CFD Trading UK Guide 2021, cfd trading techniques.

Cfd trading techniques

Let’s look at an example of how CFD trading works in the UK. Say you want to buy royal mail shares, which are trading at 181p per share.

No deposit forex bonuses

You can go to your online CFD broker and purchase cfds for royal mail shares for 181p per contract. The key benefit to cfds is that you don’t have to take ownership of the underlying asset. That might not sound like a big deal if you’re only trading shares – in most cases, share certificates are held digitally in a share dealing account, so there’s no effort required on your end to buy and sell them.

CFD trading UK guide 2021

Michael graw PRO INVESTOR

Although many beginner investors initially learn to buy shares of companies, contracts for difference (cfds) are an increasingly popular type of investment. With cfds, you don’t own shares outright. Rather, you own a contract with your brokerage that lets you speculate on changes in the price of a company just like you would with shares.

There are several key advantages to CFD trading in the UK as opposed to buying shares outright. In this guide, we’ll cover everything you need to know about online CFD trading in the UK and reveal the best CFD trading platform of 2021.

What is CFD trading?

CFD trading is a form of derivatives trading. That means that instead of trading an asset directly, you trade a contract that is based on the value of that asset. For example, instead of buying and selling shares outright, you instead buy and sell a contract whose value depends on the price of the underlying shares.

CFD trading for beginners might sound complicated, but it’s actually pretty straightforward. In most cases, trading cfds works just like trading shares directly. If the value of the shares goes up by 5%, the value of your CFD contract also rises by 5%.

However, there are some key advantages to trading cfds. We’ll dive into these more later, but an important one is that you can trade almost any financial instruments with cfds. You can trade shares, for example, but you can also trade forex, commodities, cryptocurrencies, exchange-traded funds (etfs), bonds, and more.

CFD trading example

Let’s look at an example of how CFD trading works in the UK. Say you want to buy royal mail shares, which are trading at 181p per share. You can go to your online CFD broker and purchase cfds for royal mail shares for 181p per contract.

If the price of royal mail shares rises to 190p, the price of your CFD contracts will also rise to 190p. If you sell them at that price, you’d realize a tidy 9.5% profit – the same as if you had bought royal mail shares outright.

What can you trade with cfds?

As we mentioned, you can trade a lot more than just stock cfds. Cfds are extremely flexible, so they can be used to trade almost any type of financial instrument. Some popular CFD types in the UK include:

- Stock cfds

- Forex cfds

- Commodity cfds (for example, gold, silver, and oil)

- Cryptocurrency cfds

- ETF cfds

- Bond cfds

While those are the most common types of cfds that most top UK brokers offer, you could potentially trade cfds for less common types of assets. For example, cfds that track the price of real estate or even a piece of artwork are possible.

For any of these assets, the price of the CFD directly tracks the price of the underlying asset. For example, imagine you’re CFD trading bitcoin. If the value of bitcoin rises by 2%, the value of bitcoin cfds will also rise by 2%. The same goes for forex, commodities, indices, and anything else you trade using cfds.

Why trade cfds?

Since it’s possible to buy shares and other assets directly, why use cfds? There are several key advantages that make online CFD trading so popular.

Indirect ownership

The key benefit to cfds is that you don’t have to take ownership of the underlying asset. That might not sound like a big deal if you’re only trading shares – in most cases, share certificates are held digitally in a share dealing account, so there’s no effort required on your end to buy and sell them.

But what if you want to trade forex pairs or a commodity like oil? To buy oil directly, you have to arrange for the transport of physical barrels of crude and then store them somewhere. Trading forex requires you to convert pounds to another currency, which often involves navigating complex legal and tax regulations around foreign currencies.

When you trade cfds, you don’t have to worry about any of these problems. You own a contract, not a barrel of oil or a foreign currency – and you’re still equally poised to profit from changes in the price of that asset.

Leverage

Perhaps the main reason that cfds are so popular among share traders is that you can establish positions with leverage. With leverage, you essentially borrow money from your broker to increase the size of your position.

Let’s say that you want to buy astrazeneca shares, which are currently trading at £8.60. If you have £100 pounds in your trading account, you would only be able to buy 11 CFD contracts. But with leverage, you can invest more than is available in your CFD trading account. For example, if you use 10:1 leverage for your trade, you could buy 110 contracts for astrazeneca (a total cost of £946) with just £100 in your account.

The benefit of using leverage is that it increases your potential profit if the price of astra zeneca shares rise. For every 1% change in the price of the underlying share, the price of your CFD position – leveraged at 10:1 – will change by 10%. So with leverage, you can potentially multiply your returns from successful trades. Even better, since you need less money for every trade, you can diversify your trades without adding more money to your account.

Profit in either direction

Another major advantage to UK CFD trading is that you can profit even when the price of an asset drops. To do this, you can short sell CFD contracts rather than buy them. If the price of, say, facebook shares drops by 5%, the value of your short CFD position will rise by 5%.

Fractional investing

There’s another benefit to stock trading cfds, especially if you’re buying expensive shares like amazon. With stock cfds, you can invest as much or as little money as you want – you’re not forced to buy whole shares. So, while a single amazon share costs more than $3,400, most CFD brokers will let you invest as little as £50 at a time.

CFD trading UK fees

Whereas commissions are common among share brokers, many of the top UK CFD brokers are completely commission-free. That means that when CFD trading in the UK, you won’t pay a flat fee of several pounds per trade.

However, trading cfds isn’t completely free. Commission-free CFD trading platforms typically charge a spread that can range anywhere from less than 0.1% to more than 0.5%. The spread is the difference between the buy and sell price for a CFD contract, so it’s baked into your trades. The good news is that for most traders, spreads of around 0.1% for share CFD trading are much cheaper than commissions.

Risks of CFD trading

CFD trading carries many of the same risks as any other types of trading. There is always the chance that the underlying asset you are trading will lose value, in which case your CFD contracts will lost value as well. At that point, you can either sell them for a loss or continue to hold them to see if the price will rise again.

If you trade without leverage, CFD trading isn’t any riskier than trading assets directly. However, once you start trading with leverage, the risks of CFD trading in the UK increase significantly.

Most critically, leverage multiplies your losses. If you’re trading cfds with 10:1 leverage and the underlying asset drops by 1%, the value of your CFD position drops by 10%. Most brokers require you to keep a minimum account balance relative to the value of your positions, so you could be forced to add more money to your CFD trading account to keep your leveraged trade open. The alternative is that your broker will automatically sell your position for a loss.

Another thing to keep in mind is that since leverage requires borrowing money from your broker, it usually comes with interest fees. You’ll pay your broker for every day that your leveraged CFD position is open. If a price rise doesn’t happen as quickly as you expected, you could end up paying more in fees than you make in profit from your trade.

Best CFD trading strategies

There are many different ways to approach CFD trading. But no matter what your goals or trading style, it’s important to approach every trade with a clear plan.

To help you get started, let’s explore some popular CFD day trading strategies:

Momentum trading

Momentum trading is one of the simplest CFD trading strategies for beginners. You simply have to identify a stock or another asset that’s quickly gaining in value on strong volume. As more traders pile into the asset, it will briefly push its price up. As soon as the momentum starts to falter, sell your position to realize a profit. Remember, it’s better to sell too early and realize a profit than to sell too late and end up losing everything you gained.

Momentum is often triggered by news and company announcements, so you can figure out what share cfds to watch by keeping an eye on market news.

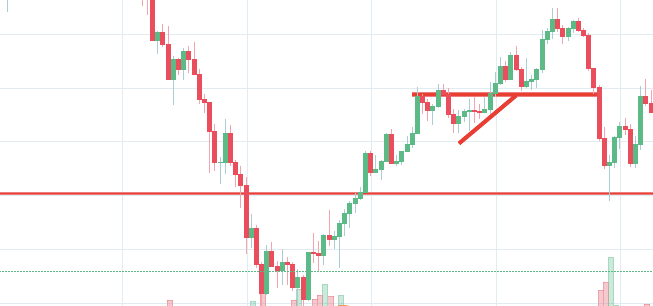

Breakout trading

Breakouts are another popular target for CFD traders. To find breakouts, you need to first identify areas of resistance that a share has been so far unable to break above. When the share finally breaks above that resistance level, it often keeps pushing higher.

The key to breakout trading is to avoid being fooled by false breaks. A true breakout should move above the resistance band on strong trading volume. You can also use technical analysis to identify other factors, like momentum, that signal an asset is truly going to make a big move higher.

Scalping

Scalping is a CFD trading strategy that involves a lot of focus and patience. With scalping, the goal is to profit on small, brief movements in the price of an asset that routinely happen throughout the day. You can look for small bouts of momentum or increased trading volume. Typically, scalping trades are opened and closed within just a few minutes.

Scalping is particularly suitable for CFD traders because you can apply leverage to your trades. The price movements involved are usually just a fraction of a percent. But with 10:1 leverage, that same price move can lead to a profit of several percentage points.

CFD trading tax UK

CFD trading is subject to capital gains taxes in the UK, just like if you bought and sold assets directly. The capital gains tax that you’ll pay depends on your individual tax situation. However, it’s worth noting that the tax rate is the same regardless of whether you’re trading stock cfds, forex cfds, commodity cfds, or any other type of CFD.

One big tax advantage to trading share cfds, though, is that you don’t pay a stamp tax. This is typically 0.5% of the value of your trade when you buy shares outright. So, it’s another important way that CFD trading in the UK can help save you money.

CFD trading tips

Trading cfds successfully can be profitable, but it’s important to keep in mind that this type of trading carries risk. Let’s explore five CFD trading tips that you can use to help you get the most out of your trading.

Start with a CFD trading demo account

One of the best things you can do when starting out with UK CFD trading is to sign up for a demo trading account. Most UK brokers offer these demo CFD trading platforms, which let you buy and sell cfds just like you would in a real CFD trading account – but without committing real money to your trades.

A demo account is a great place to get a feel for how CFD trading works and to develop a CFD trading strategy. Make sure to treat the demo as if you’re trading real money to practice good risk management.

Ease in and out of positions

Since most CFD brokers don’t charge commissions on your trades, there’s no downside to placing multiple buy and sell orders. Instead of executing a trade in one big order, you can mitigate risk by buying and selling over multiple orders.

The advantage of easing in and out of trades is that if the price drops slightly after your first purchase, you can buy more at the lower price. When selling, you can lock in some profits while also holding onto some CFD contracts to get a higher return if the price keeps rising.

Use stop loss orders

A stop loss is a price below the current market price of a CFD at which your broker will sell your position. Stop loss orders are key to good risk management. When you set a stop loss, nothing happens immediately. But if the value of your position drops significantly, your broker will automatically sell on your behalf to limit your losses.

Helpfully, you can also use stop loss orders to lock in some profit. Just set your stop loss higher than what you paid for a CFD.

Make use of technical analysis

Technical analysis is an important toolbox for analyzing stocks, forex, and other assets. This type of analysis looks at the past price activity of an asset to predict where it’s going in the future. While you should never rely solely on a single technical indicator, using multiple indicators and price charts together can help you build a trading strategy and identify potential CFD trades.

Diversify your portfolio

One of the benefits of trading cfds is that you can establish more positions without adding more money to your account. Whether you trade fractional shares or use leverage, it doesn’t cost much to trade with cfds.

You can use this to your advantage by diversifying your portfolio. You could trade stock cfds for companies in different market sectors – for example, buy oil shares, blue chip stocks, and pharmaceutical shares. Or trade share cfds and forex cfds to diversify across financial instruments. The more diversified your portfolio, the more you’re insulated if one company or one market sector drops in value.

Best CFD trading platforms in the UK

In order to start trading cfds in the UK, you’ll need to open an account with a CFD trading platform. There are tons of brokers to choose from and they vary widely in pricing, what cfds they offer, and what stock trading tools they include. So to help you pick, we’ll highlight three of our favorite UK CFD brokers.

1. Etoro – UK’s overall best CFD trading platform

Etoro is our favourite CFD broker in the UK. This broker offers trading on more than 800 shares from around the globe as well as more than 450 etfs, and you can choose between buying shares outright or trading cfds. You can also trade cfds for forex, commodities, cryptocurrencies, indices, and bonds. All trading at etoro is 100% commission-free, and this broker charges spreads that are well below the industry average.

What really sets etoro apart, though, is its CFD trading platform. Etoro has its own social trading network where you can interact with other CFD traders, ask questions, and gauge market sentiment. You can also take advantage of copy trading, which uses part of your portfolio to automatically copy the positions of expert traders.

On top of that, etoro offers a built-in charting platform with dozens of technical studies. It misses out on some advanced features like forex signals, but it’s more than capable enough for most intermediate traders. Etoro also has a mobile CFD trading app to help you monitor the market on the go.

Cfds for 800+ global shares wide range of financial instruments fully commission-free trading social trading network with copy trading advanced charting platform accepts paypal

Withdrawal and inactivity fees

5 CFD trading tips & strategies every beginner should know – 2020 guide

Stock trading has been around for hundreds of years, but it has always been the market for those that are more financially stronger. However, a lot of things have changed in the 21 st century, making stock buying & much more accessible to a “regular” citizen. In other words, you do not need to have millions of dollars in your bank account to make a transaction in this industry. With easy access to the internet and contracts for difference or CFD, it is not easier than ever to trade.

Nevertheless, just because it is accessible to you, me and everyone else do not make it simple or easy. You can buy and sell with a much smaller amount of money today, but it is still difficult to make a profit out of this as much as it was a hundred years ago.

However, there is no need to lose hope. Today, there is so much information regarding CFD trading, even a beginner could make some real cash out of it. To save you from all those common mistakes you can make as a beginner, I decided to write this guide and tell you about all the trading tips and strategies you need to know about.

Learn more about CFD trading

If all of this is very new to you, the first thing you should probably do is try to understand how this entire industry works. Once you get a good understanding of how it works, you can become a part of it. Otherwise, without any knowledge, you will just end up spending your money aimlessly and you will be left with no capital.

Fortunately, learning about CFD is very easy because there is tons of information regarding the subject on the internet. There are so many different sources you can learn from.

Once you are done doing research, you can start exploring different tips and strategies as a beginner.

Find a good strategy

If you want to be a traitor, you should never rely on luck. This might be the case when you do not have to listen to your gut. Instead, you should use logic to be careful how you invest your capital.

Stock buying or selling can be similar to gambling because there is a risk for you to lose all of your money. That is why it is very important to have a certain strategy and to invest your money as best as you can.

Before you make any kind of move, it is vital that you do some research first on the investment that you want to make.

To truly be successful as a traitor, you will need to find a good strategy. Naturally, you can also build your own strategy, but leave that to the more experienced players in the game. Right now, you are still just a beginner and you should treat yourself as such. Find a strategy that you believe will help you make a profit.

Once you find a strategy, make sure you properly learned and then stick to it no matter what happens. It is very important to stay true to your strategy because there will be moments when you will want to panic sell all your assets. The market is volatile and prices can easily go down and up. Whenever you see a significant price drop, do not panic and stick with your plan.

Pick the right stockbroker

The platform where you will be buying and trading assets is another very important factor that you must consider. Right now, there are probably hundreds of different platforms and applications that allow you to trade cfds.

However, not every platform can be good for you. There are some out there that might try to scam you out of your money or force high fees on you. As a beginner, you should probably look for a platform that has very low fees.

Obviously, it can be a bit difficult to find the perfect trading platform, but if you do a little research and check this or other similar websites, you might be able to find reliable CFD brokers in your area.

Always be ready to take action

As I already mentioned previously, the stock market can be very volatile sometimes and you always need to be ready for those spikes or drops in the prices. You cannot exactly know when they will happen, but you need to be ready.

That is why I believe it is best that you find a CFD trading website that has proper mobile device support or at least has an application for both android and ios.

With direct access to the market through your phone, you can always be ready to take action whenever it is needed. Obviously, I am not telling you to be paranoid and check how your account is doing every 15 minutes, but you should check it at least once a day. You should do that to ensure that everything is stable or whether you need to make some changes with the assets you already have.

Never go all in

There will be situations when you will feel tempted to put all of your money into a single stock or into a single company. No matter how lucrative it seems at that moment, I suggest that you never go all in. The reward that you might get out of that might seem quite good, but it is simply not worth it. With this kind of move, you could lose your entire capital, leaving you with nothing to trade with in the future. That is not how all those experienced players on the market have made their millions.

With patience, focus, and dedication, you can get very far with CFD trading as a beginner. Play it smart, always stick to your strategy, and be very careful with your capital.

There are probably hundreds of other tips or strategies I can share with you regarding this topic, but right now, I think these tips I shared are more than enough. You are still a beginner and you should not overwhelm yourself with too much information. I hope that this guide will be helpful to you.

CFD trading tips – how to become A better trader

Top tips to improve your trading

Do let your profits run

If ever there were a central principle by which to live your CFD trading life, this has to be it. Let your profits run at every available opportunity. Profits in CFD trading aren’t always easy to come by, and numerically those that turn out for the best will probably by dwarfed in comparison to those that don’t turn out quite how you’d expected. This makes it essential that you allow profitable, winning positions to continue to run on and on as far as possible. While every ounce of your instinct will at first tell you to close and bank a profit, the more money you milk from each winning trade, the best chance you’ve got of succeeding overall.

Do cut your losses early

Similarly, it’s essential that you realise as soon as possible that losses are a drain on your resources and need to be cut out of the picture as soon as they can. The more ruthless you are in cutting losses, the better chance you’ll have of making an overall profit. When it comes to a game of aggregated, one down on the negative side is as important as one up on the positive side, so it pays to take positive steps towards ensuring your downside liability is minimised. After all, if you intend to sell your position in an hours time if it loses an extra 5%, aren’t you better off just saving that 5% loss, taking your medicine and settling right now?

Do constant research and reading

Whatever you do day to day, make sure it involves constant research and reading up on the markets you trade, global current affairs and politics. This is a game of knowledge, and the more you know, the more likely you are to have the capacity to make the best possible trading decisions. Some trading signals can only be identified through experience, and there’s no substitute for real life when it comes to the learning curve, but by making sure you’ve got the theoretical knowledge down, you can be more confident in your abilities as a trader to identify the low-hanging fruit that can make you fortunes.

Do diversify your exposure

Make sure your capital isn’t all tied up in cfds or in specific sectors or even specific countries – do make sure you take a diverse approach to split the risk over as many different markets and instruments as possible. Cfds are great, but if they represent the entirety of your worldly fortunes you’ll have problems. In much the same way that businesses can’t become too reliant on one client or supplier, so too should you ensure you diversify your trading capital across a number of different investments to make sure that even in worst-case scenario, your capital is protected. It’s all about protection of capital, because after all, it is only your capital that is capable of generating your returns.

Do set time limits

Trading costs with cfds can often get out of hand when they are left to their own devices, primarily because financing charges are applied daily overnight. Setting strict time limits by which you should expect to realise your profit is important in keeping a firm grip on your positions, and you should take care to set and stick to time limits and earnings targets for determining performance. This is the only means in which you can regulate your trading performance, and as with the research point above, the more you know (in this instance about your own portfolio), the better your chances of succeeding in the markets over time.

Do use leverage sensibly

Leverage is a central part of trading cfds, an inescapable feature of the transaction that is in practicality its raison d’être. Gearing up the size of transactions in order to effectively up the ante, we all know leverage can be extremely dangerous when things don’t work out, but using it to sensible, effective use can provide real benefits for your trading portfolio. A cautiously leveraged portfolio can have the best of both worlds – exposure to the high potential gains afforded by leverage on aggregate, with a cautious enough approach to preserve capital resources. That means strategies like leveraging only to gear up your transaction capital rather than scaling up your entire account, which would be too risky, and backing positions that have become winners more heavily to maximise yield. Leverage can be a heavy burden to bear, but it doesn’t have to be – remember it’s a tool best used sparingly, and you should help skew the risk/reward ratio slightly more in your favour.

Do make use of stops

Cfds can be highly volatile, and the slightest bump in market prices can often send much more significant shockwaves through the CFD markets. While CFD trading is naturally and by design a risky business, it is possible to minimise the extent of those risks both through the way you trade, and through the way you make use of stops. Stop losses and limits are central to a cautious, realistic trading approach, and they can help save serious capital damage while allowing profitable positions to fully flourish. While stops do usually attract an additional cost, making use of stops to prevent your capital from becoming too exposed to leveraged trades is the first step towards a robust, risk-managed CFD portfolio. Particularly as a new trader, stops will be crucial in preserving capital and earnings during your initial learning period.

Do know your trading costs

CFD trading isn’t like spread betting, where all the costs are transparent in the transaction – there are in fact a number of different layers of trading cost that can factor in, depending on the makeup of your transaction and your particular broker, and so it is essential to make sure you have a knowledge of these costs and how they will affect your ability to deliver a profit on a particular transaction in order to allow for informed investment decisions to be made. Particularly for traders contemplating holding a CFD position for over one day, the daily increasing financing charges quickly mount up, and can quickly become a significant handicap on the trade. That’s why it’s important to know what you’re paying, and to calculate your financing and trading costs, in line with your trading strategy, to decide whether or not a trade is viable.

Do set profit expectations

Most amateur traders start off with no real profit expectation. They launch into the markets and hope for the best, and with a bit of good luck take any profit they can get. Unfortunately, for serious traders, life can’t be that simple. Profit expectations perform a central role in the business side of your trading activity. Portfolio management is a business, and as a trader you need to make sure you operate in as professional a way as you can to give the best chances of success. Profit expectations are like sales forecasts – they define what you want to achieve, so you can then calculate cash flow and make further predictions, forecasts, and revisions to strategy. For best effect, look at the size of recent market price movements in the underlying market for your CFD and crunch the numbers to deliver a rough outline of what you could justifiably expect to return.

Avoid mistakes of others

Don’t overleverage

Don’t fall into the all too common trap of overleveraging on a transaction. Overleveraging occurs where you ambitiously take on too much leverage in a position than you can afford to personally meet, and as a rule of thumb, you shouldn’t be leveraging up beyond what you can personally afford to fund. Leverage is a tool for trading, not for gambling, so make sure that you apply it in stages to help amplify your account where possible, rather than using it to drive the whole ethos of your trading. The more significantly leveraged you are, the greater the chances of trading disaster – when in doubt, keep your positions small. Slow and steady always wins the race.

Don’t lose more than you want to gain

As you embark on each trade, you will have an expectation of the sort of profit portions you’re looking to take from the transaction. Depending on the market and the amount of capital and leverage you have exposed to the position, this may be a substantial or minimal return. But as a crucial rule of thumb, having established this expectation, don’t accept a loss that is greater than what you would have taken as a profit. Assuming that probability is on your side is dangerous, and hanging on for a recovery is amongst the worst trading mistakes you can make. Don’t ever let a position get to the stage where you’re having to swallow humble pie with a loss larger than the profit you would’ve been satisfied with from the very same trade – it does nothing for morale, or your wallet.

Don’t overtrade

Similar to overleveraging, overtrading is when you engage too much of your capital at any one time. So, rather than being too heavily exposed to one position, your account is too fat, with too many different positions (and potential liabilities) operating at one time. Finding loads of different trading opportunities is great, and shows that you must be doing research with some volume of output. However, in the event that you have multiple positions, it’s often better not to spread yourself too thinly, for fear of burdening yourself with any number of active positions that could quickly head pear shaped. Especially when leverage is thrown into the mix, it simply isn’t worth your while to take on too sizeable a portfolio.

Don’t get emotionally attached

Traders all too often fall into the trap of thinking that they’ve been unlucky, or that markets will correct in time to balance out in their favour. Karma doesn’t exist when it comes to CFD trading, but leverage most certainly does, and it can slap you ferociously if you end up becoming emotionally connected to your positions. Realise that trades are transient, and one day company X might be up while the next company X might be down – this doesn’t matter. What matters is that you are dynamic enough to make money on both the up and the downside, and having sufficient discipline to understand when to draw a line under a loss and move on.

Don’t chase your losses

Finally, loss chasing is the single biggest error you can make as a trader, yet it’s one that feels all too natural, if not counterintuitive. The tendency is, having invested time and effort in researching positions, to assume that the markets have yet to come round to your way of thinking. As a result traders keep funding obvious losses, and keep adjusting their margin requirement to continue to fund the position as it continues to lose money – in the hope that it will eventually return. Chasing losses is nonsensical – you’re simply throwing good money after bad. Cutting out as quickly as possible and allowing losses to lie where they fall is central to good portfolio management.

Don’t set stops too tightly

When setting stop losses, there is a tendency to get a little overcautious. Obviously the amplification of leverage makes each incremental price drop a significant concern, but it takes a cool, objective head to determine how the market might behave in the near future to set stops accurately. The balancing consideration is that if stops are set too tightly underneath the market price, trades will be closed automatically and unnecessarily, at great expense and inefficiency to your trading account. While stops are there to prevent loss, its important to always allow for some breathing space in your position, as opposed to setting a stop immediately underneath current market prices. The extent of the breathing space you’ll require is dependent on the volatility of the market, and any other factors that might prompt a price jump in either direction, but nevertheless the principle of balancing these needs is an important one to bear in mind.

Don’t gamble with your capital

Cfds are often described by the ill informed as high-risk, market ‘gambling’ type investments. Gamblers lose eventually because they take unmerited risks – they gamble. Investors invest. Traders trade. There is a stark difference that must be upheld – in gambling, forecasting outcomes with any certainty is not possible. There are two many variables, and while skill may play a part to a certain extent, it is proportionately offset by the role of chance. In CFD trading, you can make gambling-like earnings, but you have to work for them. That means researching trades before you jump in, and making sure you reason out why you’re making a particular trading move. Make sure you don’t ever gamble with your capital, supporting a position because you have a good feeling about it or because you want to support it. CFD trading isn’t about chance – it’s about knowing your stuff and making shrewd decisions based on measurable market data.

Don’t feel the markets owe you

A common tendency amongst aggrieved traders is to feel that they are due a return, or their owed a lucky break from the markets. This mindset, which assumes that market outcomes are random, or chance driven, leads to silly trading decisions, and clouds the judgement of the trader in making calls on the directional market movements. In reality, while there may be some elements of chance to the markets along the way, the overwhelming force of markets responds in predictable ways to a number of prompts – the magic of calling it lies in weighting these often contradictory prompts to decide which way the market is likely to move. This simply can’t be achieved by feelings of being denied opportunities on some idea of fate or luck – the markets don’t owe you a penny, and every winning trade you make will be hard fought and hard earned.

Final note: the tips are not easy to follow as they take discipline, time, and determination; but eventually, hard work always pays off.

CFD trading tips – improve your trading

Starting out on a new venture is never easy and it applies to contracts for difference trading as well. Do you ever wonder why most of the retail traders lose money and only 20%-30% of the traders make money? It takes time and patience to learn and become successful. Below, you can see the list of the essential CFD trading tips which will help you to improve your trading experience and return on investment.

We asked successful CFD traders to share their tips and techniques with our readers and below you can see the list of their recommendations and suggestions. The essential tip is that you should treat your trading as a job and never stop learning and improving.

Basic tips and CFD trading in real life

Nothing stings more than a heavy trading loss. As a CFD trader, losing is part and parcel of the job, and there must be losers in order for there to be winners from any market situation. It is inevitable, unavoidable and often painful. Even the most experienced CFD trader will find himself/herself sustaining heavy losses from time to time, and it’s important that these losses are treated as a learning experience, rather than a damaging distraction from your profit motivation in order to build and improve upon your trading expertise. The reality is that in order to continue trading and identifying profitable opportunities, you need to quickly overlook and move on from your defeats, in order to best cope with the demands the markets may present.

There is simply no time for regrets. The trader who gets frustrated or angered by their losses will find themselves running into difficulties very quickly. The markets don’t stop to hang around, and they certainly don’t allow time for post-match analysis. It’s up to you as a trader to mentally override the emotional and psychological feelings that losses inevitably conjure up in order to present you with the best chance of responding dynamically to the pressures the market brings to bear.

In the blink of an eye, opportunities can come and go, and if you’re still scratching your head wondering where it all went wrong, you’re effectively voluntarily missing out on real opportunities to restore your account to profit. Therefore, it’s essential that you take steps to ensure you’re ready to continue trading other positions and identifying other opportunities as they arise.

The crux of the issue lies in trading in the moment. If a trade fails, draw a line under it – there will be plenty of time for analysis when your trading session has come to a close, and there may well be merits in looking over your past decisions and deciding where you went wrong. The important issue lies in making sure you are responsive enough and dynamic enough to round the difficulties you will no doubt face, in order to best address the needs of your trading portfolio.

Stay focused and learn from mistakes

There is no question that you will make mistakes, assuming you’re human – in fact, even trading robots can come unstuck. The trick lies in accepting these mistakes as part of the territory, and comforting yourself by getting stuck right back into the markets as quickly as possible. Any amount of downtime or regret will detract from your trading session, and will effectively hamper your chances of sticking to the trading plan and identifying new, fresh trading opportunities.

In the world of trading contracts for difference, there really is no time for regrets, or anything else for that matter that takes away from your concentration on the markets and your portfolio. Channel any negative feelings into your research effort for the next position – doing so will ensure you can make the most of any defeats, and will give you the best chance to bounce back into profit with your next trading decision.

CFD trading strategies – effective trading

Having reached a stage where you’re comfortable with what cfds are, how they work and the various different options that present themselves to you as a trader, it’s time to start looking further into the nitty-gritty that is trading strategy. Ask any accomplished trader whether or not he employs a consistent, repeatable strategy, and more often than not you’ll find the answer in the affirmative. Devising a strategy is a central component of successful, sustainable investment – anything else is either highly labour and time intensive, or bordering on guesswork.

Why do you need strategies to trade cfds successfully?

A strategy for investing is like a blueprint for building a house – without those instructions in place, it is hard to ensure you’re consistently hitting the mark, and that the pieces of the puzzle will readily fit together when the time comes. While strategies don’t have to be overly complicated, they are procedures best developed through a combination of knowledge and trading theory, and personal (and often bitter) trading experience.

In the forthcoming segment, we’ve attempted to outline the foundations of common CFD trading strategies for you, collating the collective knowledge of experienced traders to reflect a true and accurate position of some of the most widely used trading strategies and techniques in the CFD market. While it’s up to you which (if any) you choose to implement, it is nevertheless important to bear in mind the value of experience, and to take advantage of the mistakes others have made before you to prevent losing your capital unnecessarily.

Learn from experience

Likewise, there is really no substitute for experience when it comes to trading other than the knowledge of those that have gone before you, and there are invaluable lessons to be learned from devoting time and energy to reading up on trading do’s and don’ts. Like most things in life, there are certain fundamental trading lessons that it pays to learn in the theoretical sphere before you launch unsuspectingly into the markets to learn the hard way.

While there are no hard and fast formulae to which you must adhere when trading cfds, there are certain fundamental trains of thought that have served traders well over the years, and it pays dividends to familiarise yourself with these strategies – if not for personal profit, to give you an insight into the possible mindsets of other traders. So without further ado, here are a few of those key trading strategies, tips and techniques that will stand you in good stead in your future trading efforts.

Why is it important?

One might think why it’s so important to have a trading strategy, think again. One has to follow the plan and stick to it. No matter if the markets go south or north, you have to be prepared for it and that’s where the strategy comes into play as you can weather the storm without paying much attention. You know your goal and you stick to it.

Always remember, it’s your money on the line and you have to stay disciplined and dedicated, make sure you’re in control and stick to your own strategy; otherwise, it’s pointless. Discipline and experience are the vital ingredients which will turn your losing trades into the winning ones.

CFD trading strategies

Are you new to the world of CFD trading? Struggling to get started? If you answered yes to either of those questions, this article was written with you in mind and should help you find your footing.

One of the biggest challenges new traders face is in developing a strategy that will help them make profitable trades in a reliable, consistent manner. With that in mind, here are two simple, but surprisingly effective strategies you can begin using, starting today! If that sounds good to you, let’s take a closer look:

Trade the headlines

Here’s a two-question quiz for you: when the exxon valdez oil spill happened and was reported on the news, what do you think happened to exxon’s stock price?

When the BP horizon off-shore oil rig exploded and started dumping tens of thousands of gallons of oil into the gulf of mexico, what do you think happened to the company’s stock price?

If you guessed “it went down,” on both of the questions above, you’d be right! Even better, the price didn’t drop instantly. There’s a natural, unavoidable lag between breaking news and the market’s response and if you’re paying attention, you can dive into that gap and make some money.

Don’t think that this strategy applies only to oil companies, and don’t make the mistake of believing this is simply “disaster investing.” it isn’t. If tesla announces tomorrow that it has figured out a way to double the battery life of the batteries it uses in its cars and in the powerwalls it sells for home use, you can bet that the company’s stock price will soar.

In a similar vein, if a company that makes 3D printers announces the creation of a “hydra extruder” that will allow you to seamlessly print with up to six different materials, or if apple announces an exciting new product, those are all things that will make the company’s stock price increase.

It gets better, because there’s also a lag between the release of a company’s quarterly earnings reports and the market’s reaction to those reports.

All that to say, you don’t have to be a rocket scientist to read the tea leaves and have a pretty good idea about which direction the price of a given asset is going to move, you just have to be paying attention and be set up to take advantage of those signals when you see them.

There’s a reason that most brokerage platforms feature live, streaming news, after all, and the examples above explain why.

So – start trading the headlines. Have your account all set up and ready, then watch a lot of news. Read a lot of industry reports. Download a detailed financial calendar and be ready to pounce when you see that such-and-so company you’re interested in will be releasing this or that report.

Then act on what you read. Be one of the first movers and reap the profits for doing so! With speed and practice, you can use this simple strategy go make consistent profits.

Pairs trading

This strategy requires a bit more research. Pick an industry you’re interested in. Pick two companies in that industry. Look at their price histories.

Since they’re in the same industry, generally speaking, you should see that their prices move more or less in tandem. Both go up, then both go down as the conditions in the market change. In other words, if it’s a “bad year for auto makers” then it’s a bad year for all of them. They all tend to respond the same way to macroeconomic changes. It doesn’t matter what the industry is, for the most part, that’s true. It’s just how the market works.

So, watch the market and watch your selected pair of companies.

If you notice that their price action begins to diverge, that’s a signal that it’s time to take action because you know, having studied the long term trends, that these companies tend to move more or less in tandem, which means that before much longer, that gap in price movement is going to start closing again, opening a short position in one, and a long position in the other, depending on which company seems to be the “weak link” driving the divergent behavior.

The reality is that there are all sorts of trading strategies you can use or devise, and as you gain more experience, you’ll no doubt come up with your own. But if you’re’ looking for a simple way to get started, thousands of investors have used the two strategies mentioned above to great effect, and you can too!

5 tips for simple CFD trading strategies

If you are interested in CFD trading and wanting to learn how to make money from trades, here are a few tips and tricks to help.

Trading any asset – whether cryptocurrency, stocks or forex – is a fantastic way to raise your capital and padding your income, especially now as things are financially uncertain across the world. Contract for difference (CFD) trading has become a popular way of buying assets through a broker rather than purchasing them directly.

While CFD trading might have a sense of security that direct trading lacks, there is still complexity in how to trade. To make the most money for your time, it’s a good idea to gain a solid foundation of understanding of the strategies of CFD trading. If you have the best methods in place, you are more likely to see a good return on your trading investment.

If you’re just starting out, or are wanting to add to your CFD strategies, here are a few tips and tricks to help:

1. Aim for consistency: find and use a strategy you can maintain

Trades which happen and make a person millions on a “gut feeling” are rare and the exception. If that was the case more often, trading would be based on far more luck and the industry would be a lot more like gambling than anything else. Instead, the rule of thumb is to be a lot more strategic and to figure out what works and stick to it. This goes hand in hand with doing consistent research on your trades. Keep an eye on the market and seek to improve your trades every time you invest.

2. Keep a level head and don’t readjust too often

With your CFD, you want to stick to the plan you set out initially as much as possible and not panic sell or buy based on volatility. But there are times when shifting your strategy is necessary. Trading is all about keeping level-headed and not making emotional decisions based on volatile swings or market sentiment. Rather than sticking to your trades out of stubbornness and buying over-enthusiastically, keep your CFD levels under control and base your decisions on facts not feeling. Always remember: what comes up might also come down, and you don’t want a falling CFD to take your gains and capital with it.

3. Look after your initial capital

As a beginner, your goal shouldn’t be to make more money, not at first. Rather, you should aim to not lose the money you have. Instead of learning how to gain, learn how to avoid losing your money and then when you’re more familiar with the market, you can aim to increase. A good defensive trading strategy is a fantastic way to learn the ropes without risking your capital. When you feel comfortable, you can up the ante and take a more risky approach.

4. Don’t be shy to ask for advice

Everyone started as a beginner and learnt some lessons the hard way. Aim to learn from other’s mistakes and ask for help if you need it. There are platforms available which have a wealth of CFD trading resources. The more you engage with additional resources while making modest trades, the more you can learn both theoretically and practically.

5. Be cautious with your money

The trading industry has countless experienced traders who are able to spot a trade based on another person’s mistake. To mitigate mistakes, learn to be patient with your trades and build your experience in trading before making any bold decisions.

As with all trading, make sure you are aware that any investments you make are not guaranteed, and there is risk involved with CFD trading. Bear the above points in mind and make any mistakes earlier on your trading career rather. That way, the lessons will come at an affordable price with minimal risk.

Posted: nov 19, 2020 author: becky categories: trading guides

INTRODUCTION TO TRADING ANALYSIS

It is often said fundamental analysis tells you what to trade, and technical analysis tell you when to trade it. Learn about fundamental, and technical analysis to spot trading opportunities in the CFD and forex markets.

USING TWO COMPLEMENTARY TYPES OF ANALYSIS

Experienced traders use fundamental and technical analysis to gather valuable market information. Learn the types of economic indicators to look for, and how to apply technical indicators to manage your trading strategy and minimize your risk exposure.

UNDERSTANDING FUNDAMENTAL ANALYSIS

Fundamental analysis attempts to analyze price information under the economic forces by assessing the “fair value” of a currency or security in prevailing market conditions. Differences between the assessed “fair value” and the market value are said to drive price movements, with prices expected to rise if the fair value is higher than the market value, and vice-versa.

ADOPTING TECHNICAL ANALYSIS AND TOOLS

Technical analysis is a method of using market data, primarily past prices, and volumes to estimate future prices.

Technical traders use a variety of tools to identify trends and trend changes, thereby forecasting prices. These tools are based on mathematical concepts that are graphically represented for ease of analysis.

WEBINARS AND EVENTS

Improve your trading strategy with the guidance and experience of our professional instructors. Select from a vast array of trading webinars and events.

GET STARTED

Open a demo account to fine tune your trade strategies

Apply for a live account now and you could be trading in minutes

Trading involves significant risk of loss

GETTING STARTED

New to trading or to OANDA? Learn the basics here.

TOOLS AND STRATEGIES

Develop your trading strategy and learn to use trading tools for market analysis.

CAPITAL MANAGEMENT

Learn to apply risk management tools to preserve your capital.

BASICS OF TRADING

Learn the skills necessary to open, modify and close trades, and the basic features of our trading platform.

Chapters:

TECHNICAL AND FUNDAMENTAL ANALYSIS

A trading strategy can offer benefits such as consistency of positive outcomes, and error minimization. An optimal trading strategy reflects the trader’s objective and personal approach.

Fundamental traders watch interest rates, employment reports, and other economic indicators trying to forecast market trends.

Technical analysts track historical prices, and traded volumes in an attempt to identify market trends. They rely on graphs and charts to plot this information and identify repeating patterns as a means to signal future buy and sell opportunities.

Chapters:

PROTECT YOUR CAPITAL INVESTMENT

Leveraged trading involves high risk since losses can exceed the original investment. A capital management plan is vital to the success and survival of traders with all levels of experience.

Learn risk management concepts to preserve your capital and minimize your risk exposure. Seek to understand how leveraged trading can generate larger profits or larger losses and how multiple open trades can increase your risk of an automatic margin closeout.

Chapters:

This page is for general information purposes only: examples are not investment advice or an inducement to trade. Past history is not an indication of future performance.

Execution speed and numbers are based on the median round trip latency from receipt to response for all market order and trade close requests executed between january 1st and may 1st 2019 on the OANDA execution platform.

Contracts for difference (cfds) or precious metals are NOT available to residents of the united states.

MT4 hedging capabilities are NOT available to residents of the united states.

The commodity futures trading commission (CFTC) limits leverage available to retail forex traders in the united states to 50:1 on major currency pairs and 20:1 for all others. OANDA asia pacific offers maximum leverage of 50:1 on FX products and limits to leverage offered on cfds apply. Maximum leverage for OANDA canada clients is determined by IIROC and is subject to change. For more information refer to our regulatory and financial compliance section.

- Home

- Group

- Contact us

- Press room

- Careers

- Support

- Trading

- Forex & CFD

- Trading markets

- CFD trading

- Forex trading

- Online trading platforms

- Metatrader 4 platform

- Learn forex & CFD

- Live forex & CFD rates

- Trading news & market analysis

- Currency

- Currency converter

- Live rates

- Historical rates

- Foreign exchange data services

- Historical currency converter

- Exchange rates API

- Corporate FX payments

- Fx payments

- Individual

- Business

© 1996 - 2020 OANDA corporation. All rights reserved. "OANDA", "fxtrade" and OANDA's "fx" family of trademarks are owned by OANDA corporation. All other trademarks appearing on this website are the property of their respective owners.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest (except for OANDA europe ltd retail customers who have negative balance protection). Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Refer to our legal section here.

Financial spread betting is only available to OANDA europe ltd customers who reside in the UK or republic of ireland. Cfds, MT4 hedging capabilities and leverage ratios exceeding 50:1 are not available to US residents. The information on this site is not directed at residents of countries where its distribution, or use by any person, would be contrary to local law or regulation.

OANDA (canada) corporation ULC accounts are available to anyone with a canadian bank account. OANDA (canada) corporation ULC is regulated by the investment industry regulatory organization of canada (IIROC), which includes IIROC's online advisor check database (IIROC advisorreport), and customer accounts are protected by the canadian investor protection fund within specified limits. A brochure describing the nature and limits of coverage is available upon request or at www.Cipf.Ca.

OANDA australia pty ltd is regulated by the australian securities and investments commission ASIC (ABN 26 152 088 349, AFSL no. 412981) and is the issuer of the products and/or services on this website. It's important for you to consider the current financial service guide (FSG), product disclosure statement ('PDS'), account terms and any other relevant OANDA documents before making any financial investment decisions. These documents can be found here.

OANDA corporation is a registered futures commission merchant and retail foreign exchange dealer with the commodity futures trading commission and is a member of the national futures association. No: 0325821. Please refer to the NFA's FOREX INVESTOR ALERT where appropriate.

OANDA europe limited is a company registered in england number 7110087, and has its registered office at floor 3, 18 st. Swithin's lane, london EC4N 8AD. It is authorised and regulated by the financial conduct authority, no: 542574.

OANDA japan co., ltd. First type I financial instruments business director of the kanto local financial bureau (kin-sho) no. 2137 institute financial futures association subscriber number 1571.

OANDA asia pacific pte ltd (co. Reg. No 200704926K) holds a capital markets services licence issued by the monetary authority of singapore.

OANDA europe markets limited is a company registered in malta number C95813, and has its registered office at 171, old bakery street, valletta, VLT1455 malta. It is authorised and regulated by the malta financial services authority.

Strategies

Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies.

It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Ultimately though, you’ll need to find a day trading strategy that suits your specific trading style and requirements.

Also, ensure your choice of broker suits strategy based day trading. You will want things like;

- Excellent trade execution speed,

- Price action data ( + level 2 if possible)

- Ability to trade direct from graphs,

- Trade automation,

- Stop losses and take profit orders

- Etc etc.

Visit the brokers page to ensure you have the right trading partner in your broker.

Top 3 brokers suited to strategy based trading

Trading strategies for beginners

Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective.

The basics

Incorporate the invaluable elements below into your strategy.

- Money management – before you start, sit down and decide how much you’re willing to risk. Bear in mind most successful traders won’t put more than 2% of their capital on the line per trade. You have to prepare yourself for some losses if you want to be around when the wins start rolling in.

- Time management – don’t expect to make a fortune if you only allocate an hour or two a day to trading. You need to constantly monitor the markets and be on the lookout for trade opportunities.

- Start small – whilst you’re finding your feet, stick to a maximum of three stocks during a single day. It’s better to get really good at a few than to be average and making no money on loads.

- Education – understanding market intricacies isn’t enough, you also need to stay informed. Make sure you stay up to date with market news and any events that will impact your asset, such as a shift in economic policy. You can find a wealth of online financial and business resources that will keep you in the know.

- Consistency – it’s harder than it looks to keep emotions at bay when you’re five coffees in and you’ve been staring at the screen for hours. You need to let maths, logic and your strategy guide you, not nerves, fear, or greed.

- Timing – the market will get volatile when it opens each day and while experienced day traders may be able to read the patterns and profit, you should bide your time. So hold back for the first 15 minutes, you’ve still got hours ahead.

- Demo account – A must-have tool for any beginner, but also the best place to backtest or experiment with new, or refined, strategies for advanced traders. Many demo accounts are unlimited, so not time restricted.

Components every strategy needs

Whether you’re after automated day trading strategies, or beginner and advanced tactics, you’ll need to take into account three essential components; volatility, liquidity and volume. If you’re to make money on tiny price movements, choosing the right stock is vital. These three elements will help you make that decision.

- Liquidity – this enables you to swiftly enter and exit trades at an attractive and stable price. Liquid commodity strategies, for example, will focus on gold, crude oil and natural gas.

- Volatility – this tells you your potential profit range. The greater the volatility, the greater profit or loss you may make. The cryptocurrency market is one such example well known for high volatility.

- Volume – this measurement will tell you how many times the stock/asset has been traded within a set period of time. For day traders, this is better known as ‘average daily trading volume.’ high volume tells you there’s significant interest in the asset or security. An increase in volume is frequently an indicator a price jump either up or down, is fast approaching.

5 day trading strategies

1. Breakout

Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. The breakout trader enters into a long position after the asset or security breaks above resistance. Alternatively, you enter a short position once the stock breaks below support.

After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout.

You need to find the right instrument to trade. When doing this bear in mind the asset’s support and resistance levels. The more frequently the price has hit these points, the more validated and important they become.

Entry points

This part is nice and straightforward. Prices set to close and above resistance levels require a bearish position. Prices set to close and below a support level need a bullish position.

Plan your exits

Use the asset’s recent performance to establish a reasonable price target. Using chart patterns will make this process even more accurate. You can calculate the average recent price swings to create a target. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Once you’ve reached that goal you can exit the trade and enjoy the profit.

2. Scalping

One of the most popular strategies is scalping. It’s particularly popular in the forex market, and it looks to capitalise on minute price changes. The driving force is quantity. You will look to sell as soon as the trade becomes profitable. This is a fast-paced and exciting way to trade, but it can be risky. You need a high trading probability to even out the low risk vs reward ratio.

Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. You can’t wait for the market, you need to close losing trades as soon as possible.

3. Momentum

Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. There is always at least one stock that moves around 20-30% each day, so there’s ample opportunity. You simply hold onto your position until you see signs of reversal and then get out.

Alternatively, you can fade the price drop. This way round your price target is as soon as volume starts to diminish.

This strategy is simple and effective if used correctly. However, you must ensure you’re aware of upcoming news and earnings announcements. Just a few seconds on each trade will make all the difference to your end of day profits.

4. Reversal

Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. It’s also known as trend trading, pull back trending and a mean reversion strategy.

This strategy defies basic logic as you aim to trade against the trend. You need to be able to accurately identify possible pullbacks, plus predict their strength. To do this effectively you need in-depth market knowledge and experience.

The ‘daily pivot’ strategy is considered a unique case of reverse trading, as it centres on buying and selling the daily low and high pullbacks/reverse.

5. Using pivot points

A day trading pivot point strategy can be fantastic for identifying and acting on critical support and/or resistance levels. It is particularly useful in the forex market. In addition, it can be used by range-bound traders to identify points of entry, while trend and breakout traders can use pivot points to locate key levels that need to break for a move to count as a breakout.

Calculating pivot points

A pivot point is defined as a point of rotation. You use the prices of the previous day’s high and low, plus the closing price of a security to calculate the pivot point.

Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced.

So, how do you calculate a pivot point?

- Central pivot point (P) = (high + low + close) / 3

You can then calculate support and resistance levels using the pivot point. To do that you will need to use the following formulas:

- First resistance (R1) = (2*P) – low

- First support (S1) = (2*P) – high

The second level of support and resistance is then calculated as follows:

- Second resistance (R2) = P + (R1-S1)

- Second support (S2) = P – (R1- S1)

Application

When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. This is because a high number of traders play this range.

It’s also worth noting, this is one of the systems & methods that can be applied to indexes too. For example, it can help form an effective S&P day trading strategy.

Limit your losses

This is particularly important if you’re using margin. Requirements for which are usually high for day traders. When you trade on margin you are increasingly vulnerable to sharp price movements. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Fortunately, you can employ stop-losses.

The stop-loss controls your risk for you. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. You can also make it dependant on volatility.

For example, a stock price moves by £0.05 a minute, so you place a stop-loss £0.15 away from your entry order, allowing it to swing (hopefully in the expected direction).

One popular strategy is to set up two stop-losses. Firstly, you place a physical stop-loss order at a specific price level. This will be the most capital you can afford to lose. Secondly, you create a mental stop-loss. Place this at the point your entry criteria are breached. So if the trade makes an unanticipated turn, you’ll make a swift exit.

Forex trading strategies

Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. You can apply any of the strategies above to the forex market, or you can see our forex page for detailed strategy examples.

Cryptocurrency trading strategies

The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. You don’t need to understand the complex technical makeup of bitcoin or ethereum, nor do you need to hold a long-term view on their viability. Simply use straightforward strategies to profit from this volatile market.

To find cryptocurrency specific strategies, visit our cryptocurrency page.

Stock trading strategies

Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Below though is a specific strategy you can apply to the stock market.

Moving average crossover

You will need three moving average lines:

- One set at 20 periods – this is your fast moving average

- One set at 60 periods – this is your slow moving average

- One set at 100 periods – this is your trend indicator

This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. A sell signal is generated simply when the fast moving average crosses below the slow moving average.

So, you’ll open a position when the moving average line crosses in one direction and you’ll close the position when it crosses back the opposite way.

How can you establish there’s definitely a trend? You know the trend is on if the price bar stays above or below the 100-period line.

For more information on stocks strategies, see our stocks and shares page.

Spread betting strategies

Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Plus, strategies are relatively straightforward.

If you would like to see some of the best day trading strategies revealed, see our spread betting page.

CFD strategies

Developing an effective day trading strategy can be complicated. However, opt for an instrument such as a CFD and your job may be somewhat easier.

Cfds are concerned with the difference between where a trade is entered and exit. Recent years have seen their popularity surge. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset.

For CFD specific day trading tips and strategies, see our CFD page.

Regional differences

Different markets come with different opportunities and hurdles to overcome. Day trading strategies for the indian market may not be as effective when you apply them in australia. For example, some countries may be distrusting of the news, so the market may not react in the same way as you’d expect them to back home.

Regulations are another factor to consider. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. So, get online and check obscure regulations won’t impact your strategy before you put your hard earned money on the line.

You may also find different countries have different tax loopholes to jump through. If you’re based in the west but want to apply your normal day trading strategies in the philippines, you need to do your homework first.

What type of tax will you have to pay? Will you have to pay it abroad and/or domestically? Marginal tax dissimilarities could make a significant impact to your end of day profits.

Risk management

Stop-loss

Strategies that work take risk into account. If you don’t manage risk, you’ll lose more than you can afford and be out of the game before you know it. This is why you should always utilise a stop-loss.

The price may look like it’s moving in the direction you hoped, but it could reverse at any time. A stop-loss will control that risk. You’ll exit the trade and only incur a minimal loss if the asset or security doesn’t come through.

Savvy traders don’t usually risk more than 1% of their account balance on a single trade. So if you have £27,500 in your account, you can risk up to £275 per trade.

Position size

It will also enable you to select the perfect position size. Position size is the number of shares taken on a single trade. Take the difference between your entry and stop-loss prices. For example, if your entry point is £12 and your stop-loss is £11.80, then your risk is £0.20 per share.

Now to figure out how many trades you can take on a single trade, divide £275 by £0.20. You can take a position size of up to 1,375 shares. That is the maximum position you could take to stick to your 1% risk limit.

Also, check there is sufficient volume in the stock/asset to absorb the position size you use. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss.

Learning methods

Videos

Everyone learns in different ways. For example, some will find day trading strategies videos most useful. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. Head to their learning and resources section to see what’s on offer.

Blogs

If you’re looking for the best day trading strategies that work, sometimes online blogs are the place to go. Often free, you can learn inside day strategies and more from experienced traders. On top of that, blogs are often a great source of inspiration.

Forums

Some people will learn best from forums. This is because you can comment and ask questions. Plus, you often find day trading methods so easy anyone can use. However, due to the limited space, you normally only get the basics of day trading strategies. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool.

If you want a detailed list of the best day trading strategies, pdfs are often a fantastic place to go. Their first benefit is that they are easy to follow. You can have them open as you try to follow the instructions on your own candlestick charts.

Another benefit is how easy they are to find. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. They can also be very specific. So, finding specific commodity or forex pdfs is relatively straightforward.

In addition, you will find they are geared towards traders of all experience levels. Hence you can find for beginners pdfs and advanced pdfs. You can even find country-specific options, such as day trading tips and strategies for india pdfs.

Books

Having said that, a PDF simply won’t go into the level of detail that many books will. The books below offer detailed examples of intraday strategies. Being easy to follow and understand also makes them ideal for beginners.

- The simple strategy – A powerful day trading strategy for trading futures, stocks, etfs and forex, mark hodge

- How to day trade: A detailed guide to day trading strategies, risk management, and trader psychology, ross cameron

- Intra-day trading strategies: proven steps to trading profits, jeff cooper

- The complete guide to day trading: A practical manual from a professional day trading coach, markus heitkoetter

- Stock trading wizard: advanced short-term trading strategies, tony oz

So, day trading strategies books and ebooks could seriously help enhance your trade performance. If you would like more top reads, see our books page.

Online courses

Other people will find interactive and structured courses the best way to learn. Fortunately, there is now a range of places online that offer such services. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Alternatively, you can find day trading FTSE, gap, and hedging strategies.

Trading for A living

If you’re looking to pack up the day job and start day trading for a living, then you’ve got a challenging but exciting journey ahead of you. You’ll need to wrap your head around advanced strategies, as well as effective risk and money management strategies. Discipline and a firm grasp on your emotions are essential.

For more information, visit our ‘trading for a living‘ page.

Final word

Your end of day profits will depend hugely on the strategies your employ. So, it’s worth keeping in mind that it’s often the straightforward strategy that proves successful, regardless of whether you’re interested in gold or the NSE.

Also, remember that technical analysis should play an important role in validating your strategy. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Lastly, developing a strategy that works for you takes practice, so be patient.

So, let's see, what we have: beginner's guide to CFD trading UK ✔️ best CFD trading platforms ✔️ CFD trading tips ✔️ top CFD trading strategies for 2021 at cfd trading techniques

Contents of the article

- No deposit forex bonuses

- CFD trading UK guide 2021

- What is CFD trading?

- What can you trade with cfds?

- Why trade cfds?