What is a contract for difference, cfd trading meaning.

Cfd trading meaning

Get tight spreads, no hidden fees and access to 9,300+ instruments. Some of the benefits of CFD trading are that you can trade on marginвђ‹, and you can go short (sell) if you think prices will go down or go long (buy) if you think prices will rise.

No deposit forex bonuses

Cfds have many advantages and are tax efficient in the UK, meaning that there is no stamp duty to pay. Please note, tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the ukвђ‹.Вђ‹ you can also use CFD trades to hedge an existing physical portfolio. With a CFD trading account, our clients can choose between trading at homeвђ‹ and on-the-go, as our platform is very flexible for traders of all backgrounds.

What is a contract for difference?

A contract for difference (CFD) is a popular form of derivative trading. CFD tradingвђ‹ enables you to speculate on the rising or falling prices of fast-moving global financial markets, such as forex, indices, commodities, shares and treasuries.

Get tight spreads, no hidden fees and access to 9,300+ instruments.

CFD meaning

A contract for difference (CFD) is essentially a contract between an investor and an investment bank or spread betting firm. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specified financial instrument, which can include forex, shares and commodities.

What is CFD trading?

Some of the benefits of CFD trading are that you can trade on marginвђ‹, and you can go short (sell) if you think prices will go down or go long (buy) if you think prices will rise. Cfds have many advantages and are tax efficient in the UK, meaning that there is no stamp duty to pay. Please note, tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the ukвђ‹.Вђ‹ you can also use CFD trades to hedge an existing physical portfolio. With a CFD trading account, our clients can choose between trading at homeвђ‹ and on-the-go, as our platform is very flexible for traders of all backgrounds.

Introduction to CFD trading: how does CFD trading work?

With CFD trading, you don't buy or sell the underlying asset (for example a physical share, currency pair or commodity). Instead, you buy or sell a number of units for a particular financial instrument, depending on whether you think prices will go up or down. We offer cfds on a wide range of global markets, covering currency pairs, stock indices, commodities, shares and treasuries. An example of one of our most popular stock indices is the UK 100, which aggregates the price movements of all the stocks listed on the UK's FTSE 100 index.

For every point the price of the instrument moves in your favour, you gain multiples of the number of CFD units you have bought or sold. For every point the price moves against you, you will make a loss.

What is margin and leverage?

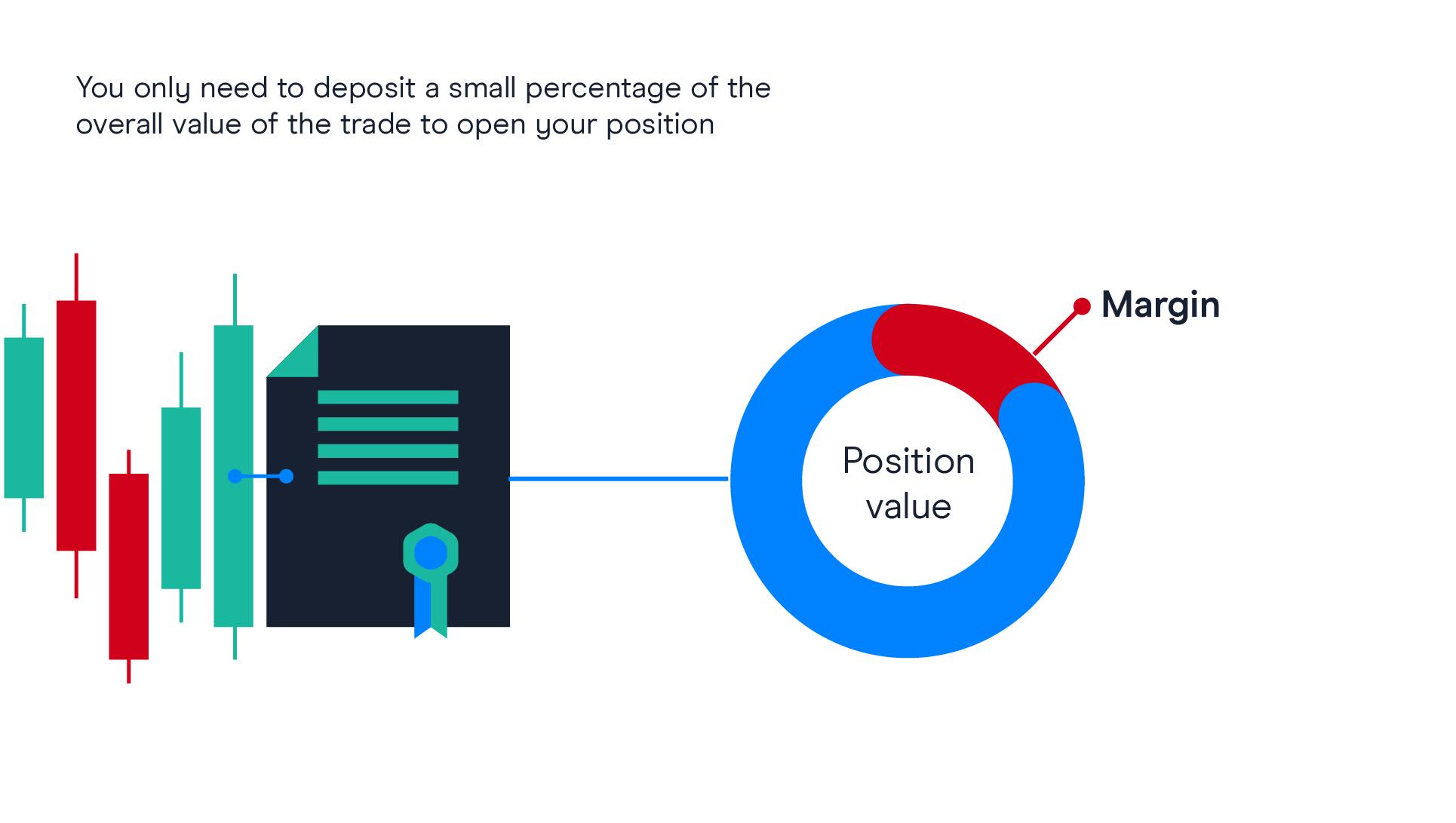

Contracts for difference (cfds) is a leveraged product, which means that you only need to deposit a small percentage of the full value of the trade in order to open a position. This is called вђ˜trading on marginвђ™ (or margin requirement). While trading on margin allows you to magnify your returns, your losses will also be magnified as they are based on the full value of the position. This means that you could lose all of your capital, but as the account has negative balance protection, you can't lose more than your account value.

What are the costs of CFD trading?

Spread: when trading cfds, you must pay the spread, which is the difference between the buy and sell price. You enter a buy trade using the buy price quoted and exit using the sell price. The narrower the spread, the less the price needs to move in your favour before you start to make a profit, or if the price moves against you, a loss. We offer consistently competitive spreads.

Holding costs: at the end of each trading day (at 5pm new york time), any positions open in your account may be subject to a charge called a 'CFD holding cost'. The holding cost can be positive or negative depending on the direction of your position and the applicable holding rate.

Market data fees: to trade or view our price data for share cfds, you must activate the relevant market data subscription, for which a fee will be charged. View our market data fees.

Commission (only applicable for shares): you must also pay a separate commission charge when you trade share cfds. Commission on UK-based shares on our CFD platform starts from 0.10% of the full exposure of the position, and there is a minimum commission charge of ВЈ9. View the examples below to see how to calculate commissions on share cfds.

Example 1 - opening trade

A 12,000 unit trade on UK company ABC at a price of 100p would incur a commission charge of ВЈ12 to enter the trade:

12,000 (units) x 100p (entry price) = ВЈ12,000 x 0.10%

Example 2 - opening trade

A 5,000 unit trade on UK company ABC at a price of 100p would incur the minimum commission charge of ВЈ9 to enter the trade:

5,000 (units) x 100p (entry price) = 5,000 x 0.10%

= ВЈ5.00 ВЈ9.00 (as this is less than the minimum commission charge for UK share cfds, the minimum commission charge of ВЈ9 would be applied to this trade.)

Please note: CFD trades incur a commission charge when the trade is opened as well as when it is closed. The above calculation can be applied for a closing trade; the only difference is that you use the exit price rather than the entry price. Learn more about CFD commissions and trading costs.

An introduction to contract for differences (cfds)

A contract for difference (CFD) is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the current value of an asset and its value at contract time. Cfds allow traders and investors an opportunity to profit from price movement without owning the underlying assets. The value of a CFD contract does not consider the asset's underlying value: only the price change between the trade entry and exit.

This is accomplished through a contract between client and broker and does not utilize any stock, forex, commodity, or futures exchange. Trading cfds offers several major advantages that have increased the instruments' enormous popularity in the past decade.

Key takeaways

- A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes.

- A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset.

- Some advantages of cfds include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short.

- A disadvantage of cfds is the immediate decrease of the investor's initial position, which is reduced by the size of the spread upon entering the CFD.

- Other CFD risks include weak industry regulation, potential lack of liquidity, and the need to maintain an adequate margin.

Contract for differences (CFD)

How cfds work

A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product (securities or derivatives) between the time the contract opens and closes.

It is an advanced trading strategy that is utilized by experienced traders only. There is no delivery of physical goods or securities with cfds. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset. For example, instead of buying or selling physical gold, a trader can simply speculate on whether the price of gold will go up or down.

Essentially, investors can use cfds to make bets about whether or not the price of the underlying asset or security will rise or fall. Traders can bet on either upward or downward movement. If the trader that has purchased a CFD sees the asset's price increase, they will offer their holding for sale. The net difference between the purchase price and the sale price are netted together. The net difference representing the gain from the trades is settled through the investor's brokerage account.

On the other hand, if the trader believes that the asset's value will decline, an opening sell position can be placed. In order to close the position, the trader must purchase an offsetting trade. Then, the net difference of the loss is cash-settled through their account.

Countries where you can trade cfds

CFD contracts are not allowed in the U.S. They are allowed in listed, over-the-counter (OTC) markets in many major trading countries, including the united kingdom, germany, switzerland, singapore, spain, france, south africa, canada, new zealand, hong kong, sweden, norway, italy, thailand, belgium, denmark, and the netherlands.

As for australia, where CFD contracts are currently allowed, the australian securities and investment commission (ASIC) has announced some changes in the issue and distribution of cfds to retail clients. ASIC’s goal is to strengthen consumer protections by reducing CFD leverage available to retail clients and by targeting CFD product features and sales practices that amplify retail clients’ CFD losses. ASIC’s product intervention order will be effective on march 29, 2021.

The U.S. Securities and exchange commission (SEC) has restricted the trading of cfds in the U.S., but non-residents can trade using them.

Fast fact

CFD trading is surging in 2020; the increase in popularity may be because of covid-19-induced volatility in the markets. A key feature of cfds is that they allow you to trade on markets that are heading downwards, in addition to those that are heading up—allowing them to deliver profit even when the market is in turmoil.

The costs of cfds

The costs of trading cfds include a commission (in some cases), a financing cost (in certain situations), and the spread—the difference between the bid price (purchase price) and the offer price at the time you trade.

There is usually no commission for trading forex pairs and commodities. However, brokers typically charge a commission for stocks. For example, the broker CMC markets, a U.K.-based financial services company, charges commissions that start from 10%, or $0.02 cents per share for U.S. And canadian-listed shares. The opening and closing trades constitute two separate trades, and therefore you are charged a commission for each trade.

A financing charge may apply if you take a long position; this is because overnight positions for a product are considered an investment (and the provider has lent the trader money to buy the asset). Traders are usually charged an interest charge on each of the days they hold the position.

For example, suppose that a trader wants to buy cfds for the share price of glaxosmithkline. The trader places a £10,000 trade. The current price of glaxosmithkline is £23.50. The trader expects that the share price will increase to £24.80 per share. The bid-offer spread is 23.48-23.50.

The trader will pay a 0.1% commission on opening the position and another 0.1% when the position is closed. For a long position, the trader will be charged a financing charge overnight (normally the LIBOR interest rate plus 2.5%).

The trader buys 426 contracts at £23.48 per share, so their trading position is £10,002.48. Suppose that the share price of glaxosmithkline increases to £24.80 in 16 days. The initial value of the trade is £10,002.48 but the final value is £10,564.80.

The trader's profit (before charges and commission) is: £10,564.80 – £10,002.48 = £562.32.

Since the commission is 0.1%, upon opening the position the trader pays £10. Suppose that interest charges are 7.5%, which must be paid on each of the 16 days that the trader holds the position. (426 x £23.48 x 0.075/365 = £2.06. Since the position is open for 16 days, the total charge is 16 x £2.06 = £32.89.)

When the position is closed, the trader must pay another 0.01% commission fee of £10.

The trader's net profit is equal to profits minus charges: 526.32 (profit) – 10 (commission) – 32.89 (interest) – 10 (commission)= £473.43 (net profit).

Advantages of cfds

Higher leverage

Cfds provide higher leverage than traditional trading. standard leverage in the CFD market is subject to regulation. It once was as low as a 2% maintenance margin (50:1 leverage), but is now limited in a range of 3% (30:1 leverage) and could go up to 50% (2:1 leverage). Lower margin requirements mean less capital outlay for the trader and greater potential returns. However, increased leverage can also magnify a trader's losses.

Global market access from one platform

Many CFD brokers offer products in all the world's major markets, allowing around-the-clock access. Investors can trade cfds on a wide range of worldwide markets.

No shorting rules or borrowing stock

Certain markets have rules that prohibit shorting, require the trader to borrow the instrument before selling short, or have different margin requirements for short and long positions. CFD instruments can be shorted at any time without borrowing costs because the trader doesn't own the underlying asset.

Professional execution with no fees

CFD brokers offer many of the same order types as traditional brokers including stops, limits, and contingent orders, such as "one cancels the other" and "if done." some brokers offering guaranteed stops will charge a fee for the service or recoup costs in another way.

Brokers make money when the trader pays the spread. Occasionally, they charge commissions or fees. To buy, a trader must pay the ask price, and to sell/short, the trader must pay the bid price. This spread may be small or large depending on the volatility of the underlying asset; fixed spreads are often available.

No day trading requirements

Certain markets require minimum amounts of capital to day trade or place limits on the number of day trades that can be made within certain accounts. The CFD market is not bound by these restrictions, and all account holders can day trade if they wish. Accounts can often be opened for as little as $1,000, although $2,000 and $5,000 are common minimum deposit requirements.

Variety of trading opportunities

Brokers currently offer stock, index, treasury, currency, sector, and commodity cfds. This enables speculators interested in diverse financial vehicles to trade cfds as an alternative to exchanges.

Disadvantages of cfds

Traders pay the spread

While cfds offer an attractive alternative to traditional markets, they also present potential pitfalls. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves. The spread also decreases winning trades by a small amount compared to the underlying security and will increase losses by a small amount. So, while traditional markets expose the trader to fees, regulations, commissions, and higher capital requirements, cfds trim traders' profits through spread costs.

Weak industry regulation

The CFD industry is not highly regulated. A CFD broker's credibility is based on reputation, longevity, and financial position rather than government standing or liquidity. There are excellent CFD brokers, but it's important to investigate a broker's background before opening an account.

Risks

CFD trading is fast-moving and requires close monitoring. As a result, traders should be aware of the significant risks when trading cfds. There are liquidity risks and margins you need to maintain; if you cannot cover reductions in values, your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset.

Leverage risks expose you to greater potential profits but also greater potential losses. While stop-loss limits are available from many CFD providers, they can't guarantee you won't suffer losses, especially if there's a market closure or a sharp price movement. Execution risks also may occur due to lags in trades.

Because the industry is not regulated and there are significant risks involved, cfds are banned in the U.S. By the securities and exchange commission (SEC).

Example of a CFD trade

Suppose that a stock has an ask price of $25.26 and the trader buys 100 shares. The cost of the transaction is $2,526 (plus any commission and fees). This trade requires at least $1,263 in free cash at a traditional broker in a 50% margin account, while a CFD broker requires just a 5% margin, or $126.30.

A CFD trade will show a loss equal to the size of the spread at the time of the transaction. If the spread is $0.05 cents, the stock needs to gain $0.05 cents for the position to hit the break-even price. While you'll see a $0.05 gain if you owned the stock outright, you would have also paid a commission and incurred a larger capital outlay.

If the stock rallies to a bid price of $25.76 in a traditional broker account, it can be sold for a $50 gain or $50 / $1,263 = 3.95% profit. However, when the national exchange reaches this price, the CFD bid price may only be $25.74. The CFD profit will be lower because the trader must exit at the bid price and the spread is larger than on the regular market.

In this example, the CFD trader earns an estimated $48 or $48 / $126.30 = 38% return on investment. The CFD broker may also require the trader to buy at a higher initial price, $25.28 for example. Even so, the $46 to $48 earned on the CFD trade denotes a net profit, while the $50 profit from owning the stock outright doesn't include commissions or other fees. Thus, the CFD trader ends up with more money in their pocket.

Cfds faqs

What are cfds?

Contracts for differences (cfds) are contracts between investors and financial institutions in which investors take a position on the future value of an asset. The difference between the open and closing trade prices are cash-settled. There is no physical delivery of goods or securities; a client and the broker exchange the difference in the initial price of the trade and its value when the trade is unwound or reversed.

How do cfds work?

A contract for difference (CFD) allows traders to speculate on the future market movements of an underlying asset, without actually owning or taking physical delivery of the underlying asset. Cfds are available for a range of underlying assets, such as shares, commodities, and foreign exchange. A CFD involves two trades. The first trade creates the open position, which is later closed out through a reverse trade with the CFD provider at a different price.

If the first trade is a buy or long position, the second trade (which closes the open position) is a sell. If the opening trade was a sell or short position, the closing trade is a buy.

The net profit of the trader is the price difference between the opening trade and the closing-out trade (less any commission or interest).

Why are cfds illegal in the U.S.?

Part of the reason that cfds are illegal in the U.S. Is that they are an over-the-counter (OTC) product, which means that they don't pass through regulated exchanges. Using leverage also allows for the possibility of larger losses and is a concern for regulators.

The commodity futures trading commission (CFTC) and the securities and exchange commission (SEC) prohibit residents and citizens of the U.S. From opening CFD accounts on domestic or foreign platforms.

Is trading cfds safe?

Trading cfds can be risky, and the potential advantages of them can sometimes overshadow the associated counterparty risk, market risk, client money risk, and liquidity risk. CFD trading can also be considered risky as a result of other factors, including poor industry regulation, potential lack of liquidity, and the need to maintain an adequate margin due to leveraged losses.

Can you make money with cfds?

Yes, of course, it is possible to make money trading cfds. However, trading cfds is a risky strategy relative to other forms of trading. Most successful CFD traders are veteran traders with a wealth of experience and tactical acumen.

The bottom line

Advantages to CFD trading include lower margin requirements, easy access to global markets, no shorting or day trading rules, and little or no fees. However, high leverage magnifies losses when they occur, and having to pay a spread to enter and exit positions can be costly when large price movements do not occur. Indeed, the european securities and markets authority (ESMA) has placed restrictions on cfds to protect retail investors.

Contract for differences (CFD)

What is a contract for differences (CFD)?

A contract for differences (CFD) is an arrangement made in financial derivatives trading where the differences in the settlement between the open and closing trade prices are cash-settled. There is no delivery of physical goods or securities with cfds.

Contracts for differences is an advanced trading strategy that is used by experienced traders and is not allowed in the united states.

Key takeaways

- A contract for differences (CFD) is a financial contract that pays the differences in the settlement price between the open and closing trades.

- Cfds essentially allow investors to trade the direction of securities over the very short-term and are especially popular in FX and commodities products.

- Cfds are cash-settled but usually allow ample margin trading so that investors need only put up a small amount of the contract's notional payoff.

Understanding contract for differences

Cfds allow traders to trade in the price movement of securities and derivatives. Derivatives are financial investments that are derived from an underlying asset. Essentially, cfds are used by investors to make price bets as to whether the price of the underlying asset or security will rise or fall.

CFD traders may bet on the price moving up or downward. Traders who expect an upward movement in price will buy the CFD, while those who see the opposite downward movement will sell an opening position.

Should the buyer of a CFD see the asset's price rise, they will offer their holding for sale. The net difference between the purchase price and the sale price are netted together. The net difference representing the gain or loss from the trades is settled through the investor's brokerage account.

Conversely, if a trader believes a security's price will decline, an opening sell position can be placed. To close the position they must purchase an offsetting trade. Again, the net difference of the gain or loss is cash-settled through their account.

Contract for differences (CFD)

Transacting in cfds

Contracts for differences can be used to trade many assets and securities including exchange-traded funds (etfs). Traders will also use these products to speculate on the price moves in commodity futures contracts such as those for crude oil and corn. Futures contracts are standardized agreements or contracts with obligations to buy or sell a particular asset at a preset price with a future expiration date.

Although cfds allow investors to trade the price movements of futures, they are not futures contracts by themselves. Cfds do not have expiration dates containing preset prices but trade like other securities with buy and sell prices.

Cfds trade over-the-counter (OTC) through a network of brokers that organize the market demand and supply for cfds and make prices accordingly. In other words, cfds are not traded on major exchanges such as the new york stock exchange (NYSE). The CFD is a tradable contract between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed.

Advantages of a CFD

Cfds provide traders with all of the benefits and risks of owning a security without actually owning it or having to take any physical delivery of the asset.

Cfds are traded on margin meaning the broker allows investors to borrow money to increase leverage or the size of the position to amply gains. Brokers will require traders to maintain specific account balances before they allow this type of transaction.

Trading on margin cfds typically provides higher leverage than traditional trading. Standard leverage in the CFD market can be as low as a 2% margin requirement and as high as a 20% margin. Lower margin requirements mean less capital outlay and greater potential returns for the trader.

Typically, fewer rules and regulations surround the CFD market as compared to standard exchanges. As a result, cfds can have lower capital requirements or cash required in a brokerage account. Often, traders can open an account for as little as $1,000 with a broker. Also, since cfds mirror corporate actions taking place, a CFD owner can receive cash dividends increasing the trader’s return on investment. Most CFD brokers offer products in all major markets worldwide. Traders have easy access to any market that is open from the broker’s platform.

Cfds allow investors to easily take a long or short position or a buy and sell position. The CFD market typically does not have short-selling rules. An instrument may be shorted at any time. Since there is no ownership of the underlying asset, there is no borrowing or shorting cost. Also, few or no fees are charged for trading a CFD. Brokers make money from the trader paying the spread meaning the trader pays the ask price when buying, and takes the bid price when selling or shorting. The brokers take a piece or spread on each bid and ask price that they quote.

Disadvantages of a CFD

If the underlying asset experiences extreme volatility or price fluctuations, the spread on the bid and ask prices can be significant. Paying a large spread on entries and exits prevents profiting from small moves in cfds decreasing the number of winning trades while increasing losses.

Since the CFD industry is not highly regulated, the broker’s credibility is based on its reputation and financial viability. As a result, cfds are not available in the united states.

Since cfds trade using leverage, investors holding a losing position can get a margin call from their broker, which requires additional funds to be deposited to balance out the losing position. Although leverage can amplify gains with cfds, leverage can also magnify losses and traders are at risk of losing 100% of their investment. Also, if money is borrowed from a broker to trade, the trader will be charged a daily interest rate amount.

Cfds allow investors to trade the price movement of assets including etfs, stock indices, and commodity futures.

Cfds provide investors with all of the benefits and risks of owning a security without actually owning it.

Cfds use leverage allowing investors to put up a small percentage of the trade amount with a broker.

Cfds allow investors to easily take a long or short position or a buy and sell position.

Although leverage can amplify gains with cfds, leverage can also magnify losses.

Extreme price volatility or fluctuations can lead to wide spreads between the bid (buy) and ask (sell) prices from a broker.

The CFD industry is not highly regulated, not allowed in the U.S., and traders are reliant on a broker’s credibility and reputation.

Investors holding a losing position can get a margin call from their broker requiring the deposit of additional funds.

Real-world example of a CFD

An investor wants to buy a CFD on the SPDR S&P 500 (SPY), which is an exchange traded fund that tracks the S&P 500 index. The broker requires 5% down for the trade.

The investor buys 100 shares of the SPY for $250 per share for a $25,000 position from which only 5% or $1,250 is paid initially to the broker.

Two months later the SPY is trading at $300 per share, and the trader exits the position with a profit of $50 per share or $5,000 in total.

The CFD is cash-settled; the initial position of $25,000 and the closing position of $30,000 ($300 * 100 shares) are netted out, and the gain of $5,000 is credited to the investor's account.

What is CFD trading?

What is CFD trading?

Experienced investors would have heard of the term CFD trading, but if you are new to the trading and investment world, you may be wondering what does it mean and how does it work.

The first thing to know is that CFD stands for contract for difference. But exactly what is CFD trading? And how can it be part of your investment portfolio, both as a novice and a seasoned investor? Let’s take a look at CFD trading in more detail to help you understand.

A contract for difference (CFD) is a financial contract between the investor and an online provider, based upon the value of a financial asset or group of assets, without owning the agreed upon underlying asset. CFD trading can be offered on a varied number of financial instruments, such as shares, bonds, commodities, forex, metals, energy, stocks, indices, currencies and cryptocurrencies.

CFD trading enables the opportunity to speculate on the price movement of a financial asset and involves trading on the price of an asset at the point of opening the contract to when it closes, exchanging the difference in price.

How does CFD trading work?

Investors can take a position on both falling and rising prices with CFD trading, as one of the conditions of a CFD is that the investor does not own the underlying asset.

Each CFD contract has a buy and a sell price, which are slightly higher or lower than the market value, respectively. The difference between these two prices is known as the spread, and the trading involves the prediction of movement of these prices. As previously mentioned, CFD trading allows an investor to speculate on the market in either direction of rising or falling, with the price of the CFD contract mirroring that of the underlying asset.

Similar to traditional trading, if you expect the market to rise, then you would aim to buy, which means that you are ‘going long’ or you are ‘long’, and will profit from the rise in prices. However, in contrast to traditional trading, you can also open a CFD position if you believe that the prices of the underlying asset in the market will decrease, then you would sell and be ‘going short’ or are ‘short’.

The profit and loss are reliant on the extent to which your predications on these prices are correct. The more the market goes in the direction that you have predicted, the larger the profits. Likewise, if the market moves in the opposite direction to what you have predicted, then the more you would lose.

What is leverage in CFD trading?

Leverage allows investors to only invest a smaller amount compared to the actual value of the trade, meaning that they can gain exposure to a much larger position on the market without having to invest the full cost, like you would have to with a standard trade. With a leveraged CFD, you can therefore put down a smaller portion of the cost and spread your investments further, controlling a much larger position of investments. The fact that CFD trading provides this leverage and this market exposure to more winning trades, are some of the reasons CFD trading is so popular among investors.

But, when CFD trading using leverage, it is important to remember that just as much as the leverage can enhance your buying abilities by multiplying the original amount invested, it can also multiple both your profits and losses. This is because the outcome is calculated on the full size of the position, not on the actual amount invested. Therefore, it is always advised to research and take into account the leverage ratio when CFD trading.

CFD trading is a popular strategy for investors for many reasons. It allows the opportunity for trading on both rising and falling markets, with short and long positions available, depending on the market and adapting to the investor’s trading strategy. As well as the option of leverage, CFD trading can also work in terms of hedging, when you can open a CFD to prevent potential losses when owning the actual asset itself and if you believe the share prices will go down. With so many benefits, its clear to see why CFD trading works for many investors.

CFD stock trading: what does it mean and how can it be done?

Contracts for difference, known as cfds, are one of the ways an investor can gain access to the stocks and shares market, and has become increasingly popular over the years. As CFD brokers commonly offer leverage when trading stock cfds, this type of trading gives investors greater exposure to the stock market, with less capital. Usually used in day trading, it also means investors can trade on falling prices, or hedge their losses against a bearish market when owning the underlying asset. Here we explain more about what exactly cfds are, and how you can they be used in stock trading.

What are cfds?

Contracts for difference (cfds) are financial derivatives, where an agreement takes place between an investor and a broker on the value of an asset, between opening and closing the contract. Unlike traditional financial markets, there is no delivery of physical goods or securities, as the underlying asset is not owned by the investor.

This type of trading allows investors to speculate on the price movement of an asset, for example shares in a company, and open and close the contract accordingly. They can open a buy position or a sell position, depending on the predicted movement of the stock price. This allows for the potential profit on both rising and falling markets.

When trading in stock cfds, you do not have ownership of the shares – meaning you do not have benefits such as voting rights or dividends from the companies in which the shares are invested in. However, cfds give traders the ability to use leverage to speculate on the movement of the stock market, without needing to use large sums of money as an initial deposit. This leverage is usually higher than that of traditional trading, and with less capital outlay and greater potential for higher returns. For example, a leverage ratio of 1:5 allows you to start trading with £100, but gain the effect of a value of £500. Leverage amplifies any profits, but this also applies to your losses too.

How to trade shares with cfds?

First of all, you should choose the trading platform in which to conduct the trade of cfds. It is vital that you go through a reputable and regulated provider, to ensure that all prices and transactions are transparent, and that you have full client protection.

Once you have created an account and deposited your initial capitol, you can then choose which shares you will speculate the rise and fall of price. There will be a variety available in terms of which market to choose, such as the USA, UK or germany, as well as popular individual assets such as share cfds in facebook and apple.

From there, you can open as many CFD contracts as you would like, known as units. One unit equates to a contract in the difference of price of one share value. With leveraged trading included, make sure you have enough money in your deposit to open this number of cfds and maintain your position.

If you think the stock price will rise, then you would open a buy position. Likewise, if you think the market will fall, then you would open a sell position. Through the online trading platform, you can choose to predefine stops and limits automatically, at a predetermined price, to limit your losses and lock in profits.

Once a CFD is closed, the profit or loss is determined by the difference in the price of the underlying asset from opening the contract, and any profit or loss will be shown in your account balance. From this same account, you can choose to trade cfds in various underlying shares.

Remember to always consult the trading platform in which you are opening the CFD, as they will have plenty of information and guides available to access. For example, if you wish to know how to trade stocks in the UK on plus500, their website offers live market data and detailed answers to frequently asked questions, all in one place.

CFD stock trading has its advantages and disadvantages, just like regular trading on the stock market, and is more suited to experienced traders. Remember to choose your investments wisely, and make your decisions based on your trading style, objectives and strategies.

What is CFD trading and how does it work?

Trading contracts for difference (cfds) is a way of speculating on financial markets that doesn’t require the buying and selling of any underlying assets. Find out everything you need to know to understand CFD trading, from what it is and how it works to short trades, leverage and hedging.

Interested in trading cfds with IG?

Call 1800 601 799 or email newaccounts.Au@ig.Com to talk about opening a trading account. We’re here 24 hours a day, except from 9am to 7pm saturdays (AEDT).

What is CFD trading?

CFD trading is defined as ‘the buying and selling of cfds’, with ‘CFD’ meaning ‘contract for difference’. Cfds are a derivative product because they enable you to speculate on financial markets such as shares, forex, indices and commodities without having to take ownership of the underlying assets.

Instead, when you trade a CFD, you are agreeing to exchange the difference in the price of an asset from the point at which the contract is opened to when it is closed. One of the main benefits of CFD trading is that you can speculate on price movements in either direction, with the profit or loss you make dependent on the extent to which your forecast is correct.

The sections that follow explain some of the main features and uses of contracts for difference:

Short and long CFD trading explained

CFD trading enables you to speculate on price movements in either direction. So while you can mimic a traditional trade that profits as a market rises in price, you can also open a CFD position that will profit as the underlying market decreases in price. This is referred to as selling or ‘going short’, as opposed to buying or ‘going long’.

If you think apple shares are going to fall in price, for example, you could sell a share CFD on the company. You’ll still exchange the difference in price between when your position is opened and when it is closed, but will earn a profit if the shares drop in price and a loss if they increase in price.

With both long and short trades, profits and losses will be realised once the position is closed.

Leverage in CFD trading explained

CFD trading is leveraged, which means you can gain exposure to a large position without having to commit the full cost at the outset. Say you wanted to open a position equivalent to 500 apple shares. With a standard trade, that would mean paying the full cost of the shares upfront. With a contract for difference, on the other hand, you might only have to put up 5% of the cost. Learn more about the differences between cfds and share trading.

While leverage enables you to spread your capital further, it is important to keep in mind that your profit or loss will still be calculated on the full size of your position. In our example, that would be the difference in the price of 500 apple shares from the point you opened the trade to the point you closed it. That means both profits and losses can be hugely magnified compared to your outlay, and that losses can exceed deposits. For this reason, it is important to pay attention to the leverage ratio and make sure that you are trading within your means.

Margin explained

Leveraged trading is sometimes referred to as ‘trading on margin’ because the funds required to open and maintain a position – the ‘margin’ – represent only a fraction of its total size.

When trading cfds, there are two types of margin. A deposit margin is required to open a position, while a maintenance margin may be required if your trade gets close to incurring losses that the deposit margin – and any additional funds in your account – will not cover. If this happens, you may get a margin call from your provider asking you to top up the funds in your account. If you don’t add sufficient funds, the position may be closed and any losses incurred will be realised.

Hedging with cfds explained

Cfds can also be used to hedge against losses in an existing portfolio.

For example, if you believed that some ABC limited shares in your portfolio could suffer a short-term dip in value as a result of a disappointing earnings report, you could offset some of the potential loss by going short on the market through a CFD trade. If you did decide to hedge your risk in this way, any drop in the value of the ABC limited shares in your portfolio would be offset by a gain in your short CFD trade.

How do cfds work?

Now you understand what contracts for difference are, it’s time to take a look at how they work. Here we explain four of the key concepts behind CFD trading: spreads, deal sizes, durations and profit/loss.

Spread and commission

CFD prices are quoted in two prices: the buy price and the sell price.

- The sell price (or bid price) is the price at which you can open a short CFD

- The buy price (or offer price) is the price at which you can open a long CFD

Sell prices will always be slightly lower than the current market price, and buy prices will be slightly higher. The difference between the two prices is referred to as the spread.

Most of the time, the cost to open a CFD position is covered in the spread: meaning that buy and sell prices will be adjusted to reflect the cost of making the trade.

The exception to this is our share cfds, which are not charged via the spread. Instead, our buy and sell prices match the price of the underlying market and the charge for opening a share CFD position is commission-based. By using commission, the act of speculating on share prices with a CFD is closer to buying and selling shares in the market.

Deal size

Cfds are traded in standardised contracts (lots). The size of an individual contract varies depending on the underlying asset being traded, often mimicking how that asset is traded on the market.

Silver, for example, is traded on commodity exchanges in lots of 5000 troy ounces, and its equivalent contract for difference also has a value of 5000 troy ounces. For share cfds, the contract size is usually representative of one share in the company you are trading. To open a position that mimics buying 500 shares of HSBC, you’d buy 500 HSBC CFD contracts.

This is another way in which CFD trading is more similar to traditional trading than other derivatives, such as options.

Duration

Most CFD trades have no fixed expiry – unlike options. Instead, a position is closed by placing a trade in the opposite direction to the one that opened it. A buy position of 500 gold contracts, for instance, would be closed by selling 500 gold contracts.

If you keep a daily CFD position open past the daily cut-off time (typically 10pm UK time, although this may vary for international markets), you’ll be charged an overnight funding charge. The cost reflects the cost of the capital your provider has in effect lent you in order to open a leveraged trade.

This isn’t always the case though, with the main exception being a forward contract. A forward contract has an expiry date at some point in the future, and has all overnight funding charges already included in the spread.

Profit and loss

To calculate the profit or loss earned from a CFD trade, you multiply the deal size of the position (total number of contracts) by the value of each contract (expressed per point of movement). You then multiply that figure by the difference in points between the price when you opened the contract and when you closed it.

Profit or loss

=

(no. Of contracts x value of each contract)

x (closing price - opening price)

For a full calculation of the profit or loss from a trade, you’d also subtract any charges or fees you paid. These could be overnight funding charges, commission or guaranteed stop fees.

Say, for instance, that you buy 50 FTSE 100 contracts when the buy price is 7500.0. A single FTSE 100 contract is equal to a $10 per point, so for each point of upward movement you would make $500 and for each point of downward movement you would lose $500 (50 contracts multiplied by $10).

If you sell when the FTSE 100 is trading at 7505.0, your profit would be $2500

2500 = (50 x 10) x (7505.0 - 7500.0)

If you sell when the FTSE 100 is trading at 7497.0, your loss would be $1500

-1500 = (50 x 10) x (7497.0 - 7500.0)

Some providers allow you to trade cfds without leverage. With IG, however, all CFD trades are leveraged. The amount of leverage offered depends on various factors including the volatility and liquidity of the underlying market, as well as the law in the country in which you are trading.

The way to use cfds for hedging is by opening a position that will become profitable if one of your other positions begins to incur a loss. An example of this would be taking out a short position on a market that tracks the price of an asset you own. Any drop in the value of your asset would then be offset by the profit from your CFD trade.

Say, for example, you hold a number of shares in apple but believe these shares may fall in value in the future. You could go short on apple via a share CFD. If you are correct and your apple shares fall in value, then the profit from your short CFD trade will offset this loss.

When you trade cfds (contracts for difference), you buy a certain number of contracts on a market if you expect it to rise, and sell them if you expect it to fall. The change in the value of your position reflects movements in the underlying market. With cfds, you can close your position any time when the market is open.

Futures, on the other hand, are contracts that require you to trade a financial instrument in the future. Unlike cfds, they specify a fixed date and price for this transaction – which can involve taking physical ownership of the underlying asset on this date – and must be purchased via an exchange. The value of a futures contract depends as much on market sentiment about the future price of the asset as current movements in the underlying market.

It is worth keeping in mind that with an IG CFD trading account, you can speculate on the price of futures contracts without having to buy the contracts themselves.

Discover CFD trading with IG

Learn about the benefits of CFD trading and see how you get started with IG.

You might be interested in…

Cfds vs share trading

Discover the differences between CFD and share trading

Managing your risk

Learn about risk management tools including stops and limits

Platforms and apps

Browser-based desktop trading and native apps for all devices

- CFD trading

- What is CFD trading and how does it work?

- How to trade cfds

- What are the benefits of trading cfds?

- Cfds vs share trading

- Our charges

- Is CFD trading for me?

- Volume-based cash rebates

- What are the risks?

- CFD account details

Markets

Trading platforms

Analysis

About

Contact us

Cfds are a leveraged product and can result in losses that exceed deposits. You do not own or have any interest in the underlying asset. Please consider the margin trading product disclosure statement (PDS) before entering into any CFD transaction with us.

The value of shares and etfs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

Please ensure you fully understand the risks and take care to manage your exposure.

IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. IG is not a financial advisor and all services are provided on an execution only basis.

Share trading accounts and new zealand CFD accounts (opened pursuant to IG’s margin trading new zealand customer agreement), are provided by IG markets limited (level 15, 55 collins street, melbourne VIC 3000. ABN: 84 099 019 851, australian financial services licence no. 220440. Derivatives issuer licence in new zealand, FSP no. 18923).

Australian CFD accounts (opened pursuant to IG’s margin trading australian customer agreement) that are opened prior to 15 november 2020 are also provided by IG markets limited. Australian CFD accounts opened from 15 november 2020 are provided by IG australia pty ltd (level 15, 55 collins street, melbourne VIC 3000. ABN 93 096 585 410, australian financial services licence no. 515106).

The information on this site is not directed at residents of the united states or any particular country outside australia or new zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

CFD trading vs share trading

Both CFD trading and stock trading provide a means of profiting from price movements in markets. But which instrument should you use? To answer the CFD trading vs share trading debate, we’ll inspect the differences.

Quick overview

What is CFD trading?

With online CFD trading, you speculate on prices derived from an underlying security, without actually owning the underlying asset. For example, let’s say you think the value of facebook shares are going to rise. You could purchase a CFD stock from your broker at the current market rate. If the value of facebook stocks then climbs, you could sell your CFD at the new, higher price. Your broker would then return the difference to your account.

For detailed guidance on the best CFD trading strategies and brokers, see here.

What is share trading?

Stock and shares trading is the buying and selling of physical company shares. Returning to our facebook example, if you think the price is about to rise, you could buy 10 facebook shares. Then if their value does increase, you could sell them and pocket any profit.

For detailed guidance on stocks, including strategies and top providers, see here.

CFD trading vs stock trading

Ownership

There are some clear differences when it comes to CFD trading vs real stock trading. Most notably, you do not own the underlying asset with CFD investing while you do when dealing in shares. This means that with FTSE cfds, for example, you can benefit from price fluctuations without entering a legal contract to own any shares and equity in companies.

Finance

Another key difference between cfds and stocks is the ability to finance trades. With cfds, you can trade on leverage, meaning for a small outlay, you can substantially increase your position by borrowing the remaining capital from your broker. Margin requirements are usually between 5% and 25%.

Let’s say you wanted to buy apple stock at $500 per share. If you bought five physical shares, you’d need $2,500. But if you bought five CFD stocks with a 5% margin, you’d only need to put down $125. Not only would this leave you with more capital to invest elsewhere, but it means you’ve increased your position by twenty-fold. This could seriously enhance profits. But while the benefit of leverage is the ability to magnify profits, losses too can be amplified. Opt for share dealing and you can’t lose more than your initial deposit.

Markets

Another distinction to consider when looking at CFD trading vs share trading is market access. You can trade a wide range of instruments with cfds, from shares and indices to forex and cryptocurrency. With stocks, you are limited to investments in shares and etfs only.

There are fees regardless of whether you opt for share trading or CFD trading. With stocks and shares, you usually pay a commission on all trades. Also, there may be a currency conversion charge on international trades. With cfds, there will normally be spreads on all markets apart from shares. With cfds on shares, most brokers charge a commission.

Cash settlement

With share positions, it can take a couple of days for a trade to settle and profits to be available. In CFD investing, there is no settlement period. Profits and losses are normally available as soon as you close out a position. As a result, you can promptly reinvest capital into your next position.

Taxes

Presented with the choice of CFD trading or share trading, take into account the tax implications. With cfds, in the UK for example, you do not pay stamp duty as you don’t actually own the underlying asset. CFD profits are, however, subject to capital gains tax. In stock investing, stamp duty is payable and so too is capital gains tax.

Note that the tax treatment of CFD or stock trading can vary greatly between different countries. We can’t cover all those differences in this article, so make sure you check with your local tax office before engaging in any trading activities.

Hedging

Stock investing is not suitable for hedging. But cfds can be used to hedge share positions. Cfds allow you to go short, so if the market price falls, any loss in your share position can be offset by profits made through your opposing short CFD position.

Market hours

As cfds give you access to thousands of markets, including index funds from across the world, you can effectively trade 24 hours a day. With shares, you can only buy and sell during stock exchange trading hours.

Short-term vs long-term strategies

For short-term intraday and day traders, cfds are arguably the better product. For long-term investments, stocks and shares are considered the better choice. That isn’t to say, of course, that profits can’t be made from day trading stocks and shares.

Platforms

Platforms shouldn’t play too much of a role in the cfds vs stocks consideration. Both instruments are available through desktop and mobile devices. Brokers offer bespoke and popular software, including arguably the best platform – metatrader 4 (MT4). Direct market access (DMA) platforms are also available with both.

Shareholder privileges

Cfds do not grant investors any shareholder privileges. Equity shares, on the other hand, bring with them voting rights on company issues. This extra influence can be particularly useful if stocks form part of a longer-term investment strategy.

Dividends

Dividends also play a part in the CFD trading vs share trading debate. Opt for cfds and positions are adjusted for changes from dividends. With stocks, you’ll receive dividends directly, if paid.

Long & short opportunities

With stockbroking, you can only trade on rising prices. With cfds, you can take both long and short positions.

Expiries

There are no expiry dates with shares. Cfds also don’t have expiries, aside from futures and options.

Which one is best for me?

CFD trading and share trading each have their benefits. For beginners, shares are straightforward and less risky. For experienced traders with a strong grasp of the financial markets, leveraged cfds can be lucrative. Cfds also open the door to a range of markets beyond stocks and shares.

If you’re not sure whether to go with CFD trading or share trading, why not try both? On many platforms, you can easily switch from an open stock position straight to a CFD. A demo account is also a fantastic way to trial both products before reaching into your pocket.

For further reading, please see our sections on CFD trading and stock trading.

Should I trade cfds or stocks?

CFD trading and share trading each have their own merits. If you’re looking for a riskier product that requires minimal outlay and opens the door to a range of markets, then cfds could be the right option. For less experienced traders who don’t want the risks that come with leveraged trading, then share trading may be more sensible.

Is CFD trading cheaper than share trading?

Because cfds are a leveraged instrument, you only need a small amount of capital to open a position, whereas you need the full share price to buy a physical share. With that said, your total exposure is the same with both. And while the nature of the fees is different, both share trading and CFD trading come with costs.

Are cfds subject to the same settlement period as shares?

No – the cash settlement period with CFD trading is automatic when you close out your position. In contrast, when share trading, it can take two days after a transaction is complete for profits and losses to appear in your account.

Can I use cfds to hedge my share positions?

Yes – cfds can be used to hedge against share positions. Cfds let you go short, so you can hedge against market volatility by opening an opposing position in the direction of your share trade.

How do I start CFD trading and share trading?

With both products, you’ll need to choose a broker, open a trading account and deposit funds into your platform. Once you’ve defined your risk parameters and have a strategy, you can take a position when you spot an opportunity in the market.

See our sections on CFD trading and stock trading for the best brokers and other tips.

What is CFD trading and how does it work?

Learn how to go long or short on thousands of global financial markets with cfds in this comprehensive guide. Starting at the very beginning – what CFD trading is, and how it works.

CFD trading enables you to hunt for live opportunities across shares, forex, indices, commodities and more. In this step-by-step guide, we’re going to cover all the fundamentals of cfds, so you can decide whether you want to start buying and selling contracts for difference yourself.

Skip ahead to a section below, or scroll down to start at the beginning.

Want to try out trading cfds with zero risk? With a city index CFD demo account, you get £10,000 virtual funds to trade our full range of markets. Click here to open one for free.

What does CFD mean?

CFD means contract for difference, which is an agreement between two parties to exchange the difference in a market’s price from when the contract is opened to when it is closed. You can use them to trade more than 12,000 global markets, without taking ownership of any physical assets.

CFD trading enables you to speculate on the price movement of a whole host of financial markets such as indices, shares, currencies, commodities and bonds – regardless of whether prices are rising or falling. And because you are speculating on price movement rather than owning the underlying instrument, you will not pay UK stamp duty on any profits*.

How does CFD trading work?

CFD trading works using contracts that mimic live financial markets. You buy and sell these contracts in the same way that you'd buy and sell the underlying market. But instead of choosing how much of a particular asset you would like to invest in – such as 100 HSBC shares – you pick how many contracts to buy.

If your market moves in your favour, your position will earn a profit. If it moves against you, it will incur a loss. You realise your profit or loss when you close the position by selling the contracts you bought at the outset.

Calculating profit or loss

Just like traditional investing, your return from a trade is determined by the size of your position and the number of points that the market has moved. If you buy 100 HSBC cfds at 400p then sell them at 450p, you will make (100 x 50) £5000. If you sold them at 350p instead, you would lose £5000.

CFD example – going long

For example, say you think the price of oil is going to go up. So you place a buy trade of five oil cfds at its current price of 5325.

The market rises 30 points to 5355. You close out your position by selling your five contracts. When you close a CFD position, you exchange the difference in the asset's price from when you opened it (5325) to now (5355).

The difference is 30 points, so you would make $30 for each contract you bought: a $150 profit (5 x 30).

However, if the market moves against you instead, then you would have to pay the difference to your provider. So if the price of oil falls 30 points to 5295, you would lose $150.

Going long vs going short

In traditional share dealing, you can only buy markets, which opens a long position. One of the key benefits of CFD trading is that you can sell an asset if you think it will fall in value. This is known as going short, and enables you to make a profit from falling prices.

Shorting with cfds works in the same fundamental way as going long. But instead of buying contracts to open your position, you sell them. In doing so, you’ll open a trade that earns a profit if the underlying market drops in price – but a loss if it rises.

CFD example – going short

The US 500 is at 3340, but you believe that it is about to fall as you expect the forthcoming US earnings season to disappoint.

So, you sell five US 500 cfds at 3340.

Your prediction is correct, and the US 500 falls to 3275. When you sell cfds, you’re still agreeing to exchange the difference in an asset’s price, but you earn a profit if the market falls and a loss if it rises.

The US 500 has fallen 65 points, so you earn $65 for each of your five contracts – a profit of $325.

But what would have happened if the index had risen 70 points instead? You would lose $70 for each of your five cfds, a total loss of $350.

Buy and sell prices

You’ll see two prices listed for every CFD market: the buy (or quote) price and the sell (or bid) price. To open a long position, you trade at the buy price. To go short, you trade at the sell price.

When you want to close, you do the opposite to when you opened. So if you’d bought, you would sell. If you’d sold, you would buy.

The buy price will always be slightly higher than the market’s current level, while the sell price will be a little bit below. The difference between the two is called the spread, and is usually how you’ll pay to open a position.

There is one significant exception to that rule, though. With share cfds, you pay a commission to open your position – just like when you buy physical shares with a stockbroker.

Choosing your deal size

As we’ve already covered, you decide the size of a CFD position by setting the number of contracts you want to buy or sell.

The size of a single CFD will change depending on your asset class. With equities, for example, buying one contract is the same as buying one share. With forex, it is the equivalent of a single lot.

What is leverage in CFD trading?

CFD trading is a leveraged product, which means you can open a trade by paying just a small fraction of its total value.

In other words, you can put up a small amount of money to control a much larger amount. This will magnify your return on investment, but it will also magnify your losses. So you should make sure to manage your risk accordingly.

Let’s return to our oil example above to see how this works in practice. Buying five oil cfds at 5325 would give you a total position size of (5 x 5325) $26,625. Because CFD trading is leveraged, you would only have to put up a fraction of that, known as your margin.

If oil requires 10% margin, then you’d only need to pay 10% of $26,625 to open your trade: $2662.50.

The advantages of cfds

Cfds are a popular way for investors to buy and sell a range of financial markets, bringing several benefits for active traders:

- Tax efficiency*

you are not required to pay UK stamp duty - Flexibility

you can trade on falling markets as well as rising ones, without borrowing any stock - Leverage

by using a small amount of money to control a much larger value position, you don’t have to tie up lots of capital

Plus, they can be a great tool for hedging.

Hedging

As cfds allow you to short sell, they are often used by investors as ‘insurance’ to offset losses made in their physical portfolios. This is known as hedging.

For example, if you hold £5,000 of barclays shares and you concerned that they are due for an imminent sell-off, you can help protect your share portfolio by short selling £5,000 of barclays cfds.

Should barclays share prices fall by 5% in the underlying market, the loss in your share portfolio would be offset by a gain in your short trade. In this way, you can protect yourself without going through the expense and inconvenience of liquidating your stock holdings.

Which instruments can I trade?

City index offers a choice of over 12,000 CFD markets, including:

- The world’s leading indices: the UK 100, wall st, germany 30 and dozens more

- GBP/USD, GBP/EUR, EUR/USD and 80+ more FX pairs

- Global shares such as rio tinto, amazon and general electric

- Commodities including oil, gold and cocoa

- Other markets such as bonds, interest rates and options

Is CFD trading right for me?

CFD trading is ideal for investors who want the opportunity to try and make a better return for their money.

However, it contains significant risks and is not suitable for everyone. We strongly suggest trying out a demo account before you get started with your own capital.

CFD trading may be ideal for people:

- Looking for short-term opportunities

cfds are typically held open for a few days or weeks, rather than over the longer term - Who want to make their own decisions on what to invest in

city index provides an execution-only service. We will not advise you on what to trade or trade on your behalf - Looking to diversify their portfolio

city index offers over 12,000 global markets to trade on including shares, commodities, FX and indices

Managing risk in CFD trading

As cfds are leveraged, it’s a good idea to manage your risk carefully when trading with them. Two key tools to help control risk on each trade are take profits and stop losses.

Take profits – also known as limit orders – will automatically close your position if it hits a certain profit level. In doing so, they help you stick to your plan when you may be tempted to hold onto a winning position, despite the risk that it may reverse.

Stop losses also automatically close your position, but they do it once it hits a specified level of loss. They help limit your total risk from any given trade. However, standard stop losses aren’t 100% effective as they can be subject to slippage if your market ‘gaps’ over your stop.

To ensure that your position will always close if your stop level is reached, you’ll need to upgrade to a guaranteed stop.

Spread betting vs CFD trading

Like CFD trading, spread betting enables you to open leveraged buy or sell positions on a range of markets without taking ownership of any assets. But these two leveraged products work in slightly different ways.

Instead of buying or selling contracts, when spread betting you bet a set number of pounds per point on the direction in which a market is headed. Your profit will increase for every point that the market moves in your direction, while your losses will increase if it moves against you.

What is the difference between cfds and futures?

While they are both derivatives – financial products that enable you to speculate on markets without buying assets – and both take the form of a contract, cfds and futures work very differently in practice.

When you buy a future, you are agreeing to trade a set amount of an asset at a set price on a set date (known as the expiry). If you hold a future when it expires, you’ll have to either buy or sell the underlying market – whether its oil, gold, forex or shares.

With a CFD, you are agreeing to exchange the difference in an asset’s price from when you opened your position to when you close it. You’ll never have to take ownership of the asset itself.

Does a CFD expire?

You can choose whether you want to trade a CFD that expires or not. Daily cfds don’t have expiry dates, while forward cfds will expire on a set date in the future.

Daily cfds are mostly intended for shorter-term positions, as they will incur overnight funding charges when held open for more than one day. Forward cfds have these charges included in the spread, so may be more cost effective if held open over the long term.

Do day traders trade cfds?

Yes. The leverage and range of markets available with cfds make them a popular option among day traders:

- Leverage magnifies profits and losses, which can be useful when trading relatively small price movements

- The range of markets helps day traders save time, accessing thousands of opportunities from a single login

Should I use CFD or invest?

It’s up to you. Cfds and traditional share investing are two very different products that suit different trading styles. Cfds, for example, can offer profits over a shorter-term horizon than investing – but they can also be more risky.

Many investors keep their share portfolios while also trading cfds.

Can you buy and sell the same stock repeatedly?

Yes – there are no limits to how many times you can buy and sell the same stock with a CFD. Some scalpers will even open and close positions on the same market multiple times within a single trading day.

So, let's see, what we have: find out how to go long or short on 10,000 CFD instruments with CMC markets and learn about the benefits of CFD trading. At cfd trading meaning

Contents of the article

- No deposit forex bonuses

- What is a contract for difference?

- CFD meaning

- What is CFD trading?

- Introduction to CFD trading: how does CFD trading...

- What are the costs of CFD trading?

- An introduction to contract for differences (cfds)

- How cfds work

- The costs of cfds

- Advantages of cfds

- Higher leverage

- Global market access from one platform

- No shorting rules or borrowing stock

- Professional execution with no fees

- No day trading requirements

- Variety of trading opportunities

- Disadvantages of cfds

- Example of a CFD trade

- Cfds faqs

- What are cfds?

- How do cfds work?

- Why are cfds illegal in the U.S.?

- Is trading cfds safe?

- Can you make money with cfds?

- The bottom line

- Contract for differences (CFD)

- What is a contract for differences (CFD)?

- Understanding contract for differences

- Transacting in cfds

- Advantages of a CFD

- Disadvantages of a CFD

- Real-world example of a CFD

- What is CFD trading?

- What is CFD trading?

- CFD stock trading: what does it mean and how can...

- What are cfds?

- How to trade shares with cfds?

- What is CFD trading and how does it work?

- What is CFD trading?

- Short and long CFD trading explained

- Leverage in CFD trading explained

- Margin explained

- Hedging with cfds explained

- How do cfds work?

- Discover CFD trading with IG

- You might be interested in…

- Cfds vs share trading

- Managing your risk

- Platforms and apps

- Markets

- Trading platforms

- Analysis

- About

- Contact us

- CFD trading vs share trading

- Quick overview

- CFD trading vs stock trading

- Ownership

- Finance

- Markets

- Cash settlement

- Taxes

- Hedging

- Market hours

- Short-term vs long-term strategies

- Platforms

- Shareholder privileges

- Dividends

- Long & short opportunities

- Expiries

- Which one is best for me?

- Should I trade cfds or stocks?

- Is CFD trading cheaper than share trading?

- Are cfds subject to the same settlement period as...

- Can I use cfds to hedge my share positions?

- How do I start CFD trading and share trading?

- What is CFD trading and how does it work?

- What does CFD mean?

- How does CFD trading work?

- Going long vs going short

- Buy and sell prices

- Choosing your deal size

- What is leverage in CFD trading?

- The advantages of cfds

- Hedging

- Which instruments can I trade?

- Is CFD trading right for me?

- Managing risk in CFD trading

- Spread betting vs CFD trading

- What is the difference between cfds and futures?

- Does a CFD expire?

- Do day traders trade cfds?

- Should I use CFD or invest?

- Can you buy and sell the same stock repeatedly?

Comments

Post a Comment