Compare Brokers That Accept Credit Cards, forex trading free credit.

Forex trading free credit

For our credit cards comparison, we found 3 brokers that are suitable and accept traders from united kingdom. 76% of retail investor accounts lose money when trading spread bets and cfds with this provider

No deposit forex bonuses

Compare brokers that accept credit cards

For our credit cards comparison, we found 3 brokers that are suitable and accept traders from united kingdom.

We found 3 broker accounts (out of 147) that are suitable for credit cards.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

73% of retail investor accounts lose money when trading cfds with this provider

Admiral markets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About admiral markets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

Online forex trading account funding: credit cards

Credit cards are one of the safest and easiest methods to fund or make withdrawals from your online trading account. They are widely accepted by most online forex brokers. Brokers that are registered with the financial conduct authority (UK) will only accept credit cards from the forex account owner to prevent money laundering/fraud.

An important consideration to take if you are opening an online trading account is that mastercard do not accept refunds from spread betting or CFD trading companies.

A few things to consider before using a credit card to fund your forex account is:

- If your card accepted by the broker

- Do they charge fees for credit cards

- Do they accept traders from your country

- Are there better alternatives

- What documents do they need

- How long does it take for transactions

Featured forex broker that accept credit cards: ETX capital

ETX capital is a top choice for traders looking for a trusted and regulated forex broker that also accept credit card payments. Why ETX capital?:

- They accept all major credit and debit cards except AMEX.

- They do not charge fees for making payments or withdrawals.

- Payments are processed quickly so you can start trading immediately- 1 working day.

- Accept deposits in several currencies including :GBP, USD, EUR, ZAR, PLN, NOK, DKK, CZK and CHF.

Credit cards accepted by most online brokers:

Credit cards accepted by a minority of online brokers:

Credit card deposit/withdrawal fees

There is a mix of brokers who do not charge the trader any fees for making deposits/withdrawals while others charge a fee, usually around 2%. Some credit cards may also treat payments to forex brokers as cash advances rather than a regular purchase and charge a high interest rate. It would be best advised to check with your credit card provider first to see how they would view the payment. Generally using a debit card will always be free to use and may be the better option.

If you just register your card without making a payment, most brokers will make a pre-authorisation charge of 0.01p from your account. This will be reversed within a week and is only to ensure that it is a real card. This is a usual practice for businesses that require a credit card to make a reservation like hotels.

Making deposits and withdrawals

Before making any withdrawals, the brokers will generally require a few documents to verify who you are and to prevent fraud.

Required documents

- Government issued ID/passport/EU driving licenses

- Utility bill/bank statement/tax assessment showing your full name and physical address

- KYC form

Once registered payments and withdrawals are simple and take only a few days.

Usual payment/withdrawal processing times

Different brokers may have different requirement so it would be best advised to check what your chosen broker requires before you are allowed to make any withdrawals.

Broker debit cards

Some brokers will even offer their own branded mastercard debit cards such as avatrade, hotforex and XM. These cards are directly connected to your trading account and allow you to instantly withdraw funds from your account.

Why choose IG

for credit cards?

IG scored best in our review of the top brokers for credit cards, which takes into account 120+ factors across eight categories. Here are some areas where IG scored highly in:

- 44+ years in business

- Offers 10,000+ instruments

- A range of platform inc. MT4, mac, web trader, L2 dealer, tablet & mobile apps

IG offers four ways to tradeforex, cfds, spread betting, share dealing. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

IG have a AAA trust score. This is largely down to them being regulated by financial conduct authority and ASIC, segregating client funds, being segregating client funds, being established for over 44

Trust score comparison

| IG | city index | admiral markets | |

|---|---|---|---|

| trust score | AAA | AAA | A |

| established in | 1974 | 1983 | 2001 |

| regulated by | financial conduct authority and ASIC | financial conduct authority, ASIC and MAS | financial conduct authority, cysec |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of IG vs. City index vs. Admiral markets

Want to see how IG stacks up against city index and admiral markets? We’ve compared their spreads, features, and key information below.

Forex trading without deposit | no deposit bonus explained

It’s generally known that in order to get started in forex, you need to put a lot of resources into it. And while these resources can be your time and energy, the most straightforward one is, of course, your money.

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

What is forex trading and is it right for me?

There are very few investors who have consistently made massive fortunes over a while. Jim simmons, a quiet recluse, has been successful with smaller frequent trades in his medallion fund. On the opposite end of the spectrum is the brash george soros, who publicly “broke the bank of england” and made billions in a single forex trade on black wednesday.

Soros had been building a substantial short position in pounds sterling for months leading up to september 1992. He knew the rate at which the united kingdom was brought into the european exchange rate mechanism (ERM) was too high, their inflation was triple the german rate, and british interest rates were hurting their asset prices.

The british government failed to keep the pound above the lower currency exchange limit mandated by the exchange rate mechanism (ERM). It was forced to withdraw the pound sterling from the ERM, devaluing the pound. The estimated cost to the U.K. Treasury was £3.4 billion. Soros' fund profited from the U.K. Government's reluctance to raise its interest rates to levels comparable to those of other ERM countries or float its currency.

Everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery.

What is forex trading?

Forex trading refers to the foreign exchange markets where investors and traders worldwide buy and sell one currency for another.

You might have even participated in forex trading without even realizing it. Anytime I visit a foreign country, I exchange my U.S. Dollars for the local currency based on the prevailing exchange rate. In its simplest form, that is forex trading.

Currencies rise and fall against each other depending on various economic and geopolitical news. If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and the country's political environment.

Because of forex's global nature, the markets trade for 24 hours a day, five days a week. Forex markets are the most liquid markets in the world.

Forex trading terminology

Forex markets have different terminologies and nuances for trading. Below is the list of most common terms.

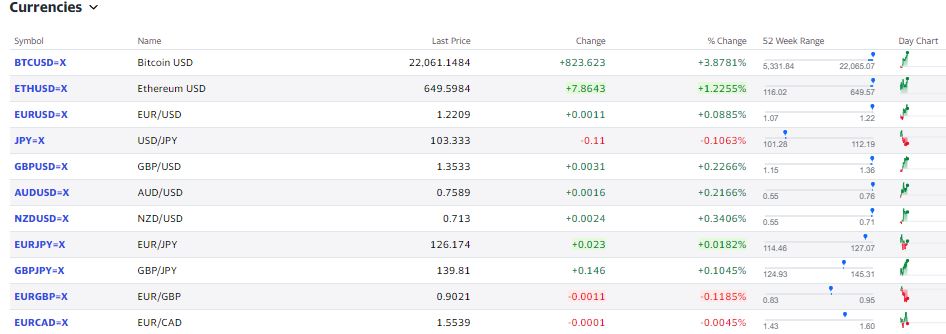

Currency pairs

Traders frequently trade currencies by selling one currency and buying another. Forex trading always involves the exchange of currencies in pairs. You could have a EUR/USD pair for U.S. Dollars and euros. You can have similar pairs against the japanese yen or the australian dollar.

The major currency pairs are the four most heavily traded currency pairs in the forex market. Because of the massive liquidity, you can always trade them with the lowest spread. The four major pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF. Note that the U.S. Dollar is involved in every major pair because it is the world reserve currency.

The minor currency pairs don't include the U.S. Dollar and are also known as cross-currency pairs. For example, EUR/AUD and CHF/JPY.

The first currency in the pair is the base currency, and the second currency is the quote currency.

If you are bullish on the european union, you want to buy EUR and sell JPY. In this case, you would buy the EUR/JPY pair.

If you are bearish on the japanese yen, you want to buy USD and sell JPY. In this case, you would sell the JPY/USD pair.

The forex quote determines the price at which you do the buying and selling.

Forex quotes

The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every euro you sell, you could buy 1.2209 USD. The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

You might have noticed the forex quote has four places to the right of the decimal. The smallest price change that a given exchange rate can make is the pip. Most currency pairs, except japanese yen pairs, are quoted to four decimal places. After the decimal point (at one 100th of a cent), this fourth spot is what traders watch to count “pips.”

For example, if the EUR/USD moves from 1.2202 to 1.2205, we say the EUR/USD has increased by three pips.

Forex lot

Forex is traded in lot sizes. Standard lot = 100,000 units mini lot = 10,000 units micro lot = 1,000 units

A larger lot size involves more risk due to the amount of money involved. If you are starting, always trade in micro-lots.

Leverage

Forex traders often use leverage to juice up the returns. Since currencies trade in a small range, they want to amplify their gains. The challenge of leverage is that it cuts both ways. If you are right, then using a 50:1 leverage will increase your profits by 50 times. However, if you are wrong, then you lose 50 times more. For this reason, it is advisable to avoid using leverage when trading forex.

Can you get rich by trading forex?

Forex investors make money by deciding what currencies will rise and fall. Some traders swear by technical analysis and others will rely on fundamental analysis. Traders believe they know what direction the currency would move based on the latest news. The challenge with making money trading is that the same information is also available to everyone else, including professional investors.

An individual investor who is not involved with trading the forex market for a living would find it very hard to make money. You could get lucky once or twice. But eventually, your steak runs out.

The individual investor has no advantage over professionals who do this for a living. My four worst investments article highlights how easy it is to lose money when trading against professional investors.

Professional traders have powerful trading tools to take advantage of their online forex trading strategy. The trading platforms provide signals for automated trading and scalping. Forex scalping methods place trades for 1 to 10 minutes and close positions after gaining five pips. An algorithmic trading system combined with leverage enables the professional traders to day trade forex pairs better than individual investors.

If you want to grow rich and retire early, the best plan is to accumulate income-producing assets. Most stocks pay a dividend, or they increase in value like moonshot stocks. The rental property provides income in the form of rent and appreciating property prices.

Forex trading only makes money if you are right in the timing and direction of currency prices change. You cannot have a “buy it and watch it grow” approach with forex. If you wonder, “when can I retire” it is quite likely that forex trading won't help you.

Who does forex trading

Professional investors trade forex to make money. Trading is done in the spot market, where exchange rates are determined in real-time depending on the current economic and geopolitical factors.

Global companies actively trade forex as well in the futures market. They create a contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. The primary purpose is not speculation but as a hedge.

For example, infosys (NYSE: INFY) is a consulting company headquartered in india, but they have clients worldwide. They report results on the indian stock exchange. Since the indian rupee trades in a wide range against the U.S. Dollar, infosys would use the forex markets to hedge against currency risk.

Similarly, ARAMCO (SAUDI-ARAMCO) is one of the leading players in the petroleum and natural gas industry. It needs to hedge its commodity exports against price changes in U.S. Dollars.

Final thoughts on forex trading

Forex is part of our everyday life as a result of living in an interconnected global economy. Currencies usually trade in a tight band. If a currency suddenly depreciates, it could be an indicator of upcoming inflation or potential geo-instability.

It is tough to get rich with forex trading for individuals. You might lose all your investment. To be profitable, one needs a deep understanding of the macroeconomic fundamentals driving currency values coupled with technical analysis experience. And it would help if you traded on it before anyone else does. Proceed with caution if you decide to incorporate forex trading as part of your investment strategy.

Do I pay tax on forex trading in the UK?

This is our ultimate guide to the UK income tax for forex traders.

Here is a summary of our key findings:

There is a ‘grey area' within the complex topic of this question, and there are 3 main factors that need to be considered:

- The first question that needs to be resolved is what type of trader you are: a speculator/gambler, or an investor?

- The second factor that comes into play is the type of instruments you trade which make you your profit - spread betting or cfds.

- The third factor which needs to be considered requires an analysis of the personal finances and circumstances of the individual trader. While performing the analysis the frequency and quantity of your trades should be examined, as well as your salary bracket and other factors.

In short - spread betting profits are generally not taxable in the UK. Profits from trading cfds however, are taxable. Let’s dive in to deeply explore the detailed guide.

At the time of this writing, spread betting profits are generally not taxable in the UK. Check out our list of UK forex brokers, many of whom offer forex, commodity, and stock trading as spread betting. Profits from trading cfds however, are taxable. However, there may be exceptions to these rules, as outlined below.

There is a ‘grey area' within the complex topic of this question. In the U.K., there are three types of tax (income, corporation and capital gains) that in various cases will be the basis of taxation of profits from forex trading. Forex traders are also categorised as different trader types which can affect the basis on which their forex trading profits will be taxed.

The first step in answering the question of whether an individual will pay tax on forex trading in the U.K. Is to assess the status of the trader, look at the instruments traded, and then determine the style and intentions behind the trading activity.

This can be confusing at times, which is why each trader should always seek their own independent financial advice from a professional accountant or consult with HMRC (her majesty’s revenue and customs, i.E. The tax office) to receive guidance, although unfortunately many traders report that HMRC is not as helpful as they had hoped for.

The forex trader’s taxable status

Broadly speaking, there are two reasons you are ‘trading’ forex (different to ‘exchanging forex’):

- To speculate or gamble, OR

- To invest (to increase the performance of your daily, weekly or annual returns, directly or indirectly).

1. The speculator gambler

This forex trader fancies the occasional punt and will spontaneously place trades with no real consistent method or system behind the decisions.

This type of trader usually will have other forms of income. Any additional income received from forex trading would be considered secondary, therefore they would not be liable to pay any tax on profits and would effectively be able to trade tax-free in the U.K.

2. The investor

This type of trader treats trading as a business.

An investor treats forex trading as his or her main source of income, or their main source of income somehow derives from trading activity, in which case, they would be liable to taxation of profit on the basis of either income, capital gains or corporation tax.

So, we can see that the first question that needs to be resolved is what type of trader you are: a speculator/gambler, or an investor.

It is worth noting however, that this alone cannot be used to determine your tax liability. Other factors outlined below are the next issues to be considered.

Are profits from spread betting and cfds taxable in the UK?

There are various types of instruments available as wrappers from most forex brokers when trading forex. For retail forex traders, the two main products offered to UK clients are ‘spread betting’ and ‘cfds’.

This is the second factor that comes into play: the type of instruments you trade which make you your profit.

Let’s look at how these products differ and review the different U.K. Tax implications of trading them.

Spread betting is the simpler way to trade. It is also the easier out of the two to understand for beginners.

With spread betting you are simply betting on the direction of the price, at a certain amount per point, for example, you bet that GBP/USD will rise at £1 per pip.

This type of bet is considered speculation/gambling and is, therefore, free of any capital gains tax.

Cfds - these are somewhat more complicated.

With cfds you size your trade according to ‘lots’, for example 1 lot of a major currency pair is typically worth $10 per pip. Note that most retail forex brokers offer trading in units as low as mini-lots, with one mini-lot equal to 0.01 lots.

Also, in CFD trading, the base currency of your bet is determined by the underlying instrument you are betting on, while in spread betting all bets are denominated in your account’s base currency.

Most forex brokers offering CFD trading also impose an additional trade when converting your profit or loss back to the original currency of your account, which adds another dimension to your profit or loss. For example, if your account’s base currency is GBP, but you make a profit of 10,000 japanese yen, your broker will usually credit you with the yen profit at the end of the day, converting it into GBP at its prevailing GBP/JPY price at the moment of conversion.

Cfds are typically traded with a longer time frame in mind than spread betting, hence a CFD position is considered ‘capital’ and is, therefore, generally subject to capital gains tax.

Personal circumstances of forex traders

As mentioned previously, when tackling the question ‘do I pay tax on forex trading in the UK’, three major factors have to be examined. We have already covered the first two.

The last factor which needs to be considered is the most complex and requires an analysis of the personal finances and circumstances of the individual forex trader combined with an examination of the trading activity that occurred which created the profit.

HMRC will consider the following issues in assessing your personal circumstances:

- Whether you pay tax or not on the remainder of your income (if any).

- If you are liable to pay tax, which tax you pay and how much.

- Salary bracket - whether you earn more or less than GBP 50,000 annually.

- Whether you are a limited company, part of a corporation or self-employed.

- Whether you have employees and the role they play in your profit.

- Products or assets involved (cfds of spread bets).

- Frequency and quantity of your trades.

- Duration of your trades (time between the opening and closing of positions).

Therefore, although you may be confident of how you should be taxed on your forex trading profits as a U.K. Resident taxpayer, HMRC may see it differently and may ask more detailed questions to arrive at a decision. This is why it is important, especially in cases where the circumstances do not appear clear-cut, to take advice from a professional accountant or tax advisor. If you think it isn’t worth the cost because your profits are modest, it is a good idea to put aside the taxes you would pay in the worst-case scenario so if you do get a bill from HMRC you will be able to pay it.

Is forex trading tax-free in the UK?

After researching this question in depth, we can conclude that if you are spread betting in the U.K. As an amateur trader, any profits you make from forex trading will not be subject to a tax demand from the HMRC.

Compared to the E.U. And the U.S.A., the UK’s tax laws for forex traders are seen as some of the friendliest in the world.

If you bear in mind that about 70% of all retail forex traders lose money, however, it is easy to understand why HMRC would not want these losses to be offset against income gained from other sources, which explains why they have not moved towards a completely law position.

Get R250 in trading credit. Open A new markets account

Risk warning: losses could exceed deposits.

Haroun kola

Questions?

Risk warning: losses could exceed deposits.

Markets.Com is offering all readers of this site R250 in trading credit when they open an account using this link and then verifying their identity in a FICA like process.

When you’re done, your account will be credited with R250. You can only use this credit for trading purposes and cannot be withdrawn.

To take advantage of this offer, please open an account and then pay close attention to your email inbox to complete the verification process and claim your trading credit.

Further reading

Market outlook for S&P500 emini futures by al brooks

Al brooks talks about what he thinks the S&P500 emini futures will likely do over the coming years.

HYCM review – deposit, withdrawal & trading conditions

Read on to find out if you should be trading with HYCM markets.

Forex no deposit bonus in 2021

Learn how you can trade forex for free with A no deposit bonus from these great brokers

Leave your get R250 in trading credit. Open A new markets account below

Forex pulse detector

Forex pulse detector is a popular scalping forex robot.

How to find & use your partner links in the ifx brokers client and IB portal

Https://www.Youtube.Com/watch?V=rhz7cvistn8 https://my.Ifxbrokers.Com/rx?Ca=harounib ifx brokers are starting to make waves as an ECN broker in south africa. In this video I

Get forex trading signals sent straight to your inbox when you open an account with vantage fx

Vantage FX partnered with trading central to offer you high-quality trading signals and market commentary delivered straight to your inbox each day. Click here to find out how to get your free access to daily email signals.

Daily commentary by marshall gittler for 25/06/15

Even though greece and their creditors are not accepting each other’s proposals for extending their bailout the euro firmed slightly. If they don’t come to an agreement by sunday night, banks have to close on monday as capital controls will be in place. EU leaders begin their summit and greece and the UK’s referendum on being in the union. This could impact on the GPB.

How A.I. Traders will dominate the trading industry by marshall chang

Watch marshall chang of A.I. Capital management sharing their research on a deep learning trading agent that over-performs humans in trading FX markets.

What will move the EURUSD, GBPUSD & AUDNZD and what levels to watch out for

RBA meeting minutes and how it will impact the AUD. Why the big flow of money into europe and how it will affect the EUR. Can the GBP sustain its move higher on positive news around brexit?

Market outlook for S&P500 emini futures by al brooks

Al brooks talks about what he thinks the S&P500 emini futures will likely do over the coming years.

HYCM review – deposit, withdrawal & trading conditions

Read on to find out if you should be trading with HYCM markets.

Forex no deposit bonus in 2021

Learn how you can trade forex for free with A no deposit bonus from these great brokers

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. By continuing to use the site either by scrolling or navigating to another page, you agree to the use of cookies. More information accept

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings, by scrolling or navigating to another page, or you click "accept" below then you are consenting to using cookies on this site.

FREE DOWNLOAD the world’s 10 most popular forex trading systems

FREE DOWNLOAD NOW – the world’s 10 most popular forex trading systems revealed. The systems have been developed, tested, and optimized for use on the 1 hour time frame, but its could actually be just as easily adapted for use on any other time frame either higher or lower.

Forex trading system with a smart and reliable indicator of the trend lines true trendline. MA trendline is highly accurate trend following forex strategy. The system gives you clear signals which will definitely help you to make best trades. Forex MA trendline hasn’t used any indicators that are hard to understand and that is confusing either. The chart looks very clean and professional.

Forexpiptaker will show you how to go from placing 10 trades a day to only placing 10 trades a month , and the best part is, your trading account will end with positive gains for a change! Sound good?

All the signals never disappear or repaint : what you see is what you get real-time.

Then under the main price chart we have two frames: on the first one we have a combination of multi-timeframe stochastic on dynamic bands, on the second we find the sync dynamic zone RSI all-in-one indicator; we will see how they work.

The great thing is that all the indicators moves in sync, and confirms each other. The last window shows the filters: momentum, volatility and major trend . Over the price chart are plotted the panel with money management system, daily pivot calculator and trend analyzer, plus all the other indicators on which sync trading strategy is based.

FOREX BOSS MODE is a trend catching setup, meaning it was designed and built to get you in and out of the trend. The reason for this is because most pips are made while catching the trend.

Dolly now also has murrey math 3 MA displays and bands plus trading signals and many more features built into the code.

Most important is the user needs to check the allow DLL imports tab and put a password into the dolly inputs before it will work. Dolly fxgraphics password = free_at_tsd

The renko channel trading method was developed as a easy to learn yet effective discretionary trading system. This is a “mechanical” based method with a clear set of rules for qualified trade entries. This training manual will cover the basic criteria needed to identify a properly qualified trade entry.

Most of your time trading is waiting for the ideal correct setup to occur. There will always be money left on the table – you will never catch 100% of the move, and once you realize that, you’ll be miles ahead of this misunderstood game.

You are waiting for those perfect setups. The better the setup is, the greater chance of you winning the trade. If you are not winning between 70% – 80% of your trades , you need to step back and start waiting for better setups.

The best way to learn forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-185920854-56a31baa3df78cf7727bcff9.jpg)

If you've looked into trading forex online and feel it's a potential opportunity to make money, you may be wondering about the best way to get your feet wet and learn how to get started in forex trading.

It's important to have an understanding of the markets and methods for forex trading so that you can more effectively manage your risk, make winning trades, and set yourself up for success in your new venture.

The importance of getting educated

To trade effectively, it's critical to get a forex education. You can find a lot of useful information on forex here at the balance. Spend some time reading up on how forex trading works, making forex trades, active forex trading times, and managing risk, for starters.

As you may learn over time, nothing beats experience, and if you want to learn forex trading, experience is the best teacher. When you first start out, you open a forex demo account and try out some demo trading. It will give you a good technical foundation on the mechanics of making forex trades and getting used to working with a specific trading platform.

A fundamental thing you may learn through experience, that no amount of books or talking to other traders can teach, is the value of closing your trade and getting out of the market when your reason for getting into a trade is invalidated.

It is very easy for traders to think the market will come back around in their favor. You would be surprised how many traders fall prey to this trap and are amazed and heartbroken when the market only presses further against the direction of their original trade.

The famous and painfully true statement from john maynard keynes states, "the market can stay irrational, longer than you can stay solvent." in other words, it does little good to say the market is acting irrationally and that it will come around (meaning in the direction of your trade) because extreme moves define capital markets in the first place.

Use a micro forex account

The downfall of learning forex trading with a demo account alone is that you don't get to experience what it's like to have your hard-earned money on the line. Trading instructors often recommend that you open a micro forex trading account or an account with a variable-trade-size broker that will allow you to make small trades.

Trading small will allow you to put some money on the line, but expose yourself to very small losses if you make mistakes or enter into losing trades. This will teach you far more than anything that you can read on a site, book, or forex trading forum and gives an entirely new angle to anything that you'll learn while trading on a demo account.

Learn about the currencies you trade

To get started, you'll need to understand what you're trading. New traders tend to jump in and start trading anything that looks like it moves. They usually will use high leverage and trade randomly in both directions, usually leading to loss of money.

Understanding the currencies that you buy and sell makes a big difference. for example, a currency may be bouncing upward after a large fall and encourage inexperienced traders to "try to catch the bottom." the currency itself may have been falling due to bad employment reports for multiple months. Would you buy something like that? Probably not, and this is an example of why you need to know and understand what you buy and sell.

Currency trading is great because you can use leverage, and there are so many different currency pairs to trade. it doesn't mean, however, that you need to trade them all. It's better to pick a few that have no relation and focus on those. Having only a few will make it easy to keep up with economic news for the countries involved, and you'll be able to get a sense of the rhythm of the currencies involved.

After you've been trading with a small live account for a while and you have a sense of what you're doing, it's ok to deposit more money and increase your amount of trading capital. Knowing what you're doing boils down to getting rid of your bad habits, understanding the market and trading strategies, and gaining some control over your emotions. If you can do that, you can be successful trading forex.

Managing risk

Managing risk and managing your emotions go hand in hand. When people feel emotional, greedy or fearful, that is when they make mistakes with risk, and it's what causes failure. When you look at a trading chart, approach it with a logical, objective mindset that only sees the presence or lack of potential; it shouldn't be a matter of excitement. If pulling the trigger on a trade feels emotional in any way, you should re-evaluate why you're not able to be objective.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Compare brokers that accept credit cards

For our credit cards comparison, we found 3 brokers that are suitable and accept traders from united kingdom.

We found 3 broker accounts (out of 147) that are suitable for credit cards.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

73% of retail investor accounts lose money when trading cfds with this provider

Admiral markets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About admiral markets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

Online forex trading account funding: credit cards

Credit cards are one of the safest and easiest methods to fund or make withdrawals from your online trading account. They are widely accepted by most online forex brokers. Brokers that are registered with the financial conduct authority (UK) will only accept credit cards from the forex account owner to prevent money laundering/fraud.

An important consideration to take if you are opening an online trading account is that mastercard do not accept refunds from spread betting or CFD trading companies.

A few things to consider before using a credit card to fund your forex account is:

- If your card accepted by the broker

- Do they charge fees for credit cards

- Do they accept traders from your country

- Are there better alternatives

- What documents do they need

- How long does it take for transactions

Featured forex broker that accept credit cards: ETX capital

ETX capital is a top choice for traders looking for a trusted and regulated forex broker that also accept credit card payments. Why ETX capital?:

- They accept all major credit and debit cards except AMEX.

- They do not charge fees for making payments or withdrawals.

- Payments are processed quickly so you can start trading immediately- 1 working day.

- Accept deposits in several currencies including :GBP, USD, EUR, ZAR, PLN, NOK, DKK, CZK and CHF.

Credit cards accepted by most online brokers:

Credit cards accepted by a minority of online brokers:

Credit card deposit/withdrawal fees

There is a mix of brokers who do not charge the trader any fees for making deposits/withdrawals while others charge a fee, usually around 2%. Some credit cards may also treat payments to forex brokers as cash advances rather than a regular purchase and charge a high interest rate. It would be best advised to check with your credit card provider first to see how they would view the payment. Generally using a debit card will always be free to use and may be the better option.

If you just register your card without making a payment, most brokers will make a pre-authorisation charge of 0.01p from your account. This will be reversed within a week and is only to ensure that it is a real card. This is a usual practice for businesses that require a credit card to make a reservation like hotels.

Making deposits and withdrawals

Before making any withdrawals, the brokers will generally require a few documents to verify who you are and to prevent fraud.

Required documents

- Government issued ID/passport/EU driving licenses

- Utility bill/bank statement/tax assessment showing your full name and physical address

- KYC form

Once registered payments and withdrawals are simple and take only a few days.

Usual payment/withdrawal processing times

Different brokers may have different requirement so it would be best advised to check what your chosen broker requires before you are allowed to make any withdrawals.

Broker debit cards

Some brokers will even offer their own branded mastercard debit cards such as avatrade, hotforex and XM. These cards are directly connected to your trading account and allow you to instantly withdraw funds from your account.

Why choose IG

for credit cards?

IG scored best in our review of the top brokers for credit cards, which takes into account 120+ factors across eight categories. Here are some areas where IG scored highly in:

- 44+ years in business

- Offers 10,000+ instruments

- A range of platform inc. MT4, mac, web trader, L2 dealer, tablet & mobile apps

IG offers four ways to tradeforex, cfds, spread betting, share dealing. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

IG have a AAA trust score. This is largely down to them being regulated by financial conduct authority and ASIC, segregating client funds, being segregating client funds, being established for over 44

Trust score comparison

| IG | city index | admiral markets | |

|---|---|---|---|

| trust score | AAA | AAA | A |

| established in | 1974 | 1983 | 2001 |

| regulated by | financial conduct authority and ASIC | financial conduct authority, ASIC and MAS | financial conduct authority, cysec |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of IG vs. City index vs. Admiral markets

Want to see how IG stacks up against city index and admiral markets? We’ve compared their spreads, features, and key information below.

Forex 101 - the forex and CFD trading course

Step up your trading game with our free online forex and CFD trading course. We hope that this 3 step programme will help you learn everything you need to know to begin trading forex and cfds. Don`t just take our word for it, see for yourself!

9 online lessons

The full course is available online and in 18 different languages. You`ll get access to 9 video lessons, each of which will be accompanied by detailed written notes and be followed by a quiz!

Learn from the pros

Learn forex from experienced professional traders. Each lesson focusses on a key topic and has been carefully crafted and delivered by two leading industry experts.

Access

Access the first 3 lessons now – free for all, get a demo trading account to unlock the rest of the course and put your knowledge to practice.

Train anytime, anywhere

Learn to trade on your commute, in a cafe, or after work - it`s up to you! With all 9 lessons available online, you can easily fit your learning around your life.

What is forex 101?

Our previous education campaign, zero to hero, was so popular that we decided to make a brand new one! Forex 101 is a forex trading course designed to help even absolute beginners learn how to trade. The training course is absolutely free and 100% online. Each lesson will feature a video, written notes and a follow-up quiz. The course will be split over 3 steps - `beginner`, `intermediate` and `advanced`. The world of forex trading awaits. Are you ready for class?

Getting started

Kick off this forex trading course by learning the basics. Our experts will tell you all about the impact of the forex market on the world-stage, teach you all the key terms you`ll need and walk you through creating your very own demo trading account.

1. Getting to know forex

2. A trader`s starter pack

3. Practise time! Get your own demo account!

1. Setting up MT4

2. Making your first trade

3. Thinking strategically

Getting a feel for forex trading

You're getting there now! Over these three lessons our forex trading experts will teach you how to set up your trading platform, how to make your first demo trade and then explain the power of utilising a trading strategy.

Getting a feel for forex trading

You're getting there now! Over these three lessons our forex trading experts will teach you how to set up your trading platform, how to make your first demo trade and then explain the power of utilising a trading strategy.

1. Setting up MT4

2. Making your first trade

3. Thinking strategically

Taking it to the next level

In this final step of the forex course our experts will teach you how to perfect your trading set ups. You`ll learn all about making a trading plan and how to use vital indicators, as well as get some tips that may help you minimise risk.

1. Creating your game plan

2. The power of indicators

3. Managing risk effectively

So, are you ready to begin?

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets AS or admiral markets cyprus ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets' refer jointly to admiral markets UK ltd, admiral markets AS and admiral markets cyprus ltd. Admiral markets' investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets AS is registered in estonia – commercial registry number 10932555. Admiral markets AS is authorised and regulated by the estonian financial supervision authority (EFSA) – activity license number 4.1-1/46. The registered office for admiral markets AS is: maakri 19/1, 11th floor, 10145 tallinn, estonia.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

So, let's see, what we have: want to trade online with a broker that accepts credit cards as a funding method? In this up-to-date comparison, we've compared the top 10 online forex brokers that accept credit cards (such as visa, mastercard, and american express) for deposits and withdrawals here. At forex trading free credit

Contents of the article

- No deposit forex bonuses

- Compare brokers that accept credit cards

- We found 3 broker accounts (out of 147)...

- City index

- Admiral markets

- Online forex trading account funding: credit cards

- Featured forex broker that accept credit cards:...

- Credit cards accepted by most online brokers:

- Credit cards accepted by a minority of online...

- Credit card deposit/withdrawal fees

- Making deposits and withdrawals

- Broker debit cards

- Why choose IG for credit cards?

- A comparison of IG vs. City index vs. Admiral...

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Do I pay tax on forex trading in the UK?

- The forex trader’s taxable status

- Are profits from spread betting and cfds taxable...

- Personal circumstances of forex traders

- Is forex trading tax-free in the UK?

- Get R250 in trading credit. Open A new markets...

- Questions?

- Risk warning: losses could exceed deposits.

- Further reading

- Market outlook for S&P500 emini futures by al...

- HYCM review – deposit, withdrawal & trading...

- Forex no deposit bonus in 2021

- Leave your get R250 in trading credit. Open A new...

- Forex pulse detector

- How to find & use your partner links in the ifx...

- Get forex trading signals sent straight to your...

- Daily commentary by marshall gittler for 25/06/15

- How A.I. Traders will dominate the trading...

- What will move the EURUSD, GBPUSD & AUDNZD and...

- Market outlook for S&P500 emini futures by al...

- HYCM review – deposit, withdrawal & trading...

- Forex no deposit bonus in 2021

- FREE DOWNLOAD the world’s 10 most popular forex...

- The best way to learn forex trading

- The importance of getting educated

- Use a micro forex account

- Learn about the currencies you trade

- Managing risk

- Compare brokers that accept credit cards

- We found 3 broker accounts (out of 147)...

- City index

- Admiral markets

- Online forex trading account funding: credit cards

- Featured forex broker that accept credit cards:...

- Credit cards accepted by most online brokers:

- Credit cards accepted by a minority of online...

- Credit card deposit/withdrawal fees

- Making deposits and withdrawals

- Broker debit cards

- Why choose IG for credit cards?

- A comparison of IG vs. City index vs. Admiral...

- Forex 101 - the forex and CFD trading course

- Step up your trading game with our free online...

- 9 online lessons

- Learn from the pros

- Access

- Train anytime, anywhere

- What is forex 101?

- Getting started

- 1. Getting to know forex

- 2. A trader`s starter pack

- 3. Practise time! Get your own demo account!

- 1. Setting up MT4

- 2. Making your first trade

- 3. Thinking strategically

- Getting a feel for forex trading

- Getting a feel for forex trading

- Taking it to the next level

- So, are you ready to begin?

Comments

Post a Comment