Forex affilliates events uk 2021, forex affilliates events uk 2021.

Forex affilliates events uk 2021

The severity of political events on global markets can range from subtle, to substantial to even catastrophic.

No deposit forex bonuses

Dubbed by political pundits as ‘the most important election of our time’, the 2020 US presidential election saw joe biden’s victory over current president donald trump. Both candidates differed greatly in their approaches to topics such as social welfare, homeland security, economic growth and the ongoing coronavirus pandemic. Thus, this ideological shift has the potential to evoke greater volatility in the country’s currency. Biden’s commitment toward ‘net-zero carbon emissions by 2050’, for example, will not only impact the US fracking and fossil fuels industry but will most likely affect several markets. New environmental conscious reforms introduced by biden will certainly for at least a short period of time reduce economic growth. Enjoy super-tight spreads and up to 1:500 leverage on all 150 tradable assets including 55 currency pairs with longhornfx. Sign up here.

Recent events set to impact the forex market in 2021

2020 became one of the most volatile years for all markets. Now many market-moving events are already expected for 2021.

The foreign exchange or forex market is the largest and most active financial market in the world. Participants from all over the globe take part in trillions worth of foreign exchange transactions daily. It comes as no surprise then that due to the global and interconnectedness of the forex marketplace, events from all corners of the world can have immediate consequences on exchange rates and currency values.

Below are just some of the events that have transpired this year that are set to have consequences in 2021.

US presidential election

The severity of political events on global markets can range from subtle, to substantial to even catastrophic. Dubbed by political pundits as ‘the most important election of our time’, the 2020 US presidential election saw joe biden’s victory over current president donald trump. Both candidates differed greatly in their approaches to topics such as social welfare, homeland security, economic growth and the ongoing coronavirus pandemic. Thus, this ideological shift has the potential to evoke greater volatility in the country’s currency. Biden’s commitment toward ‘net-zero carbon emissions by 2050’, for example, will not only impact the US fracking and fossil fuels industry but will most likely affect several markets. New environmental conscious reforms introduced by biden will certainly for at least a short period of time reduce economic growth.

New COVID-19 strain and looming brexit deals in the UK

The british pound took a major hit on monday as the U.K discovered a new 70% more infectious coronavirus strain, leading other nations to temporarily restrict travel to and from the U.K. This new strain poses a major risk for the fragile rebound of the european economy. It also still remains to be seen whether vaccines will be effective against this new strain. Additionally, the uncertainty surrounding brexit trade talks has caused currencies to fluctuate as britain and the european union remain in a deadlock, while the december 31st deadline looms. Despite the challenges the currency stands to face, analysts still remain bullish on the pound heading into 2021 as the widespread distribution of a vaccine and an agreement on a brexit deal can lend their support to the GBP.

US second stimulus package

U.S. Republicans and democrats reached an agreement for the second-largest relief bill in american history at 900 billion, following the $2 trillion cares act that congress approved in march. Eligible individuals stand to receive direct stimuli payments of $600, half the amount provided in the first stimulus round. Some families will also receive an additional $600 per child. Moreover, the paycheck protection program will reopen, targeting some of the hardest-hit small businesses who can apply for a second loan.

A large majority of US leaders view the new bill as a vital step to a larger relief package in 2021, which may provide a third round of stimulus cheques among other provisions. Although the new stimulus package is set to provide real support for the economy, its announcement failed to serve as a major bullish catalyst for stocks. This could be due to the new coronavirus strain dominating headlines shifting traders’ attention. Thus, its positive impacts remain to be seen within the coming weeks.

The new year is anticipated to witness the distribution of a COVID-19 vaccine and joe biden’s new presidential administration with a split congress, the ongoing effects of which are yet to be seen. With many analysts predicting more volatility in the months to come, traders must ensure they stay up to date with all current affairs as we continue to navigate the uncertain waters brought about by the ongoing pandemic.

Enjoy super-tight spreads and up to 1:500 leverage on all 150 tradable assets including 55 currency pairs with longhornfx. Sign up here.

Disclaimer: the content of this article is sponsored and does not represent the opinions of finance magnates.

Dollar kicks off 2021 on the backfoot, gold shines

By hussein sayed, chief market strategist (gulf & MENA)

The greenback remains an unloved currency on the first trading day of 2021. Low interest rates and an improving economic outlook following vaccines rollout has led to further short selling in the US dollar, particularly against the euro and chinese yuan.

China's renminbi strengthened 1% in early monday trade, with USD/CNY crossing below 6.50 for the first time since june 2018. That has erased all chinese currency losses since the US-china trade war kicked off officially in july 2018. The strength in the chinese renminbi came despite slowing manufacturing activity. The caixin/markit manufacturing PMI slipped 1.9 points in december to 53.0. However, activity in the world’s second-largest economy remains in expansionary mode, while developed economies continue to impose lockdowns to control the virus spread.

Another supporting source for the currency comes from china's foreign exchange trade system which announced a reduction in the US dollar's weighting in the currency basket to 18.79% from 21.59%, while increasing the euro's weighting to 18.15% from 17.40%. The absence of any intervention from the PBOC or state banks would suggest further gains in the upcoming weeks with a possible retest of the 2018 lows of 6.24.

Tuesday's georgia senate runoff elections will be critical for the US dollar as a democrat win of the two senate seats could potentially unleash a lot more stimulus which simply suggests more pain for the greenback.

Gold is also starting the new year with a bang as the precious metal has surged more than 1.2% and hit a high of $1925. Multiple factors are likely to continue lending support for gold in the upcoming months. The pandemic will not disappear in a matter of weeks with tougher lockdowns also expected as covid cases continue to rise. Hence central banks will need to keep policy loose by expanding their balance sheets. And given we are starting 2021 with extraordinarily rich valuations in equity markets, gold is a must-have asset in portfolios. I think it's only a matter of time before we cross back above $2,000 and I won't be surprised if new highs are recorded in the first quarter of 2021.

Disclaimer: the content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. Forextime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

FX week ahead - top 5 events: UK jobs, australia inflation, fed meeting, mexico & US GDP

FX week ahead overview:

- The last week of the month brings about the usual smattering of event risk from around the globe.

- The US economy will be in particular focus over the coming days, with the first federal reserve rate decision of the biden presidency and the initial Q4’20 US GDP report on the docket.

- Changes in retail trader positioning suggest that the US dollar’s recent rebound may sputter.

For the full week ahead, please visit the dailyfx economic calendar .

01/26 TUESDAY | 07:00 GMT | GBP employment change (OCT) & unemployment rate (NOV)

The UK economy has been plagued by the emergence of the B117 strain of COVID-19, which UK public health officials have warned is not only more transmissible, but also has a higher rate of fatality. To no surprise, with surging infection rates in the fall and UK prime minister boris johnson pushing lockdowns at the onset of winter, UK economic data is entering a dark period.

The upcoming UK jobs report, which covers various aspects of the labor market in october, november, and december, point to a grim outlook. According to a bloomberg news survey, the UK economy lost -100K jobs in the three months through october 2020, and the unemployment rate jumped to 5.1% from 4.9%. These numbers are likely to get worse in the coming reports, and a fly in the ointment for the british pound, which has otherwise proved resilient post-brexit.

IG client sentiment index: GBP/USD rate forecast (january 25, 2021) (chart 1)

GBP/USD: retail trader data shows 40.84% of traders are net-long with the ratio of traders short to long at 1.45 to 1. The number of traders net-long is 13.02% higher than yesterday and 20.65% lower from last week, while the number of traders net-short is 15.30% higher than yesterday and 32.13% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

01/27 WEDNESDAY | 00:30 GMT | AUD inflation rate (CPI) (4Q)

Price pressures in australia remain weak, in line with what other developed economies have been experiencing through the coronavirus pandemic. According to a bloomberg news survey, the headline australia inflation rate is due in at +0.7% (q/q) in 4Q’20, the same rate as in 3Q’20. The counterbalancing factors of rebounding base metal prices and a rallying australian dollar leave headline inflation below the lower end of reserve bank of australia’s +1-3% target range. These data may be welcomed by the reserve bank of australia, which has been complaining about the strength of the aussie and its negative impact on exports.

IG client sentiment index: AUD/USD rate forecast (january 25, 2021) (chart 2)

AUD/USD: retail trader data shows 46.62% of traders are net-long with the ratio of traders short to long at 1.15 to 1. The number of traders net-long is 9.26% higher than yesterday and 8.70% lower from last week, while the number of traders net-short is 6.33% higher than yesterday and 1.55% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed AUD/USD trading bias.

01/27 WEDNESDAY | 19:00 GMT | USD federal reserve rate decision & press conference

The week ahead is largely defined by none other than the first federal reserve policy meeting of the year, which should culminate in the FOMC keeping its main interest rate on hold. After much ado about a potential tapering of its QE program, fed officials took to the airwaves in mid-january to hush a potential taper tantrum. The first meeting of the year, without a new summary of economic projections, may offer little by way of tangible policy shifts to provoke volatility.

The federal reserve pushed back against rising expectations of a more hawkish central bank, tamping down taper tantrum concerns with a bevy of speeches in mid-january. As long as fed chair jerome powell is at the helm, the FOMC will stay the course, with the intent of keeping interest rates low through 2023. Fed funds futures are pricing in a 93% chance of no change in fed rates in 2021. The january fed meeting should come and go without much fanfare.

01/28 THURSDAY | 13:30 GMT | USD growth rate (GDP) (4Q)

A bloomberg news survey is calling for US GDP to come in at +4 % annualized in 4Q’20 after surging by a record +33.4% in 3Q’20 . Depending upon where you look, estimates vary significantly . The new york nowcast estimate for 4Q’20 GDP is at +2.58 %, while the atlanta fed gdpnow model is pointing to loftier +7.5 % growth.

But the fact of the matter is that bloomberg consensus forecasts and the regional fed bank forecasts have been coming down for the past several weeks, reflecting a deceleration in US growth as the coronavirus pandemic entered its darkest days. Even though the next tranche of US fiscal stimulus was agreed upon at the end of the trump presidency, it is still possible that 1Q’21 US GDP comes out in negative territory (but we won’t find that out until april).

IG client sentiment index: USD/JPY rate forecast (january 25, 2021) (chart 3)

USD/JPY: retail trader data shows 57.84% of traders are net-long with the ratio of traders long to short at 1.37 to 1. The number of traders net-long is 7.75% higher than yesterday and 6.26% lower from last week, while the number of traders net-short is 2.04% higher than yesterday and 3.85% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/JPY trading bias.

What is expected in the forex market in 2021?

This year, the currency market was badly affected by the coronavirus pandemic. Currencies were often bought and sold based on traders’ desire to increase or decrease exposure to riskier assets rather than individual fundamentals. In 2021, traders’ attention will slowly shift to individual fundamentals, although the pandemic will remain an important factor.

U.S. Dollar

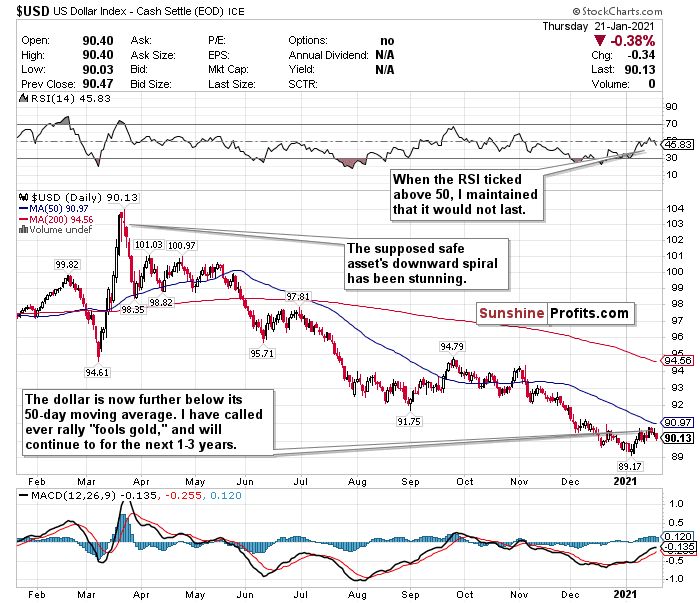

The US dollar index, which measures the strength of the US dollar against a broad basket of currencies, lost a lot of ground in 2020 when the fed cut rates while the US government gave the economy unprecedented boost.

After hitting the 103 level in march, the US dollar index fell to the 90 level. On its way down, the US dollar index only made one serious attempt to rebound in september.

Pressure on the US dollar is strong and the market consensus is that the dollar will continue to decline. While the downward move this year may seem substantial, the US dollar index could have more headroom for decline.

The US dollar index hit 71 levels back in 2008 before recovering to 88. In 2011, the US dollar index tested the 73 level.

Simply put, the current level for the american currency cannot be considered low, so it can easily gain additional downside momentum as the world economy improves and traders buy more risky currencies. The main risk to the bearish thesis is that short selling the dollar can become a very crowded trade.

Australian dollar

The australian dollar will close 2020 on a strong note. The main reason for this strength is the recent strength in the commodities segment, particularly in the iron ore market.

The reserve bank of australia’s cautious policy had little impact on AUD / USD as other central banks were also cautious.

The market consensus is that developed market rates will remain at their lows for the next few years, potentially giving the reserve bank of australia the chance to put more pressure on bond yields without hurting the australian dollar.

This year australia’s relations with its main trading partner china have deteriorated, but the interdependence of these countries is strong enough to prevent their relations from deteriorating seriously. I don’t expect any major risks on this front.

At the moment the outlook for the australian dollar looks optimistic, but its future development will depend on the continuation of the rally in the commodities segment.

British pound

The EU and UK have just managed to negotiate the brexit trade deal so the main risk to GBP / USD has not been identified.

Over the past few months, GBP / USD has risen as traders bet on the successful outcome of the brexit negotiations (and those bets paid off), but now GBP / USD traders need to find additional reasons to be bullish on the pound.

Currently, the UK is struggling to contain the new strain of coronavirus that could put additional pressure on the country’s economy. Additionally, the economy could be affected by brexit, although the magnitude of the blow will not be as severe as in the case of a no-deal brexit.

The fundamental situation appears to be challenging for the UK economy in the first half of 2021, which could put some pressure on GBP / USD, which will need additional upward catalysts after the end of the brexit negotiations. While the pound may have more wiggle room, the GBP / USD bulls will likely need help from the overall weakness of the US dollar.

Canadian dollar

Just like other major central banks, the bank of canada will be forced to provide material support to the economy until inflation shows some signs of life. Canada is also suffering from the second wave of the virus, although the situation stabilized in december. It remains to be seen whether this second wave will put additional pressure on the canadian economy.

Oil price dynamics will remain a key catalyst for USD / CAD in 2021. If WTI oil manages to stabilize above the $ 50 level and gain more upside momentum, commodity-related currencies like the canadian dollar will get an extra boost.

At this point, the outlook for the canadian dollar looks favorable. The main risk to canadian dollar bulls is the sudden general strength of the US dollar.

The european currency showed significant strength at the end of this year. In recent years, EUR / USD has been under pressure due to the cautious policy of the european central bank and the disappointing growth rates in the euro area.

However, the pandemic gave the euro significant support as traders turned their attention to the problems of the US dollar. The main question for EUR / USD in 2021 is whether it will be able to hit the 2018 highs at 1.2500.

While the ECB may be disappointed with the recent appreciation of the euro, which will put more pressure on economic growth, there is little it can do to prevent the euro from rising higher.

Interest rates are already at the low end, the asset purchase program is working, and while the ECB reiterates that it is not running out of options to support the economy, there are limits to a central bank’s power.

Traders know this, so EUR / USD bulls will likely attempt to test new highs early in 2021. If this early test shows that demand for the euro remains high, then EUR / USD has a good chance of developing a strong uptrend against the US dollar over the next year.

Conclusion

This year has been a very interesting year for forex traders, and next year is likely to be more volatile.

Market attention will be focused on the fate of the US dollar, which may come under more pressure if the fed continues to print money as the global economy recovers from the blow of the pandemic.

Commodity currencies like the australian dollar and canadian dollar may receive more support if the demand for commodities continues to grow along with the economy.

It will be very interesting to see if the british pound can continue its upward trend after the UK successfully negotiated a trade deal with the EU.

For the euro, it could be another year of strength against the US dollar despite the current problems facing the european economy.

In our economic calendar you will find all economic events of today.

This article was originally published on FX empire

More from FXEMPIRE:

Oil mixed despite positive brexit news

What is expected in the forex market in 2021?

Weekly price forecast for natural gas: natural gas at 200 weeks EMA

USD / JPY forex technical analysis – build A support base or pause before the next bounce?

Can bitcoin reach $ 100,000 in 2021? The regulators and the cops may have to compete against each other!

Crude oil price forecast – crude oil calmly heading into the holidays

Will the dollar increase in 2021?

Bank forecasts for the US dollar in 2021 bank experts predict that this will also be the case in 2021. Bank experts believe the ongoing uncertainty due to the coronavirus pandemic, a collapsing US economy, and a surge in the USD money supply will keep the USD weaker than other currencies.

Will the USD go up?

Bank forecasts for the US dollar in 2020 amid uncertainty caused by the coronavirus pandemic, a collapsing US economy, and a surge in the US dollar supply, the US dollar fell nearly 10% from over 3-year highs in march. Most banks expect the US dollar to end the year weak against other currencies.

What will happen to the dollar in 2021?

2021 could be the worst year for the US dollar, at least until 2022, ”added the economist. Stephen roach, world-famous analyst and former chief economist at morgan stanley, says the USD has a 50% chance of collapsing by the end of next year.

What is the main news in forex?

# 1: unemployment rate all of a central bank’s major monetary policy decisions are to keep it close to the unaccelerated unemployment rate, or NAIRU. All major economies publish monthly statistics on the unemployment rate, the lower it is. The better the valuation of the currency gets.

What is the best forex news site?

Top forex news sites that follow daily

- Forexnews. …

- Fx empire. …

- Babypips. …

- Forexlive. …

- Investing.Com. …

- Dailyfx. …

- Forex factory. …

- Fxstreet. Fxstreet is without a doubt one of the top sites that forex traders should check out on a daily basis.

What kind of news moves the forex market?

1. Central bank meetings. The most important high-impact forex news releases are central bank meetings and interest rate decisions. With a mandate to control inflation and ensure the value of the local currency remains stable, central bank meetings have the greatest impact on the volatility of the forex market.

Can the forex market crash?

The short answer to this question is yes and no. Forex markets cannot crash completely, but certain currencies can crash at any time. Crashes in the forex markets differ significantly from those in the stock markets in that forex crashes usually involve a specific currency.

Is it a good time to trade forex?

The best hours to trade forex the best time to trade is when the market is at its most active. … when only one market is open, currency pairs tend to move in a tight pip spread of around 30 pips. Two markets opening at the same time can easily see a move north of 70 pips, especially when big news is released.

Who moves the forex market?

The central banks move the currency markets dramatically through monetary policy, setting the exchange rate regime and, in rare cases, through currency interventions. Companies trade currencies for global business operations and to hedge against risks. Overall, investors can benefit from knowing who is trading forex and why they are doing it.

Is sunday a good day to trade forex?

Worst trading hours: sundays – everyone is sleeping or enjoying their weekend! Fridays – liquidity decreases in the final part of the US session. Holidays – everyone is taking a break. Major news events – you don’t want to whip!

Which currency pair is the most profitable in forex?

- EUR USD. This can be considered the most popular forex pair. …

- GBP / USD. Profitable pips and possible big jumps have contributed a lot to the popularity of the GBP / USD. …

- USD / JPY. This is another popular currency pair that can be seen regularly in the world of forex trading.

Should I trade futures or forex?

| Benefits | forex | futures |

|---|---|---|

| minimal or no commission | YES | no |

| up to 500: 1 leverage | YES | no |

| price security | YES | no |

| guaranteed limited risk | YES | no |

What is the easiest way to trade?

A market order is an order to buy or sell a security (e.G. A share) at the currently best available market price. Market orders are the most common type of order as they are the fastest, easiest way to buy and sell stocks.

What is more profitable futures or forex?

Don’t get me wrong, futures is great, I love it, but forex is much more profitable. It’s more profitable for a number of reasons, but the main one is this: … forex has active traders at different parts of the day and night. Futures are pretty boring about an hour after opening the normal pit.

What is the safest way to trade?

Trading options trading options is a safer investment because it offers the freedom to control a stock or other asset that benefits from its price movement without owning it. Options are usually cheap because they usually expire after a few weeks or a month.

Economic calendar

Displaying:

CHANGE TIME ZONE

LEGEND

Trade a demo account risk free

Trade market events in live market conditions for 30 days.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Your form is being processed.

Trade your strategy

Latest research

- Traders still pushing silver higher. Could it really be the next GME? January 29, 2021 4:18 PM

- What is a short squeeze and how can it be predicted? January 29, 2021 4:08 PM

- What is short selling and how do you short a stock? January 29, 2021 3:11 PM

read latest research

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

US market open: will there be a bullish start to 2021?

Joshua warner december 31, 2020 12:20 PM

US markets are expected to have a mixed start to the last trading day of 2020, capping off a year of strong gains and new record highs, as investors look to 2021 with increasing confidence.

/media/research/global/news-analysis/featured-image/trading-floor-2.Jpg?Layout=responsive" alt="trading floor 2" />

European markets have mixed end to the year

The latest US stimulus package has dominated headlines in recent weeks. A $2.3 trillion package, including a $900 billion COVID-19 relief package, was approved last week but politicians have continue to argue over certain aspects, such as whether direct payments to citizens should be raised from $600 to $2000.

Republicans in the senate have essentially killed any hopes of the stimulus bill being changed after attaching the proposal to up payments to other measures that the democrats do not support. Democrats pushed for more money for citizens after president donald trump asked for them to be increased, but most of his fellow republicans are against the idea because it would cost too much.

With the stimulus bill now largely sorted, attention turns to two senate run-off races in georgia. This will see two incumbent republican senators face-off against democrat opponents in a vote on january 5 – a requirement as no candidates secured over 50% of the vote in the november election.

It is a significant vote as it could swing the control of the senate. Currently, republicans have a slim majority but, if the democrats win both seats then it would be an equal 50:50 split between both parties – which would benefit the democrats as it would give the final say to vice-president kamala harris.

Politicians have been keen to tie-up the stimulus bill before the vote to avoid any disruption should the senate change hands, and the slim timeframe means it is unlikely to be changed beforehand. Still, the dispute over payouts could filter through to the election, with democrats arguing republicans have stopped citizens receiving more money while republicans argue they are being fiscally responsible.

Four-and-a-half years after voting to leave the EU, the last stage of brexit will finally take place at 2300 GMT tonight, when the transition period formally ends. UK politicians overwhelmingly backed the brexit deal struck on december 24 during a vote yesterday, stamping its divorce from the EU into law. EU ambassadors have provisionally accepted the deal and the bloc intends to formally ratify it during january.

Although the deal has tried to minimise disruption, brexit will bring about huge changes that businesses will have to adapt to. The UK is leaving the single market and customs union, and many sectors – such as financial services – remain largely uncovered by the new deal.

Much of the uncertainty that has plagued the market this year, whether it be brexit, the latest US stimulus package or tensions between the US and china, is disappearing as we enter 2021. Brexit is sorted, the latest US stimulus package is largely done and dusted, and relations between the world’s two biggest economies is expected to improve when joe biden becomes president on january 20.

The one major unknown heading into 2021 is how quickly the global economy will be able to recover from the coronavirus pandemic. Confidence has grown as vaccines are rolled-out and because central banks remain committed to accommodating a recovery, but surging cases and hospitalisations show we are not yet out of the woods.

Brent was trading 0.8% lower at $51.08 at midday from $51.48 at the close yesterday, while WTI followed lower to $47.96 from $48.34.

The EIA natural gas storage change, providing an insight into US stockpiles, is scheduled at 1700 GMT today.

Market-moving events in the economic calendar

Look at all the scheduled events for today using our economic calendar, and stay up to date with the latest news and analysis here.

25 best UK forex brokers for 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

Trading forex (currencies) in the united kingdom (UK) is popular among residents. Before any fx broker can accept UK forex and CFD traders as clients, they must become authorised by the financial conduct authority (FCA), which is the financial regulatory body in the UK. The FCA's website is FCA.Org.Uk. We recommend UK residents also follow the FCA on twitter, @thefca.

The FCA was formed out of the financial services act of 2012, effectively replacing its predecessor, the financial services authority (FSA). For a historical breakdown, here's a link to financial conduct authority webpage on wikipedia.

Best UK forex brokers for 2021

To find the best forex brokers in the UK, we created a list of all FCA authorised brokers, then ranked brokers by their trust score. Here is our list of the top UK forex brokers.

- IG - best overall broker 2021, most trusted

- Saxo bank - best for research, trusted global brand

- CMC markets - best web platform, most currency pairs

- Interactive brokers - great for professionals and institutions

- City index - excellent all-round offering

- XTB - best customer service, great trading platform

- FOREX.Com - great all-round offering

- Etoro - best copy trading platform

Best forex brokers UK comparison

Compare UK authorised forex and cfds brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by the firm's forexbrokers.Com trust score.

| Forex broker | accepts GB residents | authorised or regulated by the FCA | average spread EUR/USD - standard | minimum initial deposit | trust score | overall | visit site |

|---|---|---|---|---|---|---|---|

| IG | yes | yes | 0.745 | £250.00 | 99 | 5 stars | visit site |

| saxo bank | yes | yes | 0.800 | $10,000.00 | 99 | 5 stars | visit site |

| CMC markets | yes | yes | 0.740 | $0.00 | 99 | 5 stars | N/A |

| interactive brokers | yes | yes | N/A | $0 | 94 | 4.5 stars | N/A |

| city index | yes | yes | 1.100 | £50.00 | 93 | 4.5 stars | N/A |

| XTB | yes | yes | 0.860 | $0.00 | 92 | 4.5 stars | visit site |

| FOREX.Com | yes | yes | 1.400 | $100.00 | 93 | 4.5 stars | N/A |

| etoro | yes | yes | 1.00 | $200 | 91 | 4 stars | visit site |

| swissquote | yes | yes | N/A | $1000.00 | 99 | 4 stars | N/A |

| FXCM | yes | yes | 1.400 | £300 | 92 | 4 stars | N/A |

| avatrade | yes | 0.910 | $100.00 | 93 | 4 stars | visit site | |

| FP markets | yes | 1.140 | $100 AUD | 81 | 4 stars | visit site | |

| plus500 | yes | yes | 0.600 | €100 | 98 | 4 stars | visit site |

| pepperstone | yes | yes | 1.160 | $200.00 | 90 | 4 stars | visit site |

| IC markets | yes | 0.800 | $200 | 83 | 4 stars | visit site | |

| tickmill | yes | yes | 0.530 | $100.00 | 81 | 4 stars | visit site |

| fxpro | yes | yes | 1.510 | $100.00 | 89 | 4 stars | visit site |

| vantage FX | yes | yes | 1.350 | $200 | 79 | 3.5 stars | N/A |

| moneta markets | yes | yes | 1.300 | $200.00 | 79 | 3.5 stars | N/A |

| HYCM | yes | yes | 2.00 | $100 | 84 | 3.5 stars | visit site |

| eightcap | yes | $100 | 69 | 3.5 stars | N/A | ||

| VT markets | yes | 1.30 | $200 | 79 | 3.5 stars | N/A | |

| blackbull markets | yes | 0.76 | $200 | 70 | 3.5 stars | N/A | |

| octafx | yes | 1.100 | $5 | 59 | 3.5 stars | N/A | |

| hotforex | yes | yes | 1.20 | $50 | 83 | 4 stars | N/A |

| easymarkets | yes | 0.900 | $100.00 | 81 | 3.5 stars | N/A |

How to verfiy FCA authorisation

To identify if a forex broker is licensed to operate in the united kingdom (UK), the first step is to identify the register number from the disclosure text at the bottom of the broker's UK homepage. For example, here's the key disclosure text from IG's website,

Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority."

Next, look up the firm on the FCA website to validate the register number is, in fact, legitimate. Here is the official FCA page for IG markets limited.

Summary

To recap, here are the best UK online forex brokers.

More forex guides

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

IG - 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

OANDA - cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Plus500uk ltd is authorised and regulated by the financial conduct authority (FRN 509909).

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

10 best seminars for forex traders

Attending a seminar in person can be one of the most rewarding ways to learn; with access to inspirational speakers, who impart invaluable information that they have amassed during their years in the business.

Seminars are useful for live demonstrations of new and existing forex trading software and tools, as well as for discovering trading strategies, learning new techniques, and discussing the latest industry trends.

Trading expos and events enable traders to attend a variety of seminars and workshops delivered by some of the most capable trading professionals. Events are hosted around the world and are also a good forum for meeting other traders and exchanging knowledge.

Here are just a few of the best seminars and events for traders.

MENA financial forum & expo (MENA FFXPO)

This middle east and north africa financial expo is held in dubai, usually twice a year around april and november time. The popular, two-day event is free of charge and attended by over 1500 individual traders, brokers, and investment firms. It is an ideal opportunity to gain insight from industry experts, benefit from exclusive trading opportunities, and discover the latest products and tools available on the market.

Speakers from leading brokers such as avatrade, fxpro, hotforex, and activtrades are amongst the many to have been featured on the conference agenda.

The london / leeds investor show

Investor conferences ltd run a series of conferences in london and the north of england; including the london forex show, which specialises in currency market trading. There are numerous free seminars, workshops, and interactive exhibitions available to take part in at these premier trading events. Register in advance to benefit from a free place at the conference, as tickets on the door incur a fee. This was priced at £25 in previous years, but may be subject to change.

The show offers the opportunity to mix with other traders and experts, build knowledge, learn new strategies, and sharpen trading skills. The event program has previously included bar patterns, personal experiences related by successful traders, and introductions to new trading platforms.

Just some of the brokers that have participated in the shows include CMC markets, DF markets, activtrades, and roboforex.

Ifx EXPO international

This premier networking event is primarily for businesses and industry professionals, but can also be of significant benefit to individual traders.

The well-attended conference welcomes more than 2500 visitors and has featured topics such as security within the forex world, china / asia market strategies, and breakthrough trading products. If the seminars are too business orientated, traders can take advantage of the many exhibitions on offer.

Etoro and fxprimus have been amongst the many leading brokers that featured at this event.

China forex expo

This enormous conference is visited by thousands of attendees over the course of two days and features more than 60 exhibitors. It is an opportunity for traders to meet with brokers from around the world, learn about their trading platforms and gain an introduction to the exciting chinese forex market.

Talks have been provided by famous forex analysts, globally renowned brokers, and talented currency market players, offering a wealth of tips for traders.

World forex expo

These international conferences are held in bangkok (thailand), makati (philippines), moscow and kiev (ukraine). The events are open to all traders, and feature exhibitions and seminars from FX brokers, technology suppliers, investment companies and other financial institutions and organisations.

The financial expo in moscow is the largest of its kind in russia, covers a range of financial services, and has more than 3000 attendees over the course of two days.

Workshops, seminars, live demonstrations and other interactive training sessions are provided by key industry experts from brokers such as global FX; and special offers are exclusively available to attendees of the conference.

Showfx world financial conference

The showfx world financial conferences take place in cities around the world throughout the year, including bratislava, moscow, almaty (kazakhstan), singapore and kiev (ukraine). Registration is free for the one or two-day conferences, and provide visitors with access to free seminars, workshops, and exhibitions for traders to engage with.

Industry experts providing seminars at the events and exhibitions have been featured from windsor brokers, finotec, and XTB, amongst others.

Valuable prizes are also given away at the conferences, such as the latest model mobile phones and tablets.

Showfx asia

Part of the showfx world conference group, showfx asia is an annual event held in singapore that enables traders to meet with and learn from brokers, financial experts, successful traders, and instructors.

The event hosts a range of seminars and business meetings, inspirational talks and training sessions, as well as offering high-value prizes to attendees.

Just some of the topics covered in the seminars include learning practical and timesaving strategies, and how to recognise trading mind traps.

Master investor

Another major trading & investing event taking place in the UK is the master investor show. This is tailored towards retail traders and investors and features exhibitors, live trading sessions, debates, and many more learning and networking opportunities.

XM international forex seminars

XM are a member of the trading point group and registered in the UK as trading point of financial instruments UK limited. They host forex seminars around the world on a regular basis, with events previously being held in venice, dubai, london, bangkok, budapest, and athens, among other locations.

The seminars cover topics such as technical analysis techniques, risk management, and trend identification.

IG markets ltd.

IG offer live, in-person seminars in london, covering topics such as advanced technical analysis and spread betting using charts. The seminars are hosted by market experts from the firm and are based in the IG headquarters in london.

Ready to find your broker?

Brokernotes ltd is an appointed representative of resolution compliance ltd, which is authorised and regulated by the financial conduct authority (FRN: 574048). Brokernotes ltd is registered in england and wales. Company no. 10464674. Registered office: thames wing, howbery park, wallingford, OX10 8BA, UK.

Emerging markets stocks and etfs for 2021

There’s not a rigid definition of what an emerging market is. For example, china is still the leading country in many emerging market etfs and funds. But is it fair to consider china an emerging market any longer? It has nearly 1.4 billion people and was the only major economy globally to see GDP growth in 2020.

That’s like calling giannis antetokounmpo an up and coming superstar despite winning the last two NBA MVP awards.

75% of retail CFD investors lose money

But even if I did see china as an emerging market, it wouldn’t be my top choice for 2021.

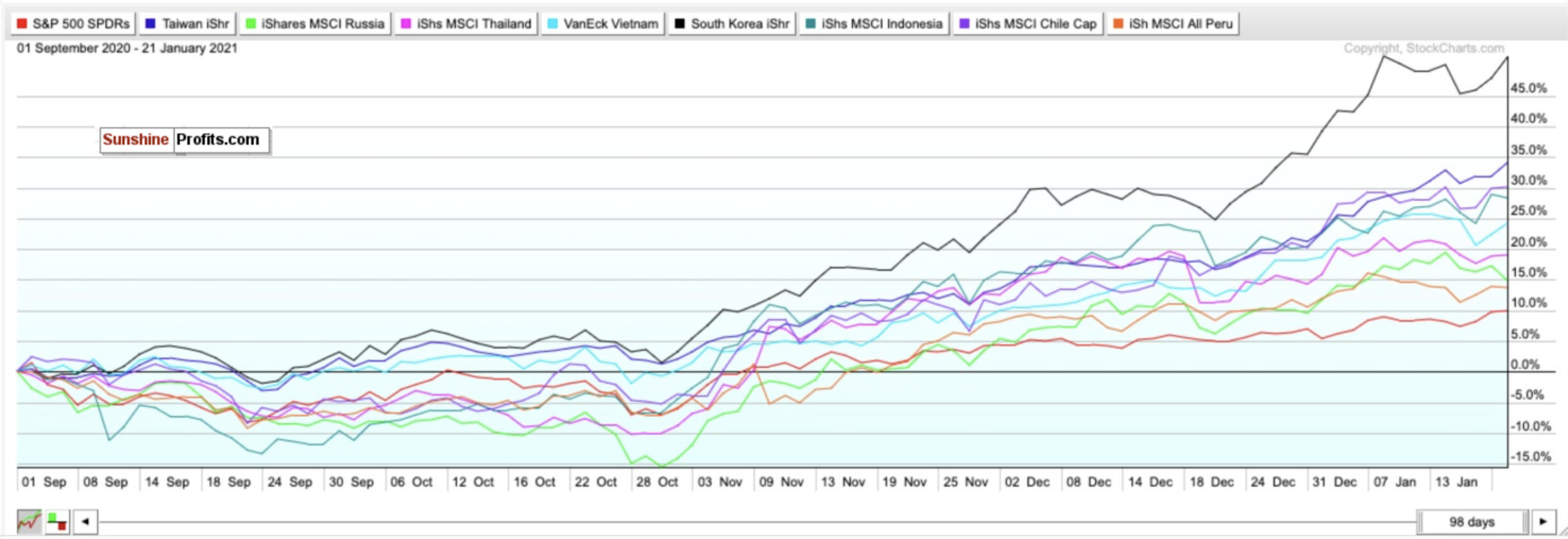

If you’ve been reading my newsletters, you know that I love emerging market exposure this year. The dollar is weakening and should continue to weaken with trillions more in stimulus and rising commodity prices.

Meanwhile, emerging markets are perfectly positioned to exploit this and grow as a result.

You also know that I’ve been talking about specific emerging markets like taiwan, thailand, and russia.

But in this special emerging markets newsletter , I will aim to further talk about what to look for when investing in a country, what other emerging markets to consider, and why I think they are set to outperform the US markets this year, after many years of underperformance.

Why emerging markets?

For one, did you know these facts about emerging markets? They have:

-85% of the world population

-63% of global commodities

-59% of global GDP (using PPP)

-12.5% of world’s market cap

Consider this for long-term investing too. Advanced economies are aging rapidly while emerging economies have youthful demographics.

That’s why PWC believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average.

For emerging markets, this could be very advantageous in the coming decades.

With american debt building up at an alarming rate, and the U.S. Dollar set for broader declines, this trend could begin sooner than we realize.

U.S. Investors also usually have >5% exposure to emerging markets, making this an even more untapped opportunity.

Aren’t emerging markets risky?

Of course, you have to consider political risk, credit risk, and economic risk for emerging markets.

But did you see the U.S. Capitol two weeks ago? Have you noticed how its currency has performed since march?

Have you also seen the fed’s balance sheet? Have you seen the S&P’s valuation and the tech IPO market?

I would even argue that emerging markets could hedge against america’s political, economic, and currency risks right now. The pandemic only exacerbated this.

Furthermore, if you look at the returns of the emerging markets I will discuss today: taiwan (EWT), russia (ERUS), thailand (THD), vietnam (VNM), south korea (EWY), indonesia (EIDO), chile (ECH), and peru (EPU), you will see that all have outperformed the S&P 500 (SPY) since september.

Figure 2-SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- sep. 1, 2020-present

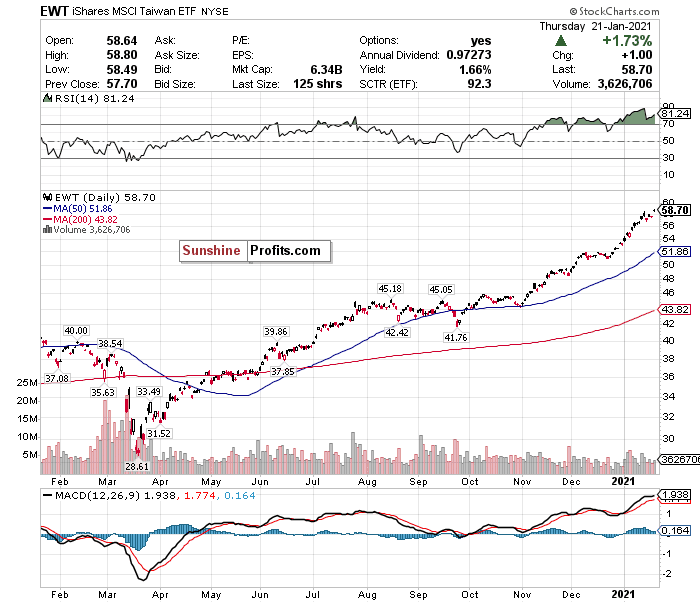

Taiwan ishares ETF (EWT)

Figure 3-ishares MSCI taiwan ETF (EWT)

The taiwan ishares ETF (EWT) has overheated more than the other emerging market etfs based on its RSI that I will discuss. But if you’ve been reading my newsletters, you know I love taiwan.

Taiwan has also arguably been the best call I’ve made since starting these newsletters.

I have been consistently calling taiwan a better buy than china, despite china’s undeniable upside. Taiwan has the same sort of regional upside, without the same kind of geopolitical risks.

Consider this too. Despite china’s robust economic response to COVID-19, retail sales still fell 3.9% over the full year, marking the first contraction since 1968. Lockdowns have also returned to china with a vengeance thanks to a new wave in COVID-19 infections.

Ever since I called the EWT a buy on december 3rd, it has gained nearly 16% and outperformed the MSCI china ETF (MCHI) by approximately 3%.

It has also outperformed the SPY S&P 500 ETF by nearly 11%.

Taiwan also is unique for a developing country because of its stable fundamentals. It has low inflation, low unemployment, consistent trade surpluses, and high foreign reserves.

It also has a diverse and modern hi-tech economy, especially in the semiconductor industry. With a diverse set of trade partners, taiwan could only be scratching the surface of its potential.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter – it’s absolutely free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to the premium daily stock trading alerts as well as our other alerts. Sign up for the free newsletter today!

For a look at all of today’s economic events, check out our economic calendar.

Matthew levy, CFA

stock trading strategist

sunshine profits: effective investment through diligence & care

All essays, research, and information found above represent analyses and opinions of matthew levy, CFA and sunshine profits’ associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, matthew levy, CFA, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Levy is not a registered securities advisor. By reading matthew levy, CFA’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading, and speculation in any financial markets may involve high risk of loss. Matthew levy, CFA, sunshine profits’ employees, and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

So, let's see, what we have: the forex market is the largest and most active financial market in the world with participants taking part in trillions worth of forex transactions daily. At forex affilliates events uk 2021

Contents of the article

- No deposit forex bonuses

- Recent events set to impact the forex market in...

- 2020 became one of the most volatile years for...

- US presidential election

- New COVID-19 strain and looming brexit...

- US second stimulus package

- Dollar kicks off 2021 on the backfoot, gold shines

- FX week ahead - top 5 events: UK jobs, australia...

- FX week ahead overview:

- 01/26 TUESDAY | 07:00 GMT | GBP employment change...

- IG client sentiment index: GBP/USD rate forecast...

- 01/27 WEDNESDAY | 00:30 GMT | AUD inflation rate...

- IG client sentiment index: AUD/USD rate forecast...

- 01/27 WEDNESDAY | 19:00 GMT | USD federal reserve...

- 01/28 THURSDAY | 13:30 GMT | USD growth rate...

- IG client sentiment index: USD/JPY rate forecast...

- What is expected in the forex market in 2021?

- U.S. Dollar

- Australian dollar

- British pound

- Canadian dollar

- Conclusion

- Will the dollar increase in 2021?

- What is the main news in forex?

- What is the best forex news site?

- What kind of news moves the forex market?

- Can the forex market crash?

- Is it a good time to trade forex?

- Who moves the forex market?

- Is sunday a good day to trade forex?

- Which currency pair is the most profitable in...

- Should I trade futures or forex?

- What is the easiest way to trade?

- What is more profitable futures or forex?

- What is the safest way to trade?

- Economic calendar

- Displaying:

- CHANGE TIME ZONE

- LEGEND

- Trade your strategy

- Try a demo account

- US market open: will there be a bullish start to...

- US markets are expected to have a mixed start to...

- 25 best UK forex brokers for 2021

- Best UK forex brokers for 2021

- Best forex brokers UK comparison

- How to verfiy FCA authorisation

- Summary

- More forex guides

- Methodology

- Forex risk disclaimer

- 10 best seminars for forex traders

- MENA financial forum & expo (MENA FFXPO)

- The london / leeds investor show

- Ifx EXPO international

- China forex expo

- World forex expo

- Showfx world financial conference

- Showfx asia

- Master investor

- XM international forex seminars

- IG markets ltd.

- Ready to find your broker?

- Emerging markets stocks and etfs for 2021

- Why emerging markets?

- Aren’t emerging markets risky?

- Taiwan ishares ETF (EWT)

Comments

Post a Comment