Best CFD Trading Platforms In The UK 2021, cfd platform.

Cfd platform

Thanks to its network of tier-one liquidity providers, pepperstone offers lightning-fast order execution on its MT4 trading platform.

No deposit forex bonuses

According to the broker, most trade orders by UK clients are filled in less than 60 ms. Our team of experts conducted an independent order speed test using a proprietary MT4 script and found an execution speed of 85 ms. Below you can view a comparison of the best CFD trading brokers in the UK with fast execution speed. As the broker ensures ECN-style trading conditions on its razor account, retail customers will have to pay a commission, which for the metatrader 4 trading platform starts from as low as GBP 2.29 per every 100,000 units traded (or GBP 4.59 round turn).

Best CFD trading platforms in the UK 2021

Cfds is a good alternative to forex for trading in the UK. When trading CFD choose a trading platform that allows you to trade the best cfds like commodities & etfs. Our team of experts have selected their best CFD trading platforms UK.

Best CFD trading platforms UK list

Here are our best platforms to trade cfds from FCA regulated brokers:

- Pepperstone - great metatrader 4 & 5 CFD trading platforms

- Plus500 - CFD risk management & balance protection platform

- Etoro - best social trading platforms

- XTB - best platform for etfs and equities

- Fxpro - recommended for ctrader

- City index - CFD trading platform for range of markets

- Thinkmarkets- CFD trading platform for mobile

- CMC markets- spread betting and CFD stock trading

Regulations and licenses

Brokerage

Markets and instruments

Trading platforms + tools

Overall

Pepperstone – best for metatrader 4 + 5 CFD trading platforms

The most popular CFD trading platforms in the UK are metatrader 4 and metatrader 5. In our attempt to find the best CFD brokers in the UK offering the full suite of metatrader 4 and metatrader 5 trading platforms, pepperstone ranks as the number one regulated forex and CFD broker. Our team of experts took into consideration three factors before awarding pepperstone as the best CFD trading broker for MT4 and MT5:

- Metatrader 4’s ultra-fast order execution speeds

- Metatrader 5 powerful technological solutions

- Market-leading spreads on the most popular CFD instruments

Pepperstone offers metatrader 4, our most popular; metatrader 5, our most powerful.

- The broker is authorised to conduct online CFD trading services in the united kingdom while being regulated and abiding by the rules imposed by the reputable financial conduct authority (FCA)

- An authorised FSP, which falls under the regulation of the australian securities and investments commission (ASIC)

- Pepperstone regulators include the cyprus securities and exchange commission (cysec) for the european region.

- Pepperstone’s operations are also licensed and regulated in the united arab emirates (UAE) by the dubai financial services authority (DFSA)

- In south africa, pepperstone is in the process to be licensed by the financial sector conduct authority (FSCA)

- As well as regulators in the bahamas (SCB) and kenya (CMA).

For traders in the UK (and europe) only FCA regulation will be of relevance.

Our team of experts at compare forex brokers recommend pepperstone to UK retail traders with interest in trading cfds on platforms such as metatrader 4 and metatrader 5.

Pepperstone’s MT4 is one of the best CFD trading platforms for UK traders

Over the past decade, MT4 has become a standard for forex trading. As a leading regulated broker, pepperstone has made certain that it offers its clients an easily customizable trading platform, allowing access to live quotes, real-time charts, in-depth news and analytics and a range of technical indicators and order management tools.

What UK retail clients will find in pepperstone’s metatrader 4 platform includes:

- Expert advisor (EA) compatibility

- Flexible order types

- 85 pre-installed indicators for greater insight into trends

- Over 150 trading instruments structured in several asset classes

- Advanced technical analysis tools for better-informed decisions

- Multiple chart setups

- Advanced demo account that comes with virtual $50,000

- 28 additional smart trader tools

- Outstanding customer support service

Another major advantage of pepperstone’s MT4 CFD trading platform is that it offers a combination of low trading costs and exceptional order execution speeds.

Trading cfds with market leading spreads

UK-based clients can trade on various CFD financial instruments with ultra-low spreads starting from 0.0 pips (pepperstone’s razor trading account). UK CFD traders can access buy and sell price quote on global markets with the following spreads:

- Tight spreads from 0.0 pips on major currency pairs, including EUR/USD, GBP/USD, AUD/USD and USD/JPY

- 1.05 average spread on UK100 and 1.0 average spread on GER30

- 0.50 razor minimum spread on XAUUSD

- 0.50 spread on WTI oil

Although pepperstone UK historically offered cryptocurrencies to retail traders, recent changes to FCA regulation now mean cryptos such as bitcoin are not able to traded with UK brokers.

Note *our review has concluded that the average spreads on all of pepperstone’s CFD products are, in fact, competitive.

As the broker ensures ECN-style trading conditions on its razor account, retail customers will have to pay a commission, which for the metatrader 4 trading platform starts from as low as GBP 2.29 per every 100,000 units traded (or GBP 4.59 round turn).

Pepperstone’s active trader program offers commission discounts (rebates), which depend on how many standard lots the client trade per month. UK retail CFD traders can expect to receive between GBP 200 and GBP 500 in monthly rebates if they generate between 200-500 lots in trading volume.

Thanks to its network of tier-one liquidity providers, pepperstone offers lightning-fast order execution on its MT4 trading platform. According to the broker, most trade orders by UK clients are filled in less than 60 ms. Our team of experts conducted an independent order speed test using a proprietary MT4 script and found an execution speed of 85 ms. Below you can view a comparison of the best CFD trading brokers in the UK with fast execution speed.

Metatrader 5 by pepperstone

Pepperstone’s metatrader 5, which is based on the MQL5 programming language, offers advanced functionality and superior analysis tools.

What UK retail clients will find in pepperstone’s metatrader 5 platform includes:

- Advanced pending orders

- Maximum of 500 total orders

- 21-time frames

- 38 built-in indicators

- Position hedging

- Optimised processing speeds

- Built-in economic calendar

Another advantage of the broker’s MT5 platform is the inclusion of shares cfds. UK-based clients have the opportunity to trade more than 60 high-quality US stocks with a maximum leverage of 1:5.

Final words – pepperstone best CFD trading platforms in the UK

Overall, pepperstone is the best CFD trading platform UK for its suite of MT4 and MT5 platforms. The minimum deposit for a live account with pepperstone UK is only GBP200. You can also start trading cfds without risking any of your hard-earned money by claiming your FREE demo account. Click the button below to enjoy the most popular CFD trading platforms in the UK.

Our rating

The overall rating is based on review by our experts

Compare the best CFD trading platforms of 2020

Sign up for our free daily digest newsletter: actionable insight every morning, designed for the self-directed investor. Find out more

We’ve put together this list of what we feel are the best CFD trading platforms currently available. Each broker has been carefully chosen to offer a range of services and features, designed to help you choose the broker that best suits your trading needs.

We will only include reputable companies on the site – each of the CFD brokers featured here are authorised and regulated by a respected international regulatory body.

Choose from our selection of the best CFD trading platforms

You’ll find a full review of each broker and our opinion on the services and features they offer. To visit the broker website, choose the ‘apply’ link.

The armchair trader is paid for by our partners through clicks, views and advertorials. So if you open an account through a link on the site, we may receive a fee for providing the introduction. This fee will in no way be passed on to you from our partners.

How do I choose from the best CFD trading platforms?

If you are new to trading contracts for difference, we offer a variety of free resources that you can use to help you select the best CFD trading platforms and meet your personal trading needs.

We suggest that you start with the basics – ask yourself these important questions in order to find the best CFD trading platforms to suit your needs.

- Do you need educational tools to support your learning?

- Are you able to check out the platform before you deposit funds using a demo account?

- How regularly are you expecting to trade and what length of time will these transactions be open for? What are the costs involved to trade or hold positions overnight?

- Does your broker offer access to the range of markets you’ll need?

- Is it important for you to trade directly with the market through direct market access or DMA, or are you happy to trade on pricing provided by your broker?

- Is your broker regulated by a respected global authority such as the FCA, SEC, ASIC, bafin or similar?

Remember, contracts for difference are leveraged products which means any trades you make are magnified, whether they are winning trades or losing trades.

It doesn’t matter if your broker offers one of the best CFD trading platforms available if your understanding of the product isn’t at the level it needs to be. It is important that you have a trading strategy in place and that you understand leverage before you begin to trade with real money.

Opening a CFD trading account

The majority of contracts for difference brokers offer demo accounts, providing traders with the chance to test out their platform before they commit real money.

We strongly suggest that you give your chosen platform a test drive before you begin trading for real.

Before you start looking at brokers, download our free guide to choosing your CFD broker. It will give you a fantastic insight into how contracts for difference brokers operate and how you can use this to choose the broker that best fits with your trading objectives.

Spread betting and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between [74-89]% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please note that % may be changing every quarter depending how this number looked in the previous period.

Trade with the UK's no. 1 CFD broker 1

Reliable, simple, innovative.

Trade the UK’s most popular: UK 100, GBP/USD & EUR/GBP with our CFD service.

Get more

We offer the complete package:

- Tight spreads

- No commissions

- Fast and reliable order execution

- Global offices & account features

Trade with trust

Plus500uk is authorised and regulated by the financial conduct authority (FRN 509909)

Plus500 ltd is a UK FTSE 250 company listed on the london stock exchange’s main market for listed companies

Your funds are kept in segregated bank accounts

* some of the payment methods may not be available in your country.

Take control

Use our advanced tools and features to gain control on your account:

- Stop limit / stop loss / trailing stop

- Guaranteed stop

- FREE email & push notifications on market events

- Alerts on price movements, change % & traders’ sentiments

Explore markets

Trade the world’s most popular markets and explore endless trading opportunities. We offer +2000 financial instruments, FREE real time quotes and dedicated round-the-clock customer support.

Play fair

Plus500 is proud to be the main sponsor of powerful teams across the globe, achieving more together

Trader's guide

Plus500 in 2019

Trading at your fingertips

Trade anywhere, anytime using our various platforms.

Need help?

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Plus500 is mainly compensated for its services through the bid/ask spread. Check our fees & charges

1 by total number of relationships with UK CFD traders. Investment trends 2020 UK leverage trading report.

Plus500 is a trademark of plus500 ltd. Plus500 ltd operates through the following subsidiaries:

plus500uk ltd is authorised and regulated by the financial conduct authority (FRN 509909). Cryptocurrency cfds are not available to retail clients. Office address: plus500uk ltd, 8 angel court, copthall avenue | london EC2R 7HJ.

Plus500cy ltd is authorised and regulated by the cyprus securities and exchange commission (licence no. 250/14). Cryptocurrency cfds are not available to UK retail clients.

Plus500au pty ltd holds AFSL #417727 issued by ASIC, FSP no. 486026 issued by the FMA in new zealand and authorised financial services provider #47546 issued by the FSCA in south africa.

Plus500sey ltd is authorised and regulated by the seychelles financial services authority (licence no. SD039).

Plus500sg pte ltd (UEN 201422211Z) holds a capital markets services license from the monetary authority of singapore for dealing in capital markets products (license no. CMS100648-1).

What is a contract for difference?

A contract for difference (CFD) is a popular form of derivative trading. CFD tradingвђ‹ enables you to speculate on the rising or falling prices of fast-moving global financial markets, such as forex, indices, commodities, shares and treasuries.

Get tight spreads, no hidden fees and access to 9,300+ instruments.

CFD meaning

A contract for difference (CFD) is essentially a contract between an investor and an investment bank or spread betting firm. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specified financial instrument, which can include forex, shares and commodities.

What is CFD trading?

Some of the benefits of CFD trading are that you can trade on marginвђ‹, and you can go short (sell) if you think prices will go down or go long (buy) if you think prices will rise. Cfds have many advantages and are tax efficient in the UK, meaning that there is no stamp duty to pay. Please note, tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the ukвђ‹.Вђ‹ you can also use CFD trades to hedge an existing physical portfolio. With a CFD trading account, our clients can choose between trading at homeвђ‹ and on-the-go, as our platform is very flexible for traders of all backgrounds.

Introduction to CFD trading: how does CFD trading work?

With CFD trading, you don't buy or sell the underlying asset (for example a physical share, currency pair or commodity). Instead, you buy or sell a number of units for a particular financial instrument, depending on whether you think prices will go up or down. We offer cfds on a wide range of global markets, covering currency pairs, stock indices, commodities, shares and treasuries. An example of one of our most popular stock indices is the UK 100, which aggregates the price movements of all the stocks listed on the UK's FTSE 100 index.

For every point the price of the instrument moves in your favour, you gain multiples of the number of CFD units you have bought or sold. For every point the price moves against you, you will make a loss.

What is margin and leverage?

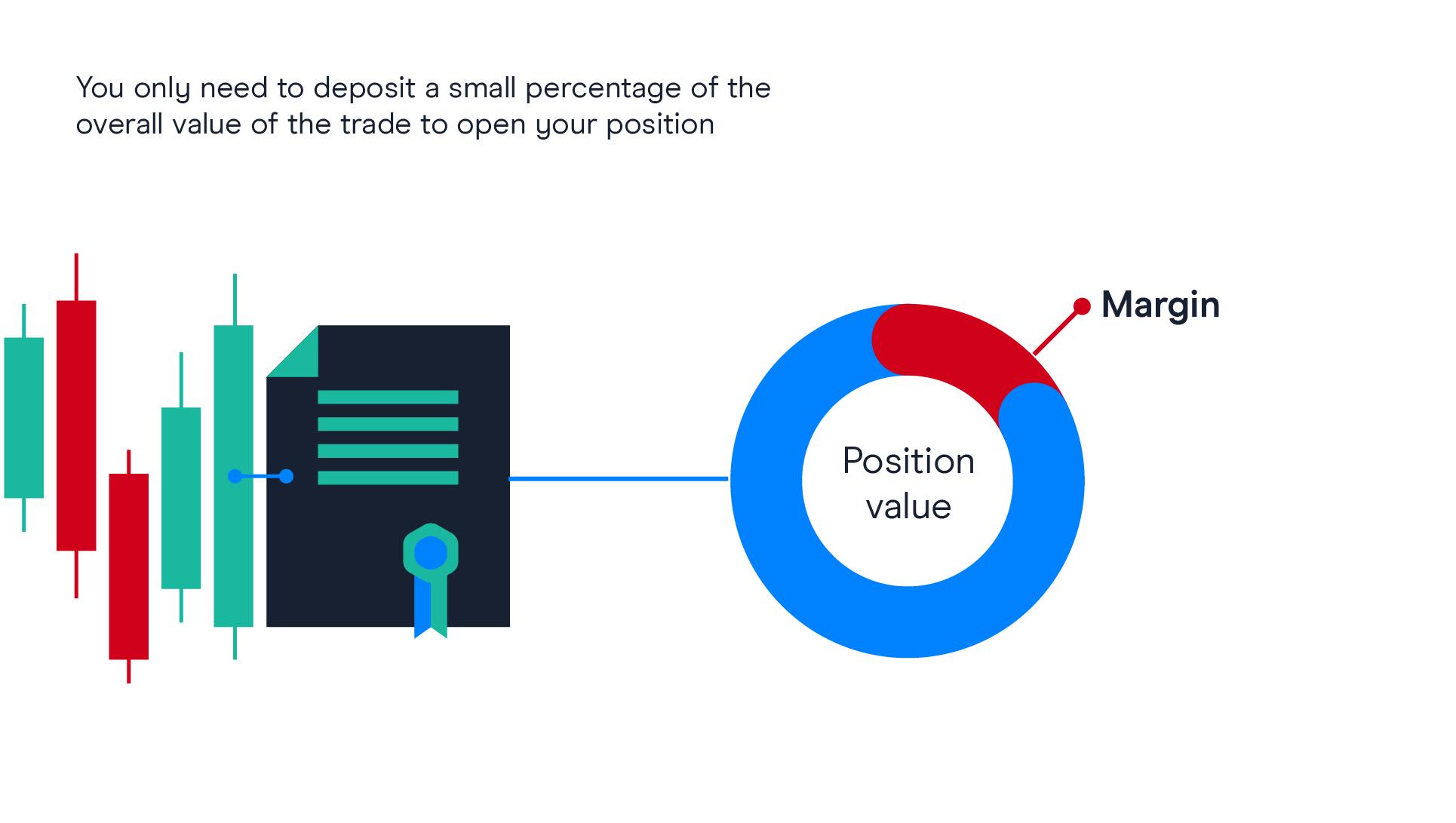

Contracts for difference (cfds) is a leveraged product, which means that you only need to deposit a small percentage of the full value of the trade in order to open a position. This is called вђ˜trading on marginвђ™ (or margin requirement). While trading on margin allows you to magnify your returns, your losses will also be magnified as they are based on the full value of the position. This means that you could lose all of your capital, but as the account has negative balance protection, you can't lose more than your account value.

What are the costs of CFD trading?

Spread: when trading cfds, you must pay the spread, which is the difference between the buy and sell price. You enter a buy trade using the buy price quoted and exit using the sell price. The narrower the spread, the less the price needs to move in your favour before you start to make a profit, or if the price moves against you, a loss. We offer consistently competitive spreads.

Holding costs: at the end of each trading day (at 5pm new york time), any positions open in your account may be subject to a charge called a 'CFD holding cost'. The holding cost can be positive or negative depending on the direction of your position and the applicable holding rate.

Market data fees: to trade or view our price data for share cfds, you must activate the relevant market data subscription, for which a fee will be charged. View our market data fees.

Commission (only applicable for shares): you must also pay a separate commission charge when you trade share cfds. Commission on UK-based shares on our CFD platform starts from 0.10% of the full exposure of the position, and there is a minimum commission charge of ВЈ9. View the examples below to see how to calculate commissions on share cfds.

Example 1 - opening trade

A 12,000 unit trade on UK company ABC at a price of 100p would incur a commission charge of ВЈ12 to enter the trade:

12,000 (units) x 100p (entry price) = ВЈ12,000 x 0.10%

Example 2 - opening trade

A 5,000 unit trade on UK company ABC at a price of 100p would incur the minimum commission charge of ВЈ9 to enter the trade:

5,000 (units) x 100p (entry price) = 5,000 x 0.10%

= ВЈ5.00 ВЈ9.00 (as this is less than the minimum commission charge for UK share cfds, the minimum commission charge of ВЈ9 would be applied to this trade.)

Please note: CFD trades incur a commission charge when the trade is opened as well as when it is closed. The above calculation can be applied for a closing trade; the only difference is that you use the exit price rather than the entry price. Learn more about CFD commissions and trading costs.

Top 5 bitcoin CFD trading platforms, rated and reviewed for 2020

If you’re new to bitcoin trading, there’s a good chance you are yet to hear about bitcoin cfds. Cfds (contracts for difference) are financial derivatives that enable you to bet on the price development of an asset, such as stocks, bonds, or bitcoin.

In this guide, you will learn what bitcoin CFD trading is and discover a list of the best crypto CFD trading platforms that you could use in 2020.

What is CFD trading?

CFD (contract for difference) trading is a way to trade digital assets without actually owning any. It’s a great way to trade bitcoin and altcoins without getting into the technical aspects of holding a digital coin.

When you trade using cfds, you don’t have to mess with backing up your personal keys, owning a wallet, or any of the other components of bitcoin that many people find intimidating or complex. It also eliminates some of the risks associated with holding bitcoin.

With a CFD, you’re buying a particular asset, like bitcoin, at a given price. From that point, the price moves up or down. Once the valuation of bitcoin hits the level you want, it’s time to conclude your contract. You receive the difference between the price at the end of the contract and the price at the beginning.

So, if you started your contract when bitcoin was worth $8,000 and ended the contract when it was $9,500, you’ve made $1,500 on your bitcoin CFD.

Top bitcoin CFD trading platforms for 2020

One of the challenges with using a CFD platform is finding the right one. How do you know which one is best for you and what you need? Here’s our breakdown of five leading bitcoin CFD trading platforms available in 2020.

| Name | description | withdrawal fee | minimum deposit | digital coin CFD markets | base currencies | score |

|---|---|---|---|---|---|---|

| etoro | etoro is one of the largest platforms in the bitcoin and altcoin market. You'll not only have access to its CFD market, but to its exchange as well. You can buy, sell, and trade your favorite digital coins in nearly any manner you wish. With etoro cfds, you can leverage your positions up to 2x. Plus, if you want to play around with the platform before using your own money, etoro gives you a demo account. | $25 | $200 | 15 | 1 | 2.3 |

| IG | IG is considered by many as one of the most reliable CFD brokers in the world. It offers an excellent trading platform that is easy to use and navigate. You'll receive top-notch customer service when using the IG exchange, plus it's very easy to deposit and withdraw funds. It's easy to see why IG is a highly-ranked bitcoin CFD trading platform. | $0 | $0 | 6 | 4 | 4 |

| plus500 | if you're looking for a platform that's been around for a while, plus500 has been in the CFD market for over a decade. The exchange is registered in the united kingdom and offers access to CFD trading for digital coins. As the first broker to provide bitcoin as a CFD option, you know that you're in good hands when trading. Additionally, plus500 charges no commissions on its trades. | $0 | $100 | 9 | 3 | 3.5 |

| markets.Com | for those who want to focus only on CFD trading, markets.Com will get the job done. This platform is easy to use, offers low trading fees, and provides excellent research tools. Opening an account is very easy, as is the deposit and withdrawal process. It's a solid choice for your CFD bitcoin trading. | $0 | $100 | 5 | 5 | 3.8 |

| XTB | XTB is a great platform for CFD traders who like swift funding and withdrawal processes. The site is easy to use and offers an intuitive user interface. You'll also receive plenty of research tools when using this platform. Like other CFD platforms, XTB offers its users a demo account so they can give it a try before depositing funds. | $0 | $250 | 16 | 4 | 3.8 |

What makes a good CFD trading platform?

Now that you have a solid idea of which trading platforms are best for bitcoin CFD trading, what should you look for when choosing the one that works best for you?

Here are a few factors to consider:

- Account opening: some platforms require a minimum deposit amount while others don’t have a set first-time deposit. If you have a particular CFD platform in mind, visit it and determine what their requirements are for those who new to the site.

- Deposits and withdrawals: there can be significant differences between CFD platforms when it comes to deposits and withdrawals. The disparity can be so large that there are some that take five times longer to complete these types of transactions than others.

- Fees: fees are another area in which there can be a great disparity between platforms. There can be fees that are 10-15 times higher at one CFD broker than they are on another. It’s definitely worth it to take a moment and verify fees before selecting your CFD platform.

- Markets: there are more digital currencies than just bitcoin, but if that’s the only one you’re interested in, then find a platform that supports it. However, there are also platforms that offer markets for altcoins like litecoin, ripple, ether, and many others.

Related reading:

Bitcoin trading is gaining popularity across the globe. To stay on top of this trend and more, take moment to subscribe to bitcoin market journal.

Best CFD brokers in the UK for 2021

Kane pepi PRO INVESTOR

If you want to actively trade stocks to benefit from tight spreads, low commissions, leverage facilities, and short-selling capabilities – you might be suited for a specialist CFD broker. In doing so, you will likely have access to thousands of stock cfds from a range of markets – both domestically and abroad.

In this guide, we discuss the best CFD brokers for trading stock cfds. Crucially, each broker meets a set of minimum requirements to ensure you are able to trade shares in a safe, convenient, and cost-effective manner.

The top CFD brokers available in the UK

We review the best CFD brokers in more detail further down this page, but if you’re just looking for a quick summary, here’s a list of the top CFD brokers of 2021.

- Etoro – best all-round CFD broker with 0% commission

- Libertex – established CFD broker with MT4

- Plus500 – low-cost CFD broker with tight spreads

- Avatrade – popular online trading platform with tight spreads

What are cfds?

Not only does this include stocks and shares, but virtually every investment class imaginable. Whether that’s gold, oil, natural gas, bonds, indices, or cryptocurrencies – if a market exists, as will a CFD instrument.

The ease in which a CFD can track the second-by-second price movement of a stock offers a plethora of benefits for an everyday trader. For example, you’ll often find that the best CFD brokers permit commission-free trading, as well as highly competitive spreads.

Furthermore – and perhaps most pertinently, stock cfds can be traded with leverage, and you also short-sell the respective company. This means that you can speculate on the value of the shares going down – which would otherwise not be possible when using traditional stock brokers.

Best CFD brokers UK of 2021

Choosing the right CFD broker for your trading needs is fundamental. For example, are you looking to trade stocks from a particular exchange or market, or are you more concerned with low commissions and tight spreads? Similarly, you might be looking to deposit and withdraw funds with a specific payment method, or you might want access to an advanced trading platform like metatrader4.

Either way, these are some of the questions that you need to be asking of a CFD broker before signing up. To help you along the way, below we have listed the best CFD brokers current serving UK clients.

1. Etoro – best UK CFD broker for beginners

Etoro actually covers both stock investment avenues – as it offers share dealing services and CFD instruments. Regarding the latter, you will have access to over 800 stock cfds – all of which can be traded on a commission-free basis. This is, however, on the proviso that you do not keep your position open overnight, as this will incur financing fees, this is industry-standard nonetheless.

In terms of tradable markets, the stock CFD library at etoro covers the london stock exchange, as well as exchanges in the US, germany, france, japan, and many others. You can place both buy and sell positions on your stock CFD trade, as well as apply leverage. As per ESMA limits – this is capped at a ratio of 1:5. The trading platform itself is native to etoro, and it has been built with the ‘newbie investor’ in mind. While this is ideal if you are just starting out, it likely won’t suffice if you’re a seasoned trader.

Outside of its stock library, you can also trade cfds in the form of indices, cryptocurrencies, bonds, and commodities. An additional option for you to consider as a beginner is the platform’s copy trading feature. Upon selecting an experienced trader that you like the look of, you can mirror their trades like-for-like. When it comes to safety, etoro is licensed by the FCA, cysec, and ASIC – so you have regulatory oversight on three fronts.

Getting started with an account takes minutes – which you can do online or via the etoro app. Minimum deposits start at $200 (approx. £160), which you can do with a debit/credit card, e-wallet, or bank account. Regardless of the payment method, all deposits come with a 0.5% conversion fee – as etoro is denominated in US dollars. Finally, etoro has a minimum withdrawal of $50 – with all cashouts costing a fee of $5.

Super user-friendly online stock broker buy stocks without paying any commission or share dealing charges 800+ stocks listed on UK and international markets deposit funds with a debit/credit card, e-wallet, or UK bank account ability to copy the trades of other users

75% of retail investors lose money trading cfds at this site

2. Libertex – best CFD broker for trading via MT4

Launched in 1997, libertex is a CFD broker that allows you to trade over 200 assets. This includes stocks, cryptocurrencies, forex, metals, indices, and etfs. Libertex is one of the few CFD providers in the space that allows you to trade without paying anything on the spread.

Instead, you will pay a small trading commission – which is charged against the value of your order. The platform now boasts over 2.2 million customers worldwide, and it is regulated by cysec. This particular regulator is a tier-one licensing body based in cyprus, so you should have no issues regarding the safety of your funds.

In terms of leverage, this is capped at 1:30 for retail clients and 1:600 if you are deemed to be a professional trader. When it comes to the trading arena, libertex offers full support for metatrade4 (MT4). This means that you can automate your CFD trades via an autonomous robot or EA (expert advisor). You will also have access to a vast range of technical indicators, and you customize your trading screen to mirror your personal requirements.

Regulated by cysec over two decades in the CFD brokerage space most asset classes covered zero spreads debit/credit cards, e-wallets, and bank transfers supported leverage of up to 1:30 for retail clients

83% of retail investors lose money trading cfds at this site

3. Plus500 – commission-free CFD provider

Plus500 is a CFD provider that hosts thousands of tradable instruments. On top of CFD indices, commodities, and cryptocurrencies – the platform hosts over 2,000 stock cfds. This covers heaps of UK and international exchanges – which is great if you are looking to gain exposure to less liquid markets. For example, while the bread and butter of the UK and US are covered, plus500 also lists stock cfds from finland, south africa, and canada.

The CFD provider does not charge any trading commissions – meaning your fees will come in the form of overnight financing (if holding positions beyond the close of trading hours) and of course – the spread. The trading platform itself is unique to plus500, and there is no requirement to download any software. Instead, you can trade via the main desktop website or the plus500 mobile application.

You can deposit and withdraw funds with a UK debit/credit card, bank account, or paypal – and all payment methods are fee-free. Minimum deposits start at £100 – although you can place buy and sell orders for much less than this. Leverage is available on all of the CFD products hosted by the platform – with stocks capped at 1:5 if you’re a retail client. Plus500uk ltd is authorized & regulated by the FCA (#509909).

Commission-free CFD platform – only pay the spread thousands of financial instruments across heaps of markets retail clients can trade stock cfds with leverage of up to 1:5 you can short-sell a stock CFD if you think its value will go down takes just minutes to open an account and deposit funds

80.5% of retail investors lose money trading cfds at this site

4. Avatrade – popular online trading platform with tight spreads

Avatrade is a good option for those of you that are looking to trade CFD assets via a day trading strategy. This is because the platform offers some of the tightest spreads in the industry. For example, most major forex pairs hosted at avatrade can be traded at a spread of less than 1 pip.

In addition to this super-competitive spread structure, avatrade allows you to buy and sell CFD instruments on a commission-free basis. In terms of tradable markets, avatrade offers thousands of financial assets. On top of forex, this includes bonds, stocks, indices, commodities, cryptocurrencies, options, and futures. As such, if there is a marketplace you are interested in, chances are you’ll find it at avatrade.

What we also like about avatrade is that it offers several trading platforms. For example, you can use the avatrade platform via your web browser or through an android/ios mobile app. Furthermore, the platform also supports MT4 and MT5, which is great for advanced chart analysis and deploying automated robots. We should also note that avatrade offers a spread betting facility. If you’re in the UK, this means that all profits are free of capital gains tax.

If you like the sound of avatrade but you want to test the platform out first, the CFD broker offers a demo account facility. You don’t need to deposit any funds to use this, which is great for getting to grips with the platform before taking the financial plunge. Minimum deposits at the platform stand at $100 – which you can via a debit/credit card or bank transfer. Finally, avatrade is heavily regulated and it holds licenses in several countries.

Dedicated forex options trading platform trade cfds for stocks, forex, and commodities includes paper trading with metatrader 4 200+ spread betting markets all fees built into the spread all trades are commission-free

Very high inactivity fee

73.05% of retail investors lose money when trading cfds at this site

How to find the best CFD brokers UK?

Irrespective of which UK CFD broker you go with, the end-to-end investment process works largely the same. In other words, you will always be required to open an account, upload some ID, deposit funds, and then place buy and sell orders on a DIY basis. With that in mind, your focus needs to be on key metrics like fees, commissions, payment methods, safety, and customer support.

Below we discuss these key factors in more detail to ensure you pick a CFD broker that is closely aligned with your needs.

FCA regulation

In most cases (but always check first), this should also mean that your investments are protected by the financial services conduct authority (FSCS). For those unaware, this means that were to CFD broker to go bust, your funds would be protected up to the first £85,000.

This won’t, however, protect you from losses you have encountered from an unsuccessful trade. FCA regulation also ensures that the CFD broker keeps client funds in segregated bank accounts.

Deposits, withdrawals, and payments

You should also visit the CFD broker’s website to assess what payment methods it supports. This is crucial. As you will be depositing and withdrawing real-world pounds and pence.

Although the specific payment methods available to you will vary from provider-to-provider, this might include:

- Debit cards

- Credit cards

- Bank account transfer

- Paypal

- Skrill

- Neteller

Once you have assessed which payment method you wish to use, check to see whether or not any transaction fees apply. You should also explore how long the UK CFD broker typically takes to process withdrawals, and whether a minimum cash out threshold applies.

Fees, commissions, and spreads

You will need to pay a fee to trade cfds online, so this should also form part of your in-depth research process.

In particular, look out for:

- Spread: the spread is the difference between the stock CFD’s ‘bid’ and ‘ask’ price. The best CFD brokers usually display this as a ‘buy’ and ‘sell’ price, respectively. Either way, you’ll want to ensure that your chosen platform offers competitive spreads, not least because this will contribute to your end-to-end trading costs. If you can get your stock CFD spreads below 1 pip, you’re doing well.

- Trading commissions: some, but not all, CFD brokers will charge you a trading commission. For example, IG charges 0.10% when trading UK stock cfds – at a minimum of £10. In other cases, etoro and plus500 charge no commissions at all.

- Overnight finance: if you plan to trade stock cfds with leverage, you might need to pay an overnight financing fee. As the name suggests, this will be the case if you keep the CFD position open overnight. CFD brokers base this on an annualized interest rate, which is broken down on a day-by-day basis. In most cases, you can view the specific charge before placing your trade.

Tradable markets

The best CFD brokers will give you unfettered access to heaps of stock exchanges. While some of you might be happy to concentrate on UK companies, others like to take a more diversified approach. As such, look to see what markets the CFD broker offers. The like of etoro, plus500, and IG cover exchanges from the US, canada, germany, france, south africa, saudi arabia, finland, and more!

Features and tools

On top of the fundamentals – we would also suggest exploring what trading features and tools the CFD broker offers.

- Technical indicators: if you want to make a success of your stock CFD trading endeavours, you’ll need to learn the ins and outs of how technical indicators work. This will ensure you have the capacity to read and interpret pricing trends. The best CFD brokers typically provide dozens of technical indicators – but be sure to check nonetheless.

- Mobile trading: CFD trading is typically carried out on a short-term basis. That is to say, seasoned investors often keep a position open for a number of minutes or hours – so they need to be ‘at the ready’ when a new trend comes to fruition. As such, the best CFD brokers will offer a free stock trading app.

- Educational resources: if you have little to no experience in trading cfds, it’s best to stick with a broker that offers educational resources. This could be anything from a selection of how-to guides, video explainers, and even live webinars.

- Leverage: if you have a slightly higher tolerance for risk, the best CFD brokers will usually offer leverage of up to 1:30. This is reduced to 1:5 when trading share cfds.

- Negative balance protection: although now the norm with CFD brokers, it’s best to make sure that the provider has negative balance protection in place. This means that an unsuccessful leveraged trade will not push your account balance into negative territory. Instead, your position will be closed when your balance hits zero.

Getting started with a UK CFD broker today – quickfire walkthrough

Based in the UK and looking to start trading cfds today? If so, below you will find a quick step-by-step walkthrough to get you started in minutes. We’ve based our demonstration on popular CFD broker etoro – but feel free to use any platform of your choosing!

Step 1: open account and upload ID

First and foremost, head over to the etoro website and elect to open an account. As is the case with all FCA-regulated CFD brokers, you will need to provide some personal information.

- Full name

- Home address

- Date of birth

- National insurance number

- Email address

- Mobile number

You will also need to upload some ID – as per UK anti-money laundering laws. This includes a passport or driver’s license and a recently issued utility bill or bank account statement.

Step 2: deposit funds

Etoro accepts several UK payment methods. To deposit funds, you can choose from a debit/credit card, e-wallet, or bank account. Minimum deposits start at $200 (£160) and you will incur a small GBP-to-USD conversion of 0.5%. All deposits at etoro are instantly credited (apart from a bank transfer which takes 1-3 working days).

Step 3: place a CFD trade

Now that your account has been verified and funded, you can start trading cfds straight away.

- Click on the ‘trade markets’ button

- Select your preferred CFD asset class (for example, stocks)

- Click on the asset you wish to trade

Next, you will be asked to set up an order. In our example, we are looking to trade apple CFD stocks.

- Choose from a buy or sell order

- Enter your stake

- Choose from a market or limit order

- Determine if you want to apply leverage and at what ratio

- Enter your stop-loss price

- Enter your take-profit price

- Confirm the trade

Once your CFD trade is executed at etoro, it will remain active until you close the position manually – or either your take-profit/stop-loss order is triggered.

The verdict

Finding the best CFD broker for your individual trading needs is imperative. Not only do you need to ensure that your research covers the regulatory standing and reputation of the broker, but other metrics like tradable assets, fees, commissions, spreads, and payments.

If you’re keen to get started today, etoro is popular with UK investors. You can open an account in minutes, instantly deposit funds with a debit/credit card, and then trade cfds at the click of a button.

Is CFD trading legal in UK?

CFD trading is perfectly legal in the UK. The industry is safeguarded by the financial conduct authority (FCA).

Do I own the asset when I trade cfds?

No, CFD instruments are tasked with 'tracking' the real-time market price of an asset, so you will have no legal right to the said asset. For example, if you were to trade stock cfds, you would not actually be buying shares in the company. Instead, you are simply speculating on the future price of the stock.

How can I get higher leverage limits when trading cfds?

If you're based in the UK - and you are classed as a retail trader, you are still bound by the leverage limits imposed by ESMA. This stands at a maximum of 1:30 on major currency pairs, and at the lower end, 1:2 on cryptocurrencies. The only way that you will be able to get higher limits is if you can provide you are a professional trader, or you use an offshore broker. The latter is not advised as you will not benefit from the protections of the FCA.

Can I transfer a CFD position to another broker?

No, the CFD instrument in question will have been created by your chosen broker, so you will not be able to transfer it to another provider.

Do UK CFD brokers accept paypal?

More and more CFD brokers in the UK are providing support for e-wallets like paypal. This includes etoro (which also supports skrill and neteller) and plus500.

About kane pepi PRO INVESTOR

Kane pepi is a british researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in malta, kane writes for a number of platforms in the online domain. In particular, kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, kane holds a bachelor’s degree in finance, a master’s degree in financial crime, and he is currently engaged in a doctorate degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find kane’s material at websites such as moneycheck, the motley fool, insidebitcoins, blockonomi, learnbonds, and the malta association of compliance officers.

CFD trading in india

CFD trading in india can open the door to lucrative markets. But firstly, is online CFD investing allowed and legal in india? We’ll explain the rules before looking at the best trading brokers and platforms.

Best CFD brokers in india

What is A CFD?

A contract for difference (CFD) is a derivative, meaning you don’t take ownership of the underlying security. Essentially, two parties agree to exchange the difference between the current asset’s price and the market value at the contract close.

Let’s say you were trading cfds on indian stocks, such as coal india. If the market moved against you, you would pay the broker the difference between the current market price and the value of the asset at the contract time. If the market moved in your favour, the broker would instead pay you the difference.

Markets

CFD trading in india is attractive because it allows for market diversification. You can trade on stocks and shares, forex, futures, options, gold, and more. And because online cfds are a relatively straightforward instrument, it’s easy to switch between commodity trading and the indian stock market index, for example.

Finance

The other benefit of cfds is the ability to trade on leverage. Brokers take collateral, known as margin, and then lend you funds so you can take position sizes that wouldn’t be possible with your cash balance alone. Not only does this increase the size of possible returns, but it also means you have capital left to take positions elsewhere. On the flip side, leveraged investing does increase risk exposure.

For more information on CFD basics, including day trading strategies, see here.

Is CFD trading in india legal?

Whether CFD trading in india is legal and allowed is a grey area. The securities and exchange board of india (SEBI) hasn’t yet rolled out laws to regulate cfds. As a result, there isn’t a licensing system, which means you can’t find regulated brokerages based in india. Instead there are many unlicensed websites, where users won’t receive any legal protection.

So, if you want to trade cfds on indian stocks, for example, you should turn to companies based outside of india. Likewise, indian residents will need to turn to offshore providers.

How to choose a CFD trading broker

The good news is there is a long list of CFD brokers in india. Key considerations when choosing a provider include:

- Regulation – make sure the broker holds a license with at least one of the following regulatory bodies: UK financial conduct authority (FCA), malta financial services authority (MFSA), european securities and markets authority (ESMA), cyprus securities and exchange commission (cysec), australian securities and investments commission (ASIC).

- Reputation – not only is it important that the exchange is licensed with a respected body, but also that it gets positive customer reviews.

- Mobile apps – online CFD trading in india is commonly done via a mobile app. So, check the broker’s platform will be compatible with your mobile device. Also check you can make deposits and withdrawals from your phone.

- Markets – one of the merits of CFD investing is wide-ranging products. With that in mind, check you’ll have exposure to all the markets you want, such as indian stock market indices.

- Customer service – fast and straightforward access to customer support in a language you can understand is important. You don’t want to be jumping through hoops when your money is on the line. Also, if companies are based in different time zones to you, make sure you’ll have access to support during the times you’ll be active.

- Fees – fees usually come in the form of commissions and spreads. Commissions will be paid on each trade while spreads will include a mark-up for the broker’s services. If you wrack up serious trading volumes, even small cost differentials will add up.

See our list of the best online CFD trading brokers.

Best platforms

What the best online platform is for CFD trading in india will be down to the user. With that said, the metatrader 4 (MT4) desktop and mobile platform is the most widely used. It’s reliable, easy to pick up, and allows for advanced charting and pattern analysis. The traders workstation (TWS) is another popular choice. Fortunately, many brokers today offer multiple options. Sign up for a demo account and have a play around to see which system works for you.

Final word

CFD trading in india is allowed, however, there isn’t the robust legal protection found elsewhere. Signing up with a broker from india is therefore risky. Instead, it’s worth choosing a broker licensed in another jurisdiction. The best brokers and platforms can be found on our list.

Is CFD trading legal in india?

CFD trading in india is legal and allowed. However, because there isn’t effective regulatory oversight through a licensing system, indian investors will need to open accounts with respected offshore brokers. Non-indian residents can also trade cfds on indian stocks through offshore brokerages.

How do I trade cfds in india?

To start day trading cfds in india, you will first need to open an account with a licensed broker. Once you’ve deposited funds into your account you can then take a position on your trading platform. For guidance on CFD trading strategies, including risk management advice, see here.

How much money do I need to start CFD trading in india?

Minimum account deposits vary among brokers, but you can start trading cfds with 4,000 INR. Margin requirements will also change depending on the provider, but are often between 5% and 25%.

Is it free to make deposits and withdrawals CFD trading in india?

Whilst deposits and withdrawals are usually free, if you’re using an offshore CFD broker there may be a currency conversion charge.

Do I need to pay taxes on CFD trading in india?

Profits generated from CFD trading in india may be taxable. The extent of your tax obligations will depend on how your trading activity is classed. See here for further guidance on day trading taxes.

CFD brokers in the UK 2021

CFD trading is the buying and selling of “contracts for difference” – referred to as “cfds”. They allow traders to speculate on price movements of an asset – both going up, or down (long or short). Often offered with leverage (or ‘on margin’), they give UK traders the ability to speculate on stocks, forex, commodities or indices. As the underlying asset is not owned by the trader, no stamp duty is applicable to cfds.

Read our full guide here and find the best CFD trading platform and the best CFD broker for UK traders 2021.

- Show advantages and disadvantages of this form of trading.

- Explain how to find the best CFD broker account, platform or software for you.

- Offer some “beginners tips” to help analysis and trading strategy

Top UK CFD brokers list

What is a CFD?

A CFD is a contract between broker and trader to pay the difference in price, between the strike price and the price at the close of the trade, of an underlying asset.

Contracts for difference defined

CFD defined: A contract for difference (or CFD) is a contract between a broker and an individual trader. It is a form of derivative. The difference refers to the value of the underlying asset at the time the contract is agreed (the strike price) and the value after the trade ends. It is essentially an agreement to exchange the difference in these two values.

The underlying asset is not brought and sold, but the contract allows traders to speculate on price movements of that asset. When trading stocks, no dividend is directly payable, but many brokers will still pass on the dividend. This balances any drop in value once a stock goes ex-dividend.

The trader does not own the underlying asset at any stage. Brokers create cfds in a wide range of individual equities, indices, commodities and forex. The price is determined by the markets. The length of the contract will vary. Trades may last just a few seconds, up to months or years.

Puts or calls

Cfds are generally used for shorter time periods (days or weeks) as more traditional investments are seen to offer better value over longer periods.

The contract features a ‘buy’ and a ‘sell’ price (known as the ‘spread’). This offers the chance for traders to go long (buy) if they believe market prices will rise, or go short (sell) if they believe market prices will fall. Buys or sells are also known as “puts” and “calls”.

If the market moves in line with the trade, profits from the contract will rise in line with that movement. Conversely if the market moves against the trade, losses increase. These contracts are often offered with a degree of leverage. This increases potential profits – but also potential losses – and therefore carries much greater risk.

Trading cfds – key points:

- A CFD is a linearly leveraged financial product. Profits and losses increase in direct relationship to market performance whether you buy or sell. The leveraged nature of cfds mean, therefore, that your losses can exceed your initial investment. The best CFD brokers will offer negative balance protection, but this is not always the case.

- A CFD does not have a fixed maturity date. The trader will dictate when the contract expires. When you judge that it’s the right time for you to close a position, this is done by placing a trade of the same value in the opposite direction. Most brokers will however, make a very small charge for positions held overnight. Each charge is miniscule relative to the trade size – but is repeated each night.

How and why CFD trading can be useful

Here we weigh up some of the pros and cons of trading financial markets via cfds. Many readers ask if cfds are “good or bad” – as with any financial product, they will be right for some traders, and not appropriate for others. Hopefully this summary will help decide if they are right for you.

Take a position in a falling or rising market

With the choice to go short or long, you have the potential to generate profits regardless of which way the market is trending. With traditional investment vehicles, it is more complex to profit from falling markets. This is especially true with forex trading.

Hedge your wider investment portfolio

Where you are invested in physical shares, your hope and expectation is obviously that they will increase in value. You may also expect to collect a dividend. But where there is a very real risk of those shares leaking value, cfds can play a useful hedging role.

So if you hold stocks in a certain company, short selling cfds based on the same shares can be a useful way of making a profit from any short-term downtrend. In turn, this can partially or wholly offset any loss from the portfolio. This security measure can be an especially useful strategy to adopt in volatile markets.

Tax efficiency

While share dealing attracts stamp duty liability, the same does not apply to a CFD trade. Unless you class yourself as a full time trader, and trading cfds is your ‘occupation’, then income tax is not applicable to any profits or earnings derived from trading.

This does work in reverse as well however, in that any losses can not be claimed back either – but the tax implications are generally positive.

Risks associated with cfds

Below are some of the hidden dangers of trading with contracts for difference. Many risks can be reduced by using a practise account before trading;

Leverage and margins

To open a CFD position, it is necessary to deposit an amount in your brokerage account, known as a margin. This ‘position margin’ tends to depend on the size of your position, the broker (CFD providers) and the type of underlying asset.

The good thing about this is the ability to deposit a percentage of the full value of the position, which means your money linked to the position is not tied up in one transaction and can be used for other investments.

The downside is that it is possible not just to lose your initial deposit but also be required to make further payments.

CFD trading – leverage risk

Keeping track of transactions

Failure to ensure you have enough funds in your account to cover total margin requirements could mean that some or all of your positions are closed out. Managing multiple CFD trades requires you to constantly monitor your account, depositing additional funds where necessary.

A “margin call” is where the broker gets in touch with the trader in order to add funds to the account. This happens where a number of trades have moved against the trader. Failure to add funds will mean certain positions are closed.

Use reputable, regulated brokers

In the UK, there are a great choice of reputable CFD brokers, many fully regulated by the FCA. Traders can use these trading platforms with confidence. Regulation is robust and is there to protect the trader.

This does mean however, that brokers will ensure they have strict policies on ID and banking facilities. FCA regulation is probably the best standard, though some brokers will ‘passport’ their own domestic regulator – which allows them to trade in the UK.

Beware of unregulated firms – a london address does not guarantee they are regulated by the FCA.

Halal or haram?

With online trading companies and CFD providers keen to expand their user base, many now offer websites boasting ‘halal’ accounts. There is reason for muslim traders to tread carefully however. While these accounts are legal, and ensure that no interest or “riba” is used on the account – they may still be haram.

Much depends on the traders themselves. In islam, gambling is haram. If a trader is using a trading account to purely speculate, then that would be forbidden.

Only the trader can know if they are investing responsibly. This site is not qualified to answer this question categorically, but there are useful forums regarding halal investing. Those discussions may help individuals decide if trading is right for them.

Is CFD trading for you?

Cfds offer a dynamic and sophisticated way of trading – although the possibility of losing more than your initial stake mean that it isn’t for everyone. The terminology can also sometimes confuse investors more use to other financial tools.

When looking for a trading platform, it’s important to opt for a format that you are comfortable with; one that allows you to keep control of your trades and one with a competitive spread – i.E. A narrow difference between buy and sell prices. Weighing up the various benefits will come down to personal choice.

How to compare CFD brokers

How should you attempt to compare CFD brokers? And how might you identify the best broker or best CFD trading platform? There are a whole host of regulated and secure brokers offering CFD (contracts for difference) trading – but how can you tell if one is “better” than another? A good start is our UK CFD brokers list, but below we will explain some important details that traders should look at.

The answer will often need you to ask questions of yourself. The best CFD broker for one trader, will not necessarily be the best choice for another.

Here we cover some key comparison elements from the leading brokers reviewed on this site. Below that, we highlight some of the key areas where CFD brokers differ from one another. We also explain how you might compare them. The needs and trading style of each trader will be different. There is not one broker that will represent the best choice for all traders. Read on to find out which broker suits you best.

What are CFD brokers?

How to compare CFD brokers

Here the “top 10” key comparison features or “rules”, by which you can judge a particular broker;

- Spread / commission

- Leverage

- Trading platform

- Deposit and withdrawal options

- Additional features

- Support

- Education

- Regulation

- Mobile app

- Range of assets

- Metatrader integration

We cover each section in detail below.

Spread or commission

The spread or commission impacts every trade, and every trader. It is the ‘cost’ of making the trade. It is therefore a very significant value to compare when judging one broker or another.

There are complications however. The spread will differ broker to broker – but also asset to asset. So a broker may have the smallest spread for forex pairs, but the largest for indices.

Depending on what assets you to invest in, the broker might be the cheapest choice – or the most expensive. So when comparing based on the spread, ensure you are checking the spread on the assets you will be trading most.

Our cfd broker comparison table lists the most popular asset in each category, and the spread for that asset. Remember also, that a demo account is a great way to check spreads – particularly where they are variable.

Margin (or leverage)

The margin is the percentage of the overall trade value that a trader must deposit (and commit) in order to open a trade.

So a £1,000 trade on the GBP/USD currency pair may only require a deposit of £50. The position however, has exposed the trader to £1,000 worth of risk (the risk of losing the entire investment is extremely small, but that is the value of the position) – hence the warning attached to CFD trading “losses can exceed your initial deposit“. Margin is also referred to as ‘leverage’. Where this is the case, the leverage is often illustrated in terms of multiples – so 200:1 would indicate leverage of 200 times the deposit. The equivalent margin would be 0.5%.

So when comparing brokers, a low margin requires smaller deposits. This will be important to some traders, but less so to others. Note high leverage means higher risk.

Trading platform

The actual CFD trading platform is often not considered before a trader makes a broker choice and opens a live account. That however, could be a mistake. Most platforms will have similar functions – but as with anything, the usability and look and feel will be a matter of personal preference.

It is vital to be trading on a platform that is familiar and easy to use. It is not uncommon for traders to miss prices, or worse, make mistakes trading, because the trading platform did not suit them for whatever reason.

The amount of flexibility may also play a role. If the platform can be resized, or reorganised exactly to your needs, trading becomes the only focus.

Deposit and withdrawal options

Not your first consideration? If moving money in and out of trading accounts has been an issue in the past, it is worth checking. See if the methods you want to use to fund and withdraw from your account are available with each broker.

Features (charts, technical analysis, research)

If you plan to research your trades on the same trading platform where you ultimately trade, you want to ensure you have the best research tools available there. Charting standards do differ significantly.

Some CFD brokers offer outstanding charting facilities. Some deliver a range of technical analysis tools that will satisfy even the most ardent technical analysis experts.

The latest news may also available within the trading area, so research can be done from one place. Other platforms seem to assume traders will have already researched their trades elsewhere, and offer pretty basic charts and little in the way of analysis tools. If this is important to you, ensure your potential broker satisfies this need.

Support and education

Many of the best CFD providers will offer educational material to their clients. These might include ebooks, webinars or even one to one training where the client requests it. Again, this might be important to some traders but not to others. Likewise, the range of languages supported by the firm may also be a factor.

It is worth noting that brokers make money when traders trade. This means most educational materials will encourage lots of trading. Over trading is a frequent issue for many traders, particularly beginners. Those just starting out are also those most likely to look for learning tools.

The available support from a broker may be reassuring for some – others may not envisage ever using it. Potential new clients who do like to know they can contact a broker might like to establish the availability and contact methods for the support desk. Most firms offer a high standard of support.

Other factors

Some other things that enable people to compare CFD brokers might include the quality and availability of a mobile trading application. As ever, trading on the move will be important to many traders – others will be happy to not use a mobile app.

It is very rare for brokers to not deliver a free mobile trading app. These run parallel to the main online site. Again, they have mostly been developed to a very high standard. While some firms may have delivered a poor mobile service in the past, they simply cannot survive without one now.

If you have a niche handset or mobile device, it may not be catered for. But mainstream users on ios, android or windows apps can be very confident any broker will deliver a very good mobile app to trade on.

Regulation

This should be a key criteria for any broker. The strongest level of regulation for UK traders will be the financial conduct authority (FCA). They regulate the majority of CFD brokers on our pages. There are exceptions, but where this is the case, the alternative regulator must be listed with the FCA via the european passporting system of regulators.

Bonuses

A bonus or promotional code might also be a factor in a broker decision. The short term nature of these offers however, should mean they rank well down in the order of importance. Taking a worse spread in order to get a larger bonus makes no sense – but any trader who is likely to be successful will already know that.

Asset lists

A broader range of tradable assets does not always mean a better broker. However, if trading a specific asset is important – and that asset is not available elsewhere – then it might be a deal breaker. Again, the largest, more established brokers tend to have a bigger range of assets. If you want particular financial instruments or markets, check the broker offers them.

Our reviews cover all of the factors covered above. Generally the CFD brokers listed on our pages provide demo accounts. So traders can take their time, read the detailed review, and try out the platforms themselves before making a choice. Once you have all the information, you can then decide the best CFD broker for you.

Summary of broker comparison tips

- Consider your own trading methods. The trades, assets and frequency.

- Shortlist the cfd brokers that suit that trading pattern

- Consider demo accounts. Compare the trading platforms shortlisted.

- Identify the best choices for you.

- Open an account, deposit and trade

Remember: traders can use multiple CFD brokers, and use those with the best terms for specific trades or assets.

CFD trading vs spread betting

On the surface, cfd trading and spread betting appear the same. There are however, subtle differences that are worth knowing, so that you can use the best investment type.

Both forms of trading allow traders to go long or short, and use leverage. Both are forms of derivative, so the underlying asset is not owned – therefore no stamp duty is applicable. Here are the main difference though:

- Deal size. Cfds are normally based on the asset price, so a £10 per point contract on vodafone for example, will cost less to open than a £1o per point position on the FTSE. The deal size for a CFD will depend on the asset price. With a spread bet, the trader chooses the size of the bet, and the asset price is not relevant.

- Capital gains tax. Cfds are liable for capital gains tax (once over a certain size). Spread betting is not subject to CGT. However, this also means that cfds losses can be claimed back in any tax return. That is not the case with spread bets. This can make cfds more attractive when using them to hedge for example.

- Commission. Cfds on share can attract a commission, with spread bets, this cost is absorbed in the spread. This makes spread betting more attractive when buying smaller amounts of stock.

- Direct market access. Cfds often offer traders direct access to markets and order books for shares and forex. This is not the case with spread bets.

- Expiry. Cfds do not generally have an expiry. Spread bets on the other hand, will have a fixed expiry or ‘settled’ date at some point. This might be end of day, end of the week or months or years away – but there is a fixed point at which the bet ends.

Given these differences, it is worth considering which investment is the best tool, each and every time you open a position. What is “best”, will often depend on the aim of each trade and it’s size.

So, let's see, what we have: our best CFD trading platforms UK guide for 2021 looks the UK's best platforms for cfds like etfs & shares. See our brokers start trading. At cfd platform

Contents of the article

- No deposit forex bonuses

- Best CFD trading platforms in the UK 2021

- Best CFD trading platforms UK list

- Regulations and licenses

- Brokerage

- Markets and instruments

- Trading platforms + tools

- Overall

- Pepperstone – best for metatrader 4 + 5 CFD...

- Pepperstone’s MT4 is one of the best CFD trading...

- Trading cfds with market leading spreads

- Metatrader 5 by pepperstone

- Final words – pepperstone best CFD trading...

- Our rating

- Compare the best CFD trading platforms of 2020

- Choose from our selection of the best CFD trading...

- How do I choose from the best CFD trading...

- Opening a CFD trading account

- Trade with the UK's no. 1 CFD broker 1

- Reliable, simple, innovative. Trade the...

- What is a contract for difference?

- CFD meaning

- What is CFD trading?

- Introduction to CFD trading: how does CFD trading...

- What are the costs of CFD trading?

- Top 5 bitcoin CFD trading platforms, rated and...

- What is CFD trading?

- Top bitcoin CFD trading platforms for 2020

- What makes a good CFD trading platform?

- Best CFD brokers in the UK for 2021

- The top CFD brokers available in the UK

- What are cfds?

- Best CFD brokers UK of 2021

- How to find the best CFD brokers UK?

- FCA regulation

- Deposits, withdrawals, and payments

- Fees, commissions, and spreads

- Tradable markets

- Features and tools

- Getting started with a UK CFD broker today –...

- The verdict

- Is CFD trading legal in UK?

- Do I own the asset when I trade cfds?

- How can I get higher leverage limits when trading...

- Can I transfer a CFD position to another broker?

- Do UK CFD brokers accept paypal?

- About kane pepi PRO INVESTOR

- CFD trading in india

- Best CFD brokers in india

- What is A CFD?

- Is CFD trading in india legal?

- How to choose a CFD trading broker

- Best platforms

- Final word

- Is CFD trading legal in india?

- How do I trade cfds in india?

- How much money do I need to start CFD trading in...

- Is it free to make deposits and withdrawals CFD...

- Do I need to pay taxes on CFD trading in india?

- CFD brokers in the UK 2021

- Top UK CFD brokers list

- What is a CFD?

- How and why CFD trading can be useful

- Risks associated with cfds

- Is CFD trading for you?

- How to compare CFD brokers

- What are CFD brokers?

- How to compare CFD brokers

- Spread or commission

- Margin (or leverage)

- Trading platform

- Deposit and withdrawal options

- Features (charts, technical analysis, research)

- Support and education

- Other factors

- Summary of broker comparison tips

- CFD trading vs spread betting

Comments

Post a Comment