update: I’ve gathered a good amount of feedback from students. In general most enjoyed the content, but there will be some areas that I will be adding videos to over the coming weeks so STAY TUNED!!

Update: 850 students in the first 3 days!

Update: I have received some feedback from some students, so i’ll be making some updates and enhancements to the course along the way! Stay tuned for more improvements here!!

This course will teach you everything you really need to know to start trading the forex market today

I will show you the exact strategies taught to me when I was trading in the banks, and you can use these to make consistent profits easily.

I implement a method that I call the checklist method, which helps traders spot winning trades by filling up a checklist. This helps eliminate most of the uncertainty traders tend to have when entering into trades.

I know your time is precious and so I’ve condensed all the important material into this crash course. It won’t take you long to finish the material and get started on trading.

Nothing will be kept secret as I share all that I have learnt with you. Avoid all the mistakes that new traders make that prevent them from making consistent profits.

- The initial free price will increase shortly, and i’ll slowly be increasing the price

- You have unlimited lifetime access at no extra costs, ever

- All future additional lectures, bonuses, etc in this course are always free

- There’s an unconditional, never any questions asked full 30 day money-back-in-full guarantee

- My help is always available to you if you get stuck or have a question – my support is legendary in udemy

How to know where banks are buying and selling in the forex market

1) low risk: entering at or close to the turn in price means you are entering a position in the market very close to your protective stop. This allows for maximum position size while not risking more than you are willing to lose. The further you enter the market away from the turn in price, the more you will have to reduce position size to keep risk in line.

2) high reward (profit margin): similar to number one above, the closer your entry is to the turn in price, the greater your profit margin. The further you enter into the market from the turn in price, the more you are reducing your profit.

3) high probability: proper market timing means knowing where banks and institutions are buying and selling in a market. When you are buying where the major buy orders are in a market, that means you are buying from someone who is selling where the major buy orders are in the market and that is a very novice mistake. When you trade with a novice, the odds of success are stacked in your favor.

Forex bank trading strategy

So how do we time the market’s turning points in advance? It all begins and ends with understanding how to properly quantify real bank and institution supply and demand in any and all markets. Once you can do that, you are able to identify where supply and demand is most out of balance and this is where price turns. Once price changes direction, where will it move to? Price moves to and from the significant buy (demand) and sell (supply) orders in a market. So, again, once you know how to quantify and identify real supply and demand in a market, you can time the market’s turning points in advance, with a very high degree of accuracy.

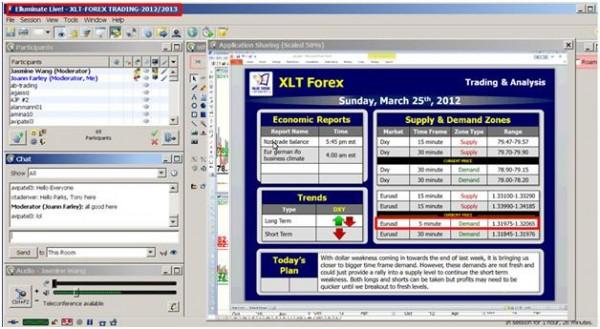

To better understand how to do this, let’s take a look at a recent trading opportunity that was identified in our online graduate trading program, the extended learning track (XLT) on march 25th. The XLT is a two hour live trading session with our students three to four times a week. During the session shown below, we identified an area of demand in the EURO (highlighted in red) / 1.31975 – 1.32065. You can also see that demand zone on the chart, the two lines creating a “buy zone”, allowing us to apply our simple rules for entering a position. This was an area of bank/institution demand for a few reasons. First, notice the strong rally in price from the origin of that rally (the demand level). Also, notice that price rallies a significant distance before beginning to decline back to the demand level. These two factors tell us that demand greatly exceeds supply at this level. The fact that price rallies a significant distance from that level before returning back to the level clearly shows us what our initial profit margin (profit zone) is.

These are two of a few “odds enhancers” we teach in our graduate program. They help us quantify the bank and institution supply and demand in a market which is the key to knowing where the significant buy and sell orders are in a market. The plan with this trade was to buy if and when price declined back to that area of demand. This trade was high probability but how do we know that? Well, being very confident that there is significant demand at that level, this tells us that we will be buying from a seller who is selling at a price level where demand exceeds supply. Selling after a decline in price and at a price level where demand exceeds supply is the most novice move a trader can take. These are “retail” sellers selling where “banks and institutions” are buying. The retail sellers are selling with the odds stacked against them which means they are stacked in the buyer’s favor like our XLT members in this trade.

As you can see below, what happens next is price declines down to our predetermined demand level where banks and XLT members buy from sellers who are selling at extreme “wholesale” (demand) prices. They are selling after that big decline in price and into that price level where demand exceeds supply.

Notice that price “declined” (down trend) to our demand level where we were willing buyers. Every trading book would say we are breaking the most important rules in trading by buying under those circumstances. Well, how many people do you know who read trading books that make a consistent low risk living year after year trading? I would be surprised if you knew one so be careful with what you read. The trading book version is conventional thinking which has you buying high and selling low so be careful. Don’t take my word for it however, read a trading book and ask yourself if how that book is teaching you to buy and sell in markets is the same as how you make money buying and selling anything in life. If there is any difference, good luck trying to profit from the information. Like anything in life, there is the book version way of learning to do something and the real world way. All we are doing at online trading academy is simply sharing real world trading with you. We are not trying to reinvent the wheel. How you make money buying and selling anything in life is exactly how you make money buying and selling in markets. I learned reality based trading during my years on the trading floor of the chicago mercantile exchange.

Shortly after reaching our demand level, offering XLT members a low risk buying opportunity in the XLT, price rallied and met the profit targets. This is market timing and while it does not guarantee that each trade will be a profitable trade, it does offer the lowest risk entry, highest reward with that entry, and highest probability of success. How high your winning percentage is with the strategy depends on your ability to identify key bank and institution supply and demand levels like we do at online trading academy.

I sometimes hear people say “I don’t want to try to pick market tops and bottoms, I am only trying to catch the middle of the move.” they are trend followers and say that as if doing that is somehow easier. If price is already moving higher for example and you want to buy, where do you enter, where is your protective stop, what is your risk / reward and so on… I would argue that catching the middle of a move and making a consistent low risk living is harder than proper market timing. I am not suggesting the trend is not important. I just want our students to be in the market well before the trend is underway. The longer we wait to enter, the greater the risk and lower the reward. Another thing I hear people say so often is this: “I wish I knew where the banks and institutions were buying and selling.” every time I hear this I say: “you can see where they are buying and selling, if you know what to look for on a price chart.” it all comes down to supply and demand, just like buying and selling anything else in life.

How can I become like institutional traders?

By louis H-P on september 26, 2018

Trading securities can be as simple as pressing the buy or sell button on an electronic trading account. This is performed by many different traders, such as retail and institutional, every day. Yet what is the difference between retail and institutional traders? Examples can include the level of sophistication and the speeds at which trades are executed. Execution-only traders who take orders for clients, better known as dealers, are only concerned with executing an order.

Retail & institutional trader differences

There are two basic types of traders: retail and institutional. Retail traders, often referred to as individual traders, buy or sell securities for personal accounts. Institutional traders buy and sell securities on accounts they manage for a group or institution. There are many key differences between the two trading groups. These differences revolve around the costs per trade, and the level of information and analysis each receives. While some differences still exist, this has significantly narrowed. Institutions maintain advantages such as access to more securities (ipos, futures, swaps). They can also negotiate lower trading fees and the guarantee of best price & execution.

Steps to becoming an institutional trader…

Traditionally, if you wanted to become a institutional trader you would start by getting a university degree in something like finance, IT, mathematics or accounting. Then you’d get a job with a bank and cut your teeth working on the trading floor before progressing up the chain. Today starting as retail trader can give you the basics to learn the following steps faster!

Know the rules of the game

Institutional trading is a game and you need to know how to play it. When markets go down, retail traders panic and sell. Whereas institutions are aggressively buying! Although catching a falling knife is risky, a pull-back/correction/sell off is a chance to buy an asset on sale. You wouldn’t buy a car today if you knew you could get 10% off in the sales next week?

Don’t wait for confirmation

People want confirmation. They are willing to increase the risk and decrease the reward for it. Retail forex traders often want different indicators to line up properly to give them confirmation. Do institutional traders wait? No they don’t! When a price is down at a level where banks and institutions are buying, then hesitation is not an option. If you wait for confirmation or reversal, all you are doing is increasing risk and decreasing the reward. Big investment banks don’t wait for prices to rally before buying. They apply a quote originally attributed to warren buffet: they are greedy when others are fearful.

Institutional traders are weary of leverage

Institutional traders focus massively on risk management and rarely use leverage. If they use leverage they are very careful about not risking more than a small percentage. Retail traders look for forex brokers that offer 200x, 500x, or even 1000x leveraged trading accounts!

Retail traders get the idea that if they really leverage up their trades they can turn something like $500 into $100,000 quickly. It is doubtful that a new retail trader has the skills and training necessary to pull that off. They typically leverage up without considering that they might just lose their $500 much faster with more leverage.

Information advantage

Institutional traders pay top dollar for the fastest news feeds and audio squawk services available. Examples of these are the two most well-known; bloomberg and reuters. They do this in order get market moving news and information faster than their competition. Retail traders typically avoid news events and pay very little attention to economic data releases. Trading patterns and technical systems typically fail during these times.

Sell yourself to institutional funds

Today, banks hire a tiny fraction of the traders they once did. With fewer opportunities through the corporate pathway, retail traders are the next generation of institutional traders in waiting. Some firms provide a link between talented retail traders and institutional trading. They provide capital funding, mentoring and professional networking to help top retail traders reach institutional levels of performance and pursue a career in trading.

Controlling your mind and emotions

Institutional traders focus heavily on developing and maintaining a healthy trade psychology. This keeps them razor focused on the things that matter the most to their trading in real time. In fact, many institutions pay to have in-house psychologists on staff to keep their traders mentally sharp and focused. Retail traders focus on systems that attempt to remove trading psychology and hopefully have a win rate of 100%.

Conclusion

The trading advantage that institutional traders had over retail traders has dissipated with the advance in technology. This includes the accessibility of sophisticated online brokerages and to trade in more securities. The ability to receive more real-time information and the widespread availability of investment data is now routine. This has narrowed the gap that had once been widely in favor of institutional traders. For those wanting to play with the big boys, learning the basics as a retail trader will help you grow into developing institutional trader skills! This can only have the benefit of turning you into a better trader!

Louis H-P

Latest posts by louis H-P (see all)

FEATURED ON

Louis H-P

Louis is a portfolio manager and a trader who brings a wealth of experience in private banking to the lazy trader. A fundamentalist and a trouble-shooter, louis makes a firm contribution to the trading team.

You may also like.

Related articles

Trade with the lazy trader in 2017!

Round the clock trader live – how to trade the news

Why there’s little room for expectations in trading (or in life)

100% FREE – INSTANT ACCESS

What creates currency appreciation?

US presidential election: gold trade setup

Why doubling down can be profitable

How old do you have to be to invest in stocks?

US elections: watching the dow

SITE NAVIGATION

- What we do

- Learn to trade

- Online trading course

- Best broker

- Trader interviews

- Lazy trader blog

- Partners

- Terms

QUICK LINKS

- Learn to trade

- Forex mentoring

forex signals

- Trading strategiesrob's forex course

- Best broker

- Trade ideas

- Why be a lazy trader

- Forex blog

- Trader training videosmake money trading

- Lazy trader testimonialshow to trade the easy way

- Press releases

about rob colville

Social media

CONTACT US

Disclaimer: all content on this website is intended for educational purposes only and “the lazy trader” (thelazytrader.Com) will not be held responsible for any losses incurred. The information of this website is “general advice only” and does not take individual circumstances into account so do not trade or speculate based solely on the information provided. But viewing and participating our and the website’s content, you fully accept and agree that this website offer’s general advice only and that trading the financial markets is a high risk activity and should understand that past performance does not indicate future performance and that the value of investments and income from them may go up as well as down, and are not guaranteed. No representation is, has or will be made that any website visitor, client or content viewer will or is likely to achieve profits similar in any way to those discussed on this website or this website’s subsidiaries. You will not hold any person or entity responsible for any losses or damages resulting from the general advice provided here by “the lazy trader” or thelazytrader.Com, its employees or directors or fellow clients. “the lazy trader and www.Thelazytrader.Com are divisions of the lazy trader ltd.

Risk warning! Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you can afford to take the high risk of losing your money. Forex, futures, options and such derivatives are highly leveraged and carry a large amount of risk and is not suitable for all investors. Please do not trade with more money than you can afford to lose. All content (news, views, analysis, research, trade ideas, commentary, videos or articles) on this website or this website’s subsidiaries does not constitute as “investment advice”.

Day trading forex live – advanced forex bank trading strategies

Sterling suhr's advanced forex bank trading course & live training room

Learn to trade like smart money

Members receive access to the following

1.) forex bank trading course

Our advanced video training course is designed to teach you how to track the banks. Learning how the banks tend to move the forex market is the key to trading successfully. If you know the position they are accumulating; no further information is needed because they control all intra-day trend!

Learning actual techniques used by the banks will give you the confidence to place trades knowing you have smart money behind you. All members receive lifetime access to all updates and continued forex training material.

2.) daily trade signals video

In my opinion, the daily market preview video is the most important part of the service.

In this daily video I break down the directional bias, as well as the exact manipulation points I will be looking to trade from. This real time training is essential to learning to trade forex!

3.) live forex trading room

Every wednesday at 4:00 PM eastern we run a live training room. This weekly live training provides you a chance to ask any questions you might have as you begin to go through the course material.

We also prepare for the day ahead and I show you the exact levels I’ll be looking to trade from.

All live training sessions which allow members to view them at their convenience. Members receive lifetime access to our live forex training room.

4.) live trade setups community forum

Our live forex forum allows for real-time discussion of forex trade setups. Additionally, members can post past setups for feedback. This is a powerful learning tool and allows for the community feedback and assistance. Lifetime access to the forum is included for all members.

5.) lifetime member email support

Members will receive lifetime personal support. We have designed the members forum to cater to the educational process in every way. Email support is yet another way we provide daily assistance to our members, to help them through the learning process as fast as possible. All emails are generally answered within 12 hours or less.

Frequently asked questions

Yes! Regardless of the length of time you’ve been trading you can learn to trade the forex bank trading strategy.

The price of the service is currently $329 USD which includes lifetime access. There are NO other fees or charges.

No! No one can guarantee your success and you should run from any educator telling you otherwise.

Here is the ugly fact…not everyone is cut out to be a trader. Some people will never stop over-trading, revenge trading, system jumping, over-leveraging, etc.

If someone cannot master their emotions then my strategy will not help them, nor will any other. A huge point people miss is that a strategy only works if you follow it.

For those members who do following the strategy, we have countless examples of traders who are now profitable and trading full-time using the forex bank trading strategy.

Since 2010, I’ve taught over 5,000 students the forex bank trading strategy.

Of course! As you go through the course I expect you to have questions. As you do, feel free to send them over!

1.) system jumpers – learning to trade takes time. I highly recommend that people research and believe in the strategy they’re going to learn. Once you decide on a strategy you need to stick with it for at least 3 months.

2.) get rich quickers – trading forex is NOT an easy way to make money! Trading is a business that takes time, money, and a great deal of effort to learn. If your goal is to turn 1K into a million in a few months then this isn’t the service for you.

So, let's see, what we have: see how i remain profitable by trading the simple strategies that banks are using at forex trading - learn to trade forex like the banks coupon

Contents of the article

- No deposit forex bonuses

- Forex trading - learn to trade forex like the...

- Чему вы научитесь

- Требования

- Описание

- Introduction to forex- learn to trade forex by...

- Day trading forex live – advanced forex bank...

- Sterling suhr's advanced forex bank trading...

- Learn to trade like smart money

- Members receive access to the following

- 1.) forex bank trading course

- 2.) daily trade signals video

- 3.) live forex trading room

- 4.) live trade setups community forum

- 5.) lifetime member email support

- Frequently asked questions

- The best way to learn forex trading

- The importance of getting educated

- Use a micro forex account

- Learn about the currencies you trade

- Managing risk

- Forex trading – learn to trade forex like the...

- What will I learn?

- Forex trading – learn to trade forex like the...

- How to know where banks are buying and selling in...

- Forex bank trading strategy

- How can I become like institutional traders?

- Retail & institutional trader differences

- Steps to becoming an institutional trader…

- Know the rules of the game

- Don’t wait for confirmation

- Institutional traders are weary of leverage

- Information advantage

- Sell yourself to institutional funds

- Controlling your mind and emotions

- Conclusion

- Louis H-P

- Latest posts by louis H-P (see all)

- FEATURED ON

- Louis H-P

- You may also like.

- Related articles

- Trade with the lazy trader in 2017!

- Round the clock trader live – how to trade the...

- Why there’s little room for expectations in...

- What creates currency appreciation?

- US presidential election: gold trade setup

- Why doubling down can be profitable

- How old do you have to be to invest in stocks?

- US elections: watching the dow

- SITE NAVIGATION

- QUICK LINKS

- Social media

- CONTACT US

- Day trading forex live – advanced forex bank...

- Sterling suhr's advanced forex bank trading...

- Learn to trade like smart money

- Members receive access to the following

- 1.) forex bank trading course

- 2.) daily trade signals video

- 3.) live forex trading room

- 4.) live trade setups community forum

- 5.) lifetime member email support

- Frequently asked questions

Comments

Post a Comment