Forex Islamic Accounts, xm forex swap free.

Xm forex swap free

No expiration, no spread widening, no commissions and no hidden fees.

100% shariah compliant.

No deposit forex bonuses

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Forex islamic accounts

About forex islamic accounts

Forex islamic accounts are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions, which is against islamic faith. We offer our islamic accounts to clients following the muslim faith.

How to open a forex islamic account

The swap-free option can be chosen as part of the trading account registration in 3 easy steps:

Open a trading account with us

Login to the members area and validate your account

Request an islamic account

As soon as our relevant department receives your request, your trading account will receive swap-free status and you will be notified by email accordingly. Please note that XM reserves the right to revoke the swap-free status granted to any real trading account in the event of any form of abuse.

No expiration, no spread widening, no commissions and no hidden fees.

100% shariah compliant.

Account features at a glance

- No interest/swap charges on overnight positions

- No spread widening

- No up-front commissions

- Positions can be held with no time limit

- No re-quotes, no hidden costs

- Leverage up to 30:1

- 100% real-time market execution

- Same trading conditions as for our trading account types

- Free and instant access to all trading platforms

- 24/5 dedicated support from your client account manager

Benefits

The XM forex islamic accounts differ greatly from those generally offered by other forex brokers. The difference lies in the fact that unlike most forex companies who substitute additional fees by widening the spread on islamic accounts, XM imposes no additional charges.

In order to abide by the religious law of islam, traders of islamic belief are forbidden to pay interest. However, if the interest charge is transferred to a different type of fee, it is basically still a charge that covers the interest. This is also known by the name of swap-free in disguise. XM is firmly against such practices as it opposes to fair and ethical trading conditions.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited, registration number HE251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Swaps calculator

A swap rate is a rollover interest rate, which XM credits to or debits from clients’ accounts when a position is held open overnight. The swap rate is credited or debited once for each day of the week when a position is rolled over, with the exception of wednesday, when it is credited or debited 3 times (i.E. 7 swaps in 5 trading days).

By using our swap calculator you can calculate the interest rate differential between the two currencies of the currency pair on your open positions.

Enter your account base currency, select the currency pair, enter the account type, the trade size in lots and the leverage.

How it works:

A swap rate is a rollover interest rate, which XM credits to or debits from clients’ accounts when a position is held open overnight. The swap rate is credited or debited once for each day of the week when a position is rolled over, with the exception of wednesday, when it is credited or debited 3 times (i.E. 7 swaps in 5 trading days).

By using our swap calculator you can calculate the interest rate differential between the two currencies of the currency pair on your open positions.

Enter your account base currency, select the currency pair, enter the account type, the trade size in lots and the leverage.

The calculation is performed as follows:

Swap = (one point / exchange rate) * trade size (lot size) * swap value in points

One point: 0.00001

account base currency: EUR

currency pair: EUR/USD

exchange rate: 1.0895 (EUR/USD)

volume in lots: 5 (one standard lot = 100,000 units)

short swap rate: 0.15

Swap value = (0.00001 / 1.0895) * (500,000 * 0.15)

swap value is €0.69

*if the result is negative your account will be debited whereas if it is positive your account will be credited.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited, registration number HE251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Xm forex swap free

6 asset classes - 16 trading platforms - over 1000 instruments.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

SWAP FREE ACCOUNTS

More time without admin fees!

For the following 2 months we will be extending the grace periods of forex, gold and silver for swap free accounts. During the promotional period, the grace periods of major instruments will be doubled, and the grace periods of minor and other instruments will be lengthened.

For example, the grace period for EUR/USD will be doubled from 2 days to 4 days.

PROMOTIONAL PERIOD: 07 DEC 2020 – 07 FEB 2021

Who is eligible for this promotion?

This promotion is open to all holders of a validated XM SWAP free account.

Are there any special requirements?

The extension of grace periods is automatically applied from our end. It does not require anything other than a validated XM swap free account.

What is an XM swap free account?

The XM swap free account type allows you to trade for a specific time window (grace period) without any admin fees.

When the grace period expires, you are charged an admin fee* for as long as you have open positions.

To read more about the XM swap free account type, please click here.

*the admin fee differs for each instrument. Terms and conditions apply.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited, registration number HE251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Overnight positions

Rollover at XM

Following current interest rates

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

Keeping your positions open overnight

Positions held open overnight may be charged rollover interest. In the case of forex instruments, the amount credited or charged depends on both the position taken (i.E. Long or short) and the rate differentials between the two currencies traded. In the case of stocks and stock indices, the amount credited or charged depends on whether a short or a long position has been taken.

Kindly note that rollover interest is only applied to cash instruments. In the case of futures products, which have an expiry date, there are no overnight charges.

About rollover

Rollover is the process of extending the settlement date of an open position (i.E. Date by which an executed trade must be settled). The forex market allows two business days for settling all spot trades, which implies the physical delivery of currencies.

In margin trading, however, there is no physical delivery, and so all open positions must be closed daily at end-of-day (22:00 GMT) and re-opened on the following trading day. Therefore, this pushes out the settlement by one more trading day. This strategy is called rollover.

Rollover is agreed on through a swap contract, which comes at a cost or gain for traders. XM does not close and re-open positions, but it simply debits or credits trading accounts for positions held open overnight, depending on the current interest rates.

XM rollover policy

XM debits or credits clients’ accounts and handles rollover interest at competitive rates for all positions held open after 22:00 GMT, the daily bank cutoff time.

Although there is no rollover on saturdays and sundays when the markets are closed, banks still calculate interest on any position held open over the weekend. To level this time gap, XM applies a 3-day rollover charge on wednesdays.

Calculating rollover

For forex and spot metals (gold and silver)

Rollover rates for positions on forex instruments and spot metals are charged the tomorrow-next day (i.E. Tomorrow, and the next day) rate, including the XM mark-up for holding positions overnight. Tom-next rates are not determined by XM but are derived from the interest rate differential between the two currencies that a position was taken in.

Assuming that you trade in USDJPY and that the tom-next rates are as follows:

+0.5% for a long position

-1.5% for a short position

in this scenario, the interest rates in the USA are higher than in japan. A long position in the currency pair held open overnight would receive +0.5% - the XM mark-up.

Conversely, for a short position the calculation is -1.5% - the XM mark-up.

More generally, the calculation is as follows:

Here the +/- depends on rate differentials between the two currencies in a given pair.

*the amount is translated to currency points of the quote currency.

For stocks and stock indices

Rollover rates for positions on stock and stock indices are determined by the underlying interbank rate of the stock or index (for example, for an australian-listed security, that would be the interest rate charged between australian banks for short-term loans), plus/minus the XM mark-up on long and short positions respectively.

Assuming that you trade in unilever (a UK-listed stock) and that the short-term interbank rate in the UK is 1.5% p.A., for a long position held open overnight, the calculation is as follows:

-1.5%/365 – the XM daily mark-up

conversely, the calculation for a short position is +1.5%/365 – the XM daily mark-up.

More generally, the calculation is as follows (with daily rates as seen below):

Here the +/- depends on whether one has taken a short or a long position on an instrument.

Booking rollover

22:00 GMT is considered to be the beginning and the end of a trading day. Any positions which are still open at 22:00 GMT sharp are subject to rollover and will be held open overnight. Positions opened at 22:01 are not subject to rollover until the next day, but if you open a position at 21:59, a rollover will take place at 22:00 GMT. For each position open at 22:00 GMT, a credit or debit will appear on your account within an hour.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited, registration number HE251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

XM review: great for no deposit bonus offer

Should you trade with XM? Overall, XM is a very suitable broker for all traders offering numerous perks with few drawbacks.

You may have heard of XM and wondered whether they are an excellent broker or not.

XM is a subsidiary of trading point holding, which initially began operations in 2009. The broker is now globally renowned, extending its services to almost all parts of the globe with multiple financial instruments traded by over 3.5 million clients.

In this review, we will look at the XM broker and see what they have to offer.

XM’s main constant fee is their variable spreads (with no commissions) across all currency pairs. XM’s average spread on EUR/USD is 1.7 pips on their standard account and 0.8 pips on their XM ultra low micro account.

Swaps

There are also overnight swap rates based on the applicable rates for each trading day. Muslim customers can obtain an islamic or swap-free account. The decision to offer this account to non-muslim clients lies solely at the broker’s discretion.

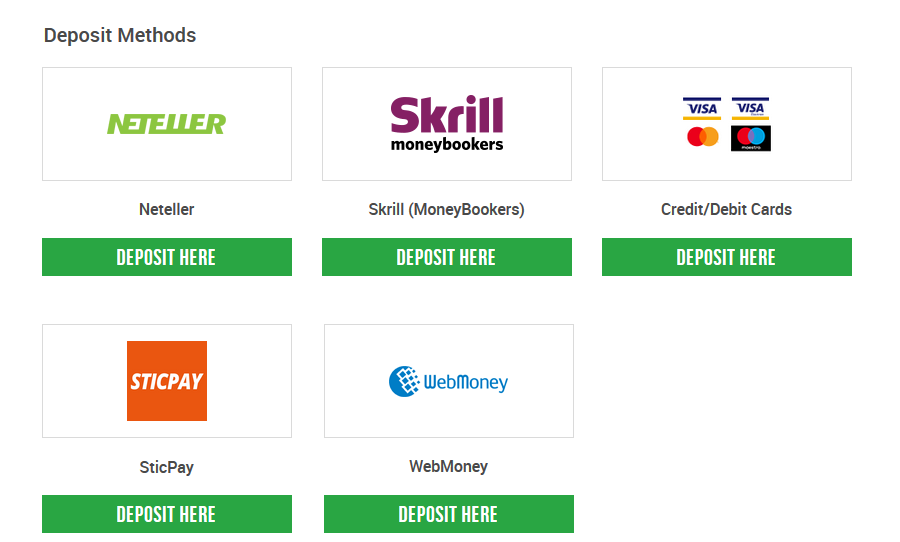

Deposit and withdrawal fees

Fortunately, there are no deposit or withdrawal fees for any of the methods as XM claims to cover these except with bank wire deposits and withdrawals less than $200.

Inactivity fees

The other fee that traders should be aware of is the inactivity or dormant fee, although it’s minor. XM deems an account inactive after 90 calendar days where there was no trading, withdrawal, depositing, transfer, or registration activity.

They charge a monthly fee of $5 or the full amount of the remaining balance if less than $5. Clients should note the inactivity fee doesn’t apply if there are no trading funds.

Accounts

Let us now dive into the procedure of opening an account with XM and the account types they offer.

Requirements for opening an account

Traders can open a demo account after a quick website registration. For live accounts, XM adheres to simple KYC (know your customer) standards. They require clients to submit a copy of their original ID (driver’s license, national ID book, or passport) and proof of address (utility bill or bank statement) in their name not older than six months.

Furthermore, their online system asks questions for suitability or compliance purposes. Passing this verification stage allows clients access to all their services, including the main live trading accounts for forex: micro, standard, and XM ultra low accounts.

Main accounts

These accounts come with a maximum leverage of 1:888, one of the highest compared to its competitors. XM’s minimum deposit required is a measly $5 for their micro, standard, and $50 for the XM ultra low.

One of the broker’s unique selling points is the ‘$30 welcome bonus’ offering new clients a $30-funded live account. There aren’t many complicated terms and conditions on this offer other than at least five round-turn trades in 30 calendar days and a minimum of 0.1 lots for total trade volume.

Deposit and withdrawals

Though this will vary depending on the region a client resides in and/or the amount funded, XM allows clients a wide array of world-recognized and accessible payment options for account funding and withdrawals.

These methods are namely all visa, mastercard, maestro and china unionpay credit/debit cards, skrill and neteller, which are all fee-free for both deposits and withdrawals (except for bank wire deposits and withdrawals under $200).

Withdrawal times

All withdrawals requested are verified within 24 hours. The funds would reflect within a day for e-wallets and two to five working days for cards and bank wire.

Withdrawal policy

As standard with most brokers, they don’t allow any third-party deposits or withdrawals due to anti-money laundering policies. Another criterion that a vast majority of brokers adhere to regarding withdrawals is a ‘return to source’ policy.

The last funding method used is given priority for withdrawals up to the sum of the original deposits. Once all withdrawals have reached the sum of the deposits made by the method/s, any subsequent withdrawal would come through via bank wire.

For example, if a client initially funded $50 via neteller, another $50 via skrill, and made $320 profit, $50 would go back to skrill, $50 back to neteller, and any portion of the profit via bank wire.

Platform and analytical research tools

The two primary trading platforms that XM offers are MT4 and MT5, both available in tablet, mobile, desktop (windows and mac), and web forms.

The broker has a broad range of research, educational, and technical tools to help their clientele.

Research tools

For research, newly-added features include a podcast, technical summaries, trade ideas, and their in-house markets overview and technical analysis research. All these features are in addition to their economic calendar, news, and youtube channel providing weekly analysis.

Educational tools

Educationally, clients can expect forex seminars at various parts globally, webinars, platform tutorials, as well as recently-included live and pre-recorded educational videos.

Technical tools

For their technical tools, these include the profit and loss calculator, swaps calculator, margin calculator, pip value calculator, and currency converter. Such tools are beneficial because they allow clients to calculate the necessary metrics using XM’s actual data rather than externally.

For example, not all brokers offer a dedicated swap calculator, meaning clients need to manually calculate the swap fee. This effort requires ensuring they are using the updated swap rates and understand the calculation their broker uses.

Using their internal swap calculator, you access an accurate reflection of their rates in a live setting and do not need manual calculations.

Pros and cons of XM

| PROS | CONS |

| – regulated by cysec, IFSC, FCA, ASIC, DFSA – offers near zero spread account- 11 years experience – ECN/STP- competitive spreads- leverage up to 1:888 – minimum deposit of $5 – negative balance protection – offers nano lots on XM ultra low – no fees on deposits and withdrawals (except for bank wire deposits under $200) – no commissions – wide range of accounts – wide range of currency pairs – wide range of payment options – wide range of base account denominations (USD, EUR, GBP, ZAR, CHF, -JPY, AUD, RUB, PLN, HUF, SGD – depending on region and account chosen) – wide range of website languages – offers both MT4 and MT5 – offers mobile app – offers $30 no deposit offer for new clients – offers cash rebates – offers 24/5 live chat, phone, and email support | – inactivity fee – doesn’t offer services to residents in the USA, canada, israel, and iran |

XM is a highly recommended forex broker suitable for all levels of traders with several perks that include competitive spreads, the $30 no deposit offer, an account to open nano lots, and no fees levied on deposits, and withdrawals, to name a few.

They only have a few disadvantages, which are barely worth mentioning when compared to the benefits. Clients interested in opening an account with XM shouldn't hesitate based on this review.

XM review

XM provides next generation online services for trading forex, precious metals, stock indices, and energies for clients in over 200 countries. It is a cysec regulated company that is also registered with the FCA (UK).

Since it was founded in 2009, XM has built a reputation for its commitment to business transparency and equally fair trading conditions for all clients. All XM clients trade with superior execution with strictly no requotes and no rejections.

XM provides all traders with the same outstanding services and trading conditions regardless of their invested capital. Opening a trading account takes less than 5 minutes and the online application form is available in over 18 languages.

For those not ready to make an investment or wanting to first test their trading strategies, a demo account with 100,000 USD in virtual currency is available without restriction or limit.When opening an account, clients are free to choose from base currency options for USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, and RUB. With tight spreads on over 60 currency pairs, the same spreads are offered on all trading account types, in addition to fractional pip pricing so that clients can trade with even tighter spreads and benefit from the most accurate pricing possible.

Account funding is 100% automatic and all deposits are processed instantly 24/7. Withdrawals are also processed on the same day via a variety of speedy yet secure payment methods. Client funds are kept in segregated accounts with top tier bank barclays UK to provide the best possible protection and to reassure client that their funds cannot be used for other purposes.A wide variety of educational material is available for all clients, with free weekly interactive webinars, MT4 video tutorials, and periodic seminars that take place in different locations around the world. XM also offers its clients the benefit of non-stop promotions and bonuses up to 100% on deposits.

Typical spread on majors - live better spreads my be offered by the broker on other accounts."alt="info" />

| headquarters | limassol, cyprus |

| type of broker | market maker |

| founded | 2009 |

| regulated by | regulated by cysec (cyprus), ASIC (australia), FCA (UK) |

| offices in | cyprus, greece, hungary, australia |

| supported languages | arabic, chinese, english, french, german, japanese, polish, russian, greek, malaysian, indonesian, hungarian, french, spanish, italian, hindi, portuguese, czech |

| ESMA regulation ? | This broker is regulated within the E.U and may be subject to ESMA's new forex and CFD trading restrictions. To find out more about these restrictions, please see this article |

| change currency | ||||

|---|---|---|---|---|

| volume | ||||

| AUDCAD | 65 | |||

| AUDCHF | 46 | |||

| AUDJPY | 78 | |||

| AUDNZD | 64 | |||

| AUDUSD | 105 | |||

| CADCHF | 26 | |||

| CADJPY | 35 | |||

| CHFJPY | 25 | |||

| EURAUD | 117 | |||

| EURCAD | 101 | |||

| EURCHF | 23 | |||

| EURDKK | 21 | |||

| EURGBP | 32 | |||

| EURHUF | 28 | |||

| EURJPY | 97 | |||

| EURNOK | 51 | |||

| EURNZD | 68 | |||

| EURPLN | 90 | |||

| EURSEK | 59 | |||

| EURTRY | 50 | |||

| EURUSD | 31 | |||

| GBPAUD | 198 | |||

| GBPCAD | 121 | |||

| GBPCHF | 64 | |||

| GBPJPY | 81 | |||

| GBPNOK | 53 | |||

| GBPNZD | 48 | |||

| GBPSEK | 130 | |||

| GBPUSD | 67 | |||

| NZDCAD | 8 | |||

| NZDCHF | 12 | |||

| NZDJPY | 32 | |||

| NZDUSD | 7 | |||

| SGDJPY | 51 | |||

| USDCAD | 52 | |||

| USDCHF | 16 | |||

| USDDKK | 14 | |||

| USDHKD | 1 | |||

| USDHUF | 22 | |||

| USDJPY | 38 | |||

| USDNOK | 41 | |||

| USDPLN | 23 | |||

| USDRUB | 104 | |||

| USDSEK | 15 | |||

| USDSGD | 46 | |||

| USDTRY | 17 | |||

| volume chart for the selected currency, green chart values are higher than XM's' volume, red values are lower. " /> | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

XM reviewsTo submit your own forex broker review please fill in the form below. Your review will be checked by a moderator and published on this page. Please ensure that you use a valid email address when posting your review and check your email after submitting the review - we will send you an email with a confirmation! Xm forex swap freeXm com review 2019 is xm com A scam or legit forex broker   Xm forex review 2019 is it A safe broker pros cons Top 10 best swap free forex brokers for 2019 brokers swap free  Mt4 swap free forex brokers mt4 islamic account brokers Xm broker review 2019 is xm trading any good forexbrokers co za  Octafx fix xm zero or fbs zero spread best account for news Best stock brokers for forex trading 2019 trade forex broker xm  Akun islamic xm akun free swap xm  How much is the commission fee on xm ultra low spread account faq  7 best swap free forex halal S! Ites mobilei95 How to calculate xm S swap points Best forex brokers in oman in 2019 Forex brokers with swap free accounts features of islamic fx accounts Top 10 migliori broker forex swap-free per il 2021Stai cercando i migliori broker swap-free perché vuoi evitare di pagare una commissione per tenere una posizione aperta più di un giorno? Innanzitutto, come è noto, molti broker caricano commissioni swap quando una posizione viene mantenuta aperta per più di un giorno, e può essere una cifra affatto trascurabile. Anche se ci sono molti broker che non caricano commissioni swap, è importante controllare se questo è vero anche quando la posizione rimane aperta per periodi più lunghi. Ad esempio, dopo 5 giorni, il broker potrebbe incominciare ad addebitare delle commissioni per la posizione aperta. Non solo, alcuni broker offrono conti swap-free solo ai mussulmani. Non accontentarti semplicemente di un broker senza swap, trovane uno rispettabile e in linea con il tuo stile di trading.  I 10 migliori broker swap-freeVuoi iniziare a fare trading come un PRO ? Scegli il tuo miglior trading broker Vuoi iniziare a fare social trading? Scegli il tuo miglior social trading broker

74-89% dei conti CFD retail perde denaro 1. IC marketsPer coloro che vogliono evitare swap, il conto islamico di IC market è la miglior opzione disponibile in assoluto. Oltre a non avere commissioni swap, il conto è disponibile sia su MT4 sia su MT5, con oltre 90 strumenti disponibili e una leva fino a 1 su 500. Non solo, con IC markets l’accesso al mercato è ECN (probabilmente la migliore caratteristica del conto) fornito tramite una ricca rete di partecipanti che vanno dalle migliori banche ai dark pool.

74-89% dei conti CFD retail perde denaro

76.5% dei conti CFD retail perde denaro 2. PepperstoneIl conto swap-free di pepperstone è incredibilmente popolare e ricco di ottime funzionalità. Gli ordini vengono piazzati tramite STP (straight through processing) e i trader hanno molta libertà su come impostare la propria strategia di trading: che sia scalping o hedging, non viene caricata nessuna commissione. Negli ultimi anni, pepperstone è ritenuto da molti il miglior broker in circolazione.

76.5% dei conti CFD retail perde denaro

79% dei conti CFD retail perde denaro 3. FxproFxpro è tra i broker più avanzati tecnologicamente e, anche solo per questa ragione, registrarsi e aprire un conto swap-free è decisamente un’ottima idea. Per farlo, i trader devono inviare un’e-mail al back office di fxpro, chiedendo di aprire un conto swap-free. È importante tenere a mente che, oltre un certo numero di giorni, su alcuni specifici strumenti verranno caricate delle commissioni.

79% dei conti CFD retail perde denaro

69.75% dei conti CFD retail perde denaro Su XM, dopo aver aperto e confermato un normale conto per il trading, è possibile richiedere un conto swap-free. Non solo è privo di ogni tipo di commissioni ma offre anche una leva di 1 su 30 e le posizioni possono essere tenute aperte per tutto il tempo desiderato, senza limiti. Con XM le condizioni di trading non sono diverse da uno qualsiasi degli altri conti standard e si hanno a disposizione tutti le piattaforme supportate.

69.75% dei conti CFD retail perde denaro

74-89% dei conti CFD retail perde denaro 5. FBSIl conto swap-free di FBS è disponibile solo per i trader che risiedono in un paese in cui la religione islamica è dominante. Soddisfatta questa condizione è facile aprirlo. In FBS è importante notare che su alcune posizioni, se rimangono aperte più di due giorni, verranno caricate delle commissioni; questa eventualità è legata al tipo di posizione, acquisto o vendita.

74-89% dei conti CFD retail perde denaro

90% dei conti CFD retail perde denaro 6. FXTMI trader possono richiedere un conto swap-free a partire da uno qualsiasi dei conti disponibili su FXTM, tranne quelli su MT5; basterà contattare il servizio clienti. Non solo, FXTM ha dichiarato che chi si registra per un conto swap-free, vedrà rimborsate tutte le commissioni caricate in passato. Alcune coppie di valute molto esotiche potrebbero non essere esenti da commissioni.

90% dei conti CFD retail perde denaro

71% dei conti CFD retail perde denaro 7. AvatradeUna volta aperto un conto islamico su avatrade potrai negoziare petrolio, indici e strumenti forex senza interessi overnight. Tuttavia, quando ti registri per un conto islamico su avatrade, è importante che tu tenga a mente che non sarà disponibile il trading su criptovalute, su alcune coppie di valute esotiche e che nei conti islamici viene caricato uno spread maggiore sul valute forex.

71% dei conti CFD retail perde denaro so, let's see, what we have: forex islamic accounts about forex islamic accounts forex islamic accounts are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions, which is at xm forex swap free Contents of the article

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Comments

Post a Comment