Exploring Scams Involved With Forex Trading, is forex trading real.

Is forex trading real

Some common examples of scams investors should look for include churning and brokers who simply underestimate risk.

No deposit forex bonuses

Churning involves brokers who execute unnecessary trades for the sole purpose of generating commissions. if you feel you are being scammed, contact the U.S. Commodity futures trading commission.

Exploring scams involved with forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/stock-market-convict-184977844-59d6c68d22fa3a0010adb629.jpg)

While foreign exchange (forex) investing is a legitimate endeavor and not a scam, plenty of scams have been associated with trading forex. As with many industries, plenty of predators exist out there, looking to take advantage of newcomers. Regulators have put protections in place over the years and the market has improved significantly, making such scams increasingly rare.

Foreign exchange trading involves the trading of pairs of currencies. for example, someone might exchange euros for U.S. Dollars. In september of 2019, 1 euro ranged in value from about $1.09 to about $1.12. So, a trader who exchanged 100 euros for $112 when the value of the dollar is high could profit by exchanging those $112 for euros when the value of the dollar drops back to $1.09 per euro. Such a transaction would result in a net profit of less than 3%, which likely would be wiped out by the broker's commission.

Forex is a legitimate endeavor. You can engage in forex trading as a real business and make real profits, but you must treat it as such. Don't look at forex trading as a get-rich-overnight business, no matter what you may read in hyped-up forex trading guides.

Exchange rates are volatile and can go up or down unpredictably. When accounting for commissions brokers take from transactions, making money requires significant changes in exchange rates in favor of the trader. High profits are possible, but it's not a market where anyone should expect quick and easy cash.

What makes a scam?

Forex trading first became available to retail traders in the late 1990s. the first handful of years was wrought with overnight brokers that seemed to pop up and then close down shop without notice.

The common denominator was that these brokers were based in nonregulated countries. While some did take place in the united states, the majority seemed to originate overseas where the only requirement to set up a brokerage was a few thousand dollars in fees.

A distinct difference exists between a poorly-run brokerage, which isn't necessarily a scam, and a fraudulent one. Even a poorly run brokerage can run for a long time before something takes it out of the game.

Some common examples of scams investors should look for include churning and brokers who simply underestimate risk. Churning involves brokers who execute unnecessary trades for the sole purpose of generating commissions.

Additionally, some brokers often overestimate the ability of investors to make a lot of money quickly and easily through the forex market. They typically prey on new investors who don't understand that forex trading is what is known as a zero-sum game. When a currency's value against another currency gets stronger, the other currency must get proportionally weaker.

How to avoid being scammed

The first step to take is to check the location of the brokerage's headquarters and research how long it has been in business and where they are regulated. The more the better.

If you feel you are being scammed, contact the U.S. Commodity futures trading commission.

The simple act of finding out who you should call if you feel that you've been scammed, before investing with a brokerage, can save you a lot of potential heartache down the road. If you can't find someone to call because the brokerage is located in a non-regulated jurisdiction, this is usually a red flag and a sign that it's best to find more regulated alternatives.

What is forex trading and is it right for me?

There are very few investors who have consistently made massive fortunes over a while. Jim simmons, a quiet recluse, has been successful with smaller frequent trades in his medallion fund. On the opposite end of the spectrum is the brash george soros, who publicly “broke the bank of england” and made billions in a single forex trade on black wednesday.

Soros had been building a substantial short position in pounds sterling for months leading up to september 1992. He knew the rate at which the united kingdom was brought into the european exchange rate mechanism (ERM) was too high, their inflation was triple the german rate, and british interest rates were hurting their asset prices.

The british government failed to keep the pound above the lower currency exchange limit mandated by the exchange rate mechanism (ERM). It was forced to withdraw the pound sterling from the ERM, devaluing the pound. The estimated cost to the U.K. Treasury was £3.4 billion. Soros' fund profited from the U.K. Government's reluctance to raise its interest rates to levels comparable to those of other ERM countries or float its currency.

Everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery.

What is forex trading?

Forex trading refers to the foreign exchange markets where investors and traders worldwide buy and sell one currency for another.

You might have even participated in forex trading without even realizing it. Anytime I visit a foreign country, I exchange my U.S. Dollars for the local currency based on the prevailing exchange rate. In its simplest form, that is forex trading.

Currencies rise and fall against each other depending on various economic and geopolitical news. If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and the country's political environment.

Because of forex's global nature, the markets trade for 24 hours a day, five days a week. Forex markets are the most liquid markets in the world.

Forex trading terminology

Forex markets have different terminologies and nuances for trading. Below is the list of most common terms.

Currency pairs

Traders frequently trade currencies by selling one currency and buying another. Forex trading always involves the exchange of currencies in pairs. You could have a EUR/USD pair for U.S. Dollars and euros. You can have similar pairs against the japanese yen or the australian dollar.

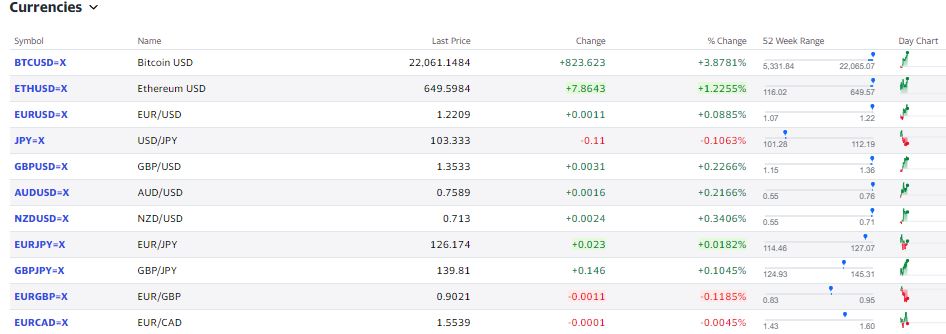

The major currency pairs are the four most heavily traded currency pairs in the forex market. Because of the massive liquidity, you can always trade them with the lowest spread. The four major pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF. Note that the U.S. Dollar is involved in every major pair because it is the world reserve currency.

The minor currency pairs don't include the U.S. Dollar and are also known as cross-currency pairs. For example, EUR/AUD and CHF/JPY.

The first currency in the pair is the base currency, and the second currency is the quote currency.

If you are bullish on the european union, you want to buy EUR and sell JPY. In this case, you would buy the EUR/JPY pair.

If you are bearish on the japanese yen, you want to buy USD and sell JPY. In this case, you would sell the JPY/USD pair.

The forex quote determines the price at which you do the buying and selling.

Forex quotes

The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every euro you sell, you could buy 1.2209 USD. The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

You might have noticed the forex quote has four places to the right of the decimal. The smallest price change that a given exchange rate can make is the pip. Most currency pairs, except japanese yen pairs, are quoted to four decimal places. After the decimal point (at one 100th of a cent), this fourth spot is what traders watch to count “pips.”

For example, if the EUR/USD moves from 1.2202 to 1.2205, we say the EUR/USD has increased by three pips.

Forex lot

Forex is traded in lot sizes. Standard lot = 100,000 units mini lot = 10,000 units micro lot = 1,000 units

A larger lot size involves more risk due to the amount of money involved. If you are starting, always trade in micro-lots.

Leverage

Forex traders often use leverage to juice up the returns. Since currencies trade in a small range, they want to amplify their gains. The challenge of leverage is that it cuts both ways. If you are right, then using a 50:1 leverage will increase your profits by 50 times. However, if you are wrong, then you lose 50 times more. For this reason, it is advisable to avoid using leverage when trading forex.

Can you get rich by trading forex?

Forex investors make money by deciding what currencies will rise and fall. Some traders swear by technical analysis and others will rely on fundamental analysis. Traders believe they know what direction the currency would move based on the latest news. The challenge with making money trading is that the same information is also available to everyone else, including professional investors.

An individual investor who is not involved with trading the forex market for a living would find it very hard to make money. You could get lucky once or twice. But eventually, your steak runs out.

The individual investor has no advantage over professionals who do this for a living. My four worst investments article highlights how easy it is to lose money when trading against professional investors.

Professional traders have powerful trading tools to take advantage of their online forex trading strategy. The trading platforms provide signals for automated trading and scalping. Forex scalping methods place trades for 1 to 10 minutes and close positions after gaining five pips. An algorithmic trading system combined with leverage enables the professional traders to day trade forex pairs better than individual investors.

If you want to grow rich and retire early, the best plan is to accumulate income-producing assets. Most stocks pay a dividend, or they increase in value like moonshot stocks. The rental property provides income in the form of rent and appreciating property prices.

Forex trading only makes money if you are right in the timing and direction of currency prices change. You cannot have a “buy it and watch it grow” approach with forex. If you wonder, “when can I retire” it is quite likely that forex trading won't help you.

Who does forex trading

Professional investors trade forex to make money. Trading is done in the spot market, where exchange rates are determined in real-time depending on the current economic and geopolitical factors.

Global companies actively trade forex as well in the futures market. They create a contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. The primary purpose is not speculation but as a hedge.

For example, infosys (NYSE: INFY) is a consulting company headquartered in india, but they have clients worldwide. They report results on the indian stock exchange. Since the indian rupee trades in a wide range against the U.S. Dollar, infosys would use the forex markets to hedge against currency risk.

Similarly, ARAMCO (SAUDI-ARAMCO) is one of the leading players in the petroleum and natural gas industry. It needs to hedge its commodity exports against price changes in U.S. Dollars.

Final thoughts on forex trading

Forex is part of our everyday life as a result of living in an interconnected global economy. Currencies usually trade in a tight band. If a currency suddenly depreciates, it could be an indicator of upcoming inflation or potential geo-instability.

It is tough to get rich with forex trading for individuals. You might lose all your investment. To be profitable, one needs a deep understanding of the macroeconomic fundamentals driving currency values coupled with technical analysis experience. And it would help if you traded on it before anyone else does. Proceed with caution if you decide to incorporate forex trading as part of your investment strategy.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

What is FOREX trading?

FOREX trading, or trading in foreign currencies, is big business. For the average investor, though, FOREX trading is not necessarily needed as a step to reaching financial goals like saving for retirement. But if you’re curious about trading foreign currency and wondering if it’s right for you, you’re in the right place. We’ll talk about how FOREX trading works – and the risks it poses.

FOREX trading: the basics

The currency market is the largest market in the world. It’s a way to buy one currency and sell another at the same time, by trading in currency pairs. For example, an investor could buy EUR/USD, a euro-dollar pair. FOREX trading is basically betting on the small changes in the value of a foreign currency relative to the dollar or another currency. A FOREX trade by its nature creates one loser and one winner (this is known as a zero-sum game). Someone bets that the value of a given currency will increase (this called being “long”) and someone else bets that it will decrease (this called “shorting” the currency). Only one party can be right.

Wondering how to trade FOREX? In the old days, retail investors had no way of accessing foreign exchange markets to make trades. It was an exclusive realm, where banks ruled. The internet has enabled average investors to get in on the action, for better for worse. If you want to dabble in FOREX trading, you can hop online and do so. But you’ll be going up against professionals who have sophisticated computer models at their disposal, so it’s important to be aware of that.

Say you opt for a EUR/USD trade, and the exchange rate for buying euros and selling dollars is 1.5. That means 1.5 dollars buys you one euro. So, let’s say you buy 10,000 euros for $15,000. Then, if the exchange rate for selling euros and buying dollars is 1.6, you can make the opposite transaction, selling your 10,000 euros and making $16,000. This is known as closing your position. And you, my hypothetical friend, just made $1,000. But if the exchange rate had moved the other way, you would have lost money.

FOREX trading: the risks

Real talk: FOREX trading is generally not seen as a reliable way to grow your money over time and pursue major financial goals like saving for a house, paying for college or securing retirement income. It’s a high-risk approach to investing that can leave you with big losses. Plus, FOREX trading involves leverage. That means you pay less to trade more, but accept that you’ll either win big or lose big.

If you make leveraged investments (also known as trading on margin) you stand to lose not just your initial investment, but potentially much more, depending on the agreement you have with your broker. Be aware that you stand to lose big-time if you, say, bet that the pound will increase in value and its value falls. Plus, there are fees and commission payments to factor in when you calculate how much FOREX trading is going to cost you.

In addition to the built-in risk of foreign exchange trading, there’s also the risk of fraud. It’s a good idea to be suspicious of any emails, tips or websites that promise astronomical returns. Check broker credentials against the records of the securities and exchange commission (SEC) and the commodity futures trading commision (CFTC). FOREX trading is a magnet for fraudsters, so it’s important to approach with caution.

Bottom line

If you’re going to dip a toe into FOREX trading, you’ll need to have a high risk tolerance – not to mention money you can afford to lose. Remember, you don’t have to get involved with FOREX trading. You’ll likely be just fine if you want to leave the FOREX trading to the professionals and stick with something like a low-cost index fund.

Is your forex broker a scam?

If you do an internet search on forex broker scams, the number of results is staggering. While the forex market is slowly becoming more regulated, there are many unscrupulous brokers who should not be in business.

When you're looking to trade forex, it's important to identify brokers who are reliable and viable, and to avoid the ones that are not. In order to sort out the strong brokers from the weak and the reputable ones from those with shady dealings, we must go through a series of steps before depositing a large amount of capital with a broker.

Trading is hard enough in itself, but when a broker implements practices that work against the trader, making a profit can be nearly impossible.

Key takeaways

- If your broker does not respond to you, it may be a red flag that he or she is not looking out for your best interests.

- To make sure you're not being duped by a shady broker, do your research, make sure there are no complaints, and read through all the fine print on documents.

- Try opening a mini account with a small balance first, and make trades for a month before attempting a withdrawal.

- If you see buy and sell trades for securities that don't fit your objectives, your broker may be churning.

- If you are stuck with a bad broker, review all your documents and discuss your course of action before taking more drastic measures.

Separating forex fact from fiction

When researching a potential forex broker, traders must learn to separate fact from fiction. For instance, faced with all sorts of forums posts, articles, and disgruntled comments about a broker, we could assume that all traders fail and never make a profit. The traders that fail to make profits then post content online that blames the broker (or some other outside influence) for their own failed strategies.

One common complaint from traders is that a broker was intentionally trying to cause a loss in the form of statements such as, "as soon as I placed the trade, the direction of the market reversed" or "the broker stop hunted my positions," and "I always had slippage on my orders, and never in my favor." these types of experiences are common among traders and it is quite possible that the broker is not at fault.

Rookie traders

It is also entirely possible that new forex traders fail to trade with a tested strategy or trading plan. Instead, they make trades based on psychology (e.G., if a trader feels the market has to move in one direction or the other) and there is essentially a 50% chance they will be correct.

When the rookie trader enters a position, they are often entering when their emotions are waning. Experienced traders are aware of these junior tendencies and step in, taking the trade the other way. This befuddles new traders and leaves them feeling that the market—or their brokers—are out to get them and take their individual profits. Most of the time, this is not the case. It is simply a failure by the trader to understand market dynamics.

Broker failures

On occasion, losses are the broker's fault. This can occur when a broker attempts to rack up trading commissions at the client's expense. There have been reports of brokers arbitrarily moving quoted rates to trigger stop orders when other brokers' rates have not moved to that price.

Luckily for traders, this type of situation is an outlier and not likely to occur. One must remember that trading is usually not a zero-sum game, and brokers primarily make commissions with increased trading volumes. Overall, it is in the best interest of brokers to have long-term clients who trade regularly and thus, sustain capital or make a profit.

Behavioral trading

The slippage issue can often be attributed to behavioral economics. It is common practice for inexperienced traders to panic. They fear missing a move, so they hit their buy key, or they fear losing more and they hit the sell key.

In volatile exchange rate environments, the broker cannot ensure an order will be executed at the desired price. This results in sharp movements and slippage. The same is true for stop or limit orders. Some brokers guarantee stop and limit order fills, while others do not.

Even in more transparent markets, slippage happens, markets move, and we don't always get the price we want.

Communication is key

Real problems can begin to develop when communication between a trader and a broker begins to break down. If a trader does not receive responses from their broker or the broker provides vague answers to a trader's questions, these are common red flags that a broker may not be looking out for the client's best interest.

Issues of this nature should be resolved and explained to the trader, and the broker should also be helpful and display good customer relations. One of the most detrimental issues that may arise between a broker and a trader is the trader's inability to withdraw money from an account.

Broker research protects you

Protecting yourself from unscrupulous brokers in the first place is ideal. The following steps should help:

- Do an online search for reviews of the broker. A generic internet search can provide insights into whether negative comments could just be a disgruntled trader or something more serious. A good supplement to this type of search is brokercheck from the financial industry regulatory authority (FINRA), which indicates whether there are outstanding legal actions against the broker. And if appropriate, gain a clearer understanding of the U.S. Regulations for forex brokers.

- Make sure there are no complaints about not being able to withdraw funds. If there are, contact the user if possible and ask them about their experience.

- Read through all the fine print of the documents when opening an account. Incentives to open an account can often be used against the trader when attempting to withdraw funds. For instance, if a trader deposits $10,000 and gets a $2,000 bonus, and then the trader loses money and attempts to withdraw some remaining funds, the broker may say they cannot withdraw the bonus funds. Reading the fine print will help make sure you understand all contingencies in these types of instances.

- If you are satisfied with your research on a particular broker, open a mini account or an account with a small amount of capital. Trade it for a month or more, and then attempt to make a withdrawal. If everything has gone well, it should be relatively safe to deposit more funds. If you have problems, attempt to discuss them with the broker. If that fails, move on and post a detailed account of your experience online so others can learn from your experience.

It should be pointed out that a broker's size cannot be used to determine the level of risk involved. While larger brokers grow by providing a certain standard of service, the 2008-2009 financial crisis taught us that a big or popular firm isn't always safe.

The temptation to churn

Brokers or planners who are paid commissions for buying and selling securities can sometimes succumb to the temptation to effect transactions simply for the purpose of generating a commission. Those who do this excessively can be found guilty of churning—a term coined by the securities and exchange commission (SEC) that denotes when a broker places trades for a purpose other than to benefit the client. those who are found guilty of this can face fines, reprimands, suspension, dismissal, disbarment, or even criminal sanctions in some cases.

SEC defines churning

The SEC defines churning in the following manner:

The key to remember here is that the trades that are placed are not increasing your account value. If you have given your broker trading authority over your account, then the possibility of churning can only exist if they are trading your account heavily, and your balance either remains the same or decreases in value over time.

Of course, it is possible that your broker may be genuinely attempting to grow your assets, but you need to find out exactly what they are doing and why. If you are calling the shots and the broker is following your instructions, then that cannot be classified as churning.

Evaluate your trades

One of the clearest signs of churning can be when you see buy and sell trades for securities that don’t fit your investment objectives. For example, if your objective is to generate a current stable income, then you should not be seeing buy and sell trades on your statements for small-cap equity or technology stocks or funds.

Churning with derivatives such as put and call options can be even harder to spot, as these instruments can be used to accomplish a variety of objectives. But buying and selling puts and calls should, in most cases, only be happening if you have a high-risk tolerance. Selling calls and puts can generate current income as long as it is done prudently.

How regulators evaluate churning

An arbitration panel will consider several factors when they conduct hearings to determine whether a broker has been churning an account. They will examine the trades that were placed in light of the client’s level of education, experience, and sophistication as well as the nature of the client’s relationship with the broker. They will also weigh the number of solicited versus unsolicited trades and the dollar amount of commissions that have been generated as compared to the client’s gains or losses as a result of these trades.

There are times when it may seem like your broker may be churning your account, but this may not necessarily be the case. If you have questions about this and feel uneasy about what your advisor is doing with your money, then don’t hesitate to consult a securities attorney or file a complaint on the SEC's website.

Already stuck with a bad broker?

Unfortunately, options are very limited at this stage. However, there are a few things you can do. First, read through all documents to make sure your broker is actually in the wrong. If you have missed something or failed to read the documents you signed, you may have to assume the blame.

Next, discuss the course of action you will take if the broker does not adequately answer your questions or provide a withdrawal. Steps may include posting comments online or reporting the broker to FINRA or the appropriate regulatory body in your country.

The bottom line

While traders may blame brokers for their losses, there are times when brokers really are at fault. A trader needs to be thorough and conduct research on a broker before opening an account and if the research turns up positive for the broker, then a small deposit should be made, followed by a few trades and then a withdrawal. If this goes well, then a larger deposit can be made.

However, if you are already in a problematic situation, you should verify that the broker is conducting illegal activity (such as churning), attempt to have your questions answered, and if all else fails, and/or report the person to the SEC, FINRA, or another regulatory body that could enforce action against them.

Forex live trading

Live forex trading is usually short-term trading, based on real-time charts and quick execution. Forex live trading accounts make use of special trading platforms, which support this type of trading activity. Live trading webinars or forums also represent a great learning tool. Most live currency trading decisions stem from technical analysis. Read on to find out more…

Traders can use real-time charts and technical analysis to place long-term trades as well. In this case, however, tracking by-the-second changes in price offers no advantage.

We are taking a closer look at real-time forex trading and its peculiarities. We cover different aspects of the practice, such as:

- Live forex trading brokers and accounts.

- Live trading services.

- Live prices, quotes, and charts.

- Trading videos.

Live forex brokers in the united kingdom

Trading forex ‘live’

Live forex brokers are service providers that act as intermediaries between retail traders and the forex markets.

They make it possible for traders to access the markets. A live forex broker features real-time charts and extremely fast electronic execution. This way, it lets traders react to price movements in real-time.

Most forex brokers generate revenue through the bid/ask spread. They may also charge commissions. Some brokers have adopted unique, creative ways to “turn a buck” off their services.

Accounts

To access the services of a forex broker, you need to create a forex account. Brokers offer several types of trading accounts .

Of these, the demo account is the quickest and simplest to open. You may only need to provide an email address to get such an account going.

Real money accounts, on the other hand, require a lot of paperwork. Some brokers will want to know your financial situation, your revenue sources and other such sensitive bits of personal information.

You have to make sure that you open the right kind of forex trading account with the right broker.

Real-time forex trading is electronic. Given the need for real-time price information and near-instant execution, it cannot be of any other kind.

In addition to being an online operation, your real-time forex broker cannot be a market maker. Some brokerages engage in market making. There is not much point in trying to trade live with such a broker.

Live traders need real-time charts. What you need to know in this respect is that different brokers have different liquidity providers.

Depending on these liquidity providers, there may be slight differences in the real-time prices the brokers use.

Platforms

Forex trading platforms, such as metaquotes’ popular MT4, let traders place trades. Most such platforms offer live charts.

Some of these platforms even allow traders to open positions directly from the chart. In regards to the platform, you have to understand that it is a mere interface.

It does not define the offer of your broker. It does, however, define how you can interact with the markets.

What can you expect from your live forex platform?

All forex trading platforms feature charting these days. You need live charting.

Make sure your broker does indeed feature live prices. Understand that the pricing of your broker depends on its liquidity providers to some degree.

They also offer a selection of technical indicators and trading tools.

Most platforms also provide live news-streams. Through this feature, you can handle the fundamental part of your analysis.

Forex trading platforms support several order types. As a live trader, you need to understand how limit orders and stop orders work, among others.

A proper trading platform comes with a reporting function. You will need to use this for tax purposes. Some platforms report transactions erratically, while others produce high-quality reports.

Demo accounts

Demo accounts let you trade for virtual money.

Not all brokers support such accounts, but the majority of them do.

Most forex trading platforms are free to download and use. There are some exceptions in this regard.

As an online forex trader, however, you will probably only deal with free platforms.

As a live trader, you have to resort to a demo account first. You need to acquaint yourself with the ins and outs of the platform.

You should place around 50 demo trades before you move on to real money trading. Experienced traders should go through these demo paces as well.

Only skilled traders should trade in real-time. How do you know whether you possess the minimum required skills? Ask yourself these questions:

- Do you know what a limit order, a stop order and a market order are?

- Can you set a limit and a stop when you enter a trade?

- What is the typical spread of your broker?

- Is the spread on your traded asset fixed or variable?

- What lot sizes can you trade?

- If your connection goes down, can you give the dealing desk a direct call?

Live forex trading apps

Most forex trading apps running on android and ios mobile devices are “mini” versions of the full trading platforms.

As such, they offer the same degree of functionality and the same features, reformatted for smaller screens.

You can download such live forex trading apps from google play or the app store. Forex trading apps are usually free to download and use.

Make sure you understand exactly what your forex trading app offers you. Take it on a demo spin, as most mobile trading platforms support demo accounts.

Ask yourself and answer all the mentioned questions before you begin real money trading through a live forex trading app.

Forex live trading room reviews

Live forex trading rooms are chat rooms through which professional traders interact with and educate an audience. Such chat rooms run from the most sophisticated, dedicated platforms, to simple skype chat groups.

Sophisticated live trading rooms allow their professional users to monetize their seminars and trading sessions.

Educators can share charts, embed various widgets, stream live video, perform analysis and complete trades in a live setting.

Some traders have found much value in such live trading setups. It is fair to say, however, that some of these trading rooms are little more than scams or half-hearted efforts.

Before joining such a trading room, read some reviews on it. Users are usually not shy to share their experiences, whether profitable or not.

What else should you consider?

- The focus of the trading room. There are chat rooms focused on swing trading, on scalping, on forex only, on commodities, etc.

The reputation of the live trading room. As mentioned, users are generally keen to share their experiences. - The monetization model. With some trading rooms, you only have to pay for sessions that turn a profit. That sounds like an advantageous monetization model.

- The platform used for communication. Trading-dedicated communication platforms are superior to ad-hoc solutions.

Live trading services

In addition to making good use of a demo account, a beginner live trader may also find it useful to employ the services of an expert.

Inthemoneystocks

Inthemoneystocks claims to have outperformed top hedge funds since 2007. The trading room peddles the services of several professional traders. Gareth soloway and nick santiago are their headliners.

The specialties of the mentioned traders include swing trading on stocks and options trading.The website of the trading room provides education as well as verified trading alerts.

Prices start from $299.99 per month.

Investors underground

Investors underground is a trading room that offers free video lessons, as well as full, step-by-step guidance.

Nathan michaud is the founder and star day-trader of the operation. He is something of a celebrity in trading circles.

Michaud is, however, only one of some 10 trading experts who peddle their services through investors underground.

The trading room is keen on not making outlandish claims. The community feedback concerning the quality of services offered by investors underground is outstanding, however.

Monthly subscriptions start from $297.

A basic package includes access to the live trading floor, study groups and pre-market broadcasts.

Forex.Com live trading webinars

Forex.Com’s live trading webinars offer market commentary, mixed with real-time insights.

Experts also answer live questions and offer actionable live trading ideas. Forex.Com users can sign up for the webinars through a special form at the broker’s official site.

Those who register can select up to three sessions.

Live trading signals

Forex trading signals are trade triggers. They tell the recipient whether to buy or sell a certain currency pair. The signal may contain additional information about the timing, stop loss, take profit, etc.

Trading signals may originate from expert traders or various technical indicators.

Live prices

For live forex traders, access to live prices and quotes is of the essence. The current price of a currency is its most recent selling price at an exchange.

Trading videos

The benefits of using trading videos to improve your profitability are obvious. Most educators deliver their lessons through videos.

Trading rooms use videos to disseminate knowledge as well.An interesting take on using videos for trading is to record yourself.

This way, you can analyze your emotional reactions later. It is important to record the screen as well as yourself when shooting such videos.

Real-time forex trading

What is real-time forex trading?

Real-time forex trading is a type of financial speculation in which the speculator bets on the movement in the exchange rates of foreign currency pairs. Traders who engage in real-time forex trading often use technical analysis techniques to inform their decisions. Because most real-time forex traders make their traders over short timeframes of less than one day, real-time forex trading can be seen as a type of day trading.

Key takeaways

- Real-time forex trading is the practice of buying and selling currency pairs over very short timeframes.

- This type of trading relies on sophisticated computer systems and brokerage platforms.

- Real-time forex traders must be careful to ensure that their potential profits are not wiped out by the commissions, bid/ask spreads, and other fees charged by their broker.

How real-time forex trading works

As their name suggests, real-time forex traders are traders who buy and sell currency pairs on the foreign exchange market. The term “real-time” refers to the fact that this trading is done over very short time periods, sometimes buying and selling in less than a few seconds. To do this, real-time forex traders use sophisticated computer programs and brokerage platforms to access real-time market information and execute transactions at nearly instantaneous speeds.

Those wishing to experiment with real-time forex trading should be aware that significant losses may be possible. Even with timely access to price quotes and trade executions, it is still possible for traders to face larger than expected losses when markets react suddenly to new events. This is especially true when trading currency pairs that have relatively low liquidity. In such situations, prices can quickly “gap” above or below their usual trading ranges.

When placing trades, real-time forex traders rely on brokers who offer forex trading accounts. Different types of accounts are available, depending on the size of trades engaged in by the trader. Although most forex accounts offer trades in lot sizes of 100,000 currency units, so-called “mini accounts” allow 10,000-unit trades, while “micro accounts” offer 1,000-unit trades. Brokers also differ in terms of commission and fee structures, as well as the types of data and charts made available through their platforms.

Real world example of real-time forex trading

To illustrate, consider the following chart, which depicts one minute of trading for the U.S. Dollar (USD) and canadian dollar (CAD) currency pair. Each minute, the chart plots a new “candlestick”, depicting the high, low, open, and closing prices for the currency pair.

:max_bytes(150000):strip_icc()/usdcadforexreal-timetradingchart-2aa6dba2c2c34cbcb08c897b2a4af234.jpg)

From looking at this chart, we can see that the USD/CAD currency pair was more volatile in the early part of the day, gradually trading between the upper and lower bounds traced by the purple rectangles near the end of the day. A real-time forex trader using a similar chart may have tried to buy near the lower bound of this range and sell minutes later once the price reached the upper bound. Other traders may use different strategies, such as trying to anticipate and profit from the more volatile swing in prices seen earlier in the day.

Regardless of their strategy, all real-time forex traders must be careful to ensure that their trades are worth making after taking into consideration the commissions, bid/ask spreads, and other costs associated with executing these trades.

Forex secret millionaire - is forex trading for real ?

See, that’s what the app is perfect for.

Forex secret millionaire - is forex trading for real ?

Hi i am forextradingsystemhere-blog rate my blog http://forextradingsystemhere-blog.Bjpw.Ru/

ᴡᴡᴡ.18sеху.Рw - ЕМОТIОNАL НОТ УОUNG GIRLS LОVЕ SЕХ SЕА VАСАТIОN УОU RАZУSСНЕSН НЕRЕ.

(I) FRIDAY TRADING SYSTEM MT4

THIS IS ONE OF THE MOST SIMPLEST TRADES OR TRADING SYSTEMS. THE WEALTH OF KNOWLEDGE THAT IS LITERALLY COMPACTED INTO THE SIMPLISTIC CONCEPTS SURROUNDED AROUND GENUINE CON-FLUENCY. WHY WOULD I EVER GIVE THIS SECRET INFORMATION OUT? BECAUSE I SEEM TO BE ABLE TO FIND IT!

THIS TRADE SET-UP IS SELF EXPLANATORY AND ALL YOU HAVE TO DO IS BE IN THE RIGHT TRADING MODE TO WIN UNTIL THE END OF THE DAY EXPIRY ON FRIDAY. THIS ONLY MEANS THAT YOU HAVE YOUR PLATFORM OPEN TO YOUR BROKER AND REALIZE THAT THE TRADE WILL BE ON FRIDAY’S DAILY CANDLE. IT IS REALLY THAT SIMPLE FOR ONCE.

THE GREAT THING ABOUT THIS SYSTEM IS THAT THE FEATURES ARE GEARED TO ACCOMMODATE A BEGINNER TRADER BUT ARE ADVANCE. THIS CATCHES THE EYE OF ALL TRADERS AND WHEN THEY FIND OUT HOW I DID IT THEY WILL GO NUTS THAT THEY DIDN’T COME UP WITH THE IDEA THEM-SELVES.

COMES WITH 6 INDICATORS BUT YOU HAVE THE OPTION TO NOT EVEN USE THREE OF THEM! THEY ARE USED TOGETHER IN A WAY THAT YOU AS A TRADER WILL BE ABLE TO SAY, BECAUSE OF THE EXPECTATION THEY CREATE.

THE GUIDE RULES AND TRADE PARAMETERS ARE ALL USING INDICATOR SETTINGS THAT ARE INTERWOVEN INTO A SYSTEM THAT IS SEARCHING FOR AUTHENTICITY.

THIS SYSTEM IS MECHANICAL THAT IS ONLY CONSIDERING ADDING VALUE TO YOUR TRADING DECISION. I REPEAT THE TREND-LINE IS AUTOMATIC SO NO OUT OF THE WAY ANALYTICS ARE NEEDED!

THIS SYSTEM IS USING DIVERGENCE INCENTIVE TO TRADE. THAT IS THE SIGNAL TO TRADE. DIVERGENCE HAS BEEN TOTALLY ISOLATED!

HAS COMPLETE ALERT BUY/SELL SYSTEM ORIENTED.

SIMPLE TRADE EXAMPLES AND CONCEPTS TO UNDERSTAND.

THIS SYSTEM HAS A GUARANTEED #1 CONDITION TRADE OF THE HIGHEST STATUS AND QUALITY. ALL OTHER TRADES ARE OF VERY HIGH QUALITY.

*THIS TRADING SYSTEM GIVES YOU THE UP MOST RESPECT AND DRIVES YOUR TRADING PORTFOLIO THROUGH THE ROOF. I’M GLAD TO GIVE THE WEALTH AND KNOWLEDGE TO ALL TAKE CARE*

*TERMS OF SERVICE*

30 DAY GUARANTEE !

*SHIPPING*

THE TRADING SYSTEM WILL BE DELIVERED TO YOUR PAYPAL E-MAIL TO DOWNLOAD AFTER PURCHASE. I’LL DO MY BEST TO GET THAT E-MAIL TO YOUR INBOX IN 24 HRS.

IF BY CHANCE YOU DON’T HAVE PAYPAL SEND ME A BUYERS NOTE WITH YOUR E-MAIL FOR RECEIVING THE TRADING SYSTEM DURING YOUR PURCHASE.

The best platform to trade-forex trading

The foreign exchange market – also known as forex or the FX market – is the world’s most traded market, with turnover of $5.1 trillion per day.* to put this into perspective, the U.S. Stock market trades around $257 billion a day; quite a large sum, but only a fraction of what forex trades. Forex is traded 24 hours a day, 5 days a week across by banks, institutions and individual traders worldwide. Unlike other financial markets, there is no centralized marketplace for forex, currencies trade over the counter in whatever market is open at that time

The term trading is very familiar to humans since the time of civilization. Barter system was its first form practiced in ancient times which involves exchange of goods. It involves the transfer of goods and services between persons or entity, often in exchange of money. An arrangement which allows the process of trading is known as market. With time the definition of trading have also evolved. Now it is not limited to exchange of goods and services rather now a days trade involves negotiation in money(and credit, commodity and non-physical money).

Moreover with the advancement of technology trading have become more convenient, now with digitization one can trade effectively from their home and earn profit. For trading one of the best platform now a days is forex. Forex stands for "foreign exchange" and is where trade happens with currency. It is a decentralized global market where all the world currencies trade. Forex trading has evolved to a great extent. In current scenario, forex is ruling global market and has became the best platform for investing. It is the world's most traded market. It has earned a reputation of money making machine, people invest in forex and with right strategies and proper timing earn tremendous profit for themselves and their families.

HOW TO TRADE IN forex?

In forex trading the very initiative is to open up an account. Now once you have your own account you'll trade forex in two ways, the primary one is that the simple buying and selling of currency pairs and therefore the other is thru the purchasing of derivative where you await the worth of the currency pair to extend . As technology has evolved such a lot , trading in forex is not any longer a cumbersome process. Now even a beginner can trade forex successfully as there are many research firms available which provides best strategies and timing for successful trading.

With internet and advance gadgets one can always get on trading platform and may trade 24 hours, 5 days every week . Perk of trading in forex is that one needn't to try to to an enormous investment for it and may start with an inexpensive amount instead.

TRADING WITH forex SIGNALS-

Forex trading gets more simpler with the assistance of forex signals. These signals are primarily the ideas that indicate the present market trends in real time. One can use these signals to understand when to sell and buy, as these signals are prepared after core fundamental and technical research. There are thousands of advisory firms and individuals who performs pure research over forex market and supply live and real time tips to trade successfully. There are many forex signals approaches available within the market, one can choose between them and perform forex trading. All you've got to try to to is to seek out the signal service provider that you simply believe can provide strong and accurate signal. They're going to then provide you with a warning when investing in forex is favorable. You'll get the forex signals over your mobiles and systems anytime, also there are many applications available which are totally dedicated for forex trading. These application provides you with live signals and tips for effective trading.

HOW TO AVOID RISK IN forex TRADING:

Like many other trading approaches forex trading also includes risk as market is extremely volatile but with the assistance of proper strategies and accurate forex signals risk are often minimized to an excellent extent and profit are often earned. Hence it's advised to require proper guidance from advisory firms in order that you'll trade profitably and learn effectively.

Best forex brokers

CMC markets: best overall forex broker and best for range of offerings

London capital group (LCG): best forex broker for beginners

Saxo capital markets: best forex broker for advanced traders

XTB online trading: best forex broker for low costs

IG: best forex broker for U.S. Traders

Pepperstone: best forex broker for trading experience

so, let's see, what we have: many have heard of the scams that took place in the early days of the forex market. Things have improved, but it still pays to be aware of new scams. At is forex trading real

Contents of the article

- No deposit forex bonuses

- Exploring scams involved with forex trading

- What makes a scam?

- How to avoid being scammed

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- What is FOREX trading?

- FOREX trading: the basics

- FOREX trading: the risks

- Bottom line

- Is your forex broker a scam?

- Separating forex fact from fiction

- Communication is key

- Broker research protects you

- The temptation to churn

- SEC defines churning

- Evaluate your trades

- How regulators evaluate churning

- Already stuck with a bad broker?

- The bottom line

- Forex live trading

- Live forex brokers in the united kingdom

- Trading forex ‘live’

- Live forex trading apps

- Forex live trading room reviews

- Live trading services

- Live trading signals

- Live prices

- Trading videos

- Real-time forex trading

- What is real-time forex trading?

- How real-time forex trading works

- Real world example of real-time forex trading

- Forex secret millionaire - is forex trading for...

- See, that’s what the app is perfect for.

- Forex secret millionaire - is forex trading for...

- The best platform to trade-forex trading

- HOW TO TRADE IN forex?

- Best forex brokers

Comments

Post a Comment