Trade Top Crypto Currencies with a Leverage, octa trade options.

Octa trade options

Octa fx option is a privately-owned investment management company that was established in 2013 by digital currency group, octa fx option is a trusted authority on digital currency investing as a mutual fund company.

No deposit forex bonuses

Octa fx option offers a range of services including fund distribution and investment advice, wealth management, life insurance. We are duly registered and licensed

download certificate now

Trade top crypto currencies with a leverage

Bitcoin, ethereum, bitcoin cash and other crypto assets at your disposal

What is octa fx option?

Octa fx option is a privately-owned investment management company that was established in 2013 by digital currency group, octa fx option is a trusted authority on digital currency investing as a mutual fund company. Octa fx option offers a range of services including fund distribution and investment advice, wealth management, life insurance.

We are duly registered and licensed

download certificate now

Access and insight for a changing world digital currencies are poised to radically transform our financial system, but it wonвђ™t happen overnight. At octa fx options, we believe investors deserve an established, trusted, and accountable partner that can help them navigate the gray areas of digital currency investing. Thatвђ™s why we are building transparent, familiar investment products that facilitate access to this burgeoning asset class, and provide the springboard to invest in the new digital currency-powered вђњinternet of money.Вђќ

WHAT IS FOREX

The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another. Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

WHAT IS CRYPTOCURRENCY

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange wherein individual coin ownership records are stored in a digital ledger or computerized database using strong cryptography to secure transaction record entries, to control the creation of additional digital coin records, and to verify the transfer of coin ownership.

Octafx a trading style of octa markets incorporated

We believe this firm has been providing financial services or products in the UK without our authorisation. Find out why to be especially wary of dealing with this unauthorised firm and how to protect yourself from scammers.

Almost all firms and individuals offering, promoting or selling financial services or products in the UK have to be authorised by us.

However, some firms act without our authorisation and some knowingly run investment scams.

This firm is not authorised by us and is targeting people in the UK. Based upon information we hold, we believe it is carrying on regulated activities which require authorisation.

Octafx a trading style of octa markets incorporated

Address: suite 305, griffith corporate centre, beachmont, kingstown, st. Vincent and the grenadines

Website: www.Octafx.Com

Instagram: @octafx_official

Twitter: @octafx

Facebook: www.Facebook.Com/octafx

Youtube: www.Youtube.Com/user/octafx

Be aware that scammers may give out other false details or change their contact details over time to new email addresses, telephone numbers or physical addresses.

How to protect yourself

We strongly advise you to only deal with financial firms that are authorised by us, and check the financial services register to ensure they are. It has information on firms and individuals that are, or have been, regulated by us.

If a firm does not appear on the register but claims it does, contact our consumer helpline on 0800 111 6768.

There are more steps you should take to avoid scams and unauthorised firms.

If you use an unauthorised firm, you won’t have access to the financial ombudsman service or financial services compensation scheme (FSCS) so you’re unlikely to get your money back if things go wrong.

If you use an authorised firm, access to the financial ombudsman service and FSCS protection will depend on the investment you are making and the service the firm is providing. If you would like further information about protection, the authorised firm should be able to help.

Report an unauthorised firm

If you think you have been approached by an unauthorised firm or contacted about a scam, you should contact our consumer helpline on 0800 111 6768. If you were offered, bought or sold shares, you can use our reporting form.

Octafx a trading style of octa markets incorporated

We believe this firm has been providing financial services or products in the UK without our authorisation. Find out why to be especially wary of dealing with this unauthorised firm and how to protect yourself from scammers.

Almost all firms and individuals offering, promoting or selling financial services or products in the UK have to be authorised by us.

However, some firms act without our authorisation and some knowingly run investment scams.

This firm is not authorised by us and is targeting people in the UK. Based upon information we hold, we believe it is carrying on regulated activities which require authorisation.

Octafx a trading style of octa markets incorporated

Address: suite 305, griffith corporate centre, beachmont, kingstown, st. Vincent and the grenadines

Website: www.Octafx.Com

Instagram: @octafx_official

Twitter: @octafx

Facebook: www.Facebook.Com/octafx

Youtube: www.Youtube.Com/user/octafx

Be aware that scammers may give out other false details or change their contact details over time to new email addresses, telephone numbers or physical addresses.

How to protect yourself

We strongly advise you to only deal with financial firms that are authorised by us, and check the financial services register to ensure they are. It has information on firms and individuals that are, or have been, regulated by us.

If a firm does not appear on the register but claims it does, contact our consumer helpline on 0800 111 6768.

There are more steps you should take to avoid scams and unauthorised firms.

If you use an unauthorised firm, you won’t have access to the financial ombudsman service or financial services compensation scheme (FSCS) so you’re unlikely to get your money back if things go wrong.

If you use an authorised firm, access to the financial ombudsman service and FSCS protection will depend on the investment you are making and the service the firm is providing. If you would like further information about protection, the authorised firm should be able to help.

Report an unauthorised firm

If you think you have been approached by an unauthorised firm or contacted about a scam, you should contact our consumer helpline on 0800 111 6768. If you were offered, bought or sold shares, you can use our reporting form.

Octafx review and tutorial 2021

Octafx offers multi-asset trading on a range of platforms and mobile solutions.

Octafx offers leveraged trading on currencies.

Trade popular digital currencies at octafx.

Octafx is a forex, CFD and copy trading broker offering the MT4, MT5 and ctrader platforms. In this broker review, we’ll login to the personal area and uncover the key features, including leverage, demo accounts, regulation and more. Read on to find out if octafx is a good forex broker or not.

Octafx details

Octafx was established in 2011. The company’s headquarters are located in saint vincent and the grenadines, with an additional support office in jakarta, indonesia. The broker’s EU entity, octa markets cyprus ltd, is located in limassol, cyprus, and is regulated by the cysec.

With over 1.5 million trading accounts and a long list of forex industry awards, the founder and owner has ensured the company has amassed a global reach.

Trading platforms

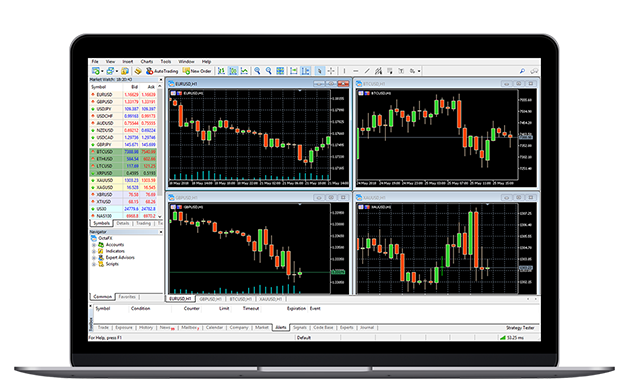

Metatrader 4

The MT4 platform is a trusted software used by both individual traders and institutions, due to its ease of use and flexibility.

The platform allows you to develop your own expert advisors and technical indicators to suit your trading style. In addition to the 30 in-built technical indicators, advanced charting tools allow you to analyse price fluctuations and trends in the market, using 3 customisable chart and graph types.

Note that MT4 is currently only available for non-EU clients.

Octafx metatrader 4

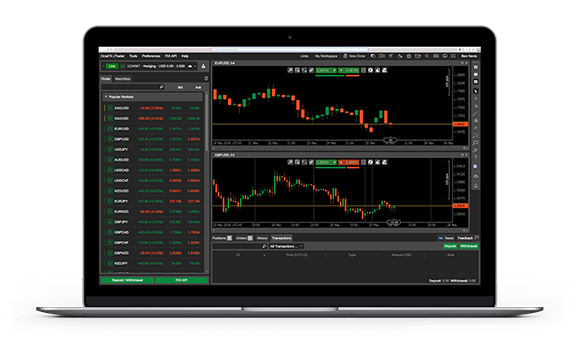

Metatrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy and more advanced features.

Users enjoy 8 types of pending orders, 44 analytical objects including gann and fibonacci retracement, plus additional technical indicators which are unique to MT5, such as trend oscillators and bill williams’ tools. There’s also an economic calendar as well as two major accounting modes for greater flexibility: hedging and netting.

Both platforms come in several languages, including english, arabic and hindi, and are compatible with windows pcs. Octafx provides a useful download guide on the website.

Octafx metatrader 5

Metatrader webtrader

For those using mac pcs, octafx also offers the web terminal version of MT4 and MT5, meaning traders can access the markets straight from an internet browser.

The web platforms are highly functional and customisable, boasting the same features found in the desktop versions, including charting tools, market indicators, scripts and expert advisors, plus access to diverse order types and execution modes.

Ctrader

The ctrader platform is a robust system designed for forex and CFD trading. The platform includes over 26 in-built chart views and up to 50 chart templates on a fully customisable interface. The platform boasts an impressive suite of 70 technical indicators and 28 chart timeframes, plus advanced level scalping and visual back-testing using cbot. With full market depth, traders can also execute advanced online trading strategies as well as programmable algorithms.

The ctrader platform is ready to download from the website once you have completed the registration process. The ctrader web terminal is also available for macos users.

Octafx ctrader

Markets

Octafx offers some of the most popular products, including:

- Forex – 28 currency pairs including EUR/USD and USD/JPY

- Indices – 10 CFD indices available such as US30 and NASDAQ

- Commodities – including spot gold and silver contracts, plus brent and crude oil

- Cryptocurrencies – 3 major digital currencies available; bitcoin, ethereum and litecoin

Trading fees

Typical variable spreads for EUR/USD are around 0.7 pips in both the metatrader and ctrader platforms. Gold spreads (XAUUSD) start from around 2 pips and major indices such as NAS100 are around 3.5 points. Bitcoin spreads (BTCUSD) are around 3.1 pips. Fixed spreads are also available for MT4 USD accounts.

Trading commissions are only charged in the ctrader account, at 0.03 USD per 0.01 lots. There are also rollover rates applied on positions held over 3 days. Details of these fees are listed in the product specifications.

Leverage

Octafx offers generous leverage limits up to 1:500 for currencies in the MT4 and ctrader accounts. Leverage in the MT5 account is available up to 1:200 on currencies. Metals can be leveraged up to 1:200, indices and energies up to 1:50, and cryptocurrencies up to 1:2.

Note that EU clients can only trade with leverage up to 1:30.

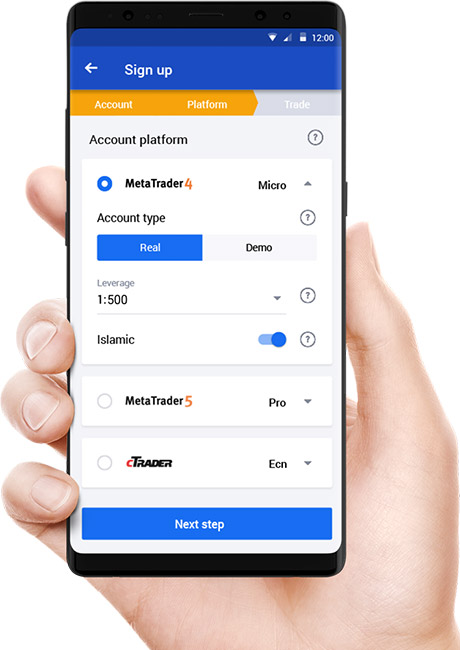

Mobile apps

Octafx delivers mobile app versions of the MT4, MT5 and ctrader platforms, available for iphone and android devices. The apps offer many of the essential features found in the desktop applications, including a complete set of orders in metatrader and full balance, margin and P&L information in ctrader. All trading apps come with a customisable mobile interface with clean and accurate trading functions, as well as custom mobile price alerts.

Octafx MT4 mobile app

Octafx (non-EU) also offers a downloadable proprietary copy trading mobile app, currently available only on android (APK) devices. The app allows you to manage and keep track of trading accounts whilst on the go. Users can also activate bonuses, access trader tools and deposit into their accounts. The app download process is quick and can be accessed from the google play store.

Octafx mobile app

Payment methods

Octafx offers a few fast funding methods which vary depending on your origin country, including bank cards, perfect money and bitcoin. Local bank transfers are also available for traders from certain countries, including thailand, india and nigeria.

The minimum withdrawal and deposit amounts are 5 USD for perfect money, 0.00096000 for bitcoin and 50 EUR for cards. All deposits methods are generally processed instantly or within a few minutes.

There are no commissions charged on deposits, withdrawals or currency exchange rates, except for 0.5% on perfect money deposits. The withdrawal time for all methods is 1 to 3 hours to approve and up to 30 minutes to transfer the funds. There is no withdrawal limit on earnings.

Demo account review

Octafx traders can open a demo account which provides the same trading experience as a live account but without risking any real investment. Each demo account is loaded with unlimited demo dollars and opportunities to participate in the broker’s demo contest to be one of the next champions. You can sign up for a free demo account in just a few minutes.

Octafx bonuses & promo codes

Octafx (non-EU) offers several deposit bonus deals, including a 50% bonus and a 100% bonus during special offer periods. In addition, there’s the trade & win promotion where traders can win gifts such as octafx t-shirts or gadgets. There are also contest opportunities, including the octafx 16 cars contest where traders are entered into a car prize draw every 3 months, as well as the champion demo contest 2020 for MT4 users.

Make sure to check all bonus terms and conditions before participating.

Regulation review

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec), under license number 372/18. EU member state residents are therefore protected by strict regulatory standards, including segregated client accounts and protection by the investor compensation fund.

The non-EU entity also claims to provide segregated client accounts to protect trader funds, as well as negative balance protection which ensures that trader account balances never fall below zero.

Additional features

Traders benefit from a range of additional education features and trading tools at octafx, including video tutorials and webinars, plus regular forex market insights and news. The brokerage also offers profit and margin calculators, as well as a forex signal service with the autochartist plugin and live quotes.

Octafx also offers a copy trading service, which is available on the desktop terminal and through the android mobile app. The copy trading services allows clients to automatically copy leading traders based on the equity and leverage of both the master trader and the copier’s accounts.

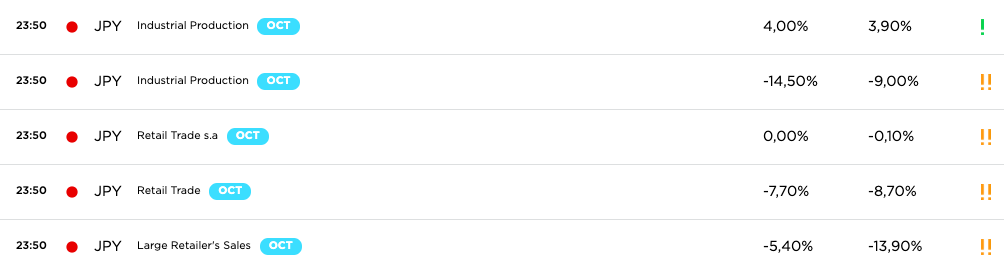

Octafx economic calendar

Account types

There are 3 account types available at octafx, which are determined by the trading platform you are using: micro (MT4), pro (MT5) and ECN (ctrader). Accounts are available in USD or EUR. The minimum trade volume across all accounts is 0.01 lots and there is no maximum.

The main differences between the accounts is the assets available to trade, the spreads and the minimum deposit amounts. The micro and ECN minimum deposit is 100 USD. The minimum deposit in the pro account is 500 USD. Commissions are also charged in the ECN account.

Account opening is easy and requires the submission of ID documents in line with KYC requirements. In most cases, if your documents are submitted clearly, verification should only take up to 3 hours.

There is also an islamic swap-free account for those worried about whether trading is haram or halal. Note clients from the united states are not accepted at octafx or octa markets cyprus ltd.

Benefits

Traders enjoy several benefits when trading with octafx vs the likes of FBS, IQ option and exness:

- Metatrader and ctrader platforms

- Bonuses and contests (non-EU)

- Commission-free trading

- EU regulation

Drawbacks

Compared to other brokers such as hotforex, XTB and olymptrade, octafx does fall short in some areas:

- Not FCA regulated

- Limited funding methods

- Zero pip spreads unavailable

- No copy trading on ios devices

Trading hours

Trading times in the MT4 and MT5 platforms are 24/5, from 00:00 on monday to 23:59 on friday server time (EET/EST). The ctrader server time zone is UTC +0, though you can set other time zones, such as GMT, for charts and trading information.

Customer support

For telephone support, non-EU clients can contact the helpline, +44 20 3322 1059, between 00:00 and 24:00, monday to friday (EET). For EU clients, the number to call is +357 25 251 973 between 09:00 and 18:00, monday to friday (EET).

There is also an email form, however, the fastest way to get in touch is via the 24/7 live chat service, which you can access by clicking on the chat logo at the bottom of the website. The support team are helpful if you need to know your withdrawal pin, any platform problems, VPS questions, or you want to delete an account.

In addition, you can find updates on the broker’s social media pages, as well as the octafx youtube channel.

The broker’s head office addresses are:

- Octafx, suite 305, griffith corporate centre, beachmont, kingstown, st vincent and the grenadines

- Octa markets cyprus ltd, 1 agias zonis and thessalonikis corner, nicolau pentadromos center, block: B’, office: 201, 3026, limassol, cyprus

The broker’s website is available in a number of languages for clients from indonesia, malaysia, pakistan and india.

Security

Octafx uses 128-bit SSL encryption and PIN codes in the personal area and trading platforms, which is the industry-standard security requirement for protecting personal data. The broker also applies 3D secure visa authorisation when processing credit and debit card transactions.

Octafx verdict

Octafx offers a promising trading service for novices and experienced traders, with a choice of metatrader or ctrader platforms as well as the copytrading app. The broker offers fee-free deposits and withdrawals, plus islamic accounts and a demo solution. The ECN spreads are also decent, though not as competitive as the zero spread accounts offered at other brokers like XM, for example.

Accepted countries

Octafx accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use octafx from united states.

Is octafx a legit company and regulated broker?

Octafx is a legit company registered in saint vincent and the grenadines. The EU entity is registered in limassol, cyprus and regulated by cysec. If you’re unsure whether a broker is a scam or legit company, you can always check out customer reviews online.

Is octafx a market maker?

No, octafx is a no dealing desk (NDD) broker and therefore acts as an intermediary between the trader and the real market. Octafx receives commissions from its liquidity providers for each transaction.

How do I delete my octafx account?

To delete your account, you will need to get in touch with the customer support team. Note accounts are automatically deactivated if you never deposit or sign in to them.

How do I open a copytrading account at octafx?

You can sign up and login to the copytrading account in a few easy steps. Once you login to your personal area, you can set up your copytrading profile and make a deposit to your wallet. You can also sign in to your new account using the android app.

Why was my octafx withdrawal rejected?

If you encounter a withdrawal problem, you will receive a notification in your email explaining the issue. Alternatively, if you need to cancel a withdrawal, you can do this within your personal area.

Does octafx offer any free bonus deals?

At the time of writing, octafx is not offering any free bonus deals, no deposit bonus deals or promo codes. There are other promotions available for non-EU clients. Make sure to check the bonus conditions before participating.

Is octafx legal in india and pakistan?

Yes, you can legally open an octafx account from 100 countries, including india, pakistan, singapore, ghana and the UAE.

Octa trade options

Benefit from a packed product suite of

Forex/cfds & binary. Octa fx ltd provides

An enjoyable trading experience with a

Straightforward and intuitive platform.

Octa fx ltd is a brokerage that works

With you. We assist, educate and train

Our clients to make educated

BO tradefinancials is a part of the

Techfinancials group and is listed on

London stock exchange AIM

Innovative and user friendly, you can explore a world of financial opportunities from a single screen: forex, cfds & binary

Join us and trade on a broad variety of assets and instruments including: stocks, commodities, currencies & indices, for a completely tailored trading experience!

Get started today with crypto currency

SEND, RECEIVE AND SECURELY STORE YOUR COINS IN YOUR WALLET

- Tight spread

- Default leverage of 1:50.

Advanced traders may request an increased leverage - Zero margins

- Multiple instruments & range of expiries

- High returns on successful binary trades

- Trade FX and binary “side by side”

1 trading account, 2 trading platforms

Why trade with octa fx ltd?

Our testimonials

GUILL MANTE

ANAS SULAIMAN

DEEPALI GANDHI

ETIENNE DREYER

ALEX HUNG

SABEEHA DAWOOD

Education center

Maximize your market potential

Octa fx ltd education center is packed with exclusive training tools, and is geared to meet the needs of investors at every level.

Trade anytime, anywhere via mobile web for an exceptional investing experience, on the move to never miss a trading opportunity.

Secured by SSL. Copyright © octa fx ltd. All rights reserved.92 laight st #A tribeca, new york, NY.

Octa trade options

Benefit from a packed product suite of

Forex/cfds & binary. Octa fx ltd provides

An enjoyable trading experience with a

Straightforward and intuitive platform.

Octa fx ltd is a brokerage that works

With you. We assist, educate and train

Our clients to make educated

BO tradefinancials is a part of the

Techfinancials group and is listed on

London stock exchange AIM

Innovative and user friendly, you can explore a world of financial opportunities from a single screen: forex, cfds & binary

Join us and trade on a broad variety of assets and instruments including: stocks, commodities, currencies & indices, for a completely tailored trading experience!

Get started today with crypto currency

SEND, RECEIVE AND SECURELY STORE YOUR COINS IN YOUR WALLET

- Tight spread

- Default leverage of 1:50.

Advanced traders may request an increased leverage - Zero margins

- Multiple instruments & range of expiries

- High returns on successful binary trades

- Trade FX and binary “side by side”

1 trading account, 2 trading platforms

Why trade with octa fx ltd?

Our testimonials

GUILL MANTE

ANAS SULAIMAN

DEEPALI GANDHI

ETIENNE DREYER

ALEX HUNG

SABEEHA DAWOOD

Education center

Maximize your market potential

Octa fx ltd education center is packed with exclusive training tools, and is geared to meet the needs of investors at every level.

Trade anytime, anywhere via mobile web for an exceptional investing experience, on the move to never miss a trading opportunity.

Secured by SSL. Copyright © octa fx ltd. All rights reserved.92 laight st #A tribeca, new york, NY.

Build secure, seamless experiences for your customers and workforce.

The okta identity cloud gives you one trusted platform to secure every identity in your organization and connect with all your customers.

Learn more about zero trust

Getting started with zero trust

Download this whitepaper to explore the shifts in the security landscape that led to the creation of zero trust, what the zero trust extended ecosystem (ZTX) framework looks like today, and how organizations can utilize okta as the foundation for a successful zero trust program now, and in the future.

How organizations use okta

More than 9,400 global organizations trust okta to manage access and authentication.

Workforce identity

Protect and enable your employees, contractors, and partners, wherever they are.

Customer identity

Build secure, delightful digital experiences for your customers.

Connect your workforce to every app.

Build auth into any app.

The okta identity cloud gives you one trusted platform to secure every identity in your organization and connect with all your customers.

How organizations use okta

More than 8,950 global organizations trust okta to manage access and authentication.

Workforce identity

Protect and enable your employees, contractors, and partners, wherever they are.

Customer identity

Build secure, delightful digital experiences for your customers.

"due to the increased work at home environment that we've had the last few weeks, we actually had to accelerate some of our plans and over a 36 hour period, we actually moved workday, office 365, webex, check point VPN and zoom to okta SSO."

– trey ray, manager cybersecurity, fedex

Make the stack of your choice work better for you

Securely adopt and automate any technology from cloud to ground with the okta integration network — the broadest, deepest set of more than 6,500 integrations.

Programmable identity for developers. See the apis + sdks.

Scale and flexibility for the world’s largest organizations and the world’s biggest ideas

More than 9,400 global brands trust okta. A modern platform allows top companies to focus on their world-changing work, knowing their identity and access management are in good hands.

Enabling global collaboration and rapid growth

Securing access to apis in the pitney bowes commerce cloud

Building an intelligent, connected world

What’s new at okta

Okta's COVID-19 preparedness

We have plans in place to ensure our service works seamlessly, so our customers can focus on their critical business goals. We do not foresee any impact to the delivery of the okta service due to COVID-19.

Identity+

At identity+, you’ll hear research-backed talks about the latest in identity and access management, get expert advice on your IAM challenges, and network with other IAM professionals from across the world.

Businesses @ work (from home) report

See how companies are adopting productivity, connectivity, and security as millions of people are suddenly working from home for the first time in the face of COVID-19.

Product demos

Wondering what okta can do for your business? Visit our library of demo videos to find out.

Go from zero to zero trust

Make identity the foundation for your zero trust strategy and enable access for all users—regardless of their location, device, or network.

Octa trade options

Octa FX | earn money back

Overall rating is an average of ratings from experts

By clicking the love you can give your rating

Cash back rates

Cash back rebates are paid per closed position unless otherwise specified. 1 lot = 100,000 base currency units traded.

- Forex

- Metal

- Forex

- Metal

- MT4 micro

- $2.50

- $2.50

- Ctrader ECN

- $2.50

- $2.50

- MT5 pro

- $1.50

- $1.50

*notes

- Trade should last more than 180 seconds.

- Price of order equals or exceeds 30 points in difference and order is not executed by means of partial and/or multiple close.

- Account must have minimum $100.

- Minimum 5 valid orders in 30 days

Promotion

Regulators

What are octa FX rebates?

Octa FX rebates are a portion of the transaction cost that is paid back to the client on each trade, resulting in a lower spread and improved win ratio. For example, if your rebate is 1 pip and the spread is 3 pips, then your net spread is only 2 pips. Many traders initially believe there must be higher costs elsewhere to compensate, however they soon find there is no catch and octa FX rebates truly reduce the costs of the transaction and improve their bottom line.

How do octa FX rebates work?

When you link a new or existing forex trading account to us the broker pays us part of their spread or commission profit for every trade you make as compensation for referring a customer to them. We then share the majority of our revenue with you, paying you a cash rebate for each trade you make as thank you for signing up with us.

Benefits of choosing us

Earn extra cash per trade

As our client you earn extra cash per trade, making trading through us more profitable than opening direct with the octa FX

Resolve issues faster with broker

Due to our unique relationship with octa FX, we have often mediated between octa FX and clients in order to help successfully resolve client issues

24/7 support team

Our knowledgeable support team is available 24 hours per day in 8 native languages & 23 total languages for any questions.

How much octa FX rebates can I earn?

Use our forex rebate calculator to estimate your octa FX rebate earnings:

10 day trading strategies for beginners

Day trading is the act of buying and selling a financial instrument within the same day or even multiple times over the course of a day. Taking advantage of small price moves can be a lucrative game—if it is played correctly. But it can be a dangerous game for newbies or anyone who doesn't adhere to a well-thought-out strategy.

Not all brokers are suited for the high volume of trades made by day traders, however. But some brokers are designed with the day trader in mind. You can check out our list of the best brokers for day trading to see which brokers best accommodate those who would like to day trade.

The online brokers on our list, fidelity and interactive brokers, have professional or advanced versions of their platforms that feature real-time streaming quotes, advanced charting tools, and the ability to enter and modify complex orders in quick succession.

Below, we'll take a look at some general day trading principles and then move on to deciding when to buy and sell, common day trading strategies, basic charts and patterns, and how to limit losses.

Key takeaways

- Day trading is only profitable when traders take it seriously and do their research.

- Day trading is a job, not a hobby; treat it as such—be diligent, focused, objective, and keep emotions out of it.

- Here we provide some basic tips and know-how to become a successful day trader.

Day trading strategies

1. Knowledge is power

In addition to knowledge of basic trading procedures, day traders need to keep up on the latest stock market news and events that affect stocks—the fed's interest rate plans, the economic outlook, etc.

So do your homework. Make a wish list of stocks you'd like to trade and keep yourself informed about the selected companies and general markets. Scan business news and visit reliable financial websites.

2. Set aside funds

Assess how much capital you're willing to risk on each trade. Many successful day traders risk less than 1% to 2% of their account per trade. If you have a $40,000 trading account and are willing to risk 0.5% of your capital on each trade, your maximum loss per trade is $200 (0.5% * $40,000).

Set aside a surplus amount of funds you can trade with and you're prepared to lose. Remember, it may or may not happen.

3. Set aside time, too

Day trading requires your time. That's why it's called day trading. You'll need to give up most of your day, in fact. Don’t consider it if you have limited time to spare.

The process requires a trader to track the markets and spot opportunities, which can arise at any time during trading hours. Moving quickly is key.

4. Start small

As a beginner, focus on a maximum of one to two stocks during a session. Tracking and finding opportunities is easier with just a few stocks. Recently, it has become increasingly common to be able to trade fractional shares, so you can specify specific, smaller dollar amounts you wish to invest.

That means if apple shares are trading at $250 and you only want to buy $50 worth, many brokers will now let you purchase one-fifth of a share.

5. Avoid penny stocks

You're probably looking for deals and low prices but stay away from penny stocks. These stocks are often illiquid, and chances of hitting a jackpot are often bleak.

Many stocks trading under $5 a share become de-listed from major stock exchanges and are only tradable over-the-counter (OTC). Unless you see a real opportunity and have done your research, stay clear of these.

6. Time those trades

Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, which contributes to price volatility. A seasoned player may be able to recognize patterns and pick appropriately to make profits. But for newbies, it may be better just to read the market without making any moves for the first 15 to 20 minutes.

The middle hours are usually less volatile, and then movement begins to pick up again toward the closing bell. Though the rush hours offer opportunities, it’s safer for beginners to avoid them at first.

7. Cut losses with limit orders

Decide what type of orders you'll use to enter and exit trades. Will you use market orders or limit orders? When you place a market order, it's executed at the best price available at the time—thus, no price guarantee.

A limit order, meanwhile, guarantees the price but not the execution. Limit orders help you trade with more precision, wherein you set your price (not unrealistic but executable) for buying as well as selling. More sophisticated and experienced day traders may employ the use of options strategies to hedge their positions as well.

8. Be realistic about profits

A strategy doesn't need to win all the time to be profitable. Many traders only win 50% to 60% of their trades. However, they make more on their winners than they lose on their losers. Make sure the risk on each trade is limited to a specific percentage of the account, and that entry and exit methods are clearly defined and written down.

9. Stay cool

There are times when the stock markets test your nerves. As a day trader, you need to learn to keep greed, hope, and fear at bay. Decisions should be governed by logic and not emotion.

10. Stick to the plan

Successful traders have to move fast, but they don't have to think fast. Why? Because they've developed a trading strategy in advance, along with the discipline to stick to that strategy. It is important to follow your formula closely rather than try to chase profits. Don't let your emotions get the best of you and abandon your strategy. There's a mantra among day traders: "plan your trade and trade your plan."

Before we go into some of the ins and outs of day trading, let's look at some of the reasons why day trading can be so difficult.

What makes day trading difficult?

Day trading takes a lot of practice and know-how, and there are several factors that can make the process challenging.

First, know that you're going up against professionals whose careers revolve around trading. These people have access to the best technology and connections in the industry, so even if they fail, they're set up to succeed in the end. If you jump on the bandwagon, it means more profits for them.

Uncle sam will also want a cut of your profits, no matter how slim. Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. The one caveat is that your losses will offset any gains.

As an individual investor, you may be prone to emotional and psychological biases. Professional traders are usually able to cut these out of their trading strategies, but when it's your own capital involved, it tends to be a different story.

Deciding what and when to buy

Day traders try to make money by exploiting minute price movements in individual assets (stocks, currencies, futures, and options), usually leveraging large amounts of capital to do so. In deciding what to focus on—in a stock, say—a typical day trader looks for three things:

- Liquidity allows you to enter and exit a stock at a good price—for instance, tight spreads, or the difference between the bid and ask price of a stock, and low slippage, or the difference between the expected price of a trade and the actual price.

- Volatility is simply a measure of the expected daily price range—the range in which a day trader operates. More volatility means greater profit or loss.

- Trading volume is a measure of how many times a stock is bought and sold in a given time period—most commonly known as the average daily trading volume. A high degree of volume indicates a lot of interest in a stock. An increase in a stock's volume is often a harbinger of a price jump, either up or down.

Once you know what kind of stocks (or other assets) you're looking for, you need to learn how to identify entry points—that is, at what precise moment you're going to invest. Tools that can help you do this include:

- Real-time news services: news moves stocks, so it's important to subscribe to services that tell you when potentially market-moving news comes out.

- ECN/level 2 quotes: ecns, or electronic communication networks, are computer-based systems that display the best available bid and ask quotes from multiple market participants and then automatically match and execute orders. Level 2 is a subscription-based service that provides real-time access to the nasdaq order book composed of price quotes from market makers registering every nasdaq-listed and OTC bulletin board security. Together, they can give you a sense of orders being executed in real-time.

- Intraday candlestick charts: candlesticks provide a raw analysis of price action. More on these later.

Define and write down the conditions under which you'll enter a position. "buy during uptrend" isn't specific enough. Something like this is much more specific and also testable: "buy when price breaks above the upper trendline of a triangle pattern, where the triangle was preceded by an uptrend (at least one higher swing high and higher swing low before the triangle formed) on the two-minute chart in the first two hours of the trading day."

Once you have a specific set of entry rules, scan through more charts to see if those conditions are generated each day (assuming you want to day trade every day) and more often than not produce a price move in the anticipated direction. If so, you have a potential entry point for a strategy. You'll then need to assess how to exit, or sell, those trades.

Deciding when to sell

There are multiple ways to exit a winning position, including trailing stops and profit targets. Profit targets are the most common exit method, taking a profit at a pre-determined level. Some common price target strategies are:

| strategy | description |

| scalping | scalping is one of the most popular strategies. It involves selling almost immediately after a trade becomes profitable. The price target is whatever figure that translates into "you've made money on this deal." |

| fading | fading involves shorting stocks after rapid moves upward. This is based on the assumption that (1) they are overbought, (2) early buyers are ready to begin taking profits and (3) existing buyers may be scared out. Although risky, this strategy can be extremely rewarding. Here, the price target is when buyers begin stepping in again. |

| Daily pivots | this strategy involves profiting from a stock's daily volatility. This is done by attempting to buy at the low of the day and sell at the high of the day. Here, the price target is simply at the next sign of a reversal. |

| Momentum | this strategy usually involves trading on news releases or finding strong trending moves supported by high volume. One type of momentum trader will buy on news releases and ride a trend until it exhibits signs of reversal. The other type will fade the price surge. Here, the price target is when volume begins to decrease. |

In most cases, you'll want to exit an asset when there is decreased interest in the stock as indicated by the level 2/ECN and volume. The profit target should also allow for more profit to be made on winning trades than is lost on losing trades. If your stop-loss is $0.05 away from your entry price, your target should be more than $0.05 away.

Just like your entry point, define exactly how you will exit your trades before entering them. The exit criteria must be specific enough to be repeatable and testable.

Day trading charts and patterns

To help determine the opportune moment to buy a stock (or whatever asset you're trading), many traders utilize:

- Candlestick patterns, including engulfing candles and dojis

- Technical analysis, including trend lines and triangles

- Volume—increasing or decreasing

There are many candlestick setups a day trader can look for to find an entry point. If used properly, the doji reversal pattern (highlighted in yellow in the chart below) is one of the most reliable ones.

:max_bytes(150000):strip_icc()/DayTradingChartsandPatterns22-1713356e5c8c447691593574eebd9e60.png)

Typically, look for a pattern like this with several confirmations:

- First, look for a volume spike, which will show you whether traders are supporting the price at this level. Note: this can be either on the doji candle or on the candles immediately following it.

- Second, look for prior support at this price level. For example, the prior low of day (LOD) or high of day (HOD).

- Finally, look at the level 2 situation, which will show all the open orders and order sizes.

If you follow these three steps, you can determine whether the doji is likely to produce an actual turnaround and can take a position if the conditions are favorable.

Traditional analysis of chart patterns also provides profit targets for exits. For example, the height of a triangle at the widest part is added to the breakout point of the triangle (for an upside breakout), providing a price at which to take profits.

How to limit losses when day trading

A stop-loss order is designed to limit losses on a position in a security. For long positions, a stop loss can be placed below a recent low, or for short positions, above a recent high. It can also be based on volatility.

For example, if a stock price is moving about $0.05 a minute, then you may place a stop loss $0.15 away from your entry to give the price some space to fluctuate before it moves in your anticipated direction.

Define exactly how you'll control the risk of the trades. In the case of a triangle pattern, for instance, a stop loss can be placed $0.02 below a recent swing low if buying a breakout, or $0.02 below the pattern. (the $0.02 is arbitrary; the point is simply to be specific.)

One strategy is to set two stop losses:

- A physical stop-loss order placed at a certain price level that suits your risk tolerance. Essentially, this is the most money you can stand to lose.

- A mental stop-loss set at the point where your entry criteria are violated. This means if the trade makes an unexpected turn, you'll immediately exit your position.

However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable. Also, it's important to set a maximum loss per day you can afford to withstand—both financially and mentally. Whenever you hit this point, take the rest of the day off. Stick to your plan and your perimeters. After all, tomorrow is another (trading) day.

Once you've defined how you enter trades and where you'll place a stop loss, you can assess whether the potential strategy fits within your risk limit. If the strategy exposes you too much risk, you need to alter the strategy in some way to reduce the risk.

If the strategy is within your risk limit, then testing begins. Manually go through historical charts to find your entries, noting whether your stop loss or target would have been hit. Paper trade in this way for at least 50 to 100 trades, noting whether the strategy was profitable and if it meets your expectations.

If it does, proceed to trade the strategy in a demo account in real-time. If it's profitable over the course of two months or more in a simulated environment, proceed with day trading the strategy with real capital. If the strategy isn't profitable, start over.

Finally, keep in mind that if trading on margin—which means you're borrowing your investment funds from a brokerage firm (and bear in mind that margin requirements for day trading are high)—you're far more vulnerable to sharp price movements. Margin helps to amplify the trading results not just of profits, but of losses as well if a trade goes against you. Therefore, using stop losses is crucial when day trading on margin.

Now that you know some of the ins and outs of day trading, let's take a brief look at some of the key strategies new day traders can use.

Basic day trading strategies

Once you've mastered some of the techniques, developed your own personal trading styles, and determined what your end goals are, you can use a series of strategies to help you in your quest for profits.

Here are some popular techniques you can use. Although some of these have been mentioned above, they are worth going into again:

- Following the trend: anyone who follows the trend will buy when prices are rising or short sell when they drop. This is done on the assumption that prices that have been rising or falling steadily will continue to do so.

- Contrarian investing: this strategy assumes the rise in prices will reverse and drop. The contrarian buys during the fall or short-sells during the rise, with the express expectation that the trend will change.

- Scalping: this is a style where a speculator exploits small price gaps created by the bid-ask spread. This technique normally involves entering and exiting a position quickly—within minutes or even seconds.

- Trading the news: investors using this strategy will buy when good news is announced or short sell when there's bad news. This can lead to greater volatility, which can lead to higher profits or losses.

Day trading is difficult to master. It requires time, skill, and discipline. Many of those who try it fail, but the techniques and guidelines described above can help you create a profitable strategy. With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds.

So, let's see, what we have: trade stocks, etfs, forex & digital options at octa fx option, one of the fastest growing online trading platforms. Sign up today and be a part of 17 million user base at octa fx option. At octa trade options

Contents of the article

- No deposit forex bonuses

- Trade top crypto currencies with a leverage

- What is octa fx option?

- WHAT IS FOREX

- WHAT IS CRYPTOCURRENCY

- Octafx a trading style of octa markets...

- How to protect yourself

- Report an unauthorised firm

- Octafx a trading style of octa markets...

- How to protect yourself

- Report an unauthorised firm

- Octafx review and tutorial 2021

- Octafx details

- Trading platforms

- Markets

- Trading fees

- Leverage

- Mobile apps

- Payment methods

- Demo account review

- Octafx bonuses & promo codes

- Regulation review

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Octafx verdict

- Accepted countries

- Is octafx a legit company and regulated broker?

- Is octafx a market maker?

- How do I delete my octafx account?

- How do I open a copytrading account at octafx?

- Why was my octafx withdrawal rejected?

- Does octafx offer any free bonus deals?

- Is octafx legal in india and pakistan?

- Octa trade options

- Get started today with crypto currency

- GUILL MANTE

- ANAS SULAIMAN

- DEEPALI GANDHI

- ETIENNE DREYER

- ALEX HUNG

- SABEEHA DAWOOD

- Octa trade options

- Get started today with crypto currency

- GUILL MANTE

- ANAS SULAIMAN

- DEEPALI GANDHI

- ETIENNE DREYER

- ALEX HUNG

- SABEEHA DAWOOD

- Build secure, seamless experiences for your...

- How organizations use okta

- Connect your workforce to every app. Build...

- How organizations use okta

- "due to the increased work at home environment...

- Make the stack of your choice work better for you

- Programmable identity for developers. See the...

- Scale and flexibility for the world’s largest...

- Enabling global collaboration and rapid growth

- Securing access to apis in the pitney bowes...

- Building an intelligent, connected world

- What’s new at okta

- Go from zero to zero trust

- Octa trade options

- Octa FX | earn money back

- What are octa FX rebates?

- How do octa FX rebates work?

- Benefits of choosing us

- Earn extra cash per trade

- Resolve issues faster with broker

- 24/7 support team

- How much octa FX rebates can I earn?

- 10 day trading strategies for beginners

- 1. Knowledge is power

- 2. Set aside funds

- 3. Set aside time, too

- 4. Start small

- 5. Avoid penny stocks

- 6. Time those trades

- 7. Cut losses with limit orders

- 8. Be realistic about profits

- 9. Stay cool

- 10. Stick to the plan

- What makes day trading difficult?

- Deciding what and when to buy

- Deciding when to sell

- Day trading charts and patterns

- How to limit losses when day trading

- Basic day trading strategies

Comments

Post a Comment