Real-time virtual fx trading online

Real-time virtual fx trading online

Disclaimer: trading foreign exchange (“forex”), commodity futures, options, contract for difference ("cfd") and spread betting on margin (the "investment products") carry a high level of risk, and may not be suitable for all investors.

No deposit forex bonuses

Before deciding to trade using the investment products you should carefully consider your monetary objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your deposited funds and therefore you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with the investment products, and seek advice from an independent advisor if you have any doubts. You understand that there is no strategy provider or recommendation service that is free from the risk of loss. You also understand that the transfer of third party trading signals by the application to your brokers trading account, shall not in any event constitute the provision of investment services or advice by duplitrade. In making a decision to follow a specific third party trading signal, account, portfolio and/or strategy, you have considered your entire financial situation including financial commitments and you understand that you could sustain significant losses in your account. Duplitrade does not imply or guarantee that you will make a profit and you agree that neither duplitrade nor any of its officers, directors, employees, consultants, agents or affiliates will be held responsible for the performance of the trading signals generated by third parties and transferred by the application to your brokers trading account or trading losses in your account. If you do not agree with the terms of the disclaimer, please exit the website and do not use any of its investment products. (the terms of your and application shall have the meaning ascribed to them in the end user license agreement)

Real-time virtual fx trading online

Duplitrade is operated by DT direct investment hub ltd. DT direct investment hub ltd is a cyprus investment firm (CIF) regulated and supervised by the cyprus securities and exchange commission with CIF licence number 347/17 and company registration number HE354263

Disclaimer: trading foreign exchange (“forex”), commodity futures, options, contract for difference ("cfd") and spread betting on margin (the "investment products") carry a high level of risk, and may not be suitable for all investors. Before deciding to trade using the investment products you should carefully consider your monetary objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your deposited funds and therefore you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with the investment products, and seek advice from an independent advisor if you have any doubts.

Past performance results are not necessarily indicative of future results. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The performance results of the demonstration ("demo") account displayed on this website imitating real time transactions made by investors using the investment products in real accounts, do not guarantee that same results would have been achieved if you were to imitate the foregoing transactions in real time using a real account. In fact, there are frequently sharp differences between performance results using the demo account and performance results achieved by using any particular investment product and third party trading signals in real account, due to factors related to the involvement of your broker in the transaction and technical limitations and capabilities, which are not under the control of duplitrade. Finally, there are numerous other factors related to the markets in general or to the implementation of any specific investment product and third party trading signal which cannot be fully accounted for by past performance results. Prospective clients should be particularly wary of placing undue reliance on past performance results and should not base their decision to use any investment product and/or any third party trading signal solely on the past performance presented. The investment products described herein have been developed for sophisticated traders who fully understand the nature and the scope of the risks that are associated with trading. Therefore, in making an investment decision, prospective clients must also rely on their own examination of the person or entity making the trading decisions and the terms of the advisory agreement including the merits and risks involved.

You understand that there is no strategy provider or recommendation service that is free from the risk of loss. You also understand that the transfer of third party trading signals by the application to your brokers trading account, shall not in any event constitute the provision of investment services or advice by duplitrade. In making a decision to follow a specific third party trading signal, account, portfolio and/or strategy, you have considered your entire financial situation including financial commitments and you understand that you could sustain significant losses in your account. Duplitrade does not imply or guarantee that you will make a profit and you agree that neither duplitrade nor any of its officers, directors, employees, consultants, agents or affiliates will be held responsible for the performance of the trading signals generated by third parties and transferred by the application to your brokers trading account or trading losses in your account. If you do not agree with the terms of the disclaimer, please exit the website and do not use any of its investment products. (the terms of your and application shall have the meaning ascribed to them in the end user license agreement)

Please refer to our risk disclosure for more detailed information.

7 sites where you can easily learn stock trading without risking your money

POSTED BY jagoinvestor ON may 22, 2018 COMMENTS (30)

Do you want to learn stock trading, but don’t want to lose money in the process? In this article, I’m going to tell you about 7 best virtual trading websites or apps which will help you to learn stock trading without risking your money.

A lot of investors are excited to know about stock markets and how they can make a lot of money. They open a demat account and start trading based on tips from various third party websites, or using their own judgment. But in the process, they lose a lot of money because of various mistakes.

However now, it’s easy to first practice stock trading. Have you heard about virtual stock practicing apps or websites? Have you ever tried using them?

How virtual stock trading works?

Let me explain virtual stock in market india for those who are new to this

- You open an account on the virtual trading platform or app

- Then login to the account and load some virtual money in the account like 1 lacs or 10 lacs to start with

- You can then start buying and selling various stocks as you do in real life

- Like this, you can make various trades and see your profits and loss over time

- Over the next few weeks, you will learn how stock market trading works and you can also see how you have performed

- Once you are confident about your abilities, then you can open a real trading account and start stock trading with your real money

Now let’s look at some of the websites which you can use to practice stock trading.

1) moneybhai

Moneybhai, a virtual stock trading game is a product of money control virtual trading which is popular in india. In this game you will get rs.1 crore virtual money on your portfolio account and also the limit of rs.1 crore intraday trading limit, which means that you can only buy and sell worth rs 1 crore in a day.

You will have the option to invest in stocks, mutual funds, FD, bonds, etc. So here you have lots of options for investing with the imaginary brokerage charge of 0.50% in the virtual trade market. This is a great feature because here you are also paying virtual brokerage charge which you have to pay in real life when you trade with your real money, so that is taken care in this website.

Who should use this one: if you want a lot of options to invest like FD, bonds, mutual funds, stock, etc. Then this game is good for you.

You can start trading at any moment once you are logged in. If you feel that you have made any mistake in investing or you went wrong at any point then you can reset your portfolio back to the original corpus of rs.1 crore and start again. I personally feel that one should not use that option of reset because then you don’t know how you are performing exactly.

2) trakinvest

Trackinvest as the name suggests itself is an investment guide. It is build up by considering the beginner’s point of view. If you have heard of the stock market but don’t have enough basic knowledge then this website will guide you in your virtual investment.

Who should use this one : if you are an absolute beginner who has no understanding of how the stock market works and you also need tutorials to educate yourself, then you can try this.

The simple interface and helpful content will ease you into the world of trading. It is more easy than it actually looks. It enables learners by giving a better understanding of the market. You can build your portfolio with zero risks and improve your market skills.

It gives the investors access to the real stock market from multiple global exchanges to trade-in. It also builds up your portfolio like an expert and tests your investment strategies and leverage analytics.

3) dalal street

Dalal street is an investment journal that offers you rs.1,000,000 as virtual money at the initial stage and provides an experience of real time stock trading with a virtual portfolio.

Who should use this one: one who wants to learn stock trading by using investment journals can get the advantage of this website.

Here you can also discuss your strategies with like-minded participants in a group. This will help you to improve your skills and strategies by other people’s experiences.

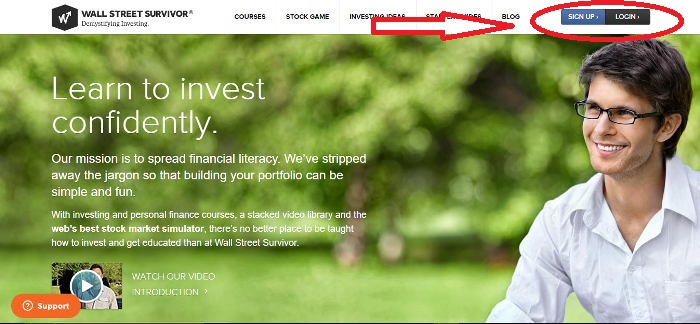

4) wall street survivor

Here you can get the actual experience of stock trading with the virtual money because of the updated data. Wall street survivor doesn’t believe in the concept of teaching through content only. As per their opinion investment is more like fun, challenging and potentially lucrative activity rather than education.

Who should use this one: if you want practical knowledge through tutorials and improve your skills and decision making which will found new strategies then try this site.

This website also offers some courses to educate you about stock trading and tests your knowledge about investment and personal finance. They have lots of articles and videos which will keep you engage in various activities by aiming to improve your skills.

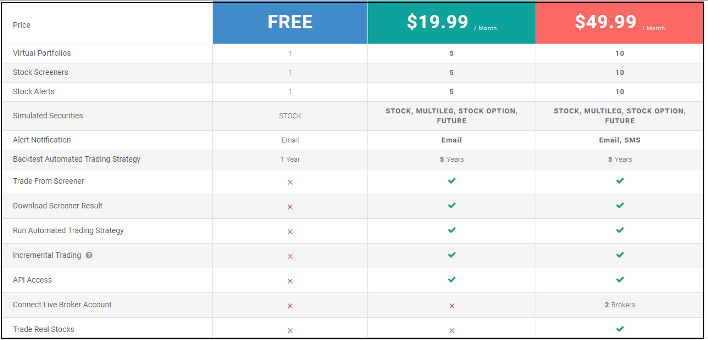

5) investfly

Using investfly is not as hard as making money through your investment. Investfly make it easy for you to make money first virtually and then in the real stock market.

Who should use this one: if you want to trade with advance information and more trading options then you can try this site.

This website provides you a brief summary of how to start investing. This will be of great help for the beginner investor who had never invested in the real stock market. If you are interested in learning about stocks more then this will be a great platform for you.

6) chartmantra

Chartmantra is a free online virtual stock market trading game cum analytical platform. It is a virtual game for trading. You can learn the basics of the technical analysis in stock trading and apply it to an actual stock exchange to analyze your portfolio.

Who should use this one : this platform is for those who want to learn stock trading and also its analysis.

Here you will get rs.1 lac virtual money and the objective of this game is to make as much money as you can from it and go the top of the rank. This game will analyze your buying and selling and give you an analysis of it so that you can track your record and apply the analysis on your real trading account.

The trading will cost 0.1% brokerage which will make the trading more realistic.

7) moneypot

Moneypot is a game of virtual trading in india which provides the platform of virtual stalk trading to students, corporate as well as investors. It aims to connect an online investment community through a social trading platform.

Signing in here just like other virtual trading sites. Once you open the website you can see the sign-up button and play game button. You can click on sign up if you are new to this site and then can play the game.

Who should use this one : this is the best virtual trading site for beginner investors or stock market learners.

Advantages of virtual trading

The advantages of virtual stock trading are as bellow:

- For beginners it is good way of practicing because it allows the direct buying and selling the virtual stock.

- You don’t need to invest real money.

- As there is no real money you can take higher risk.

- You get basic understanding and knowledge about the functioning of stock market.

- You can learn through actual practice rather than only reading.

- Mistakes don’t cause any loss here.

Disadvantages of virtual trading

The disadvantages of virtual stock trading are as bellow:

- As we said you don’t invest actual money, there is a possibility that you may not get emotionally attached with it because you are not losing anything in any case, which does not happen in real life.

- If you don’t get emotionally attached to it you will get bored after some time and stop playing.

- Sometime there is a possibility of getting bored because they are not getting any return in actual.

- If you make profits in virtual trading, people tend to get very over confident about their abilities to make money

Now as you get a lot of options for virtual trade practicing you can start to learn to trade and get the real experience of stock exchange. Leave your queries in the comment section and let us know your views regarding this article.

2 day online jagoinvestor workshop in jan & feb

click here to book your seat

Best forex demo account review (2021)

Forex demo accounts are great for beginners to practise trading and test platforms such as metatrader 4 and 5. Demos’ are also good for experienced traders to do backtesting. Below we look at the top brokers with the demo accounts for 2021.

Top forex demo accounts

The 2021 forex demo account review focused on test trading platform features, easy of use and customer service.

- Pepperstone– best MT4 demo account overall

- IC markets– best MT5 broker for CFD trading

- Plus500- offers top risk tools for practice

- Etoro– top social trading demo platform

- FXCM- good to practice charting with ninjatrader

- Oanda–top unlimited forex demo

- IG– best forex demo account for UK traders

- Thinkmarkets-best demo account for mobile trading

- Axi- best customer support with demo account

- TD ameritrade – has thinkorswim, the top demo account in the US

Pepperstone MT4 demo account

Pepperstone has one of the best demo accounts as it allows you to practice with metatrader 4 (MT4), metatrader 5 (MT5) or ctrader forex trading platforms.

Metatrader 4 is the best choice of platform for a demo trading account, as it is considered the gold standard when it comes to trading platforms. This platform offers all the essential trading tools to familiarise yourself with trading such as 30 indicators, 31 graphical tools, 9 timeframes, automated trading and social trading.

With over 60 currency pairs to choose from, all with ECN-like tight spreads, pepperstone will help you minimise your trading costs. Pepperstone is known for its lightning-fast execution speed of 30ms on average which will help you avoid slippage and its award-winning customer service team, many who are traders themselves. Traders can choose from their commission-free standard account and razor account with $7.00 commissions round-turn per lot.

Pepperstone’s demo trading account is ranked first due to the ease of setting up an account, a balance of virtual money to simulate live trading and the access an environment similar to ECN trading. You can view a complete review of pepperstone. After familiarising themselves with the platform and forex broker, users can sign up to a real money account and start trading forex and cryptocurrencies.

Key strengths of pepperstone’s forex demo account:

- Fastest execution times (avg 30ms)

- Up to 500:1 leverage (30:1 for retail traders in the UK and europe)

- $50,000 in virtual money, 30-day trial (can be reset through with pepperstone support)

- Regulation with ASIC, FCA, DFSA, cysec, bafin, CMA, SCB

- MT4, MT5 or ctrader trading platforms

- Excellent trading conditions and customer service

Note: pepperstone limited (UK) does not offer crypto products due to FCA forex broker compliance requirements. Crypto trading is available with all other subsidiaries.

IC markets demo account

IC markets demo account offers virtual forex trading on the world’s top trading platforms (metatrader 4, metatrader 5 and ctrader). Unlike most brokers which limit the virtual cash and time you can use the demo account, IC markets allows you to choose how much virtual cash you wish to trade and the account will only be closed after 30 days of inactivity. IC markets demo account is free, you don’t need to open an account (which requires a $200 deposit) to practice trading.

IC markets offers 64 currency pairs and an ECN-like environment with fast execution speeds and high leverage. Traders can choose between their standard account and raw spreads account which has commissions of $3.50 side trip.

Key strengths of IC markets forex demo account:

- Fast execution speeds

- Unlimited virtual cash (you set the amount)

- Demo account is valid until 30 days of inactivity

- Up to 500:1 (30:1 in UK and europe for retail traders) leverage

- 64 forex pairs, as well as a range of financial instruments such as commodities, metals, stocks, and bonds

- MT4, MT5 or ctrader trading platform

- Regulated by ASIC, cysec, and FSA

Plus500 demo trading account

Plus500 is one of the world’s largest cfds providers. Plus500 have designed their platforms to help traders take advantage of the wide range of cfds available with ease. Cfds available in addition to the usual forex and indices include an extensive range of commodities including some rare options such as lean hogs, cattle and 13 cryptocurrencies. Traders can also trade options, stocks and indices for sectors such as cannabis, lithium and real estate.

Plus500 does not charge commissions which means fees are included in the spread and include risk management tools such as negative balance protection and guaranteed stop-loss.

Key strengths of plus 500 demo account:

- Demo account has 50,000 in virtual cash (resets when below 200)

- Demo account has no time limit (FREE unlimited account)

- Risk management such as guaranteed stop-loss/take-profit

- Offers extensive CFD range including unique sector indices and options

- Use of ‘guaranteed stops’ in demo accounts

- Regulated by ASIC, FCA and cysec

Note: plus500uk ltd does not offer crypto trading due to FCA compliance requirements for forex brokers. Crypto is available with all other subsidiaries.

*your capital is at risk ‘76.4% of retail CFD accounts lose money’

OANDA demo trading account

Oanda’s offers a choice of their in-house developed platform oandatrade which is available as a web trader, desktop and mobile version and metatrader 4. With both platforms, your demo account will have 100,000 virtual units for trade which never expires.

Choosing oanda gives you a choice of 2 retail investor account, the premium account which is a spread only product and core account which has a commission of $7 per 1k round turn and ECN like trading execution.

The latest version of the brokers’ trading platform (oanda trade v20) offers institutional-grade execution of less than 1ms, a guarantee of no requote or rejections and trading directly from the charts.

Key strengths of OANDA markets demo FX account:

- 100,000 virtual trading unit that can be reset anytime

- Demo platform never expires

- Choose from 5 trading platforms (oandatrade, metatrader 4, tradingview)

- 70+ currency pairs including exotic currencies

- Trade directly from the charts

- No requotes or rejections

FXCM demo forex trading account

FXCM allows you to choose from 4 trading platforms to demo. These include trading station, metatrader 4, ninja trader and tradingview. Trading station is FXCM’s own proprietary trading platform which is the best option (along with metatrader 4)if you wish to use trading automation with FXCM automation and backtesting. Ninjatrader is the best option should you use to access advanced charting and trade management options. Tradingview is the best option if you wish to practice social trading.

FXCM only offers one account, and this account is spread only meaning there are no commissions*. FXCM like to be open about their transparency, the broker publishes regular reports on their trading execution performance. In 2020 Q2 59.92% of orders had no slippage and 28.48% of orders had positive slippage. 73.24 of limit and limit entry order has positive slippage

Key strengths of FXCM demo FX account:

- $5,000 to $20,000, £50,000 in virtual funds (depending on chosen platform) to trade in the demo account

- CFD trading with no commission fees

- Regulated with ASIC, FCA, FSCA (south africa)

*FXCM can be compensated in several ways, which includes but not limited to adding a mark-up to the spreads it receives from liquidity providers and adding a mark-up to rollover etc. Commission-based pricing is applicable to active trader account types.

Etoro demo forex trading account

Etoro is a social trading platform which makes it different to most other platforms. So learning the etoro trading platform with a practice account is very handy. The etoro account is available for free and includes 100,000 if etoro virtual money and has no time limitations.

Etoro’s biggest feature is its social trading component. Rather than conducting your own analysis and placing each individual order, social-copy trading platforms allow you to follow and copy the strategies of successful traders with a wealth of experience. Key features include:

- Copytrader (copy people): openbook’s standard account mirroring service, where you copy the trading strategies of other users, rather than placing trades yourself.

- Copyportfolio: designed as a longer-term investment, copyportfolios are bundles of cfds that include different traders’ strategies and asset classes.

Key strengths of etoro demo FX account:

- 100,000 etoro virtual cash with automatic refresh

- No time limitation

- No commission

- Social trading with copytrader and copyportfolio

IG markets

IG markets was founded in the UK in 1974 as a spread betting business and later renamed IG group when listing on the london stock exchange in 2000. Being a UK company, IG is a solid option for UK forex traders for a demo account. By choosing IG as your demo account, you can benefit from CFD trading such as forex, options, etfs, interest rates and bonds. If you are in the UK, you can also spread bet and binary trade. Some countries also have the possibility of trading stocks (not cfds).

IG markets allow you to use their own in-house IG platform and metatrader 4 as demo trading platforms. With the IG platform, you will get access to their online trading platform, $20,000 of virtual funds and 17,000 markets. Choosing this platform means you will get free access to exclusive educational content on the IG academy which new traders will appreciate and chart packages that may otherwise incur a fee.

If you prefer to practice using metatrader 4, IG gives you access to $10,000 in virtual currencies and 80+ markets to choose from. Choosing metatrader 4 also means you can practice with expert advisors and 18 free indicators and add-ons.

Key strengths of IG markets demo FX account:

- $20,000 in virtual cash with IG platform and 17,000 markets

- $10,000 in virtual cash with metatrader 4 and 80+ markets

- Free access to charting packages and add on indicators

- Regulated by ASIC, FCA, bafin (germany), FMA (new zealand), FINMA (switzerland), MAS (singapore), DFSA (dubai), CFTC/NFA (USA).

Thinkmarkets metatrader 4 demo account

Thinkmarkets demo account allows you to practice with their thinktrader platform thinktrader is one of the best trading apps in the market for mobile trading. With a quad screen display, 80 indicators, 50 drawing tools, 14 chart types and 200 cloud-based alerts, thinktrader is rated 5 stars by over 15,000 users in the android and ios mobile app stores.

Thinkmarkets trading includes 25,000 of virtual currency and is available for use as long as you don’t leave it inactive for 30 days.

Key strengths of thinkforex demo FX account:

- Seven demo account currencies

- Expert advisors (eas) testing available

- No scalping limit

- 500:1 leverage

- Regulation: ASIC, FCA, FSCA (south africa)

Axitrader MT4 demo account

A 30 day 100% free demo account is available with axi (formerly axitrader). This broker offers access to metatrader 4 and $50,000 in virtual cash with no minimum deposit requirements to open an account.

The most unique feature of axi’s demo account is the inclusion of a dedicated account manager in addition to their 24/5 client support. Axi customer support is award-winning and highly valued, as it means you can ask trading questions while you learn about forex trading and develop your trading style.

Key strengths of A GO markets demo FX account:

- $50k of virtual currency in a demo account

- Dedicated account manager

- 24/5 support over live chat or phone

- Authorised and regulated by ASIC, FCA, DFSA (dubai)

TD-ameritrade broker demo account

Thinkorswim is TD-ameritrade’s proprietary trading platform and available to traders based in the united states as a desktop, web trader or mobile trading platform.

Thinkorswim provides a good range of features, with inbuilt tools for both automaton and charting.

- Advanced, professional-grade charting and technical analysis tools

- In-app chat and community chat rooms

- Backtesting features

- Market monitors and heat maps

- Real-time market news

- Customisable alerts

To explore the thinkorswim platform in a risk-free environment, TD-ameritrade offers a demo account with full access to the software. A virtual trading balance of $100,00 is provided to practice trading with free access for 60 days.

TD-ameritrade is one of the few brokers that offers forex trading in the USA. Choosing thinkorswim means you can trade 70 forex pairs with no commissions and leverage of up to 50:1 for major pairs and 20:1 for minor pairs.

Key strengths of A GO markets demo FX account:

- Thinkorswim trading platform

- 70 currency pairs

- Suitable for american traders

- Commission-free trading

- Regulated in USA by CFTC, NFA, SEC

What should I look for in A forex demo account?

The most important element when looking for the best forex demo accounts is to consider the platforms offered. The trading platform is what you will be using to trade, so it is important to choose a platform you are comfortable using. Traders generally have a personal preference to metatrader 4, metatrader 5 or ctrader trading platforms.

The second important factor is the features within the demo account that will replicate a real trading environment in the CFD and forex market. This includes what access how similar the spreads are to real markets, available leverage, customer service and risk management tools. Like choosing the best forex platform for you when forex trading, having the right features within the platform to suit your forex strategy can be critical to future success.

A third factor is execution speed which helps traders make fast trades with reduced slippage in higher volatility markets that can carry high risk. A demo account should simulate real trading conditions. This means taking spreads from real markets so you can learn how cfds work in the real world.

The final factor is the expiration date of the demo account and how much virtual currency is available. Some demo accounts are only valid for one month while others are unlimited.

Why are demo accounts so important?

Trading financial instruments such as forex and shares is a high-risk investment, especially if you are exploring different forex and CFD markets for the first time. Forex and CFD markets such as cryptocurrency are high-risk environments, therefore traders should be cautious when taking on highly leveraged positions. Leverage is a complex instrument, so it’s important to understand there are risks of losing more money than you originally deposited in your trading account. It is important to get experience trading using a demo account, so you are well equipped to deal with the volatility and the high-risk nature of financial markets before signing up for a real account or live account.

Learning to trade forex can be achieved by reading and research as well as utilising forex brokers educational tools such as webinars, faqs, ebooks, online courses. However, the most effective way is to practice trading via a demo account, allowing you to develop strategies and your trading style. Demo accounts allow users to familiarise themselves with various markets and trading platforms. Virtual money accounts are suitable for levels of experience, and we encourage you to practice trading with a forex broker listed above prior to trading with real money.

Background to our forex demo review

This demo account review was compiled and published in 2016 and was updated at the start of 2021. It was put together by the dedicated staff at compare forex brokers who spent a significant amount of time researching the industry. As the market changes rapidly and brokers continue to offer new features all the time, please validate all information read above with the forex broker’s dedicated website. We aim to update our analyses frequently, but sometimes inconsistencies can be found.

Justin grossbard has been investing for the past 20 years and writing for the past 10. He co-founded compare forex brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of fintech and digital startups including innovate online and SMS comparison. Justin holds a masters degree and an honours in commerce from monash university. He and his wife paula live in melbourne, australia with his son and siberian cat. In his spare time, he watches australian rules football and invests on global markets.

Top forex demo accounts

- Pepperstone

- IC markets

- Plus500

- Etoro

- FXCM

- OANDA

- IG markets

- Thinkforex

- Axitrader

- TD ameritrade

The leading forex broker comparison site, compare forex brokers pty ltd is an authorised representative of guildfords funds management pty ltd australian financial services licence no. 471379 (A/R no. 001274082). Copyright 2021 and all rights reserved. Trading forex and cfds with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

Real-time virtual fx trading online

Our vision statement

Our mission statement

The longstanding relationship and trust we build with our clients is the base of the foundation that is virtualfx today. With over 13 years of combined financial experience, our team strives to provides our client with exceptional 24/7 service which is prompt, professional and friendly.

As our clients, your interests are our first and foremost concerns. We do value honesty and ethics which are main aspects for integrity. We hold the trust you place in us with highest regards by guarding your information, providing a work with transparency and paramount confidentiality at virtualfx.

We work through the international finance markets and FOREX making us independent of the incentives to provide to other companies. Hence our loyalties stand by you, our clients. We work through your interests providing suitable solutions to fulfill our vision of 100% client satisfaction.

Our goal is to empower you through your investment towards financial freedom. Several years of experience helped us master concepts in high probability trading platforms like FOREX developing an efficient strategy to produce excellent results. This in turn help you to reach your current needs and pursue your future goals.

Shortly about FOREX trading

FOREX (foreign exchange market) is a sum of selling and buying operations of foreign currencies in defined conditions (sum, exchange rate, time). The main players in the forex marketing are: trading banks, currency exchanges, central banks, investment fund, brokerage companies, private persons, etc.

The main currencies taking part in the forex system are: USD, EUR, JPY, CHF and GBP. The daily volume of conversion operations is about 5 trillion dollars.

The daily operation volume of the biggest banks worldwide amounts to milliards of dollars. Spot-operations or so-called current conventional operations are known as selling or buying currency deals. Their factual implementation is realized on the second day, after the deal is closed.

Thanks to the margin trade, everybody can take part in the process вђ“ even those, who donвђ™t have enough money. Brokers who can suggest marginal trading help insist on a deposit and give customers the possibility to make selling/buying operations in size, much bigger than the deposit they have given to their broker. Loss risks are taken by the clients themselves. The deposit is only a guarantee for the brokers.

Places we can obtain information about the financial markets conditions from are REUTERS, DOW JONES, CQG, BLOOMBERG, TENFORE and so on. They are using real-time systems, giving us data about the currency quotation and financial-economic news from international agencies, as well.

Unlike the real currency delivery operations/the real currency exchange, forex traders, especially those with limited monetary opportunities, are taking part in the process of deposing their money. This means they're taking part in a margin trading/leverage trading). Each margin trading operation always passes through two stages: currency sale/buying process at one price and exit sale/buying process at the same or different price. The first actions is calledвђњposition findingвђќand the second oneвђњposition closingвђќ.

When opening a position, the client deposits his own money. This insurance is like compensation, if there is some risk of loss. After closing a position, the deposit is given back to the client and he gets a loss or profit report вђ“ it depends on the final results he has obtained. In addition, the deposit is often 100 times smaller than the sum that has been invested by the customer.

Here is an illustration about position finding and position closing operations: for example, if there is a prediction euro to become more expensive than dollar does in some future moment, this means we will prefer buying euro to dollar in the present, so that we will have the ability to sell it at a higher price later.

We will proceed almost in the same way, when EUR will be cheaper than USD, so that we will get some profit in both two cases.

Explanations:

exchange rate вђ“ this is the price of the currency of a country and its equivalent expressed in another currency while selling/buying process. This price can be defined as a ratio between currency supply and demand and usually regulated by governmentвђ™s financial authority вђ“ central bank.

Types of exchange rates:

direct quotation вђ“ the quantity of a currency that can be bought for one foreign currency unit. Most of the countries has a practice foreign currencies to be expressed in their own one.

Reverse quotation вђ“ the quantity of a foreign currency that can be bought for one national currency unit

FOREX (foreign exchange) вђ“ international currency exchange. It can be met as FX

Major exchanges:

EUR = ECU

USD вђ“ (american dollar)

GBP = STG ( sterling, pound, cable)

CHF = SWF ( swedish franc, swissie)

JPY = YEN (japanese yen)

FOREX work time according to GMT (greenwich mean time)

Best forex trading simulator - virtual money

In this article, we will cover the best forex simulator software of 2019. You’ll find step by step instructions for how to choose the best simulator software, how to use simulators for day trading, and also how to test your forex trading strategy.

Using simulators will help you get rid of the bad habits and become a better trader. Simulated forex trading can be one of the most efficient ways to practice trading risk-free. Throughout this guide, you’ll learn how to gain live-market experience and discover the benefits of using a forex trading simulator software.

Is this your first time on our website? The team at trading strategy guides welcomes you. Make sure you hit the subscribe button, so you get your free trading guide delivered every week to your inbox.

To determine whether or not forex trading is for you, you need to engage in the markets and to do your due diligence before committing any real money into the game. Using real-time historical data you can reduce your learning curve and quickly determine if forex trading is right for you.

Simulated forex trading does present some issues. Often times, positive results on a demo account can translate into negative results in a live trading environment. This can make people question the validity of simulated trading.

However, the real cause behind this discrepancy is due to the lack of emotional involvement you get when real money is at stake.

Moving forward, you will learn what simulated forex trading is and how you can benefit from sim trading.

What is simulated forex trading?

A forex trading simulator is a piece of software that allows you to test your strategy offline using the historical data from the markets. If you have new trading ideas, trading simulator software can help you test them. This allows you to find what works and what doesn't, and eliminate any losing strategies.

While you might be working with a demo account, the market conditions resemble the live trading environment. You can open and close trades and modify orders the same way you would do in a live trading session.

The main advantages of using a free forex trading simulator are as follows:

- Acts as a live trading environment.

- Ability to backtest and forward test your trading strategy.

- Implement new trading ideas to see if they work.

- Risk-free account trading with all the functionalities and trading features of live trading.

Using a free forex trading simulator can help you learn the ropes to succeed in trading. If you apply the 10,000-hour rule of mastery to your trading, you definitely need a forex sim to practice your skills.

Before you start evaluating your current trading strategy, you need to make sure you use the right setup.

In the next section, we'll show you what to look for when comparing the key features of the best forex trading simulator software.

Best forex trading simulator

There are several important factors that every forex trading sim needs to be equipped with. At a bare minimum, it’s important for your simulator to satisfy the following requirements:

1. Live pricing feed

It’s necessary to ensure your simulator has a real market environment that streams live pricing data. Without live pricing data, you’ll miss the opportunity to examine your trading strategy effectively.

A live pricing feed mimics the spreads. This means when you run your strategy through a simulator, it will use the actual spreads found in the market.

This feature is more important than anything else.

Having real-time price data will ensure that your backtested results are accurate. This helps you determine whether you can rely on the simulated historical data found in the software.

This brings us to the next important feature that any sim trading software should have.

2. Forex trading simulator historical data

Secondly, you need to have accurate historical forex data that goes several months back. Not having enough historical price data to simulate the performance of your trading strategy will lead to unrealistic backtested results.

The best online forex simulators will provide you with historical prices. It will also provide you with the ability to browse historical quote data for your preferred currency pair. Aside from the end-of-day quote data, the database should also cover intraday quotes. No matter your trading style, be it day trading or swing trading, the best forex trading simulator will be able to help.

The historical price data needs to be in a clear format where you get the high, low, open and closing prices for the selected currency pair and selected time frame. In some instances, you can also get the tick volume information. If your trading strategy is based on volume, it’s vital to have access to the volume data.

Let’s move forward and see what other features your free forex trading simulator needs to have.

3. Flexible virtual money account

In our experience, traders fail to see the importance of using a virtual account balance. It's recommended to start with a balance close to the amount you wish to use in your live trades. If you can only fund your live trading account with $5,000, there's no point to use a $100,000 demo balance.

This has the potential to set unrealistic expectations that will lead to bad habits once you start live trading.

Simply put, ensure that the virtual money account you’re using to backtest your trading strategy is the amount you will fund your trading account with. This will also allow you to implement a more realistic risk management strategy.

This way you will have no issues when you transition to live trades.

When you start trading with a demo account, you don’t need to invest any real money. Make sure you pick a free forex trading simulator that has the minimum of trading features and tools to get you started.

Starting out with the world’s most popular forex trading platform aka metatrader4 might save you time in the long run.

Below you’ll find a step-by-step guide to use MT4 strategy tester

Best forex trading simulator – MT4 strategy tester

In this section, you’re going to learn how to backtest a strategy using the MT4 strategy tester. For this reason, we’re going to use a default strategy that can be found in the MT4 strategy library.

The first step is to open the strategy tester window by simply pressing CTRL+R or by clicking the respective icon found in the top toolbar.

Make sure you’ve selected the preferred time frame window and the appropriate settings. For the purpose of this example, we have chosen the following settings:

- Expert advisor = moving average.Ex4 (the name of the strategy we backtest)

- Symbol = EUR/USD (the instrument we run our strategy on)

- Model = every tick which is the most precise method

- Period = 1H (the preferred time frame to run our strategy)

- Spread = current

We recommend playing with these settings over and over again until you discover the winning settings.

Once finished with selecting the settings, click on the start button so that the simulation can begin. You can check the results of the backtesting strategy under the report tab.

In the proposed example, we can notice that the default moving average trading strategy has produced a net loss of approximately -$400 during the tested period. This means that we’re not yet ready to jump into live trading.

We need to work more on our strategy and fine-tune the strategy parameters until you discover a profitable trading strategy that you’re comfortable to go live with.

Check out our guide how to backtest a trading strategy for more trading tips and tricks.

Conclusion – forex trading simulator

The goal of simulated forex trading is to filter out bad trading strategies and to optimize your trades to get bigger profits out of your trading system. The key to successful trading is to make the transition to live trading as soon as the simulation provides evidence that you have an edge on the market.

Find a forex trading simulator that's popular among other traders, and practice your trading strategy without the risk before you start trading in real time. Get the experience first, start live trading when you develop your strategy.

Sim trading is part of the process of becoming a profitable trader, and it’s the perfect environment to learn the skills of forex trading without losing money in the process. Also, check out our zero to $1 million forex strategy.

Feel free to leave any comments or advice below, we always respond!

Also, please give this strategy a 5 star if you enjoyed it!

(4 votes, average: 2.75 out of 5)

loading.

Please share this trading strategy below and keep it for your own personal use! Thanks traders!

SIMULATE

To sharpen your trading skills and test your ideas risk free.

Ninjatrader is always FREE to use for advanced charting, backtesting & trade simulation.

Learn through free simulation

Simulated trading is an integral component of the trading education process and equally as important for experienced traders wanting to test new concepts.

Verify your trading ideas

Ninjatrader’s high performance backtesting engine allows you to simulate your automated trading strategies on historical data and analyze their past performance.

Simulate the performance of custom strategies available through the ninjatrader ecosystem.

Play, pause & rewind the markets

Replay FREE historical market data tick by tick, fully synchronized across the platform as if it was happening in real time. Technical info

Control your own data feed

Using ninjatrader’s simulated data feed, you can control market direction to test your automated strategies or simply to help you learn the platform.

Get started for free

Award-winning technology consistently voted an industry leader

by the trading community

Clear savings for traders deep discount commissions and low margins for futures

Personalize your platform customize ninjatrader with indicators,

signals and strategies

Copyright © 2021. All rights reserved. Ninjatrader and the ninjatrader logo. Reg. U.S. Pat. & tm. Off.

Ninjatrader group, LLC affiliates: ninjatrader, LLC is a software development company which owns and supports all proprietary technology relating to and including the ninjatrader trading platform. Ninjatrader brokerage™ is an NFA registered introducing broker (NFA #0339976) providing brokerage services to traders of futures and foreign exchange products.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View full risk disclosure.

Best forex demo account review (2021)

Forex demo accounts are great for beginners to practise trading and test platforms such as metatrader 4 and 5. Demos’ are also good for experienced traders to do backtesting. Below we look at the top brokers with the demo accounts for 2021.

Top forex demo accounts

The 2021 forex demo account review focused on test trading platform features, easy of use and customer service.

- Pepperstone– best MT4 demo account overall

- IC markets– best MT5 broker for CFD trading

- Plus500- offers top risk tools for practice

- Etoro– top social trading demo platform

- FXCM- good to practice charting with ninjatrader

- Oanda–top unlimited forex demo

- IG– best forex demo account for UK traders

- Thinkmarkets-best demo account for mobile trading

- Axi- best customer support with demo account

- TD ameritrade – has thinkorswim, the top demo account in the US

Pepperstone MT4 demo account

Pepperstone has one of the best demo accounts as it allows you to practice with metatrader 4 (MT4), metatrader 5 (MT5) or ctrader forex trading platforms.

Metatrader 4 is the best choice of platform for a demo trading account, as it is considered the gold standard when it comes to trading platforms. This platform offers all the essential trading tools to familiarise yourself with trading such as 30 indicators, 31 graphical tools, 9 timeframes, automated trading and social trading.

With over 60 currency pairs to choose from, all with ECN-like tight spreads, pepperstone will help you minimise your trading costs. Pepperstone is known for its lightning-fast execution speed of 30ms on average which will help you avoid slippage and its award-winning customer service team, many who are traders themselves. Traders can choose from their commission-free standard account and razor account with $7.00 commissions round-turn per lot.

Pepperstone’s demo trading account is ranked first due to the ease of setting up an account, a balance of virtual money to simulate live trading and the access an environment similar to ECN trading. You can view a complete review of pepperstone. After familiarising themselves with the platform and forex broker, users can sign up to a real money account and start trading forex and cryptocurrencies.

Key strengths of pepperstone’s forex demo account:

- Fastest execution times (avg 30ms)

- Up to 500:1 leverage (30:1 for retail traders in the UK and europe)

- $50,000 in virtual money, 30-day trial (can be reset through with pepperstone support)

- Regulation with ASIC, FCA, DFSA, cysec, bafin, CMA, SCB

- MT4, MT5 or ctrader trading platforms

- Excellent trading conditions and customer service

Note: pepperstone limited (UK) does not offer crypto products due to FCA forex broker compliance requirements. Crypto trading is available with all other subsidiaries.

IC markets demo account

IC markets demo account offers virtual forex trading on the world’s top trading platforms (metatrader 4, metatrader 5 and ctrader). Unlike most brokers which limit the virtual cash and time you can use the demo account, IC markets allows you to choose how much virtual cash you wish to trade and the account will only be closed after 30 days of inactivity. IC markets demo account is free, you don’t need to open an account (which requires a $200 deposit) to practice trading.

IC markets offers 64 currency pairs and an ECN-like environment with fast execution speeds and high leverage. Traders can choose between their standard account and raw spreads account which has commissions of $3.50 side trip.

Key strengths of IC markets forex demo account:

- Fast execution speeds

- Unlimited virtual cash (you set the amount)

- Demo account is valid until 30 days of inactivity

- Up to 500:1 (30:1 in UK and europe for retail traders) leverage

- 64 forex pairs, as well as a range of financial instruments such as commodities, metals, stocks, and bonds

- MT4, MT5 or ctrader trading platform

- Regulated by ASIC, cysec, and FSA

Plus500 demo trading account

Plus500 is one of the world’s largest cfds providers. Plus500 have designed their platforms to help traders take advantage of the wide range of cfds available with ease. Cfds available in addition to the usual forex and indices include an extensive range of commodities including some rare options such as lean hogs, cattle and 13 cryptocurrencies. Traders can also trade options, stocks and indices for sectors such as cannabis, lithium and real estate.

Plus500 does not charge commissions which means fees are included in the spread and include risk management tools such as negative balance protection and guaranteed stop-loss.

Key strengths of plus 500 demo account:

- Demo account has 50,000 in virtual cash (resets when below 200)

- Demo account has no time limit (FREE unlimited account)

- Risk management such as guaranteed stop-loss/take-profit

- Offers extensive CFD range including unique sector indices and options

- Use of ‘guaranteed stops’ in demo accounts

- Regulated by ASIC, FCA and cysec

Note: plus500uk ltd does not offer crypto trading due to FCA compliance requirements for forex brokers. Crypto is available with all other subsidiaries.

*your capital is at risk ‘76.4% of retail CFD accounts lose money’

OANDA demo trading account

Oanda’s offers a choice of their in-house developed platform oandatrade which is available as a web trader, desktop and mobile version and metatrader 4. With both platforms, your demo account will have 100,000 virtual units for trade which never expires.

Choosing oanda gives you a choice of 2 retail investor account, the premium account which is a spread only product and core account which has a commission of $7 per 1k round turn and ECN like trading execution.

The latest version of the brokers’ trading platform (oanda trade v20) offers institutional-grade execution of less than 1ms, a guarantee of no requote or rejections and trading directly from the charts.

Key strengths of OANDA markets demo FX account:

- 100,000 virtual trading unit that can be reset anytime

- Demo platform never expires

- Choose from 5 trading platforms (oandatrade, metatrader 4, tradingview)

- 70+ currency pairs including exotic currencies

- Trade directly from the charts

- No requotes or rejections

FXCM demo forex trading account

FXCM allows you to choose from 4 trading platforms to demo. These include trading station, metatrader 4, ninja trader and tradingview. Trading station is FXCM’s own proprietary trading platform which is the best option (along with metatrader 4)if you wish to use trading automation with FXCM automation and backtesting. Ninjatrader is the best option should you use to access advanced charting and trade management options. Tradingview is the best option if you wish to practice social trading.

FXCM only offers one account, and this account is spread only meaning there are no commissions*. FXCM like to be open about their transparency, the broker publishes regular reports on their trading execution performance. In 2020 Q2 59.92% of orders had no slippage and 28.48% of orders had positive slippage. 73.24 of limit and limit entry order has positive slippage

Key strengths of FXCM demo FX account:

- $5,000 to $20,000, £50,000 in virtual funds (depending on chosen platform) to trade in the demo account

- CFD trading with no commission fees

- Regulated with ASIC, FCA, FSCA (south africa)

*FXCM can be compensated in several ways, which includes but not limited to adding a mark-up to the spreads it receives from liquidity providers and adding a mark-up to rollover etc. Commission-based pricing is applicable to active trader account types.

Etoro demo forex trading account

Etoro is a social trading platform which makes it different to most other platforms. So learning the etoro trading platform with a practice account is very handy. The etoro account is available for free and includes 100,000 if etoro virtual money and has no time limitations.

Etoro’s biggest feature is its social trading component. Rather than conducting your own analysis and placing each individual order, social-copy trading platforms allow you to follow and copy the strategies of successful traders with a wealth of experience. Key features include:

- Copytrader (copy people): openbook’s standard account mirroring service, where you copy the trading strategies of other users, rather than placing trades yourself.

- Copyportfolio: designed as a longer-term investment, copyportfolios are bundles of cfds that include different traders’ strategies and asset classes.

Key strengths of etoro demo FX account:

- 100,000 etoro virtual cash with automatic refresh

- No time limitation

- No commission

- Social trading with copytrader and copyportfolio

IG markets

IG markets was founded in the UK in 1974 as a spread betting business and later renamed IG group when listing on the london stock exchange in 2000. Being a UK company, IG is a solid option for UK forex traders for a demo account. By choosing IG as your demo account, you can benefit from CFD trading such as forex, options, etfs, interest rates and bonds. If you are in the UK, you can also spread bet and binary trade. Some countries also have the possibility of trading stocks (not cfds).

IG markets allow you to use their own in-house IG platform and metatrader 4 as demo trading platforms. With the IG platform, you will get access to their online trading platform, $20,000 of virtual funds and 17,000 markets. Choosing this platform means you will get free access to exclusive educational content on the IG academy which new traders will appreciate and chart packages that may otherwise incur a fee.

If you prefer to practice using metatrader 4, IG gives you access to $10,000 in virtual currencies and 80+ markets to choose from. Choosing metatrader 4 also means you can practice with expert advisors and 18 free indicators and add-ons.

Key strengths of IG markets demo FX account:

- $20,000 in virtual cash with IG platform and 17,000 markets

- $10,000 in virtual cash with metatrader 4 and 80+ markets

- Free access to charting packages and add on indicators

- Regulated by ASIC, FCA, bafin (germany), FMA (new zealand), FINMA (switzerland), MAS (singapore), DFSA (dubai), CFTC/NFA (USA).

Thinkmarkets metatrader 4 demo account

Thinkmarkets demo account allows you to practice with their thinktrader platform thinktrader is one of the best trading apps in the market for mobile trading. With a quad screen display, 80 indicators, 50 drawing tools, 14 chart types and 200 cloud-based alerts, thinktrader is rated 5 stars by over 15,000 users in the android and ios mobile app stores.

Thinkmarkets trading includes 25,000 of virtual currency and is available for use as long as you don’t leave it inactive for 30 days.

Key strengths of thinkforex demo FX account:

- Seven demo account currencies

- Expert advisors (eas) testing available

- No scalping limit

- 500:1 leverage

- Regulation: ASIC, FCA, FSCA (south africa)

Axitrader MT4 demo account

A 30 day 100% free demo account is available with axi (formerly axitrader). This broker offers access to metatrader 4 and $50,000 in virtual cash with no minimum deposit requirements to open an account.

The most unique feature of axi’s demo account is the inclusion of a dedicated account manager in addition to their 24/5 client support. Axi customer support is award-winning and highly valued, as it means you can ask trading questions while you learn about forex trading and develop your trading style.

Key strengths of A GO markets demo FX account:

- $50k of virtual currency in a demo account

- Dedicated account manager

- 24/5 support over live chat or phone

- Authorised and regulated by ASIC, FCA, DFSA (dubai)

TD-ameritrade broker demo account

Thinkorswim is TD-ameritrade’s proprietary trading platform and available to traders based in the united states as a desktop, web trader or mobile trading platform.

Thinkorswim provides a good range of features, with inbuilt tools for both automaton and charting.

- Advanced, professional-grade charting and technical analysis tools

- In-app chat and community chat rooms

- Backtesting features

- Market monitors and heat maps

- Real-time market news

- Customisable alerts

To explore the thinkorswim platform in a risk-free environment, TD-ameritrade offers a demo account with full access to the software. A virtual trading balance of $100,00 is provided to practice trading with free access for 60 days.

TD-ameritrade is one of the few brokers that offers forex trading in the USA. Choosing thinkorswim means you can trade 70 forex pairs with no commissions and leverage of up to 50:1 for major pairs and 20:1 for minor pairs.

Key strengths of A GO markets demo FX account:

- Thinkorswim trading platform

- 70 currency pairs

- Suitable for american traders

- Commission-free trading

- Regulated in USA by CFTC, NFA, SEC

What should I look for in A forex demo account?

The most important element when looking for the best forex demo accounts is to consider the platforms offered. The trading platform is what you will be using to trade, so it is important to choose a platform you are comfortable using. Traders generally have a personal preference to metatrader 4, metatrader 5 or ctrader trading platforms.

The second important factor is the features within the demo account that will replicate a real trading environment in the CFD and forex market. This includes what access how similar the spreads are to real markets, available leverage, customer service and risk management tools. Like choosing the best forex platform for you when forex trading, having the right features within the platform to suit your forex strategy can be critical to future success.

A third factor is execution speed which helps traders make fast trades with reduced slippage in higher volatility markets that can carry high risk. A demo account should simulate real trading conditions. This means taking spreads from real markets so you can learn how cfds work in the real world.

The final factor is the expiration date of the demo account and how much virtual currency is available. Some demo accounts are only valid for one month while others are unlimited.

Why are demo accounts so important?

Trading financial instruments such as forex and shares is a high-risk investment, especially if you are exploring different forex and CFD markets for the first time. Forex and CFD markets such as cryptocurrency are high-risk environments, therefore traders should be cautious when taking on highly leveraged positions. Leverage is a complex instrument, so it’s important to understand there are risks of losing more money than you originally deposited in your trading account. It is important to get experience trading using a demo account, so you are well equipped to deal with the volatility and the high-risk nature of financial markets before signing up for a real account or live account.

Learning to trade forex can be achieved by reading and research as well as utilising forex brokers educational tools such as webinars, faqs, ebooks, online courses. However, the most effective way is to practice trading via a demo account, allowing you to develop strategies and your trading style. Demo accounts allow users to familiarise themselves with various markets and trading platforms. Virtual money accounts are suitable for levels of experience, and we encourage you to practice trading with a forex broker listed above prior to trading with real money.

Background to our forex demo review

This demo account review was compiled and published in 2016 and was updated at the start of 2021. It was put together by the dedicated staff at compare forex brokers who spent a significant amount of time researching the industry. As the market changes rapidly and brokers continue to offer new features all the time, please validate all information read above with the forex broker’s dedicated website. We aim to update our analyses frequently, but sometimes inconsistencies can be found.

Justin grossbard has been investing for the past 20 years and writing for the past 10. He co-founded compare forex brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of fintech and digital startups including innovate online and SMS comparison. Justin holds a masters degree and an honours in commerce from monash university. He and his wife paula live in melbourne, australia with his son and siberian cat. In his spare time, he watches australian rules football and invests on global markets.

Top forex demo accounts

- Pepperstone

- IC markets

- Plus500

- Etoro

- FXCM

- OANDA

- IG markets

- Thinkforex

- Axitrader

- TD ameritrade

The leading forex broker comparison site, compare forex brokers pty ltd is an authorised representative of guildfords funds management pty ltd australian financial services licence no. 471379 (A/R no. 001274082). Copyright 2021 and all rights reserved. Trading forex and cfds with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

So, let's see, what we have: duplitrade's trading simulator is a free forex trading simulator that allows you to simulate your trading and test different forex trading strategies before making any live trades. Try it now! At real-time virtual fx trading online

Contents of the article

- No deposit forex bonuses

- Real-time virtual fx trading online

- 7 sites where you can easily learn stock trading...

- How virtual stock trading works?

- 1) moneybhai

- 2) trakinvest

- 3) dalal street

- 4) wall street survivor

- 5) investfly

- 6) chartmantra

- 7) moneypot

- Advantages of virtual trading

- Disadvantages of virtual trading

- 2 day online jagoinvestor workshop in jan & feb

- Best forex demo account review (2021)

- Top forex demo accounts

- Pepperstone MT4 demo account

- IC markets demo account

- Plus500 demo trading account

- OANDA demo trading account

- FXCM demo forex trading account

- Etoro demo forex trading account

- IG markets

- Thinkmarkets metatrader 4 demo account

- Axitrader MT4 demo account

- TD-ameritrade broker demo account

- What should I look for in A forex demo account?

- Why are demo accounts so important?

- Background to our forex demo review

- Real-time virtual fx trading online

- Our vision statement

- Our mission statement

- Shortly about FOREX trading

- Best forex trading simulator - virtual money

- What is simulated forex trading?

- Best forex trading simulator

- Best forex trading simulator – MT4 strategy tester

- Conclusion – forex trading simulator

- SIMULATE

- Play, pause & rewind the markets

- Control your own data feed

- Get started for free

- Best forex demo account review (2021)

- Top forex demo accounts

- Pepperstone MT4 demo account

- IC markets demo account

- Plus500 demo trading account

- OANDA demo trading account

- FXCM demo forex trading account

- Etoro demo forex trading account

- IG markets

- Thinkmarkets metatrader 4 demo account

- Axitrader MT4 demo account

- TD-ameritrade broker demo account

- What should I look for in A forex demo account?

- Why are demo accounts so important?

- Background to our forex demo review

Comments

Post a Comment