Deposits and Withdrawals, fxopen deposit.

Fxopen deposit

Trading on the forex market involves substantial risks including total loss of your trading capital and may not suitable for all investors. Investors should make an independent judgement as to whether trading is appropriate for him/her in light of his/her financial condition, investment experience, risk tolerance and other factors. Information and market analysis on this site is considered to be general advice and may not be suitable for your personal financial position.

Before performing any transaction with fxopen, please read the financial services guide and product disclosure statement which may be downloaded from this site or obtained in hard copy by contacting our office.

Fxopen AU pty ltd is authorised and regulated by the australian securities & investments commission (ASIC). AFSL 412871 – ABN 61 143 678 719

fxopen au pty ltd does not provide services to the residents of the united states and canada. The information on this website is not intended to be addressed to the public of belgium and japan.

The information on this website is directed at residents of australia and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

No deposit forex bonuses

Deposits and withdrawals

Fxopen AU provides clients with numerous funding options for instant deposits and fast withdrawals.

Important information

- Withdrawal forms received before 12:00 (GMT) will be processed the same business day. If these are received after 12:00 (GMT) or during the weekend, they will be processed the next business day.

- Withdrawals made by bank wire transfer usually take 1-3 business days to reach your account.

- Withdrawals made by card usually take 2-5 business days to reach your account depending on your bank.

- Fxopen AU does not accept payments from third parties. Please ensure that all deposits into your trading account come from a bank account in your name. Payments from joint bank accounts / bank cards are accepted if the trading account holder is one of the parties on the bank account / bank card.

- Any international telegraphic transfer (TT) fees charged by our banking institution are passed onto the client.

- In unforeseen circumstances, withdrawal times may be longer.

- Allow up to 1 hour for the transfer of funds. Fxopen AUS shall not be held liable for any delay of processing if that delay is out of our control.

Trading on the forex market involves substantial risks including total loss of your trading capital and may not suitable for all investors. Investors should make an independent judgement as to whether trading is appropriate for him/her in light of his/her financial condition, investment experience, risk tolerance and other factors. Information and market analysis on this site is considered to be general advice and may not be suitable for your personal financial position.

Before performing any transaction with fxopen, please read the financial services guide and product disclosure statement which may be downloaded from this site or obtained in hard copy by contacting our office.

Fxopen AU pty ltd is authorised and regulated by the australian securities & investments commission (ASIC). AFSL 412871 – ABN 61 143 678 719

fxopen au pty ltd does not provide services to the residents of the united states and canada. The information on this website is not intended to be addressed to the public of belgium and japan.

The information on this website is directed at residents of australia and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Fxopen deposit

Call us

new zealand | +64 9 801 0123

russia | +7 499 346 0381

About astropay card

| astropay card is a virtual prepaid card accepted in thousands of online sites across the globe and sites affiliated with the astropay system. Astropay card is accepted worldwide and can be purchased online at astropay official website or mobile APP: for android or iphone. Find here the available payment methods per country. |

Astropay cards are available in USD, EUR or any other currency listed above (in the available payment methods per country).

There are the following nominal values of astropay card: $10, $25, $50, $100, $500 and $1,000 (or equivalent in a local currency). Depending on the country and currency, the card amounts may differ. Check your country at https://astropay.Com/checkout/cards.

Be aware of the following restrictions:

How to make a deposit via astropay

To make a deposit via astropay:

- Account: select the account to which you want to make a deposit (ewallet or a trading account).

- Currency: for ewallet, select the currency pocket.

- Amount: enter the deposit amount (min. $10.00 or equivalent amount in local currency).

You can make multiple deposits from astropay card, following the minimum limit accepted by fxopen, as well as the available balance on your astropay card. - Astropay card number: astropay 16-digit card number.

- Expiration date: astropay card expiration date (mm/yyyy).

- Code (CVC): astropay card 4-digit CVV code.

Click add funds.

| Current transaction fees are available on the fees page. |

Notice about adding funds via astropay

If you made a deposit via astropay, but the funds were not credited to your fxopen account, please use the payment notification form.

Select add funds → astropay in my fxopen, and then click the notification form link.

Fill the deposit details in the form and click notice.

To check the transaction status of your payment, click your ewallet number on the left of my fxopen.

The transaction status is shown on the account operations → history tab.

FXOPEN UK

Why choose fxopen UK pro?

Higher leverage

Trade with up to 1:500 leverage

Lower commission

From $15 a million ($1.50 per lot)

Instant and secure

Choose from credit/debit card, webmoney, wire transfer

Free VPS

The fastest execution with the lowest latency

Segregated funds

Elective professional client funds will still be fully segregated in UK tier 1 banks

FCA regulated

Fxopen UK is authorised and regulated by the financial conduct authority (FCA)

What protection do professional clients lose?

Professional clients do not get the same protections afforded to retail clients

Professional clients have an obligation to make additional payments should your account fall into a negative balance

As a professional client we will not be obliged to restrict leverage on your account.

As a professional client we may assume your level of experience when assessing product suitability

As a professional client we may prioritise other factors in giving best execution apart from price

As a professional client we can use more sophisticated language when talking about risks and benefits of leveraged trading

Am I eligible for an fxopen UK pro account?

To be eligible for a fxopen UK pro account, you need to meet the FCA’s elective professional client eligibility criteria.

If you answer yes to two of these three questions, you could be eligible for a fxopen UK pro account:

Have you placed 10 relevant trades of a significant size per quarter in the last year?

Does your cash and financial instrument portfolio exceed €500,000?

Do you, or have you, worked in the financial sector for at least 1 year?

FXOPEN UK PRO

account trading conditions

ECN PRO

Raw market spreads

from 0.0 pips

STP PRO

Floating market spreads

from 0.5 pips

How do I open a pro trading account?

- Open an account with fxopen UK below

- Request a professional client application form from [email protected]

- Complete your application and return it to fxopen UK

- Once approved, start trading with all the advantages of a fxopen UK pro account

Fxopen UK is a trading name of fxopen ltd a company registered in england and wales under company number 07273392 and is authorised and regulated by the financial conduct authority under FCA firm reference number 579202.

RISK WARNING: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Before performing any transaction with fxopen UK, please read the terms and conditions and 'disclaimers and risk warning' which may be downloaded from this site or obtained in hard copy by contacting our office.

Trade forex and

global markets

from one account

spreads from 0.0 pips

ECN trading, no dealing desk

Fxopen UK advantages

PEACE OF MIND

Fxopen UK is authorised and regulated by the FCA (579202) in the UK, with retail client funds fully protected up to £85,000 by the FSCS.

WE WANT YOU TO BE A SUCCESSFUL TRADER

We don’t make money on client losses, so there’s no conflict of interest.

MAKE YOUR MONEY GO FURTHER

Enjoy low cost forex trading with spreads from 0.0 pips and commission from $1.50 per lot.

ULTRA-FAST EXECUTION

Your trade is executed instantly through our wide range of liquidity providers streaming real-time prices.

YOUR CHOICE OF TRADING STRATEGY

High frequency trading, all types of expert advisors (EA’s) and scalping are all welcomed forms of forex trading.

200 + MARKETS OFFERED

Trade global FX, indices, equities and commodities via cfds through the highly customisable MT4 or MT5 trading platforms

ECN technology

- ECN model - all trades executed in interbank market.

- No dealing desk (NDD). No conflict of interest. No trade restrictions.

- We want our traders to be profitable. We do not trade against you.

Main conditions on fxopen UK trading accounts

- Minimum deposit:

- Account currency:

- Business model:

- Maximum balance:

- Spread:

- Commission (per 1 lot):

- Quotes format:

- Execution:

- Requotes/slippage:

- Minimum transaction size:

- Maximum transaction size:

- Minimum increment:

- Leverage:

- Margin call:

- Stop out:

- Demo accounts:

- Instruments:

- Hedging:

- Expert advisors:

- Scalping:

- News trading:

- Phone dealing:

- Market depth with level 2 quotes:

- Trading time:

- ECN

- $300, £300 or €300

- USD, GBP, EUR

- ECN

- No limit

- Floating, from 0 pips

- From $1.50

- 0.12345

- Market

- No / yes

- 0.01 lot

- Not limited*

- 0.01 lot

- Up to 1:30

- 100%

- 50%

- Yes

- Currencies cryptocurrency cfds* metal cfds energy cfds index cfds share cfds *only available for trading by professional clients

- Yes

- Yes

- Yes

- Yes

- Yes

- Yes

- 22:00 sun – 22:00 fri (UK time)

- STP

- $300, £300 or €300

- USD, GBP, EUR

- STP

- No limit

- Floating

- No

- 0.12345

- Market

- No / yes

- 0.01 lot

- Not limited*

- 0.01 lot

- Up to 1:30

- 100%

- 50%

- Yes

- Currencies

metal cfds - Yes

- Yes

- Yes

- Yes

- Yes

- Yes

- 22:00 sun – 22:00 fri (UK time)

Open a live account and select your account type

Or try a free DEMO ACCOUNT to learn how to trade!

Trade with the world's most popular trading platform metatrader 4

- used by millions of traders around the world.

- design, build and use your favorite trading systems.

- highly customisable, with a range of apps that can improve its charting, interface and functionality.

- fxopen UK clients can use MT4 to trade forex, indices, equities and commodities via cfds

- compatible with all operating systems.

- fast, reliable, secure.

MT4 desktop

An application that is downloaded onto your computer and has the full range and functionality of the MT4 trading platform.

MT4 webtrader

Access via a web browser with no need to download the desktop platform.

MT4 iphone

Trade on your ios smartphone and tablet from anywhere that hosts an internet connection.

MT4 android

Trade on your android smartphone and tablet from anywhere that hosts an internet connection.

Metatrader 5 trading platform

- compatible with all operating systems. Trade on metatrader 5 today.

- choice of accounts: in MT5 you have the choice of two order accounting systems (netting and hedging)

- fundamental analysis tools are available in MT5: the economic calendar and financial news keep you up to date with market developments

- algorithmic trading allows you to trade the markets using trading robots (expert advisors) without your direct involvement in every trade

2005-2020 © fxopen UK all rights reserved.

Fxopen UK is a trading name of fxopen ltd a company registered in england and wales under company number 07273392 and is authorised and regulated by the financial conduct authority under FCA firm reference number 579202.

RISK WARNING: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Fxopen minimum deposit

The fxopen minimum deposit amount that fxopen requires is US dollar 1.

The minimum deposit amount of US dollar 1 when registering a live account is equivalent to ZAR18.51 at the current exchange rate between US dollar and south african rand on the day that this article was written.

The minimum deposit amount will depend on the type of account that the trader opens, and it ranges from US dollar 1 – US dollar 100.

Fxopen is a UK-based broker which is authorized and regulated by one of the strictest and most demanding regulating entities namely the FCA, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as fxopen are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

Deposit fees and deposit methods

Fxopen does not charge deposit fees when traders fund their trading account and traders can use any of the following deposit methods which includes, but is not limited to:

- Bank wire transfer

- Walao! Pay

- Local wire transfers (or skrill)

- Local deposits

- Alfa-click

- China unionpay

- Credit/debit cards, and several others.

Fxopen supports a variety of deposit currencies in which traders can fund their accounts including:

Base deposit currencies including USD, EUR, GBP, AUD, CHF, JPY, and RUB

The deposit currencies available will depend on the payment method used, other deposit currencies also include:

- MYR

- THB

- IDR

- VND

- CNY

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by using these steps:

- Log into the client portal and select either one of the supported payment methods in the ‘add funds’ menu.

- Complete the form with the amount that the trader would like to deposit, in this case the minimum deposit amount, along with currency, trading account number and then click on ‘add funds’.

- The trader will then be redirected to the gateway of the chosen preferred payment method to complete the transaction.

Fxopen review and tutorial 2021

Fxopen is a highly regulated FX & CFD broker offering multiple trading platforms.

Trade major, minor & emerging forex pairs with 1:30 leverage.

Trade on dozens of cryptocurrency coins with 1:2 leverage.

Fxopen is an ECN forex broker offering a range of CFD instruments using the metatrader 4 (MT4) and metatrader 5 (MT5) trading platforms. This review will cover account types, fees, minimum deposits, and more. Find out if you should sign up with fxopen.

Fxopen details

Fxopen started as an educational centre offering courses within financial markets. Then in 2005, a group of traders turned the company into a global brokerage with offices in the UK, russia, new zealand, and australia. Today, the broker’s thousands of traders can be found everywhere from canada and germany to vietnam and nigeria.

The fxopen group operates under FX markets limited, a company registered in charlestown, nevis. Fxopen UK is authorised and regulated by the financial conduct authority (FCA). Fxopen australia is regulated by the australian securities and investments commission (ASIC).

Trading platforms

Metatrader 4

Fxopen was the first broker to offer ECN and STP trading via metatrader 4 (MT4), an award-winning platform that boasts instant trade execution at competitive prices.

MT4 is ideal for both beginners and experts and offers a range of customisable features, including:

- 50+ built-in indicators & graphical objects for technical analysis

- Three types of orders (market, limit, and stop)

- Intuitive charting package

- Automated trading (eas)

- Rich historical data

- One-click trading

- Trading signals

MT4 is available for download on windows pcs and can be accessed from the platforms page on the broker’s website.

Fxopen also offers the web-based version of MT4 – a great option for those with apple mac pcs, where a direct download is not available. The webtrader terminal has all the same features of the desktop version and is compatible with all major desktop browsers.

Metatrader 5

Fxopen also offers the metatrader 5 (MT5) platform, offering all the features of MT4 with several additional benefits:

- 80+ built-in indicators & graphical objects for technical analysis

- 21 timeframes to track price movements

- Multi-currency strategy tester

- Netting & hedging allowed

- Economic calendar

Note, cryptocurrency trading is not available on MT5.

MT5 is available for download on windows pcs and can be accessed from the broker’s website.

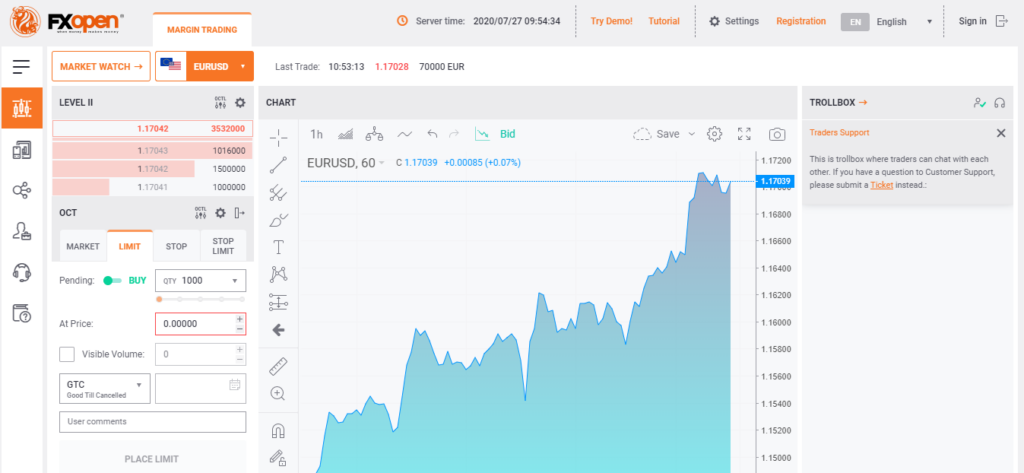

Ticktrader

For non-UK customers, fxopen also offers ticktrader, a brand new trading platform offering much of the same features as metatrader and more. Using one trading account – ticktrader ECN, the platform is suitable for both beginners and experts.

- Advanced technical analysis tools (30+ indicators)

- Customisable user-friendly interface

- One/double click trading mode

- Detailed charting system

- Trading alert system

- Strategy back tester

- Level 2 pricing

A web-based version of ticktrader is also available. Supporting all the major browsers and operating systems, the ticktrader web terminal offers easy and quick access to trading without the need for a download and without compromising on any features. Users can access the web terminal from the fxopen website.

Markets

Fxopen offers four key markets:

- Currencies – trade over 50 major, minor, and exotic currency pairs.

- Indices – trade nine global indices including the FTSE 100 and S&P 500.

- Commodities – trade on energy and metals such as gold, silver, and crude oil.

- Cryptocurrencies – trade over 40 crypto cfds including bitcoin, ethereum, and ripple.

Spreads & commissions

For major forex pairs including EUR/USD and GBP/USD, spreads average around 0.2 pips, whilst for EUR/GBP, spreads are around 0.5 pips. Spreads for the FTSE 100 start from 0.8 pips while for gold and silver, spreads start from 0.27 and 1.2 respectively. Crude oil spreads average around 4 points.

With ECN accounts, forex commissions are charged based on the account balance and start from $3.50 for accounts lower than $1,000 and reduce to $1.50 for account balances over $250,000. Discounted rates for high volume traders are available. Similarly, for cfds indices and commodities, commissions start from $5 for lower account balances and reduce to $3.50 for higher balances. Crude oil and natural gas are charged at either 0.005%, 0.0025%, or 0.0018% per side, depending on the account balance. For cryptocurrency CFD accounts the commission is 0.5% per side.

With STP accounts, the commission is included in the spread.

Other fees to be aware of include swap charges on positions held overnight. Fxopen provides instructions on how to look up a swap fee on their website.

Leverage

Leverage is available from 1:2 for cryptocurrency trading and 1:30 for forex investing. Leverage for indices is set at 1:20 and for commodities, maximum leverage is 1:10, apart from gold which is available at 1:20. Professional clients can access leverage up to 1:500. Speak to the support team to change leverage levels.

Useful margin and pip value calculators are available on the broker’s website.

Mobile apps

Fxopen offers all of its trading platforms (MT4, MT5, and ticktrader) as mobile apps, compatible with ios and android smartphone and tablet devices. The mobile apps provide the same features as the desktop versions as well as added features including push notifications. The apps can be downloaded from the user’s app store or play store.

Payment methods

Deposit

Fxopen offers several deposit options in USD, EUR, or GBP. Whilst some options are free, there are some fees to be aware of:

- Bank wire transfer – free

- Credit/debit cards – free

- Webmoney – 3.5%

- Trustly – free

- Neteller – 1%

- Skrill – 2%

Minimum deposits range from 10 GBP, USD, or EUR for cards and go up to 300 for wire transfer. For webmoney, trustly, neteller, and skrill, minimum deposits in the chosen currency are 50.

There is no maximum deposit limit for wire transfer. For cards, the limit is 15,000 (GBP, USD, or EUR) and for e-wallets, maximum deposits are either 10,000 or 20,000.

Note that fxopen also permits virtual prepaid cards for new clients. Local deposits are also available for malaysia and indonesia. Details of these can be found in the help centre.

Withdrawal

Withdrawal methods and fees are as follows:

- Bank wire transfer – free for GBP, 30 USD, or 15 EUR

- Credit/debit cards – free

- Webmoney – 3.5%

- Neteller – 1%

- Skrill – 2%

Withdrawal times for bank wire transfer usually take 1 – 3 business days, whilst cards take 2 – 5 business days. The minimum withdrawal for bank wire transfer is 50 GBP, USD, or EUR, and for all other methods, the minimum is 10. There is no maximum withdrawal limit for bank transfers, but for card withdrawals, the limit is set at 15,000 GBP, USD, or EUR. All other methods are either 10,000 or 20,000.

Demo account

Fxopen offers a demo account in any of the three account options and with MT4, MT5, and ticktrader platforms. The demo account can be opened from the main page and gives users up to $1,000,000 in virtual funds. The demo server will remain accessible as long as you log in each month. You can then upgrade to a live real-money account when you’re ready.

Bonuses & promotions

For non-UK customers, fxopen offers a $10 no deposit bonus (NDB) for the ECN ticktrader account and the STP PAMM accounts. There is also a $1 welcome bonus for micro accounts and a forexcup trading contest bonus, subject to demo contest terms and conditions. See the broker’s website for the latest promotional codes.

There are currently no bonuses or promotions for traders located in the UK.

Regulation & reputation

Fxopen UK ltd is authorised and regulated by the financial conduct authority (FCA) in the united kingdom. Fxopen australia is regulated by the australian securities and investments commission (ASIC). The broker receives a decent trust rating in customer reviews.

Fxopen also offers negative balance protection for its retail customers.

Additional features

Fxopen offers several additional features, suited to both beginner and expert traders:

- Market news

- FIX API trading

- Customer forum

- Economic calendar

- VPS (virtual private server) available

- Help centre with support options and knowledge base

- Myfxbook and zulutrade social and copy trading (non-UK only)

Account types

There are three account types available for UK customers: STP, ECN, and crypto. Tradeable instruments with the STP account are forex, gold, and silver. With the ECN account, you can trade forex, gold, silver, indices, and energy. With the crypto account, you can trade cryptocurrencies.

The minimum deposit across all three accounts is 300 GBP, USD, or EUR, which is fairly high compared to the likes of XM trading and IC markets. There are no commissions with the STP account, however, a commission is charged from $1.50 per lot in the ECN account and 0.5% half-turn in the crypto account. Leverage goes up to 1:30 in the STP and ECN accounts and remains at 1:2 for the crypto account. The minimum transaction size across all three is 0.01 lots.

Fxopen also offers PRO versions of the STP, ECN, and crypto accounts, with higher leverage of 1:500 and lower commission rates. Details of this can be found in the pro tab at the top of the broker’s website.

Note that the fxopen UK entity is unable to provide PAMM accounts.

Benefits

If you look at fxopen vs the likes of FXTM and fxpro, traders benefit from:

- MT4, MT5, & ticktrader platforms

- Positive customer reviews in 2021

- Regulated in the UK & australia

- Decent cryptocurrency offering

- True ECN model

Drawbacks

Disadvantages of choosing fxopen include:

- High minimum deposit for UK customers

- More suited to experienced traders

- Limited educational tools

- Limited range of cfds

Trading hours

Trading hours for forex, indices, and commodities run from 22:00 on sunday to 22:00 on friday (UK time). All crypto instruments are tradable 24 hours a day, 7 days a week.

Check the timezone in your area.

Customer support

There are several ways traders can contact fxopen customer support:

- Email – support@fxopen.Co.Uk

- Help centre – submit a ticket after registration

- Customer support telephone – +44 (0) 203 519 1224 (8am – 6pm GMT)

- Trading desk telephone – +44 (0) 203 519 1224 (10pm sunday – 10pm friday GMT)

- Live chat including whatsapp & facebook messenger – located in the bottom right-hand corner of the website

The support team can help with ewallet and bitcoin deposits, withdrawal problems, and proof of address queries.

User security

Both the MT4 and MT5 platforms follow industry-standard security requirements, including 128-bit secure sockets layer (SSL) encryption and two-step verification upon login. All client funds are fully segregated at barclays bank plc or lloyds bank plc in london.

Fxopen verdict

Fxopen is a good ECN broker providing a competitive trading environment with multiple platforms for active traders. Although education resources are fairly limited, the low spreads and commissions, as well as a strong track record make it an attractive option, particularly for high volume traders.

Accepted countries

Fxopen accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use fxopen from belgium, japan, united states.

Is fxopen regulated?

Yes, the brokerage holds licenses with the FCA in the UK and the ASIC in australia. These are two of the most respected agencies and a strong indicator that fxopen is trustworthy.

Is fxopen a good broker for beginners?

Although fxopen is aimed at both beginners and expert traders, there are limited resources available for beginners to learn how to trade. Fxopen also requires a minimum starting capital of £300 which is relatively high.

What leverage is available at fxopen?

Leverage is available up to 1:30 for forex, indices, and commodities, while leverage rates up to 1:2 are available for cryptocurrencies.

What markets are available on fxopen?

You can trade on 50+ FX markets, nine global indices, five commodities, and 40+ cryptocurrencies at fxopen.

How do I open an account with fxopen?

From the broker’s website, you can choose to either open a live account or a demo account from the top right-hand corner. You will need to select which account type you wish to trade and verify your identity and proof of address.

Fxopen deposit

To make a deposit via wire transfer:

Fill in the deposit form:

- To: select the account to which you want to make a deposit (ewallet or a trading account).

- Currency: for ewallet, select the currency pocket.

- Bank country: select your bank country.

- Bank: select your bank from the list.

- Amount: enter the deposit amount (min. - $100.00).

- Currency: select the deposit currency (USD, EUR, GBP).

Note: if the account currency / currency pocket and the deposit currency do not match, the funds will be converted at the fxopen UK exchange rate.

Click next.

Minimum deposit is USD 100.00.

Deposit commission rate depends on the chosen bank.

The generated invoice contains all the necessary information for making a bank transfer.

To save the invoice, click download. To view the invoice before printing, click print.

Use the invoice details to make a payment at a bank branch or via the internet banking service.

You don't need to additionally notify the fxopen finance department of the payment. The list of the generated invoices is displayed in the all previously generated invoices form. To download the invoice, click download. If you requested an invoice, but are not going to pay it, click delete.

How to check the transaction status

Click your ewallet number on the left of my fxopen.

The transaction status is shown on the operation summary tab.

OPEN

A CRYPTO ACCOUNT

AND TRADE CRYPTOCURRENCIES BITCOIN, LITECOIN, ETHEREUM

And other altcoins (43 pairs)

Cryptocurrency cfds TRADING TERMS

MINIMUM

DEPOSIT

Spread

Commissions

Leverage

Account currency

USD, EUR, GBP, RUB, JPY,

BTC, LTC

Minimum

transaction size

MG CALL / STOP OUT

Trading time

FUND YOUR CRYPTO ACCOUNT

WITH NO FEES

Over 20 ways to deposit and withdraw.

No commission for deposits in bitcoin, litecoin, ethereum, and emercoin.

TERMS OF DEPOSITING BITCOINS TO FXOPEN CRYPTO ACCOUNTS:

Minimum

WITHDRAWAL AMOUNT:

WHY TRADE BITCOINS WITH FXOPEN ?

TRADE CRYPTO CURRENCY with CFD instruments

Fxopen lets you trade all the most popular cryptocurrencies like bitcoin (BTC), bitcoin cash (BCH), ethereum (ETH), litecoin (LTC), dash (DSH), ripple (XRP), monero (XMR), IOTA, EOS, NEO, OMNI in the form of cfds without having to hold any cryptocurrency directly.

One of the largest bitcoin cfd brokers

We use top liquidity providers (exchanges) to aggregate liquidity and hedge the risks of client's exposure. Our order execution is based on the ECN aggregator.

TRUE ECN ENVIRONMENT

You can trade cryptocurrencies on MT4 platform and enjoy all the benefits of ECN execution: you trade against other market participants, not against the broker.

LOW SPREADS AND COMMISSIONS

You get tight market spreads and low trading commissions (0.5% half-turn), while the broker benefits as your traded volume and profits grow.

TRADE THE WAY YOU LIKE

All the popular forex trading styles including scalping, hedging and all the types of expert advisors are allowed.

THE MOST POPULAR TRADING PLATFORM

Buy or sell instantly with one-click trading on MT4.

Go long or short on any cryptocurrency CFD

Take a position when you expect a cryptocurrency to fall in value, as well as rise. No actual crypto assets are required.

ENJOY PEACE OF MIND TRADING WITH A TRUSTED BROKER

Fxopen is a reliable forex broker with a 10+ years' history.

FXOPEN CRYPTO ACCOUNTS HAVE

43 TRADING INSTRUMENTS AVAILABLE INVOLVING:

Most popular cryptocurrency pairs

BTC/USD

Bitcoin vs US dollar CFD

1% of the price (round turn)

ETH/USD

Ethereum vs US dollar CFD

1% of the price (round turn)

XPR/USD

Ripple vs US dollar CFD

1% of the price (round turn)

Fxopen: reliable broker with favourable trading terms.

Make profit with us!

Trading on the forex market involves substantial risks, including complete possible loss of funds and other losses and is not suitable for all members. Clients should make an independent judgement as to whether trading is appropriate for them in the light of their financial condition, investment experience, risk tolerance and other factors.

Fxopen markets limited, a company duly registered in nevis under the company no. C 42235.

Fxopen does not provide services for united states residents.

Fxopen: login, minimum deposit, withdrawal time?

Warning! Fxopen is an offshore company! Your deposit may be at risk.

RECOMMENDED FOREX BROKERS

Fxopen’s website does not carry itself as a modern, stylish broker. In fact, the broker site doesn’t feel like anything else we’ve reviewed before. But first impression can be deceiving. Is fxopen more than meets the eye?

There are two subsidiaries using the fxopen brand name.

Fxopen markets limited (fxopen.Com) is registered in nevis and is a member of the financial commission (FINACOM PLC LTD). This regulatory body is an independent organization, meaning that it is not registered within any jurisdiction as an EDR (external dispute resolution) body. Nevertheless, finacom ensures that both traders and brokers conflicts of interest are resolved in a professional and unbiased manner. Clients trading under brokers regulated by finacom are eligible for the commission’s compensation fund of up to €20,000.

Fxopen ltd (fxopen.Co.Uk) is registered in england and wales and is regulated by the FCA. The FCA strives to enforce strict industry standards, requires detailed reports from the company, and generally oversees that fxopen ltd’s activities are within the boundaries of the law. Fxopen ltd is a member of the investors compensation fund allowing for client compensations of up to € 85 000 if the broker cannot meet its obligations to the trader.

As an entity outside ESMA controlled zones fxopen rightfully offers a maximum leverage of 1:500. In europe and the UK the spread has been limited to 1:30 as decreed by esma. The spread for EUR/USD lingers on 0.3-0.5 pips.

Fxopen.Com has a bunch of assets for trade: FX pairs, gold, silver, cfds, oil, natural gas and crypto currencies. The big one missing is indices. However, there is an extensive array of cryptocurrency trading opportunities.

Fxopen.Co.Uk offers as trading assets: forex pairs, cryptocurrencies, gold, silver, enegry, oil and CFD’s on indices.

The services of fxopen.Com are offered in the following languages: arabic, english, chinese, french, dutch, czech, indonesian, malay, persian, polish, portuguese, russian, spanish, hebrew, turkish.

Fxopen.Co.Uk has translated the website in: chinese, german, russian and spanish.

FXOPEN LOGIN

The presence of MT4 and MT5 is no surprise. Zulutrade, on the other hand is a welcome addition.

Fxopen.Co.Uk comes only with the MT4 platform.

Zulutrade is a standalone platform that uses signals from expert traders to manage your account and bring you lucrative strategies. Zulutrade allows for multiple account management from one workplace, real time free signal deliveries and many more features that will aid you in your game of trade. The trader is, however, left to control his/her own funds, decides his/her own level of risk, and can set the maximum lot range.

The leverage is limited to 1:500, while the average EUR/USD spread is 0.3-0.5 pips.

METATRADER 4

The bigger chunk of retail online trading is done via MT4. This is no coincidence. The platform’s staple expert advisors, VPS, great chart management, one click trading customizable indicators are back. Add to that an assortment of tools that fxopen has added and what you get is precision trading at its finest.

Myfxbook allows for tracking, comparing, sharing and analyzing services in a matter of minutes. It is available to use for free with your MT4 account.

Fxopen allows for PAMM (percentage allocation money management) accounts to be utilized. The essence of this is that inexperienced traders, or those without the time, can allocate a sum of their money to a qualified trader of their choice. From there on, these adept traders will trade with their and your money with the sole purpose of generating as much profit as possible.

Other tools include one click trading and level2 plugin, calculator for margin and pip value, commission calculator and more.

Seeing that fxopen.Co.Uk is regulated by FCA, the inclusion of PAMM has been forbidden. However, fxopen.Co.Uk comes equiped with all the aforementioned tools, and is integrated with myfxbook.

The leverage is limited to 1:500 and 1:30 in the EU/UK (by ESMA), while the average EUR/USD spread is 0.3-0.5 pips. ECN account holder will be commissioned by $1,5 (per side) per standard lot: with the fee applied the spread changes from 0.3 pips to an actual 0.6 pips spread for ECN account holders.

The other commission scheme involves a deduction 0.5% of the total trade volume for crypto account users.

MT4 is available on apple and android devices, as a standalone desktop trader or a web based one. The web version is without trading bots.

METATRADER 5

MT5 is an improvement in every way to MT4. With its increased time frames, more pending order types, the inclusion of an economic calendar, and so much more, MT5 should slowly be taking over as the number 1 trading terminal. The platform comes with all its predecessor’s features: eas, VPS, one click trading, level2 plugin, the possibility for PAMM and myfxbook.

The leverage reaches a limit of 1:500, while spread fluctuates between 0.3-0.5 pips.

With the commission the spread for ECN accounts changes to 0.6-0.8 pips. Crypto account clients will be burdened with 0.5% of the total trade volume.

MT5 is available on apple/android devices, as a standalone desktop trader or as a browser terminal (no eas)

FXOPEN MINIMUM DEPOSIT

Fxopen allows for minimum deposit of just $1, and $25 if funding via wire transfer.

Fxopen.Co.Uk’s minimum deposit is $300.

Bear with this for there are a lot of deposit methods: credit/debit card, china union pay, SEPA, alfa click, local bank transfers, wire transfer, local deposit, rapid transfer,sorexpay, intellectmoney, neteller, paytoday, skrill, QIWI,fasapay, yandex, RBK money, perfect money, intellectmoney, epayments, bitcoin, litecoin, emercoin, ethereum, tether, paysafe card.

The methods for depositing are limited at fxopen.Co.Uk when compared to the one above: bank transfer, mastercard, visa, visa debit, visa electron, maestro, laser, webmoney, neteller and skrill.

Deposited sums will be converted into one of the following: USD, EUR, GBP, AUD, CHF, JPY, RUB, BRL, PEN, THB, CNY, SGD, CAD, IDR.

At fxopen.Co.Uk, the base currencies are limited to: USD, EUR, GBP, CHF, AUD, CAD.

Bank transfers and local transfers processes funds for about 1-3 days. Local bank transfers and paytoday deposits are processed instantly. The same applies to credit/debit cards, china union pay and epayments, paysafecard, and ewallets.

Unfortunately, payment methods are charged with a fee: wire and local transfers depend on the bank in operation; 2.29% for local bank transfers; 2% from rapid transfer; 4% from paytoday; credit/debit card are charged with 2.29%; china union pay with 3.5%; epayments and webmoney with 1%; skrill with 2.29%; RBK- 3.9%; QIWI- 6%; yandex money-7%; neteller- 3%; 5% for perfect money; sorexpay with 2.5%; intellectmoney by 3%; and paysafecard by 8.25%.

Fxopen.Co.Uk has slightly different commissions on deposits: bank tarnsfer depend on the bank; neteller, skrill and webmoney are taxed with 1%; credit/debit cards are free of charge.

FXOPEN WITHDRAWAL TIME AND LIMITS

Withdrawal methods are slightly different from the funding ones: credit/debit card, local bank transfers, wire transfer,web money, neteller, paytoday, skrill, QIWI, fasapay, yandex, RBK money, perfect money, intellectmoney, epayments, bitcoin, litecoin, emercoin, ethereum, tether, paysafe card.

The withdrawal methods at fxopen.Co.Uk are: bank transfer, mastercard, visa, visa debit, visa electron, maestro, laser, webmoney, neteller and skrill.

All wire transfer types can take up to 3 days to process. Credit and/or debit cards and ewallet withdrawals are usually handled in 24 hours. Note that the processing by the broker and the amount of time it takes for the money to arrive to your account are two different things.

The withdrawal fee for wire transfer is $45. For credit/debit cards it’s 2.5%; china union pay it’s 0.5%; epayments its 0.75%. For skrill and yandex it’s 1%; web money-0.8%; QIWI-1%; fasapay-0.5%; yandexmoney-1%; perfect money- 0.5%; epayments-0.75%. All services are eligible for payment system taxes.

Commissions at fxopen.Co.Uk are as follows: bank transfer is burdened with $30; neteller, skrill and webmoney are feed by 1% of the total withdrawal sum; credit/debit cards are free of charge.

The minimum amount you can withdrawal is $100 for bank transfer. Credit cards and epyament have a minimum of $10. While yandex, webmoney, skrill, QIWI, perfect money and fasapay have a minimum withdrawal requirement of $1. For paysafe it’s $7, for paytoday it’s 10 THB, and for neteller it’s $2.

BOTTOM LINE

In spite of offering fertile ground for trading with a high leverage, outstanding platforms and diverse payment methods, one must not ignore the fact of fxopen’s off shore regulation. It immediately creates feelings of uncertainty when a broker is regulated entirely by 1 offshore firm, and not a very common one. So be warned!

Fxopen review

Fxegypt

Fxopen is a forex broker. FX open offers the mobile, MT4, MT5 and web trading platforms. Fxopen.Com offers over 50 currency pairs, CFD, bitcoin and other cryptocurrencies for your personal investment and trading options.

Fxopen.Com is the nevis branch of fxopen.

The australian branch is at fxopen.Com.Au. The UK branch is at fxopen.Co.Uk

Also known as:

forexbrazilian.Com, fxopen.Ae, fxocnmarkets.Com, fxislamic.Com, fxfrench.Com, fxopengermany.Com, tradefxind.Com, fxmalay.Com, fxopen.Com.Mx, fxopenthai.Com, fxopentrading.Com.

Broker details

| deposit methods: | bank wire, VISA, mastercard, epayments, fasapay, intellectmoney, JCB, local bank transfers, maestro, neteller, paytoday, perfectmoney, poli, qiwi, RBK money, skrill, unionpay, webmoney, yandex money |

Live discussion

Join live discussion of fxopen.Com on our forum

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

There's been talk a lot about the credibility of that company see you my personal experience with them to know that.

First of all, in terms of credibility.

So far, I haven't seen anything wrong with that company, so trading with them hasn't had any problems, and I'll give some examples of that.

As for the market movement, I've been watching the market movement, the japanese movement, the pairs movement, comparing it to some other big companies, and I've never found any difference.

The movement of japanese candles can vary in the timing of their closing and opening on different time frames but the price movement is fixed in such timing as other companies and this in terms of market and price movement

as far as the spread is concerned, I've found the spread on different pairs is very small, which is a good thing for this company.

Once upon a time that company did not have a good reputation and had many problems have solved those problems now and no longer exist, the company improved their policy and changed it and one of those problems is the lot was very large but now it is very small to suit all traders

among other problems that were present the company is trading large amounts and I think that problem is also solved now.

The company has its own platform now other than metatrader 4 and metatrader 5, which means that the company has three trading platforms

this is unlike the company's endeavors to bring new customers through the bonus, which is 10 US dollars for registration and began trading as it tries to maintain its current customers by making periodic contests almost one of the most famous of these competitions is the forex cup competition, which reaches a total of 2000 US dollars, which are various competitions throughout the year winners

however, the company is flawed by one thing, which is the bonus system, there are a lot of problems with it, for example, the company determined by the competition announcement about the forex cup competition, which is the publication of the announcement of the competition in other forums and in exchange for each publication a certain amount of cents and after I made those and I might say I'm less at a loss than other members, even if I saw a complaint from one of the members, he was supposed to be sent 200$, and I'm only sending him 50$, and that complaint is in the forum so far.

The disadvantages are also the lack of credibility in sending the bonus they reduced the value of the bonus and reduced competitions and also do not send the bonus where it became not enough for the member to pay the value of the internet package consumed in the work of posts and topics of the company and we hope the management in looking at this and

other than multiple platforms, there are also many accounts such as STP and ECN and many withdrawal and deposit methods, both direct and indirect

and other people are good at dealing with trading and did not happen to me any problems with trading or withdrawals filing to the warren's of good companies that will developing a large in the next period is what the company is trying to do now of the improvements and interest of the company

one of the most important features of the company

account count and low spread easy withdrawal and deposit

one of the most important disadvantages of the company

weak technical support and problems of the arab section and bonus

Nov 23, 2020 - 5 stars and i want to share my experience with all the new traders in the trading world , with my experince in fxopen , i am a trader from 2011 until now , and i tried many company for trading , but i found the best one until now is fxopen , so i am with them now , they are honest company , have many trust license in trading , and the contact with them so easly , and they have many options in trading and also many pairs currency , i did not met any problems with them until now , so if you are a new trader , or even old trader, come and join us for free in fxopen , you will see the differnce by your own eyes,

my advice to every beginner trader first, choose the honest company that you will trade with, such as fxopen after that, you can train in trading by opening a free account without any money and then you can start with real money by opening a real account do not try to greed or compensation. Just analyze the market well before trading and after that start trading with fxopen and enjoy the many discounts offered by the company as well as prizes and fun competitions that continue throughout the year at fxopen

Length of use: over 1 year

I've dealt with them over the past year and gained significant experience in the trading of their way and I see it's from a reputable company that respects the customer and maintains he has them

one of the most important features of this company is trading options and the diversity of accounts and contracts they have STP accounts and ECN accounts and they have many currency pairs that can be traded on them major currency pairs and secondary currency pairs also can through them also trading digital currencies and they work throughout the week i.E. You can trade digital currencies at any

as for their spread is very little either on the account of STP or ECN and for the account of ECN is almost no spread is in some currency pairs does not exceed four points and sometimes a point or two points and for the account of STP the spread starts from 10 points and even 24 points such as trading on the japanese yen / US dollar the company's all on their own.

Features

the company is characterized by low spread, easy trading and the availability of several platforms that can be traded on such as metatrader 4 and metatrader 5 and they also have their own platform

easy withdrawal and deposit and many methods of withdrawal and deposit, we mention the former escrill bank, webmoney and benefit money, there is also the company's own document and also the withdrawal by credit card or bank transfer, all of which is considered one of the means of withdrawal and deposit with the company

disadvantages

mention some of the enemies that the company is not good at dealing large amounts of this I didn't see or notice it during the deliberative with them because trading with them no more than $ 200 and did not find any problems until now.

Their technical support service is very weak and they can rarely solve the problem because they do not have all the powers to solve the problems

the technical support service in arabic is almost non-existent at work for only one hour and on friday only

the bonus for the arab section is not enough for the effort and fatigue of members to participate in competitions and write topics, etc.

There is always a manipulation of the terms of the competitions after they are over so that the members do not get their bonus

one of the worst flaws in the company is the insufficient bonus system and also it is manipulated and not sent completely to the members so the members began to work for other companies and forums

Nov 24, 2020 - 5 stars hello traders my name is mona makien i want to tell you about my experience with fxopen , i am a old women and was hard to belive in that new things to me , but my nephew convised me to try it , and i did by little money at first but i found that i lose , so my nephew start to learn me how to trade , and he advise me to read about the trading in fxopen forum that is wroten by many language , from this time i found my self earn some money , about fxopen they are honest , and the dealing with them so easy , so my advise to all new tradres , read more about trading in fxopen forum , then start in save way with fxopen

Length of use: over 1 year

My evaluation of this company after about two years of trading with them, and I will speak with all impartiality about the most important advantages of this company and the most important shortcomings

prices can be from respectful and honest companies that can be traded with a low spreads. For example, you find that the spread for the pair of the US dollar against the japanese yen is 14 points. That, and sometimes it is lower, the market is an active stock and you find the spread for the US dollar against the canadian dollar is 16 points. Only and also the euro against the US dollar, the spread is only 13 points. As for gold against the US dollar, the spread is 20 points, and sometimes more than that.

I had the experience of trading on risky days, especially on christmas holidays in december and january, and it is known that many traders do not prefer trading at this time of the year due to the high risk and market fluctuations in these two months.

Over the past two years, I have been trading at this time, especially after december 25, and no fluctuations occurred in the market and I won from this trading. All there is, the market movement was only slow, but no fluctuations occurred and I won from trading and this is what I remember well because I was very worried that I trade at this time

among the features of the company

we have said the low spread, and the most important thing is not to be afraid of trading on holidays and fluctuations. One of the additional advantages of the company is that it carries out periodic contests between traders and various contests to obtain an additional bonus for trading with it and always encourages traders to trade and does not skimp on them with information as there are forums for the company with all languages have a multitude of information and members ’experiences in trading. It is also noticeable that the company’s activity in previous years has made remarkable progress and has worked to correct past mistakes and has improved a lot. Now the company also gives a free registration bonus as an encouragement to new traders and always comes with offers and discounts for traders to encourage them to continue trading

company flaws

among the most serious defects of the company that I notice is technical support, there is technical support and is quick to respond, but I do not find that it has all the powers to solve the problems of members and traders, so it often does not solve problems or takes more time to solve them

also, I heard that the company is not good at trading on large amounts, and this frankly, I did not try it because I usually trade on small amounts, which are less than $ 250, and I did not find any problems with the company in trading from withdrawal, deposit and trading, so the evaluation in this regard is very good

one of the biggest defects of the company is the arab section, so it is known that arabs are those who love to gamble and trade through forex, and that company is not good at winning the arab customer to it, and this is for several reasons, the most important of which is arab technical support, which is one of the biggest flaws of the company, as there is almost no technical support for the arab department, so the presence of arab technical support almost every week for an hour only and it does not solve any problems, and this is what I already tried, so I had a problem and an inquiry, and I waited a week for a response and when the response arrived a week later, I made another inquiry at the same time and I did not receive an answer to it

among the disadvantages of the arab section is the bonus, as the administration does not pay any attention to the bonus for the arab section, and there is always tampering and changing conditions for not sending the bonus for members, and this also has a great impact on the company's inability to attract the arab customer

I see the solution to this problem, which is the presence of strong arab support all the time and the company's credibility in sending the members' bonus for the arab section without manipulation so that the members can make the required advertising for the company with credibility. If the company is not honest with its members in the arab section, and the bonus is sent to them on time and without any change of conditions and complications things are so that the members do not get the bonus, and this is in addition to the reduction of the bonus that happened .. How can a company win the arab client if it cannot maintain the arab members?

Nov 25, 2020 - 5 stars welcome dear traders

my name is heno

I'd love to share with you my experience with fxopen

since about 2004 I have been searching for ways to profit on the internet and I have been doing this for several years until I realized that all of this was not working.

And then I heard about forex brokers that I also couldn't believe in

until some friends advised me to try fxopen and I did it already and since around 2018 until now I am trading with them

and I have already found that I can profit on the internet by trading forex, as sometimes I can win not a small amount of money and this is beside the pleasure of trading

I advise all new traders to try forex trading through fxopen, because they are a respectable and honest company and have many licenses and also have many trading platforms and they also have their own new platform and a novice trader can open a demo account and trade on the demo account so that he can train on trading knows that fxopen is a respectable company

and another advice for a novice trader, do not rush before opening deals. Just watch the market well and when the trend stabilizes and analyze the market well, then you can make the decision to open deals.

Length of use: over 1 year

In december 2020 i will complete 6 years of trading with fxopen. This broker is an ECN broker so all the trades go into the inter bank markets and the liquidity providers. This enables me to get my all the orders fulfilled at any time whether it is the release of the high impact news.

Other brokers many of who are market makers will be trading against you and so you will have a difficult time in earning consistent profits with them.

During these years i have been making consistent income from my trading. When i started trading i was using webmoney for both deposits and withdrwals but in the year 2018 i shifted to bitcoin as it was easy for me to cashout.

When i make a cashout i am paid in under 3 hours and this is important as the rates of the BTC are moving very fast.

We are sorry to read about your negative experience with fxopen and understand your frustration.

Unfortunately in summer the internal procedures of our card processors have changed, which has led to double-conversion. SEPA transfers were also temporarily unavailable for the clients of fxopen markets limited.

We fully understand that it creates both additional charges and inconveniences to our clients.

Therefore, we do our best to make it up to our clients by offering the reimbursement of deposit charges.

In your case, we have also offered you a deposit bonus and a commission-free account as a sign of good will.

Please not that it is fully legal to offer to cover any fees to our clients and cannot be viewed as bribery.

At the moment fxopen markets limited offer commission free SEPA deposits. They are available in fxopen backend – https://my.Fxopen.Com

We would also like to stress that our offer still stands – commission free account for 6 months and reimbursement of all deposit related fees conversion fees included (if any).

We wish you a happy new year and we would be honoured to welcome you among our clients again.

So, let's see, what we have: all about fxopen AU deposits commission & fees, minimum deposit, and withdrawal options. Fxopen AU offer a multitude of funding options to best suit your needs. At fxopen deposit

Contents of the article

- Deposits and withdrawals

- Fxopen deposit

- No deposit forex bonuses

- FXOPEN UK

- Why choose fxopen UK pro?

- What protection do professional clients lose?

- Am I eligible for an fxopen UK pro account?

- FXOPEN UK PROaccount trading conditions

- How do I open a pro trading account?

- Trade forex andglobal markets

- Fxopen UK advantages

- ECN technology

- Main conditions on fxopen UK trading accounts

- Open a live account and select your account type

- Trade with the world's most popular trading...

- MT4 desktop

- MT4 webtrader

- MT4 iphone

- MT4 android

- Metatrader 5 trading platform

- Fxopen minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Fxopen review and tutorial 2021

- Fxopen details

- Trading platforms

- Markets

- Spreads & commissions

- Leverage

- Mobile apps

- Payment methods

- Demo account

- Bonuses & promotions

- Regulation & reputation

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- User security

- Fxopen verdict

- Accepted countries

- Fxopen deposit

- OPEN A CRYPTO ACCOUNT

- AND TRADE CRYPTOCURRENCIES BITCOIN, LITECOIN,...

- Cryptocurrency cfds TRADING TERMS

- FUND YOUR CRYPTO ACCOUNT

- WHY TRADE BITCOINS WITH FXOPEN ?

- FXOPEN CRYPTO ACCOUNTS HAVE 43 TRADING...

- Most popular cryptocurrency pairs

- BTC/USD

- ETH/USD

- XPR/USD

- Fxopen: reliable broker with favourable trading...

- Fxopen: login, minimum deposit, withdrawal time?

- Warning! Fxopen is an offshore company! Your...

- RECOMMENDED FOREX BROKERS

- FXOPEN LOGIN

- FXOPEN MINIMUM DEPOSIT

- FXOPEN WITHDRAWAL TIME AND LIMITS

- BOTTOM LINE

- Fxopen review

- Fxegypt

- Broker details

- Live discussion

- Video

- Traders reviews

Comments

Post a Comment