Stop Trading Small Accounts, funding your forex account.

Funding your forex account

As all funding is provided by the firm, traders do not risk any of their own trading capital.

No deposit forex bonuses

Even if losses are incurred, the firm will still bear the costs. There are no other trading accounts available that offer this trading opportunity. Use a real account instead of a practice trading account. Preserve your own capital when speculating in FX trading. The world’s best subscriptions based FX trading solution. Fundisus provides all participants with funded accounts to access the spot market.

Stop trading small accounts

The world’s best subscriptions based FX trading solution. Fundisus provides all participants with funded accounts to access the spot market.

Who are we?

Fundisus is a revolutionary proprietary trading solution. Fundisus has years of industry knowledge and makes use of cutting-edge proprietary trading techology; thus, we are on active trading firm which understands the needs of traders in the market.

We offer $50,000 to start trading forex market with

Traders are compensated on a profit split basis only.

Our funded accounts are EA compatible

Fundisus

Let us tell you more

Your personal liability is limited to your subscription payment.

As all funding is provided by the firm, traders do not risk any of their own trading capital. Even if losses are incurred, the firm will still bear the costs. There are no other trading accounts available that offer this trading opportunity. Use a real account instead of a practice trading account. Preserve your own capital when speculating in FX trading.

Why choose fundisus?

Anyone can trade forex with a capital now.

4 easy steps

Data collection

Total damage has been caused by the civilians arounf the new apple store at wall street.

Guaranteed ROI

Total damage has been caused by the civilians arounf the new apple store at wall street.

Always online

Total damage has been caused by the civilians arounf the new apple store at wall street.

All professional traders start with a $50K trading book, regardless of their background, experience or track record. We give all our traders an equal opportunity to prove themselves as a profitable trader, or have artificial intelligence trading software manage their account hands-free. Profit withdrawals of 5% blocks are independent from the growth targets of 10%.

If you can make a 10% return on your $50K trading book – growing your account to $55k – we will double your initial funding to $100k, or $105k net. The 10% amount of $5k must be maintained in the account and may not be withdrawn. This is independent of any 5% profit withdrawals. Traders have to separately maintain the 10% for the growth target.

If you can make another 10% return on your $100K trading book – growing your account to $115k net – then we will double your account value once again, up to $200k, or $215k net. Again, the $15k amount must be kept in the account.

For the final stage, you must make 10% once again on your $200K trading book, giving you a net of $235k. If you can succeed here we will allocate $1million to you and you will have the opportunity to interview for a fund manager position.

Live trading capital: funded forex account, forex funding

Forex traders can obtain live trading capital and funded trading accounts from third party providers. Thousands of traders are receiving funding for their trading account every year from the various capital providers. Any forex trader who has a great trading system and is competent, skilled and profitable, but lacks the funds to trade live should investigate these funding companies. This article will provide lots of details on what programs are available to get forex account funding. We will also present a low drawdown, profitable trading system to use with the capital and funding providers. Traders can earn strong commissions, like 80%, to be paid for their trading skills using these funded accounts.

Companies that provide live trading capital

Several companies provide live trading capital for forex traders. Here is a partial list: topstep, FTMO, the5ers, blufx, maverickfx, fidelcrest, audacity, traders4traders, fundisus, traders4traders, skilledmarkets and enfoid. We also found a handful of forex brokers who have capital referral programs.

There are also private entities and individuals on places like linkedin that advertise funding available for forex traders. Some of these capital providers have been in business over 5 years. You can supplement this list with some google searches for “forex funding” or “funded forex account”.

How much money is available for my funded forex account

Traders who qualiyy are eligible to receive up to $2,000,000 or more USD in buying power, including leverage, from many of the available capital provider programs. Example, a funding company might offer a trader a $5,000 account with 100:1 leverage, which is $500,000 USD in buying power. Some companies will fund traders in euros rather than US dollars. Be sure to ask what leverage is being used from the providers.

If you start with a small amount of capital, you can easily qualify for more funding quickly just by increasing your account balance by a small amount. Each forex funding provider has their own guidelines for qualifying for more money. Important tip >> if you want more funding for your forex trading account, then open two accounts with two different capital providers.

Fees for obtaining forex funding

If you are seeking funding for your forex trading account, check the fee structure. Some forex funding and capital providers do not charge any fee at all, but the profit split percentages for the trader are lower. Some funding providers charge one time up front fees or monthly fees. In some cases the fees are 100% refundable out of the trading profits. So this is a wide range of possibilities. We consider most of the fees to be reasonable, since the funding providers are covering any trading losses for the end user.

When evaluating a forex funding provider, we would question each provider if the trading platform they provide has institutional spreads or direct access spreads. Inquire if the brokerage platform they provide is also a profit center for their introducing broker operation. Most funding providers likely also make money off of each trade as an introducing broker. Don’t pay for high spreads on top of the fees they charge.

How do I get A funded forex trading account

Each capital and funding provider has a qualification program to obtain funding. The rules vary quite a bit. Each qulification program has a demonstration or qualification period to obtain the funding. It can be a one or two step process. During the qualification period you must abide by the capital provider’s rules like profit targets, position size, daily and weekly total loss or drawdown limits, maximum number of positions open and position size, etc. Each capital and funding provider has their rules and guidelines are they in writing, so read them carefully. If you break the rules you might be liable for paying more fees to restartthe process to get more funding. The demonstration period can very from one month to several months to hit the profit targets. All of the providers we found cover all trading losses up to the specified loss limits. Don’t be intimidated by the funding qualification process, under some programs you can qualify for funding in as little as one day with just 2 or 3 positive trades.

Important tip >> you access much more capital quickly. Some capital providers will increase the amount of capital they make available to a trader for trading profitably. Some capital providers will double the amount of capital you can access for increasing your account balance by only 10%, which is a modest amount of profit. For example if you get a $5,000 trading account and you increase the account to $5,500 with positive trades, you will be able to access $5,000 more trading capital. We view this as quite generous, since this can be done with just one swing trade.

More criteria for selecting A live trading capital provider

Profit splits range from 50/50 to 80/20, with the traders keeping 80%. Topstepfx allows traders to keep the first 100% of $5,000 in profits. 50% seems pretty low for a profit split, in our opinion. Profits can be withdrawn via bank wire and in some cases, paypal. Transfer fees may apply to small withdrawals. Withdrawals are usually available at the end of the month.

All of the capital providers have drawdown limits. The drawdown is usually measured as the amount of loss of capital from the previous and most recent high balance. Drawdown limits can be weekly or monthly, and range from between 1% and 10% of the high balance, which is a very wide variation. Continue reading this article and we can show you a trading system that can be used that has very little drawdown on each trade entry. This system will minimize drawdown so the tighter drawdown rules can be met.

When selecting a live trading capital provider make sure they show you a list of the available pairs that you can trade with their brokerage platform. We recommend checking their offerings against the 28 most actively traded pairs, which are combinations of the 8 most frequently traded currencies. The USD, CAD, EUR, CHF, GBP, JPY, AUD and NZD are the 8 most frequently traded currencies.

Some capital providers only allow trading on 22 or 24 of these pairs, some providers allow the full 28 pairs. Some providers offer a choice of a lot of pairs to trade, but these pairs are outside the 8 most frequently traded currencies. These spreads on these pairs are very high and should not be traded inside of these programs.

Traders should inquire as to what trading platform is offered by the capital provider that you are evaluating. If all of your trading experience is on metatrader 4, but the capital provider may not offer that platform. If you are seeking their capital might have to download the platform they offer for executing trades and managing the account, so make sure you ask this important question. Being experienced using a new platform is very important before applying for funding.

Some capital providers offer expensive training programs, costing thousands of dollars up front, before you can qualify for capital. We would avoid these capital providers all together. Forexearlywarning can provide a complete training program, our 35 illustrated forex lessons, to teach you everything you need to know about our complete, profitable trading system.

Most of the capital providers we reviewed were offering 100:1 leverage. If you are used to trading at 50:1 or some other leverage rate, remember to keep this in mind as it will affect your margin balances on each trade.

Some capital providers do not let you hold trades over the weekend, or even overnight. This is not good at all. It makes it impossible to swing trade or do any trend based trading on the higher time frames. Avoid these types of restrictions, if possible.

Some capital providers offer a free trial, which is excellent.

Live trading capital forex traders

Trader profile for live trading capital

If you are a forex trader, and would like to have access to live trading capital, here are some characteristics we think you should have:

First of all you should have a rules based trading system, and you are able to consistently make positive pips when you use it, week after week. You must like your trading system and understand it well via demo trading or micro lot trading. You must be skilled at entering trades and managing trades with stops and scaling out lots. We advise using a complete trading system like the forexearlywarning trading system. We offer thorough market analysis, more exact trade entry points across 28 pairs, and very little drawdown on trade entries. The low drawdown will comply with most capital programs. If you are a rookie trader with little experience, you should avoid all live trading capital programs, you are not ready yet.

Trading system to use with your funded forex trading account

If you are a trader who is seeking capital, and you need a profitable trading system with a low drawdown, check out the forexearlywarning trading system. You can demo trade our trading system and get consistent trades prior to applying for a funded account..

Forexearlywarning provides daily trading plans for 28 pairs, and we focus on the higher time frames. The higher time frames will get you more pips and profits than scalping the same pairs over and over with indicators. Forexearlywarning also has reliable alert systems and an excellent trade entry management system, the forex heatmap®. Do not use any trading system with ambiguous or random trade entries or rules for entry that are unclear.

Live trading capital for forex traders

An example trade signal for the GBP pairs on the heatmap is shown above, consistent, clear signals like this for trading are powerful and traders will have very little drawdown on trade entries, as to fully comply with the drawdown rules from most capital providers.

By offering 28 pairs, the forexearlywarning trading system matches or exceeds the most and most liquid pairs to trade offered in most capital programs. The heatmap system will provide traders with much lower drawdown on trade entry points so almost any capital program can be used. With the forexearlywarning trading system, you can easily make 10% on your account balance on one swing trade based on the H4 time frame. This will qualify you for more capital on some of the capital providers programs.

Other advantages of using the forexearlywarning trading system are that is can be easily demo traded. You must like your trading system and enjoy using it before you apply for any third party funded account.

Conclusions about live trading capital programs: A large amount of capital is available to forex traders to fund their live accounts, and we predict that even more capital will be available going forward. Any program that offers a fully funded forex trading account, that also covers your trading losses sound like a great offer. Traders who have no capital or just a small amount of capital, who are skilled at making positive trades, should evaluate these capital providers. Traders should remember that the trading rules vary between providers, so read each capital providers’ rules carefully, get everything in writing, like the fee structure and ongoing drawdown limits.

Funding your forex account

We empower forex & stock traders by giving them the necessary funds to earn a full-time income from home. Traders are given the freedom to bring any successful day-trading strategies they may have and apply them !!

Have you got the SKILLS to pay the BILLS?

In order to secure these funds, you just need to pass the evaluation phase. In this FREE evaluation, you will need to deposit a stake to one of the select brokers, trade and we will monitor you for a few months. If you can display the attributes we look for, you’ll unlock the fully funded account.

The 3 simple steps to get funded

Get evaluated with a LIVE trading account

Secure a fully funded account

View our intro video

View our intro video

Invest responsibly. Trading the FX & stock markets can be challenging and potentially profitable for investors. You should carefully consider your investment objectives, level of experience, risk appetite and whether you can afford to take the risk of losing your evaluation fee.

Start typing and press enter to search

US-based traders

Non US-based traders:

Other non US-based traders

PORTFOLIO MANAGER

A trader who has completed with success the trading evaluation phase, and currently trading for funded trader.

QUALIFY ACCOUNT

The initial balance of the account once a trader successfully meets all of the objectives in the evaluation account.

FULLY FUNDED ACCOUNT

Is the account the trader receives to trade. The fund’s authorised personnel will monitor and evaluate the trading activity in this account to verify the trader is complying with the trading policy of the fund.

PROFIT WITHDRAWAL

A trader is entitled to a share of the profits made in the assigned trading account. In the evaluation phase the trader is entitled to 100% of their profits.

GROWTH SCHEME

Once a trader becomes an official portfolio manager for funded trader, the fund may promote the trader’s account as specified by the growth scheme. Yet it is the sole privilege of the fund to deny or delay promotion or change the promotion terms. The growth scheme may change according to the fund’s decision.

EVALUATION ACCOUNT OBJECTIVES

The trading policy a trader must apply in their trading activity, in order to qualify for a portfolio manager for funded trader.

TRADEABLE SECURITIES

Trading activity is limited to forex majors currencies and their combinations: USD, EUR, GBP, JPY, CHF, AUD, NZD, CAD.

The following is a list of securities permitted to trade:

Forex majors: EURUSD, GBPUSD, USDJPY, USDCAD, AUDUSD, NZDUSD, USDCHF.

Forex majors crosses: AUDCAD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, GBPAUD, GBPCHF, GBPCAD, GBPJPY, GBPNZD, NZDCAD, NZDCHF, NZDJPY

A trader must avoid trading any other securities unless requested and permitted by the funds official representative. Trading securities which are not permitted for trading may result in termination of the fully funded account or failing the evaluation phase.

OWNERSHIP OF FULLY FUNDED ACCOUNTS & FUNDS

It is to be acknowledged and clear; that the fully funded trading accounts and the funds are the sole property of funded trader. The portfolio manager has no rights over any of the properties mentioned.

TRADING TERMS

MAX EXPOSURE

The maximum allowance of lots summarised by all open positions, regardless of the trade direction (long or short). Exceeding the max exposure value, will automatically disqualify the trader and cause the final termination of the fully funded account. Any position at profit with SL above profit (minus commissions and swap charges), may be ignored in calculating the max exposure.

MAX DRAWDOWN

The maximum drawdown allowance in the account. A drawdown (DD) is the maximum change of equity value between the equity peak value and the equity value. This includes closed and open orders. Exceeding the max drawdown limitation, will disqualify the trader and cause the final termination of the fully funded account.

MINIMUM TRADES

Any position must have a hard stop loss value not greater than the value specified. Failing to place stop loss orders will cause the final termination of the fully funded account.

STOP-LOSS PER POSITION

Any position must have a hard stop loss value not greater than the value specified. Failing to place stop loss orders will cause the final termination of the fully funded account.

TIME LIMIT

The period of time that a trader should accomplish the evaluation objectives is up to 6 months. The time limit may be extended if a trader requests it and upon approval from the director of the fund.

PROFIT WITHDRAWALS

Trading on the fully funded account entitles the trader to withdraw profit by the percentage level specified in the plan of choice.

Profits withdrawals are paid in the following possible circumstances:

- A trader had completed with success the evaluation objectives.

- A trader files a withdrawal request.

- A trader was disqualified and the account balance contains profits.

- A trader of a fully funded account may apply for a profit withdrawal request only once. Once a profit withdrawal is requested, the fund will close all open positions and any profits will be paid by the specified split.

TERMINATION OF A FULLY FUNDED ACCOUNT

The fund will terminate a fully funded account by the following circumstances:

– A trader has exceeded the maximum drawdown allowance

– A trader has exceeded the maximum exposure allowance

– A trader fails to apply proper stop loss for all trades

A terminated account will not be recovered. Once a trader has been disqualified while profits exist in the account, the fund will close all open orders and terminate the account from further trading. Any profits will be paid out by the specified split.

The trader of a terminated fully funded account may apply again for a new evaluation phase from the start. The required minimum deposit in the evaluation phase for the chosen account (regardless of the amount) would become payable again in the event the trader wanted to get evaluated again.

PORTFOLIO MANAGER

A trader who had completed with success the trading evaluation phase and currently trading for funded trader.

QUALIFY ACCOUNT

The initial balance of the account once a trader successfully meets all of the objectives in the evaluation account.

TP EVALUATION ACCOUNT

(take profit evaluation account) is the account the trader receives to trade. The fund authorised personnel will monitor and evaluate the trading activity in this account to verify the trader is complying with the trading policy of the fund. The evaluation account balance is lower by one half of the portfolio account balance, received once the trader is qualified. E.G. To qualify for a fully funded $50,000 account, a trader must trade an evaluation account of a $25,000.

PROFIT WITHDRAWAL

A trader is entitled to a share of the profits made in the assigned trading account, whether it is on an evaluation account or in a portfolio manager account.

GROWTH SCHEME

Once a trader becomes an official portfolio manager for funded trader, the fund may promote the trader’s account as specified by the growth scheme. By default, any portfolio manager for the funded trader. Yet it is the sole privilege of the fund to deny or delay promotion or change the promotion terms. The growth scheme may change according to the fund’s decision.

EVALUATION ACCOUNT OBJECTIVES

The trading policy a trader must apply in their trading activity in order to qualify for a portfolio manager position with funded trader.

EVALUATION ACCOUNT FEE

A fee a trader pays to the fund for the privilege to receive a real money trading account with profit sharing and to be evaluated by the fund’s trading directors for becoming a portfolio manager for funded trader. This is non-refundable once a trader has received access to their LIVE account or commenced trading activity.

EVALUATION ACCOUNT TRADING GUIDELINES & OBJECTIVES

Meeting all the following guidelines and objectives entitles the trader to perform as a portfolio manager for funded trader, with a fully funded trading account.

TRADEABLE STOCKS

Traders are limited to trading stocks on the AMEX, NASDAQ and new york stock exchange (NYSE). Platform accessibility is during US market hours (9:30 a.M. To 4 p.M. EST, except stock market holidays). US based traders are not eligible for stock funded accounts. A trader must avoid trading any other stocks unless requested and permitted by the funds official representative. Trading stocks which are not permitted for trading may result a termination of the evaluation or fully funded account.

OWNERSHIP OF ACCOUNTS, TECHNOLOGY AND FUNDS

It is to be acknowledged and clear; that the trading accounts, the technology, software, the funds worth are the sole property of funded trader. The portfolio manager has no rights over any of the properties mentioned.

TRADING TERMS

MAX TRADE SIZE

Exceeding the max trade value, will automatically disqualify the trader, and cause the final termination of the evaluation or fully funded account. Any position at profit with SL above profit (minus commissions and swap charges), may be ignored in calculating the max exposure.

MAX DRAWDOWN

The maximum drawdown allowance in the account. A drawdown (DD) is the maximum change of equity value between the equity peak value and the trough equity value. This includes closed and open orders. Exceeding the max drawdown limitation, will disqualify the trader, and cause the final termination of the evaluation or fully funded account.

MINIMUM TRADES

The minimum count of trades required in the evaluation account is 40. A trader must exceed the number of minimum trades to qualify for a portfolio manager account.

- TIME LIMIT – the period of time that a trader should accomplish the evaluation objectives is up to 6 months. After the due date, the account will be terminated and the trader will be disqualified. If any profits exist in the account, the fund will send the trader’s share of profits. The time limit may be extended if a trader request from the fund, and by the fund directors approval.

PROFIT WITHDRAWALS

Trading on the TP evaluation account entitles the trader to withdraw profit by the percentage split specified in the plan of choice.

Profit withdrawals are paid in three possible circumstances:

- A trader had completed with success the evaluation objectives.

- A trader files a withdrawal request.

- A trader was disqualified and the account balance contains profits.

- Once a trader completed with success the evaluation objective, the fund will terminate the account, pay out the profits for the trader by the specified split, and reward the trader with a new portfolio manager account.

- A trader of an evaluation account may apply for a profit withdrawal request only once. Once a profit withdrawal is requested, the fund will close all open positions, terminate the account and the trader is announced disqualified. Any profits will be paid by the specified split.

- Once a trader has been disqualified while profits exist in the account, the fund will close all open orders and terminate the account from further trading. Any left profits will pay out by the specified split.

TERMINATION OF AN EVALUATION ACCOUNT

The fund will terminate an evaluation account by the following circumstances:

– A trader had exceeded the maximum drawdown allowance

– A trader had exceeded 50% of the allowable maximum drawdown within 3 months or less

– A trader had exceeded the maximum trade size allowance

– A trader had exceeded the time limit without accomplishing the evaluation objectives

– A trader had exceeded the maximum daily loss allowance 3 times or more

Once an evaluation account is terminated, it will be disabled from further future trading. A terminated account will not be recovered. A trader of a terminated evaluation account may apply again for new evaluation plan from start. The current evaluation fee for the chosen account, regardless of the amount of the original fee paid, would become payable again in the event the trader wanted to open another trading account.

The scope of this privacy policy

Effective date: 1 january 2020. This privacy policy outlines what types of information are collected from our account holders, users, and visitors (“you”, “your” or “user”), to whom it may be disclosed, and how that information may be used by funded trader. (“funded trader”, “we”, “our” or “us”), as each of the foregoing relates to your use of funded trader web site, (the “site”). Please read our privacy policy carefully to get a clear understanding of how we collect, use, protect or otherwise handle your personally identifiable information in accordance with our website. By using our website you agree that you have read, understood, and consented to this privacy policy and our terms of use. We reserve the right to change this policy including altering the purposes for which it processes your personal information. In the event that funded trader considers it appropriate to make any such change, the policy will be updated and posted on our site. Your continued use of the site will constitute acceptance of those changes. The date on which the then current privacy and cookie policy came into force will be as stated at the top of this privacy policy.

Collection of personal data

By providing us with your personal information, you explicitly consent to us processing and disclosing your personal information for the purposes, and otherwise in the manner set out in this policy, or as otherwise provided in accordance with the terms and conditions.

Collection of personally identifiable information (PII)

PII, as used in privacy and electronic communications regulations, is information that can be used on its own or with other information to identify, contact, or locate a single person, or to identify an individual in context.

When do we collect information?

We collect information from you when you subscribe to a newsletter or enter information on our site.

Types of data collected

Personal data

While using our service, we may ask you to provide us with certain personally identifiable information that can be used to contact or identify you (“personal data”). Personally, identifiable information may include, but is not limited to:

First name and last name

Address, state, province, ZIP/postal code, city

Purposes for personal data collection

Analytics to gather metrics to better understand how users access and use the sites and services; to evaluate and improve the sites and services; and to develop new products and services.

Provide our services to provide the services we offer on our sites and to communicate with you about your use of our site or services, to respond to your inquiries, to provide troubleshooting, and for other customer services designed to make your experience better.

Comply with the law to comply with legal obligations, as part of our general business operations, and for other business administration purposes.

Personalisation to tailor the content and information that we may send or display to you, to suggest personalised help and instructions, and to otherwise personalise your experience while visiting or using our site.

Provide our services to provide the services we offer on our site, to communicate with you about your use of our site, to respond to your inquiries, to provide troubleshooting, and for other customer services designed to make your experience better.

Marketing and promotions for marketing and promotional purposes, such as to send you news and updates, special offers, and promotions, or other otherwise contact you about products, services, or information we think may interest you, including information about third party products and services.

Purposes for the collection of personally identifiable information

We may use the information we collect from you when you register, make a purchase, sign up for our newsletter, respond to a survey or marketing communication, surf the website, or use certain other site features in the following ways:

To administer a contest, promotion, survey or other site feature

To send periodic emails regarding your order or other products and services

Cookies

We use cookies and other similar technologies, including log data, on our site to distinguish you from other users of our websites and apps (including when you browse third party websites). This helps us to provide you with a good experience when you use our services. We also use cookies and similar technologies to show you more personalised advertising. You may adjust the settings on your browser to refuse cookies but some of our services may not work if you do so. Examples of cookies we use include:

Session cookies we use session cookies to operate our service.

Preference cookies we use preference cookies to remember your preferences and various settings.

Security cookies we use security cookies for security purposes.

Disclosure of personally identifiable information & data legal requirements

Funded trader may disclose your personal data in the good faith belief that such action is necessary to:

To protect against legal liability

To comply with a legal obligation

To prevent or investigate possible wrongdoing in connection with the service

To protect and defend the rights or property of funded trader

To protect the personal safety of users of the service or the public

Security of data

We recognise that online security is an area of vital importance for all our customers. It is imperative that you should have full confidence that your personal details are secure. We employ security measures to protect your information from access by unauthorised persons and to prevent unlawful processing, accidental loss, destruction and damage. In order to protect both ourselves and our customers from identity theft we may verify the information you have provided with our banking institutions over secure lines. Again this is carried out in accordance with our data protection obligations. Please keep in mind that no method of transmission over the internet, or method of electronic storage is 100% secure. While we strive to use commercially acceptable means to protect your personal data, we cannot guarantee its absolute security.

Service providers

We may employ third party companies and individuals to facilitate our service (“service providers”), to provide the service on our behalf, to perform service-related services or to assist us in analysing how our service is used. These third parties have access to your personal data only to perform these tasks on our behalf and are obligated not to disclose or use it for any other purpose.

Analytics

We may use third-party service providers such as google to monitor and analyse the use of our service. Vendors, such as google use first-party cookies (such as the google analytics cookies) and third-party cookies (such as the doubleclick cookie) or other third-party identifiers together to compile data regarding user interactions with ad impressions, and other ad service functions as they relate to our website.

Opting out: users can set preferences for how google advertises to you using the google ad settings page. Alternatively, you can opt out by visiting the network advertising initiative opt out page or permanently using the google analytics opt out browser add on.

Links to other sites

Our service may contain links to other sites that are not operated by us. If you click on a third party link, you will be directed to that third party’s site. We strongly advise you to review the privacy policy of every site you visit. We have no control over and assume no responsibility for the content, privacy policies or practices of any third party sites or services.

Children’s privacy

The funded trader site is not intended for use by minors under the age of 18 and are not targeted to children. We do not knowingly collect information from children under the age of 16, solicit information from such children, or market products to such children.

How to get the best funded trading accounts?

Fully funded trading account

A forex trading job is recognized to be one of the most challenging jobs in the market due to the sheer of variables that need to be considered before implementing any decisions.

The forex market is extremely volatile, and there are very few alternatives offered to traders to accumulate funds for their account. However, you don’t have to worry about money when you get selected to trade with a funded trading account. That happens when you show great experience and skill in making profitable trades, along with the consistency of your trade.

If you show a proprietary trading firm that you are skilled and talented, and can be counted among the top forex traders, you will get the chance to join some of the best-funded proprietary funds in the market.

What are funded trading accounts at A proprietary forex fund?

A forex funded trading account at a proprietary forex fund is one of the main goals for all forex traders because that is the pinnacle of their industry. There are a lot of great proprietary forex funds that are offering traders the chance to showcase their talent and skill with a funded trading account. At the5ers proprietary firm, we offer traders the chance to elevate their trading career to the next level. We offer traders with everything they need to be successful in forex trading , if they prove their skills, and have a track record of being a successful trader.

How to choose the best funded trading accounts?

Here are some important points to understand about how to choose a funded trading account, which traders tend to get confused about, or that firms manipulate the way they present them to confuse traders:

Share split

It is important to analyze this point together with the possible account size.

Most companies will offer 60% to 80% percentage of the profits for the trader in 100K to 300K accounts.

The5ers gives up to 1.28 million accounts with a 50%-50% split. So you keep a little less percentage of the profits, in a significantly larger trading account.

Remember that when you are taking the very same winning performance, the actual money-earning potential is what matters and not the percentage split.

Payout and growing terms

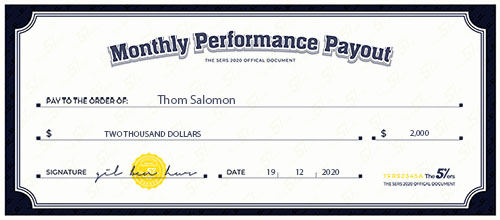

The5ers is the only fund that actually pays every month, no minimum, and no maximum applied.

The5ers is the only fund that pays and at the same time saves your milestone progression at the same level!

Meaning you pull out money every month, and you don’t hold your growth rate.

With other companies, you have to choose between taking the profits or leaving them for growth.

Terms

The duration & phases of the time you spend on being evaluated are also interesting to compare.

Most companies have 2 phases of testing before real funding and in most cases, those phases happen on demo accounts.

The5ers has only 1 evaluation phase, and it is actually on a live trading account. So practically you are already being funded – only with 1/4th of the account, you will get once you succeed. And you get paid for the profits made during the evaluation by the 50% split share.

Most companies will ask you to make a 10% profit on your evaluation account, in one month! Although it is possible to achieve, this objective doesn’t suit long term strategies and promotes overleveraging. With the 5ers you need to make 6%-7% in a maximum period of 6 months.

Weekends and nights

Look if you are allowed to leave open trades overnight and over the weekends.

Most companies won’t allow it.

The5ers.Com allows overnight and over the weekend trades, which is crucial for long term traders.

Recurring fees

In some companies, you will have to pay an initial fee plus a monthly fee.

With the5ers, there are no monthly payments. To get evaluated you only need to pay a one-time enrollment fee.

How to get qualified for a funded trading account

There aren’t any special qualities that qualify you for a funded trading account, other than proving your skills. You must show consistent results in forex trading and prove that your trading strategy is profitable. There are plenty of traders that get good results, but it can also be a fluke win, and to qualify for a funded trading account, you must showcase consistently profitable trades.

Sign up to evaluate your trading

When you sign up to trade with some of the best forex proprietary funds in the market, your trading style is going to be evaluated by the firm first. You will have to pay for the signup fee, but other than that there are no additional costs to be in a forex funded account program.

After a few weeks in testing, you will be totally in the risk-free trading zone

Once you have passed the initial evaluation, you will be tested for a few weeks, so that the proprietary firm can get a good feel of your trading style. Once you pass those few weeks, you will enter the risk-free trading zone, which is when you will be given your own funded trading account.

Get paid to trade forex

After proving yourself in the forex market with consistently profitable trades, you will earn the right to get paid to trade in the forex market. This is the best step for your trading career, as it allows you with the chance to test yourself among the best traders that are currently trading in the market.

Develop your trading career from home

When you get the chance to work with a forex funded account, your trading career is on the rise. It is best to choose a remote proprietary trading firm to work with, like the5ers, since they offer traders the chance to develop their trading career from home. This additional flexibility allows traders to trade in the market at their own time, and from wherever they choose to trade from.

Get high capital to trade

Once you are in the forex funded account program, you must keep showcasing your skills as a forex trader to climb even higher up the ladder. If you show great results while forex trading, then you will get a funded trading account with even bigger capital, so you can trade more. Only the top forex traders get that chance, and only after they apply the risk management requirements of the proprietary firm.

You can trade any trading strategy

One of the primary benefits of trading with a funded trading account is that you can trade any style without any fear of your style being compromised. You can choose any style, from scalping, day trading, to long-term position holding, swing trading, fundamentals analysis, or technical analysis trading strategies. The only thing you must keep in mind is that you must deliver profitable trades and results with your trading style.

Get your funded trading account with the5ers

There are a lot of forex proprietary firms in the market, but the5ers stands head and shoulders above them all. We are a remote proprietary trading firm, that offers some of the best forex proprietary trading funds on the market. Our forex funded account program has helped countless traders to develop their trading career, and if you are among the top forex traders in the market you should enroll now.

We have worked with some of the best forex traders in the market and offer them the following incentives, along with the best forex trading job.

Risk-free trading

Don’t risk your money anymore on the forex market. This is risk-free trading that allows you to not only think big but take more chances to get profitable trades in the market.

Develop a trading career

One of the biggest benefits of trading with our funded trading account is that we give all traders the chance to develop their careers. You will be assigned for the highest rewarding trading growth program, where you can build up your trading assets to make a substantial living.

Zero cost from your side

You don’t need to worry about the cost because there are none from your side when you work with the5ers funded trading account. You only pay for the signup fee and the rest is handled by the proprietary firm, so you get complete freedom to become the best trader you can.

Bring your own trading strategy

Worried about compromising your trading strategy? That isn’t even a consideration when you work with a funded trading account, because you have complete freedom as a trader to use your own trading strategy. That ensures that you don’t second guess yourself and keep using the trading strategies that made you successful.

Apply the fund risk management requirements to your own trading strategy

When trading with a forex funded trading account, you must follow the risk management requirements of the funded account. That ensures that you don’t take unnecessary risks that may jeopardize the capital in your funded account.

Final words about funded trading accounts

There are a lot of forex proprietary firms in the market today that are offering traders the chance to elevate their trading career. Choosing the right firm, like the5ers, will give you the chance to trade with some of the best forex traders in the industry.

If you want to receive an invitation to our weekly forex analysis live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our newsletter.

Fund your forex account

More and more traders often end up complaining when they request a withdrawal and the forex broker refuses to pay the trader. If you have been a victim of such scams, or if you are unsure what is the right way to fund your trading account then read this article which will help you to avoid making costly mistakes that could literally cost you your money.

F orex broker funding methods

In a bid to attract traders of all kinds, forex brokers now-a-days offer a wide choice of payment methods which include both deposit and withdrawal methods. They are mainly categorized into the following different payment methods.

Offline payments

Offline payment methods involve traditional means of funding your account which includes:

- Bank WIRE

- Check

- Western union

- Local deposit

These methods are best used when you want to trade huge amount of money to fund your trading account. However, before you transfer a large amount of trading capital make sure that you know the broker well enough and that they have earned your trust. Payment via bank WIRE and other methods listed are more expensive and take at least 5 days or more. There are additional fees such as bank transaction fees as well as currency exchange services fees that are levied when you make a payment.

The disadvantage with using the above methods is that if you sniff a scam, it would be hard to get your money back. The bank at best will only provide you with the payment proof which is the only thing you will have as proof of payment.

Ewallet payments

Ewallet payments are growing in popularity now a days due to their relative ease of use, lower transaction costs and faster processing times. In fact most forex brokers offer instant deposits and withdrawals via ewallets. Some of the well used ewallet funding methods include:

- Paypal

- Moneybookers/skrill

- Neteller

- Cashu

- Webmoney

Using a ewallet payment is often better than using any other funding methods. Reputable ewallet service providers such as paypal and skrill offer you the ‘protection’ meaning that in the event you want a refund of your deposit because the forex broker is not paying you, your ewallet can help by intervening between the merchant (the forex broker) and the customer (you, the trader). Ewallets are also popular as most forex brokers offer special bonuses when you deposit using any of the ewallet methods mentioned above.

Credit/debit cards

Funding your trading account using credit or debit cards is also another popular way for traders who want to deposit instantly. However, the amount you can deposit will depend on the limits enforced by your bank, so traders need to check this first. Secondly, in the event that you want to request a refund because the forex broker is a scam, you can simply chargeback. However, there are costs involved including having to explain to your bank manager on the transaction. Note that by requesting a chargeback it does not guarantee you your money back, therefore traders need to be extra cautious when funding their accounts with credit or debit cards. There is also the risk that the forex broker you use could save your credit card data, which if falls into the wrong hands can create a lot of trouble for you.

What is the best way to fund your trading account?

From the above three main methods, without a doubt using ewallet payments are the best option for the following reasons:

- Cheaper transaction costs: most forex brokers do not charge any fee. In other words, the transaction costs when you make a deposit are covered by the forex broker. Also any withdrawals you request also carry a smaller transaction fee than other methods

- Safe to use: using ewallets can help to safeguard your money. It is easy to request or dispute your transaction if you genuinely find that the forex broker has scammed you. Ewallets are known to arbitrate on your behalf and the service comes at no extra cost

- Quick processing times: depositing (and withdrawals) is usually faster when requested via ewallets as it is almost instant in most cases. The best part is that you can actually link your credit or debit card or even your bank account to your ewallet and use it.

Live trading capital: funded forex account, forex funding

Forex traders can obtain live trading capital and funded trading accounts from third party providers. Thousands of traders are receiving funding for their trading account every year from the various capital providers. Any forex trader who has a great trading system and is competent, skilled and profitable, but lacks the funds to trade live should investigate these funding companies. This article will provide lots of details on what programs are available to get forex account funding. We will also present a low drawdown, profitable trading system to use with the capital and funding providers. Traders can earn strong commissions, like 80%, to be paid for their trading skills using these funded accounts.

Companies that provide live trading capital

Several companies provide live trading capital for forex traders. Here is a partial list: topstep, FTMO, the5ers, blufx, maverickfx, fidelcrest, audacity, traders4traders, fundisus, traders4traders, skilledmarkets and enfoid. We also found a handful of forex brokers who have capital referral programs.

There are also private entities and individuals on places like linkedin that advertise funding available for forex traders. Some of these capital providers have been in business over 5 years. You can supplement this list with some google searches for “forex funding” or “funded forex account”.

How much money is available for my funded forex account

Traders who qualiyy are eligible to receive up to $2,000,000 or more USD in buying power, including leverage, from many of the available capital provider programs. Example, a funding company might offer a trader a $5,000 account with 100:1 leverage, which is $500,000 USD in buying power. Some companies will fund traders in euros rather than US dollars. Be sure to ask what leverage is being used from the providers.

If you start with a small amount of capital, you can easily qualify for more funding quickly just by increasing your account balance by a small amount. Each forex funding provider has their own guidelines for qualifying for more money. Important tip >> if you want more funding for your forex trading account, then open two accounts with two different capital providers.

Fees for obtaining forex funding

If you are seeking funding for your forex trading account, check the fee structure. Some forex funding and capital providers do not charge any fee at all, but the profit split percentages for the trader are lower. Some funding providers charge one time up front fees or monthly fees. In some cases the fees are 100% refundable out of the trading profits. So this is a wide range of possibilities. We consider most of the fees to be reasonable, since the funding providers are covering any trading losses for the end user.

When evaluating a forex funding provider, we would question each provider if the trading platform they provide has institutional spreads or direct access spreads. Inquire if the brokerage platform they provide is also a profit center for their introducing broker operation. Most funding providers likely also make money off of each trade as an introducing broker. Don’t pay for high spreads on top of the fees they charge.

How do I get A funded forex trading account

Each capital and funding provider has a qualification program to obtain funding. The rules vary quite a bit. Each qulification program has a demonstration or qualification period to obtain the funding. It can be a one or two step process. During the qualification period you must abide by the capital provider’s rules like profit targets, position size, daily and weekly total loss or drawdown limits, maximum number of positions open and position size, etc. Each capital and funding provider has their rules and guidelines are they in writing, so read them carefully. If you break the rules you might be liable for paying more fees to restartthe process to get more funding. The demonstration period can very from one month to several months to hit the profit targets. All of the providers we found cover all trading losses up to the specified loss limits. Don’t be intimidated by the funding qualification process, under some programs you can qualify for funding in as little as one day with just 2 or 3 positive trades.

Important tip >> you access much more capital quickly. Some capital providers will increase the amount of capital they make available to a trader for trading profitably. Some capital providers will double the amount of capital you can access for increasing your account balance by only 10%, which is a modest amount of profit. For example if you get a $5,000 trading account and you increase the account to $5,500 with positive trades, you will be able to access $5,000 more trading capital. We view this as quite generous, since this can be done with just one swing trade.

More criteria for selecting A live trading capital provider

Profit splits range from 50/50 to 80/20, with the traders keeping 80%. Topstepfx allows traders to keep the first 100% of $5,000 in profits. 50% seems pretty low for a profit split, in our opinion. Profits can be withdrawn via bank wire and in some cases, paypal. Transfer fees may apply to small withdrawals. Withdrawals are usually available at the end of the month.

All of the capital providers have drawdown limits. The drawdown is usually measured as the amount of loss of capital from the previous and most recent high balance. Drawdown limits can be weekly or monthly, and range from between 1% and 10% of the high balance, which is a very wide variation. Continue reading this article and we can show you a trading system that can be used that has very little drawdown on each trade entry. This system will minimize drawdown so the tighter drawdown rules can be met.

When selecting a live trading capital provider make sure they show you a list of the available pairs that you can trade with their brokerage platform. We recommend checking their offerings against the 28 most actively traded pairs, which are combinations of the 8 most frequently traded currencies. The USD, CAD, EUR, CHF, GBP, JPY, AUD and NZD are the 8 most frequently traded currencies.

Some capital providers only allow trading on 22 or 24 of these pairs, some providers allow the full 28 pairs. Some providers offer a choice of a lot of pairs to trade, but these pairs are outside the 8 most frequently traded currencies. These spreads on these pairs are very high and should not be traded inside of these programs.

Traders should inquire as to what trading platform is offered by the capital provider that you are evaluating. If all of your trading experience is on metatrader 4, but the capital provider may not offer that platform. If you are seeking their capital might have to download the platform they offer for executing trades and managing the account, so make sure you ask this important question. Being experienced using a new platform is very important before applying for funding.

Some capital providers offer expensive training programs, costing thousands of dollars up front, before you can qualify for capital. We would avoid these capital providers all together. Forexearlywarning can provide a complete training program, our 35 illustrated forex lessons, to teach you everything you need to know about our complete, profitable trading system.

Most of the capital providers we reviewed were offering 100:1 leverage. If you are used to trading at 50:1 or some other leverage rate, remember to keep this in mind as it will affect your margin balances on each trade.

Some capital providers do not let you hold trades over the weekend, or even overnight. This is not good at all. It makes it impossible to swing trade or do any trend based trading on the higher time frames. Avoid these types of restrictions, if possible.

Some capital providers offer a free trial, which is excellent.

Live trading capital forex traders

Trader profile for live trading capital

If you are a forex trader, and would like to have access to live trading capital, here are some characteristics we think you should have:

First of all you should have a rules based trading system, and you are able to consistently make positive pips when you use it, week after week. You must like your trading system and understand it well via demo trading or micro lot trading. You must be skilled at entering trades and managing trades with stops and scaling out lots. We advise using a complete trading system like the forexearlywarning trading system. We offer thorough market analysis, more exact trade entry points across 28 pairs, and very little drawdown on trade entries. The low drawdown will comply with most capital programs. If you are a rookie trader with little experience, you should avoid all live trading capital programs, you are not ready yet.

Trading system to use with your funded forex trading account

If you are a trader who is seeking capital, and you need a profitable trading system with a low drawdown, check out the forexearlywarning trading system. You can demo trade our trading system and get consistent trades prior to applying for a funded account..

Forexearlywarning provides daily trading plans for 28 pairs, and we focus on the higher time frames. The higher time frames will get you more pips and profits than scalping the same pairs over and over with indicators. Forexearlywarning also has reliable alert systems and an excellent trade entry management system, the forex heatmap®. Do not use any trading system with ambiguous or random trade entries or rules for entry that are unclear.

Live trading capital for forex traders

An example trade signal for the GBP pairs on the heatmap is shown above, consistent, clear signals like this for trading are powerful and traders will have very little drawdown on trade entries, as to fully comply with the drawdown rules from most capital providers.

By offering 28 pairs, the forexearlywarning trading system matches or exceeds the most and most liquid pairs to trade offered in most capital programs. The heatmap system will provide traders with much lower drawdown on trade entry points so almost any capital program can be used. With the forexearlywarning trading system, you can easily make 10% on your account balance on one swing trade based on the H4 time frame. This will qualify you for more capital on some of the capital providers programs.

Other advantages of using the forexearlywarning trading system are that is can be easily demo traded. You must like your trading system and enjoy using it before you apply for any third party funded account.

Conclusions about live trading capital programs: A large amount of capital is available to forex traders to fund their live accounts, and we predict that even more capital will be available going forward. Any program that offers a fully funded forex trading account, that also covers your trading losses sound like a great offer. Traders who have no capital or just a small amount of capital, who are skilled at making positive trades, should evaluate these capital providers. Traders should remember that the trading rules vary between providers, so read each capital providers’ rules carefully, get everything in writing, like the fee structure and ongoing drawdown limits.

Fund your forex account fast

Funding your account couldn't be easier. Select one of four convenient methods.

Ways to fund your account

There are four convenient ways to fund your account. All new accounts must meet the minimum balance requirement: standard accounts $2500 and mini accounts $500.

Debit card

In most cases, funds sent via debit card post to your account immediately. Login to myaccount, our secure client area, to make debit card deposits directly to your ally invest forex trading account.

Echeck

Echecks are a quick and secure way to transfer funds between your bank and ally invest forex account. We accept deposits from US bank accounts only. Echecks may take 2 - 5 business days to clear and be credited to your trading account. Login to myaccount, our secure client area, to make an echeck deposit to your ally invest forex account.

Wire transfer

This is the quickest and easiest way to fund your account. We accept deposits in US dollar, euro, canadian dollar, japanese yen, swiss franc, australian dollar and british pound (sterling). Funds are typically received within 1-2 business days. Wire transfer instructions are available in our secure client area. Click here.

Check deposit

Personal or business checks only drawn on US dollar accounts are accepted. Checks may take 5-10 business days from the day of receipt to clear and be credited to your trading account.

Mailing instructions:

Bank, cashiers' check and cash deposits are not accepted, which includes money orders, traveler's checks or other cash equivalents. Under no circumstances will payments be made or received via third parties.

Looking for account forms? Click here.

Anti-money laundering policy

GAIN capital actively complies with all anti-money laundering and anti-terrorism laws and regulations, including reporting and blocking of assets, to the fullest extent that it can do so under all applicable foreign and domestic laws. On an ongoing basis, GAIN capital shall review account activity for evidence of suspicious transactions that may be indicative of money laundering activities. This review may include surveillance of: 1) money flows into and out of accounts,2) the origin and destination of wire transfers, and 3) other activity outside the normal course of business.

Ally invest forex, LLC. (’ally invest forex") acts as an introducing broker to GAIN capital group, LLC ("GAIN capital"). Your account is held and maintained at GAIN capital who serves as the clearing agent and counterparty to your trades. GAIN capital is a registered futures commission merchant (FCM) and a member of the national futures association (NFA #0339826).

Try ally invest forex with a free $50,000 practice account. Get started below.

No need to practice?

Open a live forex account.

- East-to-use, fully functional ally invest forex trading platform

- Up to 50:1 leverage

- We offer 50 currency pairs

- Powerful charting

- 24-hour news headlines

- Daily and weekly forex research

- 24/6 support by phone and live chart

open forex account

Why ally invest forex?

Trading platforms

Education

Forex support

Foreign exchange (forex) products and services are offered to self-directed investors through ally invest forex LLC. Ally invest forex LLC, NFA member (ID #0408077), acts as an introducing broker to GAIN capital group, LLC ("GAIN capital"), a registered FCM/RFED and NFA member (ID #0339826). Your forex account is held and maintained at GAIN who serves as the clearing agent and counterparty to your trades. GAIN capital, attn: ally invest forex, bedminster one, 135 US highway 202/206, suite 11, bedminster, NJ 07921, USA.

Forex and other leveraged products involve significant risk of loss and may not be suitable for all investors. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Increasing leverage increases risk. Spot gold and silver contracts are not subject to regulation under the U.S. Commodity exchange act. Please read the full disclosure.

There are risks associated with using an internet-based trading system including, but not limited to, the failure of hardware, software, and internet connection. Ally invest forex is not responsible for communication failures or delays when trading via the internet. Any opinions, news, research, analysis, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice. Ally invest forex is not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content on this website is subject to change at any time without notice.

Forex accounts are NOT PROTECTED by the securities investor protection corporation (SIPC), NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE.

So, let's see, what we have: stop trading small accounts the world’s best subscriptions based FX trading solution. Fundisus provides all participants with funded accounts to access the spot market. Who are we? Fundisus at funding your forex account

Contents of the article

- No deposit forex bonuses

- Stop trading small accounts

- Let us tell you more

- Live trading capital: funded forex account, forex...

- Companies that provide live trading capital

- How much money is available for my funded forex...

- Fees for obtaining forex funding

- How do I get A funded forex trading account

- More criteria for selecting A live trading...

- Trader profile for live trading capital

- Trading system to use with your funded forex...

- Funding your forex account

- Have you got the SKILLS to pay the BILLS?

- The 3 simple steps to get funded

- Get evaluated with a LIVE trading account

- Secure a fully funded account

- View our intro video

- View our intro video

- PORTFOLIO MANAGER

- QUALIFY ACCOUNT

- FULLY FUNDED ACCOUNT

- PROFIT WITHDRAWAL

- GROWTH SCHEME

- EVALUATION ACCOUNT OBJECTIVES

- TRADEABLE SECURITIES

- OWNERSHIP OF FULLY FUNDED ACCOUNTS &...

- TRADING TERMS

- MAX EXPOSURE

- MAX DRAWDOWN

- MINIMUM TRADES

- STOP-LOSS PER POSITION

- TIME LIMIT

- PROFIT WITHDRAWALS

- TERMINATION OF A FULLY FUNDED...

- PORTFOLIO MANAGER

- QUALIFY ACCOUNT

- TP EVALUATION ACCOUNT

- PROFIT WITHDRAWAL

- GROWTH SCHEME

- EVALUATION ACCOUNT OBJECTIVES

- EVALUATION ACCOUNT FEE

- EVALUATION ACCOUNT TRADING GUIDELINES &...

- TRADEABLE STOCKS

- OWNERSHIP OF ACCOUNTS, TECHNOLOGY AND...

- TRADING TERMS

- MAX TRADE SIZE

- MAX DRAWDOWN

- MINIMUM TRADES

- PROFIT WITHDRAWALS

- TERMINATION OF AN EVALUATION...

- The scope of this privacy policy

- Collection of personal data

- Collection of personally identifiable information...

- When do we collect information?

- Types of data collected

- Purposes for personal data collection

- Purposes for the collection of personally...

- Cookies

- Disclosure of personally identifiable information...

- Security of data

- Service providers

- Analytics

- Links to other sites

- Children’s privacy

- How to get the best funded trading accounts?

- Fully funded trading account

- What are funded trading accounts at A proprietary...

- How to choose the best funded trading accounts?

- How to get qualified for a funded trading account

- Sign up to evaluate your trading

- After a few weeks in testing, you will be totally...

- Get paid to trade forex

- Develop your trading career from home

- Get high capital to trade

- You can trade any trading strategy

- Get your funded trading account with the5ers

- Risk-free trading

- Develop a trading career

- Zero cost from your side

- Bring your own trading strategy

- Apply the fund risk management requirements to...

- Final words about funded trading accounts

- Fund your forex account

- F orex broker funding methods

- What is the best way to fund your trading account?

- Live trading capital: funded forex account, forex...

- Companies that provide live trading capital

- How much money is available for my funded forex...

- Fees for obtaining forex funding

- How do I get A funded forex trading account

- More criteria for selecting A live trading...

- Trader profile for live trading capital

- Trading system to use with your funded forex...

- Fund your forex account fast

- Funding your account couldn't be easier. Select...

- Ways to fund your account

- Debit card

- Echeck

- Wire transfer

- Check deposit

- Anti-money laundering policy

- Try ally invest forex with a free $50,000...

- No need to practice?Open a live forex...

- Funding your account couldn't be easier. Select...

Comments

Post a Comment